Central Bank Digital Currencies (CBDCs) Explained 2025

Central Bank Digital Currencies (CBDCs) Explained 2025

Central Bank Digital Currencies (CBDCs) Explained 2025

A central bank digital currency (CBDC) is a digital form of sovereign money issued directly by a central bank as its liability essentially digital cash you hold in a wallet app rather than in your physical wallet. In 2025, Europe is pushing ahead with a retail digital euro, the UK is still designing a possible digital pound, and the US has banned a retail digital dollar, leaving regulated private stablecoins to act as the de facto digital dollars for now.

Introduction

By late 2025, over 130 countries representing close to 98% of global GDP are exploring central bank digital currencies (CBDCs), from early research to full launches. The geopolitical split is sharp: the European Union is accelerating work on a retail digital euro, the UK is still in design mode on a possible digital pound, and the United States has gone the other way banning a retail “digital dollar” under President Trump’s executive order, even as China and others keep building.

CBDCs are now a board-level issue because they shift three things at once: who issues digital money, which rails payments run on, and how much data and control public authorities have over transactions. For banks, fintechs and large enterprises in the US, UK, Germany and wider Europe, the question is no longer if CBDCs will shape markets, but where and how fast they’ll do it.

This guide breaks down what CBDCs are, how they differ from Bitcoin, stablecoins and “just online banking,” and what the emerging digital euro vs digital dollar vs digital pound split means for your products, balance sheet and compliance roadmap.

What are central bank digital currencies (CBDCs)?

A central bank digital currency (CBDC) is generally defined as a digital liability of a central bank that is widely available to the public in other words, digital cash issued by the central bank, not by a commercial bank. Like physical banknotes, each unit is a direct claim on the central bank itself, not on a private institution.

CBDCs in simple terms.

Think of a CBDC as digital cash from the central bank that lives in a wallet app on your phone instead of in your pocket. The Federal Reserve describes a CBDC as “a digital form of central bank money that is widely available to the general public,” which means it sits on the central bank’s balance sheet, not your bank’s.

That’s very different from the money behind your card, PayPal or Apple Pay transactions. When you tap in New York, London or Berlin today, you’re typically moving commercial bank money your deposit, a liability of your bank over private card or instant-payment rails. CBDCs replace that layer with sovereign digital money: the claim is on the central bank, and the payment rails are at least partly public infrastructure.

Retail vs wholesale CBDCs in the US, UK and Eurozone

Retail CBDCs are designed for households and businesses — the digital equivalent of notes and coins in a retail CBDC wallet, used for everyday payments: groceries in Munich, rent in Manchester or online subscriptions in Austin.

Wholesale CBDCs sit behind the scenes in interbank settlement and securities markets where banks, central banks and large financial institutions move high-value payments.

Across key regions.

Eurozone

The Eurosystem is pursuing both a retail digital euro for citizens and merchants and wholesale initiatives that build on existing TARGET services for settlement.

UK

The “digital pound” concept focuses on retail use and is explicitly framed as complementing, not replacing, commercial bank money and existing Open Banking and Faster Payments rails.

US

The Fed has carried out years of “neutral” CBDC research, but a retail CBDC is now effectively blocked politically, while wholesale experiments and private-sector tokenised deposits continue.

CBDCs vs Bitcoin, stablecoins and “just online banking”

A CBDC is not “just another crypto,” and it’s not simply online banking with extra steps. The core differences are who issues it, what backs it, and how stable and private it is.

What is the difference between a CBDC and a cryptocurrency?

A CBDC is issued by a central bank, denominated in the national currency (dollar, euro, pound) and designed to maintain a stable value as legal tender. A cryptocurrency like Bitcoin is issued by no central authority, has no central backing, and is typically highly volatile, so its value can move dramatically against fiat currencies.

Here’s the short comparison.

| Money type | Issuer / liability | Backing / peg | Legal status & use | Typical volatility | Typical privacy model |

|---|---|---|---|---|---|

| CBDC | Central bank | Fiat currency, 1:1 | Legal tender (by design) | Very low | Policy-driven, privacy-by-design |

| Bitcoin / crypto | Decentralised protocol | None (market-driven) | Speculative / some payments | Very high | Pseudonymous on public ledger |

| Stablecoin (e.g. USD/EUR-pegged) | Private issuer / bank / fintech | Reserves / assets, regulated by MiCA or US law | Payment, trading, DeFi | Low–medium (depends on design) | Varies by issuer & chain |

| Bank deposits / cards / Apple Pay | Commercial bank | Bank assets + deposit insurance | Everyday payments | Very low | Bank + card-scheme data flows |

For banks and fintechs, the real question isn’t CBDC or stablecoins or bank money. It’s how these layers will coexist in a more cashless society and how programmable CBDC payments might interact with tokenised deposits and regulated stablecoins.

