AI Fraud Detection in Banking: Saudi & UAE Focus

AI Fraud Detection in Banking: Saudi & UAE Focus

AI Fraud Detection in Banking for Gulf Banks: Protecting Customers in Saudi, UAE and Qatar

AI fraud detection in banking uses machine learning on transactions, devices and behaviour to score every payment or login in real time, blocking high-risk activity before money leaves the account. In the Gulf, banks in Saudi Arabia, the UAE and Qatar increasingly combine AI models with SAMA, CBUAE and QCB compliance to protect customers across cards, online and mobile banking.

Introduction

A few months ago, customers of a well-known Gulf bank woke up to find money missing after a sophisticated social-engineering scam that used fake call-centre numbers, spoofed SMS and rushed “verification” calls. In Riyadh, Dubai and Doha WhatsApp groups, people shared screenshots and asked the same question: “If banking is now digital, how can any of us feel safe?”

Fraud risk is rising across Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain and Oman because more salaries, government payments and everyday spending now run through mobile apps, instant transfers and e-commerce gateways. Each new digital channel widens the attack surface for scammers, mule accounts and cross-border payment abuse.

In simple terms, AI fraud detection in banking lets Gulf banks feed billions of past transactions, device signals and behaviour patterns into machine-learning models that spot anomalies in milliseconds. Those models now sit inside payment switches, card processors and digital channels across KSA, UAE and Qatar, silently scoring every transfer and card payment before approval.

In this article, we’ll unpack the fundamentals of AI fraud detection, its impact on customer security and trust, how regulations like SAMA, CBUAE and QCB shape deployments, and a practical implementation roadmap for GCC banks.

What Is AI Fraud Detection in Banking for Gulf Banks?

From Rules-Based to AI Fraud Detection in GCC Banks

Legacy fraud engines depended on static rules like “block transfers above X after midnight” or “flag three failed PIN attempts,” which scammers quickly learned to bypass. In Riyadh, Dubai and Doha, constantly changing scam patterns and cross-channel attacks now break these rigid thresholds. AI and machine learning act as an “extra brain” on top of existing fraud stacks, learning normal behaviour per customer and per segment, and adapting as new fraud typologies appear.

Core Components of AI Fraud Detection Systems in Banks

Modern Gulf banks feed data from transactions, devices, login behaviour, geolocation and KYC records into a unified fraud platform. Machine-learning models combine real-time transaction monitoring in banks, anomaly detection models for payment fraud, supervised models trained on confirmed fraud and graph analytics that uncover mule networks. A real-time engine then calculates risk scores and recommendations—approve, step-up authenticate, or block—for cards, online banking and mobile channels in under a second.

How Gulf Banks Use AI Across Cards, Online and Mobile Banking

AI now underpins card-not-present and e-commerce fraud controls, especially for GCC retail and logistics payments. Mobile banking apps in Saudi and the UAE use AI to spot suspicious logins, risky new device registrations and unusual transfers to new beneficiaries. In Qatar, AI fraud prevention in Qatar banks under QCB regulations increasingly focuses on real-time analytics for domestic schemes and cross-border payments, with dashboards surfaced via internal business intelligence services similar to those offered by.

