Cryptocurrency Regulation in UAE: GCC Startup Guide

Cryptocurrency Regulation in UAE: GCC Startup Guide

Cryptocurrency Regulation in UAE: GCC Startup Guide

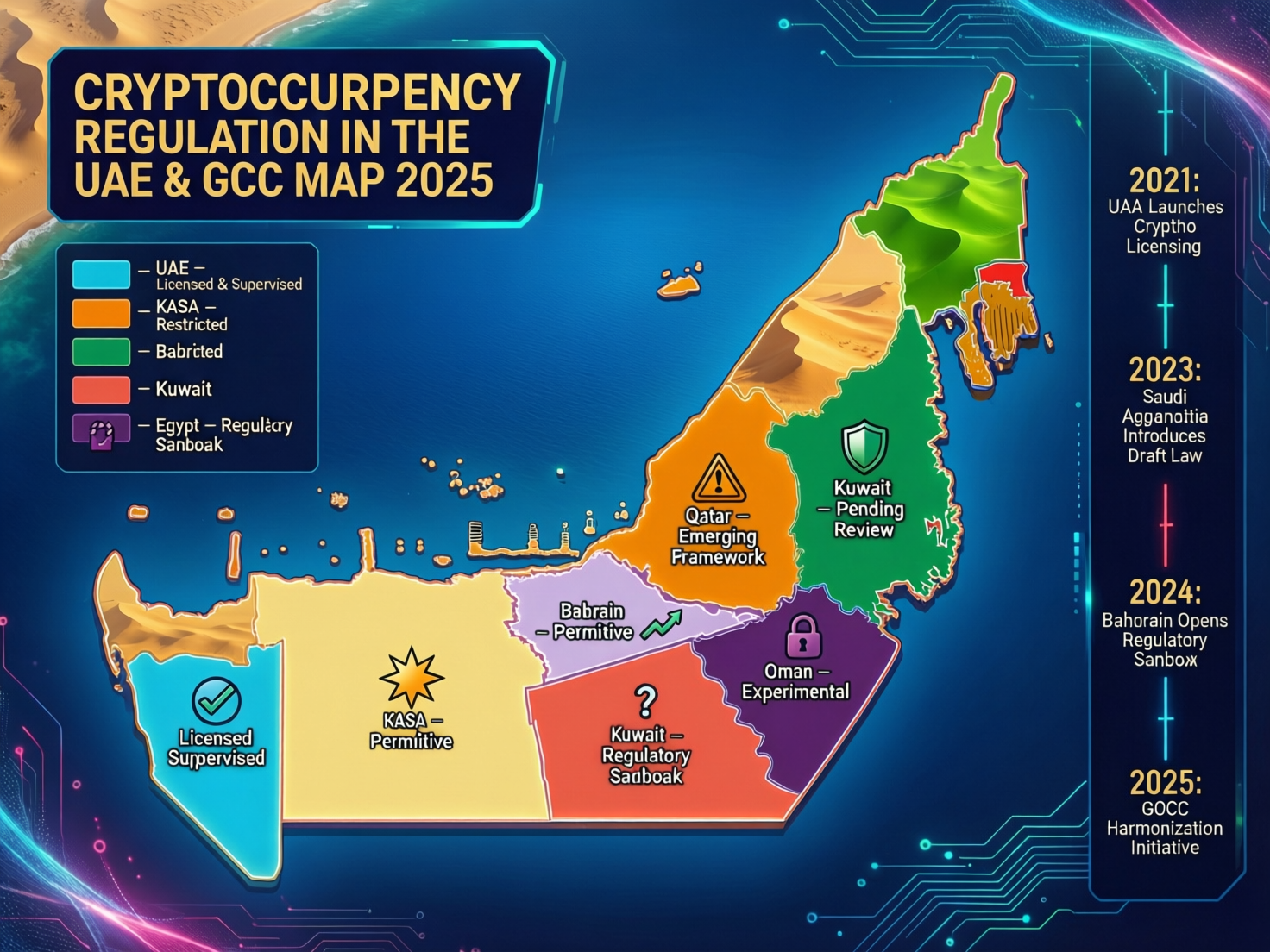

Cryptocurrency regulation in UAE is now one of the most structured in the GCC, with federal SCA rules plus dedicated regimes from VARA, ADGM and DIFC that license exchanges, brokers and custodians while exempting many virtual asset trades from VAT. For Saudi, Qatar, Kuwait, Bahrain and Oman, the picture is far more mixed, ranging from strict bans and warnings to Bahrain’s full CBB crypto-asset framework and Oman’s evolving virtual asset plans, so GCC founders usually treat Dubai and Abu Dhabi as primary hubs while carefully respecting each country’s local restrictions.

Introduction

For many GCC founders, cryptocurrency regulation in UAE has quietly become the benchmark for how the region handles virtual assets. Dubai and Abu Dhabi now sit alongside Manama as key Middle East crypto hubs, with clear licensing routes, specialist regulators and fast-moving CBDC projects like the Digital Dirham and Project mBridge.

At the same time, your investors in Riyadh or Doha might be reading official warnings or outright bans on retail crypto trading, while Kuwait is cracking down on mining and Saudi continues to rely on cautious statements from SAMA and the CMA rather than a dedicated crypto law.

This guide is written for GCC founders and family offices who want the practical picture: is crypto legal, who regulates it, what licenses exist (VARA, ADGM, DIFC, CBB, QFC), how VAT, corporate tax and zakat interact with crypto income, and when you should lean on UAE structures while still respecting Saudi, Qatar, Kuwait, Bahrain and Oman rules. It’s context, not legal advice you’ll still need specialist counsel before you launch.

Snapshot of Cryptocurrency Regulation in UAE Today

Cryptocurrency regulation in UAE has moved from “unregulated” headlines to a layered, formal system. At federal level, the Securities and Commodities Authority (SCA) regulates most onshore virtual asset service providers (VASPs), while Dubai’s VARA and the financial free zone regulators in ADGM (FSRA) and DIFC (DFSA) run their own frameworks.

