MENA Venture Capital Landscape in the GCC Today

MENA Venture Capital Landscape in the GCC Today

MENA Venture Capital Landscape in the GCC Today

The current MENA venture capital landscape is dominated by Saudi Arabia, the UAE and, increasingly, Qatar, with capital concentrating into larger tickets while early-stage founders still compete hard for pre-seed and seed cheques. For GCC teams in Riyadh, Dubai, Abu Dhabi or Doha, the real advantage comes from aligning with priority sectors (fintech, logistics, gov-tech, Arabic content), respecting local regulation, and combining mega-fund visibility with grassroots capital sources.

Introduction

From Vision 2030 to Dubai’s Unicorn Hype

Over the past few years, the MENA venture capital landscape has shifted from “nice-to-have” to core infrastructure for Saudi Vision 2030, UAE Centennial 2071 and Qatar National Vision 2030. Saudi and UAE now command the majority of regional VC funding, with Saudi leading by value and the UAE by deal count, while Egypt and the rest of MENA fight for the remaining slice.

For founders in Riyadh, Jeddah, Dubai, Abu Dhabi and Doha, that means venture capital is no longer a side story it’s how national strategies are executed in fintech, logistics, gov-tech, Arabic content and AI.

The Founder Dilemma.

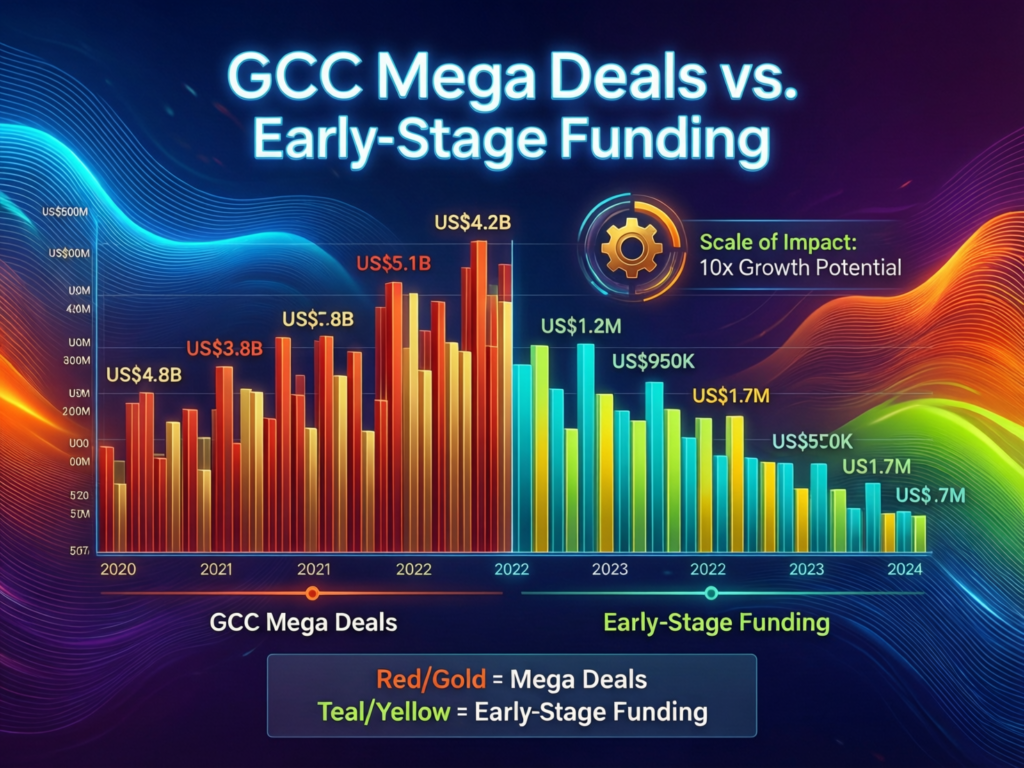

Headlines celebrate $100M+ rounds and sovereign-backed mega-deals, but most first-time founders in the Gulf still worry about the very first $250k–$1M. Across MENA, deal counts have fallen while total capital remains high or even growing, meaning bigger tickets into fewer startups and a tougher environment for pre-seed teams without strong networks.

What This Guide Covers for Saudi, UAE and Qatar Ecosystems

This guide maps today’s MENA venture capital landscape across stages and hubs, unpacks how mega-deals and sovereign wealth funds actually work, and then zooms into Saudi Arabia, the UAE and Qatar. You’ll see where early capital really lives, what regulators like SAMA, CMA, ADGM, DIFC, TDRA, QCB and NDMO care about, and how to choose the right hub and capital mix for your next round.