AI Fraud Detection Techniques Gulf Banks Use for Online & Mobile Banking

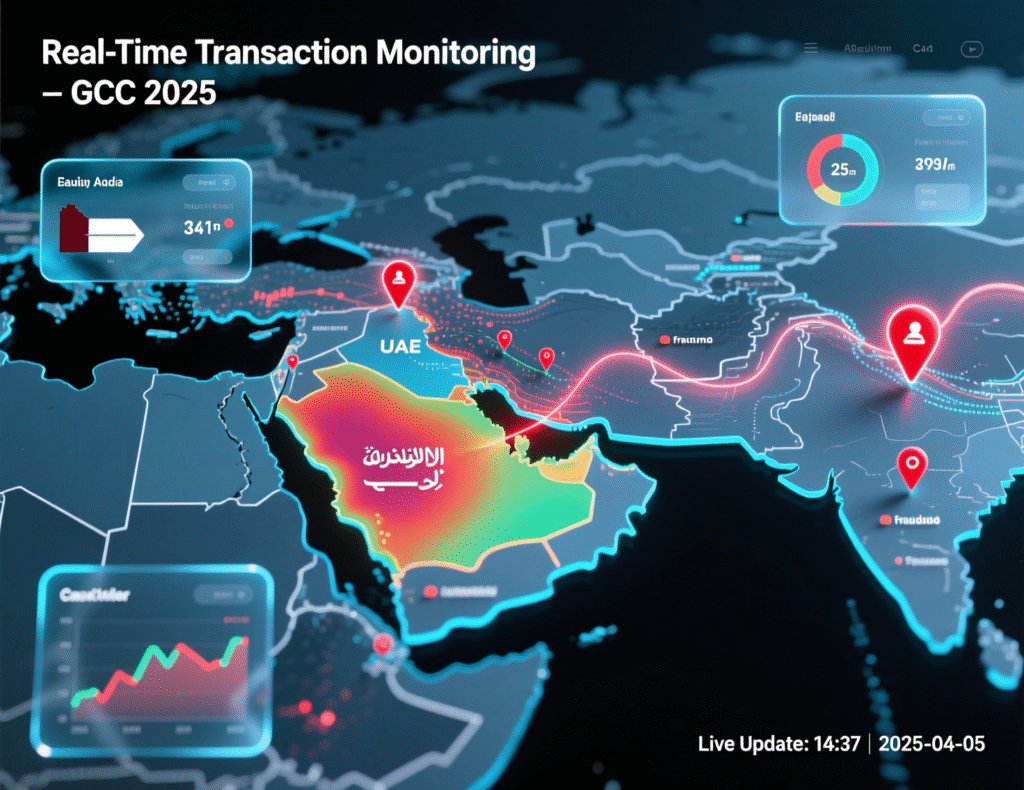

Real-Time Transaction Monitoring in Saudi, UAE and Qatar Banks

In KSA, UAE and Qatar, every high-risk payment now passes through AI-driven real-time transaction monitoring in banks. Models flag unusual patterns like sudden high-value transfers to new payees, spending at high-risk merchants, or salary accounts emptied immediately after payday often aligned with SAMA’s Counter-Fraud Framework, which explicitly stresses advanced technology and analytics for fraud prevention. A Riyadh fintech startup, for example, might tune these models to SAMA risk taxonomies while still offering instant payments.

Behavioural Biometrics and Device Intelligence for GCC Digital Banking

Gulf banks increasingly deploy behavioural biometrics for online banking security, analysing typing rhythm, swipe patterns, pressure and the way a user holds their phone. Combined with device fingerprinting, geo-velocity checks and IP reputation, these models help detect SIM-swap, OTP interception and session hijacking in Saudi and UAE apps. A Dubai e-commerce-focused bank might pair this with robust mobile journeys built with partners offering secure

AI-Powered Anti-Money Laundering and Payment Fraud Analytics

AI-powered anti-money laundering in GCC banks links AML and fraud teams around shared data. Models look for suspicious layering, mule accounts and unusual cross-border flows, enriching alerts with network graphs and anomaly scores. For a Doha SME-focused bank, anomaly detection models for payment fraud can tie into cross-border corridors while complying with QCB’s AML/CFT instructions on monitoring and reporting suspicious transactions.

Customer Security, UX and Trust in Saudi, UAE and Qatar

How AI Fraud Detection Protects Everyday Customers in Gulf Banks

For everyday customers, AI fraud detection in banking can silently stop scams before money leaves the account by blocking high-risk transfers, forcing extra authentication, or declining card-not-present payments that look abnormal. A Jeddah salary worker or Abu Dhabi government employee sees fewer mysterious debits and more timely alerts when risky login attempts appear, building trust in digital channels rather than pushing them back to branches.

Managing False Positives and Customer Complaints

However, over-blocking transactions in Riyadh, Dubai or Doha quickly leads to angry calls and social-media complaints. Gulf banks are therefore obsessed with reducing false positives in fraud detection systems by retraining models, segmenting customers more precisely, and using explainable scores so fraud teams can tune thresholds. Fewer unnecessary alerts directly reduce contact-centre volume and back-office manual reviews, cutting operational costs while improving Net Promoter Scores.

