AI Agents for GCC Businesses in Riyadh & Dubai

AI Agents for GCC Businesses in Riyadh & Dubai

AI Agents for GCC Businesses in Riyadh & Dubai

AI agents for GCC businesses are autonomous AI systems that can read data, understand Arabic and English conversations, make decisions and take actions across channels like web, mobile apps and WhatsApp. In Saudi Arabia, the UAE and Qatar, these agents are now being deployed on local, PDPL-aligned cloud regions to automate customer service and back-office workflows while keeping sensitive data inside national borders.

Introduction

From Experiments to Production AI Agents in GCC

Only a few years ago, AI agents for GCC businesses were mostly pilots in labs and innovation hubs. In 2024–2025, that changed: the UAE rolled out “U Ask”, a generative AI virtual assistant on U.AE and other government portals, powered on FEDnet sovereign cloud and now being extended across federal websites.Saudi, UAE and Qatar are following a similar pattern: rapid experimentation, then hardening successful use cases into production-grade, supervised AI agents embedded in real journeys.

Manual Processes, Talent Gaps and Compliance Friction

Across Riyadh, Dubai, Doha and beyond, leaders are under pressure: overloaded call centres, manual back-office work, and fragmented Arabic/English channels that frustrate citizens and customers. At the same time, regulators like SDAIA (Saudi PDPL), TDRA (UAE), MCIT Qatar, SAMA and QCB expect strong governance, logging and data residency but senior AI talent is scarce across Kuwait, Bahrain and Oman too.

What AI Agents Can Do for GCC Enterprises by 2026

By 2026, well-designed AI agents for GCC businesses can.

Cut bilingual response times by 20–40% across chat, email and voice.

Provide always-on agents for banking, government services and retail support, escalating only the complex edge cases.

Run as multi-agent systems for example, a customer agent plus a compliance agent hosted in Saudi, UAE or Qatar data centres to stay aligned with PDPL and local data residency rules.

Understanding AI Agents & Multi-Agent Systems for GCC Leaders

What Are AI Agents and Multi-Agent Systems in Simple Terms?

What are AI agents and multi-agent systems in simple terms for GCC business leaders?

An AI agent is software that can perceive, decide and act toward a goal for example, reading a customer email in Arabic, checking your CRM and responding with the right, compliant answer. A multi-agent system is a team of these autonomous AI agents working together: perhaps a data-enrichment agent, a compliance agent and a customer-facing agent coordinating to complete an onboarding or dispute journey end-to-end.

AI Agents vs Traditional Automation and Chatbots in Saudi & UAE

Traditional RPA bots and FAQ chatbots in Saudi or UAE environments mainly follow rigid if/else rules. By contrast, autonomous AI agents for enterprises can reason over unstructured documents, APIs and past conversations, then choose the right next action in Arabic or English. For a Dubai retailer or Riyadh bank, that means one AI agent can span WhatsApp, web chat and mobile apps instead of maintaining separate rule sets per channel.

Inside an Agentic AI Orchestration Platform

Under the hood, an agentic AI orchestration platform combines.

LLM-based agents with tools and memory connected to search, CRM, core banking, ERP and ticketing systems.

A coordination layer that routes tasks between multiple agents (for pricing, fraud, CX, collections, etc.).

Guardrails, human-in-the-loop review and detailed logging to satisfy GCC governance expectations and financial regulators.

Why GCC Enterprises Are Shifting from RPA to Agentic AI

Business Drivers in Riyadh, Dubai and Doha

Vision 2030 in Saudi Arabia, the UAE AI Strategy 2031 and Qatar’s Digital Agenda 2030 all push government and private sectors toward smarter, automated services. For CIOs in Riyadh, Dubai and Doha, AI agents are an obvious way to deliver 24/7 bilingual CX, reduce operating costs and meet rising expectations from young, mobile-first GCC populations.

Agentic AI vs RPA and Legacy Chatbots in 2026

Why should GCC enterprises choose an agentic AI platform instead of traditional RPA or chatbots in 2026?

Because regulations, channels and products change too fast. Agentic AI lets you update prompts, tools and policies rather than rewriting hundreds of brittle RPA scripts. Multi-agent workflows can coordinate across core banking, payment gateways and ID systems like UAE Pass without months of reconfiguration each time a rule changes.

