Blockchain Applications in MENA: From Riyadh to Dubai

Blockchain Applications in MENA: From Riyadh to Dubai

Blockchain Applications in MENA: From Riyadh to Dubai

In MENA, blockchain is shifting from crypto hype to practical tools for government services, trade finance, supply chains, energy and digital identity, especially in Saudi Arabia, the UAE and Qatar. For GCC leaders, the real value of blockchain applications in MENA is in permissioned, regulated distributed ledger technology that reduces paperwork, cuts fraud and enables trusted data sharing across ministries, banks and cross-border partners.

Introduction

In Riyadh, Dubai and Doha, the question has moved from “Should we launch a coin?” to “How do we fix real problems with blockchain?” Saudi Arabia’s central bank (SAMA) has already tested blockchain for money transfers and launched fintech sandboxes, while Dubai’s government has a public Dubai Blockchain Strategy to digitise and secure government services. Qatar’s regulators are exploring blockchain in trade finance and digital assets as part of their wider fintech and digital transformation strategy.

The Pain Point: Complex, Paper-Heavy Services in Riyadh, Dubai, Doha

Anyone who has tried to register land, renew licences, clear cargo or open a cross-border trade facility in the GCC knows the reality: multiple portals, paper forms, stamps, parallel databases. In Riyadh, Jeddah, Dubai, Abu Dhabi and Doha, governments are pushing hard for “once-only” data, digital signatures and end-to-end online journeys but legacy systems and siloed databases still slow everything down.

Where Blockchain Actually Adds Value in MENA

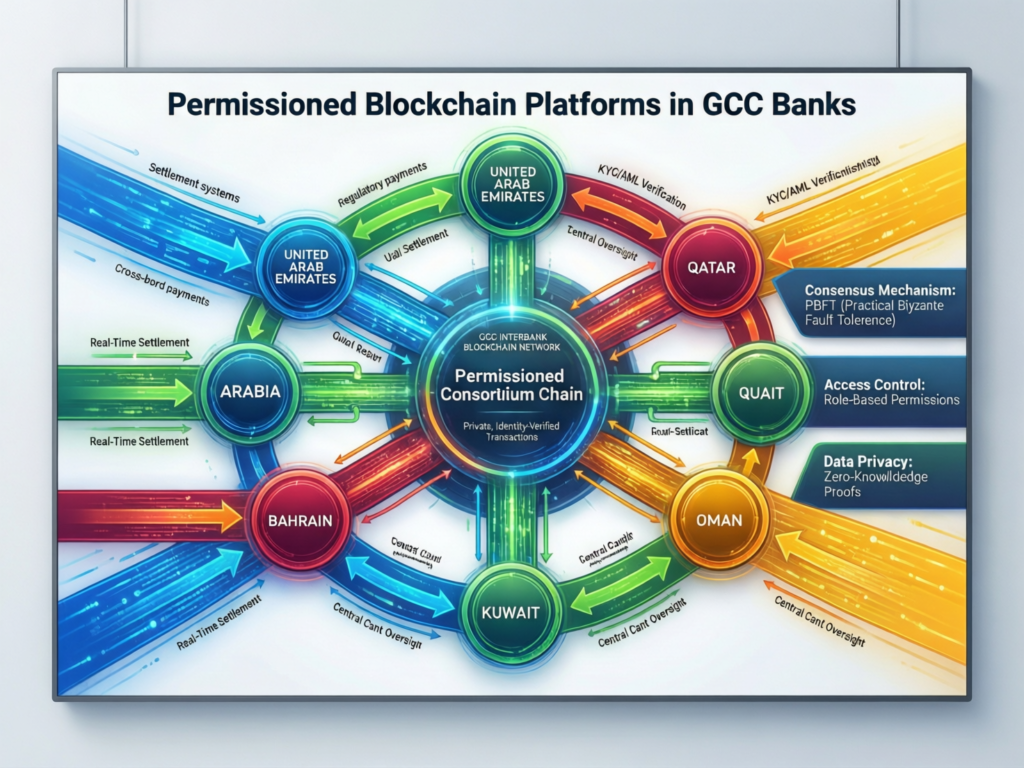

In practice, blockchain applications in MENA add value wherever many parties must trust shared records: land and company registries, customs and ports, trade finance, KYC/eKYC, supply chains, digital identity, and Islamic finance products. The most promising GCC projects use permissioned blockchain platforms integrated with existing ESBs, not public crypto chains, and run in local cloud regions in Saudi Arabia, the UAE and Qatar to meet data residency rules.