Is cryptocurrency legal in the UAE, Dubai, and Abu Dhabi?

For individuals, buying and holding crypto through regulated platforms is broadly permitted, but it is not legal tender and must pass through licensed entities in onshore UAE or approved free zones. Since Cabinet Resolution 111 of 2022 and the SCA’s VA Exchange Regulations, anyone providing exchange, brokerage, custody or platform services in onshore UAE must be licensed by SCA or a “local licensing authority” such as VARA.

In Dubai (outside DIFC), VARA now acts as the sole virtual asset regulator, supervising everything from exchanges and custodians to marketing and influencer promotions. Abu Dhabi’s ADGM and DIFC’s DFSA both treat certain virtual assets as regulated financial products, with “accepted/recognised” token lists and detailed prudential and conduct rules.

Who actually regulates crypto in the UAE? (VARA, SCA, ADGM, DIFC)

In practice you’ll interact with.

SCA (Federal)

Licenses onshore VA platform operators, brokers and dealers, and maintains an official list of tradable virtual assets.

VARA (Dubai)

Regulates all virtual asset activities in Dubai outside DIFC, including marketing rules, risk disclosures, compliance and penalties.

FSRA in ADGM (Abu Dhabi)

Pioneer of a full digital asset framework for exchanges, brokers, custodians and investment funds.

DFSA in DIFC (Dubai)

Runs a distinct Crypto Token regime with its own token recognition process and restrictions (for example, banning privacy and algorithmic tokens).

Compared to wider MENA, this gives UAE founders a relatively predictable path: clear regulators, defined license categories and increasing alignment with FATF standards on AML/CFT and the Travel Rule.

How UAE Compares with Saudi, Qatar, Bahrain, Kuwait, and Oman

What are the key differences between UAE, Saudi Arabia, and Qatar in how they regulate cryptocurrencies and virtual assets?