From Single Bot to Collaborative Multi-Agent Workflows

Most GCC organisations start with a single FAQ-style bot. The next step is collaborative multi-agent workflows: one agent handles the conversation, another pulls pricing, a third runs fraud or Sharia-compliance checks before confirming an action. Over time, this evolves into a secure multi-agent decision-making system with role-based permissions, approvals and audit trails that satisfy internal risk teams.

Real 2025–2026 AI Agent Use Cases by Sector in GCC

Banking & Fintech: SAMA- and QCB-Aware AI Agents

How can multi-agent AI systems reduce costs for GCC banks and fintechs while staying compliant with SAMA and QCB rules?

Multi-agent AI can pre-qualify leads, collect KYC documents, and orchestrate Open Banking KSA consent flows before a human ever touches the case, slashing manual work. Credit-risk agents can prioritise cases; collections agents negotiate via WhatsApp; fraud agents combine transaction analysis with rules engines to flag suspicious behaviour before settlement. All of this still sits under SAMA, QCB and PDPL frameworks, with final approvals and sensitive actions reserved for authorised humans.

Government & Digital Services: SDAIA, DGA, TDRA and MCIT Qatar

Saudi and UAE governments see AI agents as a way to scale citizen services without exploding headcount. The UAE’s “U Ask” generative AI assistant already answers questions on U.AE and is being rolled out across federal portals using a unified design system and sovereign cloud stack. (Telecommunications Regulatory Authority) In Saudi, SDAIA and the Digital Government Authority frame AI ethics and data protection for Vision 2030 services, while Qatar’s MCIT and Digital Agenda 2030 push similar journeys in Doha.

Retail, Malls and Ecommerce: Agentic Commerce in GCC

What are real AI agent use cases that GCC retailers and malls can deploy in 2025–2026?

Dubai is already piloting Mastercard Agent Pay with Majid Al Futtaim, where AI agents search, compare and buy cinema tickets autonomously the first launch of this technology outside the US. ([Mastercard][8]) GCC malls and ecommerce brands can deploy multi-agent concierges that handle product discovery, promotions and in-mall navigation across WhatsApp, kiosks and apps, with Arabic Gulf dialect support. For Jeddah or Sharjah retailers, this is a practical way to raise conversion without hiring dozens more agents.

Governance, PDPL & Data Residency for AI Agents

GCC AI & Data Regulations.

Saudi’s PDPL, enforced by SDAIA, makes data sovereignty and cross-border transfer controls central obligations for any AI program. The UAE’s Federal Decree-Law No. 45 of 2021 (PDPL) brings GDPR-style rights and duties for processing personal data, overseen by new federal authorities and sector regulators like TDRA, ADGM and DIFC. Qatar’s PDPPL similarly governs how ministries and companies process personal data under MCIT and the National Cybersecurity Agency.

How Data Residency Laws Shape AI Agent Hosting

How do UAE and Saudi data residency laws affect where AI agents and multi-agent platforms can be hosted?

Saudi PDPL treats local hosting as the default, so most production AI agents for banks or government workloads will run on local data centres or sovereign clouds in Riyadh and other regions, with strict conditions on any cross-border transfers. In the UAE, TDRA and PDPL encourage using in-country cloud regions like AWS me-central-1 (UAE) and Azure regions in Dubai/Abu Dhabi; Qatar benefits from the Google Cloud Doha region (me-central1) for government and BFSI workloads.

Designing Secure Multi-Agent Decision-Making Systems

For regulated sectors, secure multi-agent decision-making means giving each agent a narrow role and least-privilege access: one agent may read customer data, another can draft responses, but only humans (or a tightly controlled action agent) can approve payments. Risk teams in Riyadh, Dubai and Doha will expect model-risk assessments, audit logs, red-teaming and human approvals for high-risk actions, plus Sharia-compliance checks for Islamic banking use cases.

Platforms, Costs and Vendor Selection for GCC Enterprises

Agent 365, MCP and AI Agent Frameworks

Vendors are racing to offer agentic AI orchestration platforms: Microsoft is weaving agents into Copilot/365, integration players offer MCP-style orchestration, and open-source frameworks make it easier to build custom LLM-based agents with tools and memory. For GCC buyers, key questions are: Arabic quality, connectors to systems like SADAD or UAE Pass, and whether the platform supports hosting in AWS Bahrain, AWS UAE, Azure UAE North/Central or GCP Doha.

