Telemedicine in the Middle East: Digital Health in GCC

Telemedicine in the Middle East: Digital Health in GCC

Telemedicine in the Middle East: Digital Health in GCC

Telemedicine in the Middle East has moved from a COVID-19 emergency fix to a permanent, hybrid layer of care in Saudi Arabia, the UAE and Qatar. GCC regulators now encourage Arabic-first, data-resident digital health platforms that blend virtual consultations with trusted in-clinic visits instead of trying to replace hospitals completely.

Introduction

A mother in Riyadh opens the Sehhaty app instead of driving across the city to an ER. In Dubai, a busy professional jumps on a five-minute video call with a doctor through a licensed telemedicine platform and gets an e-prescription delivered to their apartment. For patients in smaller cities like Dammam, Sharjah or Al Khor near Doha, this mix of online and in-person care is becoming normal, not “experimental”.

Telemedicine in the Middle East is no longer a side project. It has become a core layer of healthcare, especially in the GCC, where governments want to increase access, reduce pressure on hospitals, and support national visions like Saudi Vision 2030 and UAE Centennial 2071. Telemedicine and digital health are here to stay in the GCC, but in a hybrid model: tightly regulated, Arabic-first, and very aware of data residency and cloud choices.

For healthcare leaders, founders and policymakers in Riyadh, Dubai, Abu Dhabi and Doha, the question is no longer “Should we use telemedicine?” but “How do we make it safe, compliant and patient-friendly for our population?”

What does telemedicine look like today in the Middle East compared with before COVID-19?

Definition of telemedicine and digital health in the GCC context

In the GCC context, telemedicine usually covers virtual consultations in healthcare (video, audio, chat), remote triage, teleradiology, remote patient monitoring (RPM), e-prescriptions and follow-up messaging. It sits inside a broader “digital health” and eHealth and mHealth apps in GCC ecosystem that also includes health information exchanges, national health IDs and hospital IT platforms.

Saudi Arabia’s Ministry of Health (MOH) and the National Health Information Center (NHIC) now define and govern “telehealth” as a regulated practice that must follow specific clinical, licensing and data rules, not just “Zoom with a doctor.” Similar moves are happening in the UAE and Qatar, where digital health frameworks explicitly include telemedicine, mobile health and virtual hospitals.

From crisis solution to normal care channel in Saudi Arabia, UAE and Qatar

Before COVID-19, telemedicine in KSA, UAE and Qatar was typically limited to niche pilots or teleradiology. Regulation was patchy, and many hospitals saw it as “nice to have”. That changed dramatically in 2020–2021 when physical clinics shut or reduced capacity and virtual channels became the only safe way to serve many patients.

Saudi Arabia launched large-scale telehealth and later Seha Virtual Hospital, now recognised as the world’s largest virtual hospital and a flagship of Vision 2030’s Health Sector Transformation Program. The UAE’s MOHAP, DHA and DOH Abu Dhabi fast-tracked telehealth standards and licensing, while in Qatar, Hamad Medical Corporation (HMC) and PHCC shifted a big share of outpatient care to telemedicine and phone-based services.

Post-COVID, telemedicine remains a normal care channel. Patients expect to renew prescriptions, manage chronic diseases or get initial triage online, then attend in person only when necessary.

Adoption trends, patient satisfaction and key platforms in Riyadh, Dubai and Doha

In Riyadh, Jeddah and Dammam, KSA residents increasingly use Sehhaty, Mawid and Wasfaty to book teleconsultations, receive lab results and manage e-prescriptions alongside physical visits. In Dubai and Abu Dhabi, platforms like Okadoc, Vezeeta, Altibbi and Alma Health offer virtual visits under Dubai telemedicine rules DHA standards for online consultation and DOH guidelines.

In Doha, HMC’s virtual clinics and hotlines such as 16000 give patients access to urgent and routine advice without travelling into central hospitals, and recent MOPH/DHP circulars now formally approve and regulate telemedicine practice.

Patient satisfaction is generally high for convenience, waiting times and access to specialists, especially in remote areas. At the same time, many still prefer physical exams for sensitive issues, which is why hybrid care models (online + in-person) dominate.

