Careem Success Story: 5 GCC Playbook Insights

Careem Success Story: 5 GCC Playbook Insights

Careem Success Story: 5 GCC Playbook Insights

The Careem success story shows Saudi and UAE founders how a Dubai-based startup became a Middle East tech unicorn by obsessively localizing for GCC users, partnering with regulators, and expanding into a super app model before its $3.1 billion Uber acquisition. By studying Careem’s approach to market selection, product localization, culture and fundraising, GCC founders in Riyadh, Dubai and Doha can build more resilient, region-first startups instead of copying generic Silicon Valley playbooks.

Introduction.

Careem started in Dubai as a simple ride-hailing app and became the Middle East’s first tech unicorn and a Dubai-based super app serving 70+ cities across 10 countries before Uber acquired it for $3.1 billion. For founders in Saudi Arabia, the UAE, Qatar and the wider GCC, the Careem success story isn’t just nostalgia; it’s a live playbook for how to build in this region, for this region.

Put simply, the Careem success story is about winning by going deep into GCC realities: local user behavior, regulator relationships, city-level operations and a culture that could survive hypergrowth. That’s exactly what today’s founders in Riyadh, Jeddah, Dubai, Abu Dhabi and Doha need to internalize.

We’ll keep the history short and focus on five actionable lessons you can apply directly in your own GCC startup whether you’re building fintech in Riyadh, logistics in Jeddah or a delivery super app from Dubai or Doha.

The Careem Success Story in the Middle East

From Dubai Startup to MENA Ride-Hailing Pioneer

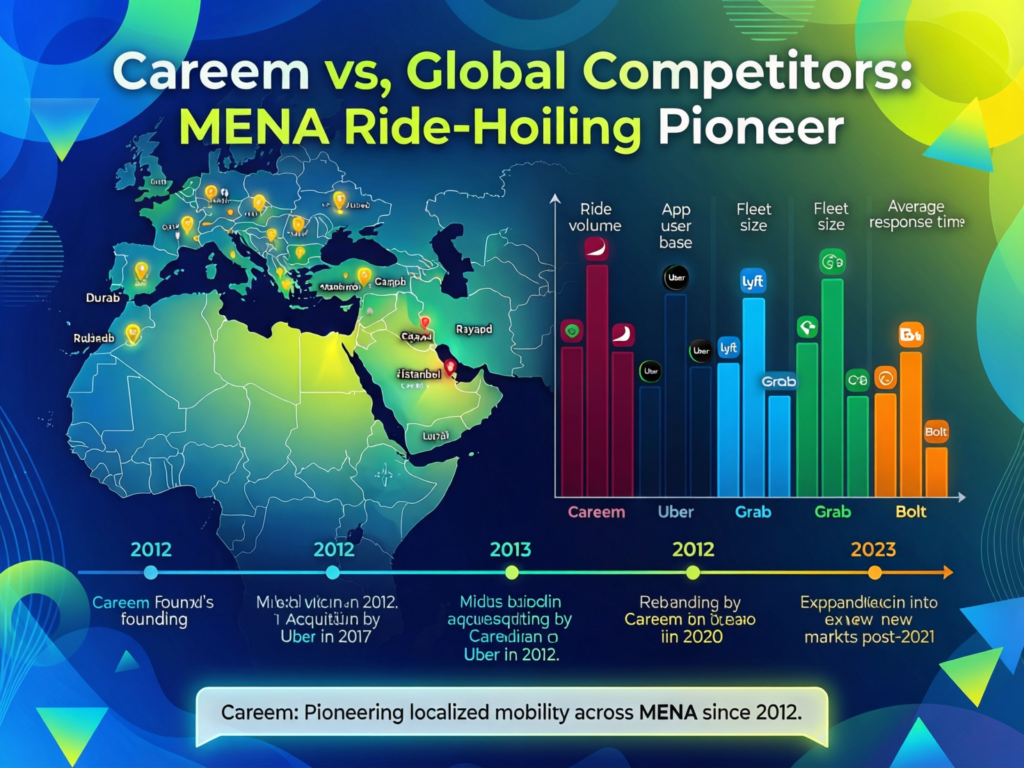

Careem launched in 2012 in Dubai with a clear mission: “to simplify and improve the lives of people and build an awesome organisation that inspires.” It started with corporate car bookings, then quickly expanded into a MENA ride-hailing pioneer across the Gulf, Egypt and Pakistan.

