GenAI Cost Optimization in GCC for CIOs & CFOs

GenAI Cost Optimization in GCC for CIOs & CFOs

GenAI Cost Optimization in GCC for CIOs & CFOs

GenAI cost optimization in GCC means treating GPU-heavy AI workloads as a separate cost category with its own FinOps rules, not “just another cloud project”. For CIOs and CFOs in Saudi Arabia, UAE and Qatar, it’s about linking every GPU dollar to clear business outcomes while staying compliant with SAMA, TDRA, QCB and local data residency rules.

Introduction

Across Riyadh, Dubai, Abu Dhabi and Doha, GenAI pilots have moved from slideware to real copilots, chatbots and document intelligence and so have the GPU invoices. The challenge is simple: genai cost optimization in gcc is now a board-level topic, especially in banking, government, logistics and retail.

The GenAI gold rush… and the GPU bill shock in GCC

Saudi and UAE executives are seeing brilliant demos… and then discovering that a single GenAI POC can burn through monthly budgets if GPU utilization efficiency is low or prompts are poorly designed. Add Arabic-heavy content, long context windows and strict data residency, and your GPU bill in AWS Bahrain, Azure UAE Central or GCP Doha can spike overnight.

For wider GCC markets like Kuwait, Qatar, Oman and Bahrain, the story is the same: demand is real, but cost discipline is missing and regulators are watching.

Why CIOs, CFOs and FinOps leads can’t treat GenAI like “just another cloud workload”

Traditional VM or storage projects scale linearly; GenAI workloads scale with tokens, prompts and model choices. A single misconfigured GPU cluster, or an over-sized model used in a simple FAQ bot, can erase months of savings from your existing cloud FinOps maturity model.

That’s why genai infrastructure optimization and ai workload cost visibility must be designed upfront with finance and risk, not bolted on later once the bill lands.

What this guide gives you: a GCC-ready FinOps playbook for GenAI GPU spend

This guide gives Saudi, UAE and Qatar leaders a practical, GCC-aware FinOps framework: how to measure GenAI costs, when to choose cloud vs on-prem GPUs, and how to respect SAMA, SDAIA, NDMO, TDRA, ADGM, DIFC, QCB and Digital Government Authority requirements without killing innovation.

If you need a partner who already builds GCC-ready AI solutions, the team at Mak It Solutions can help translate this playbook into a real roadmap.

From Cloud Cost Management to GenAI FinOps in GCC

Traditional cloud FinOps vs GenAI FinOps.

Classic FinOps focuses on rightsizing VMs, cleaning up storage and managing discounts. GenAI FinOps adds three new levers: GPU capacity, model choice and token economics. You’re no longer just asking “Which instance family?” you’re deciding between hosted APIs, fine-tuned models and in-house deployment.

For many GCC enterprises, this is also the first time ai ml ops and finops integration is happening in a single cross-functional squad, with data, engineering, finance and compliance at the same table.

