RegTech Solutions That Automate Compliance in the US, UK & EU

RegTech Solutions That Automate Compliance in the US, UK & EU

RegTech Solutions That Automate Compliance in the US, UK & EU

RegTech solutions are software and cloud platforms that automate regulatory compliance tasks such as KYC, AML, sanctions screening, reporting and regulatory change tracking. They help banks, fintechs and other regulated enterprises in the US, UK and EU cut manual workload, reduce compliance risk and stay aligned with fast-changing regulations by turning rules into executable workflows, monitoring and dashboards.

Introduction

If you’re running a bank or fintech today, compliance probably eats more time than you’d like to admit. RegTech solutions are software and cloud platforms that automate regulatory compliance tasks such as KYC, AML, regulatory reporting and change tracking, dramatically reducing manual effort, cost and risk for financial institutions across the US, UK and EU. Instead of spreadsheets, email trails and siloed tools, RegTech solutions orchestrate end-to-end compliance workflows in one place.

This shift isn’t cosmetic. Global RegTech market estimates put the sector at roughly $18–21 billion in 2025, with double-digit annual growth projected through the early 2030s. At the same time, regulators such as the SEC, CFTC, FCA and BaFin are issuing record levels of fines, including over $25 billion in combined enforcement by the SEC and CFTC in 2024 and sharply higher FCA and German penalties for control failures.For banks in New York, challenger banks in London or universal banks in Frankfurt, staying manual is no longer realistic.

Whether you run a retail bank, a payment service provider, a wealth platform or a fast-growing neobank, this guide will help you understand what RegTech solutions are, how they work, and how to choose and implement the right platform for your operations in the US, UK, Germany and wider EU.

From Manual Compliance to RegTech Platforms

For years, compliance meant policy documents, shared drives, access-controlled spreadsheets and point tools for specific regulations. Investigations relied on analysts copying data between systems, reconciling by hand and drafting reports line by line. That model doesn’t scale when you’re handling millions of transactions per day, cross-border operations and overlapping regimes like BSA/AML, OFAC, GDPR/DSGVO, SMCR and MiFID II.

RegTech platforms replace that patchwork with automated data ingestion, rules engines, real-time monitoring and workflow tools that embed policies directly into daily operations. Instead of finding issues months later, teams see risk in near real time and can act before problems become enforcement cases.

Who This Guide Is For: Banks, Fintechs and Regulated Enterprises

This guide is written for compliance, risk, operations and technology leaders at.

Retail and commercial banks

Neobanks and challenger banks

Payment service providers (PSPs) and processors

Wealth and asset managers

Insurers and insurtechs

Highly regulated sectors such as healthcare (HIPAA) and ecommerce (PCI DSS) that need financial-grade controls

If you operate in multiple regions say, a London-based fintech passporting into the EU via Dublin, or a San Francisco PSP serving merchants across Berlin, Munich and Zurich RegTech is one of the most effective ways to keep obligations manageable and auditable.

What Are RegTech Solutions?

Regulatory technology (RegTech) refers to technology-driven solutions often cloud-based that help organisations comply with regulations more efficiently by automating monitoring, reporting and controls. In practice, RegTech solutions turn regulatory text into executable logic, workflows and dashboards that match your business model.

Regulatory Technology Explained in Plain Language

Think of RegTech as “compliance autopilot” with humans firmly in control. The platform connects to your core banking, payment gateways, CRM, trading systems and data warehouses. It then:

Applies KYC and AML policies to new and existing customers

Screens names against sanctions, PEP and adverse-media lists

Monitors transactions in real time for suspicious patterns

Tracks regulatory updates from bodies like the SEC, FCA, BaFin, EBA and ESMA

Generates evidence, logs and reports that auditors and regulators can rely on

The goal isn’t to replace compliance officers, but to free them from repetitive checks so they can focus on judgement, complex cases and regulatory strategy.

RegTech vs Traditional Compliance Software and Spreadsheets

Traditional compliance software tends to be single-purpose (e.g., only trade surveillance) and heavily on-premises. It often requires bespoke customisation, batch-based data feeds and manual reconciliation with other tools.

Modern RegTech platforms, by contrast.

