Balancing Tech Talent Outsourcing vs Local Hiring

Balancing Tech Talent Outsourcing vs Local Hiring

Balancing Tech Talent Outsourcing vs Local Hiring in the Middle East

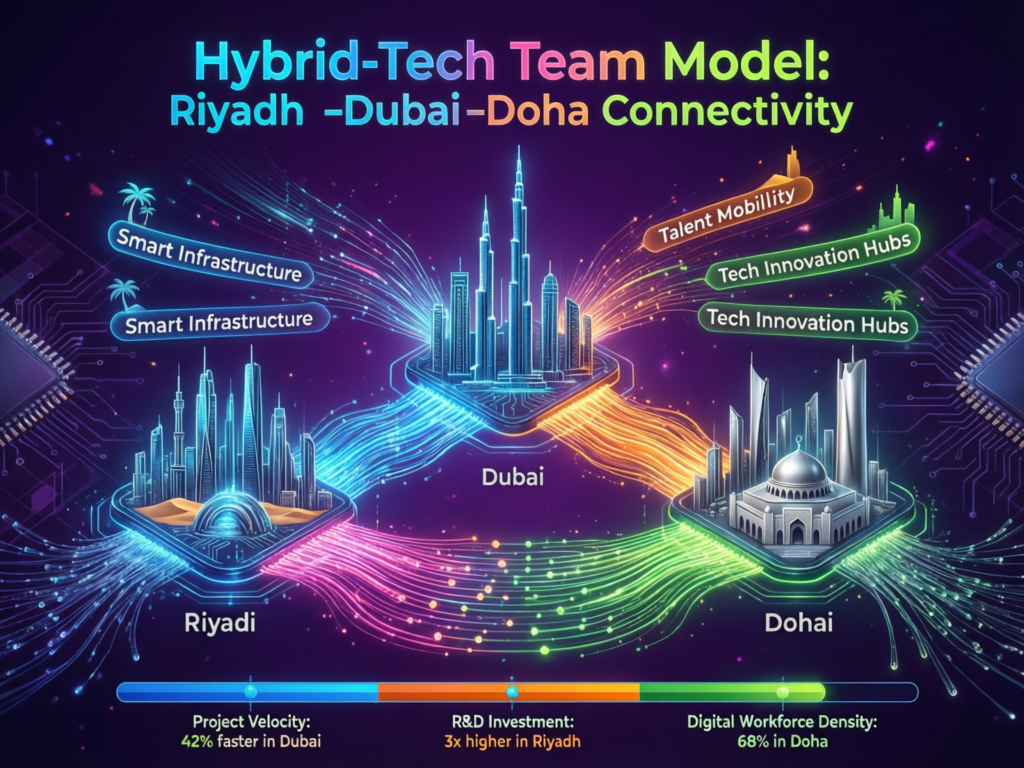

The best way for Middle East companies to balance tech talent outsourcing vs local hiring is to adopt a hybrid model: keep core, regulated and Arabic-facing roles local, while outsourcing execution-heavy and specialist work to vetted regional and offshore partners. In practice, GCC leaders align this mix with Saudization, Emiratisation and Qatarisation rules, data residency requirements, and the need for Arabic UX and stakeholder trust.

Introduction

Empty senior engineer seats in Riyadh, Dubai or Doha don’t just slow projects they hold back Vision 2030 dashboards, digital government portals and fintech launches. For many boards, tech talent outsourcing vs local hiring in Middle East markets has quietly become a strategic, not just HR, question.

The most resilient GCC companies use a hybrid model: they keep product ownership, regulated roles and citizen-facing Arabic UX in-country, while scaling with outsourced, remote and nearshore teams for delivery and specialist skills. Done right, this balances cost, compliance and speed without sacrificing nationalisation targets or data sovereignty.

Quick AEO-style takeaway

For most GCC organisations, a hybrid tech team local leadership plus outsourced build capacity on compliant cloud regions is the most realistic way to ship fast, stay within Saudization/Emiratisation/Qatarisation rules and protect sensitive data.

