Digital Markets Act Impact on Big Tech: Power Shift in Europe

Digital Markets Act Impact on Big Tech: Power Shift in Europe

Digital Markets Act Impact on Big Tech: Power Shift in Europe

The EU Digital Markets Act (DMA) is a competition law that sets strict, upfront rules for the largest “gatekeeper” platforms like Alphabet/Google, Apple, Meta, Amazon, Microsoft and ByteDance so they can’t unfairly favour their own services or lock in users and business customers. In practice, the Digital Markets Act impact on Big Tech is already visible: it is forcing changes to app stores, search results, messaging and ad targeting in Europe, reshaping how US tech giants make money and how users in the EU, UK and Germany discover apps, content and services.

If you’re in product, legal or growth, think of the DMA as a standing rulebook for Big Tech economics in Europe not a one-off fine.

Introduction

For over a decade, the European Union and Big Tech have circled each other through long antitrust cases Google Shopping, Android, browser choice screens where fines landed many years after the alleged abuse. The Digital Markets Act changes the tempo: instead of punishing past behaviour, it tells the biggest platforms upfront what they must and must not do.

On 6 September 2023, the European Commission formally designated the first group of “gatekeepers”, with core obligations starting to bite in March 2024.On 23 April 2025, the Commission imposed the first DMA non-compliance fines: €500 million for Apple over App Store anti-steering rules and €200 million for Meta over its “pay or consent” ad model €700 million in total.

For executives in New York, London, Berlin or Dublin, the question is no longer if the DMA matters, but how fast it will reshape product roadmaps, revenue models and risk.

Answer preview in the next 12–24 months, expect:

Gatekeepers

Alphabet/Google, Apple, Meta, Amazon, Microsoft, ByteDance and now Booking.com designated across roughly two dozen core platform services (CPS)

Product changes

New rules on app stores and anti-steering, search self-preferencing, messaging interoperability, and ad tracking across services in the EU.

Leadership to-dos

Product, legal, engineering and boards must build a DMA compliance backlog, stress-test EU revenue exposure, and align with GDPR, DSA, the UK’s regime and Germany’s Section 19a GWB.

EU Digital Markets Act.

What Is the EU Digital Markets Act?

The Digital Markets Act (DMA) is an EU regulation Regulation (EU) 2022/1925 that sets upfront (“ex ante”) obligations for very large digital platforms with entrenched power, so they cannot unfairly favour their own services or lock in users and business customers.

Instead of waiting years to prove abuse, the DMA defines a rulebook in advance: do not self-prefer, do not block business users from reaching customers, do not combine data across services without consent, and more.

Classic EU competition law and US-style antitrust remain “ex post” tools: authorities investigate and sanction specific conduct after the fact. By contrast, the DMA acts more like sector regulation comparable to telecoms or financial services where obligations apply continuously once you meet certain thresholds. This is why people talk about “ex ante regulation of digital platforms”, and why the DMA sits alongside, not instead of, existing antitrust law and GDPR.

Who Counts as a Gatekeeper? Alphabet, Apple, Meta & Co.

