IT Brain Drain in Arab Countries: GCC at a Crossroads

IT Brain Drain in Arab Countries: GCC at a Crossroads

IT Brain Drain in Arab Countries: GCC at a Crossroads

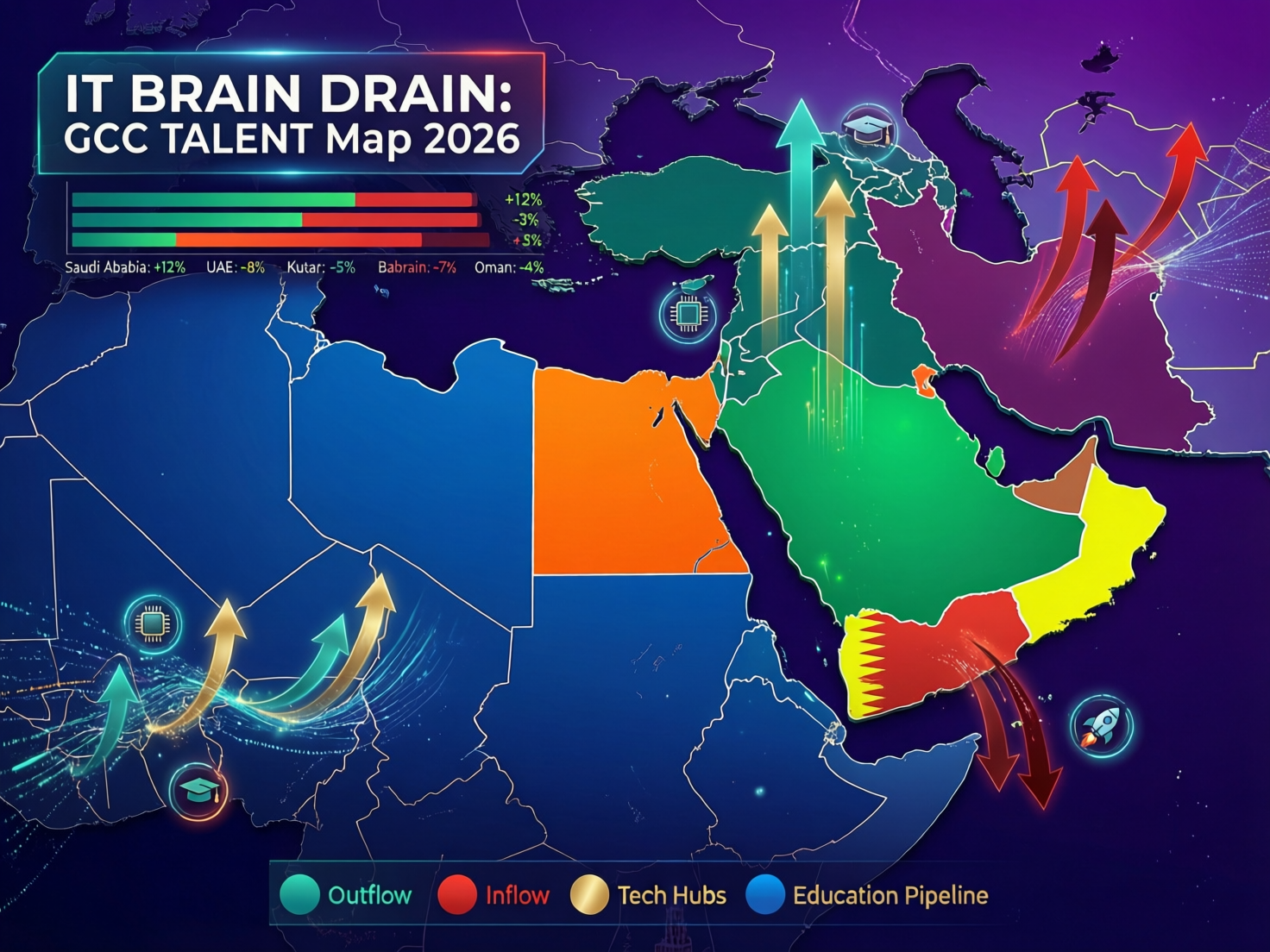

IT brain drain in Arab countries is the steady loss of software engineers, data talent, and IT specialists to global hubs like Europe and North America, plus remote-only jobs with foreign companies. For GCC countries such as Saudi Arabia, the UAE, and Qatar, reversing this trend means combining smart visas, competitive workplaces, and clear digital-economy policies so Arab tech talent sees Riyadh, Dubai, and Doha as long-term homes not just stepping stones.

