Build vs Buy Software: A Practical Decision Framework

Build vs Buy Software: A Practical Decision Framework

Build vs Buy Software: A Practical Decision Framework

A build vs buy software decision is about choosing between developing custom software in-house (or with a development partner) and buying SaaS or off-the-shelf tools. In 2025, the “right” choice is the option that delivers the highest risk-adjusted ROI over 3–5 years while still meeting your security, compliance and roadmap needs across the US, UK and EU.

You’re probably a CTO, product leader or founder trying to decide whether to build software in-house or buy SaaS/off-the-shelf for a specific problem.

Maybe you’re replatforming a legacy core in a US or German fintech, rolling out a new subscription product in the UK, or finally replacing that sprawling internal tool that only one engineer really understands.

This guide gives you a neutral, framework-based way to make that build vs buy software call anchored in cost, ROI, risk, compliance and data residency for US, UK, Germany and wider EU teams.

You’ll see where the decision shows up in your roadmap, when in-house wins, when SaaS shines, and a simple checklist you can reuse across products and regions.

What is a build vs buy software decision and why does it matter in 2025?

A build vs buy software decision weighs whether to create custom software (in-house or via a partner) or to buy SaaS/off-the-shelf products.

In 2025, higher developer salaries, fast-moving markets and stricter regulations like GDPR/DSGVO, UK-GDPR, HIPAA and PCI DSS make this choice a major driver of ROI and operational risk for US, UK and EU organisations.

Build vs buy software: core definitions

At its simplest.

Build → you create a custom solution using your own engineering team or a trusted development partner.

Buy → you adopt an existing SaaS, on-prem or off-the-shelf product and configure it to your needs.

You’ll also hear this framed as.

“Custom software vs off-the-shelf”

“SaaS vs in-house solution”

“In-house software development vs outsourcing”

All of these point to the same trade-off.

The decision usually appears early in a product roadmap (e.g. planning a new feature or platform) or during software procurement when you’re evaluating tools for CRM, payments, analytics, HR, ITSM and so on.

Typical triggers for a build vs buy decision

A build vs buy discussion is usually triggered when something important changes, for example:

You replatform legacy systems (e.g. a 15-year-old core in a New York fintech or a Frankfurt bank).

You launch a new product or business line (say, an ecommerce brand in Berlin expanding into subscriptions).

New regulations land NIS2 for critical infrastructure, DSGVO/GDPR enforcement in Germany or new NHS guidance in London.

Behind the scenes, the psychology is consistent: teams want to reduce risk, move fast enough and stay within budget. The bigger the bet—and the more regulated the space (fintech, healthcare, public sector) the more deliberate your build vs buy process needs to be.

High-level pros and cons of build vs buy

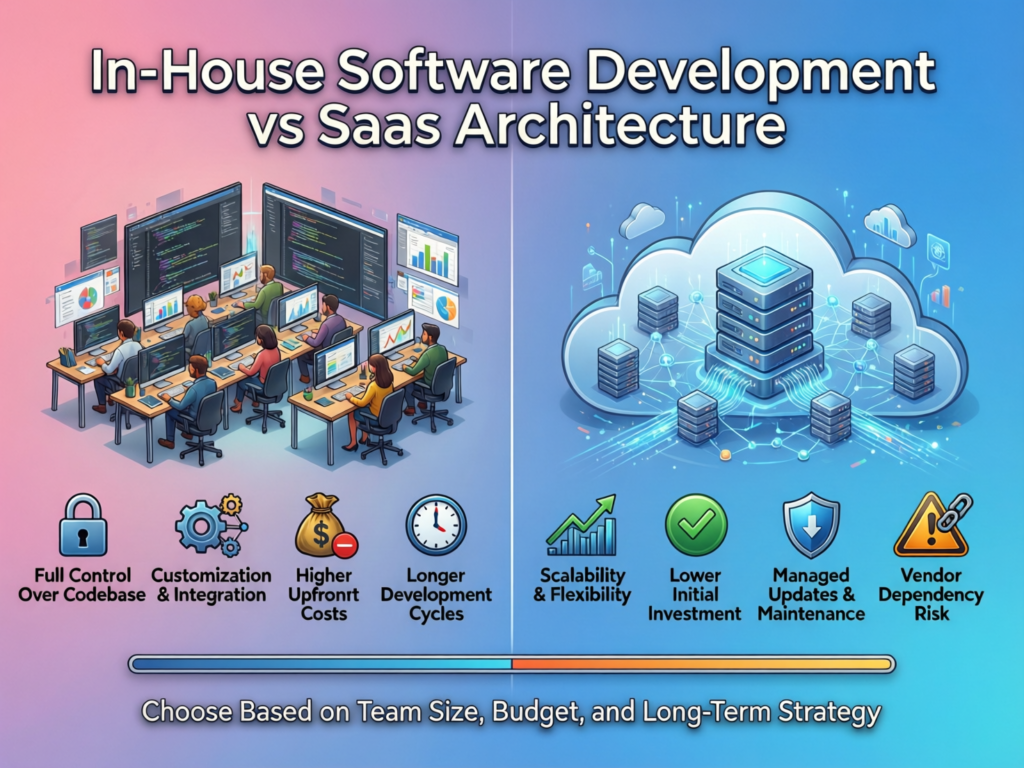

At a high level.