When GCC Companies Should Use Vendors vs Internal Teams

In Riyadh or Dubai mega-enterprises with strong engineering teams, it can make sense to build a core agent platform in-house, then bring in partners for integrations and tuning. Mid-sized banks, retailers and government entities often move faster by partnering with specialised SIs or boutiques that already understand PDPL, SAMA and TDRA expectations. Here, working with a partner like Mak It Solutions for web development, mobile app experiences and business intelligence services can accelerate delivery while keeping architecture and data under your control.

Costs and Timelines in Saudi, UAE and Qatar

Typical journeys look like this.

4–8 weeks for discovery and PoC.

8–16 weeks for a focused pilot.

6–12 months of scale-up across channels and markets.

Saudi projects may carry extra cost for sovereign-cloud or on-prem hosting; UAE projects often optimise for multi-tenant but in-country cloud; Qatar projects increasingly factor in the new AI infrastructure around Qai’s $20B JV and the Doha cloud region.

2026 Roadmap & Best Practices for GCC AI Agent Programs

From Idea to Live Multi-Agent System

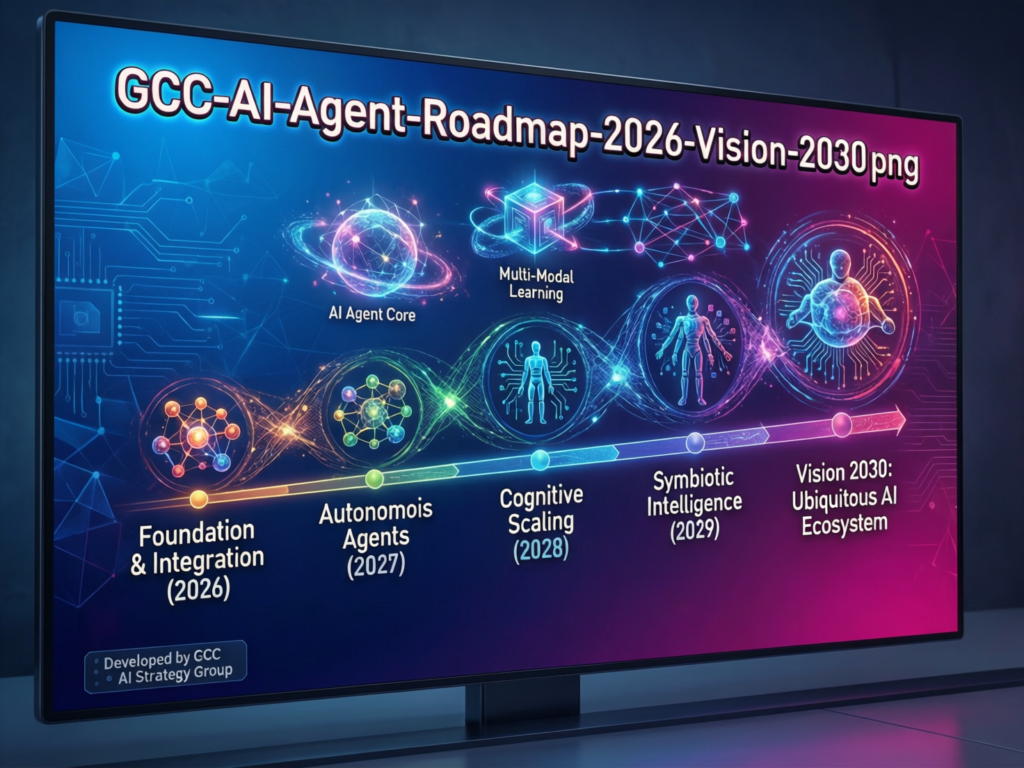

A practical 2026 roadmap for AI agents for GCC businesses.

Identify high-ROI journeys in banking, government, retail, logistics or utilities where delay and manual workload hurt most.

Prioritise Arabic/English touchpoints and compliance constraints, mapping PDPL, SAMA, TDRA, QCB and sector rules early.

Choose your platform (build vs buy), insisting on clear data residency options in KSA, UAE and Qatar.

Start with 1–2 collaborative multi-agent workflows, prove value in weeks, then expand to more sectors and countries.

Arabic-First, English-Strong UX for GCC Users

GCC users frequently switch between Gulf Arabic and English in the same conversation. Your AI agents should handle right-to-left layouts, dialectal Arabic, and mixed-language search exactly the challenges addressed in Mak It Solutions’ work on Arabic to English AI translation and MENA AI upskilling programs. Design for WhatsApp and mobile first; then bring those flows into web portals and kiosks.