Introduction

Picture a 27-year-old Saudi mobile developer in Riyadh with offers from a local Vision 2030 mega-project and a Berlin startup. Or a Palestinian engineer in Dubai choosing between a Golden Visa path and a fully remote role with a Toronto SaaS company. In thousands of quiet decisions like these, IT brain drain in Arab countries is decided every day.

Across the GCC, governments are pouring billions into AI, cloud, and digital government but still report chronic shortages of senior developers, data engineers, cybersecurity experts, and product leaders. Cloud regions in Bahrain, the UAE and Doha are live, yet teams struggle to hire people who can actually build on them.

The reality is nuanced: there is human capital flight in the Middle East, but GCC hubs like Riyadh, Dubai, Abu Dhabi and Doha are also magnets for regional talent. The real question is whether the GCC can choose a strategy that turns this from “brain drain” into “brain circulation” through better policy, incentives and remote work models.

What Is IT Brain Drain in Arab Countries Today?

From Cairo to Dubai.

When we talk about IT brain drain in Arab countries, we mean skilled engineers, architects, data scientists and UX designers leaving their home markets Egypt, Lebanon, Jordan, Iraq, Tunisia for better-paid or more stable roles elsewhere. This “human capital flight in the Middle East” no longer moves only West; it also moves into Gulf cities like Dubai, Riyadh and Doha.

Dubai and Abu Dhabi attract Arab developers from Cairo and Amman; Riyadh pulls Jordanians and Sudanese engineers into fintech and government digital projects; Doha pulls in cloud, data and cybersecurity talent through Qatar National Vision 2030 programs. At the same time, some Saudis, Emiratis and Qataris themselves leave for research roles or elite product teams abroad, so the GCC is both a destination and a launchpad.

Where Arab Software Engineers Go.

For many Arab developers, the classic path is still Canada, the UK, the US, Germany or the Netherlands. These hubs offer deep tech ecosystems, transparent promotion ladders, and sometimes easier routes to permanent residency. Toronto, London, Berlin, Amsterdam, and emerging hubs like Dublin and Tallinn compete directly with Riyadh, Dubai and Doha for the same senior engineers, data leads and AI specialists.

Remote work adds a twist: Arab IT professionals can now work for a San Francisco or London company from Jeddah, Sharjah or Doha, effectively exporting their skills without physically migrating.

Why the GCC Story Is Different From the Wider Arab World

In countries like Lebanon or Egypt, IT brain drain often looks like a one-way exit from crisis to stability. In the GCC, the picture is mixed: Saudi Arabia, the UAE and Qatar are investing heavily to import Arab and global tech talent, while also trying to grow local citizens into senior roles. Initiatives around open banking in Saudi Arabia, TDRA-driven digital government in the UAE, and Qatar’s fintech and cloud strategies all depend on this talent.

So the GCC is both affected by regional brain drain and uniquely positioned to reverse it.

What Is Driving Arab IT Professionals to Leave for Global Tech Hubs?

What is driving Arab IT professionals to leave for global tech hubs like Europe, the US, and Canada?

Most Arab IT professionals leave for a mix of better salaries, clearer career paths, and work cultures where merit matters more than connections. Add easier residency rules, world-class research labs, and strong product-management cultures, and it’s obvious why thousands of developers compare Berlin, London and Toronto to Riyadh, Dubai or Doha.

Pay, Visas, and Career Paths in Europe and North America

Global hubs typically benchmark salaries to the dollar or euro, offer equity, and provide transparent job levels from junior engineer to staff and principal. For a mid-level engineer in Riyadh or Dubai, a London or Toronto offer can look like a 1.5–2x jump in total compensation, even after tax. Visa programs for highly skilled workers, permanent residency tracks, and recognized universities create a predictable long-term path many Arab families value.

