Mobile App Trends 2025 MENA: Fintech, Super Apps, UX

Mobile App Trends 2025 MENA: Fintech, Super Apps, UX

Mobile App Trends 2025 MENA: Fintech, Super Apps, UX

In 2025, mobile app trends in MENA are driven by near-universal smartphone adoption in the GCC, the rise of super apps, GenAI-powered experiences and strict data residency rules in Saudi Arabia, the UAE and Qatar. GCC users now expect mobile apps to be instant, Arabic-first, secure by design, and deeply integrated with local payments, digital IDs and regulations. Teams that ignore these expectations will see higher churn, lower trust and tougher conversations with regulators.

Introduction

2025 is a turning point for mobile app trends 2025 MENA because GCC users are now almost permanently mobile, and their expectations have quietly become world-class. Saudis, Emiratis and Qataris live in markets where smartphone penetration is above 90%, data is cheap and 5G is common, so they benchmark every new app against the best of Riyadh, Dubai, Doha and against global leaders from the US, UK and EU.

That creates a sharp pain point for founders and product teams: high expectations and almost zero patience for slow, buggy or confusing apps. When users already spend around 3.5 hours per day in mobile apps globally, they have no reason to tolerate poor GCC apps when US, UK or German products feel smoother and safer.

In simple terms, MENA users in Saudi Arabia, the UAE and Qatar expect apps that are fast, Arabic-first, trusted and locally compliant. The rest of this guide breaks down the key trends, vertical plays and tech decisions GCC teams need to get right in 2025–26.

Snapshot of Mobile App Trends 2025 in MENA

Why MENA’s mobile app market matters in 2025

In 2025, the MENA mobile app market stands out because it combines young populations, high smartphone penetration and aggressive digital transformation agendas like Saudi Vision 2030 and the UAE’s Digital Government strategy. By the end of 2023, around 427 million people in MENA (roughly 64% of the population) subscribed to mobile services, and nearly half already used mobile internet.

Within the GCC, smartphone adoption is even more intense: multiple reports estimate over 90% of people own a smartphone, translating into roughly 40 million users across Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain and Oman. Mobile is no longer just “one channel”; it is the primary interface for banking, government, retail, logistics and entertainment.

Key mobile app usage and revenue statistics in GCC

The GCC smartphone market reached about 60 million units shipped in 2024, with forecasts pushing that towards nearly 99 million units by 2033 at a 5%+ CAGR. In the wider Middle East, smartphone shipments jumped 15% year-on-year in Q2 2025 to 13.2 million units, making it one of the fastest-growing regions worldwide.

Globally, users downloaded around 136 billion apps in 2024, and average time in apps is now about 3.5 hours per user per day, with mobile apps generating tens of billions in quarterly consumer spending.GCC markets sit at the high end of this curve: Saudi Arabia, for example, reports that more than 90% of adults own a smartphone and spend multiple hours per day online via mobile.

How 2025 trends differ from 2023–24 in MENA

Compared with 2023–24, 2025 shifts MENA from “apps everywhere” to “super apps + AI everywhere.” GCC consumers increasingly prefer ecosystems that combine payments, mobility, food delivery, retail, loyalty and even government touchpoints in a single experience.

Three big changes stand out.

Super apps are moving from early experiments to mainstream usage in Riyadh, Dubai and Doha.

GenAI is crossing from novelty into real features in fintech, commerce and customer support.

Regulatory and data governance pressure from bodies like SDAIA/NDMO, TDRA and QCB is turning “we’ll fix compliance later” into a risky myth.

What MENA Users Expect from Mobile Apps in 2025

Speed, reliability and performance benchmarks in GCC

For GCC users in 2025, “fast” generally means visible content in under 2–3 seconds on 4G/5G and no obvious jank on low-to-mid Android devices. If your app is noticeably slower than a US or UK banking or retail app, users will assume your product is low quality and uninstall quickly.

Riyadh, Dubai, Doha, Jeddah, Abu Dhabi and Sharjah all have strong 5G rollouts, but networks still fluctuate indoors, on the metro, between cities and during big events or Ramadan peaks. Apps that win in the GCC:

Cache smartly so key journeys (e.g., balance view, QR code for pickup) survive flaky networks.

Fail gracefully with clear error states in Arabic and English.