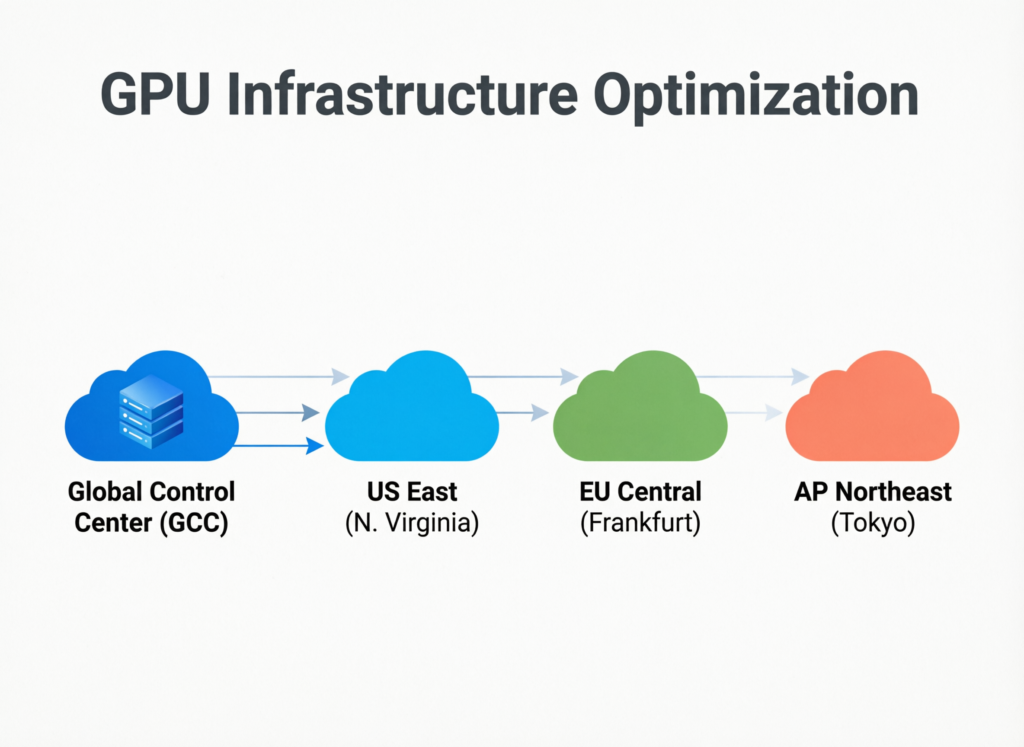

GCC context: Saudi, UAE and Qatar cloud regions, sovereign GPU capacity and pricing realities

In practice, GenAI cost optimization in GCC sits on a patchwork of regions and sovereign options: AWS Bahrain for many Saudi workloads, Azure UAE Central for Dubai and Abu Dhabi, and GCP Doha for Qatar ministries and telcos. Some regulated workloads still sit fully on-prem in Riyadh or Doha due to data residency and latency needs.

Availability of high-end GPUs is uneven, prices can be higher than global regions, and committed capacity often requires multi-year thinking especially for fintech, government and health workloads.

Why “lift-and-shift” FinOps fails for GenAI pilots and production use cases in GCC

If you apply the same dashboards and alerts you use for generic cloud, GenAI will look like an opaque “black box” line item. Lift-and-shift FinOps ignores prompts, models and user behaviour the real cost drivers.

For GCC banks, insurers and government entities, this is risky: GPU burn can clash with SAMA or TDRA budget constraints overnight. You need FinOps for AI in UAE and KSA that goes deeper: cost per conversation, per document, per transaction, not just per instance.

Key Cost Drivers of GenAI in Saudi Arabia, UAE and Qatar

GPU infrastructure.

The first cost driver is straightforward: GPUs themselves. Underutilised clusters in Azure UAE Central or AWS Bahrain, long-running dev environments in Dubai Internet City, or idle on-prem boxes in Riyadh data centres can silently add tens of thousands of dollars.

Improving gpu utilization efficiency with autoscaling, time-boxed “lab” environments and shared GPU pools across teams is often the fastest win.

Models, data and tokens.

The second driver is the model and how you talk to it. Arabic and bilingual prompts are often longer; large context windows, embeddings over huge document stores, and verbose responses all increase token spend.

For GCC e-commerce and logistics teams in Jeddah, Dubai or Doha, tuning prompts and choosing smaller, task-specific models can cut costs by 30–50% without hurting quality a core part of genai infrastructure optimization and overall GenAI cost optimization in GCC.

