Proven Enterprise Blockchain Use Cases for Global Business

Proven Enterprise Blockchain Use Cases for Global Business

Proven Enterprise Blockchain Use Cases for Global Business

In 2025, enterprise blockchain use cases that reliably deliver ROI focus on multiparty, high-compliance workflows such as supply chain transparency, trade and payments, healthcare data exchange, digital identity/KYC and asset tokenization. When these are built on permissioned blockchain networks, tightly integrated with ERP and cloud platforms and aligned with GDPR, HIPAA and sector rules, they cut reconciliation cost, fraud and audit risk instead of becoming “innovation theater.”

Introduction

Enterprise blockchain use cases are finally moving beyond the hype cycle. Instead of endless pilots, we’re seeing production deployments in finance, supply chain, healthcare and digital identity across the US, UK, Germany and wider EU, where distributed ledger technology now underpins real money, real shipments and real patient data.

If you’re a CIO, CDO or head of innovation/operations, your 2025 question is no longer “What is blockchain?” but “Where does it actually beat a database?” This guide walks through the most proven enterprise blockchain use cases, real company examples, platform and architecture choices, compliance considerations and a pragmatic 2025–2030 roadmap you can adapt in New York, London, Frankfurt or San Francisco.

What Are the Most Proven Enterprise Blockchain Use Cases in 2025?

In 2025, the most proven enterprise blockchain use cases are supply chain transparency, trade and payments, healthcare data and claims, digital identity/KYC and asset tokenization/registries. Across the US, UK and EU, these succeed because they solve multiparty data-sharing, auditability and compliance pain points better than traditional siloed databases.

Supply Chain & Logistics

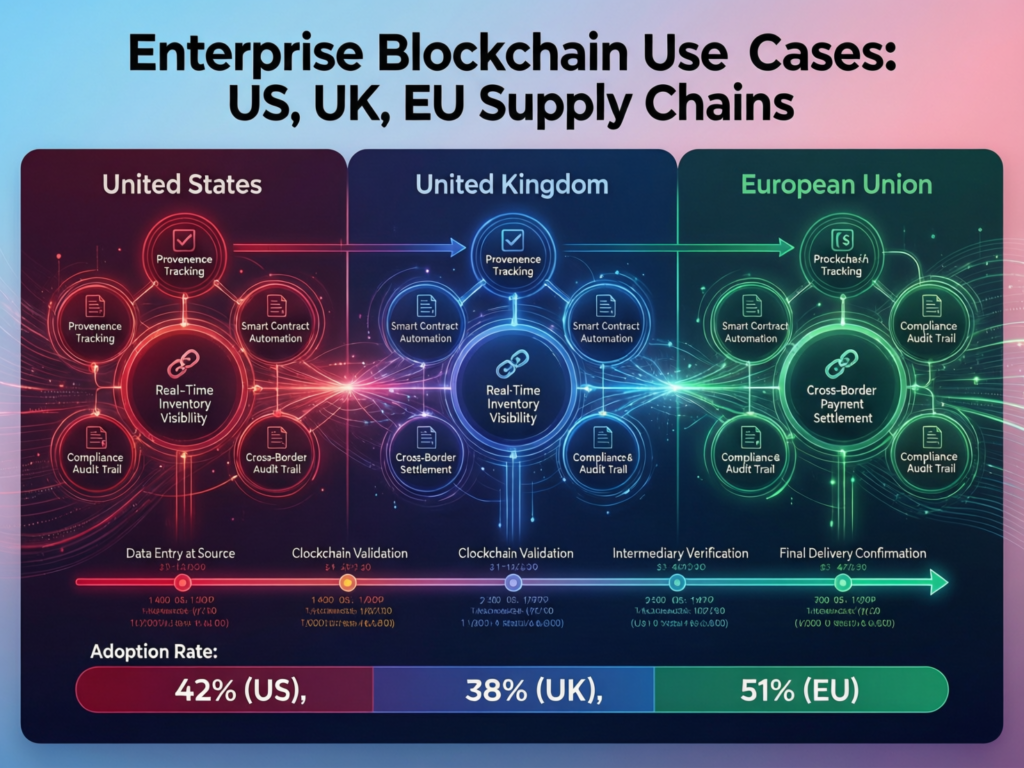

For enterprise blockchain use cases in US supply chains 2025, the big wins are provenance tracking, anti-counterfeit controls, ESG/Scope 3 reporting and digital product passports for high-value goods. EU manufacturers, German automotive OEMs and luxury brands are already using permissioned blockchain networks to trace parts, validate sustainability claims and comply with upcoming ESPR digital product passport requirements.