Why are Saudi Arabia and the UAE investing so heavily in digital health and remote healthcare?

National visions and healthcare transformation (KSA Vision 2030, UAE Centennial 2071)

Telemedicine is a direct instrument of macro strategies like Saudi Vision 2030’s Health Sector Transformation Program and the UAE’s long-term digital government and Centennial 2071 goals. Saudi leadership sees digital health as a way to expand access, improve quality and support a more diversified, knowledge-based economy.

The UAE positions itself as a regional digital health and AI hub. Government reports highlight high rankings in digital competitiveness and health infrastructure, supported by smart government and advanced hospital IT. Telemedicine and RPM are not isolated apps; they’re part of wider smart city and e-government efforts that also touch logistics, fintech and national identity systems.

Cost, capacity and access benefits for public and private hospitals

For ministries and hospital groups in Riyadh, Dubai, Abu Dhabi and Doha, telemedicine is a way to:

Reduce unnecessary ER and outpatient visits

Extend specialists from national centres into smaller cities like Hail, Tabuk, Ajman or Al Wakrah

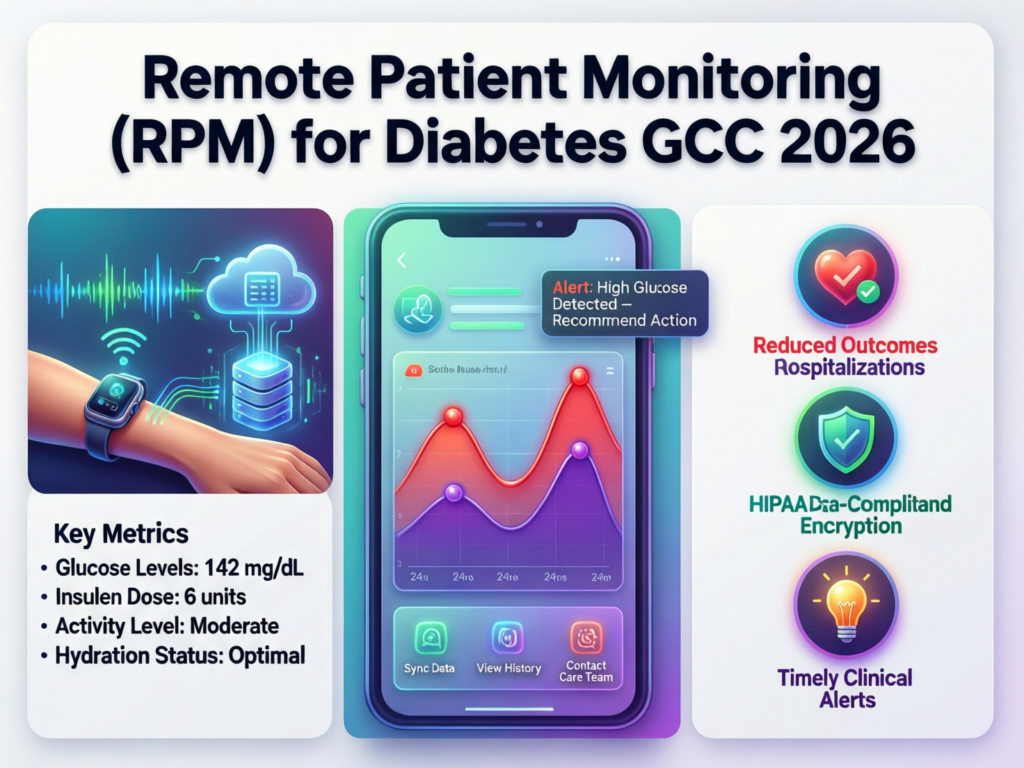

Manage chronic conditions (diabetes, hypertension, heart failure) via remote patient monitoring (RPM) solutions instead of frequent in-person check-ups

Studies and market reports forecast strong growth in telehealth and RPM across the region, driven by chronic disease burdens and the need to manage hospital capacity more efficiently.

