GCC Oil & Gas Cybersecurity Guide for KSA & UAE

GCC Oil & Gas Cybersecurity Guide for KSA & UAE

GCC Oil and Gas Cybersecurity: OT Roadmaps for Saudi, UAE and Qatar Operators

GCC oil and gas cybersecurity means protecting refineries, pipelines, LNG plants and offshore platforms across Saudi Arabia, the UAE and Qatar from cyber attacks that can disrupt production, safety and exports. It combines industrial control systems cybersecurity (ICS/SCADA/DCS), national regulations like NCA OTCC, UAE IA and Q-CERT programmes, and practical OT roadmaps so operators can reduce risk while staying compliant.

Introduction

GCC oil and gas infrastructure runs on complex operational technology (OT) ICS, SCADA and DCS that keeps refineries, pipelines and LNG plants running 24/7, alongside traditional IT systems for business operations. When these OT environments are disrupted, the impact hits national exports, downstream industries and regional energy security, especially in economies like Saudi Arabia, the UAE and Qatar that are heavily dependent on hydrocarbons and LNG revenues.

OT-impacting incidents and national drills in the region have shown how easily IT ransomware, remote access abuse or supply-chain compromise can spill over into process networks, triggering shutdowns and safety risks. For GCC operators, gcc oil and gas cybersecurity is no longer a “nice to have” but a board-level requirement tied to Saudi Vision 2030, UAE diversification and Qatar’s LNG leadership. The focus now is a practical OT roadmap for Saudi, UAE and Qatar energy companies that delivers real control improvements and alignment with NCA, TDRA, Q-CERT and related frameworks.

What Makes GCC Oil & Gas Cybersecurity Unique?

Why OT/ICS in Gulf Energy Environments Is Different

GCC energy operators manage huge OT estates: refineries in Dhahran and Ruwais, long-distance pipelines across the Eastern Province and the Abu Dhabi desert, LNG trains at Ras Laffan, and offshore platforms in the Arabian Gulf. These environments often use legacy ICS/SCADA and vendor-specific protocols, where downtime windows are tiny and patching is constrained by safety and production schedules.

Because these systems were designed for availability and safety first, industrial control systems cybersecurity has to respect process constraints while still hardening SCADA and DCS security for example, through compensating controls like network segmentation and monitored remote access when firmware can’t be quickly upgraded.

APTs, Ransomware and Supply-Chain Attacks

Today, GCC oil and gas infrastructure faces targeted OT threat groups, opportunistic ransomware, IT-to-OT spillover and politically motivated hacktivism. OT-focused vendors like Dragos track multiple threat groups that actively target Middle East oil and gas and chemical sectors, often starting in IT and moving towards ICS networks.

Shamoon-style wiper attacks against Saudi Aramco and RasGas wiping tens of thousands of workstations showed how business systems outages can slow fuel distribution and logistics even when core control networks are segmented.

Direct answer What are the main cyber threats targeting GCC oil and gas infrastructure today?

The main cyber threats targeting GCC oil and gas infrastructure are ransomware campaigns, OT-focused advanced persistent threat (APT) groups, IT-to-OT lateral movement, destructive wipers inspired by Shamoon, and supply-chain attacks via remote access vendors and engineering tools. These threats increasingly blend traditional IT techniques with ICS-aware malware and living-off-the-land tactics, aiming to disrupt production, erode safety margins or exert geopolitical pressure.

Business Impact on Saudi, UAE and Qatar Energy Operators

For a refinery in Jubail, an LNG train in Ras Laffan or offshore facilities near Abu Dhabi, cyber incidents can trigger unplanned shutdowns, safety incidents, environmental releases and weeks of recovery activities. These outcomes translate directly into lost export revenues, contract penalties and reputational damage with global buyers.

Because Saudi Vision 2030, the UAE’s energy transition and Qatar’s LNG expansion rely on highly digitised operations, OT cyber risk now sits alongside process safety and capital risk on board agendas, not just in IT committees.

GCC Regulatory Landscape for Oil & Gas Cybersecurity

Saudi Arabia NCA OTCC-1:2022 and ECC-1:2018 for Oil & Gas Facilities

Saudi Arabia’s National Cybersecurity Authority (NCA) issued the Essential Cybersecurity Controls (ECC-1:2018) as the baseline, and then extended them with the Operational Technology Cybersecurity Controls OTCC-1:2022 specifically for OT/ICS environments in critical infrastructure such as energy.