Use lightweight SDKs and cross-platform frameworks like React Native or Flutter carefully, optimizing bundle size and startup time. (Mak it Solutions)

Personalization and Arabic-first UX expectations

By 2025, “Arabic support” no longer means “we added a translation toggle buried in settings.” Saudi, Emirati and Qatari users expect:

Flawless RTL layouts for Arabic, following native iOS/Android conventions.

Seamless switching between Arabic and English in a single journey (e.g., Arabic UI but English merchant names).

Localized content and imagery reflecting Riyadh, Jeddah, Dubai, Abu Dhabi, Doha and Lusail not generic “Middle East clipart.”

Personalization that uses behavioral signals and preferences, not creepy third-party tracking.

This is also where MENA apps can leapfrog many US, UK or German incumbents that still struggle with genuine bilingual and RTL UX.

Trust, security and transparent data usage

Trust is becoming a hard differentiator. GCC users are more aware of privacy debates in the EU (GDPR), UK (UK-GDPR) and US (HIPAA, PCI DSS) and expect similar clarity from local apps.

Winning apps in KSA, the UAE and Qatar:

Make biometric login (Face ID / fingerprint) and strong device binding the default.

Clearly explain why each permission is needed (location, contacts, photos) in Arabic and English.

Provide human-readable privacy summaries, not just legal PDFs.

Reflect local laws like Saudi’s PDPL (overseen by SDAIA), UAE federal data protection law and Qatar’s data protection regime.

Sector-Specific Mobile App Trends in GCC

Fintech and banking apps in Saudi and UAE

In 2025, Saudi and UAE users expect fintech and banking apps to offer instant onboarding, real-time payments, clear Sharia-compliant options and 24/7 human support inside the app. If an app can’t open an account in minutes using Absher, UAE Pass or other digital ID rails, it feels outdated.

On the Saudi side, the Open Banking KSA ecosystem under SAMA is driving richer account aggregation, spending insights and embedded finance. In the UAE, ADGM and DIFC act as fintech sandboxes where digital banks, wallets and virtual asset platforms experiment with new flows – but still under strict AML, KYC and cybersecurity requirements.

For GCC founders, matching expectations means.

Leveraging local payment rails (Mada, SADAD, instant payments) plus Apple Pay / Google Pay.

Designing flows that respect SAMA, QCB and UAE Central Bank rules while still feeling as smooth as leading US or EU neobanks.

E-commerce, retail and super apps in Riyadh, Dubai and Doha

E-commerce and lifestyle apps in Riyadh, Jeddah, Dubai, Abu Dhabi, Sharjah, Doha and Lusail are converging into super-app experiences: one-tap checkout, loyalty wallets, ride-hailing, food delivery, ticketing and bill payments in a single interface.

What GCC users now expect.

Highly reliable same-day or next-day delivery, with real-time map tracking.

Trusted BNPL and installment options, presented transparently and compliant with regulators.

Wallets that unify loyalty points, gift cards and promo balances.

Ramadan-aware UX – for example, delivery windows tuned around iftar, themed offers and push notifications aligned with local schedules.

Government and citizen apps like Absher, UAE Pass and Hukoomi

Government platforms such as Absher (Saudi Arabia), UAE Pass and the Hukoomi Qatar e-Government Portal have quietly become UX benchmarks for GCC private-sector apps.

Under Saudi’s Digital Government Authority (DGA) and data bodies like NDMO/SDAIA, citizens now expect:

Single sign-on across dozens of services.

Digital ID, e-signatures and payments in one flow.

Real-time status updates on services (visas, fines, healthcare, education).

If your app’s onboarding or support journeys feel clunkier than Absher or UAE Pass, users will notice and churn.

Technologies and Features Shaping 2025 Mobile Experiences

GenAI, AI assistants and smart recommendations in MENA apps

GenAI in GCC apps has moved well beyond basic chatbots. In 2025, we see:

Fintech

AI categorizing spends, predicting cash-flow and flagging suspicious transactions.

Retail & logistics

AI recommending bundles based on Ramadan behavior, city-level preferences in Riyadh vs Dubai vs Doha, and real-time inventory.

Customer support

AI co-pilots resolving tier-1 tickets in Arabic/English and escalating complex cases with full context.