Global CBDC landscape in 2025

Countries are exploring CBDCs for different reasons: the EU to strengthen monetary sovereignty and reduce reliance on US-dominated payment networks, the US to lean on private stablecoins instead of a digital dollar, and the UK to keep options open while preserving financial stability.

The global map

The Atlantic Council’s CBDC Tracker shows that well over 100 jurisdictions now have CBDC projects in research, development or pilot, with a growing group already live including the Bahamas (Sand Dollar), Nigeria (eNaira), Jamaica and several members of the Eastern Caribbean Currency Union.

Early roll-outs offer sobering lessons: adoption doesn’t automatically follow launch. Nigeria’s eNaira, for example, saw slow user uptake despite policy support, underlining how much UX, merchant acceptance and trust matter.

Major economies are also moving.

China has advanced pilots of the digital yuan across large cities and major events.

Eurozone is targeting a digital euro pilot from 2027 and potential issuance around 2029.

UK remains in design and consultation on the digital pound.

US has banned a retail CBDC, effectively ceding the initiative to others while focusing on private rails.

Why central banks care.

Central banks talk about CBDCs in technical language, but the motivations boil down to four themes:

Sovereign digital money & monetary sovereignty

The EU wants a digital euro so Europeans can pay with central bank money without routing every card transaction through US card schemes or dollar-backed stablecoins.

Payments resilience & offline capability

A digital euro that works both online and offline is framed as a backup for power cuts, cyber incidents or connectivity problems.

Financial inclusion & cheaper cross-border payments

Cross-border payments still cost, on average, around 6–6.5% of the amount sent, on flows that totalled over $190 trillion in 2024, so even small efficiency gains are huge.

Data, AML and competition with Big Tech

CBDCs promise richer, real-time data for AML/CFT and could give central banks and public authorities a counterweight to Big Tech super-apps and card schemes.

US vs Europe vs UK: diverging CBDC strategies

So why are so many countries exploring CBDCs? In short: to modernise payments, retain control over money in an era of crypto and stablecoins, and avoid depending entirely on foreign platforms. At the same time, privacy concerns and bank-lobby pushback mean each region is moving at a different speed.

Europe

Pushing ahead with digital euro legislation, technical capacity-building and pilots to cut reliance on non-EU payment schemes and US dollar-based stablecoins.

United States

Trump’s CBDC ban halts a retail digital dollar and bars the Fed from issuing it, so regulated dollar stablecoins and instant-payment schemes like FedNow become the de facto digital dollar rails.

United Kingdom

The Bank of England and HM Treasury are running multi-year consultations, positioning the digital pound as a cautious, optional complement to cash and bank deposits.

The digital euro.

Timeline to 2029: investigation, preparation and pilots

The ECB’s digital euro project has moved from conceptual work into a technical capacity-building phase that started in November 2025. ([European Central Bank][6]) If EU institutions agree the legal framework in 2026, the Eurosystem plans to invite PSPs into pilots from mid-2027, with the system ready for a possible first issuance around 2029.

For banks and merchants in Germany, France, Italy, Spain, the Netherlands and Ireland, that shift moves CBDC from “policy talk” to real project planning especially around SEPA Instant, TARGET and card-acceptance infrastructure.

Design choices: online + offline, holding limits and intermediaries

The EU Council’s December 2025 position backs a digital euro that supports both online and offline payments, basic free services for citizens, and safeguards like holding limits to protect bank funding.

Key design levers.

Online + offline

Online transactions run via the ECB or supervised intermediaries; offline transactions sync later, with “privacy by design” constraints and low caps.

Holding limits & tiered remuneration

Caps and lower interest above a threshold are being considered to avoid deposit flight from banks into risk-free CBDC and to reduce bank-run risk in a crisis.

Intermediated model

Banks and PSPs distribute digital euros, run KYC and UX, while the Eurosystem maintains the core ledger and TARGET/SEPA integration.