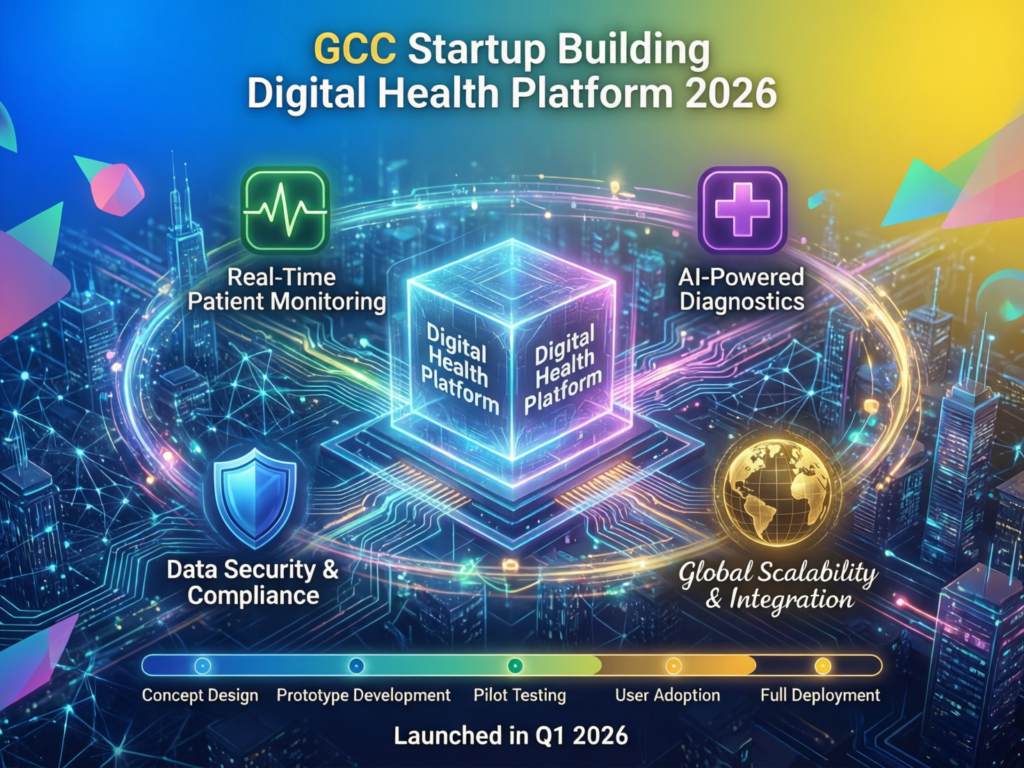

Attracting regional and global healthtech startups to Riyadh, Dubai and Abu Dhabi

Riyadh’s fast-growing startup scene, Abu Dhabi’s ADGM and Dubai’s health and free-zone ecosystems are all competing to attract digital health platforms and hospital IT vendors. Founders are building telemedicine, e-pharmacy and insurtech products that integrate with national billing systems, insurance regulations and local cloud regions.

For these startups, working with an experienced engineering partner for web development and mobile app development is essential to translate regulatory requirements into real products. Agencies like Mak It Solutions’ web development team and mobile app specialists can help founders ship compliant, scalable platforms faster.

How do telemedicine regulations differ between Saudi Arabia, the UAE and Qatar?

Telehealth rules in Saudi Arabia.

Saudi Arabia has one of the most explicit telehealth regimes in MENA. The MOH and NHIC have issued Telehealth Application Guidelines and governing rules that define telehealth categories, clinical responsibilities, and licensing for professionals and facilities. Only KSA-licensed professionals may practice, and telehealth must use approved devices and platforms.

On the data side, national bodies like NDMO and SDAIA shape rules for health data processing and localization, while SAMA and the Council of Health Insurance influence how health insurance and digital payments cover telemedicine services and risk pools. For a founder building “Saudi MOH Sehhaty telemedicine app login”-style journeys, this means thinking about consent, KYC, audit trails and insurance integration from day one.

UAE telemedicine framework.

In the United Arab Emirates, telemedicine must follow a multi-layered framework:

MOHAP general health and ICT in health laws

DHA’s Standards for Telehealth Services (Version 2) for Dubai facilities and standalone telehealth platforms

DOH Abu Dhabi’s telemedicine standards and clinical requirements

The UAE Personal Data Protection Law and sector-specific digital health rules for platforms that handle patient data

TDRA oversight of telecom infrastructure, internet traffic and certain cross-border data and cloud practices

For “Dubai telemedicine rules DHA standards for online consultation”, this typically translates into: licensed facilities, licensed clinicians, approved platforms, data protection measures and, in some cases, local or region-controlled hosting.

