Middle East Cloud Providers for KSA, UAE & Qatar CIOs

Middle East Cloud Providers for KSA, UAE & Qatar CIOs

Middle East Cloud Providers: How GCC CIOs Should Balance Hyperscalers and Sovereign Cloud

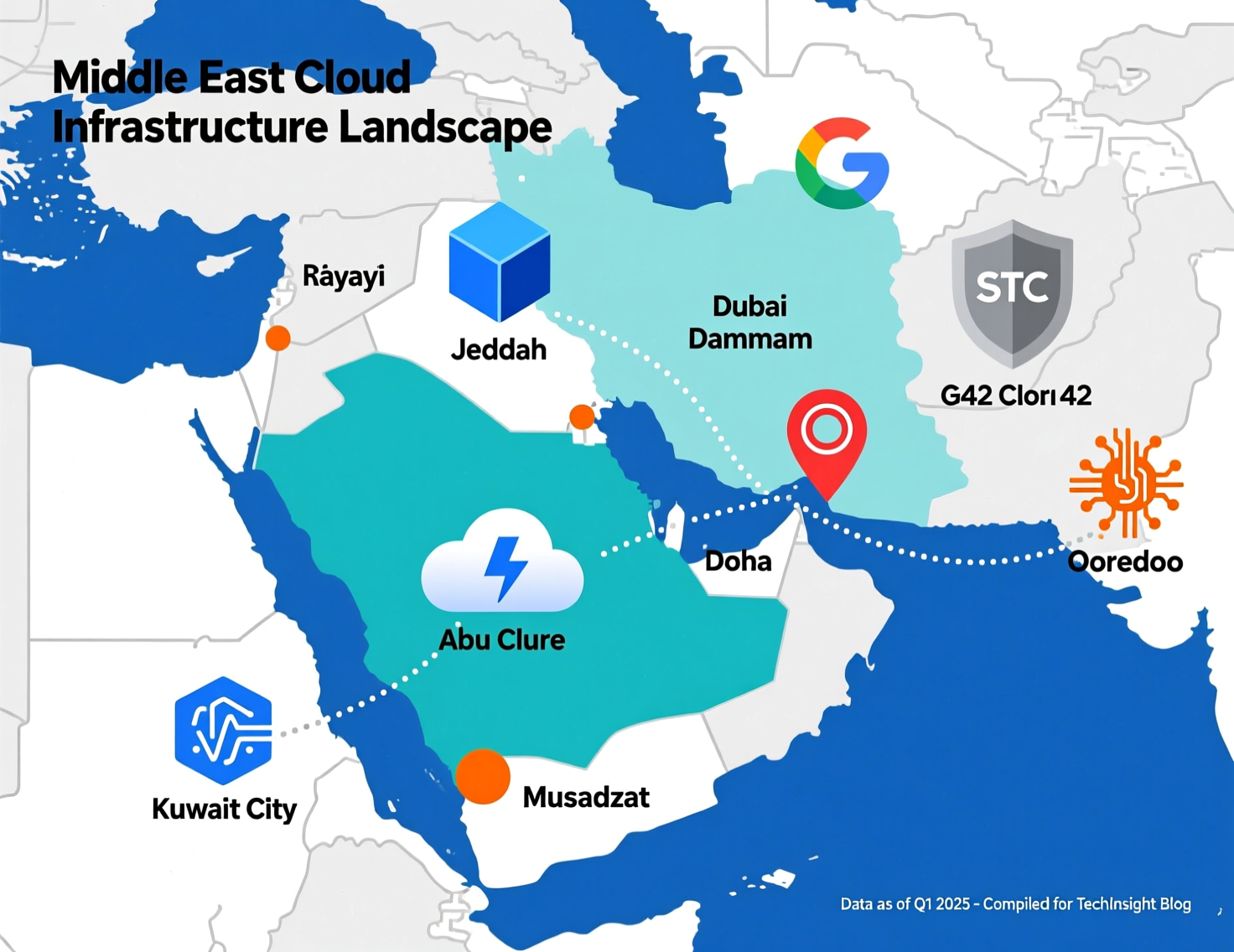

Middle East cloud providers today include both global hyperscalers like AWS, Azure, Google Cloud and Oracle, and local or sovereign platforms such as STC Cloud, G42/Core42, e& enterprise, du and Ooredoo in Saudi Arabia, the UAE and Qatar. For CIOs in Riyadh, Dubai and Doha, the winning model is usually hybrid: global cloud for innovation and regional reach, and local or sovereign cloud where SAMA, TDRA, QCB and data residency rules require in-country control.

