Who Is Leading the Race to 6G in 2026

In 2026, there are no commercial 6G networks anywhere only research projects, patents, testbeds and early standards work under the IMT-2030 (6G) vision. China, South Korea and Japan currently lead on 6G-related patents and beyond-5G trials, while the US, UK, Germany and the wider EU are building strong positions in secure design, spectrum policy roadmaps and IMT-2030 standards influence.

Introduction

If you’re wondering who is leading the race to 6G, the honest answer is: it depends on what you measure. As of early 2026, there are no commercial 6G networks anywhere, only research projects, testbeds and standards work under the IMT-2030 (6G) umbrella.

What is very real is a strategic race in patents, standards influence, spectrum policy and ecosystem building. South Korea, China, Japan, the US, UK, Germany, Finland and the wider EU are all jockeying for position, alongside India and other fast-moving markets.

In this guide, we focus on the US, UK, Germany and Europe, and set them in context against South Korea, China, Japan and India so CIOs, CTOs and policy leaders can see what the “6G race” really means for strategy, risk and vendor choice over the next decade.

Who Is Leading the Global 6G Race in 2026?

If you zoom out, no one is “winning” 6G yet, but certain regions are clearly ahead on different axes. In 2026, South Korea, China and the US lead on 6G-related patents and 5G performance, while Japan, the UK, Germany, Finland and the broader EU are punching above their weight in research programs, standards input and future-proof policy.

Top 6G-Ready Countries Right Now

Based on 6G / beyond-5G patents, 5G performance and density, and visible testbeds and roadmaps, a working “6G-readiness” top tier today looks roughly like this (the order will evolve as new data lands)

South Korea

6G readiness score around 8.75/10 in uSwitch’s index, with hundreds of 6G patents and world-leading 5G speeds (top-10% users above 800 Mbps).

Aggressive roadmap for beyond-5G pilots, strong ecosystem around Samsung, SK Telecom, KT and LG U+.

China

Dominates collaborative 6G patent filings one analysis puts China at around 75% of global collaborative 6G patents, with state-backed players like State Grid and major vendors leading.

Heavy investment in test satellites, sub-THz research and early IMT-2030 contributions.

United States

Among the top holders of 6G-related patents (about 35% of global 6G SEPs around 2021–2022, second only to China).

Strong Next G Alliance roadmap, leading hyperscalers (AWS, Google Cloud, Microsoft Azure) and major operators (Verizon, AT&T, T-Mobile) investing in 6G research and 5G-Advanced platforms.

India

Ranked second in uSwitch’s 6G race with a 7.5/10 readiness score, thanks to fast-growing 5G, hundreds of 6G-related patents and aggressive government-backed R&D.

Japan

Deep 6G / “Beyond 5G” strategy via the Beyond 5G Promotion Consortium, NTT Docomo, NEC and university labs, with a strong focus on non-terrestrial networks and industrial applications.

United Kingdom

Often ranked 4th globally for 6G readiness, with a 6G-ready score around 5/10, approximately 100+ 6G-related patents and strong 5G speeds.

Active Ofcom spectrum consultations, multiple testbeds in London, Cambridge and Bristol.

Germany & Finland (EU spearheads)

Germany: powerhouse in Industrie 4.0, automotive (Berlin, Munich, Stuttgart) and manufacturing IoT; hosts Fraunhofer institutes and major 6G programs.

Finland: home of 6G Flagship at the University of Oulu and key Nokia Bell Labs research, plus strong collaboration in Oulu, Helsinki and Business Finland’s 6G initiatives.

Wider EU & Nordics (including Sweden)

EU’s Hexa-X and Hexa-X II projects, coordinated under the Smart Networks and Services Joint Undertaking (SNS JU), explicitly aim to secure European leadership in 6G.

Sweden’s Stockholm (Ericsson HQ) and Finnish/German networks form a dense 6G research corridor.

These rankings are proxies, not absolute truth. Patent counts, readiness scores and testbeds are moving targets, and by 2030 the quality of IP and standards influence may matter more than raw volumes.