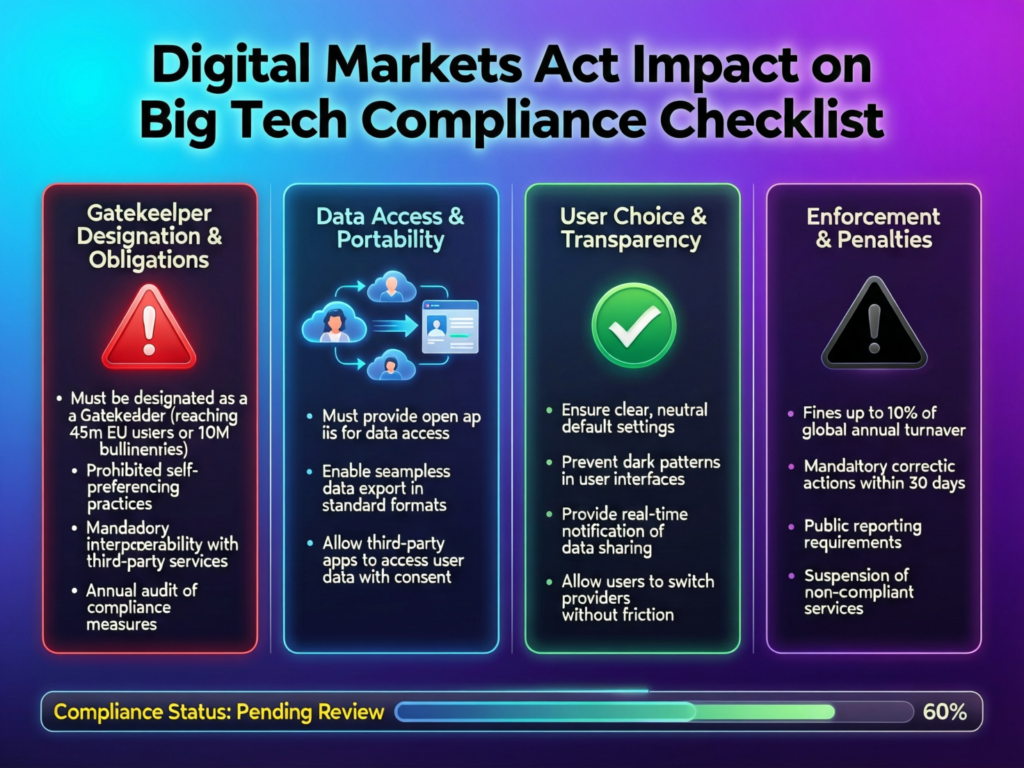

Gatekeepers are defined around core platform services (CPS) things like search engines, app stores, social networks, operating systems, online intermediation, and ad tech services.To qualify, a company must hit thresholds for EU turnover and user numbers and hold an entrenched, durable position that makes it a bottleneck between businesses and users.

The Commission has designated major US and Chinese players as gatekeepers, including Alphabet (Google Search, Android, Chrome, Google Play), Apple (iOS, App Store, iPadOS), Meta (Facebook, Instagram, WhatsApp), Amazon (Marketplace), Microsoft (Windows, LinkedIn, advertising) and ByteDance (TikTok) joined by Booking.com in 2024. These services reach tens of millions of users across Germany, France, Spain, Italy, the Netherlands, Ireland and the wider EU. Gatekeepers can challenge designations before the EU courts in Luxembourg, but they generally have to comply while appeals run.

For investors, this is effectively a list of business models whose margins are now regulated in Europe. For product teams, it’s a map of where the strictest obligations bite first.

DMA vs DSA vs Traditional EU Antitrust

The ecosystem of EU digital rules can feel alphabet-soupy, so here’s the simplest distinction.

The DMA regulates market power; the DSA regulates content and safety; classic antitrust punishes past abuses.

DMA

Focuses on contestability and fairness in core platform services think app stores, app distribution, self-preferencing in search or rankings, data access for business users.

Digital Services Act (DSA)

Focuses on content, safety and systemic risk how platforms like Instagram, TikTok or marketplaces handle illegal or harmful content, algorithmic amplification and transparency.

GDPR and ePrivacy

Focus on data protection and consent how data is collected, processed and shared.

Traditional antitrust

Long cases (e.g., Google Shopping, Android tying) that can lead to behavioural remedies and fines but not a standing rulebook.

Together, these instruments form the EU digital rulebook: DMA for gatekeeper conduct, DSA for online safety, GDPR/ePrivacy for data, plus sector-specific rules like Open Banking in financial services. For US and UK teams, understanding this stack is critical to avoid treating the DMA as “just another privacy law.”

