AWS vs Azure vs Google Cloud Comparison 2025 – Who Wins?

AWS vs Azure vs Google Cloud Comparison 2025 – Who Wins?

Cloud Showdown 2025: AWS vs Azure vs Google Cloud Comparison

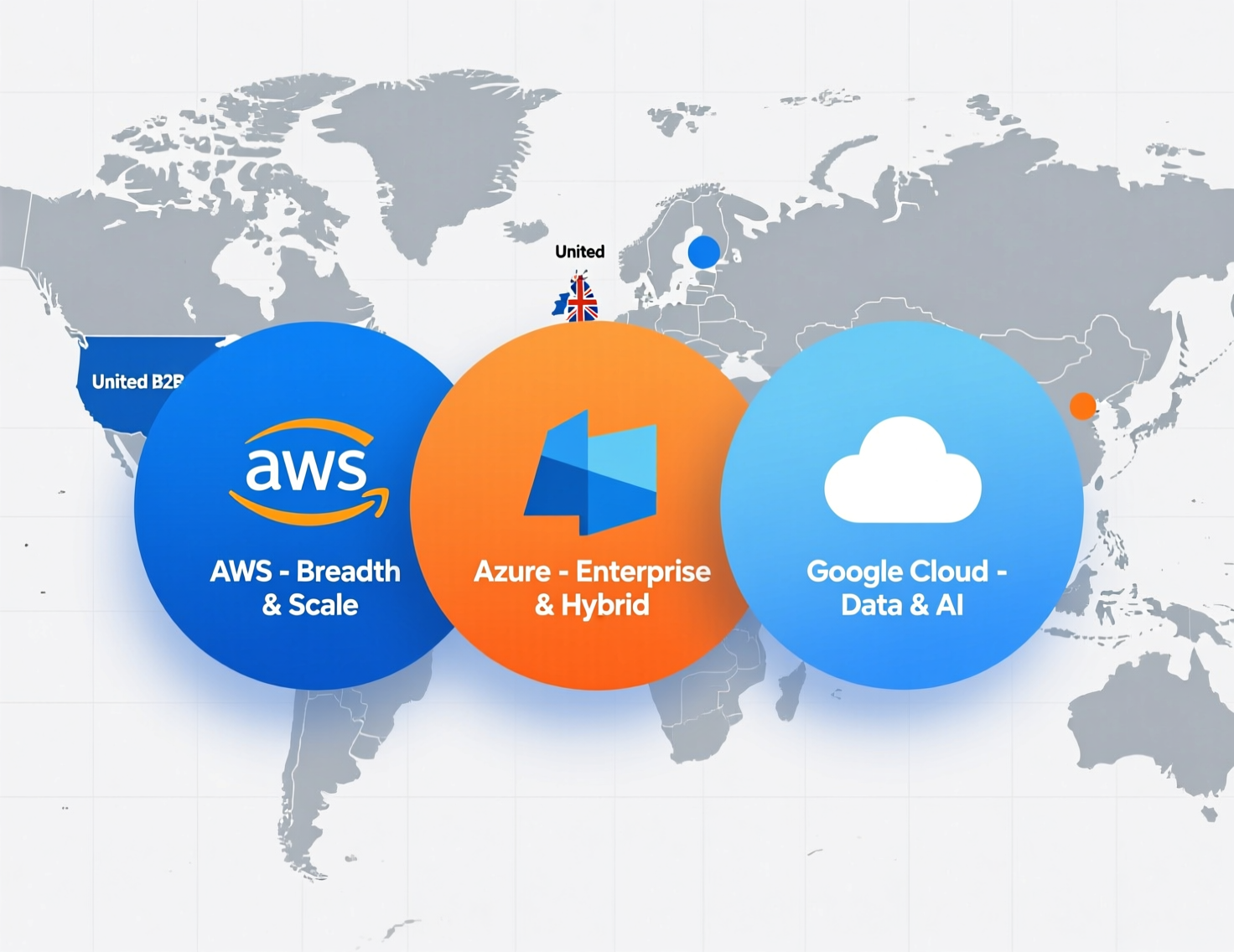

In 2025, AWS still leads global cloud infrastructure with around 30% market share, Azure is second at ~20%, and Google Cloud is third at ~13% but growing fastest in AI and data workloads. For US, UK, Germany and wider EU enterprises, AWS tends to win on breadth and maturity, Azure on Microsoft-centric and hybrid estates, and Google Cloud on analytics- and AI-heavy use cases.

Introduction

If you’re evaluating an AWS vs Azure vs Google Cloud comparison 2025 for serious enterprise workloads, you’re really choosing an operating system for your business in the US, UK, Germany and across the EU. AWS still leads with roughly 30% global cloud infrastructure share, Azure follows at around 20%, and Google Cloud sits near 13% but is the fastest-growing of the three.