KPIs, Governance and Continuous Improvement

Define success early: AHT reduction, CSAT/NPS uplift, percentage of fully automated tasks, and zero-tolerance metrics for compliance incidents. An AI steering committee that includes legal, risk, technology and business owners aligned with frameworks from SDAIA, TDRA, QCB and Saudi Vision 2030 should review logs, edge cases and model changes monthly. Over time, AI agents plug into broader initiatives like digital twin smart-city projects and platform engineering roadmaps across the GCC.

Concluding Remarks

For a CIO or Head of Digital in Riyadh, Dubai or Doha, the next week’s work is clear: shortlist 2–3 high-impact journeys, confirm regulatory boundaries with your PDPL and sector regulators, and run a tightly scoped PoC that demonstrates value within a quarter. The organisations that win will treat AI agents for GCC businesses not as a side experiment, but as a core capability built on regional cloud, bilingual UX and serious governance.

If you’re planning AI agents for GCC businesses and need a bilingual, regulator-aware roadmap, you don’t have to build it alone. The team at Mak It Solutions already helps clients design secure, data-driven architectures, from business intelligence services to platform engineering for AI-heavy workloads.

Explore our web development and mobile app development services to turn ideas into real portals, apps and conversational journeys then reach out via our contact page to book a GCC-focused AI agents workshop tailored to Saudi, UAE and Qatar priorities.

FAQs

Q : Is it allowed to use AI agents for customer onboarding under Saudi SAMA rules and Open Banking KSA?

A : Yes, but you must treat AI agents as part of your regulated onboarding process, not as a toy experiment. Under SAMA’s Open Banking Policy and Framework, banks and fintechs can use APIs and third parties as long as consent, security and auditability are clear. In practice, that means your multi-agent onboarding journey must log every step, enforce strong identity checks and give customers transparency about how their data is used all while respecting Saudi PDPL data residency rules.

Q : What are the PDPL requirements for deploying AI agents on cloud platforms in the UAE (Dubai / Abu Dhabi regions)?

A : The UAE PDPL (Federal Decree-Law No. 45 of 2021) applies to any personal data processed by your AI agents, whether on-prem or in cloud regions like Azure UAE or AWS UAE.You’ll need a lawful basis for processing, data protection impact assessments for high-risk use cases, contracts with your cloud provider, and clear data-subject rights (access, deletion, objection to automated processing). Logging, role-based access and encryption at rest/in transit are essential, especially for workloads in Dubai and Abu Dhabi.

Q : Can Qatar government entities host AI agents on international clouds, or must everything stay within Doha data centers?

A : Qatar’s PDPPL and broader digital strategies strongly favour keeping sensitive government and critical-sector data within national borders or tightly controlled environments.With the Google Cloud Doha region and major investments in AI infrastructure via the Qai–Brookfield $20B JV, many public entities can now host AI agents on in-country cloud while meeting performance and residency needs.Cross-border hosting is still possible for lower-risk workloads but will require extra contractual, technical and legal safeguards approved by the relevant authorities.

Q : How can GCC retailers ensure their multi-agent customer service bots support Arabic Gulf dialects as well as English?

A : Retailers should start with proven Arabic-capable LLMs, then fine-tune them on transcripts and FAQs from Saudi, Emirati, Qatari and wider Gulf audiences. A practical approach is to pair a customer-facing agent with a “language QA” agent that checks tone, politeness and dialectal accuracy before responses go out. Mak It Solutions’ work on Arabic to English AI translation and AI upskilling in MENA shows that training staff to review and correct AI outputs is just as important as the model choice, especially for brands operating across Riyadh, Jeddah, Dubai, Sharjah and Doha.

Q : Are Sharia-compliant AI agents possible for Islamic banking products across Saudi, UAE and Qatar?

A : Yes in fact, AI can help Islamic banks scale Sharia-compliant offerings as long as scholars and compliance teams are embedded into the design. One pattern is to give a dedicated “Sharia-review” agent the job of checking every proposed product configuration or transaction flow against agreed rules before it’s presented to the customer. Final decisions still sit with human Sharia boards under SAMA, UAE regulators and QCB, but AI helps filter routine cases, surface edge cases and maintain detailed audit trails that support regulators and Sharia governance frameworks linked to Saudi Vision 2030 and similar national plans.