Islamic Fintech in GCC: Saudi, UAE & Qatar Shift

Islamic Fintech in GCC: Saudi, UAE & Qatar Shift

Islamic Fintech in GCC: Saudi, UAE & Qatar Shift

Islamic fintech in GCC combines Sharia-compliant finance with modern digital tools such as mobile apps, APIs and open banking platforms to serve Muslim customers across Saudi Arabia, the UAE and Qatar. It is changing banking by replacing branch-heavy, paper-based processes with Arabic-first digital experiences, instant onboarding and interest-free products that still follow local regulations and Sharia governance.

Introduction

Across Riyadh, Dubai and Doha, Islamic fintech in GCC is moving from “interesting pilot” to mainstream infrastructure. Banks, regulators and startups now see that digital channels are the only realistic way to serve a young, mobile-first and Sharia-conscious population at scale.

At its core, Islamic fintech in GCC is the convergence of Sharia-compliant financial technology with GCC regulation, cloud infrastructure and Arabic-first digital design. It is transforming banking by turning profit-sharing accounts, halal cards and Islamic investments into seamless mobile experiences instead of branch-only products.

This article is for information and education only. It is not financial, legal or Sharia advice always consult qualified scholars, regulators and professional advisors before launching or changing any Islamic financial product.

The gap between Islamic finance and digital-first GCC customers

For years, many Islamic banks in KSA, UAE and Qatar focused on branch networks and paper-heavy processes, while customers shifted to super apps, Apple Pay, Mada wallets and QR payments. The result was a visible gap: products were Sharia-compliant, but the experience felt slow, fragmented and often only in English. Today’s GCC user expects instant onboarding, biometric login, Arabic RTL UX and 24/7 service that still respects Islamic values.

How Islamic fintech in GCC is closing that gap with apps, APIs and data

New and existing players are using modern stacks, cloud-native core systems and secure APIs to digitize Islamic products end-to-end. Open banking frameworks from SAMA and the UAE Central Bank allow consent-based access to account data, enabling Islamic budgeting tools, salary-linked halal BNPL and profit-distribution dashboards instead of interest statements.

Who this guide is for: founders, Islamic banks and digital product teams

This guide is written for GCC founders, Islamic banks, Sharia boards and product teams who want to design credible, compliant and lovable Islamic fintech experiences. Whether you lead innovation in Riyadh, own a family business in Sharjah or manage digital channels in Doha, it will help you connect Sharia governance, regulation and modern product design.

What Is Islamic Fintech and How It Works in GCC

What is Islamic fintech and how is it changing banking in the GCC?

Islamic fintech is the use of digital technology to deliver Sharia-compliant financial services such as savings, payments, financing and investment. In the GCC, it is changing banking by bringing these halal products into mobile apps, APIs and platforms that support profit-sharing, risk-sharing and real economic activity instead of interest-based lending.

From traditional Islamic banking to digital Islamic fintech

Traditional Islamic banking in Jeddah, Abu Dhabi or Doha centred on branches, relationship managers and manual Sharia approvals. Islamic fintech keeps the same core contracts (murabaha, mudaraba, ijara, wakala) but delivers them through mobile apps, digital onboarding and automated Sharia checks built into the core system.

For many teams, this means partnering with specialized [web development services][2] and modern back-end stacks rather than trying to extend legacy core banking alone.

Core Sharia principles behind Islamic fintech products

Every Islamic fintech product must respect the basics: no riba (interest), no excessive gharar (uncertainty), no speculative maysir (gambling), and a bias toward asset-backed or profit-and-loss-sharing transactions. That affects how profit is calculated, how late payment fees are treated and how digital contracts are structured.

It also shapes UX: instead of “interest rate”, apps must clearly present expected profit rates, underlying assets and risk-sharing logic in Arabic and English so customers in KSA, UAE and Qatar can understand how money is actually being used.