AWS wins on breadth, maturity and ecosystem; Azure is often the default for Microsoft 365, Windows Server and hybrid-heavy organizations; and Google Cloud is the favorite for modern data platforms and AI-first teams. At Mak It Solutions, we see this daily when we design web, mobile and analytics solutions for clients from New York and Austin to London, Berlin and wider Europe. Whether you’re planning a greenfield SaaS product, modernizing legacy ERP or building regulated healthcare and fintech platforms, your cloud choice will shape cost, compliance and innovation for the next 3–5 years.

AWS vs Azure vs Google Cloud at a Glance

For most global enterprises in 2025:

AWS → strongest overall breadth, maturity and partner ecosystem.

Azure → best fit for Microsoft-centric enterprises and hybrid cloud.

Google Cloud → strongest for data platforms, analytics and AI-heavy workloads.

Best choice depends on your industry (e.g., NHS, BaFin-regulated banks, US federal), regions (US vs UK vs Germany/EU) and in-house skills.

What is the key difference between AWS, Azure and Google Cloud for global enterprises in 2025?

For global enterprises, the key differences in 2025 are: AWS leads in platform maturity and ecosystem, Azure in Microsoft stack integration and hybrid, and Google Cloud in data/AI innovation and open-source friendliness. US, UK, German and EU buyers typically narrow their shortlist based on existing tools (Microsoft 365, Google Workspace, AWS-native), regulatory constraints and latency/data-residency needs.

AWS

Huge service catalog (compute, storage, networking, databases, serverless, IoT), marketplace depth and MSP/SI partner network make it the “safe” choice for complex multi-region architectures.

Azure

Tight coupling with Active Directory / Entra ID, Windows Server, SQL Server, Teams and Power Platform makes it ideal for enterprises standardised on Microsoft in London, Manchester, Frankfurt and US corporate IT.

Google Cloud

BigQuery, Vertex AI and GKE, plus strong Kubernetes and open-source DNA, attract data/ML teams, digital natives and European research clouds that want open standards and AI innovation.

Across the US, UK and DACH, we frequently see AWS-first for core workloads, Azure-first for corporate IT & collaboration and GCP-first for analytics/ML, often in a coordinated multicloud strategy.

Why does AWS still lead the cloud market while Azure and Google Cloud continue to grow in 2025?

AWS still leads because of its first-mover advantage, broadest regions and availability zones, and a massive partner ecosystem of MSPs, SIs and ISVs. Azure continues to grow by bundling cloud with Microsoft 365, Teams, Windows and enterprise licensing agreements, while Google Cloud grows fastest by capturing AI- and data-heavy projects in US and European markets.

In Q2–Q3 2025, AWS holds about 30% of global cloud infrastructure share, Azure about 20% and Google Cloud around 13%, with the “Big Three” collectively owning more than 60% of a market now over $100 billion per quarter.Azure and GCP have higher year-on-year growth rates (low-20s and 30%+ respectively) driven by AI and analytics, while AWS maintains its lead through scale and continuous reinvestment in compute, storage, networking and security.

AWS vs Azure vs Google Cloud market share 2025 in the US, UK, Germany and EU

Globally in 2025, AWS is still above 30%, Azure above 20% and Google Cloud in the low teens but the fastest-growing of the three . The pattern broadly holds across North America and Western Europe, but with local nuances:

US

AWS dominates digital-native businesses and many federal/state workloads, with Azure strong in enterprises and public sector; Google Cloud is popular with AI-first startups and media.

UK

Azure has a major footprint in NHS and central government, while AWS and Azure split large enterprises; GCP wins in open banking and analytics-heavy fintech.

Germany & DACH

AWS and Azure lead for Mittelstand and industrial/automotive workloads, with Frankfurt (eu-central-1) a key region. GCP is gaining share for BigQuery- and Vertex AI–based Industry 4.0 analytics.

Wider EU (France, Netherlands, Ireland, Spain, Switzerland)

All three operate multiple regions, with GCP particularly strong in research, adtech and data/AI platforms.

For boards and CIOs, this means none of the three are “risky” bets the question is alignment with your stack, compliance and AI strategy, not vendor survival.

Core Services & Architecture Comparison by Region

This section gives you a side-by-side view of compute, storage, networking and regions for AWS, Azure and Google Cloud, with specific focus on US, UK, Germany and EU data-residency scenarios. If you’re mapping workloads to a public cloud providers comparison, think of this as your high-level reference architecture.

Compute, storage and networking comparison across US, UK, Germany and wider EU regions

For core IaaS workloads in 2025

Compute

AWS EC2 vs Azure VMs vs Google Compute Engine all offer broad instance families (general purpose, compute/memory optimised, GPUs). For container workloads, you get EKS, AKS and GKE respectively GKE still has the reputation as the most “Kubernetes-native” experience, with EKS and AKS catching up.

Serverless

AWS Lambda, Azure Functions and Google Cloud Functions/Cloud Run all support event-driven and HTTP workloads. Cloud Run’s container-first model is especially attractive for teams standardising on containers across multicloud.