The UAE combines formal licensing regimes (SCA, VARA, ADGM, DIFC) with innovation projects like CBDC and open banking, while Saudi Arabia relies on strong warnings from SAMA/CMA and draft frameworks, and Qatar maintains bans on most virtual asset services but carves out tokenization in the Qatar Financial Centre (QFC).

Saudi Arabia.

Saudi has no dedicated crypto statute yet. Cryptocurrencies are not legal tender and SAMA’s standing committee has repeatedly warned that bitcoin and similar virtual currencies are not approved and carry high risk, while the CMA has consulted on a future virtual asset framework for licensing VASPs.

In reality, many individuals in Riyadh and Jeddah still access offshore exchanges, but they do so against a backdrop of official caution. If you’re a UAE-licensed exchange onboarding Saudi users, you should treat SAMA’s public statements as a clear signal to manage marketing carefully and consider geo-blocking for certain products especially derivatives and leveraged trading.

Qatar and Kuwait.

Qatar’s Central Bank banned banks from dealing in bitcoin in 2018 and later prohibited virtual asset services in the Qatar Financial Centre, making institutional crypto activities largely off-limits. Yet in 2024, the QFC Digital Asset Regulations created a separate framework for tokenization and digital asset rights in Doha, especially around securities and smart-contract-based instruments.

Kuwait has gone further: regulators issued an absolute prohibition on crypto trading, investment and mining in 2023, followed by raids on mining operations during the 2025 power crisis.For a GCC founder, Kuwait is a “do not touch” retail market focus instead on compliant B2B technology or non-crypto blockchain pilots.

Bahrain and Oman.

Bahrain was early. The Central Bank of Bahrain’s Crypto-Asset Module covers licensing, capital, governance and AML expectations for crypto-asset service providers, and Bahrain has attracted global platforms like Binance and Crypto.com alongside a strong fintech sandbox in Manama.

Oman sits between caution and openness: the regulator has consulted on a Virtual Assets Regulatory Framework to cover exchanges, tokens and ICOs, while the Central Bank and others still warn that crypto is not protected under banking laws.