Mapping the MENA Venture Capital Landscape Today

Deal Volumes, Stages and Sectors Across MENA

VC funding across MENA has grown in absolute terms, but shifted toward larger rounds: average ticket sizes are up while deal counts are down, especially at early stages. Saudi Arabia and the UAE together take the lion’s share of capital, with Egypt still a key third market. Fintech, e-commerce, logistics, SaaS and broader “tech startups in the Middle East” continue to dominate, with more recent momentum in AI and climate-tech.

AEO block What does the current MENA venture capital landscape look like for early-stage founders?

For early-stage founders, the MENA venture capital landscape is crowded at the top and thin at the bottom: mega-deals and large Series A/B rounds get most of the dollars, while pre-seed and seed cheques are more selective, network-driven and sector-focused. In practice, founders in Saudi, UAE and Qatar need to blend local angels, regional seed funds and government programs long before they talk to the big regional VCs.

For a deeper look at GCC digital and startup hubs, see Mak It Solutions’ guide on GCC Middle East tech startup hubs.

GCC Power Hubs.

Riyadh has emerged as the capital of capital backed by PIF, MISA and a dense cluster of Saudi funds and corporate investorswhile Jeddah adds consumer and logistics depth. Dubai and Abu Dhabi remain magnets for regional and global VCs, with DIFC and ADGM offering internationally familiar legal frameworks. Doha, supported by QIA, QCB and QDB, is now actively courting funds via its VC “fund of funds” and incentives for VCs to open local offices. (Reuters)

Sector Hotspots: Fintech, Logistics, GovTech and Arabic Content

Fintech remains the top sector for startup funding ecosystems in MENA, fueled by open banking rules in KSA and UAE, digital wallets in GCC retail, and a surge in Sharia-compliant products. Logistics and supply-chain tech benefit from Saudi ports, Jeddah and Dubai’s role as regional trade hubs, while gov-tech grows around programs like Saudi’s DGA initiatives, UAE’s digital government and Qatar’s Hukoomi. Arabic-content platforms, creator tools and AI also attract capital as investors finally price in the value of Arabic-first UX something we explore deeper in our Arabic UX design guide for Saudi & UAE apps.

Mega-Deals in the GCC.

What Counts as a “Mega-Deal” in the MENA Venture Capital Landscape?

In the MENA venture capital landscape, a “mega-deal” usually means a round of $100M or more—sometimes $50M+ in earlier years often led or anchored by sovereign wealth funds or global growth investors. Over the last few years, these rounds have driven a disproportionate share of total capital, even as the number of such deals remains relatively small.

The Role of PIF, Mubadala, QIA and Other Sovereign Investors

PIF, Mubadala, ADQ and QIA now shape late-stage capital not just in the GCC but globally, backing growth rounds, funds-of-funds and direct investments in AI, fintech, logistics and infrastructure. These sovereign investors also seed local VC funds and co-investment programs (for example, SVC in Saudi or QIA’s $1B VC fund-of-funds) that indirectly support Series A–C startups. For founders, the message is clear: sovereign capital is real—but you’ll usually meet it through local funds, not by emailing the sovereign fund directly.

How Mega-Rounds Shape Valuations, Talent Flows and Media Narratives

Mega-deals set valuation anchors for entire sectors, attract talent into a handful of “winner” startups, and dominate headlines. The risk is that early-stage founders benchmark their seed valuation expectations to those outliers, while investors quietly move toward more disciplined pricing and governance. In Riyadh, Dubai and Doha, mega-deals can distort perceptions (“capital is everywhere”) while angel and seed founders still hustle for their first $500k.

AEO block Why are mega-deals becoming more common in the MENA startup ecosystem, especially in GCC countries?

Mega-deals are more common because GCC sovereign wealth funds and large regional investors now see venture as a strategic tool to diversify economies, back local champions and build AI, fintech and infrastructure capacity. With bigger pools of capital and clear government mandates, they prefer writing larger cheques into fewer, more proven companies rather than many small experiments.

Grassroots Innovation and Early-Stage Funding in MENA

Angels, Syndicates and Seed Funds Active in the GCC

Under the mega-deal layer, a dense but fragmented layer of angels, family offices, angel syndicates and micro-VCs powers early-stage funding. In Saudi Arabia, alumni of big exits and corporate leaders increasingly join angel networks; in Dubai and Abu Dhabi, regional syndicates and rolling funds are common; in Doha, angel activity often overlaps with QSTP and QDB-backed founders. Many of these investors quietly specialize in sectors like fintech, logistics or Arabic SaaS.

