Silicon Valley vs European Tech Hubs in 2025

Silicon Valley vs European Tech Hubs in 2025

Silicon Valley vs European Tech Hubs in 2025

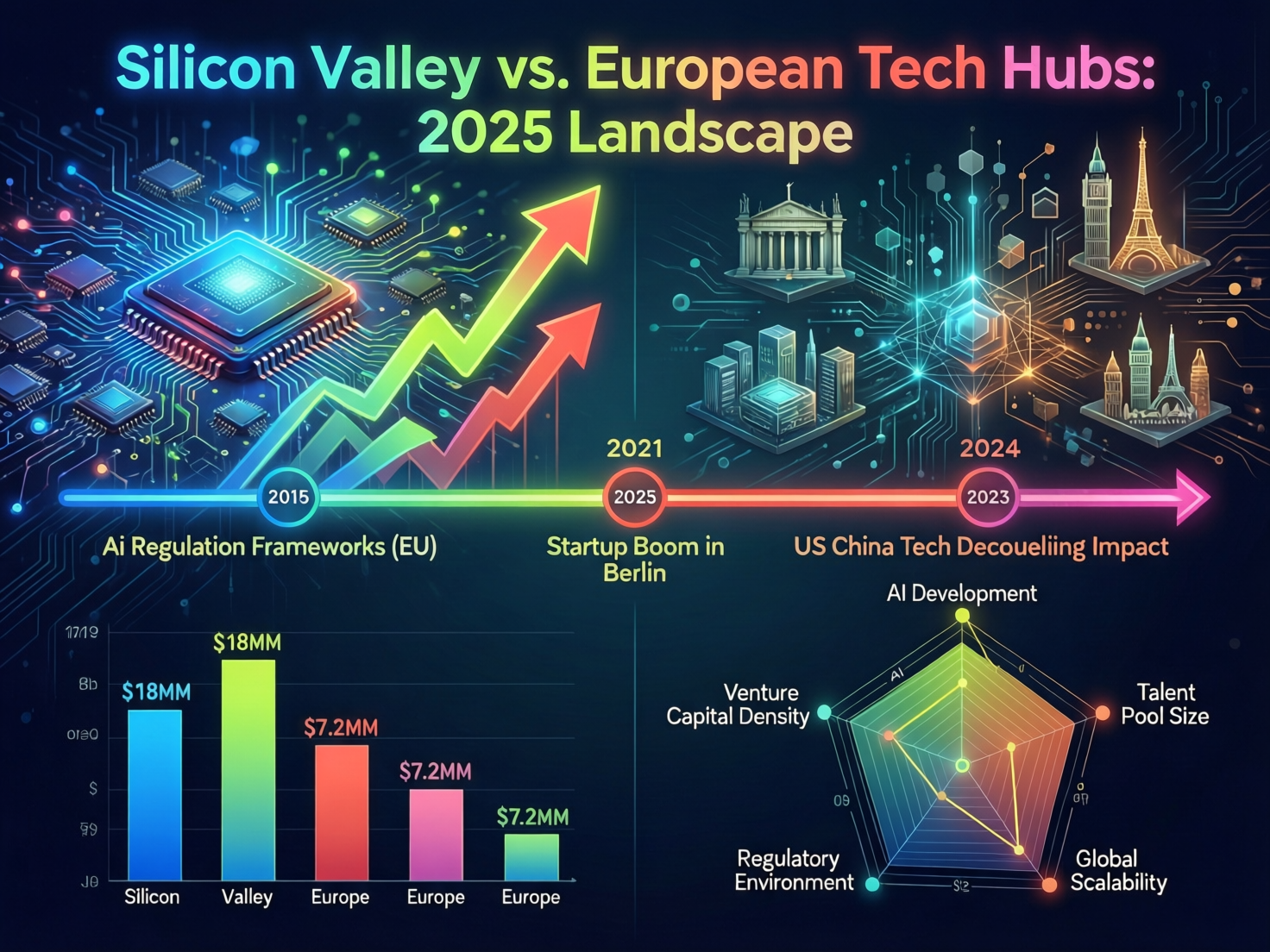

In 2025, Silicon Valley vs European tech hubs is less about picking a single winner and more about choosing the right mix for your sector and stage. Silicon Valley still offers the deepest venture capital pool, fastest deal-making and closest proximity to Big Tech, which matters for hyper-scale and late-stage funding. Leading European tech hubs like London, Paris, Berlin and Munich increasingly win on deeptech talent, regulation-ready business models, lower costs and quality of life, so many founders now combine both with hybrid or remote-first setups.