Saudi’s SDAIA positions the Kingdom as a regional AI hub, with PDPL and NDMO frameworks setting boundaries for responsible use of training data and inference logs. For GCC teams, that means aligning GenAI features with both experience value and data-governance reality.

5G, cloud-native architectures and edge for GCC performance

To hit the performance bar GCC users expect, teams are standardizing on:

Cloud-native microservices deployed across KSA, the UAE and Qatar regions using hyperscalers plus local data centers.

Aggressive CDN and edge caching, especially for media-rich commerce, news and entertainment apps.

Observability stacks that track latency per city (Riyadh vs Jeddah vs Dammam; Dubai vs Abu Dhabi; Doha vs Lusail) and across Gulf ISPs.

Compared with many US, UK or German apps still mid-migration, high-growth GCC startups are often “born cloud-native,” but must adapt architectures to data-sovereignty constraints.

Security, compliance and data residency by design

Data privacy and local data residency are critical in 2025 because regulators across the GCC now treat data location and governance as core systemic risk, not a technical detail. Saudi’s PDPL and NDMO standards, UAE data protection laws overseen by TDRA and Qatar Central Bank’s cloud and data-handling regulations all push sensitive data to stay within national borders or be subject to strict transfer conditions.

For mobile apps especially in fintech, government, retail and logistics this means:

Designing early for KSA / UAE / Qatar data centers and mapping which microservices can be regional or EU-hosted and which must stay local.

Treating GDPR/UK-GDPR as useful baselines when dealing with EU or UK users in GCC products, and aligning payment flows with PCI DSS.

Documenting data flows, DPIAs and cross-border transfers from day one, not as a last-minute legal patch.

The payoff: reduced regulator friction and higher user trust when you can clearly say, “Your data stays in Riyadh/Dubai/Doha unless you explicitly consent otherwise.”

Growth, Marketing and Monetization Trends for GCC Apps

User acquisition and Ramadan-driven app behavior

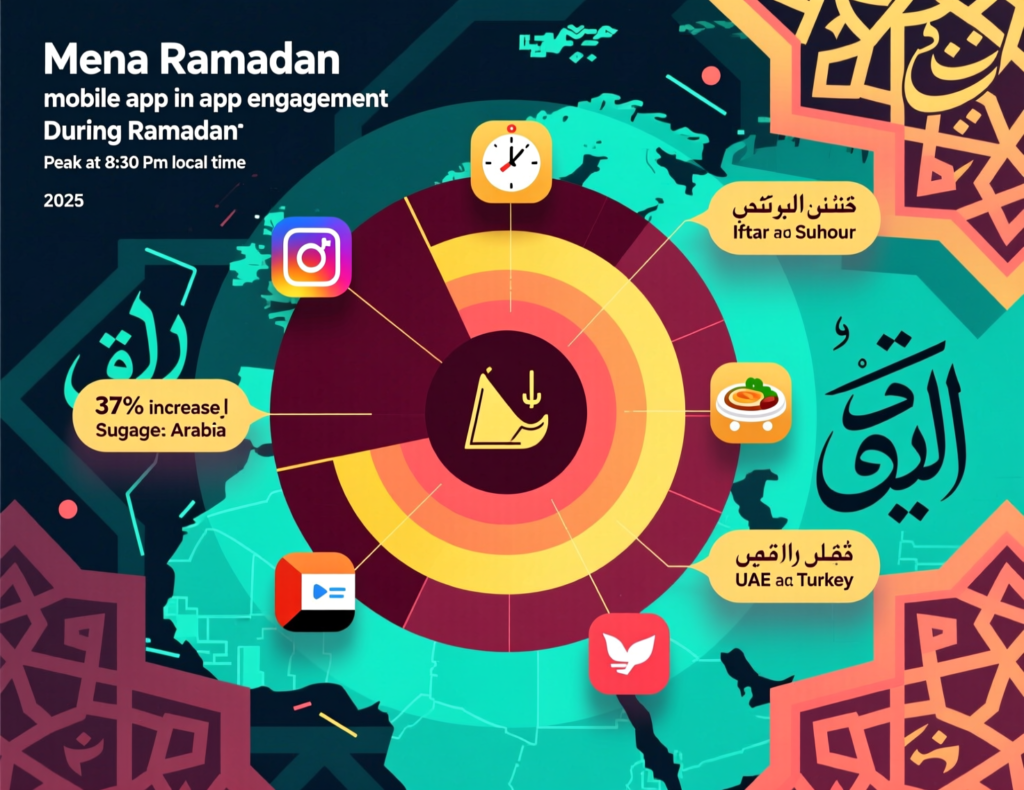

Every year, Ramadan behaves like the GCC’s “Super Q4” for many verticals but with different rhythms. In Saudi Arabia, the UAE and Qatar, installs and engagement spike for food delivery, grocery, charity, religious content, streaming and fintech donation tools.

