Freelance IT Jobs in Saudi Arabia: GCC Guide

Freelance IT Jobs in Saudi Arabia: GCC Guide

Freelance IT Jobs in Saudi Arabia: GCC Guide

Software developers who want to do freelance IT jobs in Saudi Arabia usually work legally by obtaining a Freelance Work Document through the government-backed Freelance.sa platform (for Saudi citizens) and sticking to approved categories, issuing proper invoices and respecting tax rules. Most expats cannot legally take side gigs on an employee visa in KSA and instead need a proper business or investor licence if they want to operate as independent IT contractors.

In the UAE, programmers often follow structured routes such as GoFreelance, Talent Pass or free-zone permits in Dubai or Abu Dhabi, then sign B2B contracts with clients as licensed freelancers while complying with visa conditions and local tax and data regulations.

Introduction

For many Arab developers, freelance IT jobs in Saudi Arabia and the wider GCC have moved from “side hustle” to serious, Vision 2030–aligned career path. Saudi Arabia alone has passed 2+ million registered freelancers on its national platform, with freelancing contributing billions of riyals to GDP as the Kingdom pushes a digital, diversified economy.

At the same time, every conversation in Riyadh, Dubai or Doha includes the same worries: Is this legal with my visa? Will I get in trouble with my sponsor? Can I really replace a stable salary? These are valid fears, especially for expats and fresh graduates who don’t want to risk their Iqama, Emirates ID or family stability.

This guide breaks down what freelance IT work actually looks like in KSA, why so many Arab coders are going gig-first, the legal routes in Saudi, UAE and Qatar, the platforms and skills that pay in dollars/euros, and how the gig economy is reshaping hiring for fintech, government, logistics and e-commerce across the GCC.

What Freelance IT Jobs in Saudi Arabia Look Like

Vision 2030 and the rise of Saudi IT freelancers

Saudi’s Ministry of Human Resources and Social Development (MoHRSD) has issued more than two million self-employment documents through the Freelance.sa system, with strong growth in digital and technical categories. Vision 2030 pushes e-government, fintech and smart cities in Riyadh, Jeddah and the Eastern Province, so IT freelancers now plug into everything from small Shopify builds to national cloud and cybersecurity projects.

How the gig economy is changing hiring in Riyadh: instead of hiring large permanent teams, many banks, SaaS startups and consultancies now keep a lean core, then pull in specialist freelancers for sprints—DevOps, data engineering, pentesting, UI/UX whenever new initiatives launch.

Typical freelance IT roles in KSA (dev, cloud, cyber, data)

In practice, Saudi freelance IT work clusters around:

Web/mobile development (React, Laravel, Flutter)

Cloud engineering on AWS Middle East (Bahrain), AWS Middle East (UAE) and local sovereign setups

Cybersecurity assessments and SOC support

Data analytics, dashboards and BI, including Power BI and cloud-native tools

QA automation, performance testing and DevOps

Day rates vary by city and skill, but senior specialists in Riyadh or Dammam often command more than equivalent full-time salaries, especially on remote software development projects for Europe or the US.

Who hires IT freelancers in Saudi? Fintech, gov, retail and logistics

The strongest local demand comes from.

Fintech and digital banking, under SAMA’s open-banking and payments push

Government & smart-city projects in Riyadh, NEOM and other giga-projects

Retail, logistics & e-commerce, where companies need rapid launches, integrations and optimised on-site search

Private healthcare and education platforms going cloud-first

For these teams, the gig economy means they can scale up quickly for new launches, then “cool down” to a core team one reason tech talent marketplaces in the Middle East have grown so fast.

Why Arab Tech Professionals Are Choosing Gig Work

Flexibility, remote options and work life balance in KSA & UAE

Developers, admins and designers in Riyadh, Jeddah, Dubai or Abu Dhabi increasingly want flexible schedules, not just bigger salaries. Freelance IT lets you pick projects that match your stack, work partially remote, and design a rhythm that fits around prayer, family time and community responsibilities especially attractive for parents and those avoiding burnout.