Networking

AWS VPC, Azure VNets and Google VPC networks all support segmentation, private connectivity, VPNs and ExpressRoute/Direct Connect/Cloud Interconnect equivalents.

Region examples you’ll actually pick in RFPs and migration plans.

US

us-east-1 (N. Virginia), us-east-2 (Ohio), us-west-2 (Oregon)

UK

AWS eu-west-2 (London), Azure UK South, Google europe-west2 (London)

Germany

AWS eu-central-1 (Frankfurt), Azure Germany West Central, Google europe-west3 (Frankfurt)

EU core

Dublin, Paris, Amsterdam, Zurich, Madrid, Warsaw, Milan across all three providers

Mak It Solutions often designs architectures that run web front ends on managed Kubernetes, with serverless backends for bursty APIs and managed databases (RDS, Azure SQL, Cloud SQL) across those specific regions.

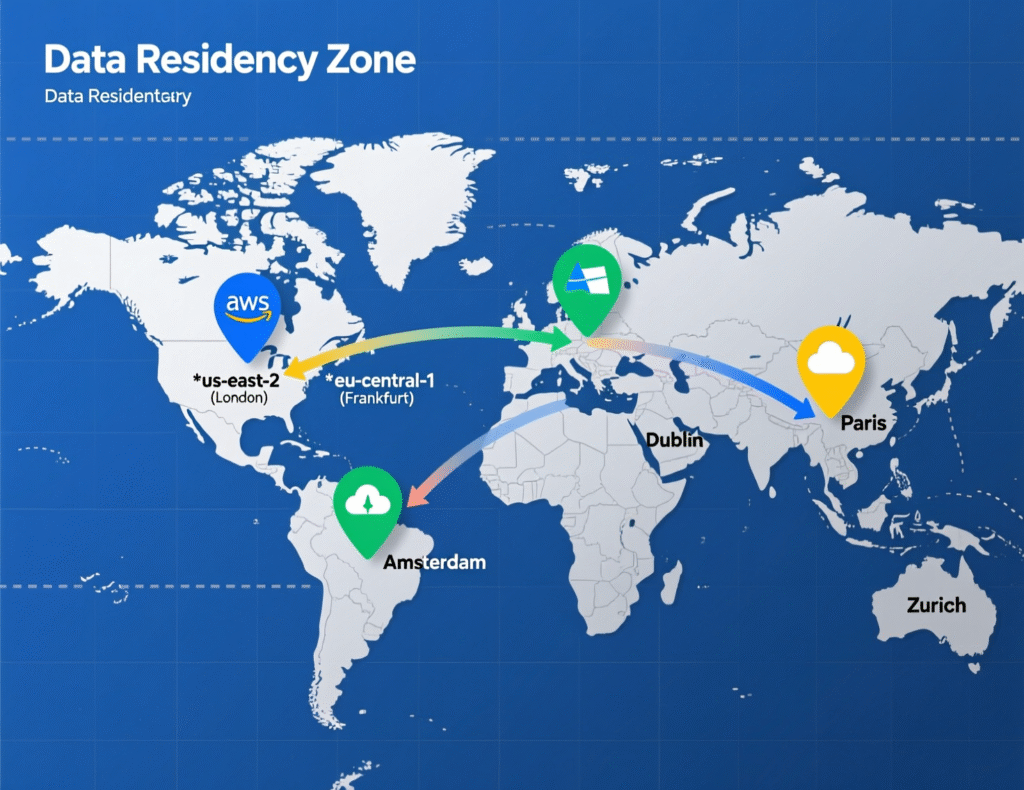

Regions, availability zones, latency and data residency

All three hyperscalers now offer multiple regions with at least 3 availability zones in most major metros, enabling high-availability designs via multi-AZ and multi-region deployment patterns. For a low-latency user experience:

US customers might split active-active between.

UK public sector workloads may cluster in London (primary) with Dublin or Amsterdam for DR.

German and DACH workloads often use Frankfurt as primary with Paris or Zurich as failover to stay within the EEA/Europe for GDPR/DSGVO.

Data residency is critical for GDPR/DSGVO, UK-GDPR, BaFin and sector-specific rules. All providers offer EU-only storage and processing options, but it’s your architecture logging, backups, analytics, support tooling that ultimately decides whether personal data leaves the EEA or UK. Many EU banks, insurers and public bodies therefore require explicit “EU-only” designs, which Mak It Solutions frequently implements with strict region pinning and encryption controls.

IaaS vs PaaS vs SaaS on AWS, Azure and Google Cloud

For IaaS, EC2/ELB/EBS, Azure VMs/Load Balancer and GCE/Cloud Load Balancing cover the basics. For managed databases, think Amazon RDS/ECS, Azure SQL/AKS and Cloud SQL/GKE.

On the PaaS side

AWS

Elastic Beanstalk, Fargate, App Runner and Lambda.

