Edge Computing in the Middle East for Saudi & UAE

Edge Computing in the Middle East for Saudi & UAE

Edge Computing in the Middle East for Saudi & UAE

Edge computing in the Middle East brings processing and storage closer to users, factories and cities instead of relying only on distant cloud regions. For Saudi, UAE and Qatar organisations, this reduces latency, supports strict data residency rules and unlocks 5G, IoT and AI use cases for smart industries and smart cities.

Introduction

Edge computing in the Middle East is shifting from buzzword to boardroom priority as Saudi Arabia, the UAE and Qatar push Vision 2030–style digital transformation. Low-latency cloud computing in GCC industries is no longer “nice to have” when factories, ports and smart cities depend on real-time decisions.

Put simply, edge means your data is processed in Riyadh, Dubai or Doha rather than waiting for a round trip to Europe or the US. For GCC organisations this translates into three big wins: faster user experiences, easier compliance with local data laws and more reliable operations at remote or harsh sites.

From Cloud-First to Edge + Cloud in GCC Industries

Most GCC CIOs started with a cloud-first mindset: centralise apps in hyperscale regions and connect everything back. Now, as AI, IoT and 5G spread across plants, campuses and cities, the pattern is changing to edge + cloud: critical data is handled at the network edge, while historical analytics and heavy workloads still run in AWS Bahrain, AWS UAE, Azure UAE Central or GCP Doha.

Pain Points for Saudi, UAE and Qatar: Latency, Data Residency and Remote Sites

Saudi factories around Riyadh and Jeddah, ports in Dubai and Abu Dhabi, and stadiums in Doha all face similar challenges:

Millisecond decisions for robotics, payments and safety

Data residency rules under PDPL-style laws in KSA, UAE and Qatar

Weak or intermittent connectivity at oilfields, mines and border sites

When a control system or payment terminal must wait hundreds of milliseconds for a European data centre, operations suffer. Edge computing in the Middle East addresses this by keeping processing, IoT edge gateways and local data handling as close as possible to the site.

What Edge Computing Delivers for GCC Factories, Ports and Smart Cities

For GCC industries, edge delivers low latency, more autonomous operations and better compliance. A Saudi-friendly edge computing solution for factories can power predictive maintenance, real-time quality checks and on-prem AI without violating PDPL or sector rules.

What Is Edge Computing in the Middle East Context?

Processing Data Closer to Users, Not Only in Distant Clouds

In simple terms, edge computing means putting compute, storage and AI inference close to where data is produced inside a Riyadh plant, a Dubai mall or a Doha stadium instead of relying only on remote clouds. You still use the cloud, but now it’s paired with real-time analytics at the network edge, tailored to GCC constraints and regulations.

Key Building Blocks in GCC Edge Setups

Typical GCC edge architectures combine.

IoT sensors on production lines, trucks and energy assets

IoT edge gateways aggregating data and enforcing local policies

5G and multi-access edge computing (MEC) in Middle East telecom networks

On-site edge data centers and micro data centers in GCC factories, ports or campuses

These nodes run containerised services, AI models and integration logic that later sync with central platforms and BI dashboards, often built with partners like Business Intelligence services.

Typical Middle East Deployment Patterns.

Across the region, you’ll see similar patterns:

Saudi oilfields and utilities using rugged edge nodes in desert environments

Dubai and Abu Dhabi ports running local vision AI for container tracking and security

Riyadh and Sharjah malls using in-mall edge clusters for digital signage and retail analytics

Doha’s Education City and Lusail smart districts hosting micro data centres for campus-wide services

All of these still connect back to regional clouds (AWS Bahrain, Azure UAE Central, GCP Doha), but critical decisions happen on-site.