What “Leading” Actually Means in the 6G Race

Talking about who is leading the 6G race only makes sense if you define which metric you care about:

Patents and IP portfolios

China and the US together hold the majority of 6G-related patents, with China at roughly 40% and the US at about 35% of early SEPs.

Analysts now count tens of thousands of 6G patent filings globally and over 1,300 organisations active in enabling-tech patents like terahertz and reconfigurable intelligent surfaces.

Standards influence

6G is being shaped within ITU-R’s IMT-2030 framework and 3GPP releases beyond 5G-Advanced, with major contributions from North America, Europe and East Asia.

Trials, testbeds and national programs

The EU’s Hexa-X / Hexa-X II, Finland’s 6G Flagship, Japan’s Beyond 5G Promotion Consortium and the US Next G Alliance are all running multi-country or multi-company pilots.

Readiness scores and ecosystem strength

Studies such as uSwitch’s “Race to 6G” index combine patents, 5G speeds and adoption to produce a composite 6G readiness score by country.

Think of it as a “6G readiness scorecard” with four dimensions: patents/IP, standards influence, testbeds/programs and ecosystem (vendors, operators, cloud and app developers). Different countries lead on different columns.

Why Nobody Has Deployed 6G Yet

Despite breathless headlines, 6G is still a research and pre-standard technology family.

IMT-2030 (the global 6G vision) was only agreed in 2023; detailed requirements and evaluation criteria are still being refined.

3GPP is finalising Release 18 (5G-Advanced) and exploring post-5G work items; full 6G radio and core specs will take the rest of the decade.

Key spectrum bands for 6G—especially upper mmWave and sub-THz / terahertz spectrum will be debated at ITU World Radiocommunication Conferences such as WRC-27 and WRC-31.

Realistically, you should expect lab and field trials throughout the late 2020s, with first commercial 6G deployments around 2030–2032 in markets like the US, South Korea, Japan, Germany and the Nordics not in 2026.

6G Development by Country.

United States Next G Alliance and the National 6G Roadmap

The US isn’t first in 6G patents, but it’s a heavyweight in standards, ecosystem and security. The ATIS Next G Alliance has published a National 6G Roadmap that lays out an ambitious vision to secure North American leadership across technology, spectrum and supply chains.)

Key US hubs include Washington, D.C. (policy and spectrum), Silicon Valley (chipsets, cloud and AI) and New York / the East Coast (finance, media and 5G-Advanced deployments). Major operators Verizon, AT&T and T-Mobile are already trialling beyond-5G features, often in partnership with AWS, Google Cloud and Microsoft Azure.

For enterprises in regulated sectors, the US 6G story is tightly coupled to NIST frameworks, SOC 2, HIPAA and PCI DSS. Expect future 6G reference architectures for hospitals, banks and critical infrastructure in New York or Austin to lean heavily on zero-trust, secure-by-design and post-quantum-ready crypto as they move from 5G-Advanced towards 6G.

United Kingdom Testbeds, Spectrum and the 6G Readiness Score

The UK consistently appears in the top five 6G-ready countries, ranking joint 4th with China in uSwitch’s analysis.

Ofcom is already shaping 6G spectrum policy, including mid-band refarming and early exploration of beyond-100 GHz bands.

Universities and operators are running 6G testbeds in London, Cambridge and Bristol, often tied to smart-city, transport and health pilots.

BT/EE, Vodafone and Three are upgrading 5G cores and RAN for 5G-Advanced features that will be stepping stones towards 6G.

Regulation-wise, the UK blends UK-GDPR, the Telecoms Security Act and sector rules from bodies such as the NHS and FCA, giving 6G deployments in London or Manchester a distinct compliance profile versus New York or Berlin.

Germany and the EU Hexa-X, Hexa-X II and 6G Flagship

In Germany and the wider EU, leadership is less about raw patent counts and more about coordinated research and values-driven policy.

Hexa-X and Hexa-X II are EU 6G flagship projects under the SNS JU, led by Nokia and Ericsson with partners like Fraunhofer HHI and leading universities in Berlin, Munich, Dresden, Helsinki and Oulu.