Qatar guidelines.

Qatar’s telemedicine environment has matured significantly. A recent DHP/MOPH circular explicitly approves and regulates telemedicine practice, setting licensing, quality and privacy requirements for providers.

Hamad Medical Corporation and PHCC, working with MOPH, have expanded virtual services since COVID-19, with some periods where around 80% of outpatient care was delivered via telemedicine, especially for vulnerable populations. For those implementing “Qatar MOPH telemedicine guidelines for virtual visits and eHealth services”, understanding this public-sector-led model and HMC’s digital strategies is key.

How are virtual hospitals and remote patient monitoring changing healthcare access in GCC countries?

Seha Virtual Hospital and virtual wards in Saudi Arabia

Seha Virtual Hospital (SVH), launched in 2022, is widely recognised as the world’s largest virtual hospital, connecting over 150–200+ hospitals across the Kingdom and delivering dozens of specialised services fully online.

For a patient in a smaller city outside Riyadh or Jeddah, this means access to top cardiologists, neurologists or mental health specialists without travelling. Virtual wards allow stable but high-risk patients to stay at home while clinicians monitor them via connected devices and dashboards.

Remote patient monitoring (RPM) pilots and chronic disease programs in UAE and Saudi

In both Saudi Arabia and the UAE, remote patient monitoring (RPM) solutions are emerging for diabetes, cardiac and elderly care. Wearables and home medical devices track vitals like blood pressure, glucose levels and oxygen saturation, feeding dashboards used by hospital-based teams in Dubai, Abu Dhabi, Riyadh and Dammam.

In Abu Dhabi and Dubai, market reports suggest RPM will grow rapidly as hospitals and insurers realise that avoided admissions and better chronic disease control often justify the cost of devices and software.

Home healthcare, logistics and insurance implications across GCC

Virtual hospitals and RPM only work if the ecosystem is ready.

Fintech & insurance

Telemedicine claims must be recognised by health insurers and regulators like SAMA in KSA and QCB in Qatar. (Saudi Central Bank)

Retail & logistics

Pharmacies and delivery providers in Kuwait, Bahrain, Oman and the rest of GCC need reliable last-mile logistics for medications and at-home devices.

Telecom & cloud providers

TDRA in the UAE, national telecom regulators and cloud providers like AWS Bahrain, Azure UAE Central and GCP Doha must offer reliable bandwidth and compliant hosting regions.

Quick scenarios.

A Riyadh fintech startup builds a health wallet app integrating telemedicine co-pays, SAMA-regulated insurance payments and Seha Virtual Hospital referrals.

A Dubai e-commerce brand adds DHA-compliant teleconsults and pharmacy delivery, using a licensed telehealth platform and integrating with their existing Shopify-style store.

A Doha SME runs its eHealth portal on GCP Doha, aligning with Qatar’s data strategies while serving patients across HMC virtual clinics.

Mak It Solutions can support these models with secure front-end development, robust PHP backends for health platforms and analytics-ready business intelligence services.

Why do many Middle East patients still prefer hybrid care instead of 100% remote healthcare?

Cultural preferences for in-person consultations and trust-building

Across Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman, medicine is still deeply personal and relationship-driven. Many families feel more confident when they “see the doctor” physically, especially for family medicine, paediatrics, women’s health and mental health.

Patients may happily use telemedicine for quick follow-ups, sick leaves or prescription renewals, but insist on in-person consultations for first visits, serious diagnoses or intimate concerns. This is not “resistance” but a rational preference for trust-building and reassurance.

Arabic-first UX, language and digital literacy barriers in telemedicine apps

Another factor is language and UX. A UAE telemedicine app with Arabic speaking doctor and clear right-to-left layouts will see much better adoption than an English-only interface designed for another region. Elderly patients in rural KSA, Oman or Bahrain may also have limited digital literacy or low-bandwidth connections.