Are API-first and cloud-based, simplifying integrations with modern stacks

Support multiple use cases (KYC, AML, reporting, change management) on one platform

Offer real-time compliance monitoring instead of overnight batches

Provide configurable rules engines instead of hard-coded logic

That means a UK challenger bank or US mid-sized bank can roll out new products faster, knowing controls and reporting will keep pace.

Key Components.

Most serious RegTech solutions share four building blocks.

Data ingestion and normalization

Connectors to core systems (CBS, card processors, trading platforms, CRMs), plus ETL pipelines to clean and standardise data.

Rules engines and models

Deterministic rules (e.g., AML thresholds), fuzzy matching (sanctions/name screening) and increasingly AI/ML models for anomaly detection.

Workflow and case management

Queues, assignment, SLAs, audit logs and approvals so investigations are traceable and repeatable.

Reporting and dashboards –

Out-of-the-box regulatory reporting (e.g., MiFID II, EMIR, PSD2) plus board-level dashboards on risk, controls and backlogs (with export for SEC/FINRA, FCA or BaFin exams).

Why RegTech Solutions Matter Now in the US, UK, Germany and EU

Banks and fintechs are shifting from manual compliance processes to RegTech platforms because regulatory expectations and penalties have risen faster than headcount budgets. Multi-jurisdiction operations make this even more acute.

Rising Regulatory Pressure and Enforcement in Financial Services

Regulators globally are signalling that weak controls will be expensive. In 2024, SEC and CFTC enforcement alone reached over $25 billion, while the FCA increased fines to around £176 million and German regulators BaFin and FOJ issued roughly €24.6 million in penalties, including for inadequate record-keeping and AML controls.Fenergo analysis shows North American regulatory penalties rising sharply again up roughly 417% in H1 2025.

The pattern is clear: regulators expect continuous monitoring, strong documentation and clear accountability frameworks like SMCR in the UK and MaRisk in Germany outcomes that are hard to achieve with spreadsheets.

The RegTech Market Size and Growth in Europe and North America

Analysts estimate the global RegTech market at around $18–21 billion in 2025, with projections ranging from about $44 billion by 2030 to roughly $77 billion by 2034, driven by demand in North America and Europe. North America currently leads adoption, but European financial centres such as London, Frankfurt, Berlin, Dublin and Luxembourg City are catching up fast, especially in capital markets, wealth and payments.

From “Cost Centre” to Strategic Advantage.

When implemented well, RegTech turns compliance into an enabler.

Launch new products faster (e.g., a Berlin-based PSP expanding to New York and London) because controls can be configured once and reused.

Reduce time to investigate alerts and suspicious activity reports (SARs).

Provide clear evidence to boards and regulators that controls are designed and operating effectively.

In competitive markets, being able to prove strong compliance can shape partnerships, correspondent banking relationships and even valuations.

Core Benefits of Modern RegTech Solutions

RegTech solutions cut manual compliance workload, reduce error rates, improve auditability and help teams keep pace with fast-changing rules across jurisdictions like SEC, FCA, BaFin and EU regulators. They’re not just “nice to have”they’re how lean teams maintain control as growth accelerates.

Reduced Manual Work and Operational Costs

By automating low-value tasks screening, basic investigations, data gathering for reports RegTech can reduce manual workload by an estimated 30–50% in mature programmes.(Validate with live benchmarks from your vendor.) Instead of hiring more analysts every time volume grows, you scale via automation. This is especially impactful for mid-sized banks in Austin or Manchester that must meet the same standards as global banks but with smaller teams.

Real-Time Compliance Monitoring and Alerts

Real-time compliance monitoring means the platform is continuously ingesting transactions, customer events and external data, then triggering alerts when rules or models are breached. That allows:

Faster detection of unusual behaviour and potential fraud

More timely SAR filings under BSA/AML in the US or AMLD directives in the EU

Immediate responses to sanctions list changes from OFAC, EU or UK authorities

It also supports more advanced scenarios such as behavioural monitoring across channels rather than just individual transactions.

Stronger Audit Trails, Reporting and Board-Level Visibility

Modern RegTech platforms create tamper-evident audit logs of every action who reviewed a case, what was decided, which rule triggered an alert. That evidence is invaluable during SEC/FINRA, FCA or BaFin exams and internal audits.

