Arabic Large Language Models Powering the GCC

Arabic Large Language Models Powering the GCC

Arabic Large Language Models: Jais, Falcon Arabic, Allam 34B & the GCC Race for Sovereign AI

Arabic large language models are AI systems trained specifically for Arabic script, Gulf dialects and bilingual Arabic English use, designed to respect local culture, regulations and data-residency needs in Saudi Arabia, the UAE and Qatar. For GCC companies, they provide a more accurate, compliant and sovereign alternative to generic English-first models when building Arabic chatbots, copilots and digital government services.

Introduction

Across Riyadh, Dubai, Abu Dhabi and Doha, the race for “sovereign Arabic AI” is no longer theoretical it’s live in production. The region now has its own flagship arabic large language models such as Jais from the UAE, Falcon Arabic from Abu Dhabi’s ATRC/TII, and Saudi’s Allam 34B powering HUMAIN Chat, each built to understand Arabic first and English second.

Global LLMs like GPT or Llama are powerful, but GCC leaders quickly hit limits: models mis-handle Gulf Arabic dialects, misunderstand religious nuance, and don’t always align with Saudi PDPL, UAE data-transfer rules or Qatar’s expectations on data staying in-region.

In this guide, you’ll get a clear, practical view of today’s key GCC Arabic AI models where they’re hosted, how “sovereign” they really are, and how to choose between Jais, Falcon Arabic, Allam 34B and global LLMs when building a compliant, Arabic-first AI stack for your organisation.

What Are Arabic Large Language Models?

From GPT to Arabic LLMs: a quick primer (Informational Concept bridge)

Most leaders now know the basics: a large language model (LLM) is an AI system trained on massive text datasets to generate, summarise and understand language. GPT, Llama and similar models are usually trained primarily on English and other global languages.

Arabic large language models, by contrast, are tuned specifically for:

Modern Standard Arabic (MSA)

Gulf dialects (Saudi, Emirati, Qatari, Kuwaiti, Bahraini, Omani)

Often bilingual Arabic–English use, because GCC business operates in both languages

Models like Jais are explicitly trained as bilingual Arabic–English language models on tens of billions of Arabic tokens plus a large English/code corpus, making them suitable for cross-border GCC workflows where contracts, dashboards and dashboards may switch between languages.

For a Riyadh fintech or a Dubai logistics platform, that means one model that can read a Shariah policy in Arabic, generate an English summary for a global partner, and answer follow-up questions in Gulf Arabic all in one workflow.

Why Arabic needs dedicated large language models

Arabic is not “just another language” to bolt onto a global model:

Script & morphology

Arabic script, diacritics and rich morphology (root-based structure) require specialised Arabic natural language processing (Arabic NLP).

Dialect diversity

Gulf, Egyptian, Levantine and Maghrebi dialects differ strongly from MSA and from each other. Call centres in Jeddah or Dubai rarely get pure textbook MSA.

Religious and cultural sensitivities

Responses must respect Islamic values, local customs and red lines around sensitive topics.

Government expectations

Authorities in KSA, UAE and Qatar increasingly expect AI systems to reflect local values, be explainable and keep regulated data close to home.

English-first LLMs can be adapted via prompt engineering, but for mission-critical services (open banking chatbots, government portals, health triage, Arabic CX) GCC organisations increasingly rely on dedicated Arabic large language models baked with regional data and guardrails from day one a core pillar of sovereign AI in the Gulf.

Arabic NLP vs bilingual Arabic English models

It helps to distinguish two families:

Pure Arabic LLMs / Arabic NLP models

Optimised almost entirely for Arabic text and speech

Excellent at Quranic and Islamic content, poetry, local news, social media dialects

Ideal for citizen-facing services where English is minimal

Bilingual Arabic English language models (like Jais and Allam 34B)

Trained on large Arabic and English corpora

Strong at translation, cross-lingual search, and mixed Arabic–English prompts common in GCC offices

Perfect when your data lake, dashboards or APIs are partly English

For cross-border GCC business e.g., a Dubai-headquartered group operating in Riyadh, Doha, Kuwait City and Muscat bilingual models reduce friction: teams can chat in any mix of Arabic and English while still benefiting from Arabic-aware reasoning and safety.

