Scaling a Startup in the Middle East for GCC Growth

Scaling a Startup in the Middle East for GCC Growth

Scaling a Startup in the Middle East for GCC Growth

Scaling a startup in the Middle East means designing your product, compliance, and team around highly regulated, state-driven markets like Saudi Arabia, the UAE, and Qatar. Founders who win here localise for Arabic users, respect data residency rules, and use government programs, hubs, and pilots as launchpads for sustainable GCC-wide growth.

Introduction

Picture a Dubai-based SaaS startup that has product market fit with a handful of UAE enterprises, but every serious RFP now asks: “Can you host data in Saudi?” and “Is your interface fully Arabic?” The founders want Riyadh and Doha logos on their deck, but they’re stuck between regulation, Saudization, data residency, and long public-sector procurement cycles.

This guide is a practical playbook for scaling a startup in the Middle East, with a focus on Saudi Arabia, the UAE, and Qatar not ecosystem cheerleading. We’ll walk through foundations (licensing, compliance, data), funding and government support, cross-border expansion from Dubai or Doha into Riyadh, talent and culture, plus survival strategies for long sales cycles in high-regulation markets. Along the way, we’ll keep pointing to real GCC innovation ecosystem drivers and playbooks you can actually execute.

What Makes Scaling a Startup in the Middle East Different?

How GCC markets differ from Europe and the US

Quick AEO snapshot main challenges vs Europe/US:

Smaller but higher-spend markets with state-driven economies

Heavy role of government and semi-government buyers

Stricter regulation, data residency, and content rules

Longer enterprise and public-sector sales cycles

GCC markets are compact, high-income, and policy-driven. Saudi Vision 2030, UAE Vision 2031, and Qatar National Vision 2030 channel significant budgets into digital transformation, fintech, logistics, and AI infrastructure especially in Riyadh, Dubai, Abu Dhabi, and Doha.

Unlike Europe or the US, your biggest early customers may be ministries, sovereign funds, or giga-projects rather than purely private enterprises. Procurement is formal, RFP-driven, and often bilingual (Arabic–English). Founders who understand that government support for tech startups in the Gulf can be both opportunity and gatekeeper are the ones who push their Middle East startup survival rate higher.

Unique scaling challenges in GCC markets

Sales cycles for fintech, gov-tech, health, and AI infra can run 9–18 months from first meeting to revenue. Regulators like SAMA, TDRA, and QCB closely supervise payments, data, and AI use, while Saudi’s NDMO sets strict standards for public-sector data governance and residency.

You’ll also navigate content controls, censorship rules, and cross-border data transfer restrictionsespecially when hosting outside KSA or Qatar, even if you use regional cloud regions like AWS Bahrain, Azure UAE Central, or Google Cloud Doha.

Why the opportunity is still huge for founders

At the same time, many verticals remain under-served: B2B SaaS for logistics, reg-tech, Arabic-first AI tools, and gov-tech workflow platforms. Riyadh and Dubai are turning into default HQs for serious founders, with Doha adding deep AI and data-center capacity.

Think of this as a scale-up survival guide: how to keep runway, win anchor pilots, and build a realistic GCC startup expansion strategy for B2B SaaS rather than just incorporating a company and hoping for the best.

Getting the Foundations Right.

Choosing the right legal structure in Saudi, UAE, and Qatar

In Saudi Arabia, many tech founders start by securing a Ministry of Investment (MISA) license and commercial registration with the Ministry of Commerce, then layer on sectoral approvals (e.g., SAMA for fintech). Monsha’at signals and classification can later help with tenders and SME programs.

In the UAE, you’ll weigh free zone vs mainland: DMCC, DSO, ADGM, and DIFC are common options for SaaS, fintech, or holding structures, while a mainland presence can be useful once you chase larger government contracts. In Qatar, structures like QFC or QSTP support tech startups with tax benefits and local partner expectations tailored to innovation.

Across all three, think ahead about foreign ownership, local partner requirements, and how investor-friendly your structure is for later rounds.