A Saudi refinery or gas plant needs clear governance, OT risk assessments, continuous monitoring, defined incident response, asset management, and third-party/vendor controls across its plants and pipelines, all mapped to OTCC domains for governance, defence and third-party security.

How do Saudi Arabia’s NCA OTCC controls apply to oil and gas facilities and pipelines?

NCA OTCC-1:2022 sets mandatory minimum cybersecurity requirements for OT/ICS environments in critical facilities, including refineries, gas plants and pipeline networks. It requires Saudi oil and gas operators to implement structured governance, asset and risk management, network and access controls, monitoring and incident response, and vendor security aligned with NCA’s domains, and to demonstrate compliance through assessments and audits

UAE IA Regulation, TDRA and CIIP/DESC Requirements for Energy

In the UAE, the Information Assurance Regulation (IAR) issued under TDRA defines mandatory controls for designated critical entities, including energy and utilities, covering governance, risk management, incident response and technical safeguards

The UAE CIIP Policy and guidance from the UAE Cyber Security Council and Dubai Electronic Security Center (DESC) extend this focus to critical information infrastructure, while Abu Dhabi/ADNOC entities typically align with IAR plus sector-specific OT guidance.

Qatar Q-CERT, National Cyber Security Strategy and CIIP Programmes

Qatar’s National Cyber Security Strategy and Q-CERT programmes emphasise protection of critical sectors such as energy and finance, with CIIP initiatives that support risk assessments, guidance and interdependency mapping for critical information assets.

Qatar LNG and energy operators typically work closely with Q-CERT for national drills, incident coordination and capability building, complementing Qatar Central Bank’s cyber regulations where financial trading and payment systems intersect with energy operations.

Designing an OT Cybersecurity Roadmap for GCC Refineries & LNG Plants

OT Risk Assessment, Asset Discovery and Gap Analysis

An effective roadmap starts with a multi-site OT risk assessment and asset inventory across refineries in Eastern Province, Ruwais, Ras Laffan and associated pipelines and offshore platforms. Using frameworks like NCA OTCC, UAE IAR and Qatar’s CIIP guidance alongside IEC 62443 and NIST 800-82 provides a consistent benchmark for operational technology risk management.

Aligning Controls with IEC 62443 and GCC Regulations

IEC 62443 offers a technical backbone for ICS security zones, conduits, security levels and lifecycle processes, which can then be mapped to OTCC requirements in Saudi and IA controls in the UAE.

For multinationals operating in KSA, UAE and Qatar, this mapping lets them design one reference architecture that still produces regulator-friendly evidence packs in each jurisdiction.

Phased Implementation by Site and Criticality

Most GCC operators prioritise pilots at a single refinery, LNG train or offshore field, then scale to pipelines and remote sites based on criticality and risk. Quick wins like ICS network segmentation and monitoring, secure remote access and logging to an OT-aware SOC are tackled first, followed by medium-term work such as full OT SOC build-out, playbooks and cross-border exercises.

How should GCC energy operators design an OT cybersecurity roadmap for refineries and LNG plants?

GCC energy operators should start with a structured OT risk assessment and asset inventory, benchmarked against NCA OTCC, UAE IA and Qatar CIIP frameworks plus IEC 62443 and NIST 800-82. From there, they can map required controls into a single target architecture and execute a phased programme beginning with high-value pilots, quick segmentation and monitoring wins, then scaling to all sites with an OT SOC, runbooks and joint drills with national CERTs.

