Saudi Vision 2030 Digital Transformation and AI Future

Saudi Vision 2030 Digital Transformation and AI Future

Saudi Vision 2030 Digital Transformation and AI Future

Saudi Vision 2030 digital transformation is Saudi Arabia’s long-term plan to move from an oil-dependent economy to a diversified, data- and AI-driven digital economy, powered by smart government, cloud, and advanced infrastructure. It is setting the pace for wider GCC digital transformation, influencing how cities like Dubai, Abu Dhabi, Doha, and Manama design e-government, AI, and smart-industry ecosystems.

Introduction

Saudi Vision 2030 digital transformation is not just a Saudi story; it’s a regional reset for how people live, work, and build businesses across the Gulf. From Riyadh’s fintech corridors to Dubai’s AI districts and Doha’s smart city projects, digital policy has become a core pillar of economic strategy, not a side project.

For citizens and residents, this shows up as seamless apps for visas, health, and payments. For companies in Riyadh, Dubai, Doha, Jeddah, NEOM, Dammam, Sharjah, Kuwait, Bahrain, and Oman, it means new rules, new infrastructure, and serious opportunities in AI, cloud, logistics, and Industry 4.0. In the rest of this guide, we look at digital government, AI and data, smart cities, skills, costs, and how GCC businesses can plug into Saudi Vision 2030 digital transformation at a practical level.

What Is Saudi Vision 2030 Digital Transformation?

From Oil Dependence to a Digital Economy

Vision 2030 is Saudi Arabia’s long-term blueprint to diversify away from oil and build “a vibrant society, a thriving economy, and an ambitious nation,” with digital technology as a key enabler.The National Transformation Program turns this vision into sector-level reforms, including e-government, smart infrastructure, and support for private-sector innovation. Digital tools from e-payments to smart ports are how Saudi grows non-oil GDP, attracts FDI, and creates knowledge-intensive jobs.

Core Digital Pillars of Vision 2030

Core pillars include digital government, AI and data, cloud and connectivity, digital skills, and innovation ecosystems. SDAIA leads the National Strategy for Data & AI (NSDAI), aiming to place Saudi among the world’s leading AI nations, while the Digital Government Authority (DGA) regulates how ministries and platforms deliver integrated services. Together with programs under the National Transformation Program, these pillars create a common digital backbone that businesses in Riyadh, Jeddah, and across the GCC can build on.

The Role of Digital Transformation in Economic Diversification

Digital transformation is the main execution engine for Saudi economic diversification under Vision 2030: it digitizes government, modernizes industry, and enables new sectors like fintech, e-commerce, cloud, and AI services. By automating workflows and embedding data into policy and operations, it raises productivity across public and private sectors.

It also lowers barriers for SMEs and foreign investors: cloud, APIs, and digital IDs make it easier to launch, scale, and integrate services across borders. For GCC neighbors, Saudi’s push sets a regional benchmark encouraging data-sharing, smart logistics, and joint AI projects that support a more connected Gulf digital economy.

Digital Government and Everyday Life in Saudi Arabia

How Platforms Like Absher and my.gov.sa Change Daily Life

Platforms like Absher, my.gov.sa, Tawakkalna, Qiwa, Najiz, and the new digital Resident ID have turned many once paper-based processes into mobile, 24/7 services. Residents now renew IDs, manage traffic violations, update labor contracts, and handle family or visa services online instead of queuing at branches.

For expats in Riyadh, Jeddah, and Dammam, these tools mean more transparency and fewer trips to government offices. Under DGA’s standards, ministries are increasingly integrated, so a single login or digital identity can unlock multiple services similar in spirit to UAE Pass in Dubai and Abu Dhabi, or Qatar’s emerging digital ID ecosystem.

NDMO, DGA, and Data Governance in Saudi Digital Government

Behind the scenes, the National Data Management Office (NDMO), under SDAIA, sets data classification, residency, and interoperability policies, while DGA regulates digital government quality and integration.For vendors and SaaS providers targeting Saudi ministries, this means solutions must respect data localization, privacy, and security rules and often integrate with national platforms and APIs rather than operating in isolation.

Comparing Saudi Digital Government with UAE and Qatar

Saudi’s my.gov.sa focuses on unifying access to services across ministries, while the UAE’s u.ae portal and UAE Pass emphasize single-sign-on and life-journey experiences (citizen, resident, visitor, investor). Qatar’s Hukoomi, backed by MCIT and overseen from a trust perspective by the Communications Regulatory Authority (CRA), serves as the one-stop gateway for living and working in Doha and Lusail. Over time, similar digital ID and trust models could enable more seamless cross-border services within the GCC.