Board-level dashboards aggregate metrics like alert volumes, backlogs, typologies, data quality issues and model performance. That turns compliance from “black box” to a measurable function that directors and regulators can interrogate.

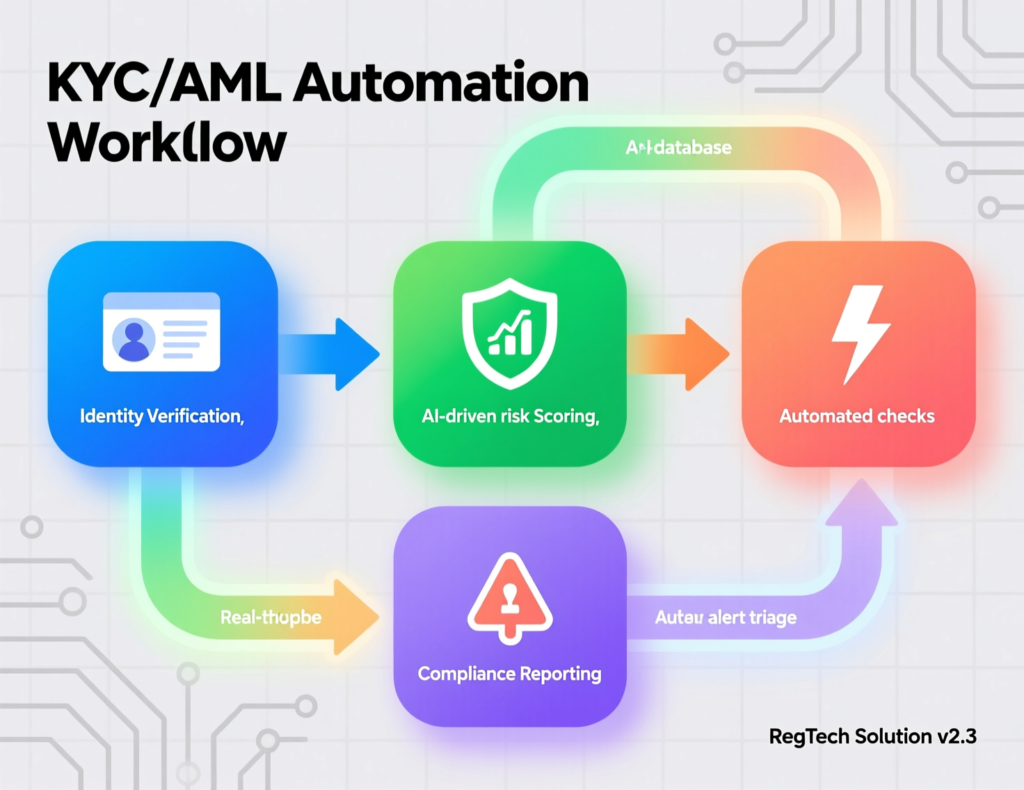

RegTech Use Cases: KYC, AML and Financial Crime Monitoring

KYC and Customer Onboarding Automation for Banks and Fintechs

RegTech solutions streamline KYC by orchestrating identity verification, document capture, risk scoring and ongoing due diligence. For a neobank in London or an online broker in New York, this means:

Configurable onboarding journeys by segment (retail, SME, high-risk)

Integration with IDV vendors (e.g., ComplyAdvantage, ComplyCube, Unit21)

Automated refresh cycles and triggers when risk profiles change

You reduce drop-off in the onboarding funnel while maintaining robust BSA/AML, SMCR and AMLD compliance.

AML, Sanctions Screening and Transaction Monitoring RegTech

For AML and sanctions, RegTech platforms typically provide.

Name, entity and payment screening against OFAC, UN, EU and HMT lists

Risk-based transaction monitoring with typologies for structuring, layering, mule activity and more

Case management and SAR filing workflows across US, UK and EU regimes

Vendors like NICE Actimize, IBM, ACTICO and Regnology focus heavily on these use cases, with pre-built rule libraries for common typologies.

Real-Time Fraud Detection and Behavioural Monitoring

Some RegTech solutions cross over into fraud detection, using AI and machine learning to spot abnormal patterns across devices, channels and time. For example, a PSP in San Francisco might combine behavioural biometrics, device fingerprinting and transaction patterns to identify mule accounts or account takeovers.