The SNS JU plans multi-billion-euro funding for 6G projects aligned with sustainability, trust, inclusion and European digital sovereignty.

Germany, in particular, connects 6G to Industrie 4.0, automotive and advanced manufacturing (think Stuttgart, Munich, Wolfsburg), making it a likely early adopter of 6G for private networks and digital twins across factory floors. Finland’s 6G Flagship in Oulu and Sweden’s Ericsson HQ in Stockholm further anchor Europe’s 6G ecosystem.

At the policy level, Brussels links 6G to the GDPR/DSGVO, EU Data Act and EU AI Act, and to initiatives like the European Health Data Space, shaping how 6G networks will handle sensitive data across borders.

6G Technology Basics Beyond 5G and 5G Advanced

What Is 6G Technology?

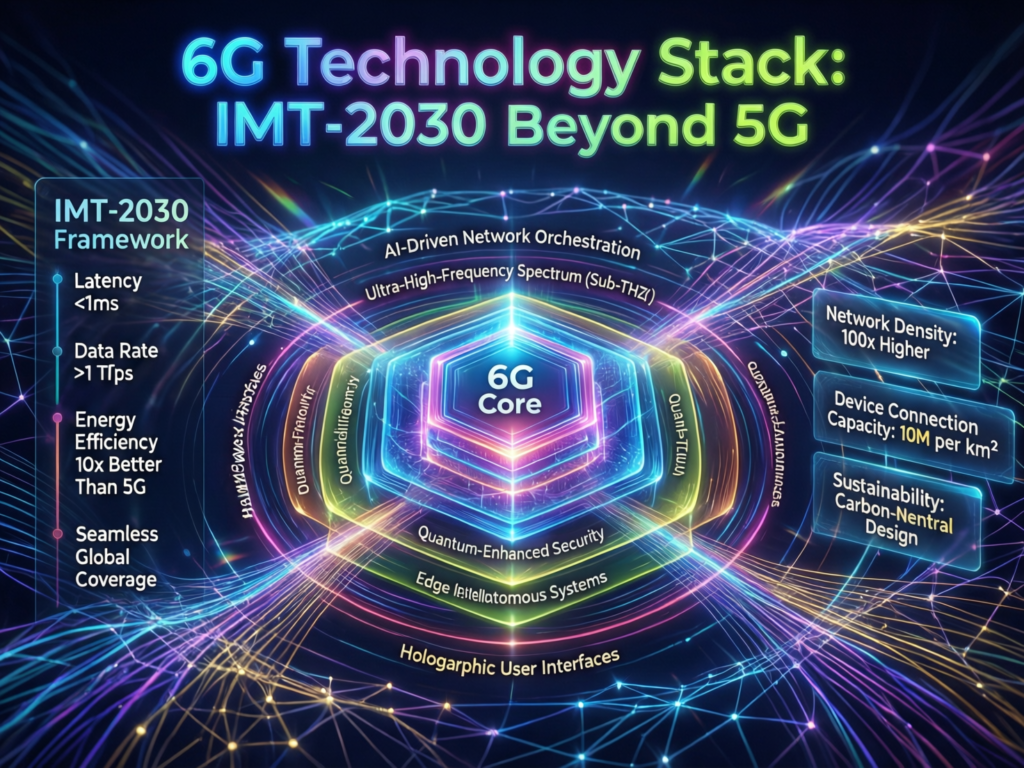

6G officially IMT-2030 in ITU language is the proposed sixth generation of mobile networks, designed to extend and surpass 5G-Advanced. It targets ultra-low latency (sub-millisecond), Tbps-class data rates, massive device density and native network sensing, all orchestrated by integrated AI.

You can think of 6G as the convergence point for beyond-5G wireless networks, combining terrestrial 5G-Advanced, non-terrestrial networks (NTN), edge/cloud computing and AI-driven orchestration under a single IMT-2030 vision.

Core Enablers Terahertz, AI-Native RAN and Non-Terrestrial Networks

Three big technology pillars keep appearing in 6G roadmaps.