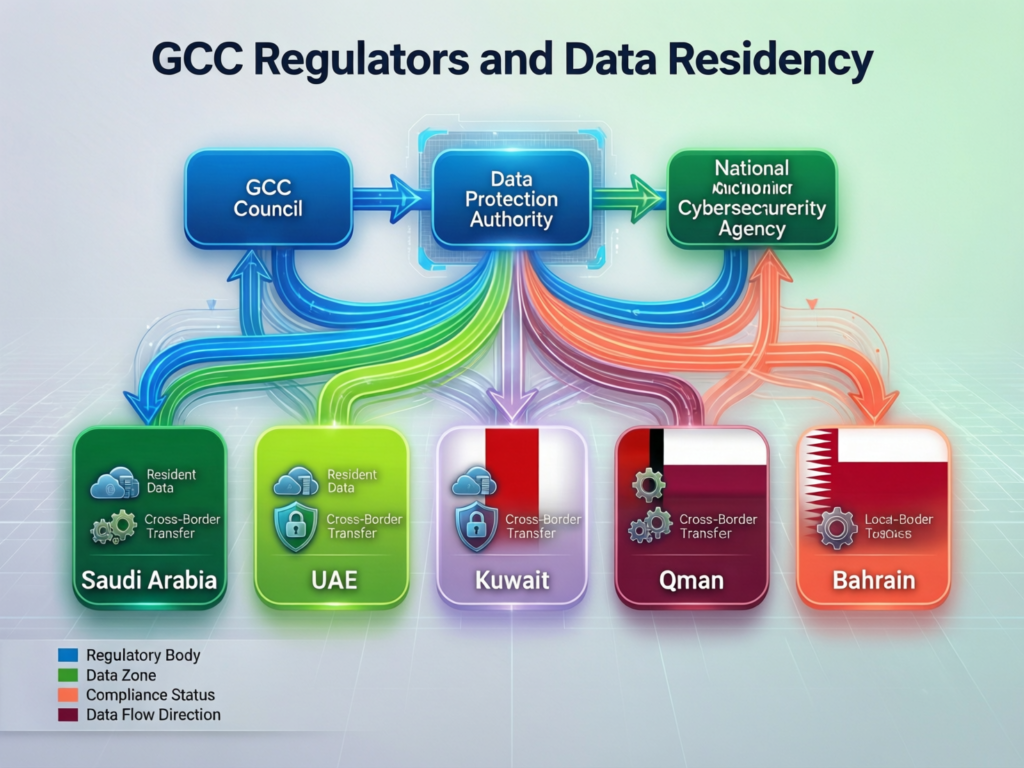

Key regulators and what they care about

KSA

SAMA (financial services and payments), CST/CITC (communications and cloud), NDMO (data governance)

UAE

TDRA overseeing telecom and digital government, plus ADGM/DIFC for financial services, each with their own fintech sandboxes and rulebooks

Qatar

QCB and QFMA shaping fintech and capital-markets rules, including sandboxes and AI guidelines

If you’re a fintech, open-banking frameworks, regulatory sandboxes, and eKYC rules will shape your product roadmap from day one. For B2B SaaS and AI infra, compliance-by-design around logging, auditability, and data protection can turn regulation from a headache into a sales asset.

Data residency, Arabic UX, and bilingual compliance

Enterprise and government buyers may require Saudi-hosted workloads (often on AWS me-south-1 or local sovereign cloud) or UAE / Qatar cloud regions such as Azure UAE Central and Google Cloud Doha, especially for AI workloads and sensitive personal data.

Expect to ship Arabic-first or bilingual UX, contracts, and SLAs. That means:

Product and support that work in both Arabic and English

Legal documents that stand up in local courts

Roadmaps that budget for in-region hosting and NDMO-aligned controls in KSA

For many founders, this is the moment to engage a technical partner; for example, working with a build partner like Mak It Solutions on web development services and architecture can help you align infra and UX with local expectations. (Mak it Solutions)

Funding and Government Support.