How the Digital Markets Act Impacts Big Tech’s Products and Power

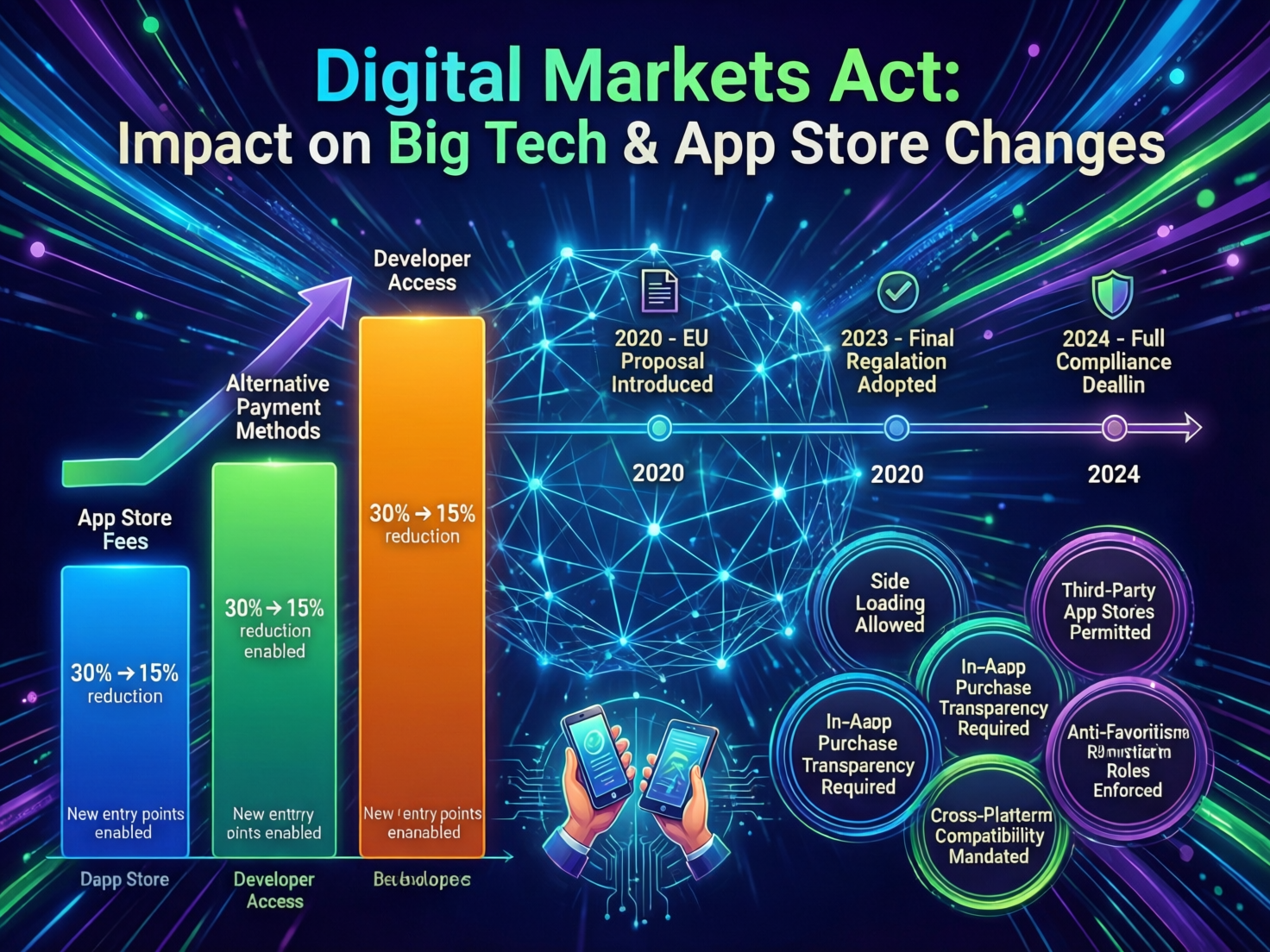

App Stores, Anti-Steering, and iPhone/Android Fees

Under the DMA’s anti-steering rules, Apple and Google can no longer block developers from telling EU users about cheaper offers or alternative payment options outside their app stores. In practice, developers must be allowed to link to external sites, display pricing, or use alternative app stores and sideloading (particularly on Android and, more recently, iOS in the EU).

Apple’s evolving EU App Store terms show how complex this can become: new tiers of Store Services fees and Core Technology/Technology Commission charges, and differentiated commissions depending on whether payments happen in-app or externally.Similar questions arise for Google Play as the company adapts to anti-steering obligations and alternative billing in the EU.

For users in Berlin or Paris, this translates into new consent flows, more links to web checkout, and eventually more visible price and subscription diversity. For a startup in Austin or San Francisco wondering “how does the EU Digital Markets Act impact US tech giants”, the answer is: it chips away at the app-store take rate and nudges developers toward cross-border, multi-store strategies that can later expand beyond Europe.

