React Native Development Services: Buyer’s Guide

React Native Development Services: Buyer’s Guide

You’re choosing a React Native partner. Here’s how to avoid overruns, delays, and rebuilds

Introduction

If you’re selecting a React Native app development partner, the fastest way to avoid overruns, delays, and costly rebuilds is to verify scope, benchmarks, and a delivery playbook up front. This guide shows exactly what services include, how to evaluate agencies, realistic cost ranges in the USA vs Europe, tech decisions (Expo, the New Architecture), a pragmatic delivery blueprint, and an RFP checklist to shortlist vendors with confidence.

You’ll see how to align expectations, compare providers apples-to-apples, and decide between React Native vs Flutter in 2025/2026 using real signals, not guesswork.

What React Native Development Services Include (Information:l Define scope & align expectations)

Strategy & Discovery (Informational Clarify deliverables)

Great React native development services start with a structured discovery so scope and success metrics are not left to chance. Expect:

Product workshops

Business goals, target users, and value propositions are mapped to measurable outcomes.

Market–solution fit

Competitor scans and customer interviews to validate must-have features vs. “nice to have.”

Platform targets:

iOS and Android first; web/desktop strategy noted if needed later.

Success metrics:

North-star KPIs (e.g., activation, retention, crash-free rate).

Roadmap & risks

Phased delivery (MVP → V1.x) with dependencies, integration partners, and mitigations.

RFP alignment

A short discovery can crystallize scope and acceptance criteria you’ll reuse in your RFP.

Example: A retail MVP focused on scan-and-pay launched in New York and London prioritized checkout conversion and a 99.5% crash-free rate as go-live KPIs keeping scope lean and measurable.

Design, Architecture & New Architecture (Fabric/TurboModules) (Informational Technical depth)

Design should deliver a reusable design system, accessible color/contrast, and consistent navigation patterns (React Navigation or native). On architecture, ask for:

New Architecture Readiness

Fabric (new renderer) and TurboModules replace the old bridge for faster JS↔native calls via JSI; fewer serialization costs can improve responsiveness (e.g., animations, complex modules)

Native modules

A plan for when to extend native code (payments, biometrics, camera).

Performance implications

Clear targets for bundle size, startup time (cold/warm), and memory usage.

Stat to know: The New Architecture swaps the asynchronous bridge for JSI, enabling direct C++ references and lower overhead between JS and native layers.

Build, Test, Release & Support (Informational Full-lifecycle view)

Expect a full-lifecycle plan

Coding standards

TypeScript, ESLint, Prettier, and strict module boundaries.

Automated testing

Unit, component (e.g., React Native Testing Library), and E2E (Detox).

App Store/Play compliance

Content policies, privacy labels, device coverage.

Release trains

Regular cadences (bi-weekly) with phased rollouts on the App Store and staged rollouts on Google Play to reduce blast radius.

SLAs & support tiers:

Clear response/restore times, on-call, and hotfix windows.

Monitoring

Crash reporting and performance telemetry (e.g., Sentry, Crashlytics, Datadog RUM)

How to Evaluate a React Native Development Agency (Commercial Investigation Comparison & Checklist)

Capabilities & Team Composition (Commercial Qualification)

A credible partner blends

React Native expertise with iOS/Android native depth (Swift/Kotlin) for custom modules.

Backend & DevOps

Experience with AWS Amplify, Google Cloud/Firebase, or Azure; CI/CD pipelines (Bitrise, Microsoft App Center).

QA discipline

Automation coverage and device lab strategy.

Proof

Case studies with metrics (e.g., crash-free %, startup time). Review directories like Clutch for transparent rate bands and project sizes (e.g., US/EU profiles)

Competitor landscape context (non-endorsement)

In the EU you’ll often see names like Netguru, Miquido, or Droids On Roids; in the US, firms like TekRevol and Simform appear frequently on directories use these only as benchmarks for rate/portfolio patterns, not as recommendations.

Code Quality & Performance Benchmarks (Commercial Risk Reduction)

Request a read-only repo or sample to inspect standards, then benchmark a demo build:

Bundle size (Android AAB/iOS IPA), startup time (cold <2–3s target for MVPs), FPS for key animations, memory footprint on low-end devices.

Stability

Crash-free sessions ≥99.5% as a go-live guardrail (measured with Crashlytics/Sentry).