Introduction

In 2025, the “Silicon Valley vs European tech hubs” debate is back on every founder’s whiteboard. AI and deeptech are maturing fast, global venture funding has reset from the 2021 peak, and remote work means your engineers might be in Berlin or Lisbon even if your investors sit in San Francisco. At the same time, regulators from Washington to Brussels are rewriting the rules for data, AI and platforms.

In simple terms, Silicon Valley is still unmatched when you need late-stage capital, proximity to Apple, Google, Meta, Nvidia and OpenAI-adjacent companies, and a culture of blitzscaling. European tech hubs like London, Paris, Berlin, Stockholm and Munich are catching up fast in AI, fintech, climate and industrial deeptech, and often beat the Bay Area on regulatory readiness, resilience and lifestyle.

This guide is written for US founders and VCs in San Francisco, New York or Austin, European founders from London to Helsinki, and policymakers or senior tech talent deciding where to build or scale next.

Silicon Valley vs European Tech Hubs at a Glance

Silicon Valley is a single, hyper-dense US ecosystem in the San Francisco Bay Area, while “European tech hubs” are a distributed network of city-based ecosystems such as London, Paris, Berlin, Stockholm and Amsterdam. That simple structural difference explains a lot about culture, capital and regulation.

What We Mean by “Silicon Valley” and “European Tech Hubs”

When we say Silicon Valley, we mean the broader San Francisco Bay Area: San Francisco, San Jose, Palo Alto, Mountain View, Menlo Park and surrounding cities. This is the home turf of Apple, Google, Meta, Nvidia, Salesforce, Stripe and many top VCs like Sequoia Capital, Andreessen Horowitz and Y Combinator.

European tech hubs are more granular. Think London (fintech, SaaS), Paris (AI and deeptech, Station F, Bpifrance), Berlin (consumer, fintech, Web3), Munich (Industry 4.0, mobility), Stockholm and Amsterdam (climate, design-driven SaaS), plus Barcelona, Lisbon, Dublin, Helsinki and university hubs such as Cambridge and Zurich. Much of the comparative data in this article comes from Startup Genome, Dealroom, Crunchbase and national ecosystem reports.

Snapshot 2025 Unicorns, Funding and AI/Deeptech Strengths

Globally, Silicon Valley still ranks as the #1 startup ecosystem, with London and New York close behind in the overall rankings.

Europe has narrowed the gap in total unicorns, but new European unicorn creation cooled significantly after 2021: only around a dozen startups passed the $1B mark in 2024 compared with several dozen in 2021.

On funding, the US still captures roughly two-thirds of global venture capital, while Europe sits in the mid-teens as a share of global VC. Within Europe, AI startups are now drawing about a quarter of all VC, up from single-digit percentages a decade ago, with the UK remaining the top European destination for AI funding.

The sector mix is shifting: Silicon Valley remains strongest in AI infrastructure, dev tools, SaaS and consumer platforms, while Europe leads in regulated fintech, climate and industrial deeptech, and healthtech.

Who Searches for This Comparison and Why It Matters

Three groups most often ask “Silicon Valley vs European tech hubs who wins?”:

US founders in San Francisco or Austin wondering whether to open a London, Berlin or Paris office to get closer to EU customers and regulators.

European founders deciding between staying headquartered in Berlin, Munich or Stockholm versus flipping into a Delaware C-corp and moving to Palo Alto.

VCs and LPs re-allocating capital between US and European funds as valuations, exits and AI regulation evolve.

If that’s you, the key isn’t to pick a “winner” once and for all, but to understand what each ecosystem optimizes for and how to design your own hybrid.