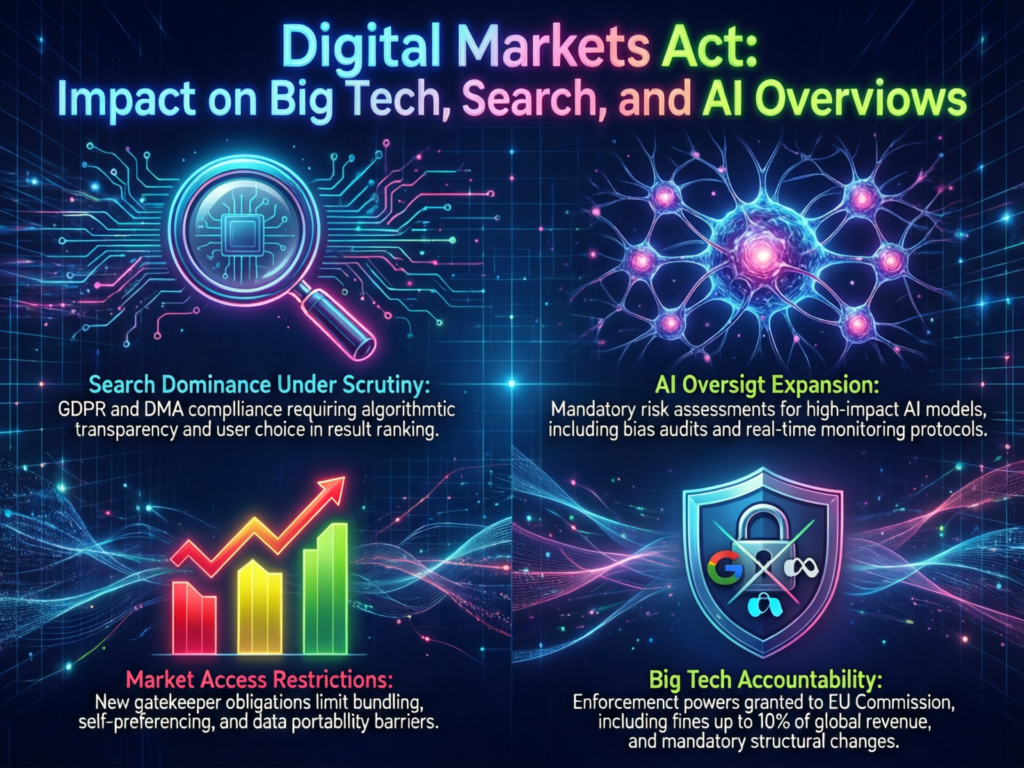

Search, Self-Preferencing, and AI Overviews

The DMA restricts self-preferencing gatekeepers cannot unfairly rank their own comparison, travel or shopping services ahead of rivals in search results. For Google, this goes beyond the old Shopping case and cuts to how Google Search surfaces Maps, Flights, Hotels or future AI-powered widgets in the EU.

At the same time, AI-generated “overviews” raise fresh competition concerns. EU and UK regulators worry that AI summaries may hoard user attention and click-through at the expense of publishers and comparison sites. The UK Competition and Markets Authority (CMA) has proposed rules—under its new Strategic Market Status (SMS) regime to give publishers more control over how their content appears in Google’s AI Overviews and training datasets, including the option to opt out of AI summaries and certain training uses.

For comparison sites in London or Munich, DMA-driven constraints on self-preferencing plus CMA oversight of AI features could mean more room to compete if enforcement lands as intended. For Google, they create a tricky design challenge: keeping EU and UK search and AI experiences useful while avoiding new DMA and SMS violations.

Messaging Interoperability and Targeted Ads

The DMA obliges designated messaging services such as WhatsApp to open up to interoperability smaller messaging providers must, over time, be able to send basic text, image and video messages to users inside those big networks, under strict security conditions.

The status of services like iMessage has been hotly debated in Europe, but the direction of travel is clear: less lock-in between messaging ecosystems.

On the advertising side, the DMA and GDPR together tighten how gatekeepers like Meta, Amazon and Google can combine personal data across services for profiling and personalised ads without explicit consent. Meta’s attempt at a “pay or OK” model for Facebook and Instagram subscriptions in the EU has already triggered DMA enforcement and a €200m fine.

In practice, the DMA should make it easier for EU users to switch apps and control how their data is used for ads but only if consent flows are genuinely free and granular. For ad-funded apps in New York or Dublin, this means higher friction for cross-service tracking and stronger incentives to invest in contextual advertising and first-party data.

Business Model Shock.

New Revenue and Cost Pressures for Gatekeepers

Gatekeepers face a pincer movement: lower app-store fees per transaction, more distribution options, and mandated choice screens that can weaken default positions. Apple’s EU changes alone illustrate how tweaks to commission tiers, external payment links and alternative app stores can shift billions of euros in annual revenue.

For US-listed shareholders in Apple, Alphabet, Meta, Amazon and Microsoft, DMA compliance shows up as:

Higher compliance and engineering costs in Brussels, Dublin, London and beyond.