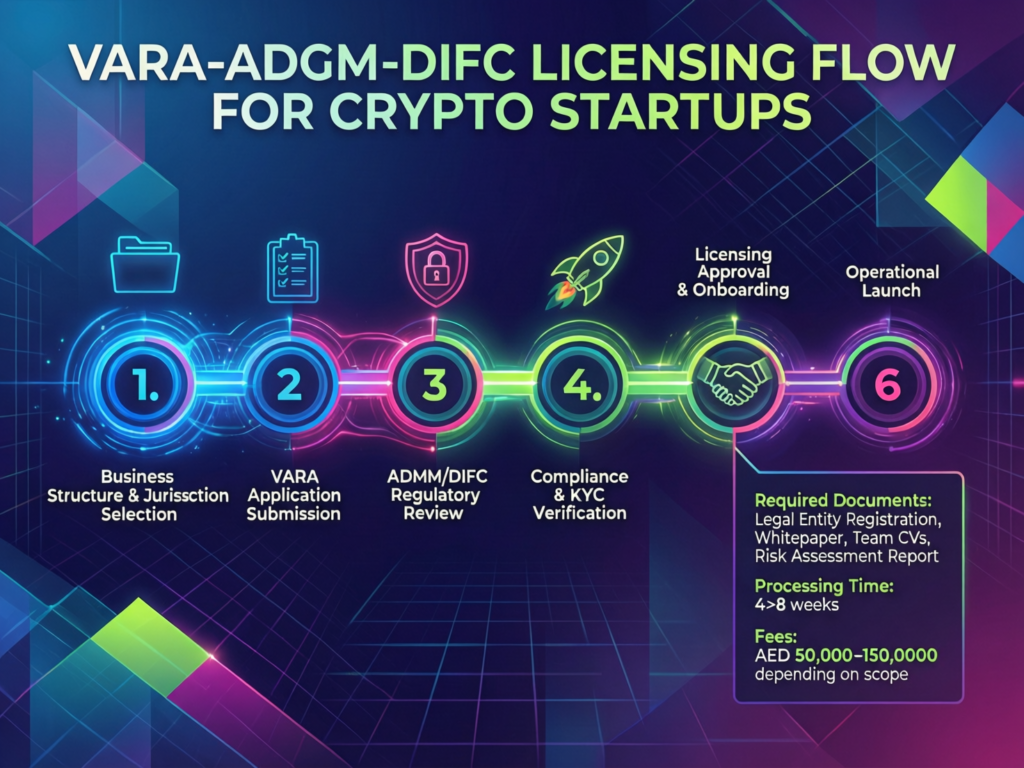

UAE Licensing Paths for Exchanges, Brokers, and Web3 Startups

What does a VARA or ADGM crypto license actually allow a startup to do in the UAE?

A full license from VARA, ADGM or DIFC typically lets you run a regulated exchange, brokerage, custody solution or investment platform for accepted virtual assets, subject to strict onboarding, AML/CFT, capital and conduct rules. The precise permissions—spot vs derivatives, retail vs professional clients, staking, OTC, token listings depend on your chosen regulator and license category.

VARA VASP licenses in Dubai.

If you are operating “in or from” Dubai (outside DIFC) and provide exchange, brokerage, custody, lending, OTC dealing, portfolio management or even marketing services for virtual assets, VARA expects you to obtain the appropriate VASPs licence. Its rulebooks define separate categories for exchanges, brokers-dealers, custodians, lending/borrowing, transfer and advisory services, with detailed marketing and promotion requirements especially for influencers speaking to retail users in Dubai.

ADGM and DIFC.

In ADGM, the FSRA’s digital asset framework lets authorised firms run multilateral trading facilities, custody, brokerage and fund activities in virtual assets, with a strong emphasis on institutional-grade governance (think regional exchanges, OTC desks and tokenization for family offices in Abu Dhabi).

In DIFC, the DFSA’s Crypto Token regime focuses on recognised tokens and restricts high-risk types like privacy and algorithmic tokens, making it attractive for more conservative fintech and digital bank propositions targeting Dubai’s financial centre.

If you’re planning product UX, API architecture or your exchange front-end, Mak It Solutions can help you design compliant, high-performance web platforms similar to the ones we describe in our piece on web development trends in the Middle East for KSA & UAE and our dedicated web development services pages. (Mak it Solutions)

Choosing the right UAE license as a GCC startup

Founders from Saudi, Qatar, Kuwait or Oman usually pick between:

VARA (Dubai) – if your brand is retail-heavy, social-media driven and Dubai-centric.

ADGM (Abu Dhabi) – if you’re building institutional exchanges, custody, or family-office-style desks.

DIFC (Dubai) – if you’re closer to regulated fintech, digital banking or tokenized securities.

To support that choice, Mak It Solutions often pairs legal workstreams with front-end and back-end development services, shaping roadmaps that respect each regulator’s UX, data and governance expectations. (Mak it Solutions)

Legal Status and Use of Crypto Across GCC Countries

Trading, payments, and remittances: what’s allowed?

Across the GCC, everyday crypto trading by individuals sits on a spectrum:

UAE & Bahrain – permitted via regulated platforms.

Saudi & Oman – not banned outright, but discouraged and high-risk.

Qatar & Kuwait – strongly restricted or prohibited, especially for licensed financial institutions.

Using crypto directly for payments or remittances is still limited; most GCC regulators prefer licensed money transfer operators and open-banking rails for day-to-day flows, especially as open banking frameworks expand in Saudi, Bahrain and the UAE.

Institutional and government use: tokenization, pilots, and sandboxes

Even where retail trading is restricted, governments are experimenting. Saudi and UAE ran Project Aber as an early cross-border CBDC pilot; the UAE is now rolling out the Digital Dirham and has completed cross-border CBDC payments with China, while Bahrain and Qatar use regulatory sandboxes for tokenization and blockchain trade-finance pilots involving logistics and government entities.

CBDC projects and mBridge

Projects like mBridge show GCC central banks are comfortable with CBDC for cross-border wholesale payments, even as they warn retail users against volatile, unregulated tokens.From a policy perspective, CBDCs let them keep monetary sovereignty, embed AML controls and support open-banking ecosystems without importing the full risk profile of crypto speculation.