When KYC, AML and fraud share a single platform or tightly integrated stack, teams can correlate evidence and reduce false positives.

Compliance Automation Platforms & Regulatory Change Management

Compliance automation platforms centralise regulatory obligations, map them to internal controls and workflows, and automatically update requirements when regulations change in the US, UK and EU. This is critical when new rules (e.g., ESG disclosures or crypto asset regimes) arrive quickly.

From Point Solutions to Integrated Regulatory Compliance Platforms

Instead of separate tools for KYC, AML, reporting and policy management, integrated platforms offer:

A unified obligations register covering SEC, FINRA, FCA, BaFin, EBA, ESMA and local rules

A single control library mapped to those obligations

Shared data and case management across use cases

Platforms like CUBE and Regnology emphasise this integrated approach, especially for large banks and insurers operating across New York, London, Frankfurt and Zurich.

Regulatory Change Management Tools: Tracking SEC, FCA, BaFin and EU Updates

Regulatory change tools continuously monitor sources such as the Federal Register, SEC and FINRA updates, FCA Handbook, BaFin circulars, MaRisk and EBA guidelines. They:

Classify changes by theme and impact area

Map them to your internal policies, controls and processes

Trigger review workflows for control owners

That means when, for example, the FCA updates SMCR guidance or ESMA refines MiFID II reporting standards, your teams receive structured tasks not just PDF newsletters.

Automated Regulatory Reporting (MiFID II, EMIR, PSD2, SEC/FINRA)

Reporting modules focus on.

Transaction reporting (e.g., MiFIR under MiFID II, EMIR derivatives reporting)

Prudential and liquidity reporting to national competent authorities

SEC/FINRA submissions and ad-hoc requests

Pre-built templates, validations and exception handling reduce the risk of mis-reporting across EU hubs like Dublin, Luxembourg City and Frankfurt.

Regional RegTech Requirements.

RegTech Solutions for US Banks and Fintechs (SEC, FINRA, BSA/AML, OFAC, SOX)

US financial institutions must juggle SEC, FINRA, OCC, Federal Reserve, CFPB and state-level expectations, plus frameworks like BSA/AML, OFAC sanctions, SOX, HIPAA (for healthcare-related products) and PCI DSS. RegTech for US banks often emphasises:

BSA/AML monitoring and SAR workflows

OFAC and sanctions screening

Transaction reporting and record-keeping (SEC/FINRA)

Model risk management documentation (SR 11-7 style)

Mid-sized banks in New York or Austin increasingly look for cloud-first RegTech platforms that are SOC 2 and ISO 27001 certified, with US data residency.

RegTech Solutions in the UK for FCA, SMCR and Open Banking

UK firms must align with FCA and PRA rules, SMCR accountability, UK-GDPR and Open Banking standards governed by the Open Banking Implementation Entity and PSR. Typical UK demands include.

SMCR documentation and conduct risk monitoring

Conduct and market abuse surveillance for trading desks

Open Banking consent, data access and security controls

Support for FCA-style outcomes testing and consumer duty

Challenger banks in London, Manchester and Edinburgh often combine RegTech with modern core systems and cloud-native data platforms.

RegTech in Germany and the EU.

German and EU institutions must consider BaFin, Bundesbank, MaRisk, DSGVO/GDPR, AMLD, MiFID II, EMIR and PSD2, plus EBA/ESMA guidance. RegTech platforms aimed at DACH/EU typically offer:

Strong data residency controls with hosting in German or EU data centres

Field-level consent, purpose limitation and retention tooling for GDPR/DSGVO

Pre-built reporting logic for MiFID II/MiFIR, EMIR and PSD2

Support for multilingual teams in Frankfurt, Berlin, Munich, Dublin and Luxembourg City