What “Blockchain Applications in MENA” Really Mean Beyond Crypto

Distributed Ledger vs Public Crypto Chains in GCC Context

For GCC policymakers, “blockchain” usually means distributed ledger technology in MENA where verified entities (ministries, banks, regulators) share a tamper-resistant record. Public crypto chains like Bitcoin or Ethereum are mostly out of scope for government workflows because of volatility, anonymity and regulatory risk. Enterprise projects instead use DLT networks where each node is operated by a known institution, often under a memorandum, sandbox approval or regulatory framework.

Permissioned Enterprise Blockchain for Government & Banks

Most real-world blockchain use cases in Saudi Arabia and the wider GCC rely on permissioned blockchain platforms (Hyperledger-style or similar). Nodes are run by banks, ministries, ports and regulators; access is KYC’d; and transaction rules are aligned with SAMA, CMA, TDRA, ADGM, DIFC and QCB guidelines. This aligns with Saudi government blockchain projects under Vision 2030, UAE smart government strategies, and Qatar’s national blockchain blueprint.

Typical Components: Smart Contracts, Identity, Integration Layers

Under the hood, most GCC leaders will see three main building blocks.

Smart contracts for government workflows (licences, approvals, SLAs, fees)

Identity & signing (integrated with national ID, UAE Pass or bank KYC to support national digital identity initiatives in GCC).

Integration & interoperability with legacy systems APIs, ESBs and reporting tools so data flows to CRM, ERP, customs systems and business intelligence dashboards. This blockchain interoperability with legacy systems is where partners like Mak It Solutions combine backend, integration and analytics capabilities.

Government Blockchain Applications in Saudi Arabia, UAE and Qatar

Priority Government Services That Can Realistically Use Blockchain Today

Today, the low-hanging fruit for government blockchain in MENA includes:

Land and property registries with tamper-resistant titles (e.g. Riyadh municipalities, Dubai Land Department).

Business licences and notarisation across Saudi Arabia, the UAE and Qatar, where smart contracts can automate approvals and expiry reminders.

Customs and ports workflows at Jeddah Islamic Port, Jebel Ali and Hamad Port tracking containers, certificates of origin and inspection results.

Cross-agency case files (e.g. justice, housing, social support) where multiple ministries need a single source of truth.

These map directly to Vision 2030 digital government, Smart Dubai and Qatar Digital Government projects.

Vision 2030, Dubai Blockchain Strategy, Qatar Digital Government

Saudi Arabia

SAMA has piloted blockchain for money transfers and runs a Regulatory Sandbox to support fintechs building on DLT and Open Banking.

UAE

The Dubai Blockchain Strategy and Emirates Blockchain Strategy 2021 aim to move a large share of government transactions onto blockchain to cut paper and improve trust.

Qatar

The Qatar Digital Government Strategy 2023–2025 explicitly lists blockchain as a key enabler for next-generation services.

Smart Contracts for Licences, Notarisation and Cross-Agency Data Sharing

For the AEO question “What government services in Saudi Arabia and UAE can realistically use blockchain today?”, the most realistic are.

Commercial registration & licences (company set-up, renewals, fee payments).

Notarisation and courts (e.g. enforceable agreements, evidence trails, expert reports)

Cross-border trade permits and customs manifests between ports and free zones.

In all cases, smart contracts encode the rules; ministries retain full control of policy; and regulators gain better audit trails, not less oversight.

Enterprise Blockchain in GCC Industries.

Blockchain in Supply Chain, Logistics and Ports (Jeddah, Jebel Ali, Hamad Port)

In logistics, blockchain shines when dozens of players touch the same shipment. At Jeddah Islamic Port, Jebel Ali and Hamad Port, shared ledgers can track containers, temperature logs, certificates and insurance on a single timeline, cutting disputes and delay fees. For wider GCC and MENA trade corridors (Kuwait, Bahrain, Oman), blockchain-based platforms can plug into existing TMS/ERP systems while giving regulators near real-time visibility.

