Is Buy Now Pay Later in MENA a Bubble or a Boom

Is Buy Now Pay Later in MENA a Bubble or a Boom

Is Buy Now Pay Later in MENA a Bubble or a Boom?

Buy now pay later in MENA is booming because young, mobile-first consumers in Saudi Arabia, the UAE and Qatar want flexible, interest-free payment plans that fit e-commerce and super-app lifestyles. At the same time, regulators like SAMA and the Central Bank of the UAE are tightening rules so BNPL can grow as a regulated experiment rather than an unchecked credit bubble.

Introduction

Across the GCC, buy now pay later MENA growth has moved from a niche checkout button to a default expectation. The surge is being driven by a perfect storm: mobile-native young Arabs, fast-growing e-commerce in Riyadh, Dubai and Doha, and a strong preference for interest-free installment payments instead of traditional revolving credit cards. At the same time, SAMA, the Central Bank of the UAE and QCB are stepping in to cap excesses, license providers and push more responsible underwriting so that BNPL becomes a sustainable consumer credit alternative for young Arabs, not a regional replay of the subprime crisis.

For GCC boards and founders, the real question isn’t “Is BNPL good or bad?” but “Under which guardrails does it create value for merchants, banks and consumers and where does it start to look frothy?”

Why Buy Now, Pay Later Is Booming in MENA and GCC

BNPL in MENA and GCC is booming because e-commerce, food delivery and travel platforms in cities like Riyadh, Dubai, Abu Dhabi and Doha have normalised one-click checkout and small-ticket installments, while youth-heavy populations prefer flexible, interest-free payment plans to long-term card debt. Growth is amplified by fintech innovation, open banking rollouts and merchant partnerships that make BNPL visible at almost every checkout.

Global BNPL slowdown vs GCC outperformance

Globally, BNPL sentiment has cooled: valuations have been cut in the US and Europe, regulators are worried about over-indebtedness and several providers are under profitability pressure. In the Middle East, however, BNPL payment volume is still forecast to grow at high double digits, with the regional market expected to reach several billion dollars by 2030.

The difference? GCC BNPL is still early, highly regulated and deeply integrated into retail and super-app ecosystems rather than chasing “growth at any cost”.

Young, mobile-first Arab consumers and e-commerce growth

In Riyadh, Jeddah, Dubai and Doha, most online shopping happens on mobile. Young professionals use BNPL inside apps they already trust fashion, electronics, groceries, education, even travel — and often see it as a budgeting tool rather than pure credit.

Noon and Amazon.sa/.ae highlight BNPL options from Tabby and Tamara right in the cart, reinforcing the idea that installments are just another payment method, not a separate financial product. For many shoppers across the GCC, “split in a few payments” now feels as normal as a card swipe.

Why “interest-free installments” resonate more than credit cards

In many GCC households, revolving interest feels culturally uncomfortable and, in some cases, religiously problematic. “No interest, no riba” Sharia-compliant pay-later solutions are easier to accept than opaque card statements with compounding interest.

Providers position themselves as interest free payment plans Middle East, charging merchants and carefully structured consumer fees instead of headline interest a framing that lands well with both Islamic finance expectations and lower financial literacy segments.

Market Size and BNPL Opportunity in Saudi, UAE and Qatar

BNPL penetration and growth in Saudi Arabia and Vision 2030

Saudi Arabia is the BNPL engine of the region. Estimates put the Saudi BNPL market at under USD 100 million in 2024 but growing at above 20% CAGR into the next decade, supported by Vision 2030’s cashless payments agenda, Mada rails and Open Banking KSA pilots.

For Riyadh fintechs, BNPL is a gateway to broader consumer finance: once you understand how a customer behaves at checkout, you can cross-sell cards, savings and micro-investments as long as you respect SAMA’s rules and treat BNPL as regulated finance, not a pure UX tweak.

UAE as a BNPL innovation hub

In the UAE, BNPL has moved from “fashion checkout gimmick” to mainstream across retail, automotive, healthcare and education. Dubai and Abu Dhabi host many of the region’s BNPL headquarters, with ADGM and DIFC acting as innovation hubs where cross-border licences, open finance and digital wallets meet.