Earning in dollars or euros while living in Riyadh, Dubai or Doha

A key motivator is currency: many Arab coders build a GCC remote IT job for Arabic speaker profile bilingual communication, GCC time zones, strong English and then pitch themselves as an independent IT contractor in GCC for US, UK or EU startups. That might mean long-term remote software development projects via Upwork, Toptal or direct retainers while physically living in low-tax hubs like Riyadh, Dubai or Doha.

How gig work supports youth, women in tech and career switchers

Freelancing also opens doors for.

Fresh graduates from Riyadh or Jeddah coding bootcamps who want portfolio projects before full-time roles (Mak It Solutions’ guide to coding bootcamps in Saudi Arabia for Arab youth is a helpful starting point).

Women in tech in more conservative communities who prefer hybrid or home-based work.

Mid-career switchers from networking, support or even non-tech fields who use short freelance contracts to transition into data, cloud or UX.

How to Legally Do Freelance IT Jobs in Saudi Arabia

Short answer (Saudi side)

Saudi citizens usually freelance legally by getting a MoHRSD Freelance Work Document through Freelance.sa in an approved IT category, issuing proper invoices and declaring income; expats generally cannot legally take side gigs on an employee visa and instead need a proper business or investor licence.

Getting the Freelance Work Document on Freelance.sa

For Saudi citizens, the Freelance Work Document is the main legal route:

Create an account on Freelance.sa using your Absher details.

Choose a supported IT profession (e.g., programmer, web developer, data analyst) and upload any requested proof.

Confirm your mobile and bank IBAN, then submit the application in Arabic (interfaces usually have English hints, but Arabic remains primary).

Once approved, download your Freelance Work Document, link it to your bank and payment channels, and start issuing invoices under that profession.

The document is typically valid for a year and renewable, but always check current HRSD rules, as regulations evolve.

Tax, Zakat and GOSI basics for Saudi IT freelancers

As a Saudi IT freelancer, you’re effectively running a micro-business:

Track all income and expenses, especially if you cross thresholds that trigger Zakat or income-tax-style obligations under ZATCA rules.

Keep contracts, invoices and bank statements organised for at least several years.

If you opt into social protection, monitor your GOSI status and contribution options.

This guide is general information only always confirm details with ZATCA, MoHRSD or a qualified Saudi tax adviser before making decisions.

What expats in Saudi must know about visas and side gigs

For most expats, informal freelancing on an employee Iqama is risky. Your residency is tied to a sponsor (employer) and contract; unapproved side gigs, even online, can breach labour and residency rules. Any “Saudi freelance visa for IT engineer” you see marketed online should be checked carefully with official channels or a licensed business incubator and not just a private agent.

If you want to stay in KSA long-term as a freelancer, realistic routes today usually involve:

Starting a proper company or investment structure through MISA, or

Working remotely for foreign clients while residing in another GCC hub with clearer individual freelance visas (often the UAE).

Freelance IT Jobs in UAE and Qatar.

Short answer (UAE side)

In Dubai and Abu Dhabi, many programmers get a UAE freelance license for programmer in Dubai via GoFreelance, Talent Pass or a free zone, then sponsor a residence visa linked to that licence and contract with clients as a legal independent. Qatar has fewer classic “freelance visas” but growing project-based roles in fintech and digital sectors.

Dubai & Abu Dhabi freelance permits for programmers.

Dubai’s GoFreelance package allows web, mobile and software developers to obtain a freelance permit through TECOM, with options to add a residence visa and shared workspace access. Abu Dhabi and other free zones offer similar “Talent Pass” or one-person company structures. Costs, allowed activities and visa rules change frequently, so always check the latest pricing and categories before budgeting.