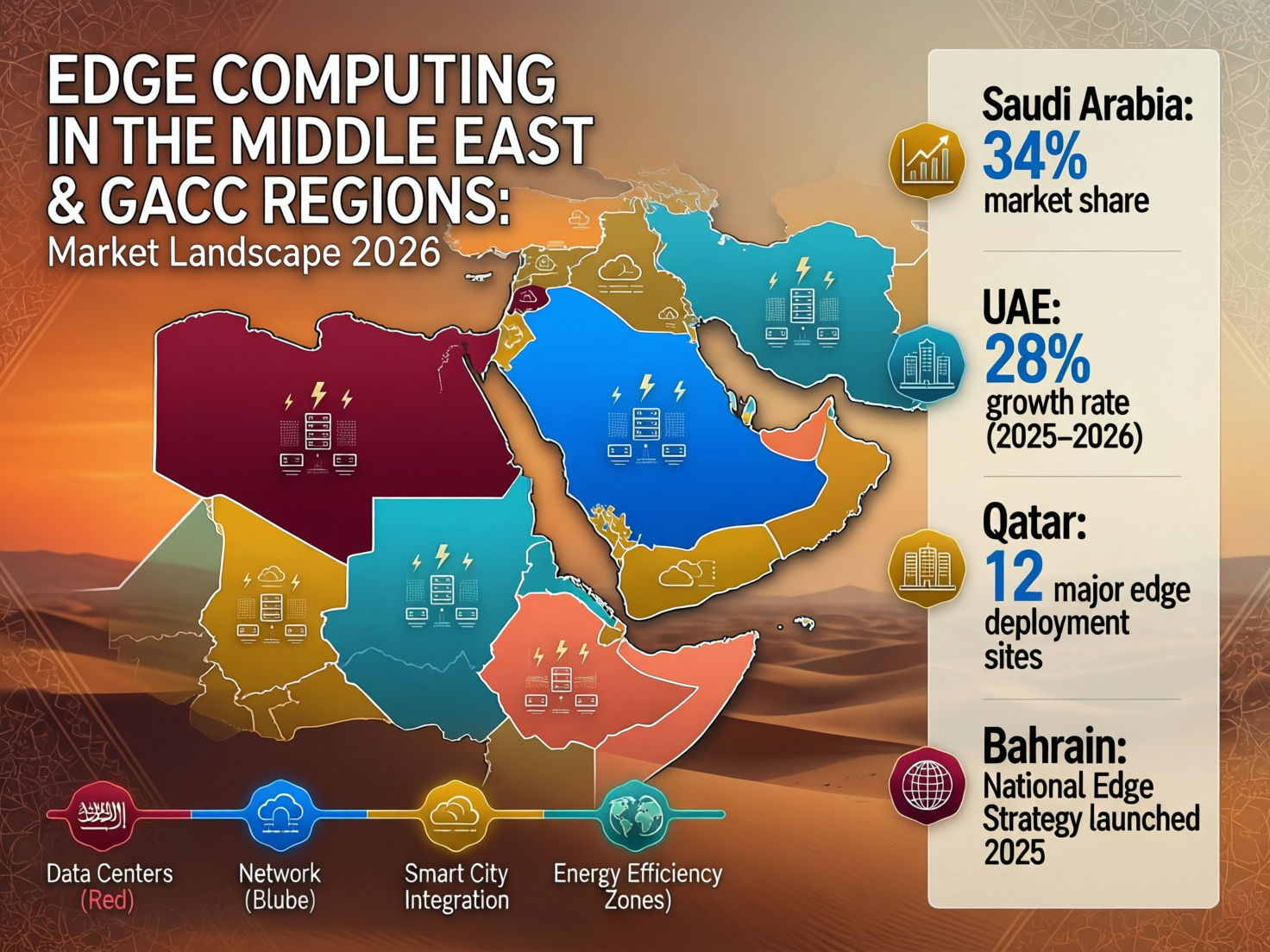

Market Momentum in Saudi Arabia, UAE and Qatar

Vision 2030, NEOM and Industrial Edge Around Riyadh, Jeddah and Dammam

Under Vision 2030, Saudi ministries and regulators like SDAIA and NDMO are pushing data classification, AI and PDPL compliance, which naturally favours local processing. Industrial zones in Riyadh, Jeddah and Dammam are piloting edge for robotics, logistics and smart warehouses, while mega-projects such as NEOM design edge-first smart-city platforms from day one.

Dubai and Abu Dhabi Leading with 5G, Smart Cities and Sovereign Edge Cloud

The UAE combines aggressive 5G roll-out with national data protection frameworks such as the UAE PDPL, overseen alongside telecom regulation by TDRA. Dubai and Abu Dhabi smart-city projects use sovereign edge nodes in government data centres and telecom MEC sites to keep sensitive data inside UAE borders, while offloading heavy analytics to public cloud. This is where UAE smart city edge cloud services in Dubai are emerging as a distinct category.

