Middle East Data Centers Guide for GCC Investors

Middle East Data Centers Guide for GCC Investors

Middle East Data Centers: How KSA, UAE and Qatar Became the New Desert Cloud Hubs

Middle East data centers in Saudi Arabia, the UAE and Qatar are rapidly evolving into hyperscale, AI-ready hubs that serve users across Europe, Asia and Africa with low latency and strong data-sovereignty controls. For global SaaS and AI leaders, this means you can now host regulated, Arabic-first and GPU intensive workloads in-region, while staying aligned with CST, TDRA, CRA and central-bank requirements.

Introduction

From “desert and oil” to “cloud and GPUs”, Middle East data centers are quietly becoming the backbone of global AI. Facilities in Riyadh, Dubai, Abu Dhabi, Doha and neighboring hubs now serve AI models, fintech apps and government platforms for users across Europe, Asia and Africa not just the GCC.

At the same time, decision-makers worry about latency, compliance, and whether to bet on Saudi, UAE, Qatar or a multi-country setup. In this guide, we’ll map how Middle East data centers are changing, who’s leading, and what that means for your next region choice.

In short: Saudi Arabia is emerging as the hyperscale desert cloud hub, the UAE as an AI mega-campus and interconnect node, and Qatar as a sovereign-cloud anchor for finance and government. For many enterprises, the winning strategy is not “either/or” but a smart combination of these locations – ideally with a neutral advisor such as Mak It Solutions on your side.

The new Middle East data center landscape

From traditional colocation to hyperscale cloud regions in GCC

Ten years ago, the conversation was mostly about colocation racks in Dubai or Jeddah. Today, the GCC hosts hyperscale cloud regions in GCC plus specialized AI-ready GPU data centers in the Middle East.

You still have classic colocation (space, power, cross-connects), but layered on top are:

Full public-cloud regions (AWS in Bahrain and UAE, Azure UAE North/UAE Central, Google Cloud Doha) Qatar Free Zones+3AWS Documentation+3Azure Speed+3

National or “sovereign” clouds for government and critical sectors

Dedicated AI/GPU campuses optimised for high-density racks and liquid cooling

This is what people mean by “hyperscale desert data centers” – massive, energy-hungry campuses built in traditionally harsh climates, but optimized for scale and efficiency.

Saudi Arabia, UAE, Qatar, plus Kuwait, Bahrain and Oman

For core workloads, three markets dominate.

Saudi Arabia

Riyadh and Jeddah for broad enterprise demand; NEOM and other Vision 2030 zones for mega-campuses.

United Arab Emirates

Dubai and Abu Dhabi as interconnect hubs for airlines, logistics, e-commerce and global finance.

Qatar

Doha as a sovereign cloud and analytics hub for banking and government, anchored by the Google Cloud region.

Secondary hubs such as Manama (Bahrain), Kuwait City, and Muscat (Oman) act as edge locations, helping you serve users around the Gulf with edge data centers and low-latency networks in MENA.

Market size, CAGR and investment signals decision-makers watch

Analysts estimate the Middle East data center market at roughly USD 5–6 billion mid-2020s, with growth forecasts of around 13–16% CAGR to 2030 several times faster than many mature European markets.

Hyperscale-only projections are even steeper, with global hyperscale data centers expected to grow at ~25% CAGR as AI and cloud demand surge.In the GCC, watch signals like:

100MW+ AI campus announcements (for example, AMD/Cisco/Humain’s joint venture in Saudi Arabia)

New cloud regions and availability zones

Power-purchase deals for renewables and nuclear

Local regulatory updates (CST, TDRA, CRA, QCB, SAMA, CBUAE, QCB)

Why Middle East data centers attract hyperscale & AI workloads

What makes the Middle East especially Saudi and the UAE attractive for hyperscale desert data centers?

Saudi Arabia and the UAE offer large, relatively affordable desert land, strong grid connections and an ideal position between Europe, India and East Asia. Submarine-cable landings in the Gulf, combined with new AWS, Azure and Google Cloud regions, make it possible to reach users across three continents with competitive latency from one footprint. AWS Documentation+1 Regulators like CST in KSA and TDRA in the UAE are actively shaping cloud frameworks instead of restricting them, which is why hyperscale cloud providers and AI platforms are investing heavily.

Renewables, nuclear and efficient cooling in the desert

Modern renewable energy for desert data centers is central to the story. Saudi Arabia’s NEOM and other giga-projects are tying large-scale solar and wind into new AI campuses, while the UAE mixes solar, gas and peaceful nuclear power to underpin AI-ready GPU data centers in the Middle East. Efficient designs indirect evaporative cooling, hot-aisle containment, and higher operating temperatures keep PUE down even in Riyadh summers.