Terahertz / sub-THz spectrum

Use of frequencies above today’s mmWave bands, potentially into hundreds of GHz, to unlock extreme throughput and ultra-precise localisation, especially in dense urban areas like New York, London or Berlin.

AI-native 6G / AI-RAN

6G radio access networks will treat AI as a core control plane, not an add-on optimising beamforming, power, mobility and interference in real time, and adjusting to demand from factories in Munich or hospitals in Manchester.

Non-Terrestrial Networks (NTN)

Integration of LEO satellites, HAPS and direct-to-device links to complement ground coverage, vital for rural US states, remote Scottish islands or pan-European transport corridors.

6G Timelines When Will 6G Be Available?

The realistic 6G timeline looks roughly like this.

2020–2026

National 6G research programs, early IMT-2030 vision work, beyond-5G pilots and lab demos.

2026–2029

IMT-2030 requirements finalised, 3GPP Release 19+ preparing for 6G, large-scale testbeds in hubs like Seoul, Tokyo, Oulu, Berlin and Austin.

Around 2030+

First commercial 6G deployments in leading markets across the US, Europe and East Asia, then gradual rollout elsewhere.

For the US, UK, Germany and broader EU, most enterprises should assume serious 6G adoption in the 2030s, with 5G-Advanced and Wi-Fi 7 doing the heavy lifting this decade.

6G Technology Leaders Vendors, Operators and Alliances

Global 6G Technology Leaders

On the vendor and operator side, a familiar cast of characters is driving the 6G ecosystem: Nokia, Ericsson, Samsung, Huawei, Qualcomm, NTT Docomo and NEC, alongside major US and European carriers.

South Korea

Samsung plus SK Telecom, KT and LG U+ combine strong IP with world-class 5G deployment density.

China

Huawei and ZTE are core to China’s 6G ambitions, especially in patents, test satellites and sub-THz research.

Japan

NTT Docomo, KDDI, SoftBank, NEC and the Beyond 5G Promotion Consortium shape a highly coordinated national approach.

On top of this are cloud and chipset ecosystems Qualcomm, MediaTek, Intel, plus hyperscalers in the US and Europe who will heavily influence how 6G is actually consumed by applications.

European Leadership Hexa-X, SNS JU and 6G Flagship

Europe’s edge is its multi-country, multi-vendor consortia model:

Hexa-X and Hexa-X II, led by Nokia and Ericsson, bring together operators, vendors, Fraunhofer, universities and SMEs to design a sustainable, inclusive, trustworthy 6G platform.

6G Flagship in Oulu coordinates large-scale research on wireless connectivity, devices, distributed computing and services often cited as the world’s first organised 6G research program.

For enterprises in Berlin, Munich, Helsinki, Stockholm or Brussels, this means 6G solutions will likely come as European-standardised, values-aligned stacks that emphasise sustainability, resilience and digital sovereignty.

North American and Asian Alliances Shaping 6G

Beyond the EU, several alliances are shaping how 6G will look by 2030.

Next G Alliance (North America) anchors the US and Canadian 6G roadmap, including spectrum, sustainability and supply-chain themes.

Beyond 5G Promotion Consortium (Japan) links government, industry and academia in Tokyo to steer B5G and early 6G priorities.

US–EU, Japan–India and other bilateral collaborations from North American European 6G workshops to Indo-Japanese 6G trials in places like Bangalore and Hyderabad.

For CIOs evaluating vendors, membership and leadership roles in these alliances are a strong signal of long-term 6G relevance.

Why 6G Leadership Matters Economy, Security and Policy

Early 6G leadership isn’t just about bragging rights. It directly affects economic growth, industrial competitiveness and national security across the US, UK, Germany and Europe.

Economic Impact Across US, UK, Germany and Europe

6G is expected to amplify the impact of 5G-Advanced across key verticals.

Smart manufacturing / Industrie 4.0

In Germany and across the EU, 6G-class ultra-reliable, low-latency networks will power autonomous robots, real-time digital twins and predictive maintenance in factories from Munich to Dresden.