Azure

App Service, Azure Kubernetes Service, Functions.

GCP

Cloud Run, App Engine, GKE.

At the SaaS layer, Microsoft 365 and Power Platform sit naturally on Azure; Google Workspace integrates closely with GCP; AWS leans more on a rich marketplace of third-party SaaS for vertical and horizontal solutions. For US and European enterprises, the practical reality is often IaaS/PaaS on one cloud plus SaaS from Microsoft/Google Mak It Solutions helps clients glue these together with secure APIs and integration layers.

Pricing, TCO & Cost Optimization in 2025

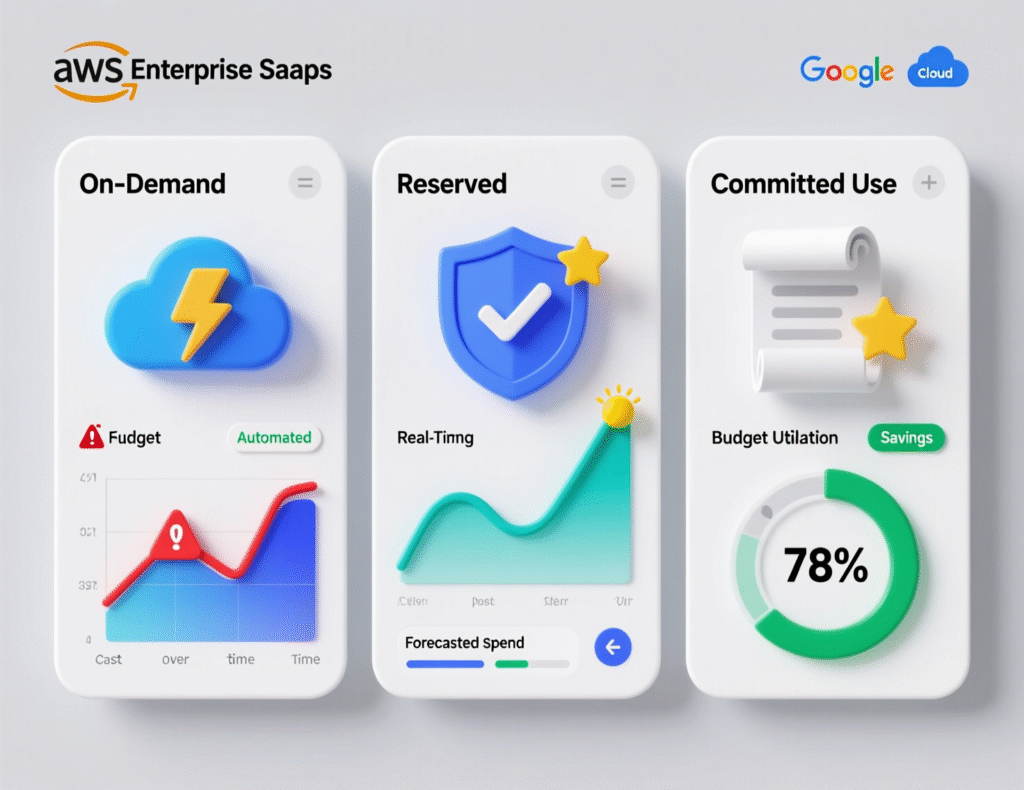

In 2025, all three hyperscalers use similar pricing models on-demand, reserved/committed use, and discounted spot/preemptible but with different names and discount curves. For CFOs and FinOps teams in the US, UK, Germany and EU, the goal is to compare long-term TCO, not just headline instance prices in USD, GBP or EUR.

How should a midsize company compare AWS, Azure and Google Cloud pricing in 2025 to avoid bill shock?

A midsize company should compare AWS, Azure and Google Cloud pricing in 2025 using a simple four-step framework: profile workloads, model usage in each provider’s calculator, compare long-term discounts, then simulate egress and managed-service costs in target regions. This approach works the same whether you’re a London SaaS startup, a German Mittelstand manufacturer or a US healthcare ISV.

Anti–bill shock framework

Profile workloads clearly

Define CPU, RAM, storage, network and data-transfer patterns for each app (steady vs spiky, dev/test vs prod).

Model usage in cloud calculators

Use AWS, Azure and GCP pricing calculators for your target regions ) in USD/GBP/EUR.

Compare discounts & commitments

Evaluate Savings Plans / RIs (AWS), Reservations + Hybrid Benefit (Azure), and Committed Use Discounts / Sustained Use (GCP) over 1–3 years.

Simulate egress & managed-service costs

Include inter-region traffic, CDN, managed databases, AI services and logging/monitoring—especially across EU/UK/US borders, where data-exit charges add up.

At Mak It Solutions, we bundle this into a TCO and FinOps assessment, often alongside application modernization and cloud migration strategy to hyperscalers like AWS, Azure and GCP.

