GCC Data Localization Laws for Cloud Computing in KSA & UAE

GCC Data Localization Laws for Cloud Computing in KSA & UAE

GCC Data Localization Laws for Cloud Computing: A Practical Guide for KSA, UAE and Qatar

GCC data localization laws for cloud computing decide which workloads must stay in-country (for example in Riyadh, Dubai or Doha) and which can sit in regional or global cloud regions. For CIOs and founders in Saudi Arabia, the UAE and Qatar, the key is mapping each dataset to PDPL-style rules, then choosing sovereign, hybrid or multi-cloud patterns that keep regulators, customers and boards comfortable.

Introduction

If you are a CIO in Riyadh, a founder in Dubai, or a legal lead in Doha, you’re walking a tightrope: your business wants global cloud agility, while GCC data localization laws for cloud computing push you to keep certain data inside national borders. Add PDPL-style rules, sector regulations and pressure from boards to “move faster on cloud”, and it quickly gets confusing.

In plain terms, GCC data localization laws decide which personal, financial, health and government datasets must remain in-country, and when controlled cross-border transfers are allowed. For most Saudi, UAE and Qatari organizations, the winning strategy is not “all-local” or “all-global”, but a smart hybrid or multi-cloud architecture aligned with local regulators.

In this guide, we’ll compare Saudi, UAE and Qatari regimes at a high level, answer practical questions like “Can we host outside KSA/UAE/Qatar?”, and show example cloud architectures you can actually implement across AWS Bahrain/UAE, Azure UAE Central/North and Google Cloud Doha.

Understanding GCC Data Localization for Cloud Computing

Data localization vs data residency vs data sovereignty

Think of data localization as “must stay in this country” (for example, Saudi government or critical financial systems kept only in KSA data centres). Data residency means “usually stored in a specific region, but can be mirrored elsewhere under controls” (for example, primary workloads in AWS Bahrain with encrypted backups in the EU). Data sovereignty is the higher-level idea that data is ultimately subject to the laws and regulators of the state where it sits SDAIA/NDMO in KSA, the UAE Data Office/TDRA, or Qatar’s CRA.

Why GCC regulators care where cloud data sits

GCC governments see data as a strategic asset. Localization rules support national security, law-enforcement access, digital sovereignty and economic policy, while also building citizen and investor trust in e-government, fintech and health platforms. Recent overviews of GCC privacy regimes highlight how Saudi PDPL, UAE PDPL and Qatar’s law all align with global trends but retain strong state interests in critical data, especially for telecoms, finance and public services.

Key GCC laws that touch cloud data

At a baseline, you’ll usually be dealing with.

Saudi Arabia

PDPL (as amended 2023) supervised by SDAIA/NDMO, plus transfer regulations for data leaving the Kingdom and cloud regulations now updated into CST’s Cloud Computing Services Provisioning Regulations (which replaced the earlier CCRF).

UAE

Federal Decree-Law No. 45 of 2021 (UAE PDPL), overseen by the UAE Data Office, with additional rules in DIFC and ADGM data protection regimes.

Qatar

Law No. 13 of 2016 on personal data, plus CRA’s cloud and interoperability/portability regulations.

Bahrain, Oman, Kuwait

Bahrain PDPL (Law 30 of 2018), Oman PDPL (Royal Decree 6/2022), and emerging frameworks in Kuwait alongside sector rules.

For GCC-wide or multi-country stacks, Mak It Solutions can help you map these regimes to a single cloud governance playbook rather than reinventing controls for every jurisdiction.

Country Snapshots Saudi Arabia, UAE, Qatar

This section gives concise, scannable answers to “What are the new data localization rules for cloud providers in Saudi Arabia under PDPL and the Cloud Computing Regulatory Framework?” and “How do UAE PDPL and free-zone laws affect where companies can host their cloud data?”