Tax, VAT, Zakat, and Reporting Rules for Crypto in UAE and GCC

UAE crypto tax and VAT

For now, individuals in the UAE typically enjoy no personal income or capital gains tax on crypto holdings, but corporate profits from trading or exchange activities are subject to the 9% federal corporate tax above AED 375,000.

Following 2024 amendments, the UAE has exempted many virtual asset transactions from VAT, including the transfer and conversion of virtual assets and certain safekeeping services, making Dubai and Abu Dhabi more attractive for exchanges and market-makers that would otherwise see VAT leakage.

Saudi, Qatar, and Bahrain: tax, zakat, and disclosure

Saudi Arabia and Qatar treat crypto within their broader frameworks for zakat and tax, focusing on proper asset valuation, disclosure and anti-avoidance, even when the underlying crypto activities are discouraged or restricted. Bahrain, meanwhile, combines no personal income tax with specific VAT guidance that classifies payment tokens and other crypto types, so expats and digital nomads in Manama still need accurate records and professional advice.

What GCC investors and family offices should track

For Riyadh-, Dubai- or Doha-based family offices with UAE-licensed structures, the practical checklist is:

Track cost basis, holding periods and counterparties for every major crypto position.

Map where economic activity occurs (e.g., UAE exchange vs Saudi family office HQ).

Align with zakat and tax guidance in KSA, including new executive regulations.

Prepare for future rules on cross-border reporting of digital assets—an area where FATF, the GCC and OECD are all moving.

Compliance, AML/CFT, and Consumer Protection Requirements

Core AML/CFT obligations for UAE and GCC VASPs

Across Dubai, Abu Dhabi, Manama and beyond, VASPs are now expected to meet full FATF-grade AML/CFT standards: robust KYC, ongoing transaction monitoring, sanctions screening, Travel Rule implementation and detailed record-keeping.

VARA ties its rulebooks to UAE federal AML laws, while the CBB and DFSA layer crypto-specific controls on top of their existing AML modules, including Travel-Rule-style requirements for crypto-asset transfers. (VARA Rulebook)