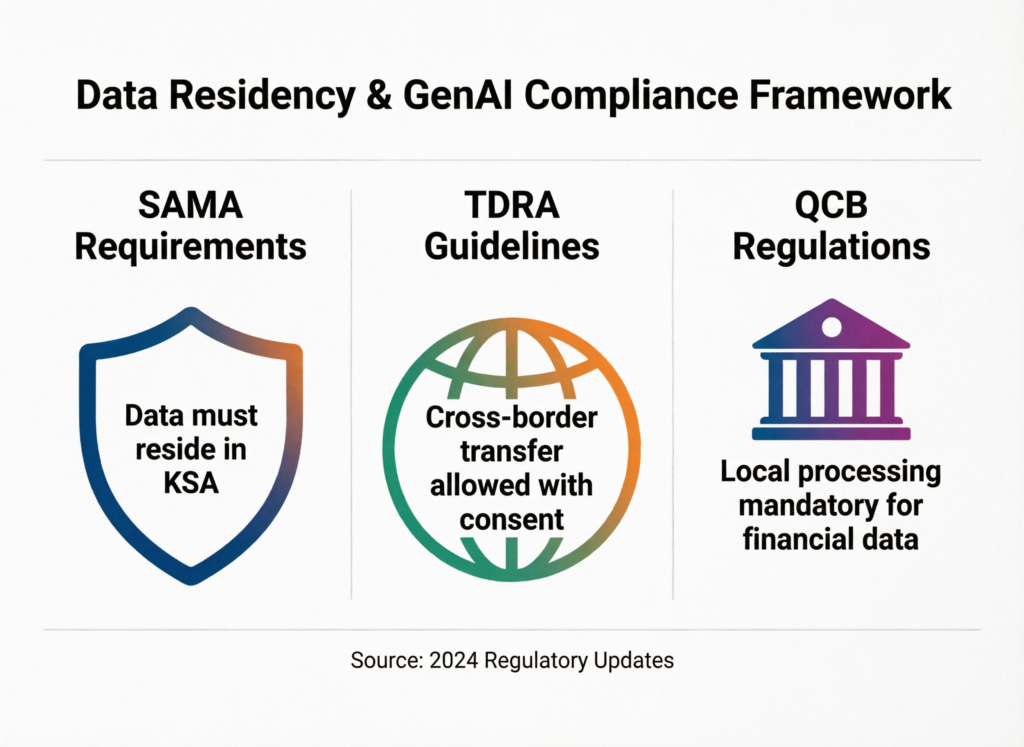

Compliance and data residency.

Finally, compliance adds invisible costs. Encrypt-everything pipelines, local KMS, separate sandboxes for PII and health data, and strict logging for regulators all consume compute.

For gpu spend control for gcc banks and insurers, this may mean separate GPU pools for regulated vs non-regulated data, plus extra storage for audit logs demanded by bodies like SAMA, NDMO, SDAIA, TDRA, QCB and Qatar Digital Government.

FinOps Framework for GPU-Heavy GenAI in GCC

Visibility: tagging, showback and unit economics for GenAI workloads

Start by making GenAI visible. Tag workloads by business unit, use case (e.g., KYC, customer service, internal copilots) and environment (lab vs production). Build showback reports that express costs as “per 1,000 conversations” or “per loan application analysed” instead of only per GPU hour.

Tools and dashboards similar to your Business Intelligence Services setup or even self service business intelligence for non-technical teams can give finance and product teams shared ai workload cost visibility.

Optimization: rightsizing GPUs, scheduling, and model-level tuning for Saudi, UAE and Qatar projects

Next, optimise. Rightsize GPU types to each workload, enable scheduling so non-critical training jobs run off-peak, and consider regional placement (for example, using GCP Doha instead of distant regions for Qatar projects).

Tuning prompts, shrinking context windows and selecting smaller models for simpler tasks are core levers of genai cost optimization services in riyadh, Dubai or Doha, especially when Arabic and English content live side by side.

Governance: guardrails, budgets and chargeback between tech and finance teams

Finally, embed governance. Define budget thresholds, approval flows for new GPU capacity, and clear chargeback rules between IT and business.

In many GCC organisations, this becomes the first formal finops for ai in uae and KSA: engineering, data, finance and compliance agreeing on policies for experiments, production SLAs and sunset criteria so GenAI cost optimization in GCC becomes a continuous discipline, not a one-off clean-up.