For UAE-based brands, that means BNPL is rarely just a plugin it’s usually part of a broader digital payments and customer journey redesign that connects web, mobile and in-store.

Qatar, Kuwait, Oman and Bahrain as the “next wave” BNPL markets

Qatar and Kuwait are now the “next wave” BNPL markets. QCB has both a regulatory sandbox and a specific Buy Now Pay Later Regulation, and has already approved the first cohort of BNPL firms, while PayLater recently became the first licensed BNPL provider in Qatar.

Deema is Kuwait’s first licensed BNPL under CBK supervision, signalling that Manama and Muscat are unlikely to be far behind as regulators in Bahrain and Oman watch demand build and study their neighbours’ frameworks.

Key BNPL Players Shaping the GCC Landscape

Tabby, Tamara and other leading BNPL providers in KSA and UAE

Two names dominate board discussions: Tabby and Tamara.

Tabby is active in Saudi Arabia, UAE and Kuwait and works with more than 15,000 merchants, including Noon, IKEA and Carrefour.

Tamara, headquartered in Riyadh, became the first Saudi fintech unicorn with a USD 1 billion+ valuation and continues to expand across retail, travel and services, often marketed as a Sharia-conscious brand.

Their scale means that when these players change underwriting, fee structures or product design, GCC BNPL economics move with them.

New BNPL models in Qatar, Kuwait and beyond.

In Doha, PayLater is positioning itself as a domestic BNPL champion aligned with QCB’s sandbox and licensing path. In Kuwait City, Deema markets itself explicitly as a Sharia-certified BNPL solution licensed by CBK a sign that “halal BNPL” will be a key differentiator in smaller GCC markets.

We can expect more local champions to emerge in Bahrain and Oman, especially in verticals like healthcare, education and government fee payments.

How banks, wallets and super apps are integrating BNPL

The real story is convergence: banks, digital wallets and super apps are embedding BNPL into existing journeys rather than building completely separate experiences.

Noon, Amazon.sa and Amazon.ae offer “split in 3 or 4” BNPL buttons at checkout.

Telco wallets such as stc pay and local super apps like Snoonu in Qatar are exploring or piloting installment journeys tied to everyday spend.

For GCC merchants, this means customers increasingly expect BNPL to be available across channels — web, mobile and, eventually, in-store.