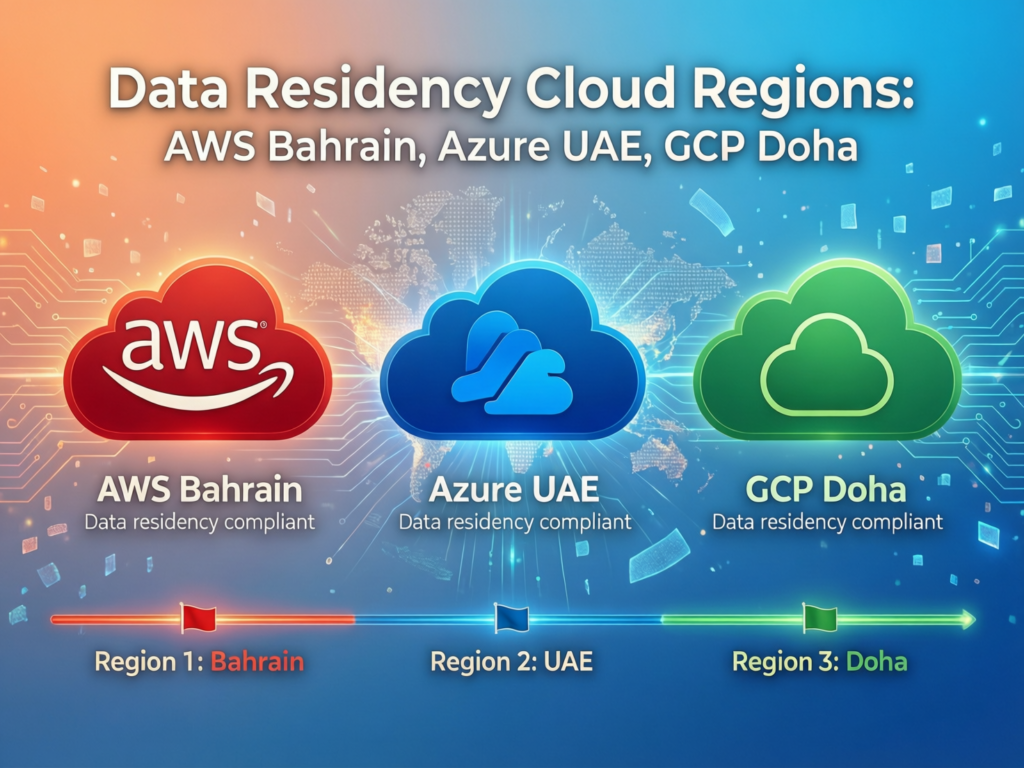

Using GCC-region cloud like AWS Bahrain, AWS UAE, Azure UAE Central/North, or GCP Doha can make it easier to satisfy data-residency and audit expectations, especially when combined with strong back-end architectures like the ones we design in our headless CMS and indexing controls guides. (Amazon Web Services, Inc.)

Marketing and promotion rules

VARA’s marketing regulations, DFSA explainer notes and CBB guidance all stress fair, clear, non-misleading promotions, mandatory risk warnings and restrictions on “finfluencer” style endorsements to unsophisticated users in Dubai, Abu Dhabi and Manama.

If you are building a content-heavy funnel—landing pages, education hubs, Web3 explainers this is exactly where Mak It Solutions’ WordPress and Webflow development services help you structure compliant messaging, localized for Arabic-speaking users in Riyadh, Dubai and Doha.

Retail investor protection.

Expect regulators to scrutinize:

Leverage and derivatives offered to retail users.

Complex products like perpetual futures, options and structured yield.

Suitability assessments and risk-scoring.

DFSA’s token regime, VARA rulebooks and the CBB crypto-asset module all push firms towards professional-client-first strategies, with tighter controls for retail.

Sharia, Halal/Haram Debates, and Islamic Finance in GCC Crypto

Is crypto halal or haram in Saudi and the wider GCC?

Scholarly opinion on whether crypto is halal or haram remains divided. Many official bodies in Saudi and the wider GCC have chosen not to issue definitive rulings, instead warning about speculation, volatility and fraud while leaving room for asset-backed or utility-based structures.

For GCC founders, the safest path is often risk-based disclosure: clearly explain where your token or virtual asset sits on the spectrum from speculative to asset-backed, and avoid overstating any Sharia credentials without robust Sharia board oversight.

How Islamic finance structures tokenization in UAE and Bahrain

UAE and Bahrain are starting to see Sharia-supervised tokenization of sukuk-style instruments, real-estate funds and trade-finance receivables, often anchored in Abu Dhabi or Manama and aligned with AAOIFI standards. The combination of tokenization frameworks (for example in ADGM and QFC) and existing Islamic finance infrastructure lets GCC institutions explore compliant digital asset structures without embracing speculative trading.

Practical tips for “halal-first” crypto platforms

If you’re building a “halal-first” platform for users in Riyadh, Jeddah, Dubai or Doha, consider:

A credible Sharia board with published opinions.

Transparent screening of tokens, including underlying business models.

Conservative product design—no leverage or unclear “yield-farming”.

Governance disclosures in clear Arabic and English, not just marketing slogans.

Choosing the Right Jurisdiction: UAE vs Bahrain vs Qatar (QFC)

How can a GCC startup choose the right jurisdiction (UAE, Bahrain, Qatar) for a virtual asset license while serving users across the region?

Most GCC founders start by mapping activity (exchange vs tokenization vs custody), target users (retail vs institutional) and risk appetite, then pick between UAE free zones, Bahrain’s CBB regime, or QFC’s new Digital Asset Regulations for tokenization-heavy projects in Doha. From there, the decision is driven by licensing timelines, substance requirements, cost and where your investors and team are physically based.

Simple steps founders can follow.