The Real Cost of Empty Tech Seats in Riyadh, Dubai and Doha

Every month without a lead engineer in Riyadh can delay core Vision 2030 programmes, while unfilled data roles in Dubai or Abu Dhabi stall AI and analytics agendas. In Doha, government and logistics projects often depend on a handful of overworked architects. The real cost isn’t just salaries; it’s missed tenders, slower innovation and frustrated business sponsors.

Vision 2030, Digital Government and Not Enough Senior Engineers

Saudi Vision 2030, UAE’s digital government agenda and Qatar National Vision 2030 all assume a deep pool of cloud, data and cybersecurity talent but the region’s demand has outpaced supply, especially in cities like Riyadh, Jeddah, Dubai, Abu Dhabi and Doha. Fintech, e-commerce, health and logistics projects all compete for the same senior full-stack, DevOps and data engineers.

A Hybrid Model That Blends Local Hires With Outsourced and Remote Teams

In reality, very few GCC organisations can choose only local or only outsourced. The sustainable answer is to define which roles must stay in Riyadh, Dubai or Doha for compliance and stakeholder trust, and which can sit with remote engineering teams for Saudi and UAE startups in places like Egypt, Pakistan or India under clear governance, contracts and cloud controls.

The Tech Talent Crunch in the GCC

Why Saudi, UAE and Qatar Can’t Hire Developers Fast Enough

Riyadh, Jeddah, Dammam, Dubai, Abu Dhabi, Sharjah and Doha are all investing heavily in cloud, digital government and AI. Yet universities, bootcamps and migration pipelines simply can’t produce enough mid–senior engineers, especially in high-demand stacks like cloud-native, cybersecurity and data engineering. Time-to-hire for a strong senior engineer can easily run into months, even with aggressive recruitment agencies and relocation packages.

Expat-Heavy Teams, Nationalisation Targets and Rising Salary Benchmarks

Most tech teams in the region are still expat-heavy, while Saudization, Emiratisation and Qatarisation are tightening local hiring expectations. HR and CTOs must juggle visa quotas, nationalisation ratios and rapidly rising salary benchmarks for both locals and expats especially in fintech and government-linked entities. This pressure often pushes decision-makers to revisit outsourcing and staff augmentation just to keep projects moving.

How This Talent Gap Triggers the “Outsourcing vs Local Hiring” Debate

When boards see projects slipping and headcount blocked, the debate quickly becomes:

Do we pay more and wait longer for local hires in Riyadh, Dubai or Doha?

Or do we scale fast with offshore vs nearshore developers for Middle East companies — and then work out compliance afterwards?

Without a clear framework, this turns into emotional arguments between finance, HR and technology rather than a structured, data-informed strategy.

Tech Talent Outsourcing vs Local Hiring in the Middle East What It Really Means

What “Outsourcing” Looks Like in GCC.

In GCC practice, “outsourcing” usually means one of four models:

Staff augmentation individual remote developers added to your sprint teams.

Managed teams a full pod (PM, devs, QA) owned and run by a vendor.

Nearshore teams in MENA or wider Middle East time zones (for example Egypt, Jordan, Pakistan).

Offshore further away but often lower cost (India, Eastern Europe and similar hubs).

Many Saudi and UAE firms use a blend of these through specialist partners or web development services providers in the region and beyond, including firms like Mak It Solutions.

What Counts as “Local Hiring” in KSA, UAE and Qatar Under Saudization, Emiratisation and Qatarisation

“Local hiring” is not just about being physically in-country; it’s about meeting nationalisation frameworks.

In Saudi Arabia, this is tied to Saudization and monitored through the Ministry of Human Resources and Social Development and platforms like Qiwa.

In the UAE, MOHRE manages Emiratisation in the private sector, while free zones such as DIFC, ADGM, DMCC and Dubai Internet City layer on their own expectations.

In Qatar, national labour law plus sector regulators and QFC rules shape how “local” staffing looks in practice.