Trade Finance, Open Banking and Cross-Border Payments in GCC

Banks in Riyadh, Dubai, Doha and Manama are exploring blockchain for trade finance, guarantees and cross-border payments, often linked to Open Banking in Saudi Arabia & UAE and eKYC initiatives. Permissioned networks can.

Share KYC results between banks.

Tokenise guarantees and letters of credit.

Synchronise payment, shipping and customs data.

Here, blockchain reduces fraud and manual reconciliation while remaining under SAMA, QCB and UAE central-bank oversight.

Energy, Oil & Gas, and LNG.

In oil, gas and LNG, joint ventures across Saudi Arabia, the UAE and Qatar need transparent cost-sharing, production volumes and ESG reporting. Blockchain can log field data, pipeline flows and cargoes, while tokenised Sukuk-style instruments are emerging in Qatar to finance green projects using DLT. For energy operators, the win is trusted data between NOCs, international partners and regulators without exposing sensitive operations on public chains.

Regulation, Compliance and Data Residency for Blockchain in GCC

How SAMA, CMA, TDRA, ADGM, DIFC and QCB View Enterprise Blockchain

GCC regulators are generally cautious but supportive of enterprise blockchain. SAMA and CMA back fintech innovation via sandboxes and clear rules, while restricting speculative crypto trading. In the UAE, TDRA, ADGM and DIFC provide digital and financial regulation frameworks, including sandboxes that explicitly cover blockchain and digital assets. QCB, meanwhile, treats DLT as part of its fintech infrastructure and is exploring CBDC and digital assets under a regulated umbrella.

NDMO, Data Residency and Where Blockchain Nodes Can Sit

In Saudi Arabia, NDMO guidelines and sectoral regulations emphasise where citizen and financial data can be stored and processed. The UAE and Qatar have similar expectations, increasingly tied to AWS Bahrain, Azure UAE Central and GCP Doha regions rather than distant data centres. A compliant blockchain design typically.

Keeps nodes with sensitive data inside KSA, the UAE or Qatar.

Uses regional cloud zones plus on-prem for critical regulators.

Minimises off-chain exports to analytic tools outside the GCC.

This is why data residency is a big issue for blockchain platforms in the GCC region you’re not just choosing a ledger, you’re choosing a data location strategy.

Sharia and “Halal-Compliant” Blockchain for Islamic Finance

For Islamic finance desks in Riyadh, Dubai, Doha and Manama, the key question is not “Is blockchain halal?” but “Is this product Sharia-compliant?” Tokenised Sukuk on permissioned chains, asset-backed financing and transparent profit-sharing structures can all be aligned with Sharia when reviewed by a recognised Sharia board. Qatar and other GCC hubs are already piloting blockchain-based Islamic products and digital asset labs.

How to Start a Low-Risk Blockchain Pilot in Riyadh, Dubai or Doha

Criteria for GCC Governments and Enterprises

To answer “How can businesses in Riyadh, Dubai, and Doha start a small blockchain pilot without huge risk?”, start with a narrow, low-risk process.

Multi-party, document-heavy workflow (e.g. internal approvals, small trade flows)

Clear regulatory comfort (no securities issuance, no public token sale).

Obvious ROI in 6–12 months (fewer disputes, faster processing).

For example, a Riyadh fintech under SAMA’s sandbox could digitise guarantee processing; a Dubai e-commerce brand could use blockchain for vendor settlements; a Doha SME could track inventory via a simple supply-chain ledger.

Permissioned Platforms, Cloud Regions and Integration with Legacy ESBs

Technically, most GCC pilots will:

Use a permissioned platform hosted in AWS Bahrain, Azure UAE Central or GCP Doha for compliant data residency.

Integrate with existing ERPs, ESBs and BI via secure APIs Mak It Solutions can help design these integration layers and dashboards using our web development and business intelligence services.

Keep the initial node count small (3–5 institutions), with a clear roadmap to add partners later.

Governance, KPIs and Scaling from Pilot to Production in GCC

Treat your pilot like a serious product, not a lab toy.

Define governance: who can write, who can read, who audits, how upgrades happen.

Set KPIs: processing time, error rate, dispute rate, and user satisfaction (across Arabic and English interfaces).

Plan scale-up: if KPIs are met, expand to more ministries, banks or ports; if not, adjust architecture or use case.