Product redesigns (e.g., choice screens, consent prompts, new APIs) and possible unbundling of services.

A greater push toward subscriptions and bundled premium offerings, where revenue is less dependent on per-transaction app-store fees or targeted ads.

If you’re tracking ex ante regulation of digital platforms as an investment risk, the DMA, Germany’s Section 19a GWB and the UK’s SMS regime now form a global cluster of rules that directly affect valuation assumptions.

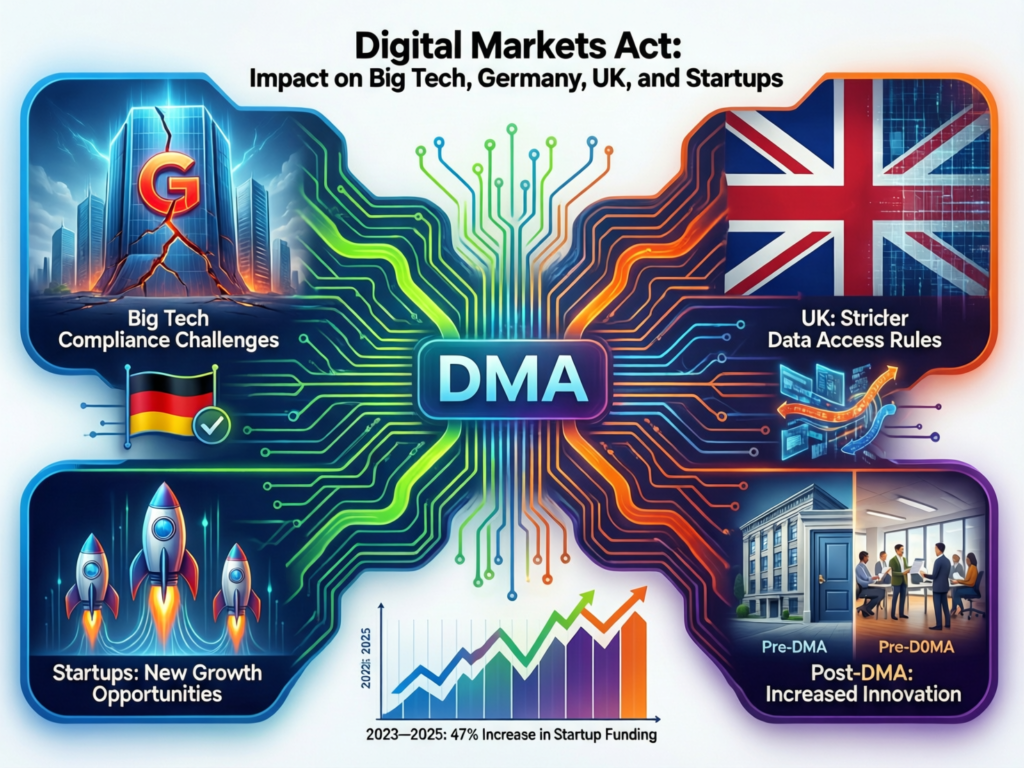

Opportunities and Frictions for EU/UK/German Startups

The flip side of pressure on gatekeepers is new opportunity for challengers. EU and UK app developers, SaaS platforms and fintechs may benefit from:

Easier access to users via alternative app stores and sideloading.

Fairer ranking and access to data in core platform services.

Stronger platform interoperability and data portability, especially when combined with Open Banking and sector rules.

In practice, this matters in ecosystems like Berlin, London, Dublin and Amsterdam, where startups already build on top of Google, Apple and Meta APIs. Data portability and interoperability make it easier to build multi-homed products say, a Berlin fintech that pulls bank data (Open Banking), wallet data, and platform usage signals while staying inside GDPR and PCI DSS safeguards.

Of course, DMA compliance interfaces and documentation won’t always be developer-friendly on day one. That friction is where agencies like Mak It Solutions can help founders navigate app-store policy changes, indexing controls and technical SEO so their products remain discoverable in a changing ecosystem.

What Changes for Consumers in Germany, the UK, and the US

For everyday users, the DMA is felt in small but accumulating nudges.

In Germany

Different app-store flows, new browser and search choice screens on Android or iOS, and extra consent prompts when apps want to track across services.

In France, Spain, Italy and the Netherlands

Similar choice screens and slightly more visible alternatives to default apps.

In the UK (post-Brexit)

The DMA doesn’t apply directly, but many changes roll out across Europe anyway, and the UK’s own digital markets regime plus CMA action on Google and Apple mobile ecosystems pulls in the same direction.