Typical patterns include.

Provenance & anti-counterfeit serializing items (from pharma in the US to UK fashion and German machinery) and anchoring lifecycle events on-chain.

ESG and Scope 3 tracking emissions, certifications and recycling data across suppliers.

Customs and trade lanes using smart contracts for documents, inspections and trade finance status across EU ports.

These networks increasingly integrate with SAP and other ERPs under Industrie 4.0 programs in Germany and the broader DACH region, using APIs to map purchase orders, shipments and quality events to on-chain states.

Finance, Trade & Capital Markets

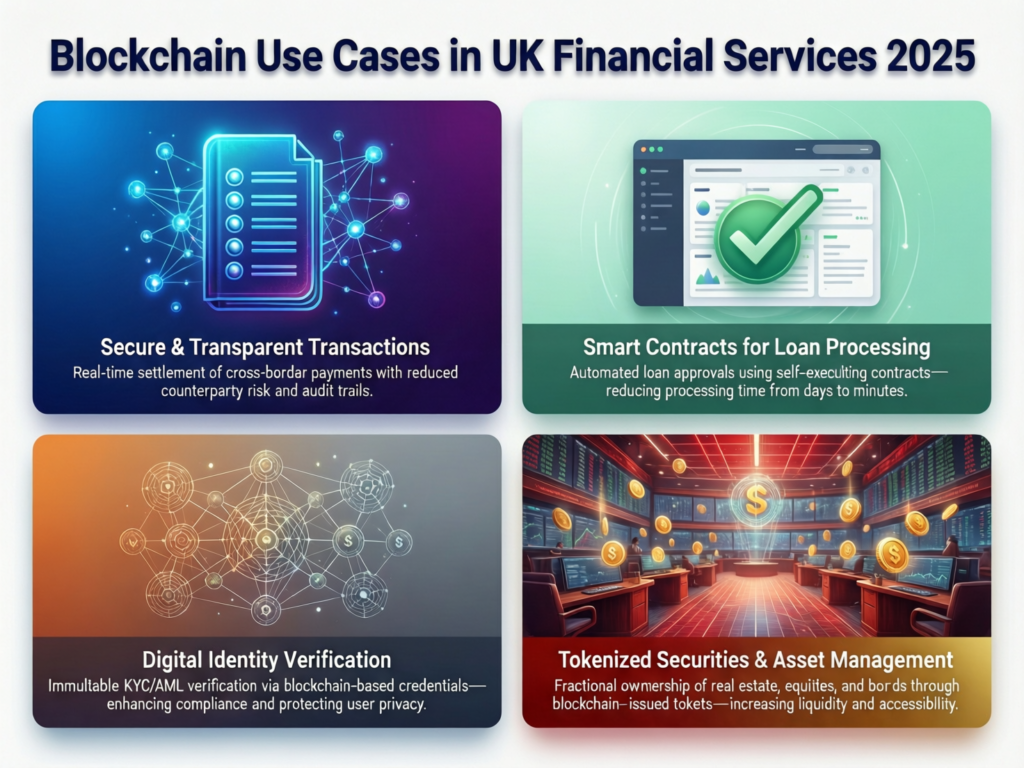

The most mature enterprise blockchain use cases in UK financial services 2025 revolve around tokenized deposits, cross-border payments, trade finance, syndicated loans and on-chain fund issuance. London Stock Exchange Group has launched blockchain-powered fundraising for private funds, and global banks are arranging tokenized securities and commercial paper on blockchain rails, with settlement in tokenized deposits and regulated stablecoins clear signals that capital-markets use cases are leaving the lab.

In the EU, the DLT Pilot Regime and SEPA rails support experiments in on-chain settlement under BaFin and ESMA supervision, while US banks mix public and permissioned rails for cross-border payments and liquidity management. Smart contracts for business processes automate coupon payments, collateral updates and lifecycle events, reducing reconciliation between custodians, CSDs and asset managers.