How AWS, Azure and Google Cloud differ

All three providers charge a premium for pure on-demand usage but offer 30–70%+ discounts for long-term or flexible commitments.

AWS

Reserved Instances (RIs) and Savings Plans (Compute and EC2) reduce costs for steady-state workloads.

US startups often start on on-demand then move core microservices and databases to 1–3 year Savings Plans once patterns stabilise.

Azure

Azure Reservations plus Hybrid Benefit let UK and EU enterprises re-use Windows Server and SQL Server licences, making Azure very attractive for Microsoft-heavy estates.

Google Cloud

Committed Use Discounts (CUDs) and Sustained Use Discounts reward consistent consumption, which is common in SaaS, analytics and gaming workloads.

For a German Mittelstand manufacturer, we often see a mix: production workloads on 3-year commitments in Frankfurt, test environments on on-demand/short commitments, and CI/CD bursts on spot/preemptible instances.

Cloud cost optimization playbook for US, UK, Germany and EU organizations

A practical cloud cost optimization playbook should combine technology, governance and FinOps:

Right-sizing & autoscaling: continuously resize instances, use autoscaling groups and Kubernetes HPA.

Spot/preemptible usage: offload non-critical workloads like batch analytics to cheap, interruptible capacity.

Storage tiering: move cold data to glacier/archival tiers and short-lived data to lifecycle-managed buckets.

Egress minimization: keep data and compute in the same region; avoid unnecessary cross-region and cross-cloud transfers, especially in Europe.

FinOps practices: tagging, budget alerts, showback/chargeback and regular reviews of idle resources.

For many enterprises, bringing in a partner like Mak It Solutions to run a cost optimization sprint pays for itself quickly especially when combined with performance tuning and application modernization.

AI, Data & Modern Workloads on AWS, Azure and Google Cloud

All three providers offer strong AI stacks in 2025, but with different strengths: AWS has the broadest AI/ML services, Azure leads in enterprise AI integration and copilot-style experiences, and Google Cloud leads in analytics and data-native AI.

What makes AWS, Azure or Google Cloud the best choice for AI and machine learning workloads in the US and Europe?

AWS is often best for broad AI/ML options and deep integration with existing AWS workloads; Azure is best for enterprises that want AI embedded into Microsoft 365, Dynamics and developer tools; and Google Cloud is the top choice for data-centric AI with BigQuery and Vertex AI. US and European teams typically evaluate GPU/TPU availability, managed foundation models, and compliance with GDPR, UK-GDPR and the evolving EU AI Act.

AWS

Amazon Bedrock, SageMaker and related services let teams orchestrate multiple LLM providers (including Anthropic) and manage the full ML lifecycle.

Azure

Azure AI Studio and Azure OpenAI provide direct access to GPT-4 class models, enterprise connectors and governance tools integrated with Entra ID.

Google Cloud

Vertex AI integrates closely with BigQuery, Gemini models and GKE, making it ideal for European research and data-heavy platforms.

In regulated US healthcare (HIPAA) and European public sector environments, AI workloads are increasingly deployed in EU/UK/US regions with strict network, encryption and logging controls.