How GCC Regulation Is Re-shaping Buy Now, Pay Later

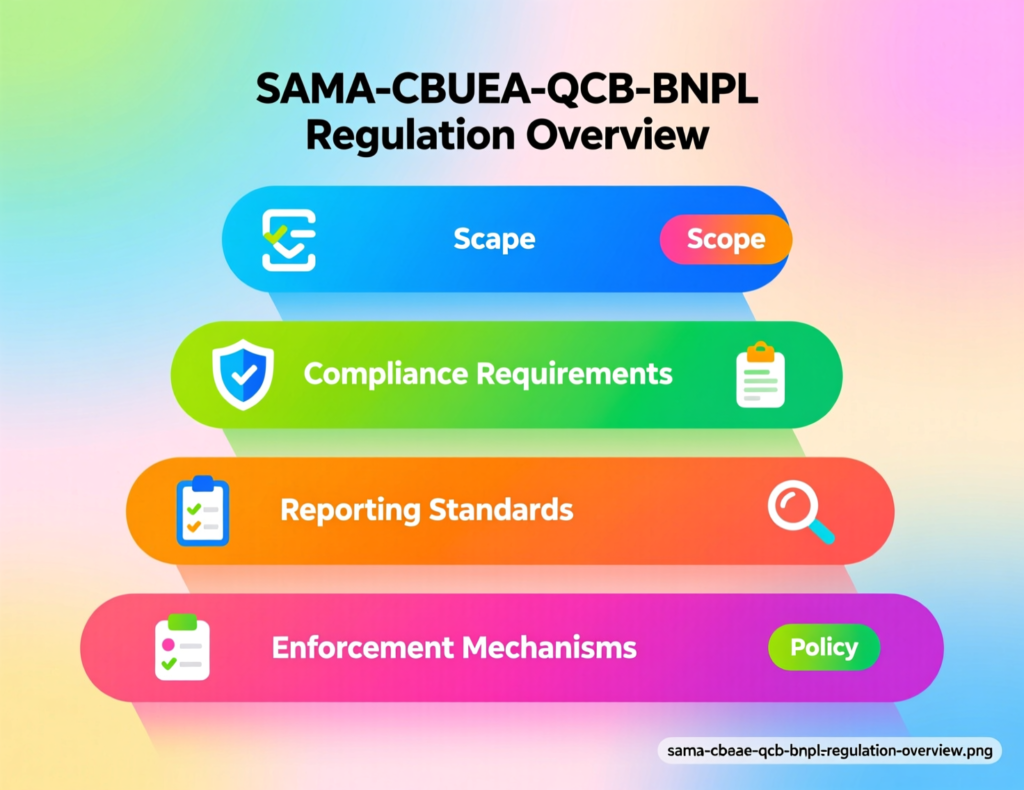

SAMA regulates BNPL in Saudi Arabia through a dedicated BNPL rulebook that requires licensing, capital, consumer protection policies and clear disclosure of fees, positioning BNPL as a supervised finance activity rather than a grey-area wallet feature. In the UAE, the Central Bank’s Retail Payment Services and Card Schemes Regulation brings BNPL and other retail payment services into a unified licensing and conduct framework, with TDRA supporting secure digital journeys via SIM registration, UAE PASS and KYC standards.

How SAMA regulates BNPL in Saudi Arabia

SAMA’s 2023 Rules for Regulating Buy-Now-Pay-Later Companies define BNPL as financing that allows consumers to purchase without a term cost, but still classify it as a finance activity requiring a licence, minimum capital, governance and robust risk management.

Providers must perform affordability checks, manage defaults and treat late fees carefully so they don’t morph into hidden interest. For boards in Saudi Arabia, SAMA’s rulebook turns BNPL from a grey-area growth hack into a licensed financial product that needs proper risk oversight.

UAE Central Bank rules and TDRA’s role in digital journeys

In the UAE, BNPL typically sits under retail payment service licensing or partnerships with licensed entities. The 2023 Retail Payment Services and Card Schemes Regulation requires clear disclosure of all fees and repayment terms, fair marketing and proper complaints handling — all designed to reduce the risk of a silent credit bubble. (rulebook.centralbank.ae)

TDRA, meanwhile, enforces SIM registration, digital identity and secure SMS/OTP flows that underpin smooth UAE PASS-based onboarding. For UAE BNPL journeys, this combination of payments regulation and digital identity standards is what keeps “one-tap” checkout from becoming “no-oversight” lending.

QCB, CBK and other GCC regulators’ sandboxes and guidelines

QCB’s sandbox and BNPL regulation, CBK’s licensing of Deema, and similar initiatives in Bahrain and Oman show a common pattern: allow innovation, but only inside a controlled, data-driven environment. (qcb.gov.qa)

For investors and founders, that means BNPL plays in GCC markets have to be regulation-first, with compliance, Sharia governance and data controls designed into the product from day one.

Is BNPL in MENA an Opportunity or a Bubble in the Making?

MENA consumers and lenders are less exposed than some Western markets because BNPL penetration is still modest, providers focus on small-ticket transactions and regulators intervene early with licensing, caps and affordability rules. However, if funding dries up or underwriting is too loose, highly leveraged providers and overextended young customers could still face stress, particularly in markets with weaker supervision.

Credit risk, defaults and over-indebtedness in GCC BNPL

In practice, GCC BNPL defaults are still manageable, helped by salary-deducted repayments, ID-linked data and closed-loop ecosystems. But over-indebtedness is a real risk for young users juggling multiple apps.

Boards should insist on.

Clear and capped late-fee policies

Soft credit checks and spending limits

Extra care for segments using BNPL for essential expenses like groceries and utilities

That last segment is already visible in Tabby’s 2024 shopper report, which highlights growing BNPL usage for everyday spend.