Automotive and mobility

6G V2X capabilities should support higher automation levels for vehicles on US interstates, the UK’s smart motorways and European corridors connecting Berlin, Paris and Milan.

Healthcare and telemedicine

NHS trusts in London, specialist clinics in New York and university hospitals in Berlin could use beyond-5G / 6G for remote surgery support, XR-based training and continuous monitoring, all governed by HIPAA, GDPR and the European Health Data Space.

Smart cities and finance

Real-time IoT payments, biometric authentication and always-on AR services in financial districts like Wall Street, the City of London or Frankfurt will lean on ultra-resilient, low-latency connectivity, supported by Open Banking, PSD2/PSD3 and PCI DSS rules.

Recent market forecasts expect the global 6G market (equipment, services and apps) to reach hundreds of billions of dollars annually by the mid-2030s, although estimates vary widely. (TechSci Research) These are directional estimates, not financial advice always cross-check with up-to-date market research.

National Security, Sovereignty and Trusted Vendors

For Washington, London, Berlin and Brussels, 6G is also a strategic asset:

It underpins critical infrastructure, from energy grids and railways to defence communications and emergency services.

It intensifies debates on trusted vendors, supply-chain resilience and export controls, especially around radio equipment and advanced semiconductors.

Expect the US to double-down on export controls and secure-by-design requirements; the EU on “toolbox” approaches to high-risk vendors; and the UK on rigorous telecom security rules. The goal is the same: 6G networks resilient to cyber attacks, espionage and geopolitical shocks.

Data Protection, AI Regulation and Cross-Border Flows

6G will also intersect strongly with data and AI regulation.

GDPR/DSGVO and UK-GDPR continue to set the bar for personal data processing, including 6G location, biometrics and health data.

The EU Data Act and EU AI Act will regulate how intelligent network functions and AI-native RAN components operate and share data. (Digital Regulation)

Cross-border transfers will hinge on frameworks like the EU–US and UK–US Data Privacy Frameworks, plus localisation rules from regulators like BaFin in Germany or state regulators in the US.

For sectors like finance (PSD2/PSD3, PCI DSS) and health (HIPAA, NHS rules), this means 6G network design is as much a compliance architecture problem as a radio-engineering one.