Innovation Culture & Risk Appetite: US vs Europe

Silicon Valley still has a higher tolerance for risk and failure than most European hubs, but London, Paris, Berlin and Stockholm are rapidly developing founder-friendly, ambitious cultures around top universities and accelerators. That cultural convergence not blind copying is what matters for 2025.

Risk-Taking and Failure Tolerance in Silicon Valley vs Europe

In the Bay Area, “fail fast” is baked into the mythology. Founders can crash two or three startups, join a rocket ship, then raise again often from the same investors. Bankruptcy is painful, but socially survivable, especially in tech circles.

In many parts of Europe, failure historically carried more stigma and legal friction. That’s changing: London’s operator-angel networks, Berlin’s repeat founders, and Paris’ new generation of deeptech entrepreneurs look much closer to Silicon Valley in their appetite for risk. Stockholm’s Spotify mafia is playing a similar role to early PayPal or Facebook alumni in California.

Talent, Universities and Spinouts

Stanford University, UC Berkeley and US national labs have long been feeders into Silicon Valley, spinning out AI, biotech and robotics startups and seeding talent into companies like Google, Nvidia and OpenAI-related ventures.

Europe now fields formidable equivalents: TUM and UnternehmerTUM in Munich, ETH Zurich, Imperial College London, Cambridge and Paris-Saclay anchor deeptech ecosystems from robotics to quantum. However, European tech transfer offices can be slower, and IP ownership rules more complex, which sometimes delays spinouts compared with US peers.

Founder Mindset, Ambition and Work–Life Balance

Silicon Valley’s default is still “go big or go home”: build a global category leader, target NASDAQ, and accept aggressive dilution along the way. Founders and early employees expect high equity stakes but also brutal hours.

European founders, especially in Germany and the Nordics, are more likely to talk about sustainable growth, earlier paths to profitability and worker protections. Strong social safety nets can encourage risk-taking for individuals, but also constrain flexible hiring and firing. Remote work has blurred boundaries: it’s now common for a Bay Area startup to have a London or Berlin engineering pod, or for UK engineers to work directly for US companies without ever relocating.

Funding, Unicorns and Exit Outcomes

Silicon Valley still dominates late-stage capital and mega-rounds, while Europe has largely closed the gap at seed and Series A and is slowly improving on exits. For many startups, the optimal path is “European build, US scale.”

Venture Capital Mindset and Availability

The Bay Area still has the highest density of top-tier funds per square mile. Term sheets can arrive within days, and US investors often target larger ownership stakes in exchange for bigger checks and higher risk tolerance.

In Europe, VC is more geographically distributed London, Berlin, Paris, Amsterdam and Stockholm all play important roles. Historically, European term sheets were more conservative on valuations and ownership, but the rise of European mega-funds and US firms opening offices in London or Berlin have narrowed these differences. Seed and Series A capital are now widely available; late-stage capital is still deeper in the US.

Unicorns and Sector Leaders: Europe vs Silicon Valley

European unicorn hotspots include:

Fintech in London and Amsterdam, leveraging Open Banking and PSD2.

Mobility and climate in Berlin, Stockholm and the wider Nordics.

Industry 4.0 and deeptech in Munich and Paris, often tied to OEMs and research institutes.

Silicon Valley’s unicorns skew toward consumer apps, social networks, AI infrastructure, cloud data platforms and dev tools. Network effects are still strongest in the Bay Area: each successful exit seeds more angel capital and experienced operators for the next generation, though Europe’s recycling flywheel is gaining momentum.

Exit Pathways and Capital Markets

For IPOs, NASDAQ and the NYSE remain the gold standard globally. The London Stock Exchange, Euronext and Deutsche Börse matter, but founders often see them as less liquid and less tech-focused.

Trade sales are a different story. Many European startups exit to US Big Tech, but regional corporate buyers such as SAP, Siemens, Schneider Electric, BNP Paribas or AXA also play a growing role, especially in B2B SaaS, fintech and industrial deeptech. Structurally, founders weigh Delaware C-corp setups versus UK structures that benefit from SEIS/EIS, or German entities aiming at BaFin-regulated listings usually in close consultation with their investors and legal teams.