App-Based and Biometric Authentication vs SMS OTP in UAE & Saudi

UAE and Saudi banks are rapidly shifting from fragile SMS OTP to app-based and biometric approvals. CBUAE has signalled that SMS/email OTPs cannot remain the sole authentication method for digital banking and payments, pushing stronger, device-bound authentication and risk-based checks. TDRA meanwhile runs campaigns and AI tools like “Digital FraudHunter” to fight telecom-based scams. In practice, this means in-app prompts, Face ID or fingerprint plus AI risk checks, often built on secure mobile architectures similar to those used in

GCC Regulation & Compliance: SAMA, CBUAE and QCB on AI Fraud Detection

SAMA Expectations for AI Fraud Monitoring in Saudi Banks

AI fraud detection in Saudi banks under SAMA rules must align with the Counter-Fraud Framework, which emphasises technology, analytics and proactive detection across the fraud lifecycle. Banks are expected to reach defined maturity levels for fraud controls, including governance, real-time monitoring and management information. That means AI platforms must produce clear audit trails, model documentation and dashboards that internal audit and SAMA supervisors can understand.

CBUAE and UAE Banking Security Guidelines for AI

UAE Central Bank guidelines on AI digital banking security sit within broader rulebooks for enabling technologies, digital ID, and strong customer authentication. Circulars increasingly restrict single-factor methods like SMS OTP and push banks toward device-binding, biometrics and risk-based authentication areas where AI models are critical. For fintechs operating from ADGM or DIFC, this means proving that AI-driven fraud and identity solutions remain explainable, well-governed and aligned with CBUAE expectations.

QCB Guidance on Ethical AI and Cyber Security for Qatar Banks

QCB combines cyber and information security regulations with AML/CFT instructions that stress robust monitoring, risk-based controls and timely reporting. While the word “AI” may appear mostly in the context of enabling technologies, supervisors expect that AI fraud prevention in Qatar banks under QCB regulations includes clear governance, data-protection safeguards and the ability to explain why a payment or customer was flagged.