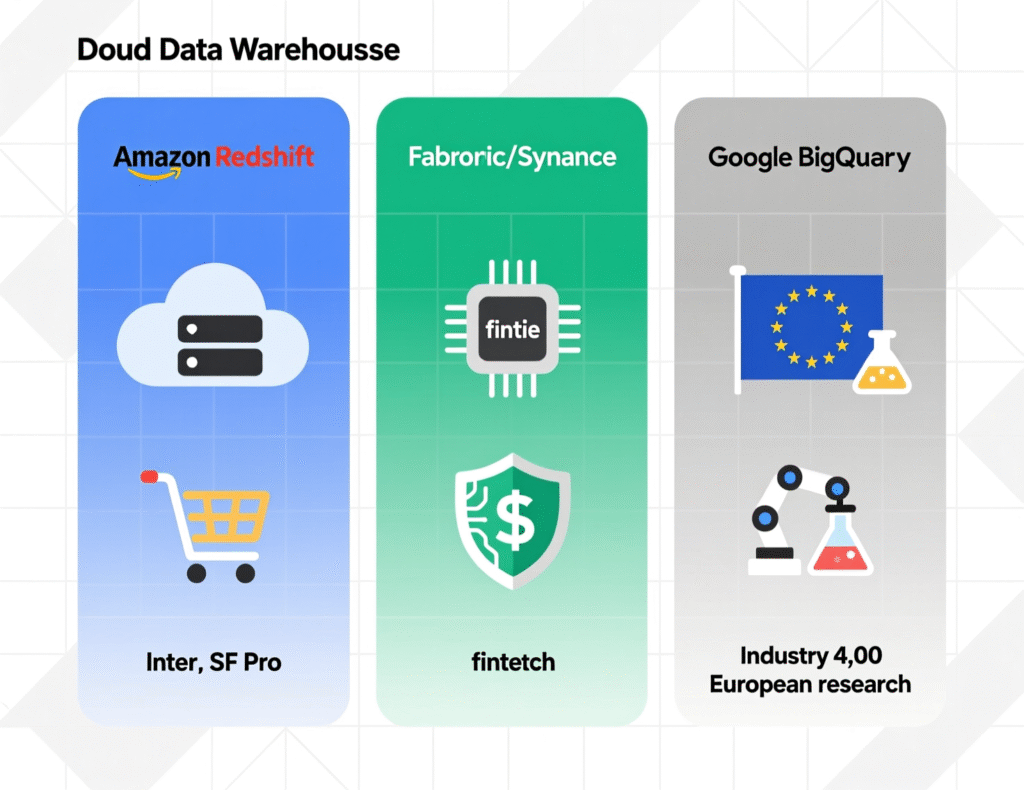

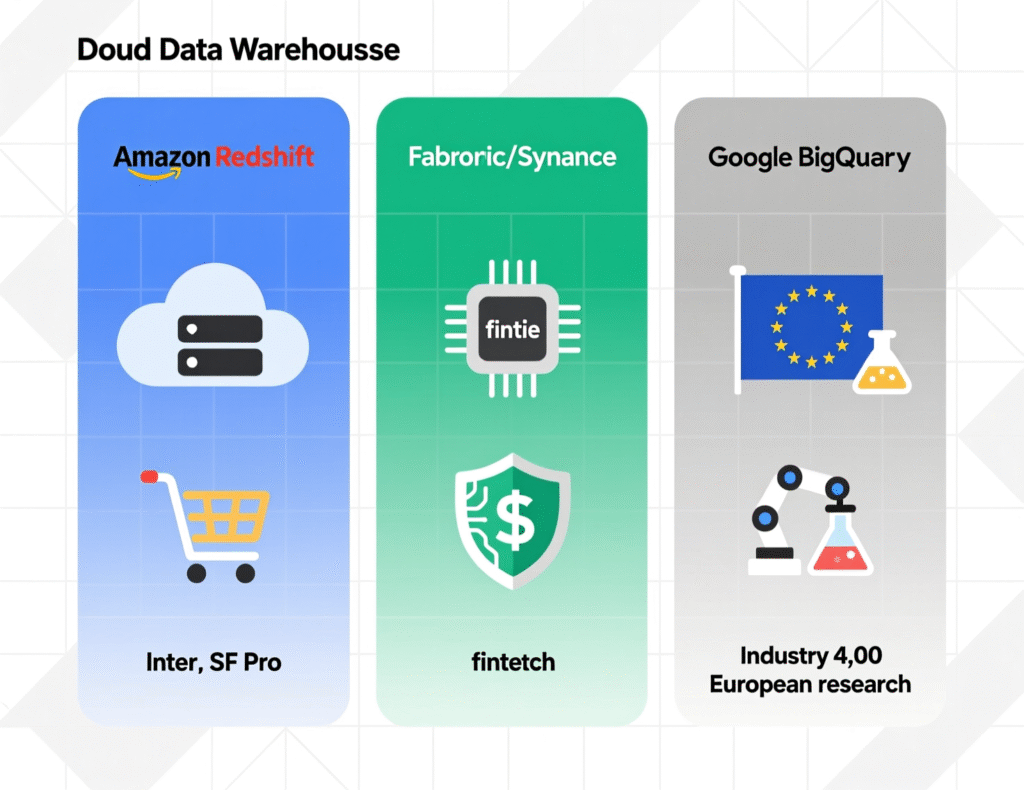

Redshift vs Fabric/Synapse vs BigQuery

For analytics, the “big three” choices are.

Amazon Redshift: good fit for customers already deep on AWS, especially retail/ecommerce analytics in the US.

Microsoft Fabric / Azure Synapse: attractive for UK and EU enterprises standardised on Power BI and the Microsoft data stack.

Google BigQuery: serverless, highly scalable and often the preferred option for adtech, gaming, open banking and EU-wide analytics platforms.

We see

US ecommerce → Redshift or BigQuery.

UK fintech / PSD2 & open banking → BigQuery or Fabric/Synapse.

German Industry 4.0 → Azure + Synapse for OT/IT integration, or GCP + BigQuery for advanced analytics.

EU research clouds → GCP and Azure feature heavily due to open-source and HPC ecosystems.

Kubernetes, serverless and modern app platforms for startups vs enterprises

For modern app development, all three have strong Kubernetes and serverless platforms:

EKS / AKS / GKE enable portable, container-based microservices.

Lambda / Azure Functions / Cloud Run support event-driven, pay-per-use functions and APIs.

Typical patterns we implement at Mak It Solutions:

US startup

GCP-first with GKE + Cloud Run for rapid iteration; or AWS with Lambda + API Gateway for low-operational overhead.

UK SaaS scale-up

Azure with AKS and integrated CI/CD and monitoring.