Mapping the Leading European Tech Hubs

There is no single “European Silicon Valley”; instead, founders choose from a portfolio of hubs like London, Paris, Berlin, Munich, Stockholm, Amsterdam, Lisbon and Barcelona depending on sector, stage and lifestyle. That diversity can be a strategic advantage.

London, Paris and Berlin vs Silicon Valley

London remains Europe’s leading fintech and SaaS hub. Shoreditch, Level39 and Canary Wharf connect startups to the City of London, Open Banking standards and the Financial Conduct Authority (FCA). UK-GDPR and Brexit create nuances for data handling, but London still attracts global capital and talent.

Paris has surged thanks to Station F, Bpifrance and heavyweight AI labs; recent ecosystem rankings show Paris climbing the global tables on unicorns and deal volume. (Startup Genome)

Berlin offers a creative, comparatively low-cost environment for B2C and B2B SaaS, fintech and Web3. Rents and salaries remain lower than London or San Francisco for many roles, extending runway.

Compared to Silicon Valley, all three generally offer lower living costs, slightly lower salaries and smaller equity packages, but a longer runway per euro or pound raised.

Deeptech and Hardware Hubs: Munich and Beyond

Munich is Europe’s closest analogue to Silicon Valley’s hardware and semiconductor heritage: TUM and UnternehmerTUM, BMW and other OEMs, and a rising defense/space ecosystem. Eindhoven, Zurich, Grenoble and Helsinki reinforce Europe’s strength in photonics, chips, robotics and quantum.

Silicon Valley still leads on semiconductor giants like Nvidia and Intel, and on Apple and Tesla hardware engineering, but European hubs are more intertwined with manufacturing, energy and automotive supply chains critical for climate and industrial deeptech.

Emerging Hubs

Lisbon and Barcelona are now serious remote-first and digital-nomad hubs, popular with US and UK founders who want EU access and lifestyle arbitrage. Amsterdam and Stockholm combine strong design cultures with fintech and climate-tech depth. Dublin and Eastern Europe particularly Poland and Ukraine — act as engineering and nearshore powerhouses for US, UK and German companies, often working across multiple AWS, Azure and Google Cloud regions.

For US founders and VCs scouting these markets, the playbook is usually: start with a small engineering or GTM pod, partner with a local firm (for example, a specialist web development or mobile app team like Mak It Solutions’ web development services), then scale as product–market fit solidifies.

Policy, Regulation and Visas: How Rules Shape Innovation

Europe trades some speed and risk-taking for stronger consumer protection and trust (GDPR, DSGVO, EU AI Act, DMA/DSA), while the US offers more regulatory flexibility but heavy sector-specific rules and immigration friction. Where you base your startup determines which rules you default into.

Data, Platforms and Competition GDPR, DSGVO, DMA & DSA vs US Rules

The EU’s GDPR and its German implementation DSGVO set strict rules for personal data processing, joined by the Digital Markets Act (DMA) and Digital Services Act (DSA) for platforms, plus Open Banking/PSD2 for finance. The EU AI Act entered into force in August 2024 and will become fully applicable by 2026, with specific timelines for prohibited, high-risk and general-purpose AI. (European Commission)

In the US, startups face a patchwork: HIPAA for health, PCI DSS for payments, SOC 2 for enterprise security, plus California and state-level privacy laws and active antitrust enforcement. UK-GDPR now diverges slightly from EU rules post-Brexit.

For healthtech selling to systems like the NHS or major US insurers, or fintech under BaFin, FCA or US banking regulators, this regulatory stack heavily shapes your go-to-market and tech architecture. It’s one reason technical SEO and architecture choices like server-side rendering vs static generation are often made alongside compliance and infrastructure decisions.

Government Support, Grants and State Aid

Europe leans on public capital: Bpifrance in France, Enterprise Ireland, Innovate UK, German state-level deeptech programs, Horizon Europe grants and EU-level state-aid frameworks. These can provide generous non-dilutive funding, but tend to come with detailed application processes and compliance overhead.

The US offers more fragmented but powerful incentives: SBIR/STTR grants, defense and space procurement, state-level tax credits and local programs in California or Texas. For dual-use or defense startups in Austin or the Bay Area, DoD and NASA contracts can be as important as VC.