How Saudi, UAE and Qatar define Islamic fintech today

In Saudi Arabia, SAMA’s open banking framework and fintech sandbox are pushing Islamic banks and startups to digitize everything from salary accounts to SME finance, aligned with Vision 2030. ([Saudi Central Bank][1])

In the UAE, the Central Bank’s open finance work and free zones like ADGM and DIFC support Islamic digital banks, wallets and robo-advisors.

In Qatar, QCB’s fintech strategy and regulatory sandbox are enabling Doha-based players to test Sharia-compliant digital wallets, SME tools and cross-border solutions.

Sharia-Compliant Digital Banking Experiences in Saudi, UAE and Qatar

What GCC users expect from Sharia-compliant digital banking apps

Users in Riyadh, Dubai and Doha expect Islamic apps that feel as smooth as global neobanks: instant KYC, Mada and card tokenisation, push notifications and simple Arabic copy. At the same time, they care deeply that products are truly halal clear fatwa references, visible Sharia board members and transparent profit-explanation screens.

Many customers now compare Islamic fintech apps not only to local banks but also to global super apps they use for rides, food and travel. If a ride-hailing or delivery app feels smoother than a banking app, users will quickly notice.

Designing Arabic-first, RTL-friendly interfaces for Islamic banking apps

A serious Islamic fintech in GCC can’t treat Arabic as an afterthought. Interfaces must be RTL-native, with careful typography, date formats (Hijri and Gregorian), and language for sensitive concepts like zakat, sadaqah and profit distribution.

Collaborating with strong [front-end development services][5] helps teams handle RTL, accessibility and responsive design without compromising speed or security.

Examples of Sharia-compliant digital wallets, cards and savings apps in Riyadh, Dubai and Doha

In Riyadh, Islamic wallets increasingly integrate with Mada, Google Pay and local QR rails while keeping Sharia-compliant limits and fee structures.

In Dubai, e-commerce and travel super apps integrate Islamic cards and halal BNPL so Muslims can split payments without interest and still enjoy flexible instalments.

In Doha, banks are using the local Google Cloud region to host Islamic mobile banking and savings tools with low latency and in-country data residency.

Platforms, APIs and Open Banking for Islamic Finance in GCC

Digital Islamic banking platforms and core banking SaaS for GCC markets

Most GCC teams now combine cloud-native cores, digital channels and specialized middleware instead of building everything in-house. Islamic banks use SaaS core platforms hosted in AWS Bahrain or UAE regions, Azure UAE Central or GCP Doha to meet data residency and latency requirements while still integrating local payment schemes.

On top, partners like Mak It Solutions provide tailored Laravel back-end and WordPress web development for portals, onboarding flows and content sites.