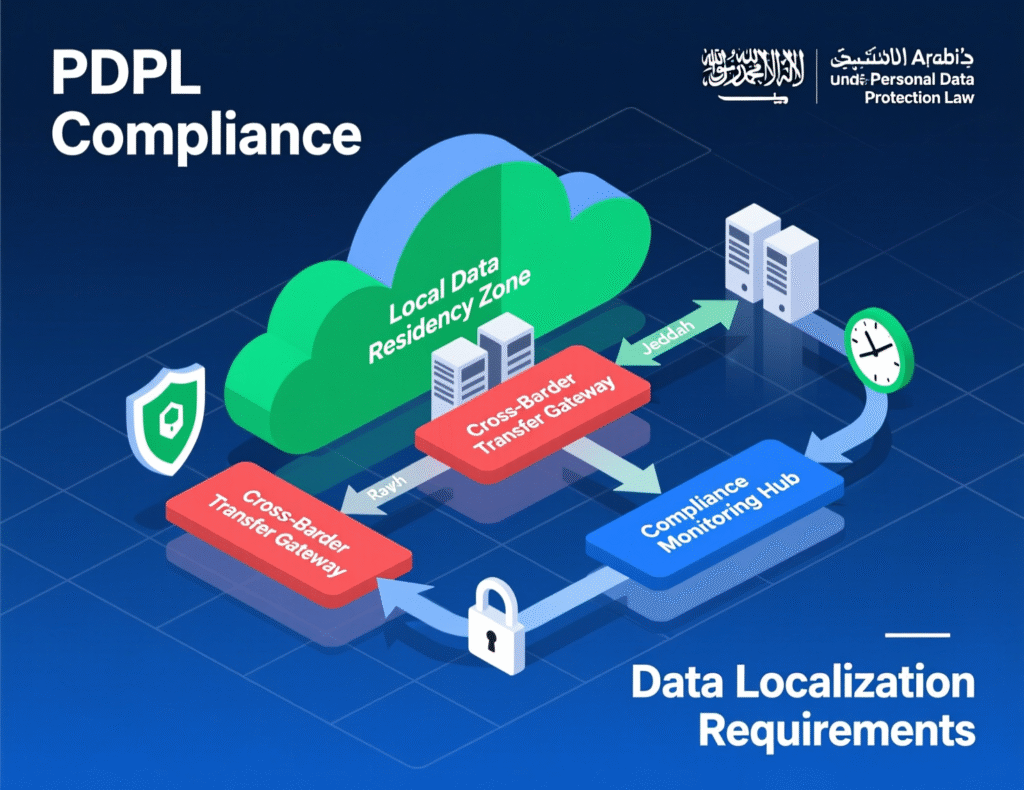

Saudi Arabia PDPL, SDAIA/NDMO, and the Cloud Computing Regulatory Framework

What are the new data localization rules for cloud providers in Saudi Arabia under PDPL and the Cloud Computing Regulatory Framework?

PDPL applies to most processing of personal data related to individuals in KSA, including by controllers outside the Kingdom targeting Saudi residents. SDAIA and NDMO issue detailed standards and cross-border transfer rules, which generally expect sensitive and government data to stay onshore unless strict safeguards are met.

CST’s updated cloud regulations (successor to CCRF) classify providers and data types, tightening expectations around government content and Level 3/critical workloads, while still allowing commercial use of regions like AWS Middle East (Bahrain/UAE) and new Saudi regions where risk is acceptable.