Funding, profitability and global sentiment

BNPL is capital-intensive. If global investors sour on the model, the cost of funding could jump and weaker players in Manama or Muscat may struggle to roll over facilities. The strongest MENA firms are racing to become full fintech platforms — adding cards, savings and merchant services — to diversify revenue beyond pure merchant discount fees.

For GCC investors, this is less about raw GMV and more about whether BNPL providers can evolve into durable, regulated consumer finance and payments platforms.

Why GCC BNPL may be more resilient than Western markets

Compared with US or European players, GCC BNPL operates under stricter licensing, smaller ticket sizes and a cultural bias toward installments rather than revolving debt. Sharia positioning, a regulation-first mindset and an existing installment culture for cars, electronics and school fees all support a more disciplined trajectory — if governance keeps up.

In other words, buy now pay later MENA looks more like a long-term “regulated experiment” than an uncontained bubble, but only if boards keep underwriting standards tight.

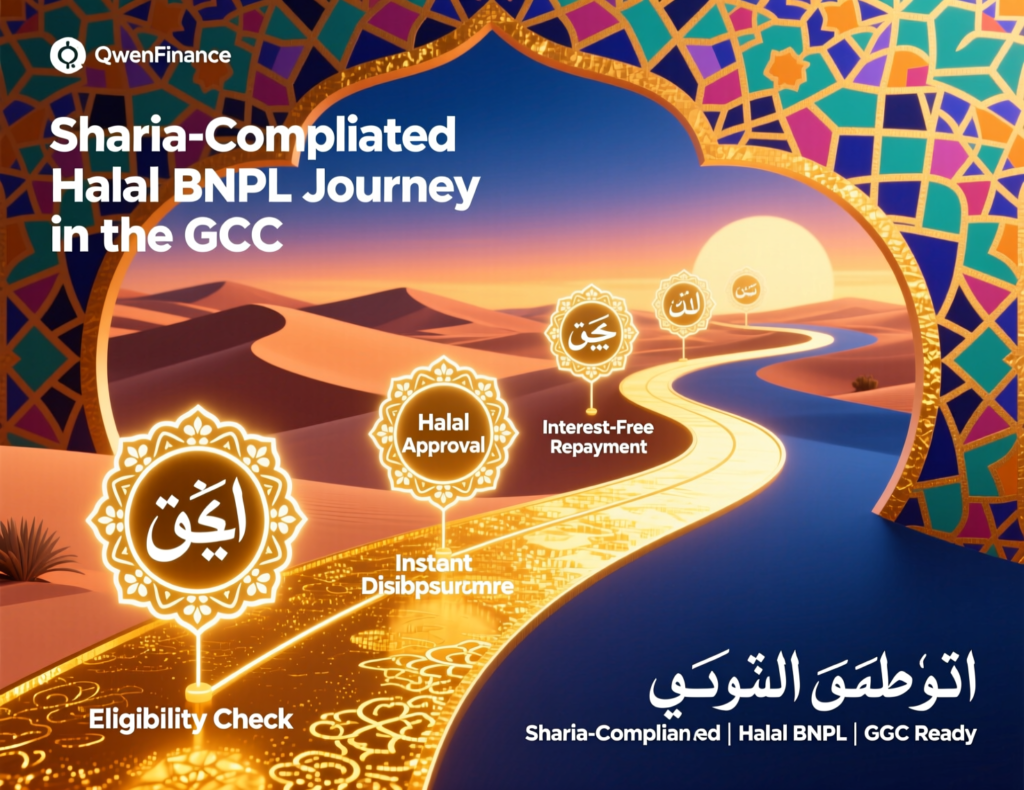

Why Sharia Compliance and “Halal BNPL” Matter in GCC

How providers frame “no interest, no riba” vs traditional credit

Most leading GCC BNPL brands market themselves as interest-free, with no riba, and emphasise fees charged to merchants rather than consumers. When they do charge consumers (for late payments or premium features) they rely on local Sharia boards to review structures and issue fatwas.