Saudi programs helping startups scale under Vision 2030

AEO micro-answer how Monsha’at helps:

Grants and vouchers that de-risk early product work

Market access via events like Biban and public-sector matchmaking

Training and advisory around regulation, Saudization, and finance

Signals that improve your credibility with banks and VCs

Under Vision 2030, Saudi has layered programs from Monsha’at, sector funds, and the SAMA Regulatory Sandbox to nurture local fintechs and SaaS players. These vehicles help founders close the gap between idea, first pilots, and sustainable revenue by combining grants, soft loans, sandboxes, and SME-friendly procurement.

UAE hubs like Dubai and Abu Dhabi as scale platforms

In the UAE, hubs like Hub71, in5, Flat6Labs, DIFC, and ADGM act as on-ramps into the broader GCC. They offer subsidised housing, co-working, cloud credits, and warm introductions to regional investors—a strong base if your path is “scale from Dubai to Saudi and GCC.

Many founders set up a holding company in Dubai or Abu Dhabi for ease of banking, visas, and international deals, then build a serious operating presence in Riyadh once they see repeatable Saudi demand.

Qatar and GCC sovereign capital as growth fuel

Qatar adds depth via QSTP, national innovation funds, and emerging initiatives like Invest Qatar’s incentive programmes, which actively target AI, cloud, and advanced tech.

Late-stage, GCC sovereigns like PIF, Mubadala, and QIA often back growth-stage rounds, especially in fintech, logistics, and AI infra. Early-stage founders usually get on their radar via pilots and PoCs e.g., a Riyadh fintech in the SAMA sandbox, a Dubai retail-tech platform piloting with a mall operator, or a Doha SME building on the Doha Google Cloud region with a QSTP-backed grant.

Cross-Border Scaling Playbooks.

When to expand into Saudi vs doubling down on your base

You’re usually ready to enter Riyadh when you have:

A repeatable sales motion and strong net revenue retention

Clear ICPs in fintech, logistics, gov-tech, or B2B SaaS

At least one referenceable enterprise or government customer

Some go Saudi-first, especially in fintech aligned with Vision 2030; others go UAE-first then Saudi, using Dubai/Abu Dhabi as a test lab before tackling KSA’s bigger, more regulated market.