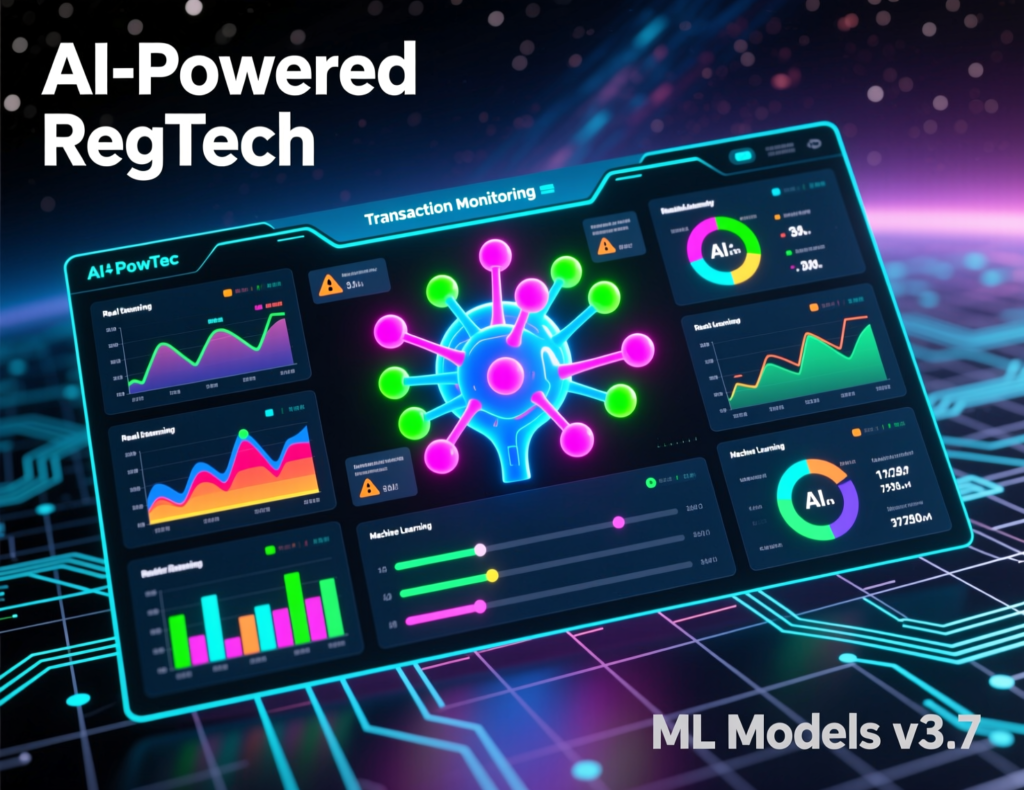

AI Compliance Tools Inside RegTech Platforms

How AI and Machine Learning Improve KYC, AML and Monitoring

AI and machine learning models enhance RegTech by reducing false positives and identifying complex patterns that rules can’t. Common applications include.

Entity resolution and fuzzy matching for sanctions and PEP lists

Anomaly detection for transaction monitoring

Risk scoring that considers behaviour over time and across channels

For example, an AI-enabled platform can distinguish between a legitimate high-spending customer in Zurich and a sudden, unusual spike in activity that might indicate mule behaviour.

Using AI for Regulatory Change Detection and Impact Analysis

Some RegTech vendors apply NLP to regulatory texts from SEC, FCA, BaFin, EBA and ESMA, automatically.

Extracting obligations and mapping them to internal controls

Flagging impacted products, entities and processes

Generating draft impact assessments for review

This is particularly useful for multi-country banks faced with overlapping ESG regulations, consumer duty frameworks and digital operational resilience rules.

Governance, Explainability and Model Risk for AI in RegTech

Regulators increasingly expect AI models used in compliance to be explainable and well-governed. That means:

Documented model development, testing and validation

Bias and performance monitoring over time

Clear “reason codes” for decisions impacting customers

RegTech platforms that bundle model risk management features make it easier to demonstrate compliance with expectations from US regulators, the FCA, BaFin and EU AI-related guidance.

Cloud-Based RegTech Platforms, Data Privacy and Security

Leading cloud RegTech platforms combine strong security controls (SOC 2, ISO 27001), data residency options and GDPR/DSGVO-compliant processing to support banks across multiple regions. The trade-off between cloud and on-premises is no longer about “secure vs insecure” but about which combination best fits your risk appetite and IT strategy.

Cloud vs On-Premises RegTech.

Cloud-based RegTech platforms

Pros: rapid deployment, continuous updates, easier integrations, elastic scale.

Cons: data residency and third-party risk to manage, reliance on vendor roadmaps.

On-premises RegTech

Pros: full infrastructure control, sometimes easier alignment with legacy systems.