Cost, Speed, Control, Culture and Arabic UX

At board level, the trade-offs are simple to state but hard to balance.

Cost: outsourced teams can be 30–50% cheaper than fully local teams once you include visas, offices and benefits.

Speed: vendors often have ready-to-deploy teams; local recruitment takes longer and is vulnerable to visa or relocation delays.

Control and culture: in-house teams give more day-to-day control, easier Arabic/English communication and stronger alignment with internal politics.

Arabic UX and local knowledge: citizen-facing apps in Riyadh or Doha usually need product managers and UX writers who deeply understand Arabic language and GCC culture these are best kept local while you retain local knowledge while outsourcing development tasks.

Compliance and Nationalisation.

Saudization and Tech Outsourcing in Saudi Arabia.

For Saudi-based companies, especially in regulated sectors, you can’t simply outsource everything and ignore Saudization. Tech-heavy roles must still respect local quota rules and the broader data protection regime overseen by SDAIA and the National Data Management Office (NDMO), which enforces the PDPL and related data governance requirements.

How Saudization affects outsourcing decisions.

Keep product owners, key architects and security roles in Riyadh, Jeddah or Dammam.

Use outsourced teams for execution work, but ensure contracts and reporting support Saudi headcount ratios where needed.

For the best way for Saudi company to outsource developers but keep Saudization, many firms treat vendors as capacity, not headcount replacement, and maintain a strong local core.

Emiratisation in UAE Tech Roles.

On the UAE mainland, MOHRE’s Emiratisation targets mean HR must plan local hiring for mid–senior tech roles while still using outsourcing to fill gaps. In free zones like DIFC and ADGM, regulations focus more on governance and risk than on strict Emiratisation percentages, but firms are still expected to create meaningful local opportunities. DIFC financial firms, for example, must also follow DFSA rules on outsourcing and cloud.

For a UAE tech startup wanting a mix of local team and remote developers, a common model is.

UAE-based founders, PMs and senior engineers.

Remote, nearshore squads for build and QA.

Clear documentation and knowledge transfer so IP and architecture knowledge remain with the UAE entity.

Qatarisation and Outsourcing Software Development in Qatar and the Wider GCC

Qatar introduced one of the GCC’s first comprehensive data protection laws (Law No. 13 of 2016), with additional guidance from national bodies and QCB for financial services. QFC entities follow their own rulebooks for outsourcing and governance.

For tech teams in Doha (and hubs like Manama, Kuwait City and Muscat), the pattern is similar: local leadership and sensitive roles plus outsourced build capacity. Qatarisation focuses on developing national talent over time, so outsourcing is usually framed as a bridge not a permanent substitute.

Cost, Speed and Access to Talent.

Cost of Outsourcing Software Development vs Local Hiring in Riyadh, Dubai and Doha

Total cost isn’t just salary. In Riyadh, Dubai or Doha you must factor in visas, benefits, office space and tools, plus recruitment fees. Outsourcing to vetted partners for example a full-stack development services company like Mak It Solutions’ services team converts much of this into a predictable service fee.

Broadly.

Riyadh and Dubai senior engineers often sit at the top of regional salary bands.

Doha is similar for niche skills, though smaller market size can limit options.

Nearshore markets (Egypt, Pakistan, India) provide significant savings, especially for larger delivery teams.

In-House Recruitment vs Outsourcing Partners and Regional Hubs

In-house recruitment can easily take 2–4 months per role once interviews, approvals and relocation are included. Outsourcing vendors and staff augmentation partners can often place remote engineering teams for Saudi and UAE startups in a few weeks, because they keep active benches or large talent pools. The trade-off is that you need stronger onboarding, documentation and product management to keep everyone aligned.

When to Tap Remote Engineers in Egypt, Pakistan, India and Beyond for GCC Companies

Remote and nearshore engineers make sense when:

You have a clear product roadmap and can break work into modules.

Security controls, VPNs and access policies are in place.