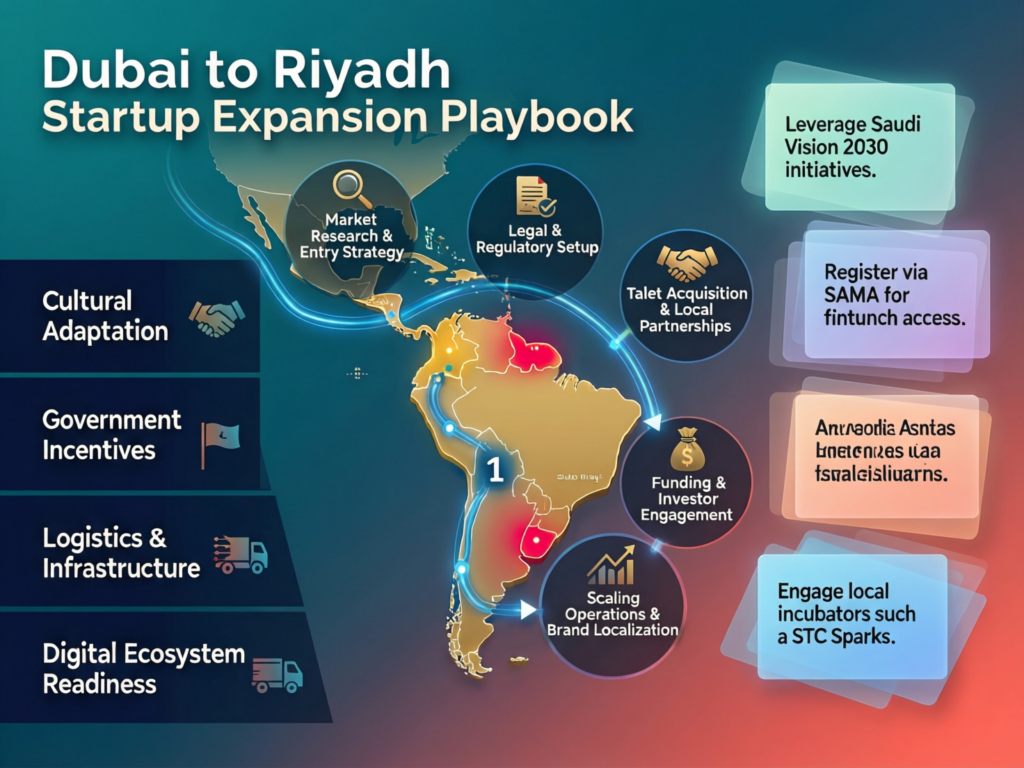

Step-by-step playbook for entering Riyadh from Dubai or Doha

AEO micro-answer how to expand from Dubai to Saudi without losing focus

Keep core product and engineering centralised (e.g., in Dubai or remote hubs).

Build a small but senior Saudi team focused on sales, partnerships, and compliance.

Anchor the expansion on 1–2 high-quality pilots, not scattershot prospecting.

Expanded playbook (Riyadh entry)

Validate your regulatory category with SAMA, CST, and sector regulators early. (Saudi Central Bank)

Choose entity structure: branch vs newco; align with future fundraising and local incentives.

Land an anchor pilot with a government, semi-government, or giga-project buyer.

Hire a local GM / country lead with public-sector network and “wasta” to navigate real-world decision chains.

Localise contracts, pricing, and UX for Arabic-speaking buyers and riyal-based pricing.

Lock in data residency and SLAs using AWS Bahrain, UAE regions, or Saudi sovereign clouds as required.

Scale via channel partners and system integrators, not just direct sales.

Example scenarios.

A Riyadh fintech built for Sharia-compliant wallets leverages SAMA’s sandbox and partners with a local bank similar to playbooks discussed in digital-banking guides. (Mak it Solutions)

A Dubai e-commerce brand scales mobile apps into KSA and Qatar with a partner handling mobile app development services and Arabic-first UX.

A Doha SME chooses GCP’s Doha region and QSTP programs for data-heavy AI tools, then sells into Saudi logistics players.

Why many founders keep HQ or holding in UAE but scale from Riyadh

Founders often choose a UAE holding + KSA operating company model because:

The UAE offers easier incorporation, English-first legal ecosystems, and global banking.

KSA offers market size, Vision 2030 giga-projects, and strong public-sector demand.

From that base, Qatar, Kuwait, Bahrain, and Oman become satellite markets served via local distributors, cloud regions, and targeted pilots.

Talent, Culture, and Remote Teams in GCC Scale-Ups

Hiring in Saudi, UAE, and Qatar.

As you grow past 15–20 people.

Saudization quotas in KSA start shaping your hiring plan.

AI, product, and data talent is fiercely competed for in Dubai and Abu Dhabi.

Qatar is increasingly attractive for AI and data-center roles thanks to the Doha cloud region and national AI initiatives. (Google Cloud)

Visa frameworks across all three countries make it possible to relocate senior leadership, but you need to budget both time and legal cost.

Building cross-border teams without breaking culture

A common GCC pattern.

Onshore presence in Riyadh, Dubai, or Doha for GTM, partnerships, and execs

Remote engineering hubs in Jordan, Egypt, Pakistan

Clear rituals around communication, planning, and feedback to respect Arabic language preferences, prayer times, and local public holidays

The goal is a culture that feels unified across borders while acknowledging real-world hierarchy and etiquette norms in the Gulf.

Using remote and outsourced teams without losing IP or quality

Outsourcing can work well for support, implementation, and parts of development especially with specialised partners like Mak It Solutions offering back-end or business intelligence services but only if you lock in NDAs, IP assignment, and code-handover processes that will later satisfy investors. (Mak it Solutions)

Survival Strategies for Long Sales Cycles and Heavy Regulation

Designing your business model around government and enterprise buyers

Usage-based pricing may not land well with ministries or large enterprises. In practice, many GCC startups evolve towards:

Multi-year contracts with clear SLAs

One-off implementation or integration fees

Embedded training and Arabic-language enablement

You must also learn to identify and cultivate internal champions who can shepherd you through RFPs and policy reviews.