Define your activity

Are you a spot exchange, broker, OTC desk, gaming studio, tokenization platform or family-office investment desk?

Match activity to regulator

Exchanges and brokers often start with VARA or ADGM; institutional custody or tokenized funds may prefer ADGM or DIFC; pure tokenization with Qatar exposure might sit in QFC.

Map users and geographies

Serving retail users in Saudi or Kuwait from Dubai or Manama may require geo-blocking, localised risk warnings and careful controls to avoid “onshore” marketing in restricted markets.

Plan substance and tech stack

Align real staff in Dubai, Abu Dhabi or Manama with in-region cloud (AWS Bahrain/UAE, Azure UAE, GCP Doha) and strong engineering partners like Mak It Solutions.

Example scenarios for GCC founders

A Riyadh fintech building a regional spot exchange might base the group in ADGM, with a Saudi sales office purely marketing open-banking-aligned fiat on-ramps.

A Dubai Web3 gaming studio using tokens for in-game items may choose VARA or DMCC plus a DIFC structure for treasury management.

A Doha family office focusing on tokenized real estate could leverage QFC’s Digital Assets framework for token rights while using UAE or Bahrain for execution venues.

Best Practices for Operating a Compliant Crypto or Web3 Business in the UAE

Governance, policies, and local substance in Dubai/Abu Dhabi

UAE regulators increasingly expect real local substance: an active board, resident senior management, MLRO and compliance officer, and documented policies covering onboarding, risk scoring, market abuse, cybersecurity and incident response.

Mak It Solutions often works with founders to embed those requirements into their product stack access controls, audit logging and modular architectures built with PHP, WordPress, Webflow and modern front-end stacks that keep compliance workable as you scale. (Mak it Solutions)

Data residency, cloud, and cybersecurity expectations in GCC

Saudi, UAE and Qatar all place increasing weight on data sovereignty, especially for finance, health and government-adjacent projects. With AWS regions in Bahrain and UAE, Azure regions in Abu Dhabi and Dubai, and Google Cloud’s Doha region, you can keep sensitive data on GCC soil while still running global-scale infra.

This is exactly the pattern we recommend in our web development trends in the Middle East for KSA & UAE guide, where GCC portals use in-region cloud plus front- and back-end development services from Mak It Solutions to balance latency, compliance and UX. (Mak it Solutions)

Working with regulators and advisors

Finally, treat VARA, SCA, FSRA, DFSA, CBB and QFC as long-term partners. Early, well-documented engagement supported by legal, tax and Sharia advisors almost always saves time versus “launch now, fix later”. For Saudi, Qatar and Kuwait users in particular, keep checking updates from SAMA, QCB, QFCRA and other regulators before expanding cross-border.

Concluding Remarks

For GCC founders, cryptocurrency regulation in UAE is now a competitive advantage: clear licensing paths, improving VAT treatment, advanced CBDC work and a maturing ecosystem around Dubai and Abu Dhabi. But the wider GCC remains diverse Bahrain is welcoming, Qatar and Kuwait are restrictive, Saudi and Oman are still evolving, and every central bank combines innovation with caution.

Before you launch your next exchange, Web3 game or tokenization platform, sanity-check at least:

Jurisdiction and regulator (VARA, ADGM, DIFC, CBB, QFC).

License categories and retail vs professional scope.

Corporate tax, VAT, zakat and disclosure obligations.

AML/CFT controls, Travel Rule and data residency.

Sharia considerations and honest “halal-first” claims.

Marketing, influencers and cross-border promotions.

Use this article as a starting map but when you move real capital or user data, bring in specialist legal, tax and Sharia counsel in the UAE and target GCC markets, and pair them with a technical partner who understands both regulation and execution.