Mini “Lighthouse-style” Scorecard (example)

Startup time (cold): ✅ <2.5s | ⚠️ 2.5–4s | ❌ >4s

Crash-free sessions: ✅ ≥99.5% | ⚠️ 98–99.49% | ❌ <98%

Bundle size (release): ✅ <15–20 MB JS | ⚠️ 20–30 MB | ❌ >30 MB

60 FPS animation target: ✅ ≥55 avg | ⚠️ 45–54 | ❌ <45

Memory (mid-range device): ✅ <400 MB | ⚠️ 400–600 MB | ❌ >600 MB

Track with Sentry performance metrics and Datadog RUM for real-user journeys.

References, Security & Compliance (Commercial Trust & governance)

References

Speak with 2–3 clients from similar domains or scales.

Security practices

Ask how they mitigate OWASP Mobile Top 10 risks (secure storage, auth, cryptography, supply chain).

Privacy & compliance:

Awareness of GDPR (EU) and CCPA/CPRA (US/CA) is table-stakes; confirm data handling and DPA templates.

Audits/Attestations:

SOC 2 familiarity if they manage data or production pipelines.

Cost, Timeline & ROI for React Native (Informational/Commercial Budget planning & conversion)

Pricing Models & Typical Rates (US vs Europe) (Informational Qualify budget)

Common engagement models

Fixed-bid for tightly scoped MVPs.

Time & Materials (T&M) for evolving scope.

Dedicated teams for long-running products.

Rate signals (2025 market):

US agencies

Often $100–$150+/hr (mid-market), with top consultancies higher.

Central/Eastern Europe

(e.g., Poland, Estonia): Frequently $25–$99/hr depending on seniority and firm profile.

Trend

2025 outsourcing rate pressure fell ~9–16% in many regions per Accelerance coverage.

Geo note

In New York or San Francisco, expect upper-tier US pricing; London, Berlin, Amsterdam, and Warsaw show more variability across boutiques vs scale-ups on Clutch.

Sample Budgets by Complexity (Informational Set expectations)

MVP ($) – $60k–$150k in ~10–14 weeks: Auth, profile, push, basic analytics, 5–7 core screens, 1–2 integrations.

Narrative:

A mid-market retail MVP shipped to iOS/Android in 12 weeks (NYC pilot) for ~$110k using Expo + EAS, with staged rollouts to manage risk.

Mid-complexity ($$) – $150k–$400k in ~4–7 months:

Payments, offline sync, real-time features, analytics/experiments.Enterprise ($$$) – $400k–$1M+

Custom native modules, SSO, SOC 2 processes, complex backend integrations, heavy observability.

For triangulation, public directories show many React Native projects in the $50k–$200k bracket; always calibrate against scope.

Total Cost of Ownership (TCO) & Maintenance (Informational Long-term view)

Plan annual maintenance at ~15–25% of the initial build for CI/CD, monitoring, OTA update pipelines, OS upgrades, and library churn. Multiple industry guides cite this range.