AI, Data, and Cloud.

SDAIA, NSDAI, and Saudi’s AI Ambitions

SDAIA’s National Strategy for Data & AI sets targets for Saudi Arabia to become a leading global AI hub by 2030, tying 66 of 96 Vision 2030 strategic objectives to data and AI. AI is being deployed in smart city planning, traffic management, healthcare, and predictive maintenance across government and regulated industries.

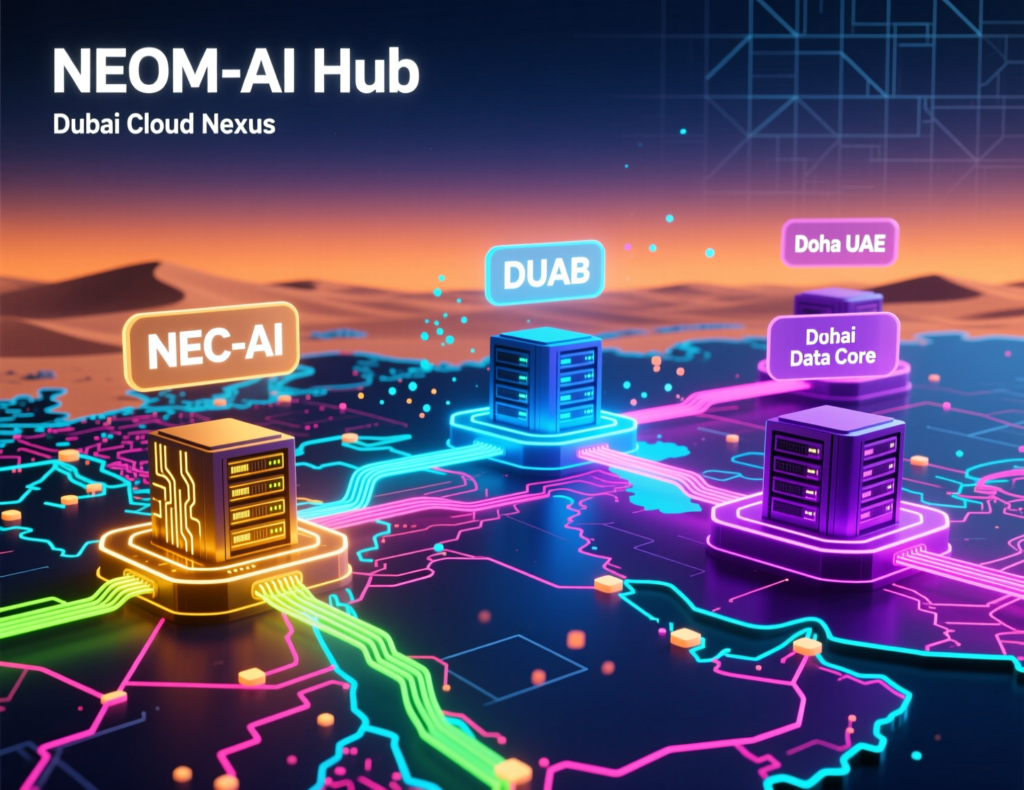

The PIF-backed AI company Humain is building large-scale data centers in Riyadh and Dammam, powered by advanced Nvidia and AMD chips, to host AI and cloud services for the Kingdom and the wider region.This infrastructure, combined with open-data and analytics initiatives, positions Saudi as a regional compute and AI services hub.

Data Centers, Cloud Regions, and Data Residency in KSA

Saudi’s data center masterplans foresee multi-billion-dollar investments across Riyadh, Jeddah, NEOM, and the Eastern Province, with hyperscale cloud regions from providers like AWS and Microsoft expected around 2026.NDMO frameworks and sectoral regulations define which data must stay inside the Kingdom, while less-sensitive GCC workloads can still leverage nearby regions like AWS Bahrain, Azure UAE Central, and GCP Doha.

UAE AI Hubs, Qatar Digital Trust, and Regional Collaboration

The UAE has positioned Dubai and Abu Dhabi as AI and fintech hubs through initiatives under TDRA, ADGM, and DIFC, enabling regulatory sandboxes for cloud, digital assets, and AI-driven services. Qatar’s CRA and MCIT focus on data protection and cloud policy, reinforcing digital trust as Doha and Lusail expand their smart-city footprint.Kuwait, Bahrain, and Oman are aligning telecom, cloud, and data regulations with these trends, opening the door for GCC-wide interoperability.