The GCC’s Leading Arabic LLMs: Jais, Falcon Arabic, Allam & More

UAE-built models: Jais 13B/30B/70B and Falcon Arabic (

The UAE has moved fastest in building exportable arabic large language models:

Jais (13B / 30B / 70B)

Co-developed by Core42 (G42), MBZUAI and Cerebras, Jais started as a 13B-parameter bilingual Arabic–English model trained on tens of billions of Arabic tokens plus a large English/code dataset. Recent iterations like Jais 70B are aimed at enterprise-grade Arabic natural language processing for sectors such as finance, customer service and media.

Falcon Arabic 7B

Developed by Abu Dhabi’s Technology Innovation Institute (TII) under ATRC, Falcon Arabic is built on top of Falcon 3-7B and trained on high-quality, native (non-translated) Arabic data that spans dialects across the Arab world. It aims to match or beat much larger models on Arabic tasks while staying efficient enough to deploy on regional infrastructure.

For UAE startups in Dubai, Abu Dhabi and Sharjah, these models offer:

Hosting options in UAE regions (e.g., Azure UAE Central, local sovereign clouds)

Strong bilingual capabilities for Arabic–English customer journeys

A story aligned with UAE AI Strategy 2031, which explicitly targets global AI leadership.

Saudi Arabic LLMs: Allam 34B and HUMAIN Chat (Informational KSA ecosystem)

Saudi Arabia’s answer is Allam 34B, a Saudi-built, Arabic-first large language model trained on one of the largest Arabic datasets assembled to date. It powers HUMAIN Chat, a Saudi-made conversational app positioned as an Arabic-first AI companion for 400+ million Arabic speakers, shaped by local culture and religion and fully hosted within the Kingdom.

Key differentiators for Allam 34B and HUMAIN Chat.

Sovereign hosting

Operated entirely in Saudi data centres, supporting the PDPL requirement that certain sensitive personal data remains in-Kingdom.

Cultural alignment

Messaging emphasises that the model is rooted in “our culture, our religion and our history”, resonating strongly with Vision 2030’s narrative of confident Saudi innovation.

Arabic-first, not English-first

Optimised for Arabic content and dialects, with English as a helpful second language.

For ministries, NEOM projects, and Riyadh/Jeddah enterprises trying to answer “how Saudi companies use arabic large language models under SDAIA rules”, Allam 34B and HUMAIN Chat offer a politically and culturally safe foundation.

Other GCC & global options for Arabic NLP (Informational Alternatives & fit)

Beyond these flagships.

Qatar & wider GCC

Emerging initiatives in Doha, Kuwait, Bahrain and Oman include Arabic NLP research groups, sector-specific models (e.g., Arabic legal or financial NLP) and cloud-hosted language APIs in the GCP Doha and AWS Bahrain regions.

Open-source Arabic models

Arabic-centric BERTs, GPT-style models and embeddings from global universities and labs can be used for narrower tasks like classification, search and basic Q&A.

Global LLMs as “fallback”

GPT, Claude, Llama and others still play a role for English-heavy tasks (e.g., summarising global regulations, technical documentation) or when you need very broad world knowledge, with Arabic models handling customer-facing Arabic flows.

A practical Middle East Arabic AI stack often blends them: a sovereign Arabic LLM (Jais, Falcon Arabic, Allam 34B) in front for user-facing Arabic, and a carefully controlled global LLM behind the scenes for English-heavy or long-tail knowledge work.

Why Sovereign Arabic AI Matters for Saudi, UAE and Qatar (Informational Strategy & policy)

Vision 2030, UAE AI Strategy 2031 and Qatar Vision 2030 (Informational National programs)

Sovereign AI isn’t just a tech trend; it’s written into national strategies:

Saudi Vision 2030 & SDAIA

Saudi Data & AI Authority (SDAIA) is tasked with turning data and AI into “the new oil” and enforcing PDPL, tying AI deployment directly to Vision 2030 goals across government, finance and industry.