Early-stage options in Qatar and Doha’s fintech & digital jobs scene

Qatar is earlier in its gig-economy journey, but the Qatar Central Bank (QCB) has a clear fintech strategy and regulatory sandbox, supported by programs like Qatar FinTech Hub. In reality, many IT professionals in Doha today work as employees in fintech, banks or consultancies while doing project-style work internally, not as fully independent freelancers. Remote contractors based in Dubai or Riyadh increasingly serve Doha clients, especially on cloud, data and cybersecurity projects.

Saudi vs UAE vs Qatar: visas, costs, demand and lifestyle at a glance

Saudi

Strong internal demand, especially in fintech and government; best legal route for freelancers is citizens with a Freelance Work Document.

UAE

Most flexible for individual foreign freelancers; clear licensing, co-working and digital nomad IT jobs in the Gulf-style visa options.

Qatar

High fintech potential, cloud expansion and rising AI investment, but fewer individual freelance permits; often better as a client market while you base yourself in Dubai or Riyadh.

Best Platforms and Skills for Arab IT Freelancers

Local GCC platforms: Freelance.sa, Ureed, Marn and Saudi/UAE talent hubs

Beyond Freelance.sa, Saudi and GCC freelancers use regional marketplaces like Ureed, Marn and other Arabic-first talent hubs, which focus on clients in Riyadh, Jeddah, Dubai and Doha. Research shows Saudi’s freelance platforms market includes both global players and regional marketplaces competing on Arabic support, payments and compliance.

Global platforms: Upwork, Fiverr and remote-first roles for GCC residents

Global platforms (Upwork, Fiverr, Toptal, etc.) give you access to higher-value remote software development projects while you live in the GCC. Position yourself clearly as:

Bilingual (Arabic–English)

Familiar with KSA/UAE/Qatar regulations and data-residency

Working in Gulf time zones for easier collaboration

Treat yourself like a tiny agency: a clear niche, strong portfolio and a process for requirements, estimates and code handover. If you need a more polished online presence, Mak It Solutions can support you with web development services, front-end development and SEO for tech founders.

High-paying freelance skills: cloud, cybersecurity, data & AI tools

Across KSA, UAE and Qatar, the most in-demand freelance IT skills include.

Cloud design and migration on AWS Middle East (Bahrain/UAE), Azure UAE Central/UAE North, and Google Cloud Doha (me-central1)

Cybersecurity (red teaming, audits, SOC automation)

Data engineering, analytics and BI for fintech and government

AI tooling: MLOps, prompt engineering, integrations with leading LLM APIs

These skills align tightly to fintech, government, retail and logistics projects in Riyadh, Dubai, Abu Dhabi and Doha and are ideal targets if you want “cloud, cybersecurity, and data freelance roles” rather than generic dev work.

Future of Gig Economy Tech Jobs in the Arab World

How AI, cloud and open banking are reshaping IT freelancing in GCC

As Saudi rolls out open banking and experiments with a Digital Riyal under SAMA, and the UAE and Qatar expand hyperscale cloud regions, tech companies need specialised contractors for integrations, security and data pipelines rather than huge permanent teams. That directly boosts demand for cloud, cybersecurity and AI freelancers who can jump between fintech, logistics and government projects.

What SAMA, TDRA and QCB care about: data, platforms and worker protection

Regulators like SAMA in Saudi, the TDRA in the UAE and QCB in Qatar focus heavily on secure data handling, licensed payment flows and, increasingly, platform accountability. When you work as a freelancer for fintech, health or government projects, assume you must respect local data residency, avoid moving sensitive data outside approved regions, and use payment channels that align with rules from bodies like SAMA or TDRA.

Staying compliant, competitive and healthy as a GCC-based IT freelancer

To stay sustainable.

Use clear, bilingual (Arabic–English) contracts that specify scope, deliverables and governing law.

Work within legal structures (Freelance.sa, UAE licences) and avoid cash-only side gigs that break visa rules.

Protect your health with realistic hours and regular time off remote burnout is real.

