Data Analytics and Business Intelligence in the Middle East

Data Analytics and Business Intelligence in the Middle East

Data Analytics and Business Intelligence in the Middle East

Data analytics and business intelligence in the Middle East help Saudi, UAE and Qatar leaders turn fragmented operational, customer and financial data into real-time insights, Arabic-friendly dashboards and AI-driven forecasts. When these platforms run on GCC-compliant cloud regions and are designed with NDMO, SAMA, TDRA and QCB rules in mind, they enable faster, more confident decisions without risking data residency breaches or falling foul of local regulators.

Introduction

A few years ago, a retail group in Riyadh still ran on “gut feel”: weekly Excel files, late-night WhatsApp screenshots and last-minute discounts. Today, the same CEO opens a bilingual dashboard on her tablet, sees real-time sales by city (Riyadh, Jeddah, Dammam), checks Dubai and Doha e-commerce performance, and approves promotions based on clear numbers not guesses. That shift is exactly what data analytics and business intelligence in the Middle East are about.

Across Saudi Arabia, the UAE and Qatar, leadership teams are under pressure: fragmented data across legacy ERPs and cloud apps, complex SAMA/NDMO/PDPL, TDRA and QCB rules, and board-level expectations to “show ROI from AI”. In simple terms, modern analytics and BI help GCC organisations unify data, build trusted KPIs and apply AI models while staying aligned with national data governance and residency rules.

If you already invest in high-performance websites and apps like the digital builds Mak It Solutions delivers for regional brands—your next competitive layer is turning those digital footprints into insight, not just traffic logs. (See Mak It’s guide on web development trends in the Middle East for KSA & UAE.)

What Are Data Analytics and Business Intelligence in the Middle East?

Core definitions for GCC leaders

For GCC executives, data analytics is the discipline of turning raw data into patterns, forecasts and recommendations, while business intelligence (BI) focuses on the dashboards, reports and self-service tools decision-makers actually use. Analytics is the engine; BI is the steering wheel and dashboard in your car.

In KSA, UAE and Qatar, this typically means combining point-of-sale, e-commerce, CRM, ERP, call centre and mobile app data into a governed data platform, then exposing KPIs revenue, margins, NPS, SLA, risk through Arabic/English dashboards for CEOs, CFOs and operations leaders.

From traditional reporting to real-time, AI-powered analytics

Historically, many Riyadh or Dubai organisations relied on month-end reports prepared by a small IT or finance team. Today, with cloud warehouses, streaming data and AI, companies are moving to near real-time, self-service BI.

Sales leads in Jeddah or Abu Dhabi appear in dashboards within minutes.

Demand forecasts for Doha or Lusail adjust daily using machine learning.

Executives receive automated alerts on WhatsApp, Teams or email when KPIs breach thresholds.

Modern front-ends can be built on performance-focused architectures (SSR/SSG, indexing controls, etc.), like those explained in Mak It’s articles on server-side rendering vs static generation and indexing controls, then wired into analytics tools.

How national digital and AI strategies shape analytics in KSA, UAE and Qatar

Middle East analytics doesn’t live in a vacuum it’s driven by national visions.

Saudi Arabia Vision 2030, SDAIA & NDMO

The National Data Management Office defines standards to keep government and personal data governed and, in many cases, within KSA borders, as part of the wider PDPL framework.

UAE Digital government & TDRA

TDRA publishes data and trust-service regulations and open data policies that shape how federal and emirate entities expose and share information.

Qatar Smart nation & QCB

QCB’s technology and cloud regulations define how financial data can be processed, including strict rules for cloud regions and security.

For GCC leaders, this means every analytics initiative must consider data classification, residency and security from day one—not as an afterthought.

What Does Data-Driven Decision Making Look Like in Saudi and UAE Businesses?

For Saudi and UAE businesses, data-driven decision making means leaders rely on shared KPIs and real-time dashboards rather than hierarchy or intuition alone to decide budgets, campaigns, hiring and expansion. In practice, that looks like Riyadh and Dubai teams accessing the same trusted numbers, drilling into root causes, and testing changes quickly instead of debating whose spreadsheet is “right”.

Executive dashboards for CEOs and boards in Riyadh, Dubai and Doha

Board members in Riyadh, Dubai or Doha increasingly expect single-page executive dashboards that show:

Revenue and profitability by country and channel

Customer acquisition, churn and NPS

Operational SLAs for logistics, call centres and digital journeys

These dashboards are often consumed on tablets or mobiles, built on top of modern web platforms (for example, the kind of responsive front-ends Mak It Solutions builds using Webflow or custom stacks—see their Webflow development services).