For US users, early DMA enforcement is a test lab: if alternative app stores, choice screens or new ad consent models work commercially in the EU, pressure will rise for similar changes in California, New York or Texas especially as CCPA/CPRA and US antitrust cases evolve.

In short, for most users, the Digital Markets Act impact on Big Tech should mean more choice of apps and services, clearer pricing, and slightly more control over tracking even if some interfaces feel more complex than before.

Enforcement, Fines, and a DMA Compliance Playbook

DMA Enforcement Timeline and Live Cases

The DMA’s journey looks roughly like this.

2022:

DMA formally adopted as Regulation (EU) 2022/1925.

6 September 2023

First gatekeepers designated (Alphabet, Amazon, Apple, ByteDance, Meta, Microsoft)

March 2024

Initial six-month compliance period ends; first gatekeeper reports and EU scrutiny of implementations.

2024–2025

Additional designations including Apple’s iPadOS and Booking.com and market investigations into other platforms.

23 April 2025

First DMA fines against Apple and Meta (roughly €700m total) for anti-steering and ad consent models.

Brussels (DG COMP and DG CONNECT) leads DMA enforcement, with coordination across national regulators and the European Court of Justice in Luxembourg handling appeals. Cases against Apple, Google, Meta, Amazon and others will likely define the practical interpretation of many obligations over the next 3–5 years.

Fines, Remedies, and Reputational Risk

Micro-answer: The DMA allows the EU to impose multi-billion-euro fines based on global turnover, and even structural remedies for repeat offenders.

Specifically, fines can reach up to 10% of worldwide annual turnover, rising to 20% for repeated infringements, plus periodic penalty payments.In extreme scenarios, the Commission can impose structural remedies, including divestments, if behavioural measures prove insufficient.

Remedies range from.

Detailed design changes (e.g., new choice screens, neutral ranking rules).

Data access or interoperability obligations for business users and rivals.

Unbundling requirements where services are tied too tightly.

Reputationally, DMA findings add to a growing stack that includes GDPR fines, DSA investigations and national actions by regulators like Germany’s Bundeskartellamt or BaFin especially in sensitive sectors like payments and health data. For Big Tech boards, that makes DMA non-compliance a clear ESG and disclosure issue.

DMA Compliance Checklist for Product, Legal, and Engineering

For gatekeepers and “almost gatekeepers” watching thresholds the DMA is now a standing product requirement. A minimalist playbook:

Map core platform services and data flows

Identify which products qualify as CPS (search, app stores, OS, social, ad tech).

Document how user and business data moves between services and regions (EU, UK, US).

Review UX patterns and contractual terms

Audit dark patterns, default settings and anti-steering clauses inside flows on iOS, Android, web and connected devices.

Align consent and tracking with GDPR, UK-GDPR and sector rules like HIPAA (health) and PCI DSS/SOC 2 (payments and SaaS).

Build interoperability, portability and consent tooling

Implement APIs and export tools for data portability and platform interoperability, in line with DMA and Open Banking norms.

Align preferences, cookie banners and account settings across EU and UK versions, so users can genuinely opt in or out.

Set up cross-functional governance

Create a DMA working group spanning legal, product, security, data and public policy.

Tie DMA risks into your risk register, internal audit and incident response playbooks.

Most organisations benefit from specialist counsel or consultants at least for an initial gap assessment and to design repeatable controls especially where DMA overlaps with DSA, BaFin, NHS data rules or Germany’s Section 19a GWB. Agencies like Mak It Solutions can then help operationalise this in your web, mobile and analytics stack.

Friendly disclaimer.

This article is general information for product and business teams. It isn’t legal advice always speak to qualified counsel for concrete decisions.

Big Tech vs Regulators Around the World

EU DMA vs US Antitrust and State Laws

Micro-answer

The DMA is stricter and more prescriptive today, but US cases could lead to more structural remedies over time.

Where the EU uses the DMA as a standing rulebook, US authorities FTC, DOJ Antitrust Division and state attorneys general still rely primarily on case-by-case litigation under existing antitrust and consumer-protection laws. State privacy laws like CCPA/CPRA in California add GDPR-style data rights, but they are not competition tools.

For a US-based product team asking “how does the EU Digital Markets Act impact US tech giants?”, the answer is twofold:

It directly constrains how US platforms behave inside the EU, under threat of turnover-based fines.