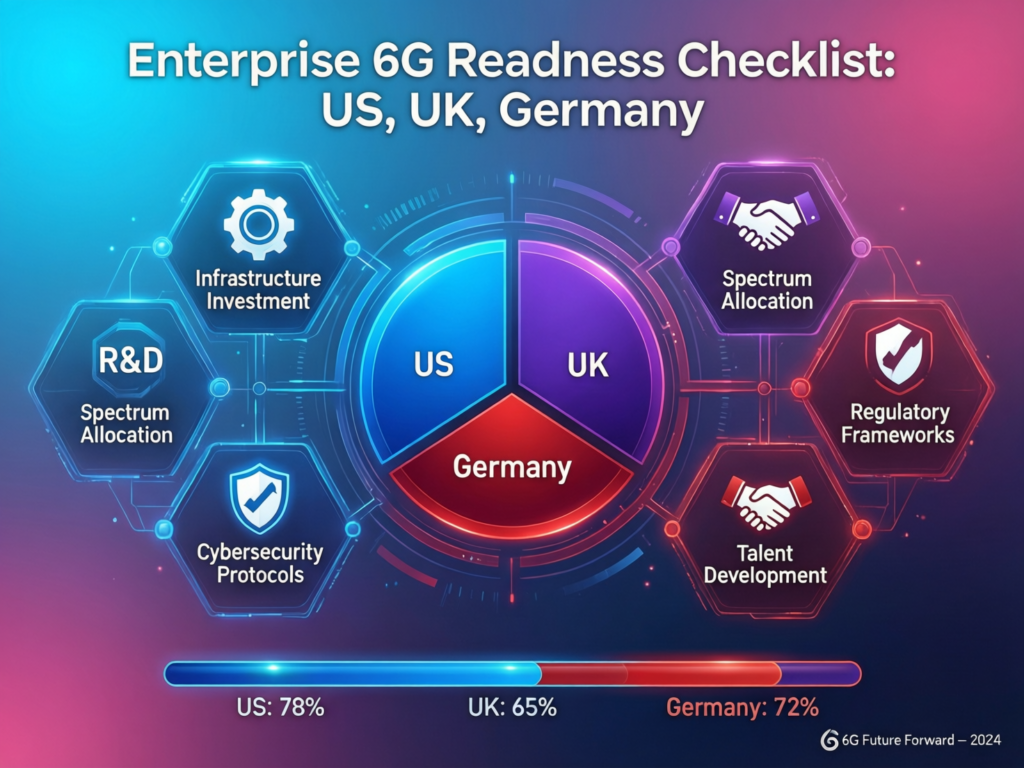

How Enterprises Should Read the 6G Race in 2026

So, how should CIOs and CTOs interpret the 6G race today especially if you’re running operations across the US, UK, Germany and the wider EU?

Assessing Your 6G Readiness Today

Instead of only asking “who is leading the race to 6G?”, a better question is: how ready is my organisation to exploit 6G when it arrives?

A simple readiness checklist for 2026.

Network modernisation

Are your sites in New York, London or Berlin already on robust 5G / 5G-Advanced and Wi-Fi 6E/7?

Private 5G and edge

Have you piloted private 5G in factories, warehouses or hospitals possibly with partners like Mak It Solutions to integrate apps, data and BI dashboards? (Mak it Solutions)

Cloud-native core and observability

Is your network stack moving towards cloud-native microservices, with proper observability and automation, rather than legacy monoliths?

Security posture

Are you aligned with NIST, ISO 27001, SOC 2 and sector rules like HIPAA or PCI DSS, with a roadmap towards zero trust and post-quantum experimentation?

Data governance

Do you have a clear data classification, residency and cross-border transfer policy for EU, UK and US entities?

If the answer to most of these is “not yet”, your 6G priority is to close today’s 5G-Advanced and data-governance gaps, not to obsess about speculative 2030 features.

What to Do Now Invest, Experiment or Wait?

A balanced 2026–2030 plan might look like this.

Invest now in enabling layers

Modernise connectivity, observability, security and data pipelines so your stack is “6G-ready” without forklift upgrades.

Use partners with full-stack capabilities from web and mobile app development through BI and digital marketing so you can turn future 6G capabilities into real products quickly. (Mak it Solutions)

Experiment with targeted pilots

Between 2026 and 2030, run pilots for digital twins, XR training, industrial IoT and real-time analytics in strategic locations (e.g., an Austin manufacturing plant, a London fintech hub, a Munich automotive R&D centre).

Avoid premature bets

Be cautious about vendor promises of “6G-ready” hardware without clear standards commitments or alliance footprints. Focus on upgradable, standards-aligned platforms instead.

Evaluating 6G Technology Leaders and Partners

When assessing vendors and partners in this pre-6G phase, look for.

Active participation in standards bodies 3GPP, ITU-R IMT-2030, ETSI, plus national regulators (FCC, Ofcom, BNetzA).

Presence in key alliances Hexa-X / Hexa-X II, 6G Flagship, Next G Alliance, Beyond 5G Promotion Consortium.

Patent and research footprint contributions to 6G enabling technologies like terahertz, RIS and AI-RAN.

Security and compliance credentials SOC 2, ISO 27001, NIST alignment and proven implementations under GDPR, HIPAA, PCI DSS or BaFin.

This is where a partner like Mak It Solutions can help you translate global 6G trends into practical roadmaps, proof-of-concepts and modernised digital platforms across the US, UK, Germany and broader Europe. (Mak it Solutions)

Concluding Remarks

By early 2026, there is no single “winner” in the race to 6G.

South Korea, China and the US lead the pack on patents and beyond-5G metrics.

Japan, the UK, Germany, Finland and wider Europe excel in collaborative research, standards leadership and trust-first policy.

For enterprises, the strategic takeaway is clear: you don’t need to bet on one country “winning” 6G. What matters is aligning your roadmap with the strongest ecosystems North America, key European hubs and advanced Asian markets while investing today in 5G-Advanced, cloud-native infrastructure and data governance.