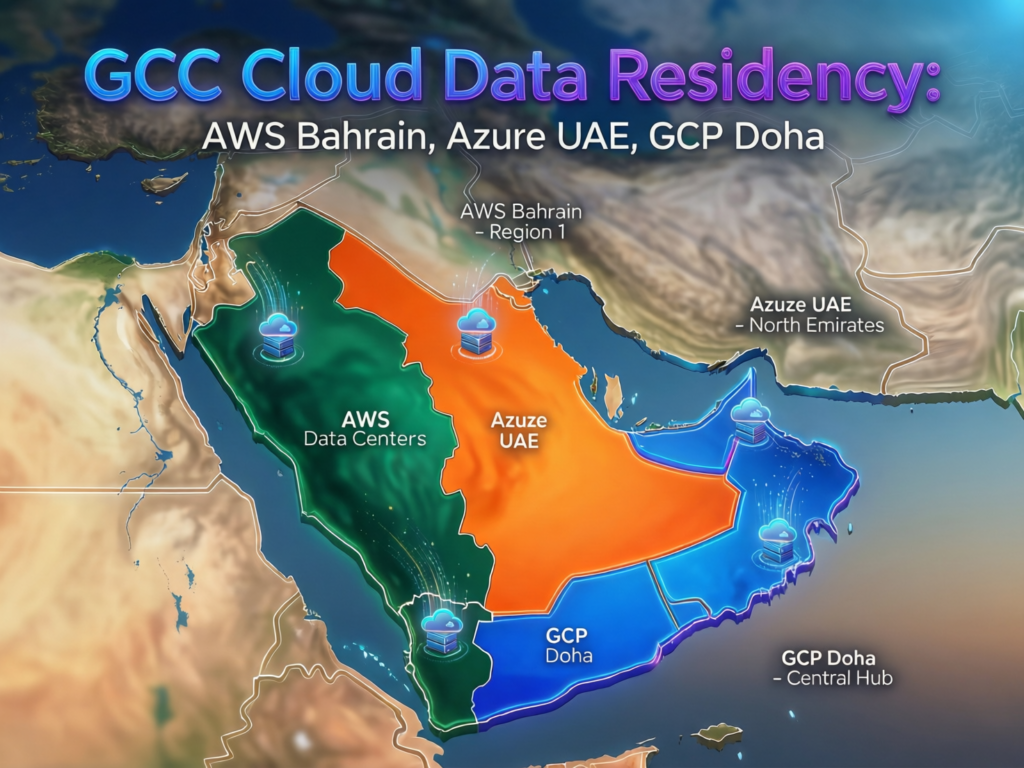

Data residency (particularly in KSA and Qatar) is solved through GCC cloud regions while engineers work remotely.

For example, a Riyadh fintech might keep its core platform in an AWS Bahrain or Middle East (UAE) region, while engineers in Lahore or Bangalore build features without holding production data locally.

Data Residency, Security and Regulated Sectors

Data Residency and Cloud Localisation for Outsourced Tech Teams in KSA, UAE and Qatar

KSA’s PDPL and NDMO guidance emphasise data localization and strict conditions for cross-border transfers, particularly for sensitive and critical data. Similarly, Qatar’s data protection law and QCB cloud regulations require many financial services workloads to stay in-country or in approved data centres.

In practice, GCC organisations often host data in.

AWS Middle East (Bahrain) or AWS Middle East (UAE) regions.

Azure UAE North / Central for government and enterprise workloads. )

Google Cloud Doha region for Qatar-based workloads, aligned with Qatar National Vision 2030. (Google Cloud)

This lets outsourced developers work from abroad while the actual data stays in Riyadh, Dubai, Abu Dhabi, Doha or other GCC data centres.

Cybersecurity, IP Protection and Vendor Governance for GCC Companies

Before outsourcing, GCC companies should.

Use strong SLAs, NDAs and IP clauses.

Enforce least-privilege access, MFA and VPNs for remote developers.