German industrial IoT

AWS IoT or Azure IoT with region-pinned processing in Frankfurt for DSGVO.

EU-wide apps

Multi-region Kubernetes with edge caching (CDN) and latency-based routing across Dublin, Amsterdam, Paris and Zurich.

Security, Compliance & Multicloud Strategy for US, UK, Germany & EU

All three hyperscalers meet core security standards like ISO 27001, SOC 2 and PCI DSS, and provide native tooling for IAM, encryption and monitoring. But enterprises must still align workloads with GDPR/DSGVO, UK-GDPR, HIPAA, BaFin, NHS, FedRAMP and EU banking guidance, and may adopt multicloud to balance sovereignty, resilience and vendor lock-in.

Why do EU and UK businesses care so much about GDPR and data residency when choosing between AWS, Azure and Google Cloud?

EU and UK businesses care deeply about GDPR/DSGVO and UK-GDPR because these laws impose strict obligations on how personal data is stored, processed and transferred especially outside the EEA or UK. Cloud buyers must ensure that data residency, access controls and cross-border transfers comply with Schrems case law, the EU US data transfer framework and the EU Digital Markets Act.

This is why regions like Frankfurt, Dublin, London, Paris and Amsterdam are so critical: they allow data to stay within EU/UK jurisdictions while benefiting from the global capabilities of AWS, Azure and GCP. Many contracts now specify EU-only storage, regional support teams and detailed audit trails, particularly for BaFin-regulated banks, NHS workloads and EU public administrations.

How can organizations use a multicloud strategy across AWS, Azure and Google Cloud to reduce vendor lock-in in 2025?

Organizations can reduce vendor lock-in by spreading workloads across AWS, Azure and Google Cloud using multicloud patterns such as per-workload splits, active-active deployments and DR on a secondary provider. In 2025, we’re also seeing growth in cross-cloud networking and interconnect services that simplify private, high-speed links between providers.

Common multicloud patterns Mak It Solutions designs.

Per-workload split: core transactional systems on AWS, collaboration and identity on Azure, analytics and ML on GCP.

Active-active: critical customer-facing services deployed simultaneously on two clouds to satisfy EU banking resilience and BaFin/EBA expectations.

DR/backup cloud: primary in one provider, warm/ cold standby in another, with portable data formats and infrastructure-as-code.

Kubernetes, Terraform, open data formats (Parquet, Delta, etc.) and GitOps pipelines are the backbone of these architectures.

Security, governance and regulated industries across AWS, Azure and Google Cloud

Security baselines are similar but implemented differently

Identity & access

AWS IAM, Azure AD/Microsoft Entra, and Google Cloud IAM.

Key management

AWS KMS, Azure Key Vault, Cloud KMS.

Compliance overlays

AWS GovCloud and Azure Government for US public sector; dedicated security controls and blueprints for HIPAA, PCI DSS, BaFin and NHS workloads.

US healthcare organizations look for HIPAA-ready architectures; payments providers (US/EU) emphasise PCI DSS; German financial institutions must align with BaFin and KRITIS; and UK public bodies must balance UK-GDPR, NHS guidance and budget constraints. A strong security and governance framework policies, landing zones, CI/CD controls and regular audits is non-negotiable in 2025.

How to Choose Your Primary Cloud in 2025

In practice, most organizations pick a primary cloud and then augment it with secondary providers. A simple decision matrix considers use case (startup, SME, large enterprise, public sector), GEO (US, UK, Germany, EU), existing stack (Microsoft/Google/AWS), regulatory constraints, AI ambitions and skills.

Decision checklist for US, UK, Germany and wider Europe buyers

Use this checklist while building RFPs and vendor shortlists.

Existing stack: Are you primarily using Microsoft 365/Windows, Google Workspace or AWS-native services?

Regulatory constraints

GDPR/DSGVO, UK-GDPR, HIPAA, BaFin, NHS, FedRAMP etc.

In-house skills

Which certifications and experience does your team or partner ecosystem have today?

Latency & regions: Where are your customers—New York, London, Berlin, Madrid, Zurich—and which regions best serve them?

AI strategy

Do you need integrated copilots, data-heavy AI, or general-purpose ML services?

3–5 year TCO

Which provider offers the best cost profile when you include commitments, egress, managed services and support?

Mak It Solutions often runs joint decision workshops that map these answers to a concrete cloud roadmap.

Common migration paths and coexistence patterns

Typical journeys we see.

On-prem → Azure-first for Microsoft shops (AD, Windows Server, SQL Server) in the UK and Germany.

AWS-first for digital natives and ecommerce in the US, later adding GCP for analytics or Azure for corporate IT.

Google-first for AI and analytics, with core transactional apps on AWS or Azure for ecosystem reasons.

Multicloud for EU banks and public sector, driven by resilience, BaFin/EBA guidance and vendor risk management.

Our teams at Mak It Solutions combine web development, mobile app development and business intelligence services to modernize workloads as they migrate—rather than simply lifting and shifting technical debt.