Healthcare, Identity & Public Sector

Healthcare, identity and public sector networks are catching up fast because they combine tough compliance with fragmented actors. Blockchain is being used for GDPR/HIPAA-aligned data sharing, EHR exchange, consent management, pharma supply chain and automated claims.

Add to this:

Digital identity & KYC shared KYC utilities for banks, self-sovereign IDs and eIDAS 2.0-ready wallets for citizens and SMEs across the EU.

Public records land registries, grant disbursement and document notarization pilots in US states, UK government sandboxes and EU member states.

Here, the blockchain doesn’t store raw medical or identity data; it anchors hashes, consents and event logs, while sensitive data stays in encrypted clinical systems or country-specific cloud regions.

Real-World Companies Using Blockchain Beyond Cryptocurrency

Flagship Enterprise Case Studies by Industry

In financial services, J.P. Morgan, London Stock Exchange Group and EU-regulated banks are using distributed ledger technology for issuance, settlement and collateral, often under pilots aligned with the EU DLT Pilot Regime and UK FCA expectations.

In supply chain and trade, European customs authorities, port operators and banks are testing shared platforms for digital bills of lading, trade finance workflows and shipment status, many integrated with SAP for German automotive supply chains and logistics networks.

Healthcare networks in the US (HIPAA) and Europe (GDPR/DSGVO) are testing permissioned chains for claims automation and EHR exchange, using privacy-preserving techniques such as zero-knowledge proofs and confidential computing in early pilots.

Luxury, ESG & Brand Protection

Luxury is one of the clearest proof-points that enterprise blockchain can work at scale. The Aura Blockchain Consortium (LVMH, Prada, OTB, Richemont and others) has registered tens of millions of products, tracking authenticity and lifecycle events on a permissioned blockchain network. Its roadmap increasingly aligns with EU ESPR rules that will mandate digital product passports for many categories by 2027.

Beyond luxury fashion, similar patterns are emerging for premium spirits, automotive and high-end consumer electronics, where provenance, warranty and resale value matter. Blockchain’s tamper-evident audit trail becomes a differentiator for ESG reporting and anti-counterfeit programs, not just an IT experiment.

Regional Snapshots US, UK, Germany/EU

US

New York and San Francisco fintechs are building on both public chains and enterprise stacks for tokenized deposits, stablecoin payments and HIPAA-compliant health data networks.

UK

London fintechs combine Open Banking/PSD2 APIs with blockchain rails for settlement and identity, while NHS-linked pilots focus on secure patient data exchange and consent logging.

Germany/EU

Frankfurt, Berlin and Munich host BaFin-supervised networks in capital markets and industrial supply chains, often under strict GDPR/DSGVO and data-residency rules, with EU cloud regions (Frankfurt, Paris, Dublin) chosen to keep sensitive metadata within the bloc.

Why Supply Chain, Finance and Healthcare Lead Enterprise Blockchain Adoption

These sectors lead adoption because they combine high compliance pressure, fragmented ecosystems and expensive manual reconciliation between organizations. Blockchain streamlines multiparty workflows, creates tamper-evident audit trails and enables data-sharing without exposing full raw data, so ROI and risk reduction are easiest to prove in these environments. ([ScienceDirect][4])

Shared Data, Shared Risk, Shared Liability

In supply chain, finance and healthcare, every dispute, recall or audit touches multiple organizations — each with its own system of record. Chargebacks, delayed payments, duplicate KYC checks and cross-border documentation all exist because there’s no single, shared state.

A permissioned blockchain network doesn’t magically solve governance, but it does give everyone a synchronized ledger of “what happened when” with cryptographic proofs. That’s powerful when millions of dollars or patient lives are on the line.

Compliance & Audit as Primary Drivers

The business case is often compliance-first

Finance

KYC/AML, capital-markets reporting and PCI DSS for card data demand strong audit trails and access controls.

Healthcare

HIPAA and GDPR require strict controls on PHI/PII, with clear logs of who accessed what and why.

Supply chain

ESPR, customs and ESG regulations drive the need for verifiable product data across borders.

Here, blockchain’s append-only ledger gives regulators and auditors confidence, while off-chain storage and encryption help satisfy “data minimization” and deletion needs.