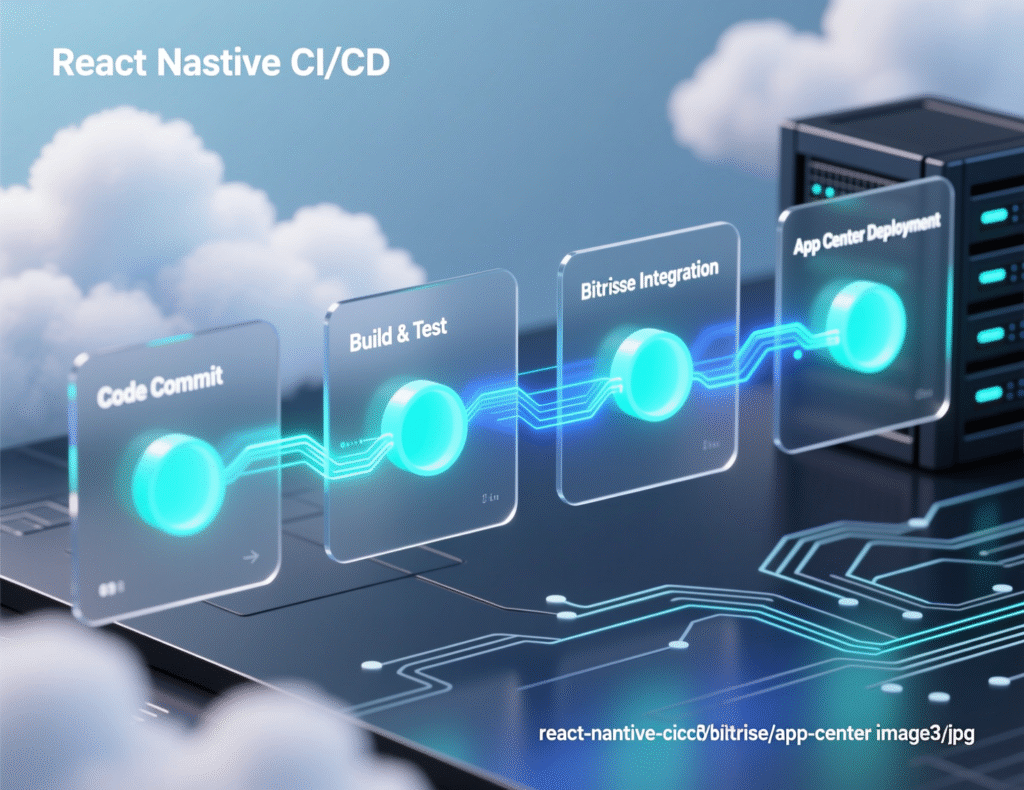

CI/CD & releases

Bitrise/App Center automation to cut manual toil.

Monitoring

Crashlytics/Sentry/Datadog for stability and performance.

OTA updates

Expo’s EAS Update reduces app-store lead time for JS/assets.

Tech Decisions That Affect Outcomes (Informational/Commercial Decision support)

React Native vs Flutter in 2025/2026 (Informational Alternative comparison)

Talent & ecosystem

RN leverages the vast React/JS talent pool and a long-standing ecosystem stewarded by Meta, with New Architecture momentum; Flutter has surged in popularity per recent surveys and GitHub signals.

Performance parity

Flutter compiles ahead-of-time and often wins synthetic benchmarks; RN’s Fabric/JSI/TurboModules narrow gaps in real products when engineered well. (Surveys show Flutter marginally ahead in usage/sentiment among pros.

Web/desktop

RN + React/Next.js is a strong web strategy; Flutter’s web/desktop are viable but strategic trade-offs remain.

When to pick RN

You already have React/TS expertise, need native integrations, and want to reuse web knowledge. When to pick Flutter: High-polish custom UI across mobile/desktop with unified rendering.

Expo vs Bare React Native for Production (Informational Practical trade-offs)

| Area | Expo (EAS) | Bare React Native |

|---|---|---|

| Dev velocity | Rapid onboarding, great tooling, OTA updates | More setup; fully flexible |

| CI/CD | EAS Build, EAS Update first-class | Choose Bitrise/App Center, Fastlane, etc. |

| Native modules | Many supported; custom native possible with config plugins | Unlimited native customization |

| Enterprise needs | Works well; verify required native SDKs | Suits complex regulated stacks |

Bottom line

For most MVPs and many scale-ups, Expo accelerates delivery while enabling OTA fixes; “go bare” when you need deep native customization or niche SDKs. Expo Documentation+1

Leveraging the New Architecture (Fabric, TurboModules) (Informational Performance & scalability)

When to adopt

New builds should start on it; legacy codebases can migrate feature-by-feature.

Migration approach

Enable Fabric, convert key modules to TurboModules via Codegen, measure regressions per release.

Measurable wins

Lower JS↔native overhead (JSI), smoother animations under load; verify with in-app metrics.

Risks

Dependency compatibility; plan spike sprints and dual-track releases.

Implementation Quality: A Delivery Playbook (Informational “How we work” pattern)

CI/CD & Release Management (Informational Reliability)

Pipelines

Branch protections, build caching, unit/E2E test gates, code-signing management. (Bitrise templates and App Center SDKs speed setup.)

Release strategy

Feature flags + staged rollouts on Google Play; phased releases on the App Store; pause if metrics degrade.

Cadence

Predictable release trains (e.g., every two weeks) with fast-track hotfix lanes.

Performance, Monitoring & Analytics (Informational Ongoing quality)

Profiling

Track startup, FPS, and memory; set SLOs for each.

Crash reporting

Firebase Crashlytics + Sentry for JS/native, with session replay where appropriate.

APM & RUM

Datadog RUM correlates user journeys with API/network performance; initialize early to catch pre-RN native crashes.

Analytics

Event schemas for activation/retention funnels; ensure consent flows for GDPR/CCPA.

Security, Accessibility & Store Compliance (Informational Risk & reach)

Security

Follow OWASP Mobile Top 10; encrypted storage, keychain/Keystore, proper auth flows, pinning where justified.

Privacy

Honor GDPR/CCPA: consent, data access/deletion, and DPA readiness. GDPR+1

Accessibility

WCAG-inspired patterns (labels, focus order, contrast).

Policies

App Store/Play guidelines and review checklists; use policy safelists for third-party SDKs.