The ECB has also hired AI-security vendors such as Feedzai to build fraud and AML scoring tools for digital-euro payments, signalling that “privacy by design” will coexist with heavy-duty surveillance for suspicious flows.

Why the digital euro matters for EU monetary sovereignty

What is the digital euro and why could it matter for Europe’s monetary sovereignty?

The digital euro is a proposed retail CBDC that would let people in the euro area pay with public money (a direct claim on the Eurosystem) in stores and online, just like they do with cash today. It matters for monetary sovereignty because it reduces Europe’s dependence on non-EU card schemes, Big Tech wallets and US dollar-based stablecoins for everyday payments.

With roughly two-thirds of euro-area card payments currently processed by US firms like Visa and Mastercard and platforms such as Apple Pay and PayPal, the ECB has warned that Europe is exposed to “economic coercion” via payment networks.

A successful digital euro, combined with SEPA Instant, MiCA-regulated stablecoins and PSD3, would give merchants in Berlin or Paris a deeper set of EU-controlled rails to route volume away from foreign networks.

For BaFin-regulated German banks and fintech hubs in Frankfurt and Amsterdam, this is as much about strategic positioning as it is about plumbing: the big prize is running wallets, merchant solutions and “programmable payments” features on top of sovereign digital money.

The digital dollar: from CBDC ban to stablecoin “digital dollars”

Trump’s digital dollar ban and the Fed’s stance on CBDCs

President Trump’s 2025 executive order bans the Federal Reserve and other agencies from issuing a retail US CBDC or promoting a “digital dollar” for general public use. That freezes years of neutral research at the Fed, which has consistently said it would not move ahead without clear support from Congress and the executive branch.

Congress is still debating how to regulate USD-pegged stablecoins and tokenised deposits, but for now the US stands out as the only major economy to explicitly ban a retail CBDC while remaining open to wholesale and private-sector rails.

Stablecoins as the de facto “digital dollar”

In this vacuum, dollar-pegged stablecoins whether issued by banks, fintechs or as tokenised deposits are becoming the de facto “digital dollars” for cross-border payments, crypto markets and programmable finance.

For a New York asset manager or a San Francisco crypto firm, stablecoins already function as 24/7 settlement instruments, enabling near-instant transfers across exchanges and DeFi protocols. For US multinationals, tokenised commercial bank money on private chains can deliver some of the same efficiencies a wholesale CBDC promises, without the politics of a fully public digital dollar.

Impact on US banks, community lenders and cross-border payments

How does Trump’s CBDC ban affect the future of the digital dollar?

The ban pushes US innovation towards private rails like FedNow, RTP, tokenised deposits and regulated stablecoins instead of a public retail CBDC. That keeps control closer to commercial banks and state regulators but risks fragmentation versus the more unified digital-euro roadmap in Europe and the digital yuan in China.

Community banks and credit unions may welcome the absence of a “risk-free competitor” for deposits, but they now face a different challenge: competing with large issuers of “digital dollars” and Big Tech-style platforms that can integrate FedNow, stablecoins and embedded finance at scale.

The digital pound.

Where the digital pound project stands in 2025

The Bank of England and HM Treasury have spent the last few years consulting on a possible digital pound, emphasising that no final decision has been taken. Their latest updates keep the UK in an extended design phase, with a go/no-go decision only expected later this decade.

For London, Edinburgh and Manchester, that means planning for optionality: UK banks and fintechs must be ready to integrate a digital pound if it arrives, while continuing to compete via Faster Payments, CHAPS, Open Banking and private stablecoins.

Everyday use.

A retail digital pound would likely sit on top of existing UK payment infrastructure, not replace it. Imagine:

salaries paid in digital pounds into wallets linked to Open Banking APIs;

welfare payments and NHS reimbursements distributed via programmable government wallets;

local government grants in Manchester or Cardiff paid as conditional CBDC, released when milestones are met.

For PSPs and vendors including full-stack engineering partners such as Mak It Solutions, who already build compliant mobile apps and payment flows for clients across the USA, UK and EU the opportunity is to build retail CBDC wallet UX, offline capabilities and analytics that plug neatly into today’s Faster Payments, card schemes and Open Banking interfaces.

Scepticism and risk concerns from banks and Parliament

UK banks and some MPs describe the digital pound as a “solution in search of a problem”, highlighting costs, cyber risk, deposit disintermediation and privacy worries. There are also concerns that a future government could more easily impose negative interest rates or targeted restrictions on certain sectors or transactions using programmable money.