Instead of chasing hype features, Careem focused on reliability, local service and trust things that matter when you’re booking a car at midnight in Riyadh or catching a flight from Dubai.

Key Milestones on the Road to Unicorn Status

Rapid expansion across Saudi Arabia, the UAE, Qatar and beyond, plus aggressive fundraising, pushed Careem’s valuation above $1 billion and into Middle East tech unicorn territory.

In 2019, Uber agreed to acquire Careem’s mobility, delivery and payments businesses across the region in a deal worth $3.1 billion one of the largest tech exits in Middle East history. For many GCC founders and operators, that deal turned “maybe we can do this here” into “we absolutely can”.

Why Careem Became a Symbol of GCC Startup Ambition

Because Careem was born in Dubai, scaled through Riyadh, Jeddah and Doha, and still competed head-on with Uber, it became a symbol of GCC startup ambition. Harvard Business Review even used Careem as a case study for how a Middle East startup navigated culture, hypergrowth and unit economics on its way to unicorn status.

For founders building the next generation of GCC tech companies, the Careem success story is proof that region-first bets can beat global incumbents.

Why Careem Won Against Global Competitors in MENA

Competing with Uber on GCC Terms, Not Silicon Valley Terms

Careem didn’t try to “out-Uber Uber” with the same playbook. It leaned hard into regional realities. traffic patterns in Riyadh and Jeddah, cash culture, patchy maps, and different expectations around safety and gender norms.

While global players chased blitzscaling and top-line growth, Careem built a GCC startup success story by prioritising depth in Saudi and UAE over shallow global expansion. That meant more focus on city-by-city operations and less on flashy product announcements.

Designing for Captains and Customers in Saudi, UAE and Pakistan

Careem treated its captains (drivers) as a core customer group, not a disposable resource. It invested in:

Flexible income options

Better support and training

Practical safety standards on the ground

On the rider side, Careem designed family-friendly and women-friendly use cases in Saudi Arabia, helping more women move independently before and after Vision 2030 reforms.

If you’re building your own platform, Mak It Solutions’ mobile app development services and React Native development services can help you architect two-sided marketplaces that respect these GCC realities from day one.

Resilience Through Economic and Political Shocks

Careem faced regulatory changes, market suspensions and currency shocks from Pakistan to the Gulf, but kept iterating its operating model instead of exiting early.

For today’s founders, that means:

Modelling subsidy cuts, fuel price changes and tax shifts

Stress-testing your CAC and unit economics

Treating regulatory shifts and new transport rules as part of the game, not “black swan” events

Resilience is not a slogan; it’s built into your financial model, runway plan and hiring roadmap.

Localize Relentlessly for Saudi, UAE, Qatar and Beyond

Arabic UX, Cash Options and Ramadan Peaks as Product Features

Careem’s product choices RTL Arabic interfaces, cash and wallet options, promo campaigns around Ramadan and Eid weren’t “nice to have”. They were conversion and retention levers for Arabic-speaking users in Riyadh, Dubai and Doha.

GCC founders can take similar cues for their super app-style PWAs and sites by following patterns in web development trends in the Middle East and mobile app vs mobile-first web content.

Think of localization as a checklist, not a vibe.

Arabic-first interfaces (with thoughtful typography)

Cash and wallet options alongside cards and Apple Pay

Ramadan, Eid and local event spikes mapped into your product and marketing calendar

City-specific UX tweaks for Riyadh vs Dubai vs Doha

Working with SAMA, TDRA, QCB and City Transport Regulators

Careem learned early that SAMA, TDRA, QCB and local transport regulators weren’t just compliance hurdles they were long-term stakeholders.

The Saudi Central Bank (SAMA) set clear expectations for payment services and later open banking.

TDRA in the UAE drove telecom and digital government alignment, touching everything from SMS OTP flows to gov-tech integrations.

In Qatar, the QCB Payment Services Regulation created structure for wallets and fintech players.

As a founder, planning a fintech or super app without budget, time and senior attention for these partnerships is simply unrealistic.

Data Residency, NDMO and Cross-Border Operations Across 10+ Markets

Operating across 10+ markets meant taking data residency seriously. Saudi’s National Data Management Office (NDMO) has clear guidance on data classification and personal data protection, while UAE and Qatar reinforce in-country hosting for many workloads.

Today, a Careem-style startup might split workloads between AWS Middle East (Bahrain), Azure UAE regions and Google Cloud’s Doha region to balance latency, cost and compliance.(AWS Documentation)

If you’re planning this architecture, resources like Middle East cloud provider guides and web development services help you choose the right stack for GCC data rules.