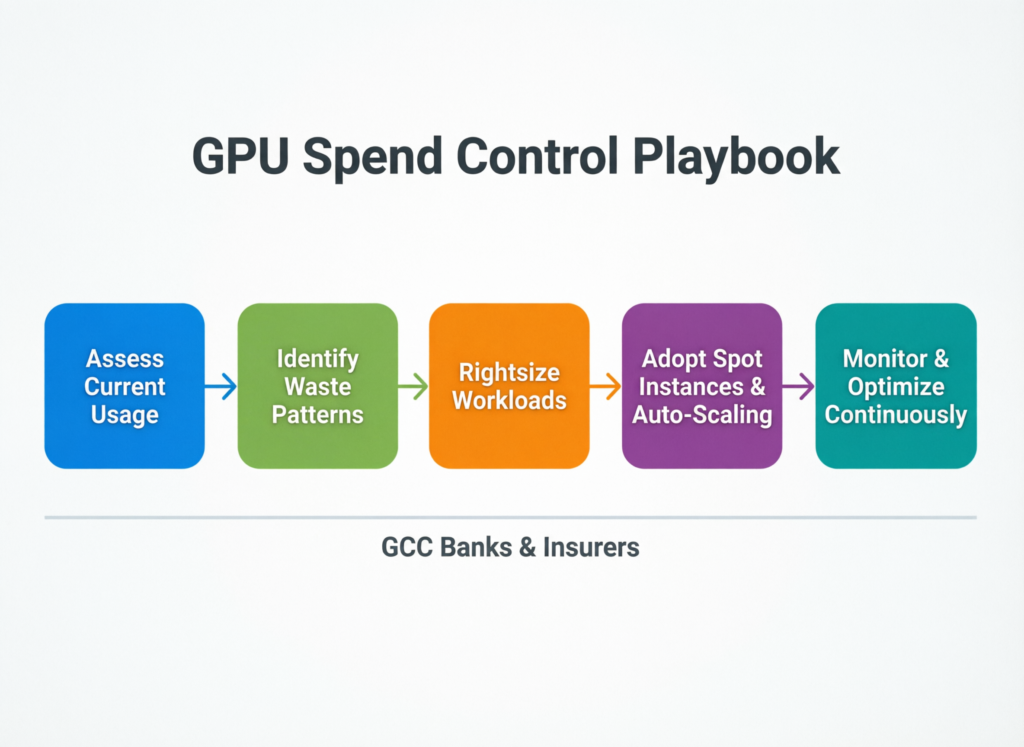

GPU Spend Control Tactics in GCC.

When to choose on-prem vs cloud GPUs for GenAI in UAE, Saudi and Qatar

On-prem GPUs in Riyadh or Abu Dhabi can make sense for steady, predictable loads (e.g., document understanding for government archives) where data residency is strict. Cloud GPUs in AWS Bahrain, Azure UAE Central or GCP Doha are better for spiky, experimental workloads.

Many CIOs settle on a hybrid model: core regulated workloads stay sovereign, while conversational AI for customer service pilots run in the cloud where teams can experiment faster.

Reserved, committed and spot GPU pricing: how to mix them for GenAI workloads in GCC

Reserved or committed use discounts work well for always-on banking assistants or call-centre bots; spot or pre-emptible GPUs are ideal for overnight training and fine-tuning. A common pattern across Riyadh, Dubai and Doha is to anchor 50–70% of capacity in committed contracts and leave the rest flexible, balancing risk and agility.

Practical levers: autoscaling, workload scheduling, and lab vs production policies for GPU-heavy teams

Practical cost control is often about habits: autoscaling policies that enforce minimum and maximum GPU counts; lab environments that shut down every evening; and strict separation between experimentation and production.

For support teams adopting automated ticket resolution with AI support agents, this can be the difference between a controllable pilot and runaway spend.

Compliance, Data Residency and Sovereign Cloud: How They Change GenAI Costs

Saudi lens: banking, open banking and government workloads under SAMA, NDMO and SDAIA

In the Kingdom of Saudi Arabia, SAMA, NDMO, SDAIA and the Digital Government Authority drive strict guidance on data classification, residency and AI usage — especially in banking, open banking, health and government services. Hosting GenAI workloads in-kingdom, encrypting data end-to-end and maintaining detailed audit logs all add cost.

For official guidance, leaders should review the Saudi Central Bank (SAMA) site alongside internal risk policies before finalising architectures.

TDRA, ADGM, DIFC and sovereign cloud choices for regulated GenAI workloads

In the UAE, TDRA sets the digital and telecoms baseline, while ADGM and DIFC have their own expectations for financial and fintech firms. This often pushes regulated entities towards sovereign cloud options or dedicated regions in Abu Dhabi and Dubai.

Startups in Dubai Internet City may run more freely, but still need to design for future audits, especially if they plan to serve banks, telcos or government entities later.

QCB, digital government programs and on-prem vs cloud trade-offs

Qatar’s financial and digital agenda, led by QCB and Qatar Digital Government initiatives, is pushing banks and ministries to explore GenAI while staying cautious on data export. Some Doha teams opt for GCP Doha or local private cloud; others start fully on-prem and then extend into public cloud as controls mature.

For CIOs and CFOs, GenAI cost optimization in GCC here means mapping each use case to the right residency option from day one.