Why Other Use Cases Lag

Internal workflows like basic HR processes, marketing attribution or ad-tech bidding rarely justify the complexity of a blockchain. A well-designed database and message bus will be cheaper, faster and easier to operate. For non-regulated, low-risk use cases, blockchain often adds governance overhead without clear incremental value an important sanity check for any innovation team.

Platforms, Architecture & Integration for Enterprise Blockchain in 2025

Permissioned Enterprise Platforms

Most B2B networks still standardize on Hyperledger Fabric, R3 Corda, Quorum or enterprise Ethereum variants. Fabric and Corda dominate permissioned networks, with Quorum and Ethereum-compatible stacks often used where institutions want a path toward public liquidity or interoperability.

When you evaluate platforms, focus on.

Performance and privacy throughput, latency, channels, private data collections.

Governance who runs ordering/validation nodes, how upgrades are decided.

Ecosystem & tooling SDKs, monitoring, key management.

Fit by vertical Corda and Ethereum-style stacks for finance; Fabric for supply chain, government and healthcare; and sector-specific SaaS built on top. ([scnsoft.com][13])

Integration with ERP, SAP and Cloud

No enterprise blockchain use case survives without deep integration. Typical patterns include:

ERP integration SAP, Oracle and Microsoft Dynamics acting as system-of-record for inventory, invoices and general ledger, with blockchain used for multiparty events and shared documents.

Legacy/mainframe adapters that translate EDI messages into smart contract calls, letting you compare blockchain vs traditional EDI/API integration for B2B data sharing.

Cloud architecture nodes deployed in AWS, Azure or Google Cloud regions, with VPC peering, HSM/KMS for keys and dedicated regions for EU vs US data residency.

Mak it Solutions already helps teams align cloud region choices, data localization and multi-cloud strategy, as covered in its guides on GCC data localization and AWS vs Azure vs Google Cloud.

Reference Architectures for Multiparty Data Sharing

A typical enterprise blockchain architecture includes:

Nodes & ordering services across organizations.

APIs & integration layer connecting ERPs, CRM, TMS/WMS and mobile apps.

Identity providers (enterprise IAM, eIDAS 2.0, bank KYC utilities).

Key management via HSMs or cloud KMS.

On-chain vs off-chain design hashes and tokens on-chain; documents and PII off-chain, plus selective disclosure or ZKP-based proofs where needed.

This is where tokenization of real-world assets in B2B comes in: invoices, deposits, carbon credits or warranties become digital tokens whose state transitions are driven by smart contracts for business processes.