This is where strong front-end and mobile UX work clear icons, short flows, bilingual support, WhatsApp reminders can make the difference between frustration and delight. Partnering with a GCC-aware product team like Mak It Solutions’ mobile app developers and digital marketing specialists helps ensure journeys are designed for real users, not just for app stores.

Designing hybrid care journeys that combine clinics with virtual follow-ups

In practice, a “win-win” model for GCC providers is usually hybrid:

In-person for first consultations, examinations and procedures.

Telemedicine for stable follow-ups, results review, medication adjustments and lifestyle coaching.

RPM for high-risk chronic patients who need closer remote monitoring.

Clinics in Riyadh, Dubai or Doha can start by mapping their most common conditions and designing hybrid pathways—something a good web development and integration partner can capture in portals, dashboards and automated workflows. (Mak it Solutions)

How can healthtech startups design Saudi- and UAE-compliant telemedicine and digital health platforms?

GCC data residency and cloud choices (Saudi/AWS ME, UAE/Dubai, Qatar/Doha zones)

For Saudi and UAE-focused platforms, infrastructure decisions are not just technical—they’re regulatory. Data protection frameworks, national cloud strategies and sector rules often favour or require hosting in approved regions such as:

AWS Bahrain for wider Middle East workloads

Azure UAE Central / UAE North for UAE health platforms

GCP Doha or national private clouds for Qatari workloads

Founders must map NDMO, SDAIA, TDRA and central bank expectations against their architecture: where primary databases live, how backups work, which analytics tools are used and how cross-border data flows are controlled. (National Health Information Center)

Working with experienced engineering teams and structured IT outsourcing partners can help here—especially if you lean on a firm like Mak It Solutions that already designs compliant architectures for regulated industries and remote teams, as discussed in their piece on IT outsourcing trends.

Product checklist.

Here’s a simple, step-by-step product checklist you can adapt for a KSA/UAE launch:

Core clinical journey

Define which telemedicine services you’ll offer (primary care, specialist second opinions, mental health, etc.) in line with Saudi MOH, DHA or DOH telehealth scopes.

E-prescriptions and pharmacy flows

Integrate secure e-prescription modules, ideally with national or insurer-approved formats, and connect to partner pharmacies for home delivery across Riyadh, Jeddah, Dubai and Abu Dhabi.

E-payments and insurance integration

Support local payment gateways, SADAD or cards, and design flows that respect SAMA rules in KSA and local insurance regulations in UAE and Qatar.

Identity, consent and records

Implement reliable ID verification, explicit consent flows and clear access logs for clinicians and patients.

Arabic-first, mobile-first UX

Make Arabic the default (with English available), design for small screens and low bandwidth, and test with real GCC users not just internal staff.

A partner like Mak It Solutions can combine front-end engineering, web development and long-term support to keep these checklists aligned with evolving rules—and to cover cyber skills gaps highlighted in their article on fixing the cybersecurity skills shortage in 2026.

Go-to-market strategies for telemedicine in Saudi Arabia, UAE and Qatar

GTM in GCC healthtech is not just “run ads and hope”.

Regulator-first: engage early with MOH, NHIC, SAMA, MOHAP, DHA, DOH and MOPH/QCB depending on your target markets.

Anchor partners: work with one or two hospitals or large clinics in Riyadh, Dubai, Abu Dhabi or Doha as design partners to validate workflows.

Enterprise sales: target insurers, government programs and corporate health schemes, not just direct-to-consumer.

Education content

Publish authoritative content explaining telemedicine benefits in Arabic and English, similar in depth and structure to Mak It Solutions’ own long-form guides (for example their CodeIgniter development services article).

For many GCC founders, the smartest route is to pair a local clinical / regulatory team with a specialised software partner like Mak It Solutions, who can deliver everything from business intelligence dashboards to secure APIs and long-term maintenance.

Outlook

Telemedicine in the Middle East has shifted from a crisis workaround to a core layer of care. In Saudi Arabia, the UAE, Qatar and wider GCC, the winners will be those who combine:

strong alignment with MOH, NHIC, MOHAP, DHA, DOH, MOPH, SAMA, TDRA and QCB rules,

hybrid models that respect patient preferences for in-person trust plus digital convenience, and

Arabic-first, patient-centric design backed by secure cloud and data architectures.