Core OT/ICS Controls for GCC Pipelines, Offshore Platforms & Terminals

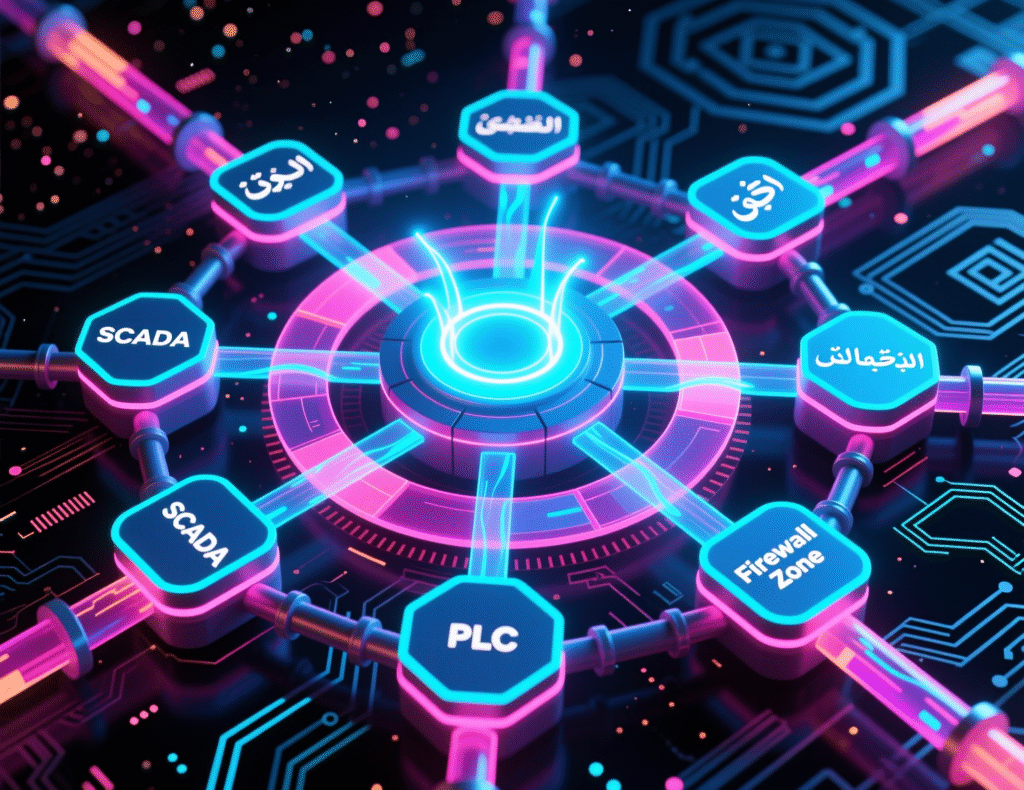

OT Network Segmentation, Zoning and Secure Remote Access

Effective ICS network segmentation and monitoring means separating IT and OT, creating DMZs for historians and jump hosts, and zoning engineering workstations away from safety/real-time control. SANS and others recommend identity-centric, multi-factor remote access for vendors and field teams, particularly for long-distance pipelines and offshore rigs in the Arabian Gulf.

Continuous Monitoring, OT SOC and Incident Response

An OT-aware SOC in Riyadh, Dubai or Doha needs protocol-aware monitoring, OT threat hunting and playbooks tailored to refinery, pipeline and LNG scenarios, with clear paths to NCA, TDRA and Q-CERT when incidents cross national thresholds.

Ransomware Resilience, Backup and Recovery for Energy Operations

Because business IT remains a common entry point, ransomware resilience for energy infrastructure should include offline and immutable backups, segmented management networks, tested restoration drills and safe failover strategies that protect both OT and supporting IT systems.

Country-Specific GCC Oil & Gas Cybersecurity Use Cases

OTCC-Aligned Architecture for a Refinery in Eastern Province

A refinery near Dammam can adopt an OTCC-aligned architecture with clear OT/IT separation, asset discovery mapped to OTCC domains, monitored vendor access via jump hosts and centralised log collection stored in-Kingdom for compliance. Evidence for NCA audits is generated through control mapping, policy documentation and SOC reports aligned with OTCC assessment tools.

ADNOC-Style OT SOC and Offshore Platform Protection

An ADNOC-style central OT SOC in Abu Dhabi can monitor Ruwais, onshore fields and offshore platforms, integrating TDRA IA reporting and CIIP requirements, and using secure remote access for international OEMs and local crews via hardened jump servers.

LNG OT Security Anchored in Q-CERT Exercises

A Qatar LNG operator in Ras Laffan might build its OT roadmap around regular Q-CERT exercises, CIIP guidance and sector drills, ensuring coordination between operations, IT and national cyber authorities for both prevention and incident response.

Choosing a GCC OT Cybersecurity Partner for Oil & Gas

OT Track Record, Frameworks and Local Presence

When issuing RFPs, GCC energy companies should favour partners with IEC 62443 expertise, proven OTCC/IA/Q-CERT mappings, dedicated OT labs and references in refineries, pipelines and LNG. Bilingual (Arabic/English) capability and shift-aware services are critical for 24/7 operations across Riyadh, Dubai and Doha.