Smart Cities, Infrastructure, and Industry 4.0 Use Cases

NEOM, The Line, and Next-Gen Saudi Smart Cities

NEOM and its sub-projects like The Line are flagship Vision 2030 initiatives that combine AI, IoT, digital twins, and green energy with new models of urban living and tourism. For GCC tech vendors, they are testbeds for everything from autonomous mobility and robotics to immersive tourism and advanced manufacturing setting patterns other cities in the region can adopt.

Smart Logistics, Ports, and Drone Delivery in Saudi Arabia

Saudi is investing heavily in smart ports, logistics corridors, and drone delivery pilots to support its ambition to become a global logistics hub. These initiatives tie directly to Vision 2030 goals and complement trade flows through Dubai’s Jebel Ali Port, Abu Dhabi’s Khalifa Port, and Qatar’s Hamad Port, plus cross-border e-commerce serving Riyadh, Jeddah, Doha, and Dubai.

Industry 4.0 and Advanced Manufacturing (Alat, Robotics, Automation)

Initiatives like PIF-backed Alat focus on advanced manufacturing, robotics, and electronics, plugging Saudi into global supply chains for AI hardware and industrial equipment. GCC manufacturers from Jubail to Abu Dhabi and Sohar—can partner on automation projects, robotics integration, and smart factory platforms, often delivered via specialized partners such as business intelligence services and industrial IoT solutions.

Skills, Jobs, and Private Sector Growth Under Vision 2030

Saudi Tech Jobs in AI, Cloud, and Cybersecurity

As Vision 2030 projects scale, demand is rising for data scientists, AI/ML engineers, cloud architects, cybersecurity specialists, and digital product managers in Riyadh and other Saudi cities.For Arabic-speaking professionals from across the GCC, this creates mobility options and remote roles tied to Saudi-based platforms, especially in AI, 5G, and industrial IoT topics also explored in the 5G business opportunities in the Middle East guide.

Digital Skills Programs and Partnerships (MCIT, SDAIA, Global Tech)

Saudi’s MCIT, SDAIA, and global partners like IBM run large-scale digital skills programs, coding bootcamps, and AI academies aligned with NSDAI and Vision 2030.Universities in Riyadh, Jeddah, and Dammam are updating curricula around data, cybersecurity, and cloud, while EdTech platforms provide flexible learning for young Saudis and GCC residents who want to participate in this new labor market.

Startups, Investors, and GCC Private Sector Opportunities

Saudi’s startup ecosystem is buoyed by PIF-backed funds, accelerators, and AI champions like Humain, while investors from Dubai, Abu Dhabi (ADGM, DIFC), and Doha increasingly view Riyadh as a core market. A Riyadh fintech, for example, might build open-banking products under SAMA’s framework, then use UAE or Qatar entities for regional expansion.Meanwhile, a Doha SME can deploy apps in Saudi-aligned cloud regions with help from partners like our web development services and front-end / back-end development teams.

Costs, Timelines, and Best Practices for Engaging With Vision 2030 Tech

Key Milestones on the Road to 2030 and Beyond

Between now and 2030, the big milestones are national-scale data centers and cloud regions, AI infrastructure rollouts, and smart city phases in places like NEOM. Beyond 2030, the focus will likely shift from building to optimizing: monetizing data, exporting AI services, and deepening GCC integration across logistics, fintech, and digital government.

Budget, Compliance, and Risk Considerations for Tech Vendors

Budgets for Vision 2030-related tech must factor in Arabic/English UX, local hosting or Saudi-compliant data residency, cybersecurity, and regulatory work with NDMO, SAMA, TDRA, and Qatar’s CRA/MCIT. Fintechs, for example, need to align with SAMA’s open banking rules, while telecom- and cloud-focused vendors align with TDRA and CRA frameworks and may rely on regional partners such as cloud-ready Next.js or Flutter development services.

How GCC Businesses Can Practically Engage With Saudi Vision 2030 Opportunities

Research and prioritise sectors

Map your products to Vision 2030 priorities like digital government, AI, logistics, health, and Industry 4.0, focusing on Riyadh, Jeddah, NEOM, Dubai, Abu Dhabi, Doha, and Lusail.

Run a compliance and data assessment

Identify which Saudi and GCC regulations apply (SAMA, DGA, NDMO, TDRA, CRA, QCB) and define where data should be hosted (KSA vs AWS Bahrain vs Azure UAE Central vs GCP Doha).

Choose the right local and technical partners

Work with regional implementation teams such as Mak It Solutions’ services in web, mobile, BI, and digital marketing to localize UX, integrate with government systems, and harden security.