Bureaucracy, Hiring Practices, and English-First Workplaces

On the home side, talent often bumps into bureaucracy, inconsistent HR practices and “wasta” in hiring and promotion. Some local employers still underinvest in product culture: unclear roadmaps, weak documentation, and limited mentoring. English/Arabic UX maturity is also uneven Arabic interfaces, right-to-left layouts, and bilingual content are often afterthoughts, even in GCC public services.

Governments are trying to fix this through digital authorities like Saudi’s Digital Government Authority (DGA) and the UAE’s digital government programs, but cultural change inside organizations is slower than policy announcements.

Remote Work and Tech Migration

Remote work and tech migration now blur the line between “staying” and “leaving”. A Saudi data engineer in Dammam may work fully remote for a US fintech; an Egyptian full-stack developer in Sharjah might be on a Dutch payroll. This model brings foreign income into the region but can also hollow out local companies that can’t match salaries.

For GCC-based professionals, remote work also raises compliance questions: labor laws, personal taxation (back home or abroad), and data residency when connecting to foreign systems. Regulators like SAMA, TDRA and QCB increasingly consider these realities when writing cloud, fintech and data rules.

How Does IT Brain Drain Affect the Arab Digital Economy?

The Digital Skills Gap in MENA’s Knowledge Economy

When senior engineers, data scientists and cybersecurity experts leave, the digital skills gap in MENA widens. That slows the transition to a true knowledge economy in the Arab world, where growth comes from software, platforms and data not just oil, real estate or construction. Vision strategies in Saudi Arabia, the UAE and Qatar all talk about innovation and productivity; without enough local digital talent, those goals become harder to execute.

Impact on Innovation Ecosystems in GCC Cities

Innovation ecosystems in Riyadh, Jeddah and Dammam depend on senior engineers who can design architectures, mentor teams and ship resilient systems. The same is true for Dubai, Abu Dhabi and Sharjah, where free zones and startup hubs need experienced CTOs and product leaders, not just junior coders.

To support these ecosystems, many companies partner with external teams for web development services or specialized Next.js development services, especially when they can’t hire quickly enough in-house.

Sector-Level Risks.

In fintech, open banking frameworks led by SAMA in Saudi Arabia and QCB in Qatar require teams fluent in secure APIs, data standards, and regulatory reporting. E-government platforms Saudi’s unified digital services, UAE Pass, Qatar Digital ID rely on secure cloud and identity engineers.

If this talent is missing, progress in national AI programs, health data platforms and logistics optimization slows, increasing dependence on foreign vendors.

Why Are GCC Countries Facing a Tech Talent Shortage Despite Huge Digital Investments?

Why are GCC countries facing a tech talent shortage despite huge investments in AI and digital transformation?

Because demand is growing faster than the local skills pipeline, and every government and mega-project is chasing the same small pool of senior engineers. Vision programs act like a demand shock: they create thousands of new tech roles before universities, bootcamps and mid-career upskilling can catch up.

Vision 2030, UAE AI Strategy, and Qatar National Vision 2030

Saudi Vision 2030, the UAE’s AI Strategy and Qatar National Vision 2030 all prioritize cloud, AI, data and digital government, with dedicated programs under the National Transformation Program and similar initiatives. Each announcement from new data centers in the UAE to fresh AI investments adds more demand for scarce skills.

GCC Tech Talent Gap by 2030.

By 2030, most GCC states aim to localize significant shares of private and public tech roles, not just outsource to expatriates. Yet senior cloud architects, product managers and security specialists take a decade to grow. The result is a “GCC tech talent gap by 2030”: fierce competition between ministries, banks, telcos and startups for the same CVs, often pushing salaries up without always improving work culture.

The Salary and Lifestyle Equation.

On paper, tax-free salaries and family-friendly benefits in Riyadh, Dubai, Abu Dhabi and Doha are attractive. But engineers compare more than take-home pay: cost of housing, schooling, long-term residency options, and the ability for spouses to work.

London or Amsterdam may offer less net income but more predictable residency, diverse tech ecosystems and flexible remote/hybrid policies. Cities like Riyadh and Dubai are rapidly improving on these fronts premium residencies, Golden Visas, and more but the comparison is still live in every senior engineer’s head.