UAE AI Strategy 2031

The UAE’s National AI Strategy 2031 and the UAE AI Office aim to make the country a global AI hub, specifically embedding AI in government, healthcare, transport and education.

Qatar National Vision 2030 & Qatar Digital Government

Qatar ties digital government and AI to long-term economic diversification, with a strong focus on smart services, security and data-residency in Doha.

In practice, this means AI projects built on arabic large language models are no longer “nice experiments”; they are mechanisms to deliver national KPIs and regional AI competitiveness.

Data residency, PDPL and GCC privacy laws shaping AI choices (Informational Regulatory drivers)

Across the Gulf, data protection and residency rules directly shape AI architecture:

Saudi PDPL

PDPL and its regulations govern how personal data is collected, processed and transferred. Cross-border transfers generally require specific conditions or approvals, pushing banks, telcos and health providers to favour in-Kingdom processing.

UAE rules

UAE federal and free-zone frameworks (e.g., ADGM, DIFC) plus oversight by TDRA create guardrails around cloud usage, security and cross-border data exports, especially for telecoms and digital government services.

Qatar regulations

QCB and sector regulators in Doha often require that critical financial and government data stays in Qatar or approved regional cloud regions.

For arabic digital transformation in GCC, that means you rarely start by asking “Which model is smartest?”. You start with:

Where can this model run? (Riyadh, Dubai, Abu Dhabi, Doha, Bahrain)

Which data classes may leave the country, if any?

How will we log, audit and explain AI decisions to regulators?

Sovereign clouds in Riyadh, Dubai and Doha (Informational Infrastructure & trust)

Sovereign AI is built on sovereign infrastructure:

Saudi / Riyadh regions

National data centres plus hyperscalers and local partners providing PDPL-aligned hosting for models like Allam 34B.

AWS Bahrain & Azure UAE Central

Common choices for GCC organisations needing regional cloud proximity and compliance-aligned architectures.

Qatar data centres & GCP Doha

Critical for Qatari government and financial institutions that need in-country or near-country processing.

When you deploy arabic large language models into these environments — ideally with VPC isolation, private networking and strong encryption — regulators are far more comfortable than when traffic goes to distant, opaque overseas endpoints.

How Arabic LLMs Are Used Today in GCC Sectors (Commercial Investigation Use cases & value)