Middle East vs Europe/Asia as a cloud & AI computing hub

Compared with Europe, Middle East power prices can be more attractive for long-term PPAs, with fewer planning bottlenecks for new sites. Compared with some Asian markets, GCC regulation around data sovereignty and residency in GCC cloud is clearer for foreign investors, especially when you work with a local partner such as our managed cloud and DC advisory team. For global SaaS and AI players, this combination of energy, geography and regulation makes KSA/UAE/Qatar a serious alternative – or complement – to Frankfurt, London or Singapore.

The $10B+ desert cloud hub

Mapping Saudi data center clusters

KSA’s main clusters sit around Riyadh (enterprise and government), Jeddah (Red Sea connectivity) and emerging giga-projects like NEOM. Local carriers such as stc/center3, Mobily and Zain, plus operators like Gulf Data Hub and DataVolt, are building large campuses that connect into AWS, Azure and other clouds via private links.

NEOM, center3, DataVolt, Humain and Vision 2030 mega-projects

Under Vision 2030, Saudi Arabia is positioning itself as a multi-gigawatt AI and cloud hub, with projects like NEOM, center3’s hyperscale expansions and Humain’s GPU campuses backed by the Public Investment Fund. These are designed for dense GPU clusters, liquid cooling and renewable power – ideal for training Arabic-first LLMs and video models.

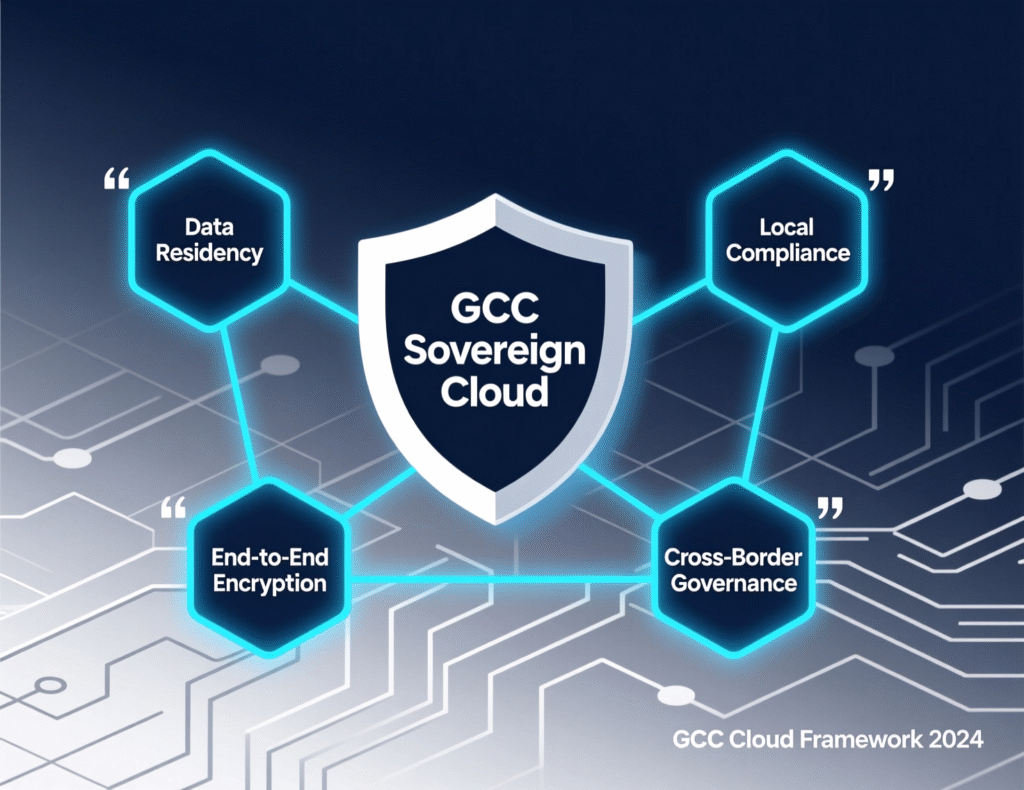

Saudi sovereign cloud, CST Cloud Computing Regulatory Framework and NDMO standards

For government, fintech and critical sectors, the Cloud Computing Regulatory Framework (CCRF) from CST, plus SDAIA/NDMO data-classification rules and SAMA requirements for financial data, define where and how you can host workloads. A “Saudi NDMO-compliant data center” typically means local data residency, strong encryption, audited controls and alignment with Saudi Cloud First Policy crucial for ministries, banks, digital-health platforms and some logistics platforms.