Done well, this allows BNPL providers to sit comfortably inside Islamic finance expectations while still scaling modern digital experiences.

Islamic BNPL structures and compliance debates

Many “halal BNPL” models resemble short-term Murabaha-style arrangements or fee-based payment services layered on top of merchant contracts, rather than long-term loans. Scholars still debate boundaries for example, whether repeated late fees start to look like interest but the direction is clear: products must avoid gharar (excessive uncertainty) and obvious exploitation.

For product teams, that means Sharia governance is not just paperwork; it shapes fee design, dunning journeys and product copy.

Impact of Sharia branding on adoption in Saudi, UAE and Qatar

In Saudi Arabia and Qatar particularly, Sharia branding is a real conversion driver: parents feel safer using a Sharia-compliant plan to spread school fees; young professionals in Jeddah or Doha feel better about using BNPL for essentials.

In Dubai, Sharia-compliant pay-later solutions also appeal to expats who prefer ethical or transparent finance, even if they are not Muslim. This combination of religious trust and ethical branding is one reason buy now pay later MENA adoption has moved so quickly beyond pure fashion and electronics.

How GCC Merchants and Startups Can Use BNPL Safely

GCC merchants can use BNPL to lift conversion and average order value by offering it at checkout for well-defined use cases, while capping order sizes, monitoring repeat usage and partnering only with regulated providers. A simple playbook choose the right use cases, due diligence providers, integrate carefully and monitor portfolio risk lets e-commerce, travel, healthcare and education brands benefit without importing credit risk to their own balance sheet.

Best BNPL use cases for e-commerce, travel, healthcare and education

For Riyadh and Dubai e-commerce, BNPL works best for mid-ticket fashion, electronics and home goods — the sweet spot where installments meaningfully smooth cash flow but baskets are still manageable. For travel, it fits flights and packages booked via portals built on robust web development services.

Healthcare and education in Doha or Abu Dhabi can use BNPL for elective procedures and tuition installments, but should add stricter limits, enhanced KYC and clearer disclosures. In all cases, aligning journeys with your wider GCC web strategy and UX approach is crucial.

Key questions to ask BNPL providers before integrating

Turn this into a simple step-by-step checklist:

Regulation & Sharia

Are you licensed (or partnered with a licensee) under SAMA, CBUAE, QCB or CBK, and do you have current Sharia board opinions?

Fees & economics

What are your merchant fees, settlement timelines and chargeback rules?

Risk & data

Who holds the credit risk you or us and what data will we see in dashboards or via APIs (ideal if you already use business intelligence services)?

Customer support

How are disputes handled, in Arabic and English, across WhatsApp, call centres and in-app chat?

Tech fit

Can you integrate cleanly into our web stack (Next.js, Shopify, WooCommerce) and mobile apps without harming performance or SEO ideally via modern front-end and Next.js architectures?

Managing risk.

For GCC brands, “safe BNPL” typically means:

Setting sensible BNPL limits per customer and per basket.

Requiring affordability checks for bigger tickets, especially in healthcare, automotive and education.

Designing clear Arabic and English UX so users know repayment dates, late fees and how to get support a natural fit with modern bilingual GCC web and mobile app development standards.

Using data and analytics to track conversion uplift, default rates and repeat usage by segment, powered by a solid business intelligence stack.

When BNPL is treated as a core payment rail, not a cosmetic widget, merchants can capture uplift without taking on surprise risk.

What GCC Regulators, Investors and Founders Should Watch Next

Data, AI underwriting and potential bias in GCC BNPL models

The next frontier is AI underwriting using telco, wallet and open banking data. While this promises better risk models and lower defaults, it also raises questions about bias and exclusion especially if certain nationalities, income brackets or neighbourhoods in Dubai, Riyadh or Kuwait City are quietly down-weighted.

Boards should push for.