How Can Saudi Arabia, the UAE, and Qatar Reverse the Arab Tech Brain Drain?

How can Saudi Arabia, the UAE, and Qatar design incentives to reverse the Arab tech brain drain?

By aligning visas, work culture and digital policies around what top engineers actually value: stability, meaningful work, modern engineering practices, and remote-friendly flexibility. When GCC countries combine premium residency, startup-friendly regulations and truly attractive workplaces, many Arab tech professionals will choose to build their careers in the region or come back from abroad.

Visas, Residency, and Free Zones Designed for Tech Talent

Saudi’s Premium Residency (“Green Card”), the UAE’s Golden Visa for programmers, and Qatar’s free zones (like QFC and innovation parks) are tangible levers to attract and retain talent. Free zones such as ADGM and DIFC already operate as fintech magnets, combining regulatory sandboxes with global-standard company structures.

When these visa and free-zone frameworks are paired with clear fintech and cloud regulations such as SAMA’s Open Banking Policy or TDRA’s cloud service provider framework they give Arab engineers confidence that the ecosystem is serious and long-term.

Building Attractive Workplaces.

GCC employers can’t compete on visas alone. They need product cultures where roadmaps are clear, engineers talk directly to users, and releases are frequent but safe. Remote- and hybrid-friendly policies matter too; many senior engineers will happily stay in Riyadh or Dubai if they can work part-time from Jeddah, Sharjah or even abroad, while still complying with local labor and data rules.

Investing in bilingual Arabic/English UX proper right-to-left design, localized content, and Arabic-first research—is another differentiator. It lets Arab engineers build products that actually serve their communities, not just global templates.

Turning the Arab Tech Diaspora Into a Strategic Asset

Thousands of Arab engineers now work at global giants in London, Berlin, Toronto and Silicon Valley. GCC governments and corporates can turn this diaspora into an asset: remote advisory roles, visiting professorships, short-term secondments, and targeted “return home” packages for founders and senior specialists.

Programs that co-fund diaspora-led startups or research labs in Riyadh, Dubai, Abu Dhabi and Doha create “brain circulation” instead of one-way brain drain.

How Can GCC Governments, Regulators, and Universities Build a Sustainable Pipeline of Local Tech Talent?

Aligning Education With the GCC Digital Economy

To close the skills gap long-term, GCC states need a clear, step-by-step plan that aligns education with real jobs:

Map skills to projects

Ministries and regulators (MCIT in Saudi, TDRA in the UAE, Qatar Digital Government) publish concrete skills lists tied to live initiatives open banking, digital ID, smart cities.

Modernize curricula and bootcamps

Universities partner with coding bootcamps in Saudi Arabia and similar programs across the GCC to add cloud, DevOps, data engineering and security tracks aligned with AWS Bahrain, Azure UAE and GCP Doha regions.

Co-op and apprenticeship programs

Riyadh, Dubai and Doha employers co-design semester-long placements and junior rotations so graduates ship real code before they even graduate.

Measure outcomes, not inputs

Governments track job placement, salary growth and startup creation not just number of graduates to adjust funding and visas.

Role of SAMA, TDRA, QCB, and Digital Government Authorities

Regulators are not just rule-makers; they can be talent accelerators. SAMA, TDRA, QCB, the Saudi DGA and UAE/Qatar digital government bodies can:

Embed skills requirements into licenses and sandboxes (e.g., fintechs must demonstrate strong local engineering teams).

Incentivize data residency and cloud-region usage so local engineers learn on real platforms, not just theory.

Clarify remote-work compliance so GCC-based engineers can work with global clients without legal grey zones.

Fund scholarships tied to return commitments in fintech, AI, cybersecurity and digital government.

From Brain Drain to Brain Circulation: A Shared GCC Human Capital Strategy

Because talent moves across borders, the response should be regional, not just national. A practical brain circulation roadmap could include.

Shared tech visas

Fast-track permits that let an engineer move between Riyadh, Dubai, Doha, Kuwait City, Manama and Muscat without starting from zero.

Cross-border sandboxes

Joint fintech and AI sandboxes run by SAMA, TDRA, QCB and others, so startups can test once and scale across markets.