Edge nodes, AI mega-campuses and sovereign cloud

G42’s Stargate campus, Khazna and hyperscaler regions

In the UAE, Dubai and Abu Dhabi form a dual hub:

UAE North (Dubai) and UAE Central (Abu Dhabi) Azure regions, plus AWS me-central-1 in UAE, host enterprise and government workloads. AWS Documentation+2Azure Speed+2

Local players like G42 (with the Stargate AI super-computing concept), Khazna, e& and du add colocation and AI-campus options.

Together, they make the UAE a powerful interconnect point between Riyadh, Doha, Mumbai, Istanbul and European hubs – ideal for airlines, logistics, retail and media.

Doha sovereign cloud, MEEZA, Ooredoo and Qatar Digital Government

Doha complements the UAE with a strong sovereign-cloud narrative. Google Cloud’s Doha region – the first in GCC and North Africa – launched with support from Qatar Free Zones Authority and MCIT, and is projected to contribute nearly USD 19 billion to the Qatari economy by 2030. Local providers like MEEZA, Ooredoo and Qcloud power Qatar Digital Government initiatives and give banks and ministries options for in-country residency under CRA and QCB rules.

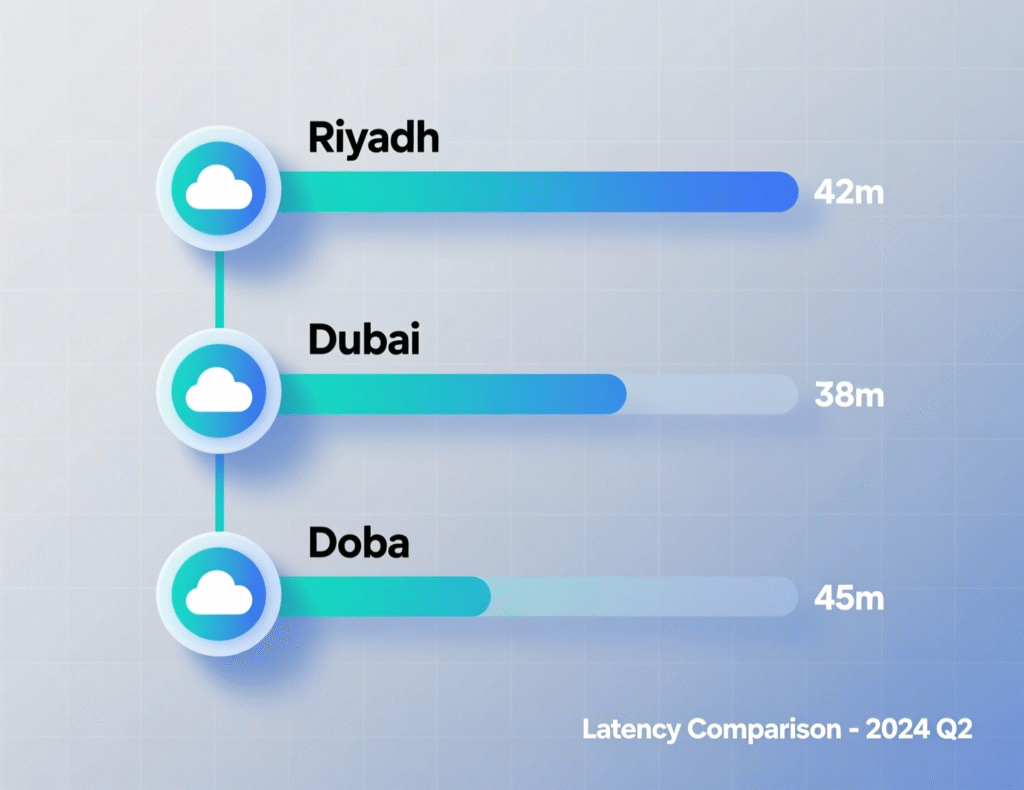

Latency, Arabic UX and GCC edge data centers

For Arabic-first apps, latency and localization matter as much as compliance. Edge nodes in Dubai, Doha, Manama and Muscat help you serve GCC users with <30–40ms latency, while keeping content and AI inference close to end-users. This is especially important for mobile-heavy e-commerce and travel apps; our regional UX and infrastructure team often pairs a primary region (Riyadh or Dubai) with smaller edge deployments across the Gulf.

GCC regulation, data sovereignty and green cloud

Why are GCC governments pushing sovereign cloud and data residency rules for AI workloads?