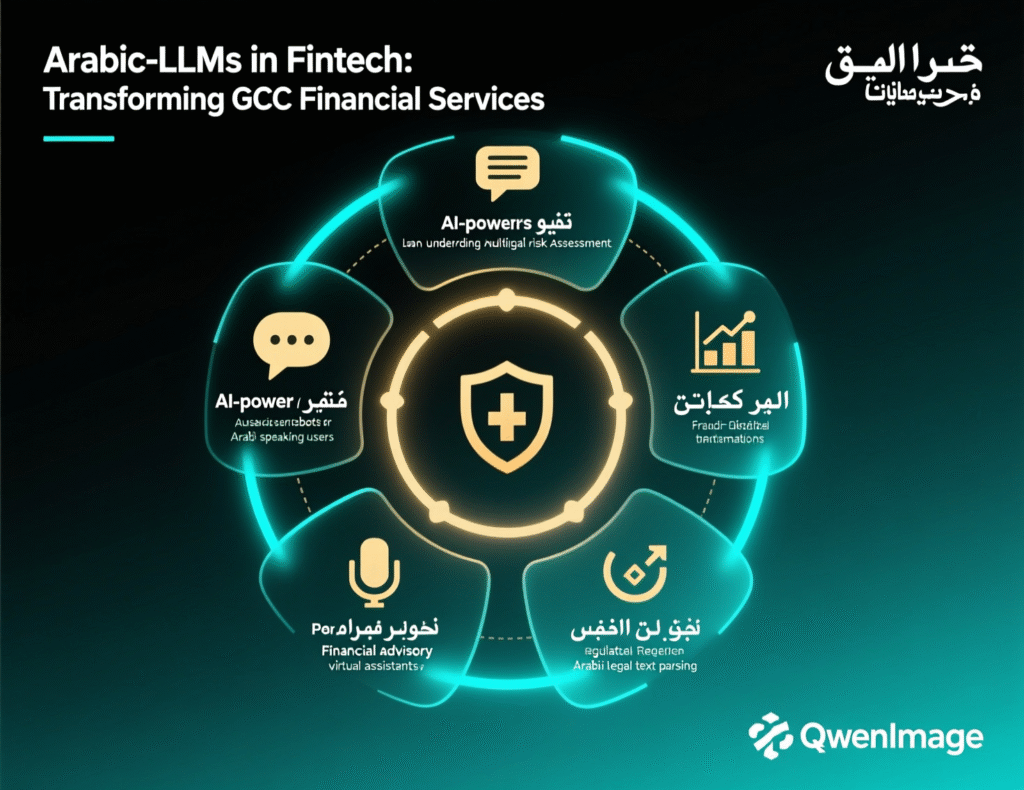

Fintech and open banking in Riyadh, Dubai and Doha (Commercial Investigation Fintech use cases)

Fintech has been one of the earliest adopters of arabic natural language processing:

Sharia-compliant advisory chatbots

Saudi and UAE digital banks use Arabic LLMs to answer questions about Islamic products, zakat, and profit-sharing in a tone aligned with local scholars.

Arabic KYC assistants

Chatbots guide customers through Arabic eKYC flows, explaining PDPL consents and open banking permissions in plain Gulf Arabic.

PDPL-aware document summarisation

Internal copilots summarise contracts, KYC packs and QCB/SAMA circulars, while keeping regulated data inside Saudi, UAE or Qatar environments.

Regulators like SAMA (Saudi), QCB (Qatar), ADGM and DIFC (UAE) increasingly expect banks to show that AI systems are explainable, logged and aligned with local privacy laws, not just “plugged into a foreign black box”.

Digital government & smart cities in Saudi and UAE (Informational — Gov & smart city)

Digital government is where bilingual Arabic English language models shine:

E-government portals

UAE-style “U Ask” assistants and Saudi citizen portals can answer questions about residency, visas, benefits and municipal services in Arabic, English or mixed. TDRA has already rolled out generative AI on federal government portals, signalling official support for this pattern.

Smart city operations

Projects like NEOM and Dubai’s smart city initiatives can use Arabic LLMs to summarise incident reports, interpret sensor logs described in Arabic, and generate recommendations for planners in both languages.

Riyadh & Jeddah municipality bots

Municipalities can deploy Arabic chatbots for permits, fines and community feedback, tuned to local dialect and etiquette.

Here, sovereign AI isn’t just about control; it’s about trust. Citizens in Riyadh or Sharjah are more likely to engage with a “Saudi-made Arabic LLM for Vision 2030 services” than with an unnamed foreign model.

Tourism, retail and logistics: Arabic customer support copilots (Commercial Investigation CX & ops)

For tourism boards, e-commerce brands and logistics players, arabic large language models have become powerful CX engines:

Tourism & events in Doha and Dubai

“Arabic customer support chatbot UAE” and “generative AI for Qatar tourism and events” systems handle bookings, event info and travel FAQs across Arabic, English and sometimes other languages.

Retail & e-commerce

A Dubai fashion brand or a Jeddah grocery delivery app can use Arabic LLMs to power customer support, product recommendations and refund flows on WhatsApp, web and mobile.

Logistics & transport

GCC logistics firms use Arabic NLP to parse customs documents, answer shipment-status queries in Gulf dialects, and generate bilingual updates for customers.

In Kuwait, Bahrain and Oman, smaller SMEs increasingly tap hosted Jais or Falcon Arabic APIs rather than building their own models, letting them benefit from high-quality Arabic AI without heavy infrastructure spending.

Compliance, Risk and Culture: Deploying Arabic LLMs Safely (Commercial Investigation Trust & risk)

Meeting SDAIA, NDMO, TDRA and QCB expectations (Commercial Investigation Regulatory compliance)

To stay out of trouble, GCC deployments need to treat regulators as design partners:

SDAIA & NDMO (Saudi)

Expect clear data classification, lawful basis for processing, consent handling, logging and incident response for AI systems that touch personal data.