Start with a pilot project

Launch a focused pilot (for example, a Riyadh fintech MVP, a Dubai–Riyadh e-commerce integration, or a Doha-based analytics platform using Saudi data) to validate product–market fit and compliance.

Scale across the GCC

Once validated, extend to UAE, Qatar, Bahrain, Kuwait, and Oman with a unified architecture, shared data models, and ongoing optimization using analytics and AI supported by partners that understand both tech and regulation.

Bottom Lines

Saudi Vision 2030 digital transformation is reshaping how governments serve people, how companies operate, and how cities grow across the GCC. The real engines are clear: AI and data, cloud and data centers, smart cities and logistics, and a new generation of digital skills and startups.

For startups, enterprises, regulators, and investors in Riyadh, Dubai, Abu Dhabi, Doha, Jeddah, NEOM, Kuwait, Bahrain, and Oman, the next step is structured: honestly assess where you stand today, decide which Vision 2030 streams you want to play in, and design a roadmap technology, compliance, and partnerships that lets you grow with the region’s digital future.

If you’re a GCC-based founder, CIO, or investor trying to understand where your products fit into Saudi Vision 2030, you don’t have to figure it out alone. Our team at Mak It Solutions can help you map regulations, design cloud and data architectures, and build the web and mobile platforms your customers actually want to use—securely.

Explore our full range of services, from web development and digital marketing to custom analytics and AI advisory, or contact us for a tailored Vision 2030 and GCC digital strategy.

FAQs

Q : Is Saudi Vision 2030 digital transformation aligned with SAMA rules for fintech and open banking apps?

A : Yes. SAMA’s Open Banking Policy and Open Banking Framework were launched specifically to support Vision 2030 goals around financial sector innovation and inclusion.Fintech and open banking apps operating in Riyadh, Jeddah, and across the Kingdom must align with SAMA’s technical standards, customer-consent rules, and security controls, including how APIs handle account and payment data. In practice, Saudi Vision 2030 digital transformation creates demand for new fintech products, while SAMA’s framework ensures those products remain safe, interoperable, and trustworthy.

Q : How can UAE-based startups collaborate with Saudi Vision 2030 smart city or AI projects?

A : UAE startups in Dubai, Abu Dhabi, or Sharjah can join Vision 2030 by targeting Saudi smart city and AI initiatives as technology partners, especially in sectors like Industry 4.0, logistics, fintech, and citizen services. Many pilots in NEOM, Riyadh, and other Saudi cities rely on cloud, data analytics, and AI platforms similar to those supported by UAE regulators and zones like TDRA, ADGM, and DIFC. Building compliant, Arabic-first digital products—and partnering with implementation firms used to working on both sides of the border makes collaboration much smoother.

Q : Can Qatar companies use Saudi cloud regions while meeting CRA and MCIT data protection requirements?

A : In many cases, yes, but it depends on the type of data and sector. Qatar’s Data Protection Law and CRA guidance regulate how personal and sensitive data can be processed and stored, while cloud policy documents clarify requirements for cross-border hosting. A Doha or Lusail company might use Saudi data centers for analytics or AI workloads if contractual and technical safeguards are in place, including encryption and data-processing agreements aligned with CRA and MCIT rules. Legal review and a solid architecture are essential before moving workloads.

Q : Are Saudi digital government platforms like Absher and Tawakkalna fully available in English for expats?

A : Most core Saudi e-government services such as Absher, Tawakkalna, and my.gov.sa offer strong English support, but coverage and depth can vary by service and update cycle. For expats in Riyadh, Jeddah, and Dammam, this means they can usually handle essentials like traffic, residency, health status, and appointments from their phone in English, though some advanced journeys may still require Arabic or assistance. DGA’s broader mandate under Vision 2030 is to keep improving accessibility, UX, and consistency across all government platforms for citizens, residents, and visitors.

Q : What are the main differences between Saudi, UAE, and Qatar regulations for hosting AI workloads in local data centers?

A : Saudi Arabia focuses on data classification and localization via NDMO, sector regulators (like SAMA), and SDAIA’s AI strategy especially for government and critical sectors The UAE, through TDRA and free zones like ADGM/DIFC, emphasizes flexible but supervised AI, cloud, and fintech sandboxes, with strong telecom and digital-government regulation. Qatar, under CRA and MCIT, puts heavy weight on data protection and cloud policy, especially for telecom, government, and financial services. AI workloads that touch personal or critical data must be carefully mapped to these three regulatory environments before deciding hosting locations.