Debates are tightly linked to UK-GDPR, FCA oversight, and the UK’s approach to bank-issued stablecoins. Expect the UK to focus heavily on “privacy floors”, competition with commercial bank money and the possibility of letting private stablecoins carry much of the innovation risk.

How CBDCs will change finance: banks, cards, privacy and programmability

Commercial bank business models under pressure

CBDCs introduce a new form of sovereign digital money that could, in theory, compete with deposits as a store of value, especially in stress scenarios. That’s why the ECB, BaFin and others stress holding limits and tiered remuneration without them, digital euro wallets could drain deposits from banks in Germany, France or Italy during a panic.

Even with limits, banks in New York, London or Frankfurt may face pressure on net interest margins, funding costs and liquidity management if a slice of balances moves into risk-free CBDC. Card networks and Big Tech payment providers could see more competition from public rails (for example digital euro + SEPA Instant at POS) and merchant pressure to route volume away from high-fee schemes.

Privacy, AML and compliance.

Central banks are trying to balance privacy by design with tough AML/CFT expectations. In the EU, offline digital-euro transactions are being designed with higher privacy and lower data visibility, while online payments will be subject to standard or enhanced AML monitoring.

Compliance and risk teams need to think across:

GDPR/DSGVO, UK-GDPR, CCPA for data;

PSD2/PSD3, SEPA, MiCA, AMLD for payments and crypto assets;

PCI DSS, SOC 2, ISO 27001 for security and operational controls;

FATF guidance on virtual assets and CBDCs.

The ECB’s AI-based fraud and AML tooling for the digital euro underlines where this is heading: highly automated, behaviour-based monitoring that scores every transaction, even as policymakers promise that small offline payments in a café in Dublin or a kiosk in Berlin will feel “as private as cash”.

Programmable money.

Programmable payments are where CBDCs intersect with smart contracts and tokenised finance: instant escrow on house purchases, just-in-time payroll, tax withheld and remitted automatically, or supply-chain payments released when IoT sensors confirm delivery.

At the same time, citizens worry about “programmable surveillance money” the idea that governments might one day block certain purchases or apply dynamic restrictions. Tolerance for this varies:

in the US, the CBDC ban shows strong political scepticism;

in Germany and across the EU, privacy safeguards are politically crucial;

in the UK, the emphasis is on voluntariness and competition with private money.

For product and compliance teams, the key is to design programmable features that solve clear user problems (for example automated B2B workflows) while staying far away from dystopian narratives in customer communications.

Implementation, regulation and use cases: from pilots to production

Regulatory stack: MiCA, PSD2/PSD3, BaFin, FCA, Fed & Congress

In the EU, CBDCs and stablecoins will sit in a dense legal stack:

MiCA regulates stablecoins and crypto-assets;

PSD2 / PSD3 + SEPA define access to accounts and payment initiation;

GDPR/DSGVO governs data;

BaFin and national supervisors overlay prudential rules.

The UK mix involves the Bank of England, HM Treasury, the FCA and Parliament committees coordinating on the digital pound and stablecoins, with UK-GDPR and Open Banking shaping implementation.

In the US, Congress and state regulators are shaping stablecoin rules while the CBDC ban effectively freezes retail CBDC work at the Fed, pushing the innovation frontier to private rails and wholesale pilots.

Design choices: intermediated vs direct, token vs account, offline vs online

Architecturally, central banks are weighing.

Intermediated vs direct

Most models, including the digital euro and digital pound concepts, use intermediated architectures, where banks and PSPs handle customer relationships and wallets. Direct central-bank accounts for millions of citizens are seen as too disruptive.

Token vs account

Token-style CBDCs behave more like digital cash or bearer instruments, while account-based designs look more like today’s banking systems. The choice affects how CBDCs interoperate with DeFi, tokenised deposits and wholesale CBDC for interbank settlement.

Offline-first vs always-online

The EU has opted for both online and offline modes; others may prioritise always-online models and rely on commercial innovation for offline fallback.

High-priority use cases: cross-border, remittances, wholesale, government

The most compelling early CBDC use cases include.

Cross-border & remittances

Linking CBDC systems and instant-payment networks could chip away at global remittance costs, still averaging around 6–7% today.

Wholesale settlement & tokenised securities

Pilots in Frankfurt, London, New York, Singapore and Hong Kong already test wholesale CBDCs for securities settlement and repo.