Cons: slower upgrades, higher maintenance burden, limited elasticity.

Many EU banks adopt hybrid approaches: sensitive workloads in-country or private cloud, with lighter-weight functions hosted in AWS, Azure or GCP regions that meet data residency needs.

Data Residency in the EU, German Data Centres and Schrems II Considerations

Post-Schrems II, EU and especially German institutions are cautious about cross-border data transfers. Banks in Frankfurt or Berlin frequently require:

Hosting in EU or specifically German data centres

Clear data processing agreements and SCCs

Configurable data localisation (e.g., only metadata leaving the EU for analytics)

RegTech vendors now routinely offer EU-only environments and, in some cases, in-country deployments.

Security, Certifications and Third-Party Risk (SOC 2, ISO 27001, PCI DSS, HIPAA)

When onboarding a RegTech platform, due diligence should cover:

SOC 2 Type II and ISO 27001 certifications

PCI DSS alignment if card data touches the platform

HIPAA considerations if you handle US healthcare-related financial data

Secure SDLC, penetration testing and incident response processes

Security teams in New York, London and Frankfurt will expect evidence and RegTech vendors that can’t provide it will struggle to pass bank-grade procurement.

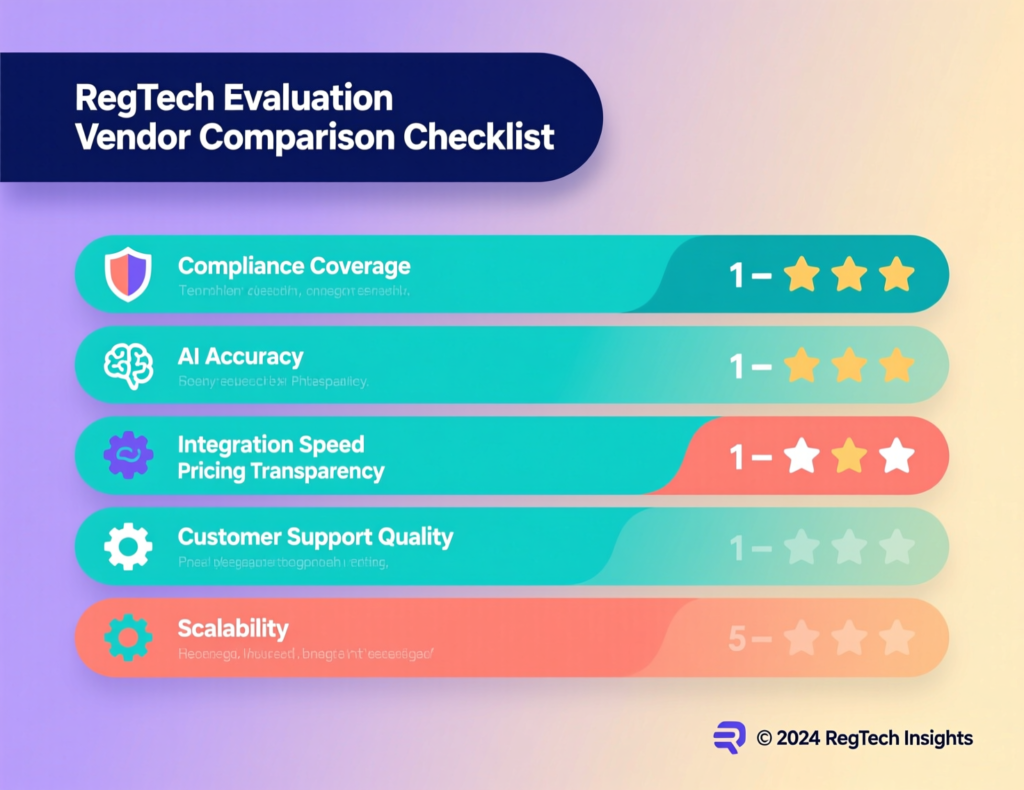

How to Evaluate and Select the Right RegTech Solution

For a mid-sized bank operating across the US, UK and EU, evaluating RegTech means aligning use cases, coverage and cost. A structured, step-by-step approach reduces risk and vendor fatigue.

Defining Use Cases.

Start by identifying your primary pain points:

High AML alert volumes and slow investigations?

Fragmented KYC across branches and digital channels?