Regional scholarships and research grants

Funding at HBKU, QCRI, KAUST and UAE universities that explicitly supports cross-GCC mobility.

Common skills frameworks

Shared digital skills standards so a “senior cloud engineer” in Doha means roughly the same thing in Riyadh and Dubai.

If Gulf countries treat tech talent like a shared strategic asset rather than competing in isolation they can turn today’s IT brain drain in Arab countries into a platform for regional strength.

If you’re a policymaker, HR leader, or founder in the GCC, now is the moment to stress-test your talent strategy against this reality. Are your projects, products and policies designed for the engineer deciding between Riyadh and Berlin, Dubai and Toronto, Doha and a fully remote role?

If you’re serious about reducing IT brain drain in Arab countries and building durable tech teams in the GCC, Mak It Solutions can help you design remote-ready teams, modern engineering practices, and bilingual digital products that attract and retain Arab tech talent. Explore our web development services, mobile app development services, SEO and digital growth support, and tailored Next.js and backend development offerings or talk to us directly for a custom GCC tech talent strategy. ( Click Here’s )

FAQs

Q : Is IT brain drain the same problem in Saudi Arabia as in Lebanon or Egypt, or is the GCC situation different?

A : No Saudi Arabia and the wider GCC face a different version of IT brain drain than Lebanon or Egypt. In countries with economic or political crises, brain drain often looks like a one-way exit. In the GCC, Vision 2030, UAE AI initiatives and Qatar National Vision 2030 are actively pulling in regional and global talent, even as some local citizens still head abroad. That means Saudi Arabia, the UAE and Qatar can design policies, via regulators like SAMA and TDRA, that convert this movement into brain circulation instead of permanent loss.

Q : Can Saudi and UAE-based software engineers work remotely for US or European companies while staying compliant with local rules?

A : Yes, but they need to think carefully about contracts, tax, and data rules. In Saudi Arabia, digital platforms like Qiwa and evolving labor regulations under Vision 2030 are tightening how work relationships are documented, while SAMA and other regulators set expectations around data security and cross-border finance. In the UAE, TDRA and digital government bodies oversee cloud and telecom frameworks that affect remote access to systems and data. Many engineers use local employers of record or carefully drafted consultancy agreements to stay compliant.

Q : How do tech salaries and career growth in Dubai and Riyadh compare to offers in Europe for Arab engineers?

A : In pure numbers, senior engineers in Dubai or Riyadh can earn globally competitive, tax-free packages, especially in fintech, government digital units and major enterprises. But candidates also weigh cost of living, long-term residency options, and the depth of tech ecosystems. European hubs like London, Berlin and Amsterdam may offer slightly lower net income but strong social systems, dense startup scenes and easier permanent residency. For GCC-based talent, the decision often comes down to whether local employers offer modern engineering culture, remote flexibility and clear promotion paths, not just a higher base salary.

Q : What role do regulators like SAMA, TDRA and QCB play in making the GCC more attractive for fintech and AI talent?

A : Regulators shape both the opportunity and the complexity for tech talent. SAMA’s Open Banking Framework in Saudi Arabia, for example, has created a wave of fintech demand for API, security and data skills aligned with Vision 2030. ([Saudi Central Bank][3]) TDRA in the UAE sets cloud and telecom standards that underpin AI workloads and digital government services. QCB’s Fintech Strategy in Qatar, tied directly to Qatar National Vision 2030, pushes banks and startups to build local teams around payments, open banking and regtech.

Q : Are Qatar and other GCC countries offering scholarships or programs to bring Arab tech professionals back home?

A : Yes. Qatar, Saudi Arabia, the UAE and other GCC states have expanded scholarships, research funding and startup programs tied to national visions. QCB’s fintech strategy and Qatar Digital Government initiatives align scholarships with roles in payments, cybersecurity and digital services. Saudi Vision 2030 funds digital skills and scholarship pathways in AI, data and engineering, often linked to return commitments. The UAE combines university partnerships with free zone incubators and Golden Visas to attract both returning citizens and regional diaspora talent. Together, these programs aim to make “coming back” a realistic and attractive option.