If you’re a GCC founder or family office planning a crypto, Web3 or tokenization project, you don’t need to guess your way through UAE and GCC regulation. Mak It Solutions can help you turn complex rules into clear product architecture secure onboarding, compliant UX flows, in-region hosting and dashboards that your regulators will actually understand. (Mak it Solutions)

Whether you’re evaluating VARA vs ADGM vs DIFC, exploring Bahrain or QFC options, or simply want a crypto-ready web platform built for Riyadh, Dubai or Doha users, reach out to Mak It Solutions for a tailored consultation. We’ll work with your legal and tax advisors to design a solution that respects Sharia, data residency and long-term regulation not just today’s hype.( Click Here’s )

FAQs

Q : Is it legal for Saudi residents to use UAE-licensed crypto exchanges like those regulated by VARA or ADGM?

A : There is no specific Saudi law that criminalises an individual simply holding crypto, but SAMA and the CMA have repeatedly warned that virtual currencies are high-risk, unregulated and not approved as official money in the Kingdom. A Saudi resident who onboards to a VARA- or ADGM-licensed exchange is still subject to Saudi law, and the platform’s marketing into KSA could attract regulatory scrutiny. In practice, many UAE exchanges either limit features for Saudi IPs or avoid targeting them directly, especially for leveraged products. Saudi Vision 2030’s fintech agenda may bring clearer rules over time, so founders should keep watching SAMA announcements and seek local legal advice before actively serving KSA retail users.

Q : Can Qatar-based startups use the QFC Digital Assets Regulations to offer tokenization services while retail trading remains restricted?

A : Yes within limits. Qatar’s Central Bank and QFCRA still prohibit most virtual asset services for retail trading, particularly speculative crypto exchanges. However, the QFC Digital Assets Framework 2024 was designed to support tokenization of securities, real-world assets and smart-contract-based instruments in a regulated environment. A Doha startup can, in principle, build tokenization, custody or infrastructure services under QFC supervision if it stays within that framework and avoids banned retail crypto activities. Alignment with Qatar National Vision 2030 and clear separation from prohibited retail trading are critical, so founders should treat local legal counsel as non-negotiable.

Q : How does the new Bahrain stablecoin and crypto-asset framework affect GCC remittances and cross-border payments?

A : Bahrain’s CBB crypto-asset rules and related initiatives such as licensed exchanges and stablecoin pilots in Manama make it one of the most open GCC jurisdictions for regulated crypto services. For GCC remittances, this could mean cheaper, faster corridors between Bahrain, UAE and other markets, especially for expatriates and regional SMEs. But even with licensed platforms, remittances must respect sanctions rules, local FX controls and consumer-protection expectations in receiving countries such as Saudi or Kuwait. Family offices and fintechs experimenting with crypto-enabled remittances should treat Bahrain as a regulated hub, not a loophole, and align with both CBB guidance and their home regulators’ expectations.

Q : Are Dubai-based crypto influencers allowed to promote offshore exchanges that are not licensed by VARA?

A : Under VARA’s marketing and promotion regulations, any person in Dubai who promotes virtual asset products or services to the public is expected to follow strict guidelines, including risk warnings and, in many cases, promoting only licensed entities.Promoting unlicensed offshore exchanges to Dubai residents can be risky for both the influencer and the platform, particularly if the content targets retail users or encourages leveraged trading. Influencers should verify whether a platform is listed in VARA’s public register, coordinate with licensed entities and, where needed, seek compliance advice. As UAE’s broader digital governance (including TDRA and UAE Pass initiatives) tightens, regulators are likely to pay closer attention to crypto advertising that blurs the line between education and solicitation.

Q : What data residency and cloud rules should a GCC crypto platform consider when hosting user data from Saudi, UAE, and Qatar?

A : A GCC crypto platform serving users from Riyadh, Dubai and Doha should assume data-residency expectations are tightening, especially for financial and government-grade services. Saudi, UAE and Qatar all encourage or require certain data to be hosted locally or in approved regions, and major cloud providers now offer GCC regions: AWS in Bahrain and UAE, Azure UAE Central/North, and Google Cloud’s Doha region.Platforms should: map where each category of data sits; ensure encryption, access controls and logging meet local standards; and consider segregated environments for especially sensitive Saudi or Qatari data. Open-banking and CBDC initiatives across the GCC will only increase scrutiny, so building compliant data architectures from day one is far easier than retrofitting them later.