Operational analytics for sales, supply chain and customer service across the GCC

Operational teams need something different: real-time analytics for day-to-day decisions. Typical GCC examples:

A sales manager in Jeddah reroutes reps based on live conversion rates.

A warehouse in Dubai adjusts picking priorities based on delayed inbound shipments.

A contact centre in Doha changes scripts when real-time sentiment turns negative.

Here, “self-service BI dashboards for executives” expand to supervisors and front-line teams, with role-based, Arabic/English views and mobile-friendly layouts.

AI and advanced analytics use cases in Middle East enterprises

Beyond descriptive reporting, leading enterprises apply advanced analytics and AI to:

Predict churn for fintech customers under SAMA rules

Forecast energy demand in Dammam or Abu Dhabi

Detect fraud in real-time payment streams

Optimize pricing and promotions for e-commerce brands

A Riyadh fintech startup, for example, might build an open-banking-ready platform using SAMA’s Open Banking Framework, applying machine learning to transaction data while staying inside KSA or approved cloud regions.

Why Are Middle East Companies Investing in Analytics and BI, Not Just Traditional Reporting?

From gut feel to evidence-based culture in GCC companies

GCC organisations are realising that gut feel doesn’t scale when you’re expanding from Riyadh to Dubai, Doha and beyond. A data-driven culture means:

Decisions documented with KPIs, not just opinion

Experimentation (A/B tests in apps and websites) becomes normal

Teams align around a few “north-star metrics”

Internal analytics squads work side by side with web, app and SEO teams—like the cross-functional approach Mak It promotes in its Shopify vs WooCommerce analysis, where tech, UX and growth are considered together.

Competitive advantages in Saudi, UAE and Qatar markets

In highly competitive sectors fintech, logistics, retail, energy whoever learns fastest wins. Better analytics deliver.

Faster reaction to demand shifts (Ramadan, Eid, school seasons)

More personalised customer experiences in Arabic and English

Leaner operations and reduced waste

For example, a Dubai e-commerce brand can use near real-time funnel analytics from web and mobile apps (built via mobile app development services) to tune campaigns in Abu Dhabi, Sharjah and Jeddah within hours, not weeks.

How AI-powered analytics supports national visions and foreign investment

National visions Saudi Vision 2030, the UAE’s AI and digital strategies, Qatar National Vision 2030 explicitly call for data-driven government and private sectors. AI-enabled analytics supports these goals by:

Improving transparency of public services and megaprojects

Attracting foreign investors who expect robust reporting and risk analytics

Supporting compliance with evolving fintech and cybersecurity frameworks

In reality, governments and regulators across the region now expect evidence-based submissions, not just PDFs and slide decks.

Governance, Regulation and Data Residency for Analytics in the GCC

Building Saudi analytics platforms that comply with NDMO and SAMA

Saudi organisations can build compliant analytics platforms by classifying data under NDMO/PDPL rules, keeping restricted data inside KSA or approved regions, and aligning financial datasets with SAMA’s security and open banking standards. Practically, that means using data governance policies from the National Data Governance Platform, enforcing role-based access, encrypting data at rest and in transit, and logging all access for audit.

For banks and fintechs, SAMA’s Open Banking Framework adds further requirements around consent, API security and customer data protection your analytics pipelines must respect those same principles, especially for account and payment data. Always involve legal and compliance; this article is guidance, not legal advice.

UAE TDRA, UAE Pass and local cloud regions: what BI teams must know

In the UAE, TDRA sets key digital government and data policies, including open data and interoperability standards, while UAE Pass acts as the unified digital identity layer for citizens, residents and visitors.

BI teams in Dubai, Abu Dhabi and Sharjah should.

Prefer UAE cloud regions (Azure UAE Central/North, AWS me-central-1) for sensitive workloads.

Integrate with UAE Pass for secure, single sign-on where government services or regulated sectors are involved.

Align data sharing with TDRA’s interoperability and open data guidelines.

Recent initiatives, like Dubai Police’s AI-powered digital platform for lawyers accessible via UAE Pass, illustrate how analytics, AI and digital identity now converge in everyday services.

QCB, Tawtheeq and data residency rules for analytics in Qatar

Qatar Central Bank’s technology and cloud regulations make one point very clear: many QCB-licensed entities must use cloud service providers with data centres inside Qatar, with limited exceptions that require explicit approval.

For analytics, this often means:

Hosting data warehouses in the Google Cloud Doha region, now a fully-fledged GCC region supporting Qatar’s digital transformation.