When to bring in a cloud consultancy or managed service provider

You should bring in a cloud consultancy or MSP when:

You’re designing multi-region or multicloud architectures.

You operate in heavily regulated sectors (healthcare, banking, public sector) in the US, UK or EU.

You need to migrate large data sets and legacy applications without extended downtime.

You’re planning complex AI workloads, including sensitive data and EU AI Act considerations.

Mak It Solutions offers end-to-end support from architecture and prototyping through migration, DevOps, FinOps and ongoing managed services so your internal teams can focus on products and customers instead of low-level infrastructure.

Key Takeaways

AWS stays the market leader with ~30% share and unmatched breadth; Azure is #2 with deep Microsoft and hybrid strengths; Google Cloud is #3 but fastest-growing in AI and data workloads.

Region and regulation matter: choose regions like Frankfurt, Dublin, London and Paris carefully to satisfy GDPR/DSGVO, UK-GDPR, BaFin, NHS and HIPAA constraints.

TCO beats list price: commitments, egress, managed services and AI tooling drive real-world cost differences across AWS, Azure and GCP.

AI strategy can tilt the decision: pick AWS for breadth, Azure for enterprise and copilot integration, GCP for data-native AI and analytics

Multicloud is rising: organizations use per-workload splits and DR-on-second-provider to balance lock-in, resilience and sovereignty.

Choosing between AWS, Azure and Google Cloud in 2025 isn’t about a single “winner”it’s about matching the right platform mix to your workloads, regions and regulations. If you’d like a neutral, architecture-led view on which provider (or combination) fits your roadmap, Mak It Solutions can help.

Our Editorial Analytics Team works closely with our web development, mobile app development and business intelligence experts to run structured cloud comparison and TCO assessments for clients across the US, UK, Germany and wider Europe.

Ready to compare AWS, Azure and Google Cloud for your next project? Reach out via the Mak It Solutions Contact page to book a tailored cloud strategy session.

FAQs

Q : Is AWS, Azure or Google Cloud better for small US startups on a tight budget?

A : For small US startups, all three offer generous free tiers and credits, but the “best” option depends on your stack and growth plans. AWS is attractive if you want maximum service breadth and an ecosystem you’re unlikely to outgrow; Azure works well if you already rely on GitHub, Visual Studio and Microsoft 365; Google Cloud often offers very competitive pricing for data-heavy or container-based workloads and has a simple developer experience. Many startups start on one provider and later adopt multicloud as they scale, so don’t over-optimise pick the platform your team can ship on fastest.

Q : Which cloud provider offers the most data centers and regions across Europe in 2025?

A : In 2025, AWS, Azure and Google Cloud all operate multiple European regions, but AWS and Azure still have the largest overall regional footprints globally. Across Europe you’ll find AWS in Dublin, Frankfurt, Paris, Milan, Spain and Zurich; Azure in UK South, West Europe (Netherlands), France, Germany, Switzerland and more; and GCP in London, Frankfurt, Netherlands, Warsaw, Madrid and Milan, among others. For most EU buyers, all three providers meet baseline coverage your choice is more about specific latency, regulatory and ecosystem needs than raw region count.

Q : Can I run a single application across AWS, Azure and Google Cloud without major rewrites?

A : Yes, but only if you design for portability from day one. The most common pattern is to build around containers and Kubernetes (EKS, AKS, GKE), externalise configuration, and use open data formats and standard protocols. Serverless or proprietary PaaS features (e.g., DynamoDB, Cosmos DB, Cloud Functions) can make porting harder, so many multicloud teams use Postgres, MySQL, Kafka and object storage as the common denominator. You’ll still need cloud-specific wiring for IAM, networking and observability, but your core application code can remain largely unchanged.

Q : How do free tiers and training credits compare between AWS, Azure and Google Cloud for new teams?

A : All three providers offer free tiers, always-free services and time-limited credits for new accounts, startups and education programmes. AWS Activate, Microsoft for Startups and Google for Startups regularly provide tens of thousands of dollars in credits for eligible teams in the US, UK, Germany and EU. These offers can significantly offset your early infrastructure costs, but they expire, so your FinOps plan should model post-credit costs as well. Mak It Solutions often helps clients combine credits with a phased migration plan to avoid cliff-edge bills.

Q : Is it easier to hire AWS, Azure or Google Cloud talent in the US, UK, Germany and the wider EU?

A : In most markets, AWS and Azure talent pools are the largest, reflecting their longer enterprise presence and certification ecosystems. In the US and UK, AWS and Azure certifications are still the most common on CVs, while GCP expertise is especially strong in AI, data and startup ecosystems. In Germany and wider EU, all three have active partner and training networks, though GCP specialists are more concentrated in analytics, research and digital-native hubs like Berlin and Amsterdam. For many organisations, the deciding factor is which cloud your existing developers are most comfortable with today.