This is where partnering with a GCC-aware team like Mak It Solutions helps you move from prototype to production without tripping over compliance or integration gaps.

Concluding Remarks

For GCC leaders, blockchain applications in MENA are no longer about “launching a coin”; they’re about fixing messy, cross-organisation workflows in government, finance, logistics and energy. The winning projects stay close to policy goals Vision 2030, Digital Dubai, Qatar Digital Government and respect regulatory and data residency boundaries from day one.

What to Look for in a GCC Blockchain Partner

Your ideal partner understands both blockchain and the reality of GCC integration: bilingual citizen services, legacy systems, cloud-plus-on-prem, and regulators like SAMA, TDRA and QCB. Alongside blockchain design, you’ll likely need web development, mobile apps, analytics and DevOps areas where Mak It Solutions already delivers regional projects.

Where Blockchain Fits in Your 12–24 Month Digital Roadmap

In the next 12–24 months, treat blockchain as an enabler inside your wider digital roadmap, not a standalone fad. Start with one or two well-scoped pilots in Riyadh, Dubai or Doha, design them to scale regionally, and bring in a partner who can align architecture, compliance and user experience.

If you’re a policy maker, CIO or business leader in Saudi Arabia, the UAE or Qatar and you’re tired of slideware blockchain pitches, let’s talk about practical, low-risk pilots. Mak It Solutions can help you prioritise use cases, design permissioned architectures, and integrate them with your existing portals, mobile apps and BI stack.

Explore our broader services, review our web development and business intelligence solutions, or head straight to our contact page to book a GCC-focused discovery session.

FAQs

Q : Is blockchain use in Saudi government services aligned with Vision 2030 priorities?

A : Yes when designed correctly, blockchain projects fit directly under Vision 2030 themes of digital government, financial sector development and private-sector growth. For example, SAMA’s fintech initiatives and digital payments push are part of the broader Vision 2030 transformation agenda. Practical blockchain use cases licensing, registries, trade finance help ministries deliver faster, more transparent services without losing control over policy or Sharia compliance.

Q : Can GCC banks run blockchain nodes outside the region if data is encrypted?

A : In theory, strong encryption helps, but in practice data residency rules often care about where data sits, not just how it is encrypted. Saudi’s NDMO guidance and central bank expectations, as well as policies in the UAE and Qatar, increasingly favour regional hosting, especially for PII and financial data. Many banks therefore keep full nodes in KSA, the UAE or Qatar cloud regions (AWS Bahrain, Azure UAE Central, GCP Doha) and use anonymised or aggregated data for cross-border analytics. Always validate designs with SAMA, QCB or your lead regulator.

Q : Is enterprise blockchain allowed under SAMA and QCB rules for payments and trade finance?

A : Neither SAMA nor QCB bans enterprise blockchain; they focus on ensuring that any solution respects licensing, risk management, AML/CFT and consumer protection rules. SAMA’s fintech frameworks and QCB’s fintech strategy both explicitly reference advanced technologies like DLT for payments and market infrastructure. As long as you operate under a regulated entity (bank, PSP, fintech licensee) and align with sandbox or production rules, blockchain can be the underlying rails for compliant trade and payment workflows.

Q : How do UAE free zones like ADGM and DIFC treat tokenization and digital assets projects?

A : ADGM and DIFC have become regional hubs for digital assets and tokenisation by issuing tailored frameworks for virtual assets, securities tokens and blockchain-based financial services. These regimes emphasise KYC/AML, investor protection and clear categorisation of tokens (security, utility, payment), rather than banning the technology outright. Many GCC groups run experiments in ADGM/DIFC while keeping mass-market, citizen-facing services under national regulators such as SAMA, the UAE Central Bank or QCB.

Q : Do GCC governments require Arabic interfaces for citizen-facing blockchain applications?

A : In practice, yes. While most blockchain infrastructure is English-first, citizen services in Saudi Arabia, the UAE and Qatar are expected to offer Arabic interfaces and content, especially when they touch identity, licensing or payments. National strategies like Saudi Vision 2030, Digital Dubai and Qatar Digital Government emphasise inclusion and accessibility for residents and citizens, which includes language. When you design a blockchain solution that surfaces in portals or mobile apps, plan for Arabic UX, RTL layouts and bilingual communications from day one.