Real-world GCC scenarios.

A Riyadh fintech startup hiring a Saudi cloud freelancer for an open-banking API project, fully documented under SAMA guidelines.

A Dubai e-commerce brand using a UAE-licensed freelancer to scale its mobile app and on-site search, supported by a specialist mobile app development partner.

A Doha SME choosing Google Cloud Doha and AWS Bahrain for data residency, then hiring remote data engineers based in Dubai and Dammam.

Summary and Next Steps for GCC IT Freelancers

Is freelancing in IT worth it in Saudi and UAE?

Yes if you treat it like a real business, not a side-hustle shortcut. Freelance IT careers in Saudi and the UAE can deliver better income, more meaningful projects and geographic flexibility, but only when you respect visa rules, pay attention to compliance and keep up with fast-changing cloud, security and AI skills. For Arabs targeting freelance IT jobs in Saudi Arabia, the combination of local demand and global remote work can be powerful when you stay within official frameworks.

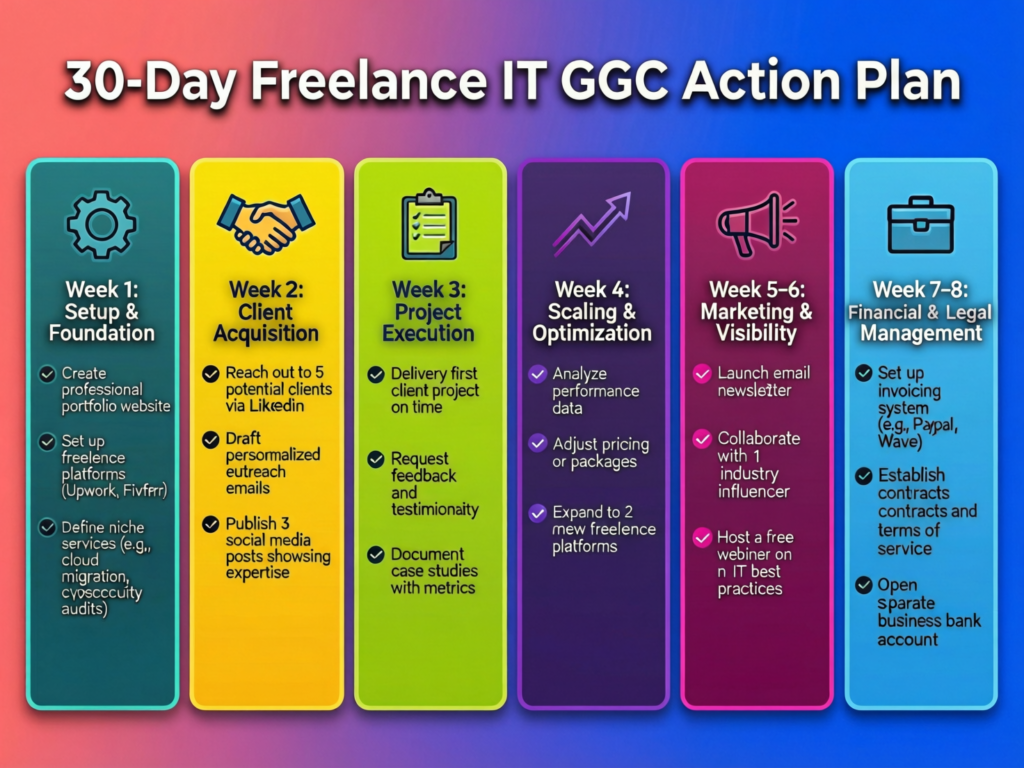

30-day action plan to test freelance IT work safely

Days 1–7

Clarify your niche (e.g., React front-end + Tailwind, or AWS security reviews). Refresh your CV, LinkedIn and a simple landing page Mak It can help with digital marketing and positioning.