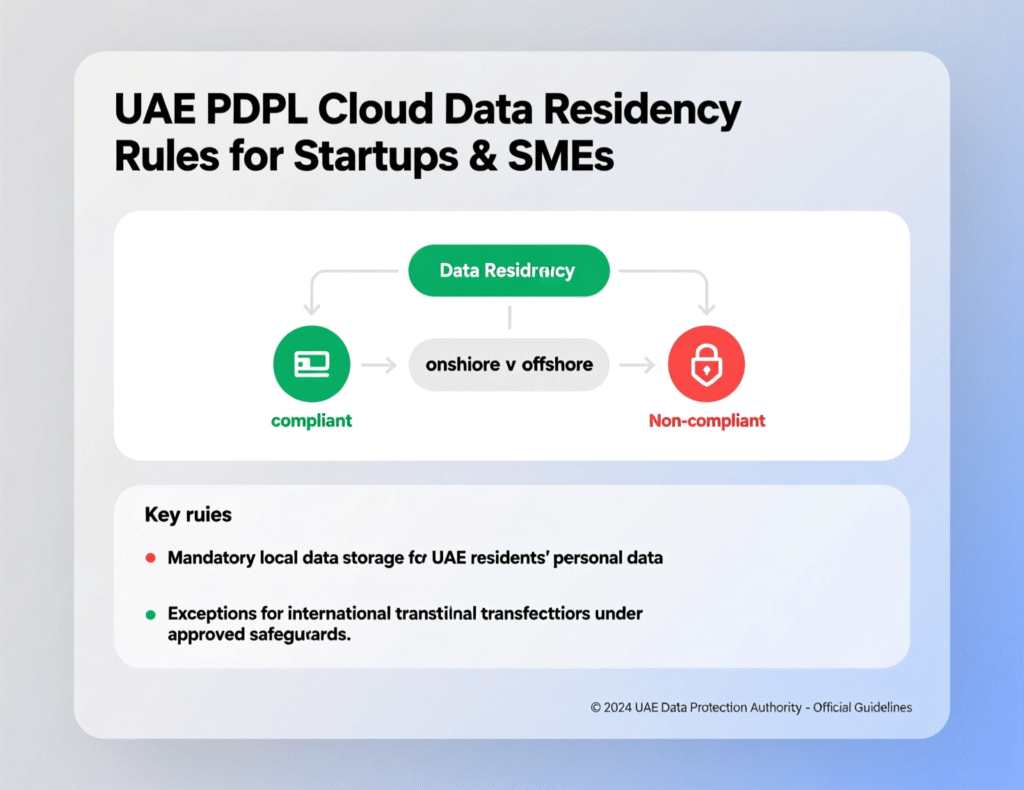

United Arab Emirates Federal PDPL, sector laws, and free zones (DIFC, ADGM)

How do UAE PDPL and free-zone laws (DIFC, ADGM) affect where companies can host their cloud data?

Onshore, UAE PDPL sets GDPR-style rules for processing and cross-border data transfers, allowing hosting abroad where “adequate” protection or contractual safeguards exist. DIFC and ADGM run their own GDPR-like regimes, often with stricter expectations around impact assessments and transfer mechanisms.

For Dubai and Abu Dhabi companies, this means: check which regime applies (onshore vs DIFC/ADGM), then align your cloud contracts and data flows. Some sectors (banking, telecoms, health, public services) face extra localization/approval requirements via the Central Bank, TDRA and health data laws.