Integrating with national identity solutions like Tawtheeq for secure citizen access.

Designing cross-border analytics carefully so aggregates, not raw personal data, leave Qatar.

Again, always validate your design with compliance and regulators before going live.

Choosing Analytics and BI Platforms That Fit GCC Requirements

Local cloud and data warehouse options for Saudi, UAE and Qatar

GCC-ready analytics architectures typically balance global scale with local residency.

AWS

Middle East (Bahrain me-south-1) and Middle East (UAE me-central-1) regions serve many KSA/UAE workloads.

Azure

UAE North (Dubai) and UAE Central (Abu Dhabi) are certified against local frameworks like DESC, suitable for many regulated workloads.

Google Cloud

Doha region enables Qatar-resident analytics.

KSA-specific sovereign clouds and on-premises options are often used when NDMO standards or PDPL require strict locality. A trusted implementation partner such as Mak It Solutions, which already advises on architectures in its SSR vs SSG content can help align infrastructure with analytics needs.

Evaluating BI tools for Arabic UX, self-service dashboards and GCC data sources

When shortlisting BI tools (Power BI, Tableau, Qlik, SAP, Looker, etc.), GCC leaders should check.

Arabic language and right-to-left (RTL) support: menus, labels and numbers

Connectivity to local ERPs, POS, banking systems and Gulf-hosted databases

Row-level security for multi-country setups (KSA, UAE, Qatar, Kuwait, Bahrain, Oman)

Mobile experiences for executives who live on their phones

Most enterprises pair one primary BI platform with custom portals or apps where Mak It-style web and mobile builds layer a friendly UX on top of raw BI content.

Working with regional BI and analytics partners in Riyadh, Dubai and Doha

When choosing a partner in Riyadh, Dubai or Doha, look for.

Proven GCC case studies (fintech under SAMA/QCB, government, logistics, energy)

Deep understanding of local hosting and residency options

Ability to integrate BI with your existing web stack and marketing platforms

If you already work with Mak It Solutions for web or commerce builds for example, after reading their analyses like WordPress vs Webflow vs Wix you can often extend that relationship into analytics, since the same data and UX foundations are needed.

Industry-Specific Analytics and BI Use Cases in the GCC

Banking and fintech analytics under SAMA and QCB rules

Under SAMA and QCB regulations, banks and fintechs must manage risk, AML and cybersecurity while innovating with open banking and instant payments.

Typical use cases.

Real-time fraud detection on cards and wallets in Riyadh and Jeddah

Risk dashboards for QCB-licensed PSPs hosted fully in Doha

Open banking analytics that recommend products while respecting consent

A Riyadh fintech startup, for example, might run its customer-facing app on a high-performance stack (see Mak It’s web development trends in the Middle East) while feeding anonymised transaction data into models for churn and credit risk.

Government performance dashboards in Riyadh, Dubai and Doha smart cities

Smart city programmes in Riyadh, Dubai, Abu Dhabi, Doha and Lusail rely heavily on government performance dashboards:

Service SLAs for permits, visas, healthcare and policing

Citizen satisfaction broken down by channel (mobile app, web, call centre)

Usage of digital identity systems such as UAE Pass and Qatar’s digital IDs.

The Dubai Police AI-enabled Lawyer’s Digital Platform is a recent example where secure identity (UAE Pass), AI and analytics come together to monitor service usage and performance.

Retail, logistics and energy analytics across Saudi, UAE and Qatar

For retailers, logistics operators and energy companies, analytics unlocks:

Demand forecasting for malls in Riyadh, Jeddah, Dubai and Doha

Route optimisation for trucking and last-mile delivery across GCC corridors

Field and asset analytics for oil, gas and renewables in Dammam, Abu Dhabi and offshore fields

A Dubai e-commerce brand might work with Mak It to build a headless storefront, then connect clickstream, order and logistics data into a BI layer; a Doha SME in Lusail may use GCP Doha for a low-latency data warehouse while selling across Qatar and Saudi

How Can GCC SMEs Start Using Data Analytics and BI Without Huge Upfront Investment?