Accelerators, Incubators and Government Programs Fueling Early Stages

Grassroots capital is amplified by national programs: Monsha’at and various Saudi accelerators; Monsha’at- and MISA-linked sandboxes; Flat6Labs across the region; Dubai Future Accelerators and DIFC/ADGM sandboxes in the UAE; and QSTP, Qatar Fintech Hub and QDB in Doha. These initiatives mix grants, equity cheques, subsidised space and connections to corporates and regulators, turning government vision into practical early-stage pipelines.

If you’re building fintech or Islamic finance products, our guide on Islamic fintech in GCC dives deeper into how accelerators and sandboxes intersect with Sharia-compliant products.

The Funding Gap.

Despite all this, gaps remain in pre-seed (sub-$250k) and “post-accelerator” seed rounds, especially outside obvious hotspots like Riyadh and Dubai. Founders in Sharjah, Manama, Kuwait City or Muscat often feel invisible to mainstream VCs; Qatar founders may still need to prove regional expansion beyond Doha to unlock larger tickets. Many early-stage rounds are under-governed weak data rooms, little clarity on cap tables and compliance which later becomes a friction point when larger GCC-wide venture capital funds step in.

AEO block How can Saudi and UAE founders access early-stage venture capital instead of relying only on mega-deals?

Saudi and UAE founders should start with local angels and syndicates, join sector-relevant accelerators, and target specialized seed funds that understand their vertical, rather than waiting for sovereign-backed mega-funds. Combine that with solid governance (data rooms, clean cap tables, compliance) so that when regional VCs and corporate venture arms look down-ticket, you already fit their investment checklist.

Country Deep-Dive

Saudi Arabia.

Saudi Arabia now leads the region in VC funding, driven by Vision 2030, PIF-backed initiatives and a growing local fund ecosystem. (svc.com.sa) SAMA and CMA supervise fintech and capital markets, while MISA (ex-SAGIA) handles market entry and licensing for foreign investors. Monsha’at offers SME programs, grants and accelerators that quietly act as the first “yes” for many Riyadh and Jeddah founders.

UAE.

The UAE positions itself as the region’s most familiar jurisdiction for global capital: ADGM in Abu Dhabi and DIFC in Dubai provide common-law frameworks, clear fintech regulations and sandbox programs. Mubadala and ADQ anchor late-stage deals and funds, while Dubai Future Foundation and Dubai’s ecosystem of accelerators attract gov-tech, logistics and Arabic consumer apps. For many teams, Dubai/Abu Dhabi is still the preferred HQ even if most revenue is in Saudi.

Qatar.

Qatar is using QCB’s fintech agenda, QDB’s funding instruments and QSTP’s infrastructure to pull startups and funds into Doha. QIA’s VC “fund of funds” requires global VCs to build some local presence, strengthening the founder/investor network over time. For founders building in Doha, the play is often “Qatar-first, GCC-second”: leverage deep local support, then show regional expansion.

Comparing Term Sheets, Ticket Sizes and Founder Experience Across GCC

In broad strokes, Saudi tickets tend to be larger but more regulated and relationship-driven; UAE deals are still slightly faster to close, especially at seed and Series A; Qatar rounds can be attractive but may come with expectations around local presence and alignment with national priorities. Founder experience also varies: Riyadh and Dubai have thicker communities of repeat founders, while Doha still offers more “white space” and direct government access.

For teams choosing their base, our article on ecommerce in the GCC and the Riyadh–Dubai boom gives a practical sense of how customer demand and infrastructure differ between these hubs.

Regulation, Data and Sharia.

Financial and VC Regulation: SAMA, CMA, ADGM, DIFC, QCB

Serious GCC investors expect you to know your regulators. In Saudi, that means SAMA for payments and fintech, CMA for securities and crowdfunding, and sector regulators like the DGA for gov-tech. In the UAE, ADGM and DIFC regulate much of the fintech and VC activity alongside the UAE Central Bank, while TDRA oversees digital government and telecom. In Qatar, QCB and QFC frameworks shape fintech and financial innovation. You don’t need to be a lawyer—but you must know where your product sits.

For a wider legal context, you can compare local expectations with GDPR-style principles explained by the UK ICO, which many GCC regulators reference when designing data and privacy rules.