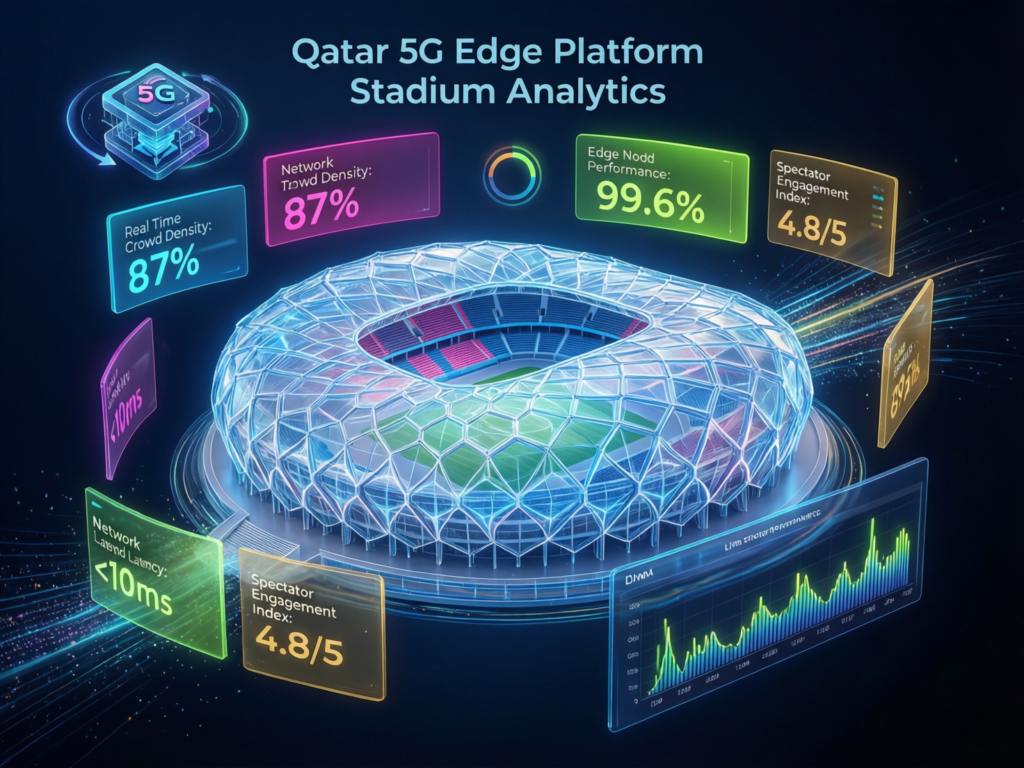

Doha, Lusail and Smart Infrastructure as Fast Followers

Qatar’s Law No. 13 of 2016 and QCB/CRA cloud guidance push financial and telecom players toward carefully governed edge deployments. (QCB) Stadiums in Doha, transport in Lusail and new smart districts across Kuwait, Bahrain and Oman are investing in localised platforms often combining a Qatar 5G edge platform for stadium and events with regional clouds for fan apps and analytics.

High-Impact Edge Computing Use Cases for Middle East Industries

Oil & Gas, Utilities and Mining.

Upstream and midstream operators across KSA, UAE, Oman and Bahrain face bandwidth constraints, sand, heat and strict safety SLAs. By placing edge clusters at pumping stations or substations, teams can run AI models close to SCADA systems, detect anomalies, reduce truck rolls and buffer data when satellite links drop.

Factories and Logistics Hubs in Riyadh, Dubai and Doha.

What are the main benefits of edge computing for Saudi factories and logistics hubs under Vision 2030?

Edge computing lets Saudi factories and logistics hubs process sensor data locally, enabling millisecond responses for quality checks, safety controls and robotics. It also helps them comply with PDPL and SAMA or NDMO rules while improving uptime through predictive maintenance and real-time performance dashboards aligned with Vision 2030 targets.

Riyadh warehouses, Dubai free-zone hubs and Doha logistics centres often combine edge nodes with mobile apps built by partners like Mobile App Development services to give supervisors live insights on handheld devices.

Smart Cities, Transport and Public Safety in NEOM, Abu Dhabi and Lusail

Smart traffic systems, CCTV analytics and crowd management can’t depend on distant data centres. NEOM, Abu Dhabi and Lusail increasingly run video analytics, license plate recognition and incident detection on edge servers in local control rooms, while long-term storage goes to regional clouds. For UAE and Qatar governments, this design also aligns with national security and public safety policies.