On-Prem, Onshore SOC in Riyadh/Dubai/Doha and Hybrid

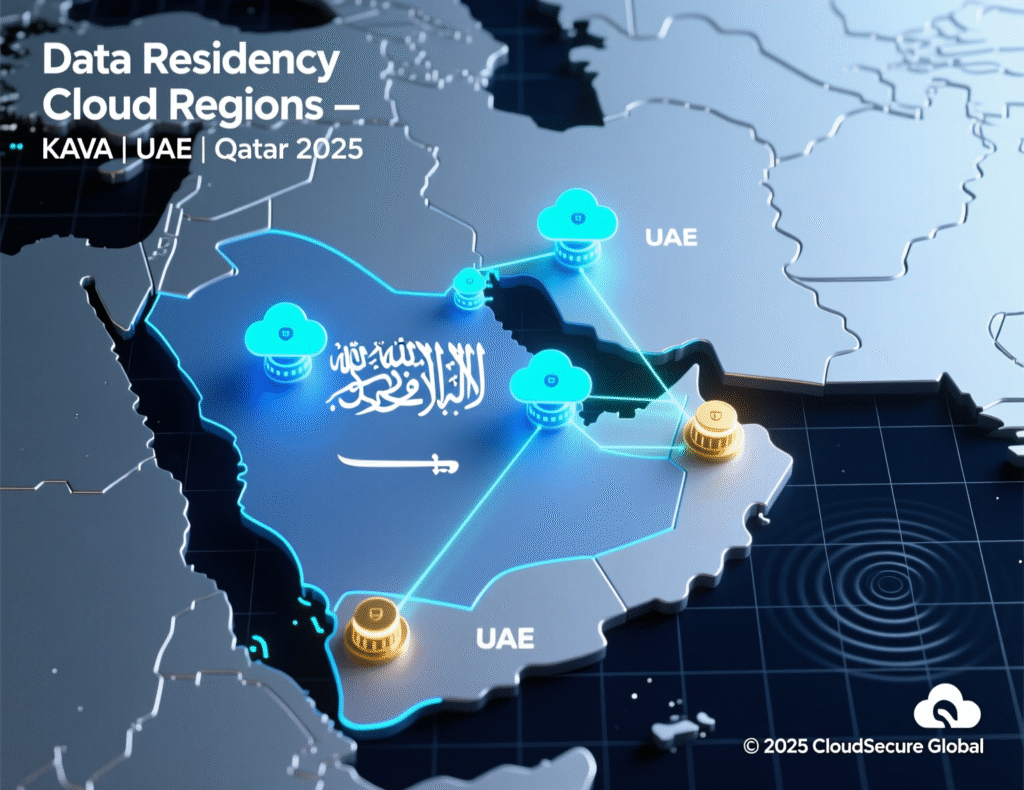

Service models range from fully on-prem monitoring to onshore SOCs in Riyadh, Dubai or Doha and hybrid co-managed options with global vendors. Data residency considerations mean OT logs and forensic images may need to stay in KSA, UAE or Qatar, while analytics can sometimes use regional cloud regions such as AWS Bahrain, Azure UAE Central or Google Cloud Doha with appropriate controls.

RFP Checklist and Common Pitfalls in GCC Energy Projects

An effective RFP checklist includes regulatory mapping, OT-specific SLAs, drill frequency, integration with NCA/TDRA/Q-CERT, and clarity on offshore and remote site coverage. Common pitfalls include hiring IT-only partners, underestimating legacy OT and ignoring the complexity of pipelines and offshore platforms.

Governance, Data Residency and Board-Level Reporting

Data Residency and Cross-Border Log Storage in KSA, UAE and Qatar

Saudi NDMO standards and PDPL, SAMA’s cyber framework and sector cloud guidelines emphasise that sensitive and government data, including many OT-related datasets, should be stored and processed within the Kingdom or under strict transfer conditions.

The UAE’s IA Regulation and CIIP policy take a risk-based view that still expects critical entities to maintain strong control over where OT data and logs reside, while Qatar’s data protection law and QCB regulations set requirements for in-country processing of financial and certain personal data, influencing where OT monitoring platforms can be hosted.

OT Cyber Risk KPIs and Reporting for Regulators and Boards

Practical OT risk KPIs include the percentage of critical OT assets monitored, mean time to detect and respond to OT incidents, compliance scores against OTCC/IA/CIIP, and drill performance. These metrics help satisfy regulator expectations (NCA, TDRA, Q-CERT, SAMA, QCB) while giving boards transparent visibility into operational resilience.

Aligning OT Cybersecurity with National Visions and ESG

Strong OT security supports national visions and ESG agendas by reducing accident risk, protecting the environment around the Arabian Gulf and building investor confidence in regional energy assets. For Gulf operators, OT security becomes part of long-term operational excellence and digital transformation, not simply an IT cost line.