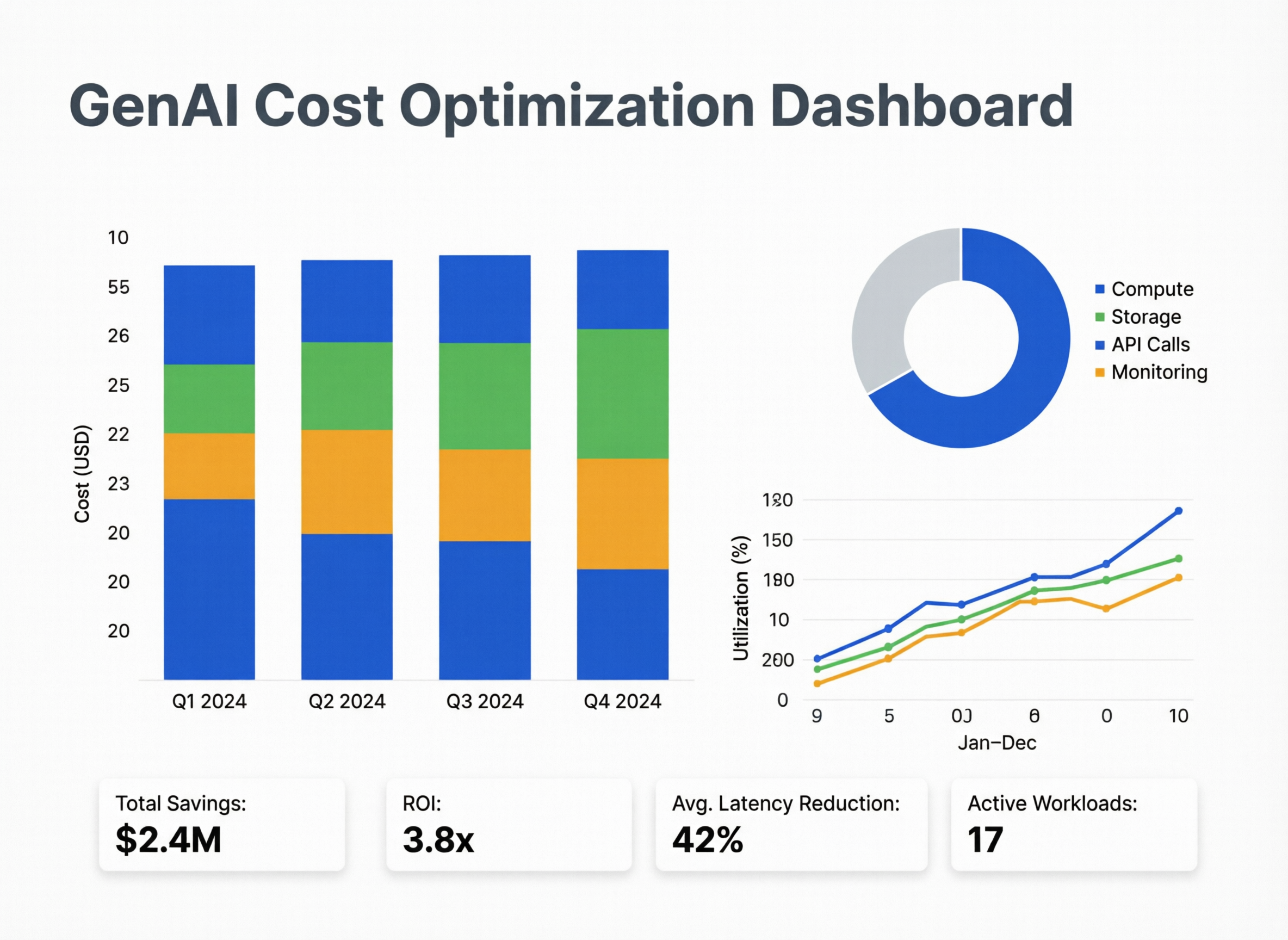

Building the Business Case.

Turning GenAI pilots into sustainable ROI.

The fastest way to justify GenAI cost is to connect it to metrics executives already care about: reduced call-centre AHT, higher loan conversion, faster onboarding, fewer manual document checks.

For example, a Riyadh fintech under SAMA rules might tie GenAI KYC automation directly to FTE savings; a Dubai e-commerce brand using web development services plus GenAI product copy can show higher conversion; a Doha SME using GCP Doha can track reduced processing time in logistics.