Introduction

Middle East cloud providers now combine global hyperscalers with national and telecom-backed sovereign clouds to serve Saudi Arabia, the UAE, Qatar and wider MENA. For GCC CIOs, the practical answer is a mix: use AWS, Azure and Google Cloud for fast innovation, and rely on local or sovereign platforms when regulations, data residency and national security demand tighter control.

Across Riyadh, Dubai and Doha, cloud regions and data centers are becoming almost as strategic as oil and gas especially for AI, open banking, e-government and healthcare workloads. CIOs must reconcile global capabilities with SAMA rules in KSA, TDRA and UAE Digital Government policies in the Emirates, and QCB and MCIT requirements in Qatar. The challenge is to design a GCC-ready architecture that respects digital sovereignty without sacrificing performance or cost efficiency.

The New Landscape of Middle East Cloud Providers

Hyperscalers vs Local GCC Cloud Providers

On the hyperscaler side, AWS, Microsoft Azure, Google Cloud and Oracle Cloud all operate or have announced regions and PoPs across the Middle East, forming the backbone of regional cloud infrastructure in MENA. AWS runs Middle East (Bahrain) and Middle East (UAE) regions, each with multiple Availability Zones and edge locations. Azure offers UAE North (Dubai), UAE Central (Abu Dhabi) and Qatar Central (Doha), while Google Cloud now runs a Dammam region in KSA and a Doha region in Qatar.

Local champions focus on sovereign, telecom-integrated and sector-specific offerings: STC Cloud and other Saudi telco platforms; e& enterprise and du in the UAE; G42/Core42 in Abu Dhabi; Moro Hub and Khazna as major UAE data center and cloud operators; and Ooredoo in Qatar. Many of these providers emphasize regulated workloads on cloud in GCC markets, with in-country operations, Arabic support and local SLAs that hyperscalers alone may not match.

Crucially, joint-venture “sovereign cloud” models are emerging: Microsoft partnering with G42/Core42 in the UAE, and Oracle working with stc and other national players in KSA to deliver regulated and AI-ready platforms under local jurisdiction.

Where Are the Middle East Cloud Regions and Data Centers?

Today, GCC workloads can sit in AWS Bahrain (serving Manama, Riyadh and Jeddah with sub-regional latency) or AWS UAE (well placed for Dubai, Abu Dhabi, Sharjah and Muscat), complemented by CloudFront edge locations across the Gulf. Azure’s UAE and Qatar regions give low-latency access for users in Dubai, Abu Dhabi and Doha, while Google Cloud’s Dammam and Doha regions add further options for Saudi and Qatari workloads.

Neutral colocation and data center specialists such as Khazna in the UAE or other GCC hubs provide carrier-neutral facilities where both hyperscalers and local operators deploy infrastructure. These hubs are gradually forming an informal “GCC data grid” that ties together Riyadh, Jeddah, Dammam, Dubai, Abu Dhabi, Doha, Manama, Kuwait City and Muscat with dense peering and regional backbones.

Why GCC Governments Are Accelerating Cloud Adoption

GCC governments see cloud as a pillar of national transformation agendas: Saudi Vision 2030, the UAE Digital Economy Strategy and Qatar’s national digital programs all call for digital government, advanced analytics and AI at scale. AI-powered services, smart cities (from NEOM to Dubai Smart City to Lusail), open banking and e-government portals generate demand for hyperscale data centers in the Middle East and sovereign solutions for sensitive data.

As a result, digital sovereignty and local control over citizen, financial and health data have become board-level topics. Regulators increasingly expect critical workloads to follow national data strategies and classification schemes, making the choice between local and global Middle East cloud providers a strategic governance decision, not just a technical one.