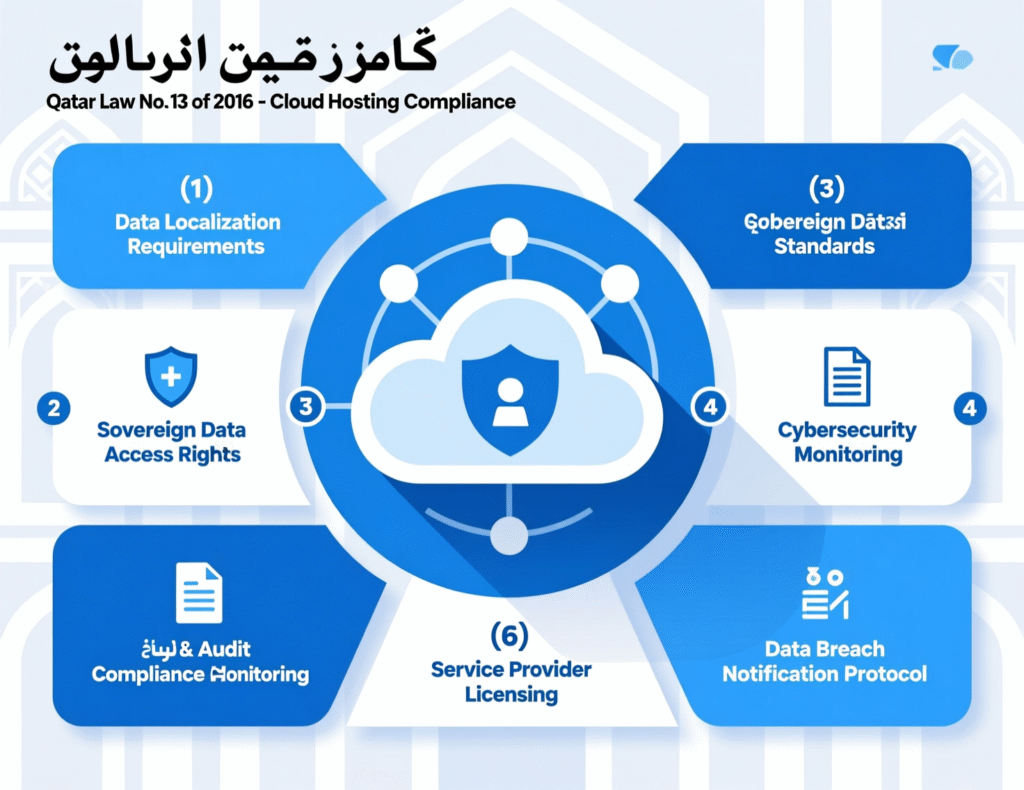

Qatar Law No. 13 of 2016 and CRA cloud framework

Qatar’s data privacy law covers most electronic processing of personal data and restricts transfers to countries without an adequate level of protection unless consent or other specific conditions apply.

CRA’s cloud policies and the Cloud Data Interoperability and Data Portability Regulation focus on portability between providers and preventing lock-in, while supporting Qatar’s ambition to be a regional digital hub through local facilities such as the Google Cloud Doha region and free-zone data centres.

Can We Host Cloud Data Outside KSA, UAE, or Qatar?

Saudi Arabia When can Saudi data leave the Kingdom?

Short answer: yes, some Saudi personal data can be hosted abroad, but not everything. Under PDPL and NDMO’s transfer regulation, cross-border transfers are allowed where there is an adequate destination, appropriate safeguards (such as contract clauses, binding rules) or specific necessity grounds, but transfers must stop if they harm data subjects or national security.

In practice, many Saudi teams keep government, security-sensitive or regulated financial workloads in Riyadh/Jeddah data centres or sovereign clouds, while using AWS Bahrain/UAE or other regions for lower-risk SaaS, analytics and content delivery.

UAE Data residency options across onshore, DIFC, ADGM, and foreign regions

In the UAE, fully local hosting is often required for government, some telecom and regulated financial data, especially when using national ID or critical infrastructure systems. For standard commercial SaaS, onshore PDPL typically allows EU/US or regional hosting if you implement transfer mechanisms, DPIAs and clear notices/consents.

Dubai and Abu Dhabi startups frequently combine Azure UAE North/Central, AWS UAE (me-central-1) and global regions, with contracts spelling out primary and backup locations, sub-processors and incident reporting.

Qatar & wider GCC Conditions for cross-border cloud transfers

Qatar PDPL generally allows cross-border transfers where the destination ensures adequate protection or specific conditions (such as explicit consent or contractual safeguards) are met. CRA’s cloud guidance and new interoperability rules push providers towards transparent data location, portability and clear exit rights.

Across Bahrain, Oman and Kuwait, laws increasingly follow the same pattern: a preference for in-country or GCC-region hosting for sensitive data, with adequacy or safeguards for wider transfers, particularly in financial and telecom sectors centred in Manama and Muscat.