TDRA (UAE)

Oversees telecom and digital government; its AI initiatives emphasise secure, high-quality digital experiences on sovereign clouds and official portals.

QCB (Qatar)

For banking chatbots and Arabic generative AI agents connected to core systems, QCB typically expects strict access controls, auditable logs and strong vendor oversight.

When you design your arabic large language models stack, include:

Policy-based prompts (what is allowed / disallowed)

Central logging of prompts and outputs

Human-in-the-loop review for high-risk use cases

Regular risk assessments and Arabic AI benchmarks and evaluation cycles

Data residency patterns under PDPL and regional rules (Informational Data location choices)

Typical patterns we see across Saudi, UAE and Qatar:

KSA PDPL “in-Kingdom only” workloads

Sensitive workloads (retail banking, health, public sector) use models hosted in Riyadh or other Saudi regions, with no external calls for production data.

UAE-hosted models for regional operations

A Dubai group may host Jais or Falcon Arabic in Azure UAE Central and onboard subsidiaries from Sharjah, Kuwait, Bahrain and Oman under a common, policy-driven framework.

Qatar-specific residency for critical systems

Doha banks keep customer data and Arabic AI workloads in Qatar or GCP Doha, using external LLMs only with strict anonymisation and masking.

For many GCC organisations, the right answer to data residency is hybrid: keep arabic large language models that process live customer data in-region, and allow limited, controlled connections to global LLMs for low-risk, non-personal content.

Arabic UX, dialects and cultural alignment in generative AI (Informational Safety & culture)

Compliance is necessary but not sufficient — cultural alignment is the other half of safety.

Models like Allam 34B and HUMAIN Chat emphasise responses grounded in Islamic values and local customs, reducing the risk of offensive or tone-deaf answers in religious or social contexts.

Key Arabic UX lessons for GCC deployments:

Test prompts in Gulf, Egyptian and Levantine dialects, not just MSA.

Localise tone: polite forms of address, religious greetings (where appropriate) and business etiquette.

Avoid generic jokes or metaphors that may not translate culturally.

Offer bilingual UI (Arabic–English) so users can switch languages easily.

Pitfall to avoid: simply “translating” English prompts and flows. A bilingual Arabic–English language model is powerful, but only if the UX around it is built with Arabic-first thinking.

How GCC Companies Can Choose the Right Arabic Large Language Model (Transactional Evaluation & next steps)