Manual MiFID II / EMIR / PSD2 or SEC/FINRA reporting?

Regulatory change management handled via inboxes and spreadsheets?

Prioritise one or two flagship use cases (e.g., KYC/AML for cross-border retail banking) for your first phase and make sure internal stakeholders agree.

Key Evaluation Criteria: Coverage, Integrations, GEO Support, Total Cost

When shortlisting vendors like IBM, NICE Actimize, Unit21, CUBE, ComplyAdvantage, ACTICO or Regnology, compare:

Regulatory coverage

US (SEC, FINRA, BSA/AML, OFAC), UK (FCA, SMCR, UK-GDPR), EU (BaFin, MaRisk, AMLD, MiFID II, EMIR, PSD2, GDPR/DSGVO).

Integrations

Can they plug into your core, CRM, data lake, card processors and RegTech marketplaces such as NayaOne?

GEO and language support

US, UK, German and EU-wide requirements, including data residency.

Total cost of ownership

Licence, implementation, ongoing configuration, internal team time.

Ask for references from comparable institutions e.g., a UK challenger bank, a German regional bank or a US mid-sized commercial bank.

Vendor Checklist.

Key questions include.

Which regulators and regimes do you cover out of the box for the US, UK and EU?

What’s your roadmap for AI/ML features and how do you handle model risk governance?

How do you support data residency in Germany/EU?

What’s your typical implementation timeline for a bank our size?

How do you manage configuration vs custom code?

Implementing RegTech Across US, UK and EU Operations

Building a Cross-Functional RegTech Team (Compliance, Risk, IT, Data)

Successful RegTech implementations involve.

Compliance and financial crime teams defining policies and use cases

Risk and internal audit shaping controls and second-line oversight

IT and security owning architecture, integration and third-party risk

Data teams managing quality, lineage and governance

In a New York–London–Frankfurt operating model, appoint regional champions to ensure local nuances are captured.

Phased Roll-Out.

A pragmatic roadmap might look like.

Pilot in one business line (e.g., UK retail bank AML) with clear KPIs.

Scale to other regions (e.g., Germany and US) and use cases once baseline performance is proven.

Optimise rules, models and workflows based on analytics and feedback.

This phased approach reduces disruption, especially where legacy tools and manual processes still run in parallel.

Measuring Success.

Define KPIs before you start, such as.

Reduction in manual case handling time

Alert false-positive rate and quality of true-positive identification

Time to implement regulatory changes (e.g., new AMLD directive)

Audit findings and regulatory feedback

Reporting these metrics to boards in London, Berlin and New York demonstrates ROI and regulatory maturity.

Example RegTech Solution Architectures by Region

US Mid-Sized Bank.

A typical US stack might include:

Core banking and payments platform feeding data into a central data lake

RegTech platform for BSA/AML monitoring, OFAC screening and SAR workflows

Case management integrated with enterprise GRC

Reporting layer for BSA, SEC/FINRA and OCC interactions

Cloud hosting in a US region with SOC 2 and FedRamp-aligned controls is increasingly common.

UK Challenger Bank.

A London or Manchester challenger bank might use:

Cloud-native core and payment processors

RegTech tools for KYC/AML, SMCR, conduct risk and Open Banking consents

API gateway enforcing consent and security with UK-GDPR alignment

Real-time dashboards for SMF-holders to evidence their responsibilities

This setup supports fast feature launches without weakening FCA compliance.

German/European Bank.

A Frankfurt-based bank might favour:

EU-resident cloud (Frankfurt or Berlin region) for core and analytics

RegTech platform deployed in German data centres to meet BaFin and DSGVO expectations

Tight integration with MaRisk-driven risk frameworks and EBA/ESMA reporting

Strong logging and encryption to satisfy both BaFin and ECB oversight

Final Words

RegTech solutions transform regulatory compliance from a manual, reactive chore into an automated, data-driven capability. By unifying monitoring, reporting, KYC/AML and regulatory change management across US, UK and EU operations, you reduce operational drag and strengthen your defence against enforcement.

Key Takeaways

Manual compliance can’t keep up with today’s regulatory volume and complexity.

RegTech platforms centralise obligations, controls and workflows across regions.

AI and real-time monitoring cut false positives and surface real risk faster.