Looking ahead, expect continued scaling of Seha Virtual Hospital, more unified licensing inside the UAE, and deeper integration of RPM into standard chronic disease pathways from Riyadh to Doha. If you’re planning a GCC-ready telemedicine platform, it’s the right time to turn strategy into a concrete product roadmap with the right engineering and UX partner beside you.

If you’re serious about launching or upgrading a GCC-compliant telemedicine or digital health platform, you don’t have to navigate the technical and regulatory maze alone. The team at Mak It Solutions can help you translate MOH, DHA, DOH, MOPH and SAMA/TDRA rules into real product features, architectures and roadmaps.

Share your goals, target markets (Saudi, UAE, Qatar and wider GCC) and timelines, and we’ll help you scope a practical solution whether that’s a new virtual care platform, an RPM dashboard, or modernising your existing stack. ( Click Here’s )

FAQs

Q : Is telemedicine allowed for first-time consultations in Saudi Arabia under current MOH and NHIC rules?

A : Yes, telemedicine is allowed for first-time consultations in Saudi Arabia, but only within the scope set by MOH and the National Health Information Center. The Telehealth Application Guidelines and telehealth governing rules define which services can be delivered remotely, who can provide them, and what documentation is required. In practice, most hospitals in Riyadh, Jeddah and Dammam now use virtual visits for triage, routine primary care and chronic disease management, while complex or high-risk cases are still directed to in-person clinics. Providers must also consider health insurance coverage and SAMA-related requirements if they’re billing private payers.

Q : Can Dubai or Abu Dhabi residents use telemedicine platforms that are hosted outside the UAE cloud regions?

A : Technically, patients in Dubai or Abu Dhabi might access platforms hosted abroad, but compliance is more complicated. UAE healthtech regulations, MOHAP rules and the ICT in health law require strong data protection, and in many cases favour data being stored in UAE or approved regional cloud zones. TDRA also oversees telecom services and has a say in how cross-border data flows are managed. Using UAE cloud regions like Azure UAE Central or local partners usually makes it easier to satisfy regulators and reassure patients. For serious, long-term telemedicine offerings, you should assume that “local or region-controlled hosting” is the default expectation.

Q : Are online telemedicine consultations in Qatar covered by major health insurance plans?

A : Coverage for telemedicine in Qatar has improved since COVID-19, especially within public services. HMC and PHCC virtual clinics are integrated into the public system, and DHP/MOPH circulars now formally approve telemedicine practice with quality and ethical standards. For private insurance, coverage depends on policy wording and negotiations with insurers regulated by the Qatar Central Bank (QCB). As more employers and insurers see the cost and access benefits of telemedicine, parity with in-person visits is becoming more common, but providers should still confirm how virtual visits are coded and reimbursed under each plan.

Q : Do GCC telemedicine apps offer Arabic-speaking female doctors for women’s health and family medicine?

A : Yes many GCC telemedicine apps now highlight access to Arabic-speaking female doctors, particularly for family medicine, obstetrics and gynaecology, paediatrics and mental health. Platforms in Saudi Arabia, Dubai and Doha understand that cultural and religious considerations make this a key trust factor for women. Providers must still comply with Saudi MOH, DHA, DOH and MOPH licensing standards for each clinician, but within those rules they can allow patients to filter by gender, language and specialty. For governments, this also aligns with Saudi Vision 2030 and national gender-inclusion goals, making digital channels a powerful tool to expand safe, comfortable access to care.

Q : What minimum internet speed is recommended for stable video teleconsultations in rural areas of Saudi Arabia, Oman or Bahrain?

A : Most telemedicine providers in the region recommend at least 2–4 Mbps of stable upload and download speed for standard-quality video calls, although more bandwidth will improve reliability. In rural parts of Saudi Arabia, Oman or Bahrain, the bigger issues are often latency, data caps and device quality. Regulators like TDRA in the UAE and their counterparts across GCC work with telecom operators to improve 4G/5G coverage and quality, which indirectly supports medical video calls. For clinics, it’s wise to offer fallback options audio-only calls, secure messaging and offline instructions so care can continue even when connectivity is limited, especially for chronic patients on RPM programs.