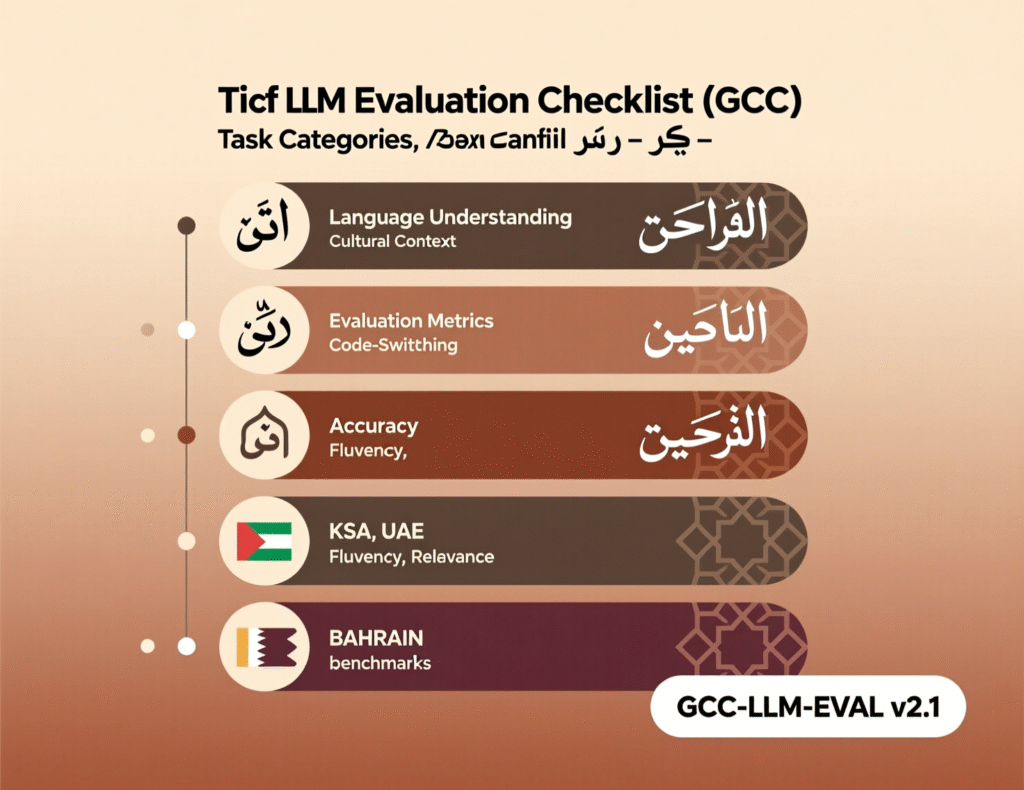

A step-by-step evaluation checklist for Arabic LLMs (HowTo Practical framework)

Use this simple checklist when evaluating arabic large language models for your organisation:

Clarify use cases

Are you building customer chatbots, internal copilots, document summarisation, or all of the above?

Choose hosting region & residency model

Decide early: KSA-only, UAE+GCC, or Qatar-centric; map against PDPL, TDRA and QCB expectations.

Test Arabic NLP benchmarks

Evaluate models on Arabic comprehension, summarisation and reasoning using your own samples, plus public Arabic AI benchmarks and evaluation suites where available.

Evaluate dialect coverage & cultural fit

Run scripts covering Gulf, Egyptian and Levantine dialect prompts; include religious and sensitive content to see how the model responds.

Compare costs & performance

Look at inference cost per 1,000 tokens, latency from Riyadh/Dubai/Doha, and hardware needs (GPU/accelerator requirements).

Stress-test safety & logging

Ensure you can log, monitor and override model behaviour to satisfy SDAIA, TDRA and QCB if something goes wrong.

Document these steps hey will also help you demonstrate due diligence to auditors and boards.

Choosing between Jais, Falcon Arabic, Allam and global models (Commercial Investigation Model selection)

A simple way to think about model selection:

Pick Jais or Falcon Arabic when…

You’re a UAE or GCC company wanting strong bilingual Arabic–English capabilities.

You prefer hosting in UAE or nearby regions and aligning with the UAE AI Strategy 2031.

You need efficient models that can still deliver high-quality Arabic for chatbots and copilots.

Pick Allam 34B / HUMAIN Chat when…

You’re Saudi-based, under PDPL and want a sovereign, Saudi-made model tightly aligned with Vision 2030.

You need strong Arabic-first performance and culturally tuned responses for citizens and customers in KSA.

Combine with global LLMs when…

You have heavy English workloads (e.g., global research, engineering docs).

You can safely route only anonymised or non-personal data to external endpoints.

You want the best of both worlds: sovereign Arabic AI at the edge, global models for background knowledge.

In other words, most mature GCC stacks don’t ask “Jais or GPT?” but “How do we orchestrate Jais, Falcon Arabic, Allam 34B and a global LLM safely in one architecture?”

From pilot to production: GCC implementation patterns (Transactional Summary & CTA)

A typical journey we see for GCC organisations

Pilot in a low-risk domain

For example, a Riyadh or Dubai startup uses Jais to power an internal Arabic knowledge bot, or a Dubai e-commerce company tests Falcon Arabic on a subset of customer chats.

Harden for compliance

Add PDPL-aware policies, logging, red-teaming and human-in-the-loop reviews. Involve SDAIA/NDMO or TDRA-level expectations early.

Scale across channels & markets

Extend to WhatsApp, mobile apps and portals; roll out across Saudi, UAE, Qatar, Kuwait, Bahrain and Oman with regional configurations.

Measure KPIs

Track first-contact resolution, AHT (average handling time), NPS/CSAT, Arabic self-service rates and incident counts.