US cases may later draw on DMA-style evidence and remedies when arguing for structural changes (e.g., separating ad-tech units or app-store businesses).

For now, the EU remains the most prescriptive regime on core platform services. But if landmark US cases succeed, they may go further in forcing break-ups or asset divestitures.

UK Digital Markets Regime and CMA’s Strategic Market Status

The UK has chosen a parallel path: the Digital Markets, Competition and Consumers Act 2024 gives the CMA powers to designate companies with Strategic Market Status (SMS) in specific digital activities and impose tailored conduct requirements.

Key points.

SMS applies only to the very largest firms, similar in spirit to DMA gatekeepers.

Once designated, companies face bespoke rules on self-preferencing, data use, interoperability and more.

The CMA is already using this framework to scrutinise Google’s AI Overviews and Apple/Google mobile ecosystems.

For UK users wondering “how the EU Digital Markets Act affects UK users after Brexit”, the reality is hybrid: the DMA doesn’t apply directly, but cross-European product changes plus SMS-driven UK rules mean London and Manchester users experience many of the same shifts as Berlin or Dublin.

Bundeskartellamt, BaFin, and National Courts

Germany has been an early mover on regulating digital gatekeepers via Section 19a of the Act against Restraints of Competition (GWB), allowing the Bundeskartellamt to act quickly against companies of “paramount significance for competition across markets” mostly large US tech platforms.

Alongside the DMA, Germany brings.

Bundeskartellamt proceedings on self-preferencing, data combination and platform access.

BaFin oversight of payments and fintech, including Big Tech wallets, buy-now-pay-later and embedded finance.

A network of German and other national courts that interpret both EU-level and national rules in concrete cases.

If you’re analysing “Digital Markets Act Auswirkungen auf deutsche Nutzer und Unternehmen”, Germany’s mix of DMA, Section 19a GWB and BaFin rules means higher scrutiny of US platforms, particularly where competition, consumer protection and financial stability intersect.

What Leaders Should Do Now.

For Product and Engineering Teams

Between 2025 and 2027, product and engineering leaders should treat DMA work as a multi-year backlog, not a one-off compliance sprint:

Prioritise DMA-driven items: app-store flows, browser/search choice screens, data portability, and interoperability interfaces.

Align UX and AI features such as recommender systems and AI overviews with DMA, DSA and GDPR expectations on fairness, transparency and data minimisation.

Collaborate with SEO and analytics teams to ensure new consent flows and routing don’t accidentally break indexing, sitemaps or Core Web Vitals; Mak It Solutions’ guidance on indexing controls and rendering strategies is a useful benchmark here.

For Legal, Compliance, and Policy Teams

Legal and compliance leaders should build a DMA compliance program that plugs into existing GDPR, DSA, UK-GDPR and sector frameworks:

Map obligations per CPS and jurisdiction (EU DMA, UK SMS, Germany’s Section 19a GWB, DSA, GDPR, CCPA/CPRA).

Integrate with sectoral rules like HIPAA (health apps), PCI DSS (card payments), SOC 2 (SaaS) and NHS data governance for UK health data.

Run stress-test scenarios: investigations, dawn raids, media scrutiny, cross-border audits, and how quickly your teams can produce evidence of compliance.

Maintain a living register of DMA-relevant decisions (product changes, risk acceptances, data-sharing arrangements) to support future discussions with regulators.

For Boards, Investors, and US Stakeholders

Boards and investors—especially in US-based tech giants should treat DMA and related regimes as structural, not tactical, risks:

Add DMA and equivalent rules to the board risk register and ESG reports, with clear KPIs (e.g., compliance milestones, incident metrics).

Quantify revenue exposure to Europe from app-store fees, targeted ads and dependent business users; model how much is at risk under stricter enforcement.

Ask for an inward-looking checklist.

Where are margins dependent on gatekeeper-style control?

Which products risk future gatekeeper designation or SMS status?

How resilient is the business if app-store or ad-tech rents fall 10–20% in the EU?

For US stakeholders in New York or the Bay Area, the EU is no longer a remote legal experiment; it’s a leading indicator of where digital platform regulation and competitive pressure may head globally.

Big Tech vs regulators in an AI world

The DMA is not the end of the story; it’s the opening chapter of a broader shift where AI-driven interfaces, app ecosystems and cloud platforms are treated as regulated infrastructure in Europe and, increasingly, the UK and US. The winners between 2025 and 2027 will be the companies that treat compliance as a design constraint, not an afterthought and that turn openness, interoperability and user trust into competitive advantage rather than a tick-box exercise.