How Middle East Cloud Providers Compete with AWS & Azure

Latency and Performance for Riyadh, Dubai and Doha

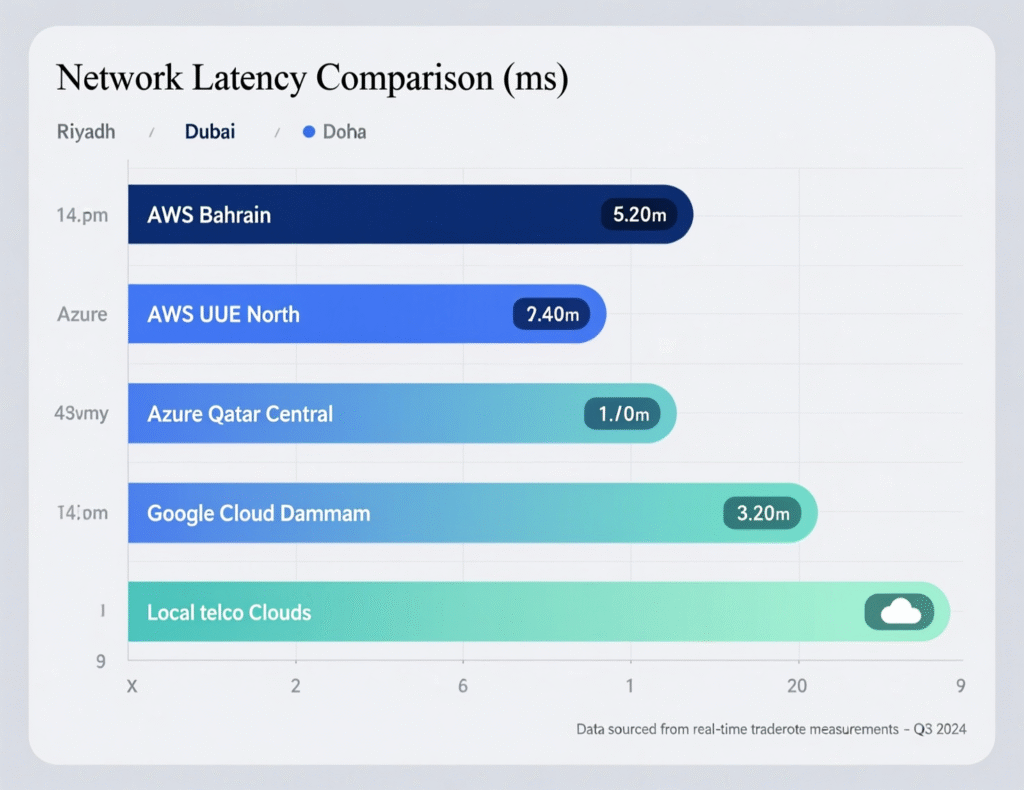

For customer apps in Riyadh or Jeddah, hosting in AWS Bahrain or UAE often delivers good latency, but ultra-low-latency use cases like trading, payment switching or core banking may benefit from Saudi-based clouds such as STC Cloud or in-country PoPs and edge nodes. Similarly, Dubai and Abu Dhabi users typically see strong performance from Azure UAE North or AWS UAE, while local providers and telcos can push latency even lower for smart city, IoT and video workloads.

In Doha, Azure Qatar Central, Google Cloud Doha and Ooredoo’s local platforms give public and private sector organizations options that keep traffic close while integrating with regional services for global reach.

Pricing, Contracts and Local Currency Models

Hyperscalers tend to use standard pay-as-you-go and reserved instance models, invoiced in USD or EUR, which can expose GCC organizations to FX volatility and cross-border billing complexity. Local and sovereign Middle East cloud providers more often bill in SAR, AED or QAR, with contracts aligned to local law and tax requirements, and optional long-term commitments for cost predictability.

Telecom-operated clouds in KSA, UAE and Qatar frequently bundle connectivity, security, managed monitoring and even application support, whereas hyperscalers typically offer infrastructure à-la-carte and rely on partners or in-house teams for managed services. For many GCC CIOs, partnering with a provider such as Mak It Solutions for architecture and operations on top of these platforms becomes a practical way to bridge the gap.

Support, Language and Account Management

In practice, a big differentiator is human experience. Local clouds and integrators often provide bilingual Arabic/English support, on-site engineers in Riyadh, Dubai and Doha, and account managers who understand local procurement, governance and Sharia-compliant finance.

Hyperscalers bring huge partner ecosystems and advanced services (from serverless to advanced analytics), but hands-on help is usually routed through partners. GCC organizations increasingly look for teams that can design cloud-native architectures, from web development services to complex business intelligence platforms, with local language and culture in mind.

Data Residency, Sovereign Cloud and GCC Compliance

What Data Residency Really Means in KSA, UAE and Qatar

Data residency simply means where your data is stored and processed; data localization implies that certain categories must remain within national borders and under local law. In the GCC, this typically applies to citizen data, financial records, national ID systems and sensitive health information.