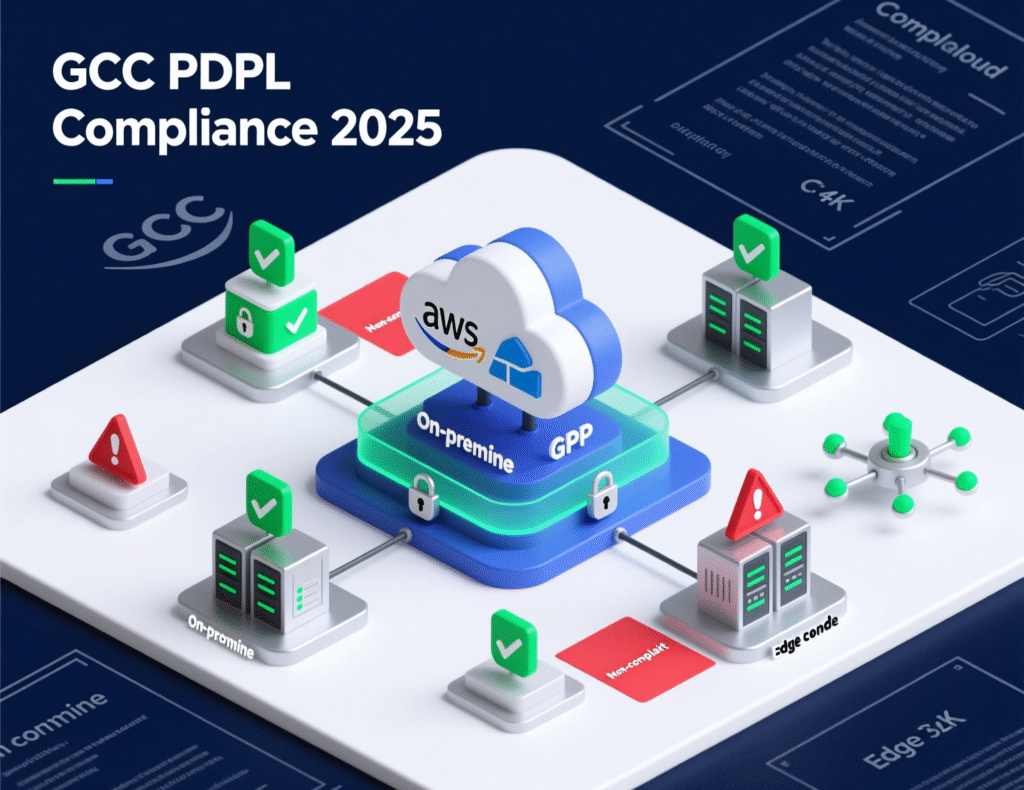

Designing a Compliant GCC Cloud Architecture

How can GCC businesses design hybrid or multi-cloud architectures that stay compliant with PDPL-style data localization rules?

Classify your data by sensitivity, sector, and regulator

Start with a data map: which systems hold Saudi, UAE or Qatari personal data; which are banking, health or government workloads; and which are generic logs or content. Use NDMO-style classifications (public, internal, confidential, restricted) and sector rules (SAMA, UAE Central Bank, QCB, health authorities) to tag every workload.

Choose between sovereign, hybrid, and multi-cloud models

For many GCC teams, patterns look like this:

KSA

Sovereign or in-Kingdom cloud for Level 3/government/financial data, with analytics or dev/test in AWS Bahrain or UAE.

UAE

Mix of onshore cloud, DIFC/ADGM stacks (for financial/legal entities) and global regions for non-regulated content.

Qatar

Primary hosting in Doha data centres/Google Cloud Doha, with tightly controlled external processing or regional DR.

Mak It Solutions often designs hybrid blueprints where sensitive tables stay in-country, while anonymised or aggregated data feeds global AI and analytics engines.

Implement controls for cross-border transfers and third parties

Once the architecture is sketched, operationalise it via:

contract clauses and DPAs covering data location, sub-processors and export controls;

strong encryption with customer-managed keys in Riyadh, Dubai, Abu Dhabi or Doha;

logging and DPIAs for all transfers; and

regular vendor reviews against PDPL-style standards and sector outsourcing rules (especially SAMA, TDRA, CRA).

Sector-Specific Localization Banking, Health, Government

Banking & fintech SAMA, UAE Central Bank, QCB expectations

Banks and fintechs in Riyadh and Jeddah face SAMA’s Cybersecurity Framework and cloud/outsourcing guidelines, which expect strong oversight of cloud providers, clarity on data location and restrictions on offshore processing of critical financial data.