Immigration, Visas and Talent Mobility

US visas like H-1B and O-1 remain coveted but capped and uncertain. EU and UK schemes such as the EU Blue Card, French Tech Visa, Germany’s new skilled-worker rules and the UK Global Talent and Scale-up visas offer alternative paths, especially for senior engineers and founders.

Remote work and employer-of-record services now let a Delaware C-corp in San Francisco legally employ engineers in Berlin, designers in Lisbon and product managers in London without establishing full local entities though you’ll still need to navigate payroll, tax and GDPR/DSGVO.

How Founders Should Choose Between Silicon Valley and Europe

Choose Silicon Valley when you need hyper-scale capital, direct access to Big Tech and US customers; choose a European hub when regulation, deeptech talent, costs and long-term resilience matter more — or combine both with a hybrid strategy.

A practical three-step way to decide is: (1) map your sector and regulatory exposure, (2) map where your first 100–500 customers will be, and (3) design a corporate and hiring structure that matches both.

Decision Framework for US Founders

If you’re a US founder in San Francisco or New York, start by asking.

Are your customers primarily US-based (e.g., US hospitals under HIPAA or US financial institutions) or do you need early EU traction?

Is your regulatory exposure heavy (fintech, healthtech, AI dealing with sensitive data) or lighter (developer tools, horizontal SaaS)?

Where can you access specialized talent for example, Munich for mobility engineers, London for fintech, or Paris/Berlin for AI?

Many US companies open a European HQ in London, Dublin, Amsterdam or Berlin to handle sales, customer success and support, while keeping core product in the Bay Area. That often means a Delaware C-corp with European subsidiaries and local leadership. When scaling, partners like Mak It Solutions’ mobile app development services or digital marketing services can help localize product and growth for UK, German or wider EU markets.

Decision Framework for European Founders

European founders typically face the “flip or stay” decision: when (if ever) to flip into a Delaware C-corp and raise from US VCs versus doubling down on local and pan-European funds.

Relocating to the Bay Area can accelerate funding and partnerships, but you’ll compete in the most expensive hiring market on earth. Many European unicorns have kept HQs in London, Berlin or Stockholm while building strong US go-to-market teams. A hybrid approach HQ in Europe, US C-corp or subsidiary for fundraising and GTM is increasingly common.

Choosing your tech stack and growth engine with global scale in mind from day one helps. For example, comparing CMS and hosting options like WordPress vs Webflow vs Wix or Shopify vs WooCommerce early can avoid painful migrations when you expand.

Hybrid and Remote-First Models

The most realistic model for 2025 is hybrid:

Engineering in Berlin, Lisbon or Ukraine.

Design and marketing in London or Amsterdam.

Enterprise sales and partnerships in the Bay Area or New York.

To make this work, you’ll need robust legal and compliance foundations, good compensation benchmarking between US and European packages, and clean technical architecture. Getting your SEO foundations (like indexing controls) right and investing in a performant, globally distributed site via professional web design or Webflow development services also becomes a hard requirement rather than a “nice to have”.

The Future: Convergence, Not Copying Silicon Valley

Europe is unlikely to clone Silicon Valley and probably shouldn’t try. The more interesting future is a convergence where Europe and the US play complementary roles in global innovation.

Does Europe Need Its Own Silicon Valley?

Some argue Europe needs one mega-hub to rival the Bay Area. Others point out that a network of hubs — London, Paris, Berlin, Munich, Stockholm, Amsterdam, Lisbon, Tallinn, Zurich — can be more resilient, specialized and policy-diverse. War in Ukraine, the energy transition and strategic autonomy debates in Brussels have already pushed Europe toward climate, defense and industrial deeptech as priority sectors.

Instead of chasing the exact Silicon Valley playbook, Europe can lean into its own strengths: strong public research, industrial depth, and sophisticated regulators.