Local AI dev houses and system integrators in Riyadh, Dubai and Doha can help you integrate arabic large language models into apps, ERP/CRM platforms and data lakes and partners like Mak It Solutions can help you plan, build and iterate the full stack, not just the model.

Whether you’re in finance, healthcare, education, energy or logistics across the GCC, designing a compliant, Arabic-first AI stack is complex—but you don’t need to figure it out alone. Your ideal combination of Jais, Falcon Arabic, Allam-34B and global models varies by workload, data exposure and industry-specific regulations.

Mak It Solutions can help you map your use cases, choose the right arabic large language models, design a PDPL-aligned architecture and move from pilot to production with clear KPIs. Reach out for a tailored GCC AI roadmap and a practical implementation plan your leadership and your regulators can trust. ( Click Here’s )

FAQs

Q : Is it legal to deploy Arabic AI chatbots for customers in Saudi Arabia under PDPL and SDAIA rules?

A : Yes, it is legal to deploy Arabic AI chatbots in Saudi Arabia as long as they comply with the Kingdom’s Personal Data Protection Law (PDPL) and SDAIA guidance. That means defining a lawful basis for processing, limiting data collection to what is necessary, and ensuring secure storage and access controls. You should log interactions, provide clear consent notices and allow customers to exercise their rights (access, correction, deletion). Engaging your DPO or legal team early and aligning with SDAIA and NDMO frameworks is essential when using arabic large language models for banking, health or government services.

Q : Can UAE companies keep all Arabic large language model data inside Abu Dhabi or Dubai data centers only?

A : Yes, many UAE organisations design architectures so that prompts and responses stay within Abu Dhabi or Dubai data centres, often using Azure UAE Central, local sovereign clouds or on-prem solutions. This approach aligns well with the UAE National AI Strategy 2031 and TDRA’s role in supporting secure digital government and telecom services. By deploying Jais or Falcon Arabic in-region and avoiding unnecessary cross-border transfers, UAE companies can reduce legal and reputational risk while still benefiting from powerful generative AI for Arabic customer experience and internal productivity.

Q : Do Qatar banks allow Arabic generative AI for customer support if it connects to systems overseen by QCB?

A : Qatar banks can use Arabic generative AI for customer support, but they must comply with Qatar Central Bank (QCB) regulations on outsourcing, information security and data confidentiality. In practice, this usually means hosting models in Qatar or in closely controlled regional clouds, enforcing strict access controls, encrypting data in transit and at rest, and maintaining full audit trails of AI interactions. Banks also need to ensure that any third-party provider cannot reuse sensitive financial or personal data. Early consultation with QCB and internal risk committees is recommended before deploying arabic large language models into live contact-centre or mobile-banking environments.

Q : Which Arabic LLMs handle Gulf Arabic dialects best for call centers in Riyadh and Dubai?

A : For Gulf Arabic call centres, models specifically trained on native, non-translated Arabic data tend to perform best. Falcon Arabic was built to capture the linguistic diversity of the Arab world using a high-quality native dataset, while Allam 34B and HUMAIN Chat focus heavily on Saudi and Gulf usage, deeply rooted in regional culture and religion. Jais also offers strong Gulf-friendly performance thanks to its large Arabic token corpus and bilingual design. For mission-critical contact centres in Riyadh, Dubai or Jeddah, most organisations run their own evaluations, using local call transcripts and involving CX teams to validate dialect understanding, politeness and compliance with SDAIA or TDRA expectations.

Q : How can a small GCC startup access Jais, Falcon Arabic or Allam 34B without building its own data center?

A : Smaller GCC startups rarely need their own physical data centres. Instead, they typically access arabic large language models via managed cloud services or APIs hosted in regional clouds like AWS Bahrain, Azure UAE Central or GCP Doha. Some providers make Jais or Falcon Arabic available as hosted endpoints, while Saudi-based startups can integrate with platforms like HUMAIN Chat or other Allam 34B-powered services under PDPL-aligned contracts. By combining cloud-native security features with good IAM practices and clear data-processing agreements, even a small team in Riyadh, Dubai or Doha can launch robust Arabic AI features while staying aligned with Vision 2030, UAE AI Strategy 2031 and local regulator expectations.