For a deeper look at SAMA’s approach to Open Banking, see the official Open Banking Policy.

From Ride-Hailing to Dubai-Based Super App & Fintech Player

Stacking Services.

After ride-hailing, Careem layered food delivery, groceries, bikes, micro-mobility and Careem Pay into a single Dubai-based super app. Each new vertical rode on top of the same login, wallet and routing infrastructure.

For your own product, think in terms of a platform: once you have a solid PWA or mobile app, you can extend it with new modules rather than building separate apps similar to the patterns covered in mobile app trends 2025 MENA: fintech, super apps, UX.

Careem Pay, Wallets and the Role of ADGM, DIFC and GCC Central Banks

To move into payments and wallets, Careem had to align with financial regulators:

SAMA’s payment services law and Open Banking framework

QCB’s fintech and payments rules

UAE free zones like ADGM and DIFC for licensing and sandboxes.

For Saudi and UAE founders, this is the real moat: getting fintech licensing, E-KYC and Open Banking APIs right before dreaming about super app banners and cross-sell flows.

When a Super App Strategy Fits (or Fails) for GCC Startups

A super app strategy can work when.

You already dominate one daily-use category (e.g., mobility or food)

You have strong brand trust across Saudi and UAE

Your infra and UX can handle multiple journeys without confusion

It usually fails when early-stage founders in Riyadh or Doha spread themselves thin across too many verticals instead of nailing one core problem.

Often, a focused app plus a solid mobile-first web experience built with modern stacks like React Native or Angular PWAs is a better starting point with a realistic roadmap to “super app” status later.

Culture, Talent and the ‘Careem Effect’ in the GCC

A Mission-Driven, Owner Mindset Culture

Careem’s founders pushed an “owner mindset” asking teams to think like shareholders, not employees. HBR’s case study highlights how they handled fast growth by giving teams autonomy and accepting failed experiments as tuition for better playbooks.

For GCC founders, that translates into:

Clear mission and narrative people can repeat

Real ownership via ESOPs, not just slogans

Psychological safety to ship, fail and learn quickly

The Alumni Network: Startups Spun Out of Careem

Over time, ex-Careem operators launched or joined new startups in Riyadh, Dubai and other hubs, creating a “Careem effect” similar to ex-PayPal networks in Silicon Valley.

Many of these alumni are now building fintech, logistics and e-commerce ventures that again rely on strong web and mobile foundations areas where partners like Mak It Solutions’ front-end development services and web designing services plug in.

ESOPs, Leadership Pipelines and What GCC Startups Can Copy

Careem normalised ESOPs, leadership rotations and remote hubs for Middle East tech talent. For Vision 2030 in Saudi and Dubai’s digital economy agenda, this is critical: equity, clear growth paths and exposure to multiple markets.

Quick GCC scenarios you can mirror:

A Riyadh fintech startup using ESOPs and SAMA’s sandbox to attract senior talent.

A Dubai e-commerce brand building a mobile-first PWA instead of rushing into native apps.

A Doha SME hosting in GCP Doha while integrating with regional payment gateways.

The culture you design today will drive your alumni network — and your long-term impact tomorrow.

Fundraising, Unicorn Status and the $3.1B Uber Deal

Key Funding Rounds and Strategic Investors Across the GCC

Careem raised from regional and global investors, including sovereign-linked funds from the GCC, before reaching unicorn status and negotiating Uber’s $3.1 billion acquisition.

The message for today’s founders: your cap table should reflect your strategic markets think Riyadh, Dubai, Abu Dhabi and Doha not just global VCs. Investors who understand local regulators, talent and customer behavior will be worth more than “tourist” capital.

What the Uber Acquisition Changed for GCC Investors and Policymakers

Uber’s acquisition of Careem signalled that GCC tech can create multi-billion-dollar outcomes, influencing how Saudi, UAE and Qatar policymakers designed new startup and venture rules.

That deal helped unlock more capital for funds focused on:

Saudi Vision 2030’s entrepreneurship and fintech goals

UAE’s digital economy and global hub positioning

Qatar’s National Vision 2030 and innovation agenda

Even today, founders still reference the Careem success story and that $3.1 billion exit when pitching regional scale and strategic exit potential.

A Practical Playbook for Today’s GCC Founders

Use the Careem success story as a practical checklist, not a museum piece.

Choose your beachhead market wisely

Start where your problem is most painful and policy momentum is strongest (e.g., Riyadh for fintech, Dubai for logistics, Doha for certain B2B services).