Align with UAE’s Information Assurance Regulation and sector-specific rules in telecom and digital services, overseen by TDRA. (TDRA)

Banks and payment firms also need vendor due diligence, regular security audits and incident response expectations baked into contracts especially when cloud is involved.

Outsourcing vs Local Hiring for Banks, Fintechs, Telecom and Government

Regulated sectors face stricter guardrails.

Banks & fintechs (SAMA, QCB): often must seek regulator approval for material outsourcing or cloud moves, and show that data stays in approved locations with strong controls.

Telecom & digital government (TDRA, Hukoomi): sensitive government and citizen services are typically hosted in-country with stringent controls, as reflected in UAE and Qatar digital government frameworks.

Here, outsourcing is usually limited to development and support, while operations, security and data stewardship remain with local teams or sovereign cloud providers.

How Middle East Companies Can Design a Hybrid Tech Team Model

Deciding Which Roles to Keep Local and Which to Outsource in Riyadh, Dubai and Doha

For GCC leaders wondering what is the best way for Middle East companies to balance tech talent outsourcing and local hiring, this step-by-step approach works well:

Map critical systems and data. Identify what’s regulated, citizen-facing or mission-critical.

Classify roles. Keep ownership roles (CIO/CTO, product, security, data protection) local in Riyadh, Dubai, Abu Dhabi or Doha.

Pick outsourcing candidates. Shortlist feature delivery, testing, integrations and analytics as candidates for remote teams.

Check nationalisation and labour rules. Validate Saudization, Emiratisation, Qatarisation and free-zone implications.

Select cloud regions and residency model. Use GCC cloud regions that satisfy NDMO, TDRA, QCB and local guidance.

Pilot, measure, then scale. Run a 3–6 month pilot with one vendor before expanding scope.

Building a Hybrid Operating Model.

A good hybrid model treats the GCC-based team as the “brain” and outsourced teams as “muscle”.

Product managers and tech leads in Riyadh or Dubai own the backlog and architecture.

Remote teams in Egypt, Pakistan, India or Eastern Europe deliver against well-defined user stories.

Daily stand-ups, shared tooling and clear escalation paths keep everyone aligned.

Tools and practices from web development with AI copilots can accelerate delivery while preserving quality and governance; see Mak It Solutions’ guide to web development with AI copilots for examples.

Fintech, Government, Retail and Logistics in GCC

Some typical patterns.

Fintech and banks (KSA, UAE, Qatar): core banking, payments and risk engines stay on regulated GCC cloud regions with strong local oversight; non-core apps, reporting and front-ends are often outsourced.

Government / public sector: digital ID, portals like Qatar’s Hukoomi, and national platforms are led by in-country teams; UX and supporting apps may involve vetted vendors.

Retail & e-commerce: local teams focus on Arabic UX, campaigns and omnichannel; outsourced teams handle mobile, integrations and performance tuning.

Logistics & supply chain: regional operations hubs (Dubai, Dammam, Doha) keep product owners close to warehouses, while distributed teams build routing engines, tracking apps and analytics supported by business intelligence services like those from Mak It Solutions.

When Outsourcing Wins, When Local Hiring Wins and When You Need Both

Outsourcing wins when you need speed, specialised skills (for example advanced cloud, AI, DevOps) or 24/7 coverage without long visa processes.

Local hiring wins when roles involve regulators, internal politics, Arabic stakeholder management or highly sensitive data.

Hybrid wins for most GCC organisations: a strong local product and architecture core, plus distributed engineering capacity.

If you’re unsure which model fits your stage, a practical approach is to start with a scoped module (for example a new mobile app) and a trusted mobile app development services partner such as Mak It Solutions, then expand based on measurable results.

Concluding Remarks

For GCC boards, the question isn’t “outsourcing or local?” it’s how to design hybrid tech teams in GCC that deliver reliably while satisfying regulators and national strategies. With the right mix of local leadership, compliant cloud regions and well-governed outsourcing partners, Saudi, UAE, Qatar and wider GCC organisations can ship faster, stay secure and still invest in local talent pipelines.