Building gives you control, differentiation and alignment with your roadmap.

Buying gives you speed, predictable pricing and built-in best practices.

The central tension is often technical debt vs vendor lock-in.

Build too quickly with limited resources and you accumulate technical debt that slows you down later.

Buy purely on convenience and you risk vendor lock-in, making it painful or expensive to switch in 2–3 years.

The rest of this guide goes deeper into when each path makes sense and how to compare them with a consistent framework.

When to build software in-house

You generally build software in-house when it’s strategically critical, differentiates your product, or must integrate tightly with core systems and sensitive data.

In regulated or complex domains, teams often find no SaaS that truly fits their workflow, governance or performance constraints.

Why do companies choose to build software in-house instead of buying SaaS?

Companies choose to build in-house to own the roadmap, avoid vendor lock-in, meet niche requirements and control data end-to-end.

Across US, UK and EU markets, this is common in fintech, healthcare and enterprise platforms where standard SaaS can’t match domain-specific workflows or regulatory obligations.

Examples.

Fintech & banking in San Francisco, New York, London or Frankfurt may build custom onboarding, risk engines and Open Banking integrations to satisfy BaFin/EBA expectations and internal risk policies.

Healthcare platforms for the NHS or US hospital systems often build or heavily customise patient flows and EHR integrations to align with HIPAA and local NHS data standards.

Infrastructure and platform products (developer platforms, core data hubs) often become the company’s competitive edge, so leaders are unwilling to hand that edge to a third-party SaaS.

Custom UX, deep ERP/core banking/EHR integration, and specific performance SLAs (e.g. low latency in a trading system) are all strong signals that build deserves serious consideration.

Benefits and risks of in-house software development

Benefits of in-house development include.

Full IP ownership and control over the roadmap.

Custom features aligned with your exact workflows and domain.

Tailored security controls and architecture, tuned to your threat model.

A tight feedback loop between users, product and engineering.

But the risks are real.

Higher total cost of ownership (TCO): in 2024, median US software developer wages were around $133,000 before benefits and overhead.

Hiring and retaining strong engineers in London, Berlin or Munich is competitive and slow.

Time-to-value often stretches from months into quarters if scope isn’t ruthlessly managed.

Under-resourcing leads to technical debtfragile code, poor documentation and dependency on a few key people.

Many teams adopt hybrid models: keep the core logic in-house, and outsource or buy for commodity components like auth, billing or marketing automation.

Total cost of ownership for in-house builds in US, UK and DACH

TCO for in-house builds typically includes.

People: salaries, benefits, recruitment, training. US tech hubs like San Francisco, New York and Austin are at the top end; London and Munich aren’t far behind.

Tooling and cloud: CI/CD, observability, security tooling plus AWS/Azure/GCP infrastructure across multiple regions.

Ongoing maintenance: bug fixes, refactors, security patching, roadmap updates.

Compliance overhead: GDPR/DSGVO, UK-GDPR, SOC 2, HIPAA and PCI DSS all require additional security, documentation and audits.

DACH companies (Germany, Austria, Switzerland) frequently invest in more senior engineering and security talent to satisfy German regulators and data residency expectations. That investment pushes TCO up but can reduce regulatory risk over the long term.

When to buy SaaS or off-the-shelf software

Buying SaaS or off-the-shelf software is usually the right choice when the problem is well understood, non-differentiating, and there are mature, compliant solutions in the market.

This route typically reduces time-to-value and upfront cost for standard capabilities like CRM, HR, ticketing, analytics and collaboration.

What factors make buying off-the-shelf software better than building in-house?

Off-the-shelf software wins when you need proven functionality quickly, predictable subscription costs and acceptable compromises on customisation.

Established SaaS tools often ship with security certifications and compliance artefacts SOC 2, GDPR/DSGVO, HIPAA, PCI DSS which lowers due-diligence effort for US, UK and EU buyers.

Key advantages.

Speed to market: roll out a CRM or ITSM platform to teams in New York, London and Berlin in weeks, not quarters.

Built-in best practices: workflows shaped by thousands of customers (e.g. support queues, sales pipelines).

Support and SLAs: documented response times, uptime commitments and dedicated success managers.

Ecosystem value: app marketplaces, integrations and APIs mean you can plug tools together rather than reinventing everything.

SaaS vs in-house solutions across US, UK and EU

Regional nuances matter.

US

US-hosted SaaS is abundant, and many startups prioritise speed and growth over strict data localisation though HIPAA- and PCI DSS-scope apps still need serious diligence.

UK

public sector and NHS buyers need NHS-compatible software, UK-GDPR assurances and often UK or EU data centres; procurement frameworks and tenders shape vendor choice.

Germany/EU

German customers often insist on DSGVO-konforme SaaS, German or EU data centres, and clear positions on Schrems II and international transfers.

When in doubt, many enterprises choose EU-based or EU-hosted SaaS for anything involving large volumes of customer data.