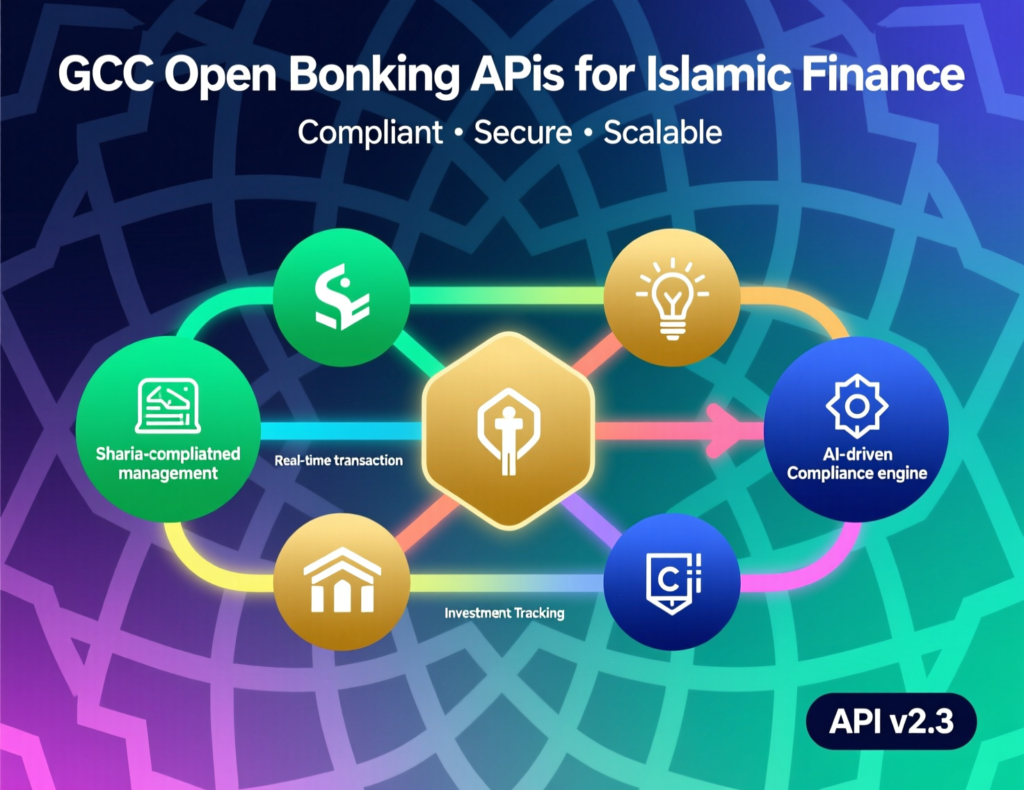

Islamic fintech APIs for payments, KYC and profit-calculation instead of interest

APIs now handle payment initiation, KYC/AML checks, customer scoring and profit-sharing logic that replaces traditional interest. A Riyadh-based fintech might call KYC, national address and Digital ID services; a Dubai startup can plug in UAE Pass for seamless login and verification; and a Doha SME app can calculate profit shares dynamically based on Sharia-approved formulas

How open banking in KSA and UAE enables Islamic finance use cases

How does open banking support Islamic finance use cases in Saudi Arabia and UAE?

Open banking in KSA and UAE lets licensed fintechs and banks, with customer consent, access account data and initiate payments over secure APIs. This enables use cases like Islamic personal finance dashboards, halal BNPL, salary-linked savings jars and SME tools that sit on top of existing Islamic accounts while staying within SAMA and CBUAE rules. ([Saudi Central Bank][1])

Compliance, Sharia Governance and Data Residency in GCC

Working with Sharia boards and fatwa approvals for fintech products

Every serious Islamic fintech in GCC should have a named Sharia board or certified scholars who review product structures, contracts, UX copy and edge cases such as penalties or refunds. For app teams, that means building feedback loops with scholars early, not after launch, and documenting decisions clearly for regulators, marketing teams and future audits.

Key regulators for Islamic fintech.

Regulatory touchpoints are multi-layered.

In Saudi Arabia, SAMA supervises banks and fintechs, while SDAIA/NDMO set data rules and the Digital Government Authority influences e-government payment rails.

In the UAE, the Central Bank covers licensing and open finance, TDRA oversees telecom and digital identity (including UAE Pass), and ADGM/DIFC provide fintech-friendly free-zone regimes.

In Qatar, QCB, QFC and national digital programs combine to support sandboxes and Islamic fintech experimentation.

Data residency, cloud hosting and NDMO expectations in Saudi, UAE and Qatar

Data residency is no longer optional. Saudi’s NDMO and cloud frameworks push critical financial data to stay inside the Kingdom or approved regions, while allowing some processing in nearby zones like AWS Bahrain or future KSA regions.

The UAE offers Azure regions in Dubai and Abu Dhabi plus local hyperscale expansion, and Qatar now has a Google Cloud region in Doha giving Islamic fintechs multiple GCC hosting options that align with Sharia-conscious risk control.

What are the main compliance challenges for Islamic fintech in Qatar and the wider GCC?