Wrapping it Up

For Saudi, UAE and Qatar energy operators, the path forward is clear: understand your OT risk, map it to national controls, and execute a realistic roadmap that starts delivering segmentation, monitoring and resilience within 60–90 days. Combining OTCC/IA/Q-CERT requirements with IEC 62443 and local data residency rules lets your team protect production while staying audit-ready.

In practice, that means a short engagement to baseline maturity, co-design an OT architecture per site, launch pilots in one refinery or LNG train, and then present a board-ready roadmap that links OT cybersecurity to safety, ESG and national vision goals.

If you’re responsible for OT or cybersecurity in a refinery, pipeline or LNG operation in KSA, the UAE or Qatar, you don’t need another generic framework you need a GCC-specific plan. The Mak It Solutions team already works with regional CIOs and CISOs on cloud, data residency and multi-cloud strategy for regulated environments. (makitsol.com)

Book a GCC OT cybersecurity discovery workshop, request an OTCC/IA/Q-CERT gap assessment, or explore how an onshore SOC model could work for your environment. Together, we can turn OT cyber risk into a structured 90-day roadmap instead of an open-ended worry. ( Click Here’s )

FAQs

Q : Is NCA OTCC-1:2022 mandatory for all Saudi oil and gas companies operating refineries and pipelines?

A : NCA OTCC-1:2022 applies to OT/ICS environments in facilities designated as critical national infrastructure, which typically includes major refineries, gas plants, pipeline networks and some petrochemical complexes. For these entities, OTCC is not optional – it sets minimum requirements for governance, asset management, access control, network security and incident response in OT. In practice, many upstream and downstream operators treat OTCC as the reference standard across all sites to simplify operations and align with Saudi Vision 2030 expectations around digital resilience.

Q : Do UAE offshore platforms and LNG terminals fall under the Information Assurance Regulation and CIIP policy?

A : Yes. The UAE Information Assurance Regulation applies to entities designated as critical by TDRA under the CIIP Policy, which explicitly targets essential services such as energy and utilities. For offshore platforms and LNG terminals operated by national or semi-government entities, IA and CIIP expectations cover governance, risk management, technical controls and incident response for both IT and OT systems. Dubai DESC and the UAE Cyber Security Council provide additional sector guidance, so most major offshore and LNG operators in Abu Dhabi and Dubai align with IA plus these sector-level standards.

Q : How can a Qatar LNG operator work with Q-CERT during an OT cyber incident affecting production?

A : In Qatar, LNG operators are expected to treat Q-CERT as a central coordination hub for serious cyber incidents affecting critical infrastructure. During an OT incident, operators typically activate their internal incident response plan, notify Q-CERT via agreed channels, and share high-level technical indicators, impact assessments and containment plans. Q-CERT can then support with additional threat intelligence, coordination with other national stakeholders, and guidance on CIIP reporting and recovery expectations. Regular national drills and CIIP exercises help operators rehearse this coordination before real-world events.

Q : What is the difference between IT cybersecurity and OT/ICS security in GCC oil and gas plants?

A : IT cybersecurity in oil and gas focuses on business systems like ERP, trading, HR and email, where confidentiality and integrity are primary concerns and downtime is usually tolerable. OT/ICS security protects real-time control systems – SCADA, DCS, PLCs and safety systems – where availability and deterministic behaviour are critical, and even small disruptions can lead to safety incidents or production losses. In GCC plants, OT security must account for legacy hardware, vendor constraints and process safety, while still applying principles like network segmentation, secure remote access and continuous monitoring inspired by frameworks such as IEC 62443 and NIST 800-82.

Q : Can GCC oil and gas companies use cloud-based OT monitoring while still meeting local data residency rules in Saudi, UAE and Qatar?

A : Yes, but design matters. Many operators adopt a hybrid approach: keeping raw OT logs and sensitive forensic data in-country to satisfy NDMO, PDPL, SAMA, IA and Qatar data protection requirements, while using regional cloud regions (AWS Bahrain, Azure UAE Central, Google Cloud Doha) for analytics, dashboards or long-term trend analysis. Clear data classification, encryption, strict access controls and regulator-aligned data transfer agreements are essential. When in doubt, organisations should consult guidance from NDMO, TDRA, Q-CERT and QCB and align their design with existing cloud and data localisation strategies.