Government & crisis use

Fiscal transfers, crisis support and cross-border projects like mBridge will benefit from CBDCs’ programmability and 24/7 settlement, even as BIS steps back from running some platforms.

What CBDCs mean for banks, fintechs and enterprises

Scenario planning for the US, UK, Germany and wider Europe

By 2029, a few plausible scenarios stand out.

EU live, UK follows, US doubles down on private rails

The digital euro is live, the UK launches a digital pound as a complement to cash, and the US relies on FedNow, RTP and regulated stablecoins instead of a digital dollar.

EU delays, private rails dominate

Legislative delays or political backlash in Europe slow the digital euro, giving private payment schemes, Big Tech wallets and bank-backed stablecoins more room to grow.

Interoperable standards emerge

Major CBDCs (digital euro, digital yuan) and private stablecoins align on messaging and AML standards, enabling smoother cross-border flows but raising complex geopolitics around sanctions and data.

Boards in New York, London, Frankfurt and Berlin should treat these as planning lenses, not predictions mapping product, funding and compliance strategies to each.

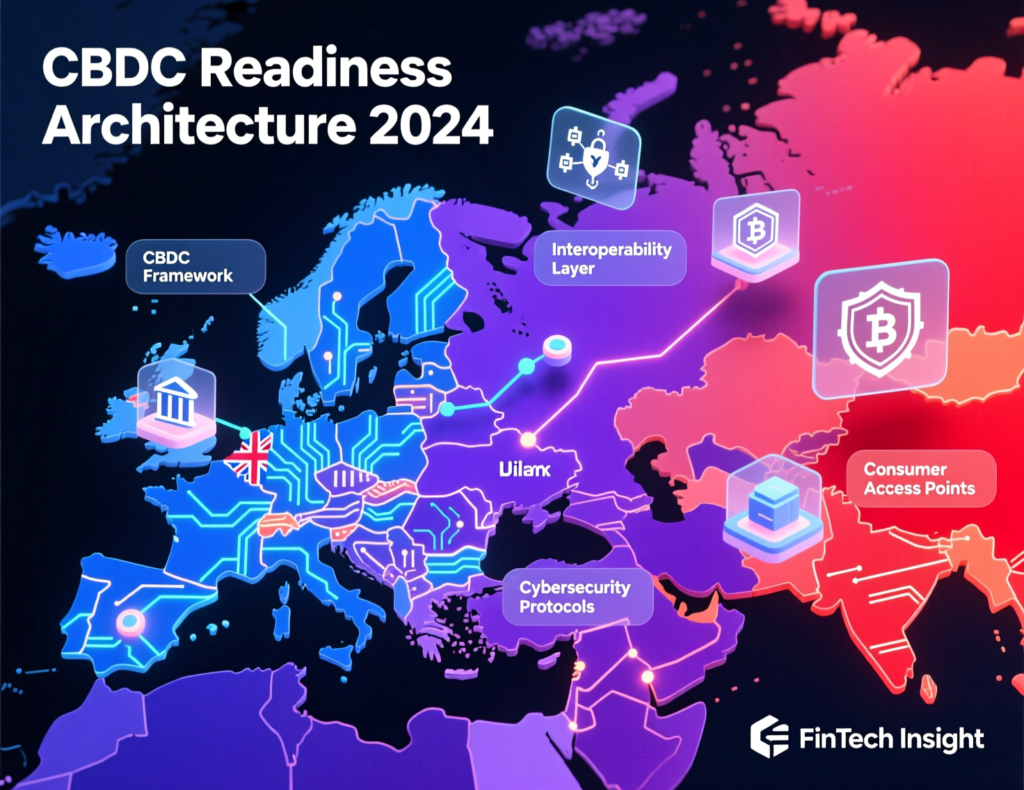

Building a CBDC-ready architecture today

Even before a digital euro or pound goes live, banks and fintechs can invest in a CBDC-ready architecture

Wallet and CBDC integration

Design retail CBDC wallets (including offline-capable devices) that plug into SEPA Instant, FedNow and Faster Payments.

API-first core systems

Modern, API-driven cores that already support instant payments and tokenised assets will plug into CBDC rails more easily. Partners like Mak It Solutions, with experience in SaaS, mobile and data engineering across the USA, UK, Germany and the wider EU, can help modernise legacy stacks.

Compliance stack for the new regime

Build for MiCA, GDPR/DSGVO, AMLD, PCI DSS, SOC 2 and FATF from the outset, anticipating CBDC-specific data retention and analytics requirements.