Days 8–15

Set up or update your profiles on 1–2 platforms (local + global). Publish 2–3 case studies or code samples.

Days 16–23

Apply intentionally to 5–10 well-matched projects. Prioritise small, low-risk gigs that fit your legal status.

Days 24–30

Deliver your first project excellently, collect feedback, and review whether you need a Freelance Work Document in Saudi or a licence in the UAE.

When to get professional advice (legal, visa, tax) in KSA, UAE, Qatar

Seek specialist advice when.

You plan to switch from full-time employment to full-time freelancing.

You’re earning consistently from foreign clients and unsure about tax/Zakat.

You want to open a company, move to a UAE free zone, or base yourself in Qatar while serving cross-border clients.

For your tech stack, product strategy and digital presence, an experienced partner like Mak It Solutions (see our services overview) can help you package your skills into services GCC businesses actually buy.

If you’re serious about building a compliant, profitable career around freelance IT jobs in Saudi Arabia, the UAE or Qatar, you don’t have to figure it out alone. Mak It Solutions can help you shape your positioning, build a high-converting portfolio site and align your skills with what GCC clients are really buying. Ready to map your next 90 days? Contact our team and ask for a GCC freelance IT strategy session tailored to your situation.

FAQs

Q : Is freelance IT work legal for expats in Saudi Arabia if they already have an employer?

A : Freelance IT work is not automatically legal for expats just because it is online. In most cases, your Iqama, labour contract and MoHRSD rules restrict you to working only for your sponsoring employer, unless you have a separate, officially approved structure (such as a licensed company or incubator-backed investor licence). Recent tightening of digital contract verification and labour enforcement in KSA means informal side gigs carry real risk. Always confirm your status with your HR department, MoHRSD resources and, if needed, an immigration lawyer.

Q : What are the cheapest freelance visa options in Dubai for software developers?

A : Dubai’s GoFreelance and similar packages are often the entry point for developers, as they bundle a freelance permit with access to TECOM’s ecosystem; however, you still need to budget for establishment cards, visas and health insurance. Sometimes a one-person free-zone company can be cheaper over several years if you plan to scale or hire. The “cheapest” option depends on how long you’ll stay, whether you need visas for family, and whether you want co-working or office space, so it’s wise to compare 2–3 zones before deciding.

Q : Can I work remotely for US or Europe clients while holding a Saudi or UAE freelance permit?

A : Generally, yes many GCC-based freelancers legally serve US or European clients as long as they operate within the activities allowed on their Saudi Freelance document or UAE freelance licence and respect cross-border tax and data rules. You’ll need solid contracts, clear payment channels and awareness of where client data is stored (for example, using GCC cloud regions like AWS Bahrain or Azure UAE Central to satisfy residency expectations). For high-risk sectors like fintech or health, double-check with your client’s compliance team.

Q : Do Saudi and UAE freelance IT workers get GOSI or pension benefits like full-time employees?

A : Freelancers in Saudi and the UAE don’t automatically receive GOSI or pension benefits the way full-time employees do. In Saudi, some freelancers may voluntarily contribute to social protection schemes linked to their Freelance Work Document or other self-employment structures, while UAE freelancers often rely on private savings and investment plans rather than employer pensions. Regulators like SAMA and entities behind programs such as Vision 2030 are studying ways to improve long-term security for gig workers, but benefits are still more limited than for traditional employees.

Q : Is it easier to start freelance IT work in Qatar, or to base myself in Dubai and work remotely for Doha clients?

A : Right now, many freelancers find it simpler to base themselves in Dubai (or occasionally Abu Dhabi) under a clear UAE freelance or free-zone licence and then work remotely for Doha clients. Qatar’s fintech and digital sectors are growing fast under QCB’s fintech strategy and Qatar FinTech Hub, but individual freelance visa options are still more limited than in the UAE. Practically, a Dubai base with occasional business trips to Doha often gives you both regulatory clarity and access to Qatar’s emerging digital economy.