GCC governments are doubling down on sovereign cloud to protect citizen data, ensure financial stability, and build local AI value chains instead of exporting data and compute. For AI workloads, this controls where training data lives, who can access it, and how models are governed – key for national-security use cases, public-sector chatbots and sensitive health or education platforms. At the same time, green-cloud requirements push operators towards more efficient, renewable-powered campuses to align with Vision 2030 and similar national strategies.

How Saudi CST, SDAIA/NDMO and SAMA shape data center strategy

In KSA, you’ll typically map workloads against:

CST’s CCRF and Cloud First Policy

SDAIA/NDMO data-classification and residency guidance

SAMA cloud guidelines for banks and fintechs, published on the Saudi Central Bank website (sama.gov.sa)

Together, they determine whether you can host in public cloud, must use Saudi sovereign cloud, or need hybrid on-prem plus local data center something our helps clients interpret.

How UAE TDRA, PDPL, ADGM and DIFC guide cloud deployments

In the UAE, TDRA leads on national cloud and FedNet, while the UAE PDPL sets the baseline for personal-data processing. Financial workloads in Abu Dhabi and Dubai must also respect ADGM and DIFC requirements, which may demand region-specific residency and contractual controls. For many international SaaS providers, the pattern is: UAE region for commercial/government workloads, plus private connectivity into regulated free-zone environments.

Qatar CRA, QCB and Qatar Digital Government rules

Qatar’s CRA Cloud Policy Framework, QCB circulars and Qatar Digital Government roadmaps shape where ministries, banks and telcos place data. Often, this means: primary hosting in Doha (MEEZA, Ooredoo, Google Cloud Doha), optional DR in another GCC state, and carefully documented cross-border flows for analytics or global AI model training.

Choosing the right GCC data center location

Latency, network routes and edge data centers across GCC cities

Start by mapping where your users are: Saudi and Kuwaiti consumers? Dubai tourists? Enterprises across the whole MENA region? Then overlay subsea-cable routes and major IXs. Dubai and Fujairah land many cables; Jeddah and Yanbu link the Red Sea; Bahrain, Doha, Muscat and Kuwait City act as regional edges. For high-frequency trading or aviation operations, micro-seconds between Riyadh–Dubai–Doha may matter more than raw GPU capacity.

Compliance, data residency and sector-specific rules to check

Next, align your sector with regulators

Fintech & banking – SAMA (KSA), CBUAE (UAE), QCB (Qatar)

Government & smart cities CST/MCIT, TDRA, CRA, Qatar Digital Government

Healthcare & education additional health-data or children-data directives

A quick way to de-risk is to engage a regional advisor like Mak It Solutions’ cloud strategy team, who can translate legal language into concrete landing-zone designs.

How can international SaaS and AI companies choose the right GCC country for latency, compliance, and cost?

Think of it as a five-step process

Map your users and latency needs where are customers, regulators and internal teams located?

Classify your data and regulators SAMA vs CBUAE vs QCB, plus CST, TDRA and CRA obligations.

Compare provider ecosystems in KSA, UAE and Qatar hyperscale regions, sovereign clouds, colocation partners.

Model costs and incentives power, land, tax and government-support programs through 2030.

Design a multi-region or hybrid strategy e.g., KSA for sovereign workloads, UAE for interconnect, Qatar for analytics.

If you don’t have in-house expertise, our GCC cloud and data center advisory service can run this assessment and build a practical roadmap.

Key takeaways and next steps for your Middle East data center strategy

Checklist for shortlisting GCC locations for 2025–2030

For the next 5–7 years, a robust shortlist process should cover:

Market maturity and hyperscale presence (AWS, Azure, Google Cloud, local players)

Latency to your top 5 user clusters

Compliance fit with CST, TDRA, CRA, SAMA, CBUAE, QCB

Energy mix and ESG reporting (renewables, nuclear, PUE)

Ecosystem strength (ISPs, IXs, managed services like

AI chips, energy mix and new cloud regions

Looking ahead, track new GPU clusters (such as Humain’s Saudi ventures), evolving Arabic sovereign AI models, and fresh cloud regions or AZs in the Gulf. Expect more renewable-based campuses in NEOM and the UAE, and deeper interconnects tying Riyadh, Dubai, Abu Dhabi and Doha to Mumbai, Singapore and major European hubs. The earlier you align your architecture and contracts to this reality, the easier it will be to scale AI and SaaS workloads across the Middle East.

Best-practice GCC scenarios

Riyadh fintech startup

Keeps core banking data in a Saudi NDMO-aligned facility, uses a UAE region for non-sensitive analytics, and connects both via encrypted private links under SAMA guidance.