Cashflow and runway tactics for GCC startups

In a region where procurement is slow, survival depends on:

Milestone-based fundraising tied to pilots and PoCs

Blending grants, revenue, and VC—rather than relying solely on equity

Conservative runway planning: assume deals in KSA public sector will slip

For some founders, building a lean, revenue-driven product with help from an external engineering partner (for example via web development or low-code platform builds) is the difference between closing a Vision 2030-aligned contract and running out of cash.

Operational efficiency in high-regulation markets

Lean compliance operations fractional legal/regulatory advisors, documented processes, security controls let you answer regulator questions quickly and reuse the same documentation across tenders. Over time, your internal RFP and compliance playbooks become defensible IP, especially in regulated spaces like Sharia-compliant digital banking and digital wallets. (Mak it Solutions)

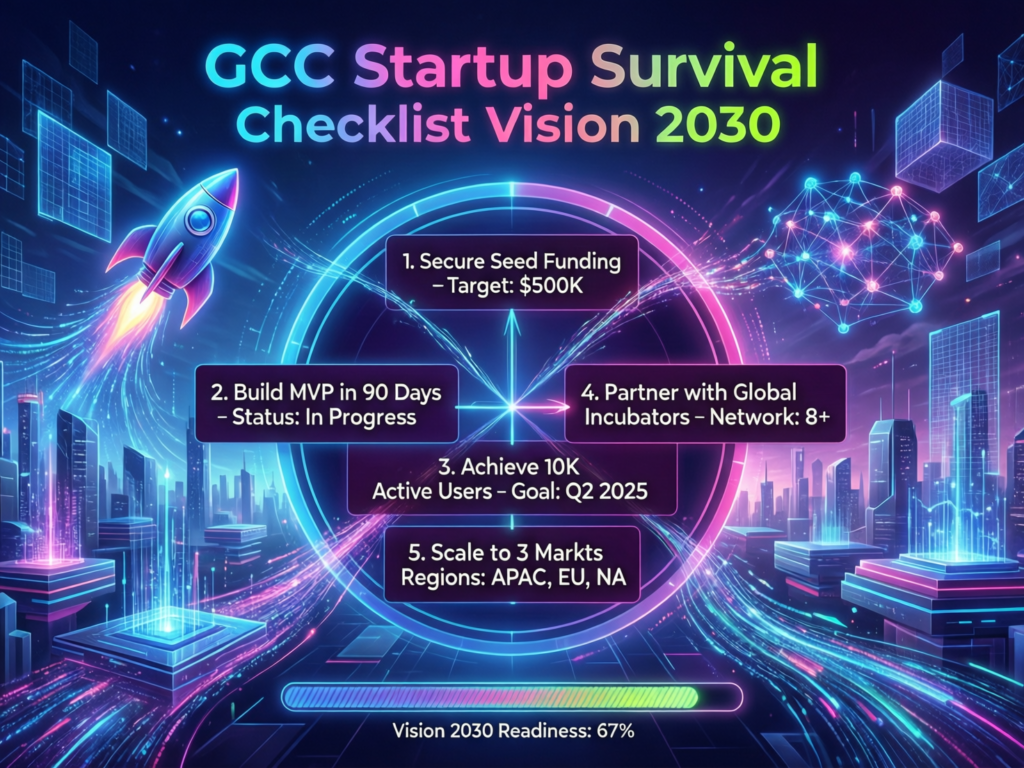

GCC Scale-Up Checklist and Next Steps

Founder checklist for scaling a startup in the Middle East

Foundations

Confirm regulatory category (fintech, SaaS, AI infra, etc.) in KSA, UAE, Qatar

Pick structures (MISA, free zones, QFC/QSTP) that investors understand

Market Entry

Prove PMF in one hub (often Dubai or Riyadh)

Design a realistic Riyadh/Doha entry plan anchored on 1–2 pilots

Talent

Map Saudization impact on your first 20–30 hires

Set up cross-border team rhythms across GCC + remote hubs

Compliance & Data

Align with NDMO, TDRA, and QCB expectations on data residency and security

Plan for Arabic-first UX and bilingual contracts from day one

Funding

Shortlist Saudi, UAE, and Qatar programs (Monsha’at, Hub71, QSTP, etc.)