The biggest challenges are coordinating Sharia board approvals with changing fintech rules, meeting strict KYC/AML standards for fully digital onboarding, and aligning cloud and data residency choices with NDMO, QCB and other local policies. Teams must design their architecture, contracts and risk processes so that regulators, scholars and auditors can all verify that products remain both compliant and genuinely Islamic over time.

Real GCC Use Cases Islamic Fintech from Riyadh, Dubai and Doha

Retail and consumer use cases: salary, savings, halal BNPL and micro-investments

A Riyadh fintech startup can plug into SAMA’s open banking framework to read salary deposits (with consent) and automatically route a share into halal savings buckets or micro-investment sukuk portfolios.

A Dubai e-commerce brand can offer Sharia-compliant BNPL at checkout, using APIs to verify affordability, calculate profit instead of interest and settle via local payment gateways.

In Doha, a small business app can bundle invoicing, pay-by-link and zakat estimation into a single Islamic-friendly interface for freelancers and micro-SMEs.

Government, payroll and subsidy disbursement via Sharia-compliant rails

In Saudi Arabia, Digital Government Authority programs and local banks already handle salary and subsidy disbursement at scale; layering Islamic fintech on top can add budgeting tools, zakat tracking and family wallets.

In the UAE, government

Qatar’s e-government and QCB sandbox pilots can power Sharia-compliant G2P programs delivered directly to digital wallets.

Cross-border GCC payments and remittances built on Islamic fintech platforms

For expatriates and GCC nationals, Islamic fintech platforms can offer Sharia-aware remittances between Riyadh, Dubai and Doha, using transparent FX markups and avoiding interest-bearing credit lines. Corridor-specific solutions can host services on AWS Bahrain, Azure UAE Central or GCP Doha to keep data near users while still serving the full GCC.

How to Build a Sharia-Compliant Fintech Product in GCC

Validate the use case with Sharia scholars and target regulators

Identify and frame the use case

Define whether you are solving for consumer finance, SME, government payouts or cross-border flows, and map which Islamic contracts will apply.

Engage Sharia scholars early

Share user journeys, pricing and risk scenarios with a qualified Sharia board, and capture their guidance before you lock in your tech architecture.

Talk to regulators and sandboxes

Align with SAMA, CBUAE, QCB, ADGM, DIFC or QFC on licensing expectations, open banking participation and sandbox entry points.

Choose cloud region, data strategy and Islamic fintech platform/APIs

Pick your GCC cloud regions

Decide between AWS Bahrain/UAE, Azure UAE or GCP Doha (and upcoming KSA regions) based on residency, latency and integration with national networks.

Design a data-residency and privacy model

Classify data according to NDMO and local privacy rules, and document where each data class is stored, processed and backed up.

Select Islamic-friendly platforms and APIs

Combine digital cores, KYC, payment and profit-calculation APIs, plus a strong Webflow/WordPress front-end that can evolve quickly.

Pilot, enter sandboxes (SAMA, ADGM, DIFC, QFC) and scale across GCC

Pilot with a narrow, well-governed segment

For example, start with salaried employees of a Riyadh employer or SMEs in Sharjah, gathering qualitative feedback and Sharia board input.

Enter regional sandboxes and iterate

Use SAMA, ADGM, DIFC or QFC sandboxes to test edge cases, refine risk controls and strengthen reporting. ([Saudi Central Bank][1])

Scale with platform thinking

Once validated, invest in robust web development and PWA architectures so you can launch new features (e.g., dashboards, partner portals) without breaking compliance.

Concluding Remarks

Islamic fintech in GCC is no longer a side experiment; it is becoming the default way Muslims expect to engage with finance. The winning teams will be those who combine strong Sharia governance, serious regulatory compliance and modern digital experiences powered by GCC cloud regions.