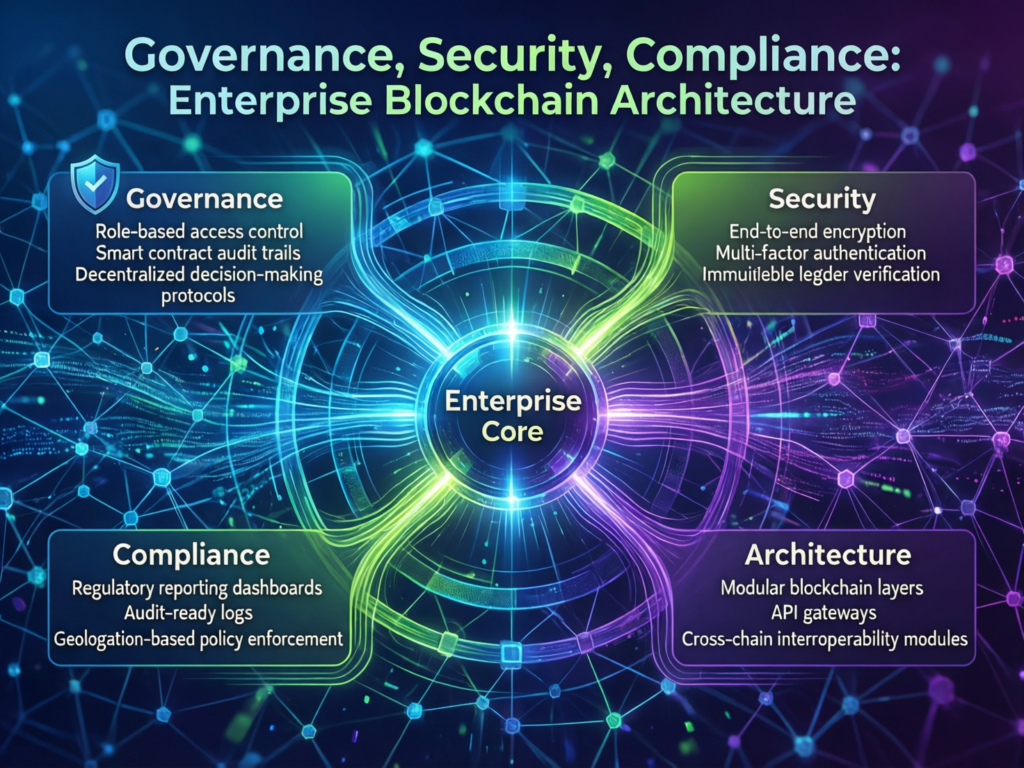

Governance, Security & Compliance for Enterprise Blockchain

US, UK and EU regulations shape enterprise blockchain by constraining where data lives, who controls it and how it can be deleted or audited. This pushes serious deployments toward permissioned networks, off-chain storage, robust identity/governance models and region-specific rollouts aligned with GDPR/DSGVO, UK-GDPR, HIPAA, PCI DSS and regulators such as BaFin and the FCA.

Data Protection GDPR, DSGVO, UK-GDPR, HIPAA & PCI DSS

There is a built-in tension between blockchain’s immutability and rights like erasure under GDPR/DSGVO and UK-GDPR. The practical pattern is: keep PII/PHI off-chain, store only hashes or pseudonymous identifiers on-chain and manage “erasure” by deleting or revoking access to off-chain data.

For healthcare, updated HIPAA Security Rule proposals in 2025 emphasize encryption, MFA and stronger incident response for electronic PHI — controls that must extend to any blockchain-connected systems.

Identity, Access & Network Governance

Serious enterprise networks integrate with corporate IAM and often with eIDAS 2.0 wallets or external KYC providers. Role-based access, transaction approval workflows and consortium voting rules are as important as the chain’s throughput. Financial networks under BaFin or FCA oversight often adopt formal operating rules and supervisory access for regulators.

Security Best Practices & Operational Controls

Blockchain is not inherently secure. You still need:

Node hardening, network segmentation and patch management.

Strong key management with HSMs or cloud KMS.

SOC 2 / ISO 27001-aligned processes for change management and incident response.

Regular pen-testing and red-teaming of smart contracts and integration APIs.

Mak it Solutions’ experience in secure cloud, backend and business intelligence services can be extended to blockchain analytics and monitoring, ensuring events on-chain are visible in your existing SIEM/BI stack.