Training AI Models While Protecting Data, Privacy and Sharia Requirements

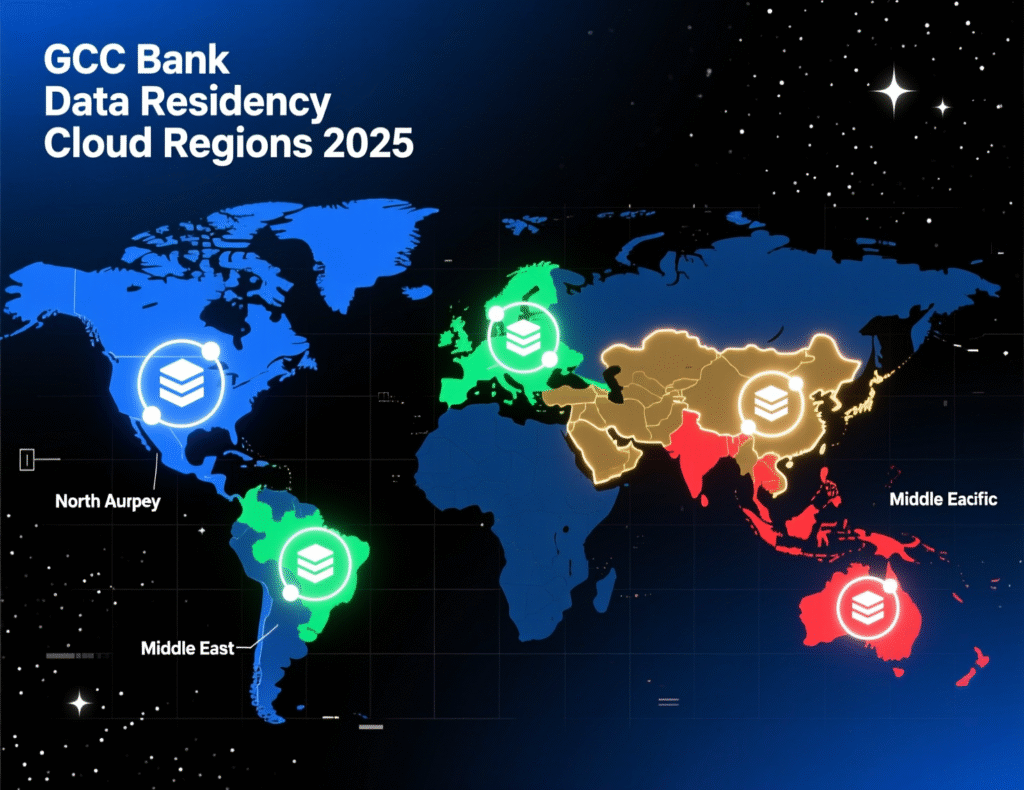

Data Residency and Cloud vs On-Prem AI Fraud Detection

GCC regulators increasingly expect sensitive banking data to stay within national borders. Saudi’s NDMO and PDPL set strict rules on storing and processing personal data, often requiring local hosting or approved transfers. In practice, banks combine sovereign or local cloud zones such as AWS Bahrain, Azure UAE Central and GCP Doha with carefully segmented AI workloads. Some keep raw data in-country while using global models or shared feature libraries.

Privacy, Consent and Model Governance in GCC Banks

To train models safely, banks anonymise or pseudonymise transaction and behavioural data, limiting direct identifiers. Model-risk governance frameworks monitor performance, drift and bias across Arabic and English UX journeys, ensuring fairness for different customer groups. When supervisors or Sharia boards ask why a transaction was blocked, teams need clear documentation, human-readable reason codes and dashboards often built on modern web stacks similar to.

Sharia-Compliant and Ethical AI Fraud Solutions for Islamic Banks

For Islamic banks, a “sharia-compliant AI fraud solution” mainly means models that respect Islamic product structures, avoid discriminatory features and do not steer customers toward non-halal products. A halal investment app, for example, might use AI to block suspicious withdrawals or logins while ensuring that training data and alerts do not penalise customers simply because they prefer zakat payments, charitable transfers or specific Islamic contracts.

Choosing and Implementing AI Fraud Detection Solutions in GCC Banks

AI Fraud Detection Solutions for GCC Banks

Some large banks in Riyadh, Dubai or Doha build their own machine-learning models; others adopt vendor platforms with pre-trained libraries for GCC fraud patterns, Arabic language support and local regulatory mappings. Evaluation should consider latency, explainability, integration with core systems and the vendor’s experience with SAMA, CBUAE and QCB examinations alongside digital-channel expertise similar to

Integration with AML, eKYC and Digital Channels

The strongest architectures connect AI fraud engines with AML transaction monitoring, sanctions screening and AI-powered eKYC. In Qatar, for instance, banks align AI-driven onboarding with digital-ID and e-KYC requirements; in Saudi, Open Banking APIs allow fraud systems to see cross-bank account behaviour; and in the UAE, UAE Pass helps tie secure identity flows directly into banking apps and web channels built by partners offering .

Step-by-Step Implementation Roadmap for Riyadh, Dubai and Doha Teams

Assess the current fraud stack

Map channels, loss types, fraud-operations capacity and regulatory gaps against SAMA, CBUAE and QCB expectations.

Define a data strategy

Identify required transaction, device and behavioural feeds; confirm data-residency constraints per country.

Run a focused PoC

Test AI models on one or two high-risk use cases (e.g., new payees or card-not-present) with clear success metrics.

Engage regulators and Sharia boards early

Share model-governance approaches, validation results and customer-impact assessments.

Industrialise and integrate

Roll out into production channels, link to case-management and AML systems, and embed into mobile and web apps potentially with partners experienced in

Monitor, tune and expand

Track fraud losses, false positives and customer satisfaction; expand AI coverage to new products and regions.

How Can Customers in Saudi, UAE and Qatar See AI Working to Protect Them?

Visible Signals That a Bank Uses AI Fraud Detection

Customers may notice smarter alerts, real-time warnings about unusual logins from new locations, or app screens asking them to confirm new devices or payees. Extra checks for high-risk transfers, temporary card locks after strange e-commerce activity, and contextual in-app education are all signs that AI fraud detection in banking is active behind the scenes.

What Customers Should Ask Their Bank About AI Security.