Data Residency and Localization: NDMO, Cloud Regions and Compliance

Data residency is no longer a footnote. Saudi’s NDMO and PDPL, UAE’s data office and Qatar’s privacy law all influence where you can host, which cloud regions you may use and how cross-border transfers work. Practically, many startups combine AWS Bahrain, Azure UAE Central and Google Cloud’s Doha region to keep sensitive workloads closer to regulators while still benefiting from global scale. Our guide to Middle East cloud providers for KSA, UAE & Qatar CIOs breaks down those trade-offs.

If your product handles personal data, also review the Mak It Solutions deep dive on GCC data protection laws for business in Saudi & UAE.

Sharia-Compliant Structures and Arabic-First UX Expectations

Many GCC LPs and founders care about Sharia-compliant structures—especially in Saudi and Qatar—even when the startup itself seems “neutral.” VC funds may use Sharia-screened LP structures, while fintech and banking startups must align their revenue models with Sharia boards. At the same time, Arabic-first UX is now a hygiene factor: regulators like SAMA, TDRA and QCB increasingly expect bilingual, RTL-friendly journeys in banking, gov-tech and public services apps.

For more detail, see our pieces on Sharia-compliant digital banking in the GCC and web development trends in the Middle East.

How Founders and Ecosystem Builders Can Navigate the MENA VC Landscape

Position Your Startup Within the MENA Thesis

Start by mapping your startup clearly against active MENA theses:

Sector

Are you in fintech, logistics, gov-tech, climate, or Arabic AI/content where GCC investors already have conviction?

Stage

Pre-seed, seed, Series A be honest, not aspirational.

Geo

Saudi-first, UAE-first, Qatar-first, or regional from day one?

Then build a short, data-backed memo (“Why now, why MENA, why GCC?”) that matches how venture capital firms in GCC explain their own investment focus.

Choose the Right GCC Hub and Capital Mix

Think in “hub + spokes”: you might base your HQ and holding structure in Dubai or ADGM for legal familiarity, while building go-to-market and product teams in Riyadh and Jeddah, and a specialized R&D or gov-tech team in Doha. Combine:

Local angels and family offices

Seed funds with GCC-wide mandates

Government programs (Monsha’at, QSTP, QDB, Dubai Future Foundation)

Later-stage regional funds and sovereign-linked investors

Align your roadmap so each round unlocks a new region (Saudi, then UAE, then Qatar, then wider MENA).

Build an “Investor-Ready” Story for Both Mega-Deals and Grassroots Capital

Investors across the innovation ecosystem in MENA now expect:

Clean cap tables and clear founder/ESOP split

Governance basics (board meetings, reporting, compliance dashboards)

Evidence of product–market fit in at least one GCC market

Make sure your narrative works both for grassroots capital (angels, seed funds) and, eventually, mega-deal investors: same story, just different depth. A specialist partner like Mak It Solutions can help here with web development services and mobile app development services that are regulator-ready and friendly to serious due diligence.

Where the MENA Venture Capital Landscape Is Heading

Consolidation, Local IPOs and Cross-Border M&A Within the GCC

By 2030, expect more local IPOs on Tadawul and Dubai Financial Market, plus cross-border M&A as Saudi, UAE and Qatar champions buy regional competitors. Sovereign funds will likely double down on backing “national champions” that can also scale abroad, especially in AI, clean energy, logistics and digital infrastructure.

Why the Next Wave May Favor Early-Stage Builders Over Pure Mega-Deal Plays

As the mega-deal cycle matures and returns are scrutinized, attention often shifts back to disciplined early-stage building. In practical terms, that means more selective but smarter investment trends in the Gulf region at pre-seed and seed, with better support for founders who combine strong governance, Arabic-first UX and regional expansion plans.

What Saudi, UAE and Qatar Stakeholders Should Do Today

Founders should get ahead of regulation and data residency, and build products that genuinely solve GCC-specific problems, not just clone US or EU models. Investors should put more structured capital into seed and Series A, not just late-stage growth. Ecosystem builders from Monsha’at to Dubai Future Foundation and QSTP should keep connecting “Riyadh Dubai–Doha” into one integrated, cross-border corridor.

Concluding Remarks

Mega-deals, sovereign funds and unicorn headlines are now part of everyday life in the MENA venture capital landscape but they sit on top of a far more fragile grassroots layer of angels, accelerators and seed funds. Long-term success for Saudi, UAE and Qatar depends on getting both right: visible champions and a healthy pipeline of early-stage builders.

How to Use This Framework in Riyadh, Dubai or Doha Tomorrow

Pick your primary hub (Riyadh, Dubai, Abu Dhabi or Doha), map your startup into a clear MENA thesis, and build a short list of angels, funds and programs that logically fit your sector and stage. Use this article as a checklist in your next internal strategy session: sector fit, hub choice, regulatory readiness, capital mix.