GCC Real-World Scenarios and Patterns

A Riyadh fintech startup running fraud-detection models at edge nodes near payment gateways, while core systems stay in compliant data centres aligned with SAMA rules.

A Dubai e-commerce brand using in-mall edge clusters plus responsive web development services to personalise offers within milliseconds.

A Doha SME choosing a nearby cloud region and lightweight edge appliance to keep data residency under local guidance while serving customers across Education City. (Mak it Solutions)

Data Residency, Compliance and Sovereign Edge in the GCC

This section is for general information only and does not constitute legal or regulatory advice. Always confirm your architecture with legal and compliance teams.

How Saudi PDPL, UAE PDPL and Qatar Law 13/2016 Affect Edge Data Storage

Saudi Arabia’s PDPL, the UAE PDPL and Qatar’s Law No. 13 of 2016 all prioritise transparency, consent and controlled cross-border data transfers. For edge, this means you must know exactly what personal data is collected on devices and gateways, how long it is stored locally, and where it is replicated (AWS Bahrain, UAE, Europe, etc.). Local classification schemes from SDAIA/NDMO or CRA should drive which workloads stay fully inside the country.

Sector Rules for Banks, Government and Healthcare

Financial institutions must align with SAMA and NDMO in Saudi, UAE Central Bank plus ADGM/DIFC in the UAE, and QCB in Qatar; telecom and digital services must also consider CST and TDRA or CRA. Many of these regulators provide cloud and outsourcing rules that explicitly address data location, subcontractors and security controls. Linking your compliance strategy to recognised authorities such as SAMA is essential when designing edge architectures for fintech, govtech or health.

Designing Compliant Architectures: Local Hosting, Sovereign Cloud and Hybrid Edge

How does data residency in Saudi Arabia, UAE and Qatar impact where edge devices and gateways can store data?

Data residency rules in Saudi Arabia, the UAE and Qatar generally require personal and some regulated sector data to stay within national or approved regions. Practically, this means edge devices and gateways should store and process sensitive data locally or in sovereign or in-country cloud regions, only sending aggregated or anonymised data abroad under clear legal bases and contracts.

For many GCC teams, the winning pattern is hybrid: on-prem edge for sensitive workloads, regional GCC cloud regions for scalable analytics and backups, and strong encryption plus role-based access control end-to-end.

Architecture & Implementation Roadmap for GCC CIOs

Cloud-Only vs Hybrid vs Edge-First for AI and Analytics Workloads

Cloud-only still works when latency and data residency are mild concerns, such as basic reporting sites optimised via SEO services. But for AI/ML on production lines or public safety, hybrid or edge-first architectures are better. Hybrid keeps training and heavy analytics in the cloud, while inference and streaming analytics run on edge nodes. Edge-first is common in highly regulated or connectivity-constrained sites, with the cloud mainly used for off-site backup and coordination.

Decision Checklist for GCC CIOs.

How can GCC CIOs choose between cloud-only, hybrid cloud and edge architectures for AI workloads?

GCC CIOs should balance four axes: required latency, regulatory risk, connectivity quality and total cost of ownership. If latency and data residency risk are both high as in Saudi banking or UAE public safety a hybrid or edge-first architecture with in-country regions and local edge nodes typically wins.

A practical approach is to map workloads against:

Latency sensitivity (sub-50ms vs seconds)

Data classification (public vs restricted vs secret)

Site connectivity (5G fibre vs VSAT)

Budget and skills (internal vs external partners like Mak It Solutions services)

Step-by-Step Roadmap: Pilot → Scale-Up in Saudi, UAE and Qatar

Define use cases and constraints

Start with one or two high-value scenarios (e.g., Riyadh factory monitoring, Dubai port operations, Doha event analytics) and map regulatory and data residency requirements.

Choose locations and reference architecture

Select pilot sites and decide which data stays on-prem, which goes to regional cloud, and how IoT edge gateways and micro data centres will be managed.

Build a minimum viable edge stack

Deploy a small edge cluster, integrate with your existing web and app stack (for example via web development solutions, BI and mobile apps), and connect to AWS Bahrain, Azure UAE Central or GCP Doha as needed. (Mak it Solutions)

Run the pilot and measure KPIs

Track latency, uptime, cost, user experience and compliance auditability. Use logs and dashboards to validate real-time benefits.