Saudi, UAE and Qatar customers can ask simple questions at branches, call centres or via chat: “How does my bank monitor suspicious activity?”, “Do you use AI to detect fraud?”, “Where is my data stored?” and “Can I opt out of certain data uses?” Knowing how banks align with SAMA, CBUAE or QCB expectations helps customers compare providers not just on rewards, but on security.

Staying Safe from Scams in GCC Even with AI Protection.

Even the best AI systems cannot stop every social-engineering scam. Customers in Riyadh, Dubai and Doha should treat unsolicited calls, SMS or WhatsApp messages asking for OTPs or passwords as fraud, and verify messages via official channels. TDRA and UAE Banks Federation run national fraud-awareness campaigns; similar initiatives appear under Saudi Vision 2030 and Qatar’s cybersecurity programmes, all reinforcing the basics: never share OTPs, double-check URLs, and act slowly when someone pressures you to “verify now.

If your bank or fintech in Saudi, the UAE or Qatar is reviewing its fraud controls, you don’t need to tackle AI in isolation. The team at Mak It Solutions can help you design secure web and mobile journeys, integrate AI engines, and build the dashboards your fraud and compliance teams actually use. Explore our or reach out for a tailored GCC-specific AI fraud readiness review that fits your regulators, your channels and your customers. ( Click here’s )

FAQs

Q : Is AI fraud detection allowed under Saudi SAMA rules for local banks?

A : Yes. SAMA’s Counter-Fraud Framework expects Saudi banks to use technology, analytics and proactive monitoring to manage fraud risks. AI fraud detection in Saudi banks under SAMA rules is therefore not only allowed but increasingly viewed as necessary to meet required maturity levels, provided it sits inside strong governance, documentation and testing regimes. Banks must evidence how models are validated, how false positives are handled, and how alerts flow into case management in line with SAMA’s broader cyber- and data-protection expectations under Vision 2030.

Q : Do UAE banks use AI to stop scam calls, phishing SMS and WhatsApp fraud?

A : UAE banks and telecom regulators actively fight phone and SMS fraud, combining AI analytics with awareness programmes. TDRA has launched multiple campaigns and AI-driven tools like Digital FraudHunter to help the public analyse suspicious messages, while UAE Banks Federation and CBUAE support national fraud-awareness initiatives. Banks themselves increasingly route suspicious links, unusual login attempts and risky device fingerprints through AI models, then warn customers via app notifications rather than relying solely on SMS supporting CBUAE’s broader push toward stronger, app-based authentication.

Q : Are AI fraud detection platforms for GCC banks usually hosted inside the region or on global cloud?

A : Hosting choices depend on each regulator’s data-residency rules and the bank’s risk appetite. In Saudi Arabia, NDMO and PDPL strongly favour keeping personal data inside the Kingdom or in tightly controlled transfers, which pushes many banks towards local or sovereign cloud deployments. In the UAE and Qatar, banks increasingly use regional cloud regions such as AWS Bahrain, Azure UAE Central and GCP Doha for AI workloads, while ensuring that raw customer data stays in-region and cross-border transfers are minimised and documented. Hybrid models—local data, global model logic are becoming common across GCC.

Q : How does AI fraud detection work for Sharia-compliant Islamic banking products in the Gulf?

A : For Islamic banks, AI fraud detection focuses on the how of monitoring, not changing the underlying Sharia-compliant products. Models still look at payment patterns, devices and behaviour, but governance ensures they do not discriminate based on protected attributes or penalise customers because they use specific Islamic structures such as murabaha, ijara or zakat payments. Fraud teams work closely with Sharia boards to document which data is used, how decisions are made and how customers can appeal. This mirrors broader ethical-AI discussions under Saudi Vision 2030 and national AI strategies emerging in the UAE and Qatar.

Q : Do Qatar banks use AI for e-KYC, face recognition and onboarding under QCB regulations?

A : Yes many Qatar banks are gradually embedding AI into e-KYC and digital onboarding journeys, including face recognition, document checks and risk scoring. QCB’s AML/CFT and technology-risk regulations require robust customer due-diligence, ongoing monitoring and cyber-security controls, but they remain technology-neutral, allowing AI as long as governance, accuracy and auditability requirements are met. In practical terms, banks often run AI checks behind digital-ID flows and video KYC, while ensuring that any biometric data is stored and processed in line with Qatar’s data-protection and cybersecurity expectations.