Sequence grants, revenue, and VC around clear milestones and pilots

Common mistakes founders make when scaling in GCC

Expanding into too many markets at once instead of dominating one hub

Underestimating the importance of Arabic UX and local legal language

Ignoring data residency, NDMO rules, or cloud-region constraints

Misjudging procurement timelines and Saudization obligations

When to bring in advisors, partners, or accelerators

You probably need local advisors, tech partners, or accelerators when:

RFPs start asking detailed questions about regulation and data residency

Your first Saudi or Qatari opportunities require complex legal structures

You’re not sure which hub (Riyadh, Dubai, Doha) should be your primary base

At that point, it’s often cheaper and faster to work with a specialist partner whether an accelerator like QSTP or a build-and-strategy team like Mak It Solutions than to learn every lesson the hard way.

If you’re a founder in Riyadh, Dubai, Abu Dhabi, Doha, or building remotely for the GCC and serious about scaling a startup in the Middle East, you don’t have to guess your way through regulation, cloud regions, and cross-border product strategy. Mak It Solutions can help you turn this GCC playbook into a concrete roadmap architecture, Arabic-first UX, and go-to-market tailored to Saudi, UAE, and Qatar.

Explore our core services page and related GCC guides, then reach out to design a scale-up strategy that matches your funding, talent, and regulatory reality instead of fighting it.( Click Here’s )

FAQs

Q : Is it better to base my GCC startup in Riyadh or Dubai for fundraising and exits?

A : Both cities can work, but they play different roles. Riyadh gives you direct access to Vision 2030 projects, SAMA-driven fintech reforms, and large government buyers, which can significantly boost your revenue and Middle East startup survival rate. Dubai, meanwhile, offers easier incorporation, international banking, and access to regional and global VCs who understand cross-border tech plays. Many founders use a Dubai holding with a Saudi operating company, aligning with Saudi Vision 2030 while keeping investor-friendly structures in the UAE.

Q : Can a 100% foreign-owned startup scale in Saudi Arabia without a local partner?

A : In many sectors, yes Saudi has steadily liberalised foreign ownership, especially for tech and digital businesses aligned with Vision 2030. What you cannot skip, however, is a serious local presence: in-country leadership, Saudization-aligned hiring, and relationships with regulators like SAMA, NDMO, and CST. Even with full ownership, you’ll often collaborate with local banks, telcos, or system integrators to navigate procurement and compliance. Building those partnerships early is as important as the cap table structure.

Q : What is the best UAE free zone for a B2B SaaS startup targeting Saudi and Qatar?

A : There’s no single “best” zone, but patterns exist. Many B2B SaaS founders choose Dubai Internet City, DSO, or DMCC for general tech, while ADGM and DIFC appeal if you’re doing fintech or dealing with investors who like English-law jurisdictions. Your choice should consider visa needs, banking ease, and how often you’ll work with Saudi and Qatari clients, not just headline costs. UAE free zones plus the digital-government ecosystem overseen by TDRA make it relatively straightforward to serve Riyadh and Doha from a UAE base.

Q : How do Saudization rules impact early-stage tech startups hiring their first 20 employees?

A : Saudization can shape your org chart earlier than you expect. As soon as you incorporate locally and start hiring beyond a handful of staff, quotas and classification can affect your ability to issue visas and win government contracts. Many founders hire Saudi nationals into sales, operations, and product roles early, then complement them with regional engineering talent from Jordan, Egypt, or Pakistan. Aligning your hiring plan with Monsha’at category requirements and Vision 2030 goals makes it easier to access programs, grants, and tenders.

Q : Are there specific grants or incentives in Qatar for AI and data startups serving the wider GCC?

A : Yes. Qatar Science & Technology Park (QSTP) runs incubators, accelerators, and funding programs that specifically target AI, cloud, and data-driven innovation. At the macro level, initiatives from Invest Qatar also include incentive packages for technology and logistics, and the Google Cloud Doha region reinforces Qatar’s role as an AI hub for the Gulf. AI startups that plug into these schemes can combine local support with GCC-wide reach, especially when they host workloads in Doha and sell into Saudi and UAE customers.