In Dubai and Abu Dhabi, Central Bank and free-zone rules drive similar requirements, while QCB guidance in Doha increasingly emphasises local or GCC-region data centres for real-time payments and open banking.

Practical scenarios:

A Riyadh fintech keeps core ledgers in KSA but uses AWS Bahrain for sandbox APIs.

A Dubai payment startup runs production in Azure UAE North, with EU regions only for pseudonymised analytics.

Healthcare and life sciences Hosting patient data in the cloud

Health data is treated as highly sensitive. UAE Federal Law No. 2 of 2019 and related guidance restrict export of medical records without approvals, pushing hospitals towards UAE regions or accredited health clouds.

Saudi and Qatari providers follow similar principles: patient identifiers and clinical records are typically kept onshore, while de-identified datasets feed AI, research or regional analytics platforms in Bahrain or other GCC nodes.

Government & critical infrastructure National clouds and security carve-outs

For Saudi government entities, SDAIA/NDMO standards and national data classification frameworks require strict localization and security controls, especially for “Secret/Top Secret” levels and critical infrastructure.

UAE TDRA frameworks, e-government platforms (like UAE Pass) and CRA rules for Qatari public entities similarly push agencies towards national or approved sovereign clouds, with external regions only for well-defined, low-risk use cases or anonymised workloads.

Costs, Timelines, and Vendor Choices Under GCC Data Localization Laws

TCO of localized vs regional cloud deployments in Riyadh, Dubai, and Doha

Localized or sovereign deployments usually mean higher unit costs (specialist facilities, compliance overhead, limited economies of scale) but lower regulatory and reputational risk — especially for banks, health providers and government projects. Regional-only hosting may be cheaper and faster to scale, but can trigger legal reviews, approvals and contract re-negotiations whenever laws or guidance change (which in the GCC is frequent).

A typical Mak It Solutions engagement compares 3–4 options (local-only, GCC-regional, global hybrid, phased migration) and models both capex/opex and compliance risk.

How to evaluate cloud and SaaS vendors for GCC data residency

For each vendor in your RFP, ask.

Exactly which regions host production, backups and logs?

Which sub-processors are involved and where are they based?

Can you restrict data to KSA, UAE or Qatar regions (including AWS Bahrain/UAE, Azure UAE, GCP Doha)?

How do they support PDPL-style DPIAs, breach notifications and data subject rights under local laws?

Mak It Solutions’ cloud assessment services can help you standardise this checklist across all vendors instead of reinventing due-diligence for every new SaaS.

Roadmap — 6–12 month plan to reach PDPL-ready cloud compliance

A realistic GCC roadmap might look like.

0–3 months: data mapping, quick policy fixes, urgent contract updates and stop-gap controls for highest-risk transfers.

3–6 months: implement new architectures (segmentation, region moves), roll out DPIAs and logging, and rationalise vendors.

6–12 months: embed governance (training, playbooks, annual audits), then regularly review against updated KSA, UAE and Qatar guidance.

Key Takeaways and Next Steps for GCC Cloud Teams

Executive checklist for CIOs and founders in KSA, UAE, Qatar

For a quick “Red/Amber/Green” view

Laws

Are you tracking Saudi PDPL, UAE PDPL, Qatar Law 13/2016 and sector rules (SAMA, TDRA, CRA, QCB)?

Architecture

Do you know exactly which workloads live in Riyadh, Dubai, Abu Dhabi, Doha, Bahrain or further afield?

Vendors

Can every key SaaS/cloud vendor show you data location maps, sub-processor lists and transfer safeguards?

If any of these answers feel vague, it’s a red flag.

When to involve local counsel and cloud compliance partners

Bring in GCC counsel and a specialist cloud partner like Mak It Solutions when:

entering a new market (for example, expanding from Dubai into Riyadh or Doha);

onboarding a mission-critical global SaaS provider; or

moving regulated workloads (banking, health, gov) to AWS, Azure or GCP.