For example, a Riyadh hospital may keep patient data inside KSA while using regional cloud infrastructure in MENA for anonymized research, and a Dubai government entity may store citizens’ UAE Pass records inside the UAE while consuming global AI APIs. Qatar’s public sector can follow a similar pattern by keeping Qatar Digital ID and Hukoomi portal data in local regions while scaling some workloads across the wider Middle East.

Key GCC Regulators and Cloud Frameworks

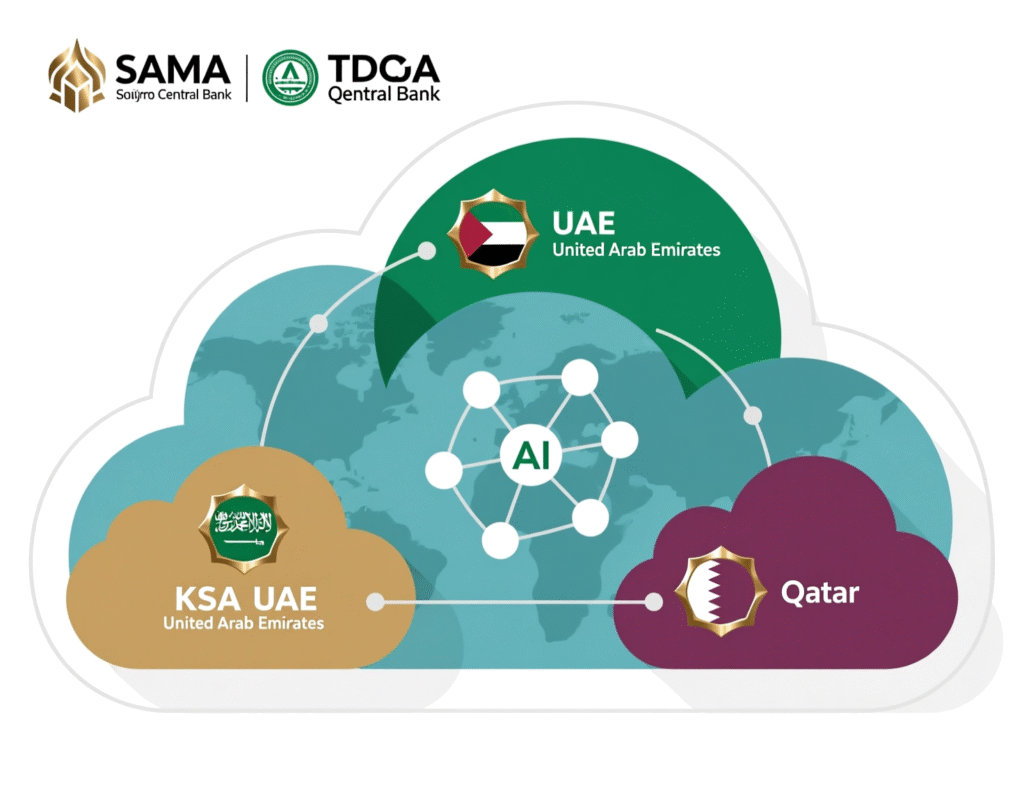

In Saudi Arabia, the SAMA cloud framework, NDMO data classification policies and SDAIA/DGA guidelines together define how banks and government entities may use public, hybrid and sovereign cloud. The UAE combines TDRA regulations, UAE Digital Government policies and financial free-zone rules from ADGM and DIFC to govern data processing and outsourcing. Qatar’s QCB guidance for banks and MCIT/Hukoomi policies for e-government play a similar role.

For GCC CIOs, mapping workloads to these frameworks is as critical as picking between providers. Many organizations work with specialized partners to align architectures, documentation and controls with local regulators while still using advanced cloud patterns such as SSR/SSG for high-performance web experiences.

How Sovereign Cloud Works in the Middle East

Sovereign cloud in the GCC usually means infrastructure hosted in-country, operated by a locally controlled entity (often telecom or government-backed), with strict controls on data location, access and jurisdiction. Examples include STC sovereign cloud offerings, G42/Core42 platforms in the UAE and national cloud initiatives across the region.

Joint solutions such as Microsoft G42 and Oracle stc combine hyperscaler technology with local operations so that encryption keys, support staff and legal oversight remain under national control. Typical features include in-country data storage, local key management, restricted admin access and contracts governed by Saudi, UAE or Qatari law a model increasingly attractive for banking, government and defense workloads.

Industry Use Cases for Local and Sovereign Cloud in GCC

Government and Smart Cities in Riyadh, Dubai and Doha

GCC governments are building e-government platforms, digital IDs and national portals on a mix of sovereign and hyperscale cloud. UAE Pass and UAE Digital Government services heavily leverage cloud-native architectures hosted in UAE regions, while Qatar’s Digital ID and Hukoomi portals rely on local hosting aligned with national policies.

In Riyadh, Vision 2030 megaprojects and smart city initiatives often combine local Saudi clouds for citizen systems with global cloud for analytics and AI experiments. Dubai and Doha use similar patterns for transport, utilities, tourism and mega-events all driving demand for resilient, compliant Middle East cloud providers.

Banking, Insurance and Sharia-Compliant Fintech

A typical Riyadh fintech startup building open banking APIs will often prototype on AWS or Azure, then shift core workloads to a SAMA-aligned sovereign or telecom-operated cloud as it progresses toward production and licensing. Traditional banks in KSA and Qatar frequently keep core banking, AML and payments on sovereign or private cloud while using global regions for less sensitive channels and analytics.

Insurance firms and Takaful operators across the GCC face similar patterns: they want the elasticity and rich services of hyperscale data centers in the Middle East, but must prove to SAMA, TDRA or QCB that customer data never leaves the approved jurisdiction without the right safeguards.

Startups and Digital-Native GCC Companies

Digital-native startups in Dubai Internet City, Abu Dhabi’s Hub71, Riyadh’s startup hubs or Doha’s free zones often start 100% on AWS, Azure or Google Cloud for speed. As they win B2G or banking clients, they introduce local cloud providers for specific regulated datasets, creating a multi-cloud architecture by necessity rather than by design.

You might see a SaaS vendor hosting its core platform in Azure UAE North, sensitive Saudi banking tenants on STC Cloud, and Qatar public sector tenants in a local sovereign environment all fronted by a single application layer developed by partners like Mak It Solutions using modern web and mobile stacks.

Cost, Latency and Commercial Trade-Offs Across Providers

Cost Structures for Local vs Global Cloud

Total cost of ownership spans compute, storage, bandwidth, managed services, security tooling and compliance overhead. Global public cloud can be cheaper for elastic, internet-facing workloads, while sovereign or private cloud options may carry a premium due to specialized facilities, governance and dedicated capacity.

For regulated workloads, that premium is often non-negotiable: complying with SAMA, TDRA or QCB rules can be cheaper than regulatory findings or forced remediation later. Many GCC firms use external experts to model TCO, often combining cloud-native development, front-end and back-end services, and e-commerce solutions into a single transformation roadmap.

Latency, Peering and Data-Gravity Considerations

Placing data near users in Riyadh, Jeddah, Dubai, Abu Dhabi, Doha, Manama, Kuwait City or Muscat reduces latency and improves UX, especially for mobile-first audiences. Regional backbones, subsea cables and IXPs are steadily turning the Gulf into a tightly interconnected mesh, where careful choice of region and peering can shave milliseconds off response times.

Data gravity also matters: the more data you store in a given region, the harder it becomes to move later. That’s why many GCC architects plan “data domains” aligned to countries (KSA, UAE, Qatar) and sectors (government, fintech, healthcare, oil & gas, logistics, retail) from day one.

Lock-In, Jurisdiction and Geopolitics

Vendor lock-in is a concern with both hyperscalers and local providers, especially when proprietary services are used heavily. A multi-cloud or hybrid approach, with clear exit plans and portability (containers, Kubernetes, open databases), can reduce risk and support negotiable contracts.

Jurisdiction and geopolitics add another layer: foreign-headquartered providers may be exposed to extra-territorial regulations, while local providers may be closer to national policies but less global. Sovereignty clauses, local arbitration and data residency commitments in contracts can help balance these pressures for GCC organizations.

Best Practices for GCC CIOs Choosing a Cloud Strategy

Map Workloads by Data Sensitivity and Regulation

Start by classifying workloads according to SAMA/NDMO categories in KSA, TDRA and UAE Digital Government standards in the Emirates, and QCB/MCIT guidance in Qatar (public, internal, confidential, restricted). Highly regulated data, such as core banking, citizen IDs or clinical systems, should default to sovereign or in-country cloud, while less sensitive analytics, content sites or marketing systems can safely use global public cloud regions.

This mapping becomes your single source of truth when auditors, regulators and boards ask why a workload sits in Bahrain, UAE, Dammam, Riyadh or Doha.

Design a Hybrid/Multi-Cloud Architecture for GCC Realities

A practical pattern is “global for innovation, local for regulated data.” That might mean using AWS or Azure for AI, analytics and developer tooling, while placing payment engines, national ID systems or bank cores on STC Cloud, G42/Core42, e&/du or Ooredoo Qatar. Service meshes, APIs and integration layers help connect these worlds securely.

Specialized partners can design architectures that combine web applications, mobile apps and business dashboards across multiple providers, while keeping governance, observability and security consistent.

Build an Evaluation Checklist for KSA, UAE and Qatar

Before committing, GCC CIOs should build a provider checklist: in-country region or PoP presence, regulatory attestations (SAMA, TDRA, QCB), data residency guarantees, Arabic-language support, SLA terms, exit strategy and migration tooling. Ask how each provider supports PoCs in Riyadh, Dubai and Doha, and what it takes to move from pilot to production without downtime.

Running small pilots across two or three shortlisted Middle East cloud providers lets you test latency, support quality, cost and compliance alignment before large migrations and gives you hard data to take back to the board.

If you’re a CIO, CTO or Head of Cloud working with Saudi, UAE or Qatari workloads, you don’t need to figure this alone. Mak It Solutions can help you map regulations, design hybrid and multi-cloud architectures across hyperscalers and local providers, and modernize your web, mobile and e-commerce platforms without losing compliance.

Book a consultation with our team to review your current deployments, or reach out via our contact page to discuss a tailored GCC cloud strategy aligned with SAMA, TDRA, QCB and your board’s risk appetite. ( Click Here’s )

FAQs

Q : Is AWS considered a “local” cloud provider for data residency in Saudi Arabia, UAE and Qatar?

A : AWS operates regions in Bahrain and the UAE plus multiple edge locations across the Gulf, which can help with latency and sometimes regional data residency requirements. However, for strict national localization for example, workloads governed by SAMA rules or national data laws — regulators in KSA, UAE and Qatar may still require certain data to remain within local borders or on sovereign platforms. Organizations typically treat AWS as a regional Middle East provider and then layer on data classification, encryption and residency controls to decide which datasets can be hosted there versus in local or sovereign clouds.

Q : Which Saudi cloud providers are commonly used by banks that must follow SAMA and NDMO rules?

A : Saudi banks and fintechs often work with STC Cloud and other KSA-based telecom or national clouds that can offer data centers physically located in the Kingdom, contracts under Saudi law and alignment with SAMA’s cloud computing and cyber security frameworks. Some institutions also use global cloud in a limited way (for example, for non-critical analytics) while keeping core banking, payments and AML systems on sovereign or private cloud. The pattern is usually: start from SAMA and NDMO classifications, then pick providers that can show clear evidence of compliance and local auditability.

Q : Can UAE government workloads run on Azure UAE North, or do they require a sovereign or telecom-operated cloud?

A : Many UAE government entities comfortably use Azure UAE North and UAE Central regions because they provide in-country hosting, strong security and alignment with UAE Digital Government and TDRA requirements. However, some highly sensitive workloads such as national identity systems, defense or critical infrastructure control may be routed to sovereign, telco-operated or government-backed clouds, including platforms from e&, du or G42/Core42. The decision often comes down to data classification, sector-specific regulations and risk appetite defined by each authority.

Q : How do Qatar-based organizations handle cross-border data transfers when using regional Middle East cloud regions?

A : Qatar-based organizations generally prioritize hosting government and financial data within Qatar, leveraging Azure Qatar Central, Google Cloud Doha or QCB-aligned local platforms.When they use regional Middle East cloud providers for analytics or customer-facing apps, they typically implement data minimization, pseudonymization and encryption, plus contractual controls and transfer impact assessments. For truly cross-border services, QCB and MCIT expectations guide what can be processed outside Qatar and what must remain resident, especially for banks, telcos and critical infrastructure operators.

Q : Are GCC startups forced to move from global cloud to local providers when they start serving government or banking clients?

A : They’re not always forced, but they are strongly nudged by procurement and compliance requirements. A startup that began life purely on AWS or Azure may continue using those platforms for core application logic and public content, while spinning up new tenants or data stores on KSA, UAE or Qatar sovereign clouds for government, banking or healthcare clients. Over time, this creates a natural hybrid or multi-cloud model. Working with experienced partners helps startups refactor architectures, harden security and document controls so that they meet SAMA, TDRA, QCB or other regulators without losing the speed and flexibility that made them competitive in the first place.