ROI, Adoption Strategy & Why Many Blockchain POCs Fail

Why Many Enterprise Blockchain POCs Don’t Reach Production

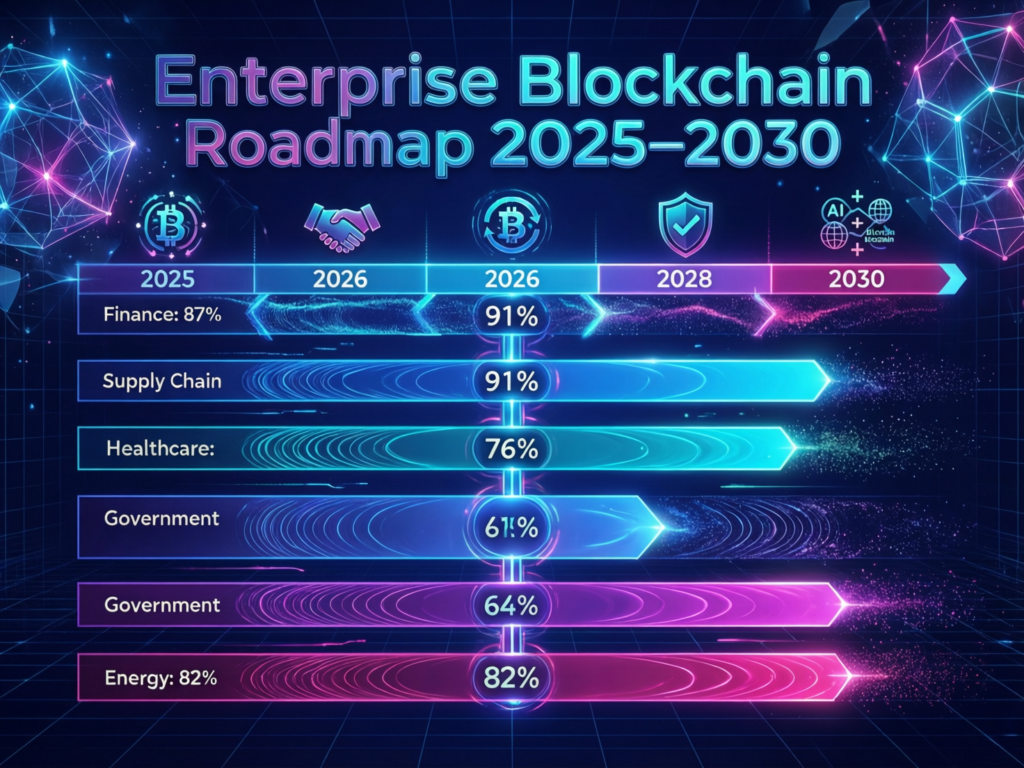

Despite a booming enterprise blockchain market forecast at around $145B by 2030 with a CAGR near 47% — many pilots never reach production.

Typical failure modes:

Wrong use case no real multiparty need; a database would do.

Unclear governance nobody wants to pay for or operate shared infrastructure.

Misaligned incentives partners won’t share data or change processes.

Underestimated integration ERP, mainframe and cloud integration blow up timelines.

Regulation as an afterthought data residency and compliance checked too late.

This is why many Mak it Solutions clients now run small, tightly scoped blockchain initiatives alongside broader IT cost optimization and cloud cost optimization programs, rather than giant, standalone “DLT transformations.”

How to Decide If a Process Actually Needs Blockchain Instead of a Database

You can filter candidates quickly using a five-question checklist:

How many independent organizations are involved?

If it’s mostly within one company, a shared database is usually enough.

Is there a genuine trust or incentive gap?

Do parties need independent verification, or are they already aligned and audited together?

Are compliance and auditability major pain points?

If regulators care about end-to-end traceability across firms, blockchain is a stronger contender.

What’s the cost of reconciliation and disputes today?

If teams spend significant time reconciling ledgers, tickets or medical records, a shared ledger can save serious money.

Is long-lived shared state more important than ultra-low latency?

If yes, a permissioned blockchain network may be worth the overhead; if no, consider other integration patterns.

Score each question from 1–5; workflows scoring 18+ deserve a deeper blockchain assessment, others probably don’t. We’ll model this checklist as a HowTo in the schema so assistants and AI overviews can surface it cleanly.

Building a 2025–2030 Enterprise Blockchain Roadmap

A practical roadmap for CIOs in the US, UK or Germany might look like this: ([ScienceDirect][4])

Discovery & scoring (0–3 months)

Inventory processes across supply chain, finance and healthcare lines of business; apply the checklist above to identify 3–5 promising enterprise blockchain use cases.

Architecture & platform selection (2–4 months)

Decide between Fabric, Corda, Quorum or SaaS platforms; align with cloud strategy on AWS, Azure or GCP and your data localization constraints (for example, EU-only regions for GDPR/BaFin).

Regulatory & risk assessment (parallel)

Engage risk, legal and security teams early, mapping GDPR/DSGVO, UK-GDPR, HIPAA and PCI DSS implications per workflow.

Pilot (6–12 months)

Run a narrow but production-grade pilot with a few committed partners. Measure KPIs like dispute reduction, settlement time and audit effort.

Scale-out & operations (12–24 months)

Harden operations to SOC 2 / ISO 27001 levels, onboard additional participants and integrate blockchain analytics into your self-service BI initiatives.

Across regions, priorities differ: US teams often start with capital markets and payments; UK financial services with Open Banking-adjacent projects; Germany and the EU with automotive and industrial supply chains; and GCC markets with digital wallets and non-crypto blockchain pilots, as covered in Mak it’s content on digital wallets in the GCC and cryptocurrency regulation in UAE.