Winning 2025 tactics

Launch UA bursts just before Ramadan, then pivot to retention and reactivation mid-month.

Tailor content and offers to iftar/suhoor hours by city (Riyadh vs Dubai vs Doha).

Use culturally sensitive creatives and limit intrusive ad formats.

Monetization models that resonate in KSA, UAE and Qatar

In-app purchases, subscriptions, ads and hybrids all work in the GCC – but only when paired with trusted local payment options and transparent pricing.

Best practices we see:

Combining subscriptions (for premium features) with transaction revenue (for payments, logistics, ticketing).

Supporting local cards, Mada, regional wallets and BNPL to reduce checkout friction.

For ad-supported models, frequency caps tuned for Arabic-first users who tend to bounce quickly if bombardment feels disrespectful.

Retention, churn and lifecycle optimization in GCC

GCC churn patterns can be brutal: users download quickly during Ramadan or big sales, then uninstall just as fast if you miss expectations. To optimize lifetime value:

Track cohorts by city + language (e.g., Arabic-first Riyadh vs bilingual Dubai).

Align push notifications with local time, holidays and prayer times.

Use server-side experiments to test offers and flows without constant store releases – especially helpful if you build with React Native, Flutter or Xamarin. (Mak it Solutions)

How MENA Teams Can Build Apps That Feel Native to Arabic-First Users

Research local user journeys in Riyadh, Dubai and Doha

Treat Riyadh, Dubai and Doha as distinct but connected markets. Start with:

User interviews across Arabic-only, bilingual and expat segments.

Analytics from existing mobile or mobile-web funnels (Mak It’s teams often begin by analyzing your current web and app data together). (Mak it Solutions)

Task-based usability tests that compare your app to benchmark journeys in Absher, UAE Pass, Hukoomi and leading private-sector apps.

The goal: map the real jobs-to-be-done for citizens, residents and visitors in each city – not just copy Western journeys and translate labels.

Design Arabic-first, bilingual UX and content systems

Next, you need a design system that natively supports Arabic and English:

RTL-first layout with vetted fonts that read well on mid-range Android devices.

Copy guidelines for tone of voice in Modern Standard Arabic vs English, plus clear rules for when to mix both (e.g., product names, compliance text).

Components that follow Apple HIG and Android Material Design while still feeling culturally local.

This is where partnering with teams experienced in both design systems and cross-platform stacks (React Native, Flutter, Xamarin) pays off – Mak It Solutions, for example, offers dedicated mobile app development services plus React Native, Flutter and Xamarin practices that can encode these rules once and reuse them across apps. (Mak it Solutions)

Plan data residency, hosting and compliance from day one

Finally, treat data residency as an architectural requirement, not a deployment afterthought. For a typical GCC app:

Choose primary regions in KSA, the UAE and/or Qatar based on your core market, then define where backups, analytics and failover live.

Map how your design lines up with NDMO, SDAIA, SAMA, TDRA and QCB requirements, plus GDPR/UK-GDPR if you touch EU/UK data subjects.

Design PCI-ready payment flows and, if you operate in health or insurtech, understand HIPAA-style expectations from US partners or investors.

Working with an experienced web and mobile development partner who already builds in these constraints (including for US, UK, German and EU clients) can drastically reduce rework. (Mak it Solutions)

Concluding Remarks

Where to invest in 2025–26 across Saudi, UAE and Qatar

If you’re prioritizing a roadmap for 2025–26, three bets look particularly strong:

Fintech + payments anchored in Saudi Arabia and the UAE, deeply integrated with Open Banking KSA, ADGM/DIFC ecosystems and instant payment rails.

Super apps and logistics platforms that combine commerce, mobility and everyday services across Riyadh, Dubai, Abu Dhabi, Doha and Lusail.