Common pitfalls GCC teams face when digitizing Islamic products

Common mistakes include copying conventional fintech UX (with “interest rate” language), ignoring data residency until late or treating Sharia boards as stamp-approval bodies instead of strategic partners. Another risk is building rigid systems that can’t adapt when SAMA, CBUAE or QCB issue new open banking, data or AI guidelines.

How our team can help you design, launch and scale Islamic fintech in GCC

Mak It Solutions already helps global clients ship high-performing web platforms, PWAs and mobile-friendly experiences for complex industries. If you need a partner to translate Sharia, regulation and product ideas into scalable code across front-end, PHP/Laravel, WordPress or Webflow our team can support everything from MVPs to regional roll-outs.

If you’re planning to launch or modernize an Islamic fintech in GCC whether a Riyadh salary app, a Dubai e-commerce wallet or a Doha SME platform let’s talk. Our team at Mak It Solutions can help you design the architecture, UX and integrations you need while staying aligned with Sharia boards and GCC regulators.

Explore our services hub at https://makitsol.com/services/ or reach out for a tailored roadmap for your next Islamic digital product in KSA, UAE or Qatar.

FAQs

Q : Is a fully digital Islamic bank account considered halal in Saudi Arabia under SAMA rules?

A : Yes what matters is not whether the account is opened via an app or in a branch, but whether the underlying contract and operations comply with Sharia and SAMA regulations. A fully digital Islamic account in Saudi Arabia should use approved Islamic contracts (e.g., wadiah, mudaraba), disclose how profit is generated and distributed, and avoid riba-based structures. SAMA’s open banking and fintech programs already assume customers will open and manage accounts digitally, as long as KYC, AML and cybersecurity requirements are met.

Q : What Sharia checks do UAE fintech startups usually need before launching a halal BNPL product?

A : In the UAE, fintech startups offering BNPL or instalment products need Sharia review of the entire structure: purchase contracts, profit markups, late payment handling and any promotional campaigns. Scholars typically examine whether the BNPL agreement resembles an interest-bearing loan or a clear cost-plus sale with fixed profit. Startups also need to align with the UAE Central Bank’s consumer protection and credit rules, and often operate within ADGM or DIFC frameworks while showcasing their Sharia board members on their apps and sites.

Q : Can GCC customers use Islamic fintech apps from abroad if their salary is paid in Riyal or Dirham?

A : Many Islamic fintech apps in KSA, UAE and Qatar allow customers to keep using services while travelling or living abroad, as long as their accounts remain active and compliant with KYC standards. Salaries paid in SAR or AED can still flow into local Islamic accounts, with users accessing apps over secure channels and often using international card schemes or digital wallets. However, certain featuresespecially investments or cross-border transfers may be geo-fenced or require additional checks under local and host-country regulations. It’s important to review each app’s terms and guidance from regulators like SAMA and CBUAE.

Q : How do Qatar-based Islamic banks handle KYC for app-only customers compared to branch customers?

A : Qatar-based Islamic banks increasingly use digital KYC for app-only customers, combining document uploads, liveness checks and data validation with national ID systems. The process must still meet QCB’s AML and CTF expectations, so many banks use risk-based approaches—simpler for low-risk accounts and stricter for higher limits or cross-border activity. In some cases, customers may still need a one-time in-person verification, but the long-term goal is frictionless digital onboarding aligned with QCB’s fintech and sandbox guidelines.

Q : What are common mistakes GCC startups make when marketing an app as “Islamic fintech” to Muslim users?

A : A frequent mistake is focusing on visuals Arabic fonts, Islamic motifs, Ramadan campaigns—without ensuring the core contracts and business model are genuinely Sharia-compliant. Others include vague references to “halal” without naming scholars or Sharia boards, weak disclosure of fees and profit, or using language that resembles conventional interest. Regulators like SAMA, QCB and UAE authorities are watching these claims closely, especially as Islamic fintech becomes central to Vision 2030 and national digital strategies. Startups must treat “Islamic” as a governance commitment, not just a brand label.