Over time, this balance between tech talent outsourcing vs local hiring in Middle East markets becomes a competitive advantage: your teams stay close enough to regulators and customers to build trust, but broad enough across regions to hire the skills you actually need.

If you’re a GCC leader trying to align Saudization, Emiratisation or Qatarisation with real delivery dates, you don’t have to figure it out alone. The team at Mak It Solutions has shipped complex web, mobile and data projects with blended local–remote models for clients worldwide.

Explore our web development services, SEO and digital visibility services and wider service portfolio, or talk to our team about designing a GCC-compliant hybrid tech team tailored to your roadmap.

FAQs

Q : Is tech talent outsourcing allowed under Saudi Saudization rules for IT jobs?

A : Yes, tech talent outsourcing is allowed in Saudi Arabia, but it doesn’t remove your Saudization obligations. Saudization focuses on the ratio of Saudi nationals in your own payroll, particularly in key roles, while outsourced developers are usually counted as external capacity. For IT and digital teams, most organisations keep leadership, architecture, cybersecurity and data protection roles in-house, then use outsourcing for delivery tasks. HR should always align with the Ministry of Human Resources and Social Development and Saudization programmes linked to Vision 2030 before finalising any large outsourcing deal.

Q : Can a Dubai or Abu Dhabi company use remote developers outside the UAE and still meet Emiratisation targets?

A : Yes, many Dubai and Abu Dhabi companies use remote developers from neighbouring countries while still meeting Emiratisation goals. The key is that Emirati employees are hired into meaningful roles such as product ownership, cybersecurity, data or leadership on the UAE payroll, while offshore developers support delivery. MOHRE tracks Emiratisation for mainland companies, while free zones like DIFC and ADGM add their own governance expectations. As long as Emirati hiring plans are credible and aligned with UAE labour policy and the country’s digital economy vision, remote teams can be a powerful complement rather than a conflict.

Q : How can Qatar-based organisations outsource IT services while complying with Qatarisation and QCB guidelines?

A : Qatar-based organisations can outsource IT and cloud services, but must respect Qatar’s data protection law and sector guidance. For financial services, the Qatar Central Bank issues detailed technology and cloud regulations that require approvals for significant outsourcing, strong security controls and, in some cases, local data centres. Qatarisation objectives mean local staff should still hold core leadership and oversight roles, even if development or support is done by vendors abroad. A practical approach is to keep architecture, security and compliance in Doha while outsourcing well-defined development, testing or analytics work to vetted partners.

Q : Do GCC banks and fintechs need special approvals from SAMA or QCB before outsourcing core technology functions?

A : Often yes. GCC financial regulators treat core tech functions such as core banking, payments processing or customer data platforms as material outsourcings. In Saudi Arabia, SAMA and SDAIA expect strong governance over data residency, security and cross-border transfers under the PDPL and related regulations. In Qatar, QCB’s outsourcing and cloud regulations can require prior approval, in-depth risk assessment and ongoing monitoring of service providers. UAE regulators apply similar expectations via sector-specific circulars. Fintechs should involve compliance and legal teams early and design architectures that keep sensitive data in GCC cloud regions while leveraging partners for non-core components.

Q : Is it better for a Riyadh or Dubai startup to set up in a free zone like DIFC or ADGM if they plan to use outsourced tech teams?

A : Free zones such as DIFC and ADGM can be attractive for Riyadh- or Dubai-focused startups, especially fintechs targeting regional markets. These zones offer their own regulatory frameworks, IP protection and modern company law, plus well-established rules on outsourcing and cloud use through regulators like the DFSA and the ADGM FSRA. This can make it easier to structure cross-border contracts with outsourced vendors. However, you must still consider where your main customers, regulators and investors are based — many Saudi-focused startups still incorporate locally or operate through Saudi entities to align with Vision 2030 programmes and SAMA or CMA expectations.