Bottom Lines

The pattern for enterprise blockchain use cases is consistent: start where multiparty pain and compliance pressure are highest, choose a permissioned blockchain network that fits your stack and regulators, and treat integration and governance as first-class citizens. Partners like Mak it Solutions, with experience across cloud, SaaS, data and mobile, can help you shape that roadmap so pilots lead to production — not another forgotten POC.

Key Takeaways

Enterprise blockchain shines in supply chain, finance and healthcare, where multiparty workflows, regulation and high dispute costs collide.

Permissioned networks (Fabric, Corda, Quorum, Ethereum-based stacks) dominate serious B2B deployments; public chains are used selectively for liquidity or interoperability.

Successful programs design for compliance and data residency from day one, aligning with GDPR/DSGVO, UK-GDPR, HIPAA, PCI DSS and sector regulators like BaFin and FCA.

Integration with ERP, legacy systems and cloud is usually the hardest work more so than the ledger itself.

A simple five-question checklist helps teams decide whether a process needs a blockchain or just better APIs and data governance.

The best roadmaps combine narrow, high-value pilots with broader modernization, cloud and analytics initiatives to make blockchain an enabler, not a silo.

If you’re evaluating enterprise blockchain use cases for your organization in the US, UK, Germany or wider EU and aren’t sure where to start, you don’t need another abstract whitepaper. Share a shortlist of candidate workflows and your current ERP/cloud stack with Mak it Solutions, and our team can help you score use cases, sketch a compliant architecture and plan a 6–12 month pilot that targets measurable ROI not just hype.( Click Here’s )

FAQs

Q : What is the typical budget and timeline for an enterprise blockchain project in 2025?

A : Most serious enterprise blockchain projects start with a discovery and design phase in the low six-figure range (USD/EUR), followed by a pilot that can reach mid six figures once integration, security and partner onboarding are included. A realistic timeline is 3–4 months for discovery and architecture, 6–12 months for a production-grade pilot and another 12 months to scale out across regions and partners. Costs vary by sector and regulator expectations financial markets and healthcare usually require higher security and assurance budgets than simple supply-chain pilots.

Q : Can small and mid-sized businesses benefit from enterprise blockchain platforms, or is this only for large corporates?

A : SMBs can absolutely benefit, especially when they join networks run by larger ecosystem players such as banks, logistics providers or manufacturers. Instead of building their own ledger, smaller firms typically integrate through APIs or light nodes, gaining better visibility on payments, shipments or certifications while sharing only the data they need to. Pricing models range from SaaS-style per-transaction fees to consortium membership tiers, making it feasible for mid-market companies in places like Manchester, Austin or Munich to participate without hiring a huge blockchain team.

Q : How does blockchain compare to traditional EDI and API integration for B2B data sharing?

A : Traditional EDI and APIs are great for point-to-point or hub-and-spoke integration, but they still create multiple copies of the truth across partners. A permissioned blockchain network instead creates a shared, tamper-evident ledger where all authorized parties see the same state, with smart contracts encoding the business rules. For low-risk, bilateral integrations, EDI/API will remain cheaper and simpler; but when disputes, fraud risk or regulatory audits span many organizations — like trade finance or cross-border supply chains a shared ledger can reduce reconciliation effort and legal friction.

Q : Do enterprises need in-house blockchain developers, or can they rely fully on consulting partners and SIs?

A : Most enterprises don’t need a large in-house blockchain engineering team on day one. What they do need internally are strong product owners, enterprise architects, security and compliance leads who understand the requirements and can manage partners. For design, prototyping and integration, many organizations work with consulting firms, boutique blockchain specialists and local SIs, then gradually bring critical skills in-house as platforms mature. Over time, existing backend, cloud and mobile teams can be upskilled to maintain smart contracts and integration layers, much like they do today with APIs and microservices.

Q : What are the biggest risks of choosing a public blockchain vs a permissioned network for enterprise use cases?

A : The main risks of public chains are regulatory uncertainty, data-residency concerns and governance that’s outside your direct control. While public networks can offer greater liquidity and openness, storing sensitive metadata or transaction details on them can conflict with GDPR/DSGVO, UK-GDPR, HIPAA or sector rules. Permissioned networks let you choose validators, enforce KYC and define clear operating rules, but they trade off some openness and ecosystem reach. Many enterprises now adopt hybrid models using public chains for specific asset layers and permissioned ledgers for regulated workflows and private data.