Invite Collaboration

If you’re sitting on real founder stories, LP insights or ecosystem data from across the GCC, this is the time to share them. Teams like Mak It Solutions are already partnering with VCs, founders and regulators on Islamic fintech, cloud, data protection and digital products see, for example, our guides on Middle East data centers and digital wallets in the GCC.

If you’re a founder or investor planning your next move in the MENA venture capital landscape, you don’t have to navigate it alone. The Mak It Solutions team can help you validate markets, design regulator-ready products, and build the digital infrastructure that impresses both seed angels and sovereign-backed funds. Reach out to explore a custom GCC strategy for your startup, fund or ecosystem initiative and turn Riyadh, Dubai or Doha into a true growth engine, not just a pin on the map. ( Click Here’s

FAQs

Q : Is venture capital for tech startups in Saudi Arabia usually Sharia-compliant?

A : Not every VC cheque in Saudi Arabia is formally Sharia-compliant, but Sharia considerations are increasingly important. Many local LPs and funds screen for sectors (avoiding obvious non-compliant areas) and structure their vehicles to be acceptable to Sharia boards, especially when capital ultimately comes from government-related or family sources. Startups in fintech, banking or investment products should expect deeper Sharia review, with revenue models, contracts and even UX flows checked against Islamic finance principles. For a practical view of how this works in digital products, see our guide on Islamic fintech in GCC and related regulations from SAMA and CMA under Vision 2030.

Q : Which GCC city is better for fundraising: Riyadh, Dubai or Doha for early-stage founders?

A : “Better” depends on sector, stage and your own network. Riyadh offers larger tickets and stronger links to national programs and PIF-linked funds, especially for Vision 2030 sectors like fintech, logistics and industrial tech. Dubai provides a dense mix of regional VCs, global funds, ADGM/DIFC sandboxes and a deep expat founder community often ideal for cross-border SaaS, marketplaces and Arabic consumer apps. Doha is smaller but increasingly attractive for founders who can anchor a solution to Qatar National Vision 2030 priorities and leverage QDB, QSTP and QIA-backed initiatives. Many teams pick a dual strategy: incorporate or structure through UAE hubs, pursue customers and revenue in Saudi, and treat Doha as an emerging, high-support market.

Q : Can non-GCC founders raise venture capital from Saudi and UAE funds while being based abroad?

A : Yes but there are conditions. Many Saudi and UAE funds invest globally, especially those linked to sovereign wealth (PIF arms, Mubadala, QIA), but they typically look for a strong strategic fit: GCC expansion potential, AI or infrastructure that benefits the region, or alignment with Vision 2030 and UAE digital strategies. You’ll often be asked to set up a local entity (for example, with MISA in KSA or in ADGM/DIFC in the UAE), open regional offices, and adapt your product to Arabic-first UX or regional compliance. Non-GCC founders should treat GCC funds not only as capital sources but as strategic partners for entering markets like Riyadh, Dubai, Abu Dhabi or Doha.

Q : How do data residency rules in Saudi, UAE and Qatar affect fintech and SaaS startups raising VC?

A : For fintech, health, gov-tech and data-heavy SaaS, data residency is one of the first questions serious GCC investors ask. Saudi’s PDPL and NDMO guidance, UAE’s data office and sector rules, and Qatar’s privacy law and QCB rules determine where and how you can store or process personal and financial data. Practically, that often means using in-region cloud regions AWS Bahrain, Azure UAE Central, Google Cloud Doha or local/sovereign cloud providers and limiting cross-border transfers to what regulations allow. Investors will look for a clear architecture diagram, DPA templates, and references to GCC data protection expectations like those we cover in GCC data protection laws: a Riyadh & Dubai guide.

Q : Are there government-backed VC funds or grants for pre-seed startups in Qatar and the wider GCC?

A : Yes. In Qatar, QDB and QSTP run grants, equity programs and accelerator-linked funding, while QIA’s VC fund-of-funds is bringing more global VCs into Doha with local commitments. In Saudi Arabia, entities linked to SVC, Monsha’at and sector programs provide co-investments, guarantees and accelerator funding for early-stage teams. In the UAE, Dubai Future Foundation, ADGM, DIFC and emirate-level initiatives sometimes combine grants, credits and small equity cheques to de-risk early product building. These schemes rarely replace venture capital entirely, but they can extend runway and make early-stage rounds more attractive to regional VCs focused on the MENA venture capital landscape.