Key Takeaways

The Digital Markets Act impact on Big Tech is structural: it reshapes app-store economics, search design, messaging interoperability and ad tracking for EU users and global platforms.

Gatekeepers like Alphabet, Apple, Meta, Amazon, Microsoft and ByteDance face lower margins, higher compliance costs and closer scrutiny from Brussels, London, Berlin and national courts.

EU, UK and German startups can gain from reduced lock-in, better interoperability and more open app distribution but only if they invest in compliance-aware product and growth strategies.

Enforcement is real: early DMA fines and investigations show that regulators will use turnover-based penalties and possibly structural remedies for repeat offenders.

Boards, investors and US leaders should integrate DMA risk into strategy, pricing, product roadmaps and M&A, not just privacy or legal checklists.

Partnering with experienced technical and data teams such as Mak It Solutions for architecture, SEO, analytics and compliance-ready builds can accelerate adaptation without sacrificing speed.

If your product, legal or data teams are still treating the DMA as “just another EU law,” you’re already behind. Mak It Solutions can help you translate dense regulatory text into concrete product changes app store flows, consent UX, data pipelines, indexing and analytics that actually ship.

Book a consultation via the Contact page on Mak It Solutions, share your current EU footprint, and we’ll help you assess DMA exposure, prioritise a 2025–2027 roadmap, and align it with your broader SEO, performance and analytics strategy.( Click Here’s )

FAQs

Q : Does the Digital Markets Act apply to smaller platforms and startups, or only to gatekeepers?

A : The DMA’s most stringent obligations apply only to companies formally designated as gatekeepers large firms meeting thresholds for EU turnover, user numbers and entrenched market power in core platform services. Smaller platforms and startups are not directly subject to gatekeeper rules, but they can still be affected indirectly: they may gain new access rights, data portability tools, or ranking fairness, and they must ensure their own GDPR, DSA and competition compliance. As some scale-ups grow, they should monitor whether their services could be considered “almost gatekeepers” and start adopting best practices early.

Q : Will DMA-driven changes to the iPhone App Store also reach users in the US and UK?

A : Many DMA-driven changes like new consent flows or alternative payment options are implemented region-specific for EU users, but global product teams rarely maintain completely separate stacks for long. Apple, for example, is rolling out complex new fee structures, external link options and alternative stores in the EU to comply with the DMA, and these experiments will inform future strategies in the US and UK. While there is no automatic legal spill-over, if European changes prove commercially viable or if UK/US regulators push in similar directions, some features are likely to spread beyond the EU.

Q : How does the DMA interact with GDPR when it comes to tracking, consent, and personalised advertising?

A : The DMA and GDPR are complementary: GDPR governs lawful processing and consent for personal data, while the DMA restricts how gatekeepers can combine and use that data across services especially for profiling and personalised ads without opt-in consent. Meta’s “pay or OK” subscription model sits at the intersection of DMA and GDPR consent rules, and has already triggered enforcement. In practice, this means gatekeepers must design ad and tracking flows that are both privacy-compliant and competition-safe, with clear, unbundled choices for users and robust audit trails.

Q : What’s the difference between the EU Digital Markets Act and the UK’s new digital markets regime?

A : The EU’s DMA is a single, harmonised regulation that applies across the EU and defines a fixed set of obligations for all designated gatekeepers. The UK’s Digital Markets, Competition and Consumers Act instead allows the CMA to designate firms with Strategic Market Status (SMS) for specific digital activities and impose tailored conduct requirements on each. Both regimes focus on the largest platforms, but the UK’s system is more bespoke and potentially more flexible over time. Companies active in both jurisdictions need to map overlaps and differences carefully especially around app stores, self-preferencing, data use and interoperability.

Q : How can a non-EU business that relies on Apple, Google or Meta prepare for DMA risks without a large in-house legal team?

A : Non-EU businesses whether a SaaS startup in New York or an ecommerce brand in Manchester can prepare by focusing on a few practical steps: stay informed about platform changes in EU app stores, search and ad tools; review how your business relies on Apple, Google or Meta policies; and ensure your own data, consent and payment flows are GDPR-aligned. Partnering with specialised agencies or consultants can be more cost-effective than building a full in-house legal function: they can help interpret DMA updates, adjust your app-store strategy, and update websites or analytics setups (for example, indexing controls, rendering, and schema) so you stay compliant and visible in EU, UK and German markets