Transparent model governance

Regular bias audits

Clear escalation paths when customers are declined

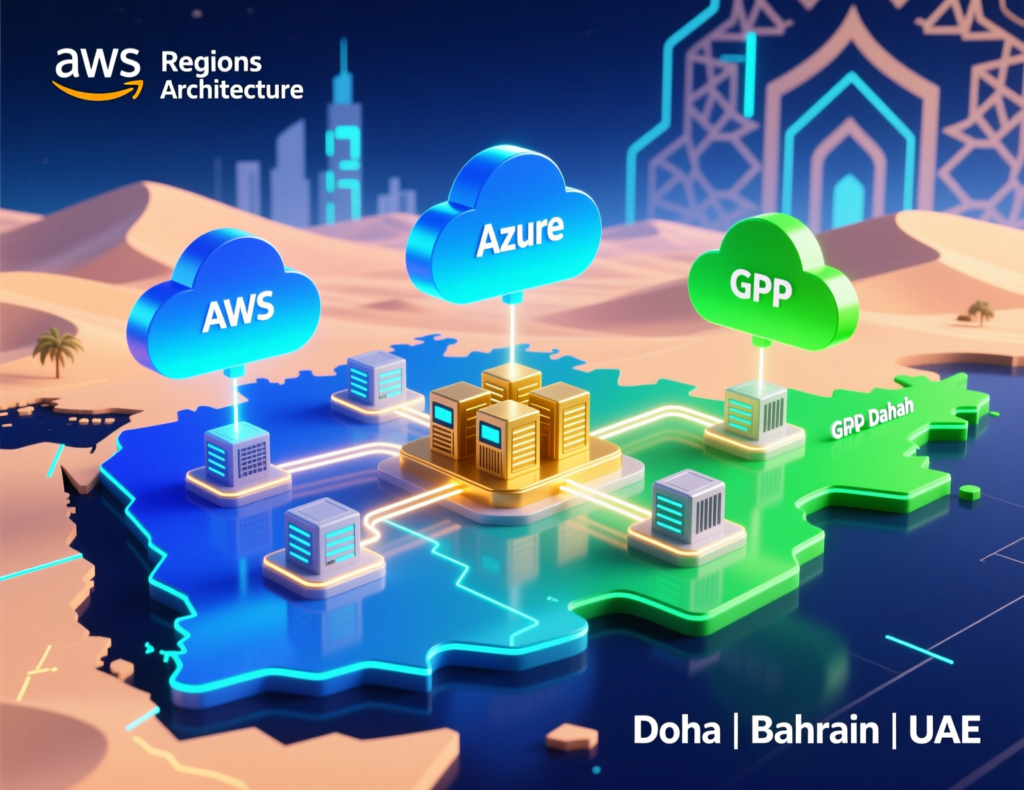

Data residency, cross-border flows and cloud.

BNPL platforms increasingly run on cloud regions like AWS Bahrain, Azure UAE Central and GCP Doha. Boards must ensure compliance with NDMO in Saudi, TDRA cloud guidelines in the UAE and QCB data rules in Qatar, especially when data is replicated in EU or US regions for analytics.

For engineering teams, this is where headless and composable architectures help keep BNPL components flexible while respecting data residency.

Three scenarios for BNPL in MENA by 2030: healthy, frothy or burst

By 2030, BNPL in MENA could be:

Healthy: tightly regulated, integrated with banks, profitable and relatively boring.

Frothy: high growth with thin margins and noisy valuations.

Burst: if funding collapses and regulation lags local innovation.

Most signs today point to the “regulated growth” path but only if regulators, investors and founders keep talking to each other and treat buy now pay later MENA as a long-term structural shift, not a passing trend.

BNPL in MENA Regulated Experiment, Not Just a Bubble

Quick recap

The opportunity is clear: BNPL can boost conversions for GCC merchants, provide transparent consumer credit alternatives for young Arabs and accelerate fintech innovation from Riyadh to Dubai and Doha. For most sophisticated players, buy now pay later MENA looks less like a speculative fad and more like a regulated experiment in modern, Sharia-conscious consumer finance.

The winners will be providers that treat regulation, Sharia governance and data ethics as product features, not as paperwork.