Local legal advice plus a regionally experienced cloud architecture team usually costs far less than fixing a mis-designed deployment after a regulator, auditor or large customer raises concerns.

If you’re juggling PDPL obligations, sector regulations and ambitious digital roadmaps across Riyadh, Dubai, Abu Dhabi or Doha, you don’t have to design your cloud architecture alone. The Mak It Solutions team can help you classify data, choose the right combination of sovereign, hybrid and multi-cloud, and work through vendor and contract risks step by step.

Reach out via our services page at Mak It Solutions to book a consultation, or plan a workshop where we review your current stack and draft a GCC-ready blueprint that your board, regulators and customers can all trust.( Click Here’s )

FAQs

Q : Does Saudi PDPL always require personal data to be stored inside the Kingdom?

A : No, Saudi PDPL does not require all personal data to remain in the Kingdom, but it does create a strong onshore default, especially for sensitive and government data. Under the NDMO transfer regulation, data can leave KSA where adequacy, safeguards or specific legal bases (like necessity for a contract) exist, but transfers must stop if they endanger national security or harm data subjects. In practice, many organizations keep critical workloads in KSA regions and use offshore environments mainly for lower-risk or anonymised data, in line with Saudi Vision 2030 and SDAIA’s emphasis on trusted data use.

Q : Is it legal for a Dubai or Abu Dhabi startup to host customer data in an EU or US cloud region?

A : Yes, many UAE startups legally host data in EU or US regions, provided they comply with UAE PDPL (or DIFC/ADGM rules where applicable). That typically means identifying a transfer mechanism, such as adequacy, contractual clauses or explicit consent, and documenting risk through DPIAs. Some data types (for example, certain government, telecom or health data) are more tightly constrained and may need to remain in approved UAE data centres or require regulator approvals. The UAE’s PDPL and data strategies aim to support digital transformation and cross-border trade while still protecting residents’ rights, so a balanced, risk-based approach is expected.

Q : Can a Doha-based SaaS provider keep backups in another GCC country like Bahrain or Oman?

A : Often yes, especially where the backup environment offers strong security and contractual safeguards, but it’s not automatic. Qatar’s Law No. 13 of 2016 restricts transfers to destinations without adequate protection unless conditions such as consent or contractual guarantees are in place. CRA’s cloud and interoperability rules also emphasise transparency and portability of data across providers. In practice, many Doha SaaS companies keep production in local data centres or Google Cloud Doha and use GCC neighbours such as Bahrain or Oman for encrypted disaster-recovery copies, carefully documenting controls to satisfy Qatar’s regulators and the expectations of QCB-regulated customers.

Q : What are the main data localization risks for banks using global cloud providers in Riyadh and Dubai?

A : For banks in Riyadh and Dubai, the core risks centre on non-compliance with SAMA, UAE Central Bank and PDPL-style requirements. If critical ledgers, payment data or identity records are stored or processed in unapproved regions, regulators may challenge outsourcing arrangements, impose remediation or, in extreme cases, restrict services. There is also operational risk if incident reporting, audit trails or key-management responsibilities are unclear between bank and cloud provider. To manage this, banks typically maintain local copies of key data, use approved in-country or GCC regions, and subject cloud contracts to detailed regulatory and legal review a process firms like Mak It Solutions often facilitate with both IT and compliance teams in the room.

Q : Do GCC data localization laws apply to non-personal analytics and log data in the cloud?

A : Usually the laws focus on personal data, but in real projects the line is blurry. Aggregated analytics or logs may still contain identifiers, IP addresses or behavioural patterns that bring them within the scope of PDPL-style regimes in Saudi Arabia, the UAE and Qatar. Sector rules (especially for telecoms, banking and critical infrastructure) may also treat certain non-personal operational data as sensitive for security reasons. A safe approach is to classify logs and analytics by content and re-identification risk, then decide whether they can sit in regional or global regions, or need local storage. This aligns with the direction regulators and GCC digital strategies are taking, and avoids surprises during audits or investigations.