Vendor Shortlist Tools: Questions & RFP Template (Transactional Drive action & lead capture)

12 Due-Diligence Questions to Ask (Transactional Disqualify/qualify fast)

How do you adopt Fabric/TurboModules and when do you write native code?

What’s your plan to keep startup <3s on mid-range devices?

Can you show crash-free %, FPS, and bundle size from a recent app?

Which CI/CD do you prefer (EAS/Bitrise/App Center) and why?

What’s your release train and rollback process (phased/staged)?

Which monitoring stack (Sentry, Crashlytics, Datadog) and what SLOs do you set?

How do you secure secrets and address OWASP Mobile risks?

What’s your GDPR/CCPA posture and DPA template?

Who owns code, IP, and build pipelines post-handover?

How do you estimate and de-risk integrations (payments, analytics, offline)?

What are your post-launch support tiers and SLAs?

Can we speak to a reference with similar scale/regulation? (Clutch listings help validate basics.)

What to Include in an RFP (Transactional Structured comparison)

Business goals & target users

Scope & integrations (auth, payments, analytics, offline, push)

Non-functionals (performance SLOs, accessibility, privacy)

Tech choices (Expo vs Bare, New Architecture plan)

Milestones & acceptance criteria (demoable increments, perf gates)

Delivery model (fixed vs T&M) and budget bands

Handover (docs, runbooks, access, CI/CD ownership)

Red Flags & Green Signals (Transactional Buyer protection)

Red flags

Vague estimates, no performance benchmarks, no production references, no security/privacy plan, high staff churn.

Green signals

Transparent metrics, shared playbooks, code samples, staged/phased rollback strategy, clear ownership terms.

Summary & Key Takeaways (Informational Recap & next step framing)

Scope clearly

Discovery should lock outcomes, KPIs, and risks.

Evaluate rigorously

Team depth, code benchmarks, references, and compliance are non-negotiable.

Budget realistically

US vs EU rates differ; most MVPs land $60k–$150k; plan 15–25% annually for maintenance.

Choose tech wisely

Expo/EAS for velocity; Bare for deep native; adopt the New Architecture for performance.

Deliver predictably

CI/CD, monitoring, and staged/phased rollouts keep quality high.

RFP right

Use the checklist to compare vendors apples-to-apples.

At Mak It Solutions, we are offering React native development services. Book a 30-minute scoping call with Mak It Solutions to validate your scope, benchmark performance, and receive a tailored estimate, or download our React Native RFP template to run a clean vendor comparison. We’ll help you ship faster with fewer surprises. (Click here)

FAQs

Q : Can React Native handle complex animations and high-FPS interactions?

A : Yes especially on the New Architecture. Fabric and TurboModules reduce JS↔native overhead via JSI, improving responsiveness under animation-heavy screens. Use native-driver animations, off-main-thread work where possible, and test at 60 FPS targets on mid-range devices. Track frame drops and CPU/GPU hotspots in Sentry/Datadog to catch regressions early, and set performance gates in CI before each release.

Q : How do maintenance and support contracts work for React Native apps?

A : Most teams budget 15–25% of initial build cost per year for upkeep, covering CI/CD, OS updates, SDK upgrades, monitoring, and minor features. A typical support SLA defines response/restore times, hotfix windows, and monthly release trains. Expect higher effort after major iOS/Android upgrades or architecture migrations. OTA updates via EAS can reduce app-store lead time for non-native fixes.

Q : What’s a realistic timeline to ship a React Native MVP?

A : Assuming validated scope: 10–14 weeks for a focused MVP (auth, profile, push, analytics, 5–7 core screens) with a small cross-functional team, followed by staged/phased rollout and telemetry hardening. Scope creep, complex native SDKs, or compliance (e.g., SSO, strong PII rules) can add cycles. Use a discovery sprint to confirm milestones and acceptance criteria before you start.

Q : Is Expo suitable for enterprise apps, or should we go bare?

A : Expo is production-proven EAS Build and EAS Update deliver velocity and reliable OTA fixes. Enterprises that require niche native SDKs or highly customized modules may prefer Bare or a hybrid (Expo with config plugins). Decide based on SDK requirements, security reviews, and your CI/CD posture.

Q : How do you future-proof a React Native codebase against breaking changes?

A : Adopt the New Architecture on new apps, maintain strong typing (TypeScript), isolate native modules behind clear interfaces, and automate upgrades with canary branches plus E2E tests. Keep dependencies current, run quarterly upgrade windows, and monitor crash-free % and startup regressions after each release with Crashlytics/Sentry/Datadog.