Scale across sites and countries

Standardise templates and automation, then extend to more plants, warehouses and cities across KSA, UAE, Qatar and wider GCC, adjusting configurations for each regulator.

To Sum Up

Edge computing in the Middle East is no longer experimental it’s becoming the default for latency-sensitive, regulated and mission-critical workloads. The winning GCC strategies combine local edge, regional GCC cloud regions and strong data governance tuned to PDPL-style laws.

Aligning Edge Investments with National Digital Agendas

When aligned with Saudi Vision 2030, UAE digital government plans and Qatar’s smart nation agenda, edge investments support both competitiveness and compliance. Working with experienced engineering partners such as Mak It Solutions’ service teams and cross-GCC technology talent (see their insights on IT brain drain in the GCC) can accelerate execution while keeping risk under control.

If you’re exploring edge computing in the Middle East and need to balance latency, compliance and cost, you don’t have to design everything alone. Mak It Solutions can help you architect and build edge-ready web platforms, data pipelines and mobile apps that respect KSA, UAE and Qatar regulations while supporting growth. Reach out to discuss a tailored GCC edge roadmap or to start with a focused pilot project in your factory, port or smart district.( Click Here’s)

FAQs

Q : Is edge computing allowed for Saudi banks under SAMA and NDMO cloud rules?

A : Yes, Saudi banks can use edge computing as long as they respect SAMA and NDMO guidance on outsourcing, data residency and security. Typically this means keeping core banking data in approved in-country data centres, while using edge nodes at branches, ATMs or payment gateways mainly for processing and temporary storage. Strong encryption, logging, access control and vendor management are critical. Many banks pair edge solutions with in-country cloud regions and on-prem infrastructure, ensuring PDPL and sector rules are met before any data leaves the Kingdom.

Q : Do UAE PDPL and TDRA regulations require edge data to stay inside UAE borders?

A : The UAE PDPL and related TDRA frameworks emphasise protecting personal data and regulating international data transfers rather than banning all cross-border movement. In practice, many organisations keep identifiable personal data from edge devices (CCTV, kiosks, IoT sensors) within UAE borders or approved regions, and only send aggregated or anonymised insights abroad. Contracts, DPIAs and technical controls must demonstrate that transfers are lawful and proportionate. For public sector, critical infrastructure and financial services, a “UAE-first” approach to edge data storage is strongly recommended.

Q : Can Qatar fintech startups use regional edge data centers while still complying with QCB and CRA policies?

A : Qatar fintech startups can generally use regional edge data centres if they align with QCB and CRA rules on data protection, outsourcing and cloud use. That usually means prioritising in-country or nearby GCC regions with clear contractual guarantees on data location, access and encryption. Sensitive payment or identity data may need to stay in Qatar-based infrastructure or QCB-approved locations, while less sensitive workloads run in regional edge and cloud zones. Startups should document their architecture, perform risk assessments and engage early with compliance and legal advisors to avoid surprises later.

Q : What is the difference between using public cloud zones in Europe and local edge data centers in Riyadh or Dubai?

A : Public cloud zones in Europe offer scale and rich services, but introduce higher latency and more complex data-transfer risk for GCC organisations. Local edge data centres in Riyadh or Dubai, whether on-prem or telecom-hosted, keep processing physically close to users and under local jurisdiction. This improves response times for AI, IoT and transactional workloads and makes it easier to comply with PDPL-style data residency rules. Most mature organisations blend both: local edge and GCC regions for sensitive, real-time workloads, and selected European zones for specialised or global services under strict safeguards.

Q : How much does a typical pilot edge project cost for a smart warehouse in the Middle East?

A : Costs vary, but many GCC smart-warehouse pilots fall in the low to mid six-figure USD range, depending on scope. Budget drivers include ruggedised edge hardware, IoT sensors, cameras, networking (often 5G or Wi-Fi 6), software licences and integration with WMS/ERP and analytics tools. Using existing platforms, reusable components and experienced partners can significantly reduce cost and time-to-value. Starting with a narrow pilot in one Riyadh, Dubai or Doha warehouse and then reusing the blueprint for wider rollout is usually more efficient than trying to “build everything” at regional scale on day one.