Cloud-based RegTech is viable when data residency, security and certifications are addressed.

A phased, KPI-driven rollout across the US, UK and EU is the safest path to adoption.

Build vs Buy vs Marketplace: When to Partner with a RegTech Platform

Very few institutions now build complete RegTech stacks from scratch. In practice.

Buy a core RegTech platform for KYC/AML, monitoring and reporting.

Extend with marketplace-style connectors (e.g., via NayaOne) for niche needs.

Build only where you need proprietary models or highly differentiated IP.

This mix gives you speed and flexibility without locking your entire compliance posture into custom code.

If your teams are still wrestling with spreadsheets, siloed tools and last-minute reporting scrambles, now is the right moment to assess your compliance stack. Map your key use cases, gaps and regional obligations, then run a structured RegTech evaluation focused on your US, UK and EU footprint. A well-chosen platform can significantly reduce risk, cost and complexity over the next 3–5 years.

This article is for general information only and does not constitute legal, regulatory or financial advice. Always consult qualified advisers before making decisions that affect your regulatory obligations.( Click Here’s )

Work with Mak It Solutions on Your RegTech-Ready Platform

Mak It Solutions helps banks, fintechs and regulated enterprises plan, design and implement modern, cloud-ready platforms exactly the foundation you need before or alongside a RegTech rollout. If you’re re-platforming customer journeys, data pipelines or analytics, we can help you align technology choices with regulatory expectations in the US, UK, Germany and wider EU.

Next step

share your current architecture and target markets, and request a scoped consultation to see how a RegTech-ready platform roadmap could look for your team.

FAQs

Q : How do RegTech solutions differ from traditional regulatory compliance software?

A : Traditional compliance tools are usually single-purpose, on-premises and batch-based, with heavy customisation and manual reconciliation. RegTech solutions are cloud-first, API-driven platforms that automate data ingestion, monitoring, case management and reporting across multiple regimes. They support real-time compliance monitoring, configurable rules engines and integrated regulatory change tracking, making it easier for banks and fintechs to keep pace with evolving SEC, FCA, BaFin and EU requirements across regions.

Q : Which RegTech features are most important for KYC and AML compliance in cross-border banking?

A : For cross-border KYC/AML, prioritise robust data ingestion from all channels, high-quality sanctions/PEP/adverse-media screening, flexible risk scoring and transaction monitoring that can handle multiple currencies and jurisdictions. Look for strong case management, SAR/STR workflows and regulatory reporting tailored to BSA/AML, UK and EU AMLD directives. Native support for multilingual teams and regional nuances—like German MaRisk expectations or UK SMCR accountability also becomes critical as you expand from, say, London to Berlin or New York.

Q : Can cloud-based RegTech platforms meet strict EU data residency and DSGVO requirements?

A : Yes, many modern cloud-based RegTech platforms are explicitly designed to satisfy EU and DSGVO/GDPR requirements. Vendors increasingly offer EU-only or even country-specific hosting (e.g., German data centres), granular access controls, encryption at rest and in transit, and configurable data retention policies. The key is to verify data residency options, review data processing agreements and SCCs, and involve your DPO and security teams early so Schrems II, BaFin and local supervisory expectations are addressed before go-live.

Q : How much does a typical RegTech solution cost for a mid-sized bank or fintech?

A : Costs vary by vendor, scope and volume, but mid-sized banks typically see annual licence fees in the low- to mid-six-figure range, plus a one-off implementation project covering integrations, configuration and change management. Additional costs may include data providers (sanctions/PEP lists, credit data), cloud infrastructure if self-hosted and internal team time. When evaluating TCO, compare it to the cost of additional headcount, fines, remediation projects and delayed product launches in the US, UK or EU. These figures are indicative only and do not replace formal vendor quotations or financial advice.

Q : What internal capabilities do we need before onboarding a RegTech vendor (data, team, governance)?

A : Before onboarding a RegTech platform, you need clear data ownership (who controls which systems), basic data quality standards, a cross-functional project team and defined governance. Compliance and financial crime teams should own policy and use-case definitions; IT and data teams handle integrations and pipelines; risk and audit provide oversight. A clear RACI for model changes, rule tuning and regulatory change management ensures the platform doesn’t become “just another tool” but a core part of your control environment.