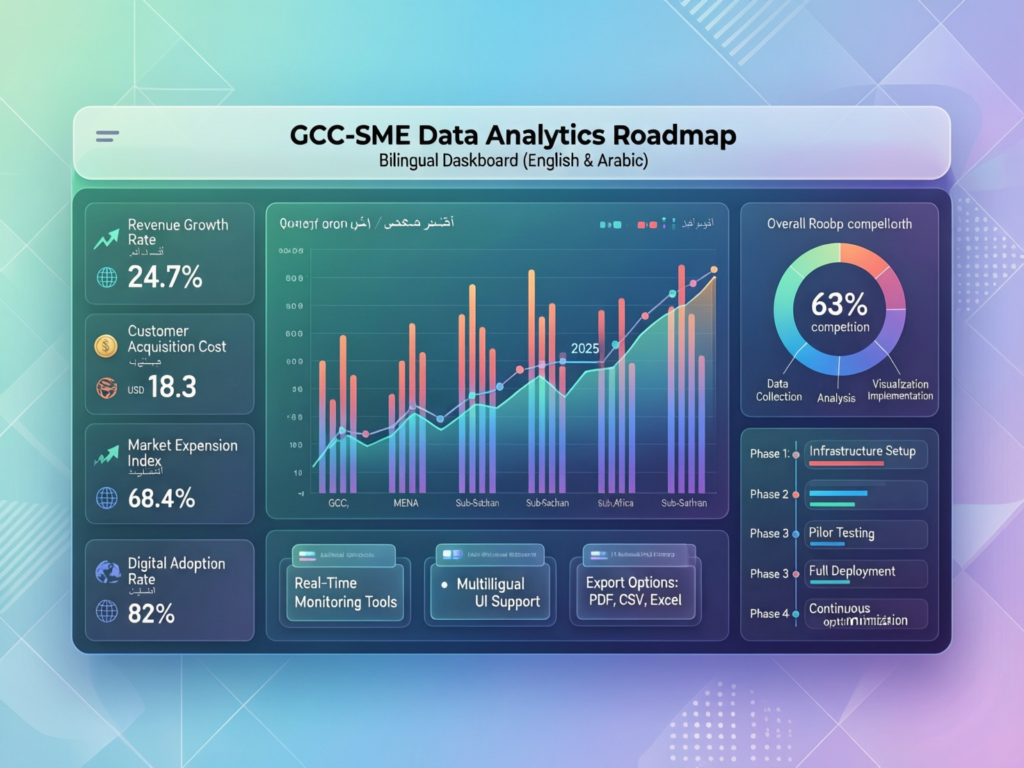

GCC SMEs can start using analytics and BI cheaply by focusing on a few priority questions, using cloud BI subscriptions instead of buying heavy on-prem tools, and leveraging local cloud regions so they avoid expensive hardware and data-centre deals. In KSA, UAE and Qatar, that often means plugging existing accounting, POS and e-commerce tools into a managed cloud stack, then rolling out simple bilingual dashboards for owners and managers.

Assessing data maturity and setting realistic goals for SMEs

Start with a quick, honest assessment.

What systems do you already use (POS, accounting, CRM, e-commerce)?

Who uses reports today, and how often?Which three to five decisions hurt the most when you “guess”?

For a Riyadh, Dubai or Doha SME, the first milestone might be a single monthly CEO dashboard with cash flow, sales, top products and aged receivables, before dreaming of AI. Articles like Mak It’s indexing controls guide show how to prioritise high-impact templates; the same idea applies to analytics start with high-impact decisions.

Starting small with cloud BI, templates and ready-made dashboards

A simple SME roadmap.

Connect existing tools

Use built-in connectors from cloud BI tools to plug into accounting, e-commerce and CRM.

Use templates

Start with pre-built sales, finance and marketing dashboards rather than custom builds.

Limit scope

Focus on one business unit or city (for example, Riyadh or Dubai) before rolling out GCC-wide.

Host smartly

Choose cloud regions (AWS Bahrain/UAE, Azure UAE, GCP Doha) that fit your main market and residency needs.

Often, the same partners who created your website or mobile app such as Mak It Solutions can help you wire those platforms into a basic analytics stack without massive capex.

Building a sustainable, data-driven culture with bilingual dashboards and training

Technology is the easy part; habits are harder. For SMEs in KSA, UAE and Qatar:

Make dashboards bilingual (Arabic/English) so owners, finance and shop-floor teams all understand them.

Run short monthly “data huddles” to review KPIs and agree actions.

Nominate a “data champion” in Riyadh, Dubai or Doha to own quality and definitions.

Over time, this creates a data-driven culture in GCC companies, where people ask “What does the data say?” before making big decisions about expansion, hiring or marketing.

Future of Data Analytics and Business Intelligence in the Middle East

Generative AI, augmented analytics and natural language BI in the GCC

The next wave of data analytics and business intelligence in the Middle East is conversational, Arabic-capable BI: leaders typing or speaking questions like “Show me Q4 margins by city in Riyadh, Dubai and Doha” and getting instant charts plus narrative insights. Generative AI will increasingly auto-build dashboards, explain anomalies and propose actions subject, of course, to regulator expectations around transparency and model risk.