Data-sovereign, AI-enabled platforms that respect PDPL, UAE data protection law and QCB/NDMO guidance from day one.

Checklist for your next MENA mobile app roadmap

Use this quick checklist when scoping your next release or new build:

Market fit

Have we researched real journeys in Riyadh, Jeddah, Dammam, Dubai, Abu Dhabi, Sharjah, Doha and Lusail?

Arabic-first UX

Is RTL flawless, with tested Arabic+English flows on mid-range Android and iOS?

Performance

Are we reliably under ~2–3s to first meaningful paint on 4G, tested across GCC networks?

AI & personalization

Are GenAI features genuinely useful and PDPL / GDPR-aligned?

Compliance & data residency

Can we show regulators exactly where data lives and how it flows?

Growth & monetization

Do we have a Ramadan plan, local payment options and clear retention tactics?

Key Takeaways

GCC users in 2025 benchmark local apps against global leaders in the US, UK and EU slow or clunky products are quickly uninstalled.

Fintech, government, retail and logistics apps are converging into super-app ecosystems, especially in Riyadh, Dubai and Doha.

Data privacy, PDPL, TDRA and QCB rules make local data residency and documented flows non-negotiable.

Arabic-first, bilingual UX is now expected, not optional, and must be supported at the design-system level.

Cloud-native architectures, GenAI features and strong analytics are key to sustaining performance, compliance and growth.

If you’re planning or refreshing a GCC-focused app for Saudi Arabia, the UAE or Qatar, this is the moment to align UX, tech and compliance before user expectations move even further. Mak It Solutions can help you shape a mobile-first, Arabic-native roadmap, validate performance and data residency decisions, and deliver cross-platform apps that feel at home in Riyadh, Dubai and Doha and compliant in the US, UK, Germany and wider EU markets. Reach out to our team to scope a focused discovery sprint or a full mobile app build.( Click Here’s )

FAQs

Q : Are Arabic-only mobile apps enough to reach users in Saudi Arabia, or do GCC users prefer bilingual (Arabic–English) experiences?

A : Arabic-only apps may work for some government or citizen services, but most GCC users now expect bilingual experiences. In Saudi Arabia, many users are comfortable switching between Arabic UI and English brand names, and in Dubai or Doha the expat mix makes English essential. The safest approach is an Arabic-first design system with English fully supported, including search, notifications and support content.

Q : How do mobile app expectations differ between users in Riyadh, Dubai and Doha in 2025?

A : Riyadh users often prioritize deep fintech and government integrations (e.g., Absher, Open Banking KSA), while Dubai users lean toward lifestyle, super apps and cross-border commerce. Doha users value high reliability around logistics, payments and government services integrated with Hukoomi. All three cities demand fast, Arabic-first, secure apps – but the balance of fintech vs lifestyle vs public-service use cases shifts by city.

Q : Is hosting a MENA mobile app on EU or US servers acceptable if most users are in KSA, UAE or Qatar?

A : It depends on your vertical and data types. For many regulated sectors (banking, payments, some government-related services), regulators like SAMA, TDRA and QCB increasingly expect sensitive data to be hosted locally or under tightly controlled transfer rules, even if you also use EU or US regions. For less regulated verticals, EU or US hosting can be acceptable, but you should still map data flows, document transfer bases under GDPR/UK-GDPR and be ready to justify your approach.

Q : What special UX considerations are needed for Ramadan campaigns inside GCC mobile apps?

A : During Ramadan, users shift routines: peaks move to pre-iftar, late evening and pre-suhoor slots. Apps should adjust notification timing, delivery windows, customer-support availability and even app theming to reflect the month. Overly aggressive upsell or non-relevant content can backfire; users respond better to respectful, community-minded offers such as charity, family bundles and logistics aligned with prayer and iftar times.

Q : Do fintech apps in Saudi, the UAE and Qatar need separate approvals from SAMA, TDRA and QCB before launch?

A : Yes. In practice most serious fintech products require separate approvals or licenses from each relevant regulator. In KSA, SAMA and related sandboxes govern many banking and payments activities; in the UAE, the Central Bank, TDRA and free-zone regulators like ADGM and DIFC have their own expectations; in Qatar, QCB issues regulations for cloud, cybersecurity and AI use in financial services. You should plan your technical architecture, data residency and UX flows alongside a clear regulatory roadmap, not after launch.