What a GenAI FinOps engagement typically looks like in GCC

A typical GCC engagement starts with a discovery and cost baseline, similar to other analytics or Business Intelligence Services. Then come quick wins (idle GPU cleanup, prompt optimisation), followed by a roadmap that aligns models, infra and compliance with Saudi Vision 2030, UAE AI strategies and Qatar digital programs.

First 90 days: how CIOs and FinOps leads in Riyadh, Dubai or Doha can get started

In the first 90 days, most leaders focus on three moves.

Build a clean cost and usage baseline for all GenAI workloads.

Implement basic guardrails for labs vs production.

Align with compliance (SAMA, TDRA, QCB) before scaling.

From there, you can expand into contact-centre projects like Arabic AI voice bots for GCC call centers, customer-service copilots, and data-driven experiences, supported by the broader Mak It Solutions services overview.

If you’re a CIO, CFO or FinOps lead in Riyadh, Dubai, Abu Dhabi, Doha or the wider GCC and GenAI costs are starting to surprise you, this is the moment to put a proper GenAI cost optimization in GCC lens on your GPU spend.

The Mak It Solutions team can help you baseline current costs, design a GCC-ready GenAI FinOps framework and map concrete savings opportunities without slowing innovation. Reach out to explore a tailored GenAI cost optimization roadmap for your bank, government entity, logistics network or digital brand.

FAQs

Q : Is GenAI cost optimization different for Saudi government projects compared to private sector companies?

A : Yes. Saudi government projects operate under stricter data classification, residency and security rules driven by bodies like SDAIA, NDMO and the Digital Government Authority, so GenAI workloads usually have fewer cloud options and more controls. This often means higher baseline costs for infrastructure, encryption and logging compared to a private retail or logistics firm. However, the optimisation principles are the same: improve GPU utilisation, narrow the scope of use cases, and design prompt and model choices carefully so every riyal spent supports Saudi Vision 2030 outcomes.

Q : Which GCC cloud regions offer sovereign GPU capacity suitable for banking and fintech GenAI use cases?

A : Today, many regulated GCC GenAI workloads land in AWS Bahrain, Azure UAE Central (and related UAE regions) or GCP Doha because they offer low-latency access and stronger data residency assurances for banks and fintechs. Saudi banks also combine these with in-kingdom hosting and private cloud to meet SAMA requirements. The right mix depends on how your risk team interprets SAMA, TDRA, QCB and other regulations, and whether workloads involve sensitive payments, open banking data or lower-risk analytics.

Q : How can Dubai and Abu Dhabi startups keep GenAI experimentation affordable while scaling?

A : For startups in Dubai Internet City or Abu Dhabi’s ecosystems, the key is separating “lab” and “production” environments very clearly. Labs should use small models, shared GPU sandboxes and strict auto-shutdown policies; production should earn its keep through clear revenue or efficiency metrics. Using spot GPUs for training, limiting context windows, and monitoring cost per user or per conversation keeps experimentation aligned with fundraising realities and TDRA’s evolving digital guidelines. Many UAE startups also partner with consultancies like Mak It Solutions to design scalable, FinOps-aware GenAI architectures from day one.

Q : What is a realistic GenAI GPU budget for a mid-sized bank in Riyadh or Doha starting with pilots?

A : There is no single benchmark, but many mid-sized GCC banks start with tightly scoped pilots in the low six figures (USD) per year across infrastructure, models and delivery. A Riyadh bank under SAMA guidelines might allocate this to a mix of KYC automation, internal copilots and contact centre assistants; a Doha bank under QCB may start with fewer, high-impact use cases tied to Qatar Digital Government priorities. The important step is to cap lab spend, treat GenAI as a portfolio of use cases, and expand budgets only when pilots prove measurable ROI.

Q : Can GCC organisations mix local sovereign cloud and global regions to reduce GenAI costs without breaking data residency rules?

A : Yes with careful architecture and legal review. Many GCC organisations keep sensitive data and production inference in sovereign or regional clouds (for example, AWS Bahrain, Azure UAE Central or GCP Doha), while using global regions for anonymised training, experimentation or non-sensitive workloads. The design must be aligned with SAMA, TDRA, QCB and internal legal interpretations of data residency and cross-border transfer. With the right patterns pseudonymisation, encryption and clear data flows it is possible to balance cost efficiency with strict regulatory compliance.