Cross-border data, regional expansion and multi-country BI strategies

As companies expand across KSA, UAE, Qatar, Kuwait, Bahrain and Oman, analytics teams must design multi-country BI that respects:

NDMO and PDPL expectations for Saudi data locality.

QCB rules around keeping certain financial data in Qatar

UAE frameworks for data classification and digital identity

A common pattern is to keep sensitive data in-country and centralise aggregated, anonymised metrics in a regional warehouse.

Practical next steps for leaders in Saudi Arabia, the UAE and Qatar

For most leadership teams in Riyadh, Dubai and Doha, the next few months can be simple:

Identify three to five decisions you want to improve with data.

Audit your current systems, data quality and hosting locations.

Shortlist a GCC-savvy implementation partner such as Mak It Solutions to design a roadmap, pilot dashboards and ensure compliance is baked in from day one.

From there, you can evolve steadily towards a fully data-driven organisation aligned with national visions, investors and customers.

If you’re a leader in Saudi Arabia, the UAE or Qatar and you’re tired of running your business from scattered spreadsheets and late-night WhatsApp threads, we can help. Mak It Solutions combines modern web and app development with GCC-aware data architectures to build dashboards, data pipelines and analytics that actually support your strategy.

Reach out via our contact page to discuss a tailored data analytics and business intelligence roadmap for your organisation or to review how your current digital platforms can be upgraded to become truly data-driven.

FAQs

Q : Is cloud-hosted business intelligence allowed for Saudi financial data under SAMA rules?

A : Cloud-hosted BI can be used with Saudi financial data, but only when it fully complies with SAMA’s regulations and broader national standards such as NDMO and PDPL. Financial institutions must ensure that core banking and payment data is encrypted, access-controlled, auditable and where required hosted within approved regions or local data centres. SAMA’s Open Banking Framework also demands strict consent, API security and customer privacy, which your analytics stack must mirror. Always confirm design choices with your internal compliance team and SAMA where necessary.

Q : What are the data residency requirements for hosting analytics platforms in UAE cloud regions?

A : In the UAE, residency requirements depend on sector and regulator, but a common expectation is that sensitive government and financial data is hosted in UAE regions such as Azure UAE North/Central or AWS me-central-1, often under frameworks like DESC. TDRA’s data and interoperability policies, plus CBUAE regulations for financial institutions, guide exactly what can leave the country and under which safeguards. In practice, many organisations keep detailed personal data in-country, while pushing only anonymised or aggregated metrics to multi-region analytics platforms. Always align with TDRA, CBUAE and your legal advisors before cross-border transfers.

Q : Can Qatar-based companies analyse customer data stored in other GCC countries?

A : Yes, Qatar-based companies can usually analyse data from other GCC countries, but QCB rules and local laws in each country shape how this is done. For QCB-licensed institutions, regulations typically require that primary customer and payment records remain in Qatar, with QCB-approved exceptions for any offshore processing. A common pattern is to replicate high-level KPIs and anonymised datasets into a regional warehouse (for example, in Doha’s Google Cloud region) while keeping raw, identifiable data inside Qatar. Legal and compliance teams should validate every cross-border analytics use case.

Q : Which BI tools support Arabic language dashboards for Gulf companies?

A : Several mainstream BI tools such as Microsoft Power BI, Tableau, Qlik and SAP Analytics Cloud offer varying levels of Arabic language and right-to-left (RTL) support. For Gulf companies, the key is not just Arabic fonts, but full Arabic labels, number formats, RTL layouts and mobile support for teams in Riyadh, Dubai and Doha. Many organisations layer custom web portals or mobile apps (developed by partners like Mak It Solutions) on top of these tools to provide a fully localised UX. Before committing, always test real production dashboards with Arabic/English toggles and involve end users early in Saudi Arabia, the UAE and Qatar.

Q : How long does it typically take for a GCC enterprise to roll out a regional analytics and BI platform?

A : Timelines vary, but a realistic range for a multi-country GCC analytics platform is four to twelve months. A focused first phase of roughly eight to twelve weeks usually covers requirements, data discovery and a pilot dashboard often for one market like KSA or the UAE using existing cloud regions such as AWS Bahrain/UAE, Azure UAE or GCP Doha. Subsequent phases add more data sources, advanced analytics and rollout to Qatar, Kuwait, Bahrain and Oman, while ensuring compliance with NDMO, SAMA, TDRA and QCB. Mature organisations also invest in training and data governance, so adoption keeps pace with the technology.