If you get that right between now and 2030, you’ll be ready to plug into whichever 6G flavour arrives first in New York, London, Berlin or beyond and you’ll be in a much better position than competitors still arguing about who “won” the race.

If you’d like to translate the global 6G race into a concrete roadmap for your organisation, Mak It Solutions can help you modernise your stack today so you’re ready for 5G-Advanced, Wi-Fi 7 and, eventually, 6G. From web and mobile apps to business intelligence and cloud-native architectures, our team works with clients across the US, UK, Germany and the wider EU. (Mak it Solutions)

Reach out to our Editorial Analytics Team and request a scoped consultation: we’ll review your current architecture, highlight 6G-relevant gaps and propose a realistic 2026–2030 action plan tailored to your sector and geography.( Click Here’s )

FAQs

Q : Is 6G real today or just a research concept in 2026?

A : 6G is very real in research and standards, but there are no commercial 6G networks in 2026. Work is happening under the IMT-2030 (6G) framework at ITU-R, with 3GPP evolving beyond 5G-Advanced. Countries like the US, South Korea, Japan, China, Germany and Finland are funding labs, testbeds and pilot projects, but these are still experimental. Commercial 6G services are expected around 2030 and beyond, after spectrum decisions at WRC-27 and WRC-31 and completion of key 3GPP releases.

Q : How fast could 6G be compared with 5G and Wi-Fi 7 in real-world use?

A : Early 6G visions talk about terabit-per-second (Tbps) peak speeds, roughly 10× beyond high-end 5G and several times faster than today’s Wi-Fi 7 in ideal conditions. In practice, real-world 6G speeds in cities like London, New York or Berlin will depend on spectrum, device capabilities and network design think hundreds of Mbps to multi-Gbps for everyday users, with specialised links delivering much more for industrial or backhaul use. This will sit on top of 5G-Advanced and Wi-Fi 7, which will remain critical for many enterprise and campus scenarios even after 6G arrives.

Q : Will 6G eventually replace fibre broadband in cities like London, New York and Berlin?

A : 6G is unlikely to fully replace fibre in major cities. Instead, it will complement fixed networks by providing ultra-high-capacity wireless last-mile links, backup connectivity and specialised services like XR streaming, connected vehicles and industrial IoT. Fibre remains hard to beat for raw capacity and reliability especially for data centres, enterprise campuses and dense residential blocks while 6G will offer flexibility, mobility and coverage where fibre is expensive or slow to deploy. In practice, you’ll see hybrid architectures combining fibre, 6G, Wi-Fi 7 and edge compute in places like London’s financial district, Manhattan or Berlin’s innovation hubs.

Q : What skills and roles will telecom and IT teams need to prepare for 6G deployments?

A : Preparing for 6G is less about learning a specific “6G protocol” today and more about building foundational skills. Telecom and IT teams will need expertise in cloud-native networking, Kubernetes, observability, security engineering, AI/ML for network optimisation and data governance. On the radio side, skills around mmWave, beamforming, non-terrestrial networks and RF planning will be valuable. For enterprises, capabilities in edge computing, digital twins, XR, analytics and compliance (GDPR, HIPAA, PCI DSS, BaFin, etc.) will matter at least as much as pure RAN expertise. Many of these skills can be developed now through 5G-Advanced, Wi-Fi 7 and private 5G projects.

Q : How can regulators balance rapid 6G innovation with privacy, AI and cybersecurity regulations in the US, UK and EU?

A : Regulators will likely continue the pattern we already see with 5G and AI: enable innovation, but bake in safeguards. In the EU, that means aligning 6G with GDPR/DSGVO, the EU Data Act and EU AI Act, plus sector rules in finance and health. In the UK, Ofcom, DCMS and the ICO will coordinate telecom security and UK-GDPR compliance. In the US, agencies like the FCC, NTIA and HHS will shape spectrum, security and health data rules, while NIST and CISA push secure-by-design guidance. The challenge is to design 6G networks with privacy, resilience and AI transparency built in from day one, not bolted on later.