Where Europe Can Lead Fintech, Climate, Deeptech and AI

Europe already leads in fintech (Open Banking/PSD2, strong banking regulators), climate and industrial deeptech (Nordics, Germany, France) and applied AI in regulated sectors. Paris, London and Berlin are increasingly important AI hubs, often building on US foundation models hosted on AWS, Azure or Google Cloud but tuned to EU data and rules.

For startups in these spaces, being “born compliant” with GDPR, the EU AI Act and BaFin/FCA expectations can become a significant moat versus US-first rivals who retrofit compliance later.

Practical Next Steps for Founders, Investors and Policymakers

If you’re serious about choosing between Silicon Valley vs European tech hubs.

Run your own ecosystem due diligence

Using datasets from Startup Genome, Dealroom and national reports.

Visit ecosystems physically

San Francisco Bay Area, London, Paris, Berlin, Munich, Stockholm or join soft-landing and accelerator programs on both sides of the Atlantic.

Audit your product, architecture and growth engine

So you can scale in both directions. Technical partners like Mak It Solutions’ web development and business intelligence services can help you build data and product foundations that withstand regulatory and market shifts.

Done right, the question stops being “Silicon Valley vs European tech hubs?” and becomes “What’s the right mix of both for our mission, market and team?”

If you’re weighing Silicon Valley against London, Berlin, Paris or Munich, you don’t just need a flight itinerary you need a product, data and growth stack that works on both sides of the Atlantic. Mak It Solutions helps founders across the USA, UK, Germany and wider EU design scalable web, SaaS and mobile platforms that are performance- and compliance-ready from day one.

Reach out via Mak It Solutions to book a strategy call, and we’ll help you map your ecosystem options and turn them into a concrete product and expansion roadmap.( Click Here’s )

FAQs

Q : Is Europe catching up to Silicon Valley in AI and deeptech startups?

A : Yes, Europe is clearly catching up in AI and deeptech, especially in hubs like Paris, London, Berlin, Munich, Zurich and Helsinki. AI startups now attract a substantial share of European venture capital, and the EU AI Act is pushing many teams to build “responsible by design” products. However, Silicon Valley still dominates foundation models, AI infrastructure and the largest AI funding rounds, so many founders choose a hybrid strategy: R&D in Europe, GTM and partnerships in the Bay Area.

Q : Which European city is closest to Silicon Valley in terms of funding and startup density?

A : London is generally considered the closest analogue to Silicon Valley in Europe for funding depth, startup density and international talent. It leads Europe in overall VC raised and is a global fintech capital, while also hosting strong SaaS, AI and creative tech scenes. Paris and Berlin are catching up fast, especially in deeptech and B2B SaaS, but London still offers the broadest mix of capital, talent and English-language business infrastructure.

Q : How do salary and equity packages compare between Silicon Valley and hubs like London or Berlin?

A : In Silicon Valley, cash compensation and equity grants are typically higher, reflecting intense competition for talent and higher living costs in places like San Francisco and Palo Alto. London salaries are usually somewhat lower in dollar terms, with smaller but still meaningful equity grants, and Berlin tends to offer lower cash and equity but a much lower cost of living and longer runway per euro raised. For hybrid teams, founders often use location-adjusted salary bands while keeping equity philosophy consistent across US and European employees.

Q : What are the biggest regulatory risks for US startups expanding into the EU and UK?

A : The biggest regulatory risks are around data protection (GDPR/DSGVO and UK-GDPR), AI compliance (EU AI Act), financial regulation for fintech (BaFin, FCA and other national regulators) and platform rules under the DMA/DSA. US startups used to relatively flexible US rules may underestimate data residency, consent and algorithmic transparency requirements in Europe. Engaging EU-savvy legal counsel early, and designing your architecture (infrastructure, logging, analytics, marketing stack) with these rules in mind, dramatically reduces expansion risk.

Q : Can a startup be incorporated in the US but keep most of its team in Europe?

A : Absolutely. Many high-growth companies are Delaware C-corps with distributed teams across London, Berlin, Lisbon, Stockholm or Ukraine. They use a mix of local subsidiaries and employer-of-record services to stay compliant with labor and tax rules. The key is aligning corporate structure, IP ownership, employment contracts and equity plans so that you remain attractive to US investors while staying compliant in each European country where you hire.