Risk checklist for boards, investors and founders in the region

If you sit on a board or investment committee, your BNPL checklist should cover:

Licensing and capital strength

Governance and Sharia oversight

Underwriting quality and default management

Data residency and cloud architecture

Arabic/English UX clarity

Resilience of funding and path to profitability

Next steps for GCC companies exploring BNPL partnerships

For GCC organisations, BNPL should be approached like any critical payment rail: architected, not improvised.

That may mean revisiting your e-commerce platform, mobile apps and data stack with a partner experienced in GCC web development, front-end engineering, mobile UX and analytics so BNPL is embedded cleanly across touchpoints not bolted on as an afterthought.

If you’re a bank, retailer, super app or fintech in Saudi Arabia, the UAE or Qatar and you’re trying to decide whether buy now pay later MENA is an opportunity or a bubble, you don’t have to guess.

Mak It Solutions can help you review your current web and mobile stack, assess BNPL integration options and design GCC-ready journeys that respect regulation, Sharia and data residency.

From modern e-commerce builds to analytics architectures that track BNPL performance by city, segment and provider, our team can turn this “regulated experiment” into a real growth lever for your business. Reach out to Mak It Solutions to schedule a BNPL strategy workshop tailored to your GCC roadmap.

FAQs

Q : Is buy now, pay later allowed in Saudi Arabia under SAMA’s latest rules?

A : Yes. Buy now, pay later is allowed in Saudi Arabia, but only under SAMA’s 2023 Rules for Regulating Buy-Now-Pay-Later Companies, which treat BNPL as a supervised finance activity. Licensed providers must meet capital and governance requirements, follow consumer protection rules and carry out basic affordability assessments, while partnering merchants in Riyadh, Jeddah and other cities must ensure clear disclosures at checkout. For Saudi founders, the key is to treat BNPL as part of the Vision 2030 financial sector programme, not as a quick side feature

Q “: Which BNPL apps actually work for shoppers in Qatar today?

A : In Qatar, QCB is building a regulated BNPL ecosystem through its fintech sandbox and BNPL regulation. Consumers in Doha can already use PayLater, a homegrown BNPL provider that has been approved by QCB and is progressively rolling out across e-commerce, retail and service merchants. Other regional players may enter via partnerships, but QCB’s priority is clear: only regulated or sandboxed BNPL providers can operate at scale, aligning with Qatar National Vision 2030 and the country’s broader digital finance strategy.

Q : Does using BNPL in the UAE affect my credit score or future loan approvals?

A : Today, using BNPL in the UAE may not always show up like a classic loan on your credit report, but lenders increasingly look at BNPL behaviour when assessing risk. The Central Bank’s Retail Payment Services and Card Schemes Regulation already pushes providers to improve transparency and data reporting, and future open finance rules are likely to make BNPL usage more visible to banks. That means frequent late payments or heavy reliance on BNPL could eventually influence how lenders view mortgage, car or personal loan applications, even if the exact mechanics differ from traditional credit cards.

Q : Are Sharia-compliant BNPL plans in Kuwait and Bahrain really interest-free?

A : Kuwaiti and Bahraini BNPL providers that market themselves as Sharia-compliant typically avoid explicit interest, instead charging merchants or using carefully structured fees approved by local Sharia boards. Deema, for example, is Kuwait’s first licensed BNPL app under CBK, positioning itself as Sharia-certified and focused on transparent installments. However, consumers should still read terms carefully: repeated late fees, unclear charges or aggressive upselling can undermine the spirit of Sharia compliance even if the headline says “no interest”. As with any Islamic finance product, it’s wise to check the Sharia board credentials and fatwa documents where available.

Q : How can a Saudi or UAE e-commerce store choose the right BNPL partner for its customers?

A : A Riyadh or Dubai e-commerce store should start by filtering BNPL providers by licence status (under SAMA or CBUAE), Sharia credentials and experience in its specific vertical, whether that’s fashion, electronics, logistics, healthcare or education. From there, merchants should compare fees, settlement times, dispute processes, Arabic/English support and technical integration options with their existing web stack and mobile apps. Aligning with national agendas like Saudi Vision 2030 and the UAE’s digital government and financial inclusion strategies means prioritising partners that take regulation and data residency seriously not just those offering the highest short-term conversion uplift.