Build a localization checklist

Arabic-first UX, cash and wallets, Ramadan seasonality, city-specific regulations. Use resources like web development trends in the Middle East and Beyond Dubai: GCC tech hubs to sharpen this.

Design culture and ESOPs from day one

Document your mission, decision rights and ways of working early, and offer real equity, even at seed stage.

Map your regulator and cloud strategy together

Align SAMA/TDRA/QCB or transport regulators with your cloud regions (AWS Bahrain, Azure UAE, GCP Doha) so data residency and licensing never clash.

Plan your fundraising and exit narrative early

Decide whether you’re aiming for a strategic exit (like Uber–Careem), regional roll-up, or “forever company” story and pitch investors accordingly, as discussed in MENA venture capital landscape in the GCC today.

Concluding Remarks

Careem’s journey from Dubai startup to Middle East tech unicorn offers GCC founders five clear lessons: compete on regional terms, localize aggressively, expand into adjacencies carefully, invest in culture and talent, and think strategically about capital and exits.

For Saudi, UAE, Qatar and the wider GCC, the opportunity is bigger today than when Careem started but the bar on UX, compliance and trust is also higher. The Careem success story should give you confidence that world-class outcomes are possible if you play to the region’s strengths instead of forcing a Silicon Valley template.

This article is for educational purposes only and is not financial, legal or regulatory advice. Always consult relevant professionals and do your own research before making funding, licensing or product decisions.

If you’re a founder or operator in Riyadh, Dubai or Doha and want to turn these Careem-inspired lessons into a real product, you don’t need to figure it out alone. Mak It Solutions can help you validate your strategy, design Arabic-first web and mobile experiences, and build GCC-ready infrastructure from day one.

Reach out to explore a custom GCC startup playbook, or share this article with your co-founders as a starting point for your own Careem-style success story. ( Click Here’s )

FAQs

Q : Is Careem still a good role model for startups under Saudi Vision 2030 and UAE’s digital economy agenda?

A : Yes as long as you treat Careem as a playbook, not a template. Its focus on localization, regulator partnership and culture fits perfectly with Saudi Vision 2030’s push for fintech, mobility and digital services, and the UAE’s ambition to be a global digital hub. The key is to adapt the model to today’s realities: Open Banking frameworks from SAMA, TDRA’s digital government agenda and far more demanding users across Riyadh, Dubai and Doha.

Q : How did Careem adapt its product for Arabic-speaking users in Saudi Arabia, the UAE and Qatar?

A : Careem built RTL Arabic interfaces, offered cash and wallet options, added local language support, and timed campaigns around Ramadan, Eid and local events in cities like Riyadh, Jeddah, Dubai and Doha. It also reflected local norms in features like family bookings and women-friendly travel options. GCC founders can apply similar principles using modern UX patterns (e.g., Arabic-first PWAs and mobile apps) and respecting each country’s data and content rules under NDMO, TDRA and QCB.

Q : What impact did the Uber Careem deal have on startup valuations and exits in the GCC?

A : Uber’s $3.1 billion acquisition of Careem was a proof-of-concept that GCC startups can achieve global-scale outcomes, not just small trade sales. The deal encouraged more regional VCs and sovereign-linked funds to take early-stage bets, influenced policy to support venture funding under Saudi Vision 2030, and raised expectations around exits in hubs like Dubai Internet City and ADGM. Today’s founders still reference that deal when pitching regional scale and strategic exit potential.

Q : Can a startup from Riyadh or Doha realistically build a super app like Careem today?

A : Yes, but the barrier is higher. In 2012, there were few serious digital incumbents; now GCC users already have super app-style journeys through Careem, local banks, telco apps and government portals. A Riyadh or Doha startup can still build a super app, but usually by dominating one wedge first (e.g., logistics, health, B2B payments) and then layering services, while complying with frameworks like SAMA Open Banking and Qatar’s payment regulations.

Q : What can early-stage founders in Kuwait, Bahrain and Oman copy from the Careem success story?

A : Founders in Kuwait, Bahrain and Oman can copy Careem’s regional mindset: start in one city, but design your culture, infra and data strategy to cross borders early. Think about cloud regions like AWS Bahrain or Azure UAE, plus local partners for payments and logistics. Focus on solving a painful local problem extremely well, treat regulators as collaborators, and make ESOPs non-negotiable so you can attract the kind of talent that once joined Careem in Dubai or Riyadh.