Advanced fraud & AML analytics

Expect central banks to push AI-based monitoring; your own fraud and AML systems must ingest CBDC transaction data and behave consistently with public-sector tooling.

Practical next steps for 2025–2029

Here is a pragmatic five-step roadmap you can start now.

Audit your CBDC & stablecoin exposure

Map where you already depend on stablecoins, tokenised deposits and instant-payment schemes, broken down by region (US, UK, EU, emerging markets).

Engage with policymakers

Respond to consultations from the ECB, Deutsche Bundesbank, Bank of England, HM Treasury, the Fed and EU/UK trade bodies; ensure your use cases and risk concerns are represented.

Pilot internal CBDC/stablecoin use cases

Use sandboxes or vendor partnerships to test programmable payouts, cross-border flows or treasury use cases with synthetic or pilot CBDC.

Upgrade customer communications

Prepare clear, plain-language content that addresses fears about surveillance, cashless societies and “programmable control,” especially for retail customers in Germany, the UK and the US.

Build a board-level CBDC playbook

Document scenarios, risk impacts, tech dependencies and regulatory timelines so your board and regulators can see a coherent plan.

Mak It Solutions already helps organisations modernise web, mobile and cloud stacks from WordPress vs Webflow vs Wix decisions to headless CMS and indexing controls. The same discipline applies here: treat CBDC readiness as a structured digital-transformation program, not a one-off experiment.

If CBDCs feel abstract today, they won’t in 3–5 years when digital-euro pilots are live and your customers start asking about “digital cash” in Germany, the UK and across Europe. Now is the moment to align your architecture, compliance stack and product roadmap with where sovereign digital money is actually heading.

If you’d like a CBDC-readiness review of your current apps, payment flows and data stack, connect with the team at Mak It Solutions to scope a focused, actionable roadmap tailored to your US, UK, German and wider EU footprint. ( Click Here’s )

FAQs

Q : Will CBDCs replace cash completely in the US, UK or Eurozone?

A : It’s very unlikely that CBDCs will fully replace physical cash in the foreseeable future. Central banks in the US, UK and Eurozone repeatedly emphasise that cash will remain available, both for inclusion and resilience reasons. The EU Council’s position on the digital euro even pairs CBDC legislation with measures to “strengthen the role of cash,” signalling a long-term coexistence model rather than abolition.

Q : Are CBDCs safer than keeping money in a commercial bank account?

A : In credit-risk terms, a retail CBDC is as safe as holding physical cash because it is a direct claim on the central bank, not on a commercial bank that could in theory fail. However, CBDCs will likely have holding limits and may offer no interest, while bank deposits come with deposit insurance and can earn yield. For most people and corporates, a mix of bank deposits, CBDC balances and other instruments will make sense, depending on risk appetite and regulation.

Q : How could a digital euro or digital pound affect the value of Bitcoin and stablecoins?

A : A successful digital euro or digital pound could reduce the payment-use case for some stablecoins in Europe and the UK by giving merchants and PSPs a public alternative with strong legal backing. But Bitcoin’s main driver is speculation and its “digital gold” narrative, not payments, so its price may be influenced more by macro sentiment than CBDC launches. Meanwhile, compliant euro and pound stablecoins may still thrive in DeFi and tokenised-asset markets, especially where CBDCs are kept deliberately simple.

Q : What does a world of multiple CBDCs mean for cross-border business payments and FX risk?

A : Multiple interoperable CBDCs could eventually make cross-border payments faster, cheaper and more transparent, especially when linked to instant-payment systems and projects such as mBridge or Nexus. In practice, governance, sanctions policy and data-sharing will determine how much FX risk and friction can be removed. Until standards mature, treasurers in New York, London, Frankfurt and Singapore should assume a hybrid world where CBDCs, stablecoins and traditional correspondent banking co exist.

Q : How should small and mid-sized banks or credit unions prepare for CBDCs and stablecoins?

A : Smaller institutions don’t need in-house CBDC research labs, but they do need a clear plan. That means modernising payment and core systems to connect to instant-payment rails, designing wallet-ready mobile apps, and partnering with vendors that can handle tokenised money, advanced AML analytics and cloud-native security. It also means engaging with national associations (such as UK Finance or US community-bank groups) to influence how CBDC and stablecoin regulation lands on smaller balance sheets.