Dubai e-commerce brand

Serves GCC shoppers from a Dubai primary region with edge cache nodes in Riyadh and Doha to ensure fast Arabic UX on mobile.

Doha SME analytics firm

Trains models in the Google Cloud Doha region for data residency, with burst capacity in another Google region for non-identifiable datasets.

Regional logistics player

Uses UAE as the hub for airline and port integrations, while keeping customs and government data in KSA and Qatar under local residency rules.

For architectures like these, our cloud and infrastructure consultants often act as the neutral middle layer between your legal, security and engineering teams.

If you’re trying to decide between Riyadh, Dubai, Abu Dhabi or Doha for your next cloud region, you don’t have to guess. Our GCC-focused team at Mak It Solutions can help you model latency, compliance, cost and AI-readiness in one clear decision framework.

Whether you’re a global SaaS vendor, fintech, or AI startup, we’ll design a practical, regulator-ready architecture and shortlist the right Middle East data centers for your roadmap. Reach out to our services team to book a discovery call or request a custom GCC data center strategy.

FAQs

Q : Is it allowed to host Saudi government or healthcare data in UAE or Qatar data centers?

A : In most cases, highly sensitive Saudi government and healthcare data must stay inside the Kingdom under CST, SDAIA/NDMO and sector-specific rules, which prioritise national security and citizen-data protection. Cross-border transfers to UAE or Qatar can be possible for specific workloads (for example, anonymised analytics or global SaaS components), but usually require data-classification, legal basis, strong encryption and clear contracts. For health data, you may need extra approvals from relevant Saudi health authorities in addition to CST guidance. Practically, many organisations use a Saudi sovereign or NDMO-aligned cloud for core records, with UAE/Qatar used for peripheral or de-identified workloads.

Q : What are the key differences between Saudi CST and UAE TDRA cloud regulations for foreign companies?

A : CST in Saudi Arabia is tightly linked to Vision 2030 and Cloud First Policy, while UAE’s TDRA is closely tied to FedNet and federal e-government ambitions. Both focus on data-classification, residency and security, but KSA often emphasises local data centers for critical and public-sector workloads, whereas the UAE provides more flexibility through a mix of national and free-zone regimes (including ADGM and DIFC for financial services). For foreign companies, KSA may lean more towards in-Kingdom hosting for regulated sectors, while the UAE can act as a regional hub with tailored controls. In practice, many organisations deploy a dual-strategy across both markets for resilience and market access.

Q : Can Qatar-based banks use public cloud regions outside Doha under QCB rules?

A : Qatar Central Bank (QCB) cloud guidelines generally allow banks to leverage public cloud, but they impose strict conditions on data residency, outsourcing, subcontractors and incident-response obligations. In many cases, primary or identifiable banking data must reside in-country (for example, in Doha data centers or the Google Cloud Doha region), while carefully controlled secondary workloads may run in external regions. Contracts must give QCB and bank auditors clear rights to access audit logs, source data and facilities where needed. Each bank’s risk appetite and architecture are reviewed against QCB circulars and CRA’s Cloud Policy Framework, so early consultation with legal and cloud-architecture teams is essential.

Q : How do renewable energy commitments in NEOM and UAE impact data center ESG reporting for global companies?

A : Large ESG-conscious enterprises increasingly need to report Scope 2 and sometimes Scope 3 emissions for digital infrastructure. Hosting workloads in NEOM-linked or UAE renewable-powered campuses can help lower your reported carbon intensity, especially if operators provide granular energy-mix and PUE data. Many Middle East data centers now publish sustainability metrics, renewable PPAs and efficiency improvements to attract AI and cloud workloads. For global companies preparing EU CSRD or similar reports, being able to show that mission-critical workloads run on solar-backed or nuclear-supported infrastructure in KSA or the UAE can be a tangible ESG win – provided these claims are backed by proper evidence and third-party assurance.

Q : Do GCC data centers support Arabic AI models and LLM training with local GPUs?

A : Yes. A growing number of GCC operators are building GPU-rich clusters specifically for training and serving Arabic AI models, including large language models, speech systems and recommendation engines. In Saudi Arabia, projects backed by Vision 2030 and public-investment funds are investing in high-density GPU campuses; in the UAE, AI-focused initiatives around G42 and its partners are driving similar build-outs. Many of these clusters are integrated with major cloud regions, allowing you to mix local GPUs with global capacity when data-sovereignty rules permit. For companies building Arabic-first digital products, this means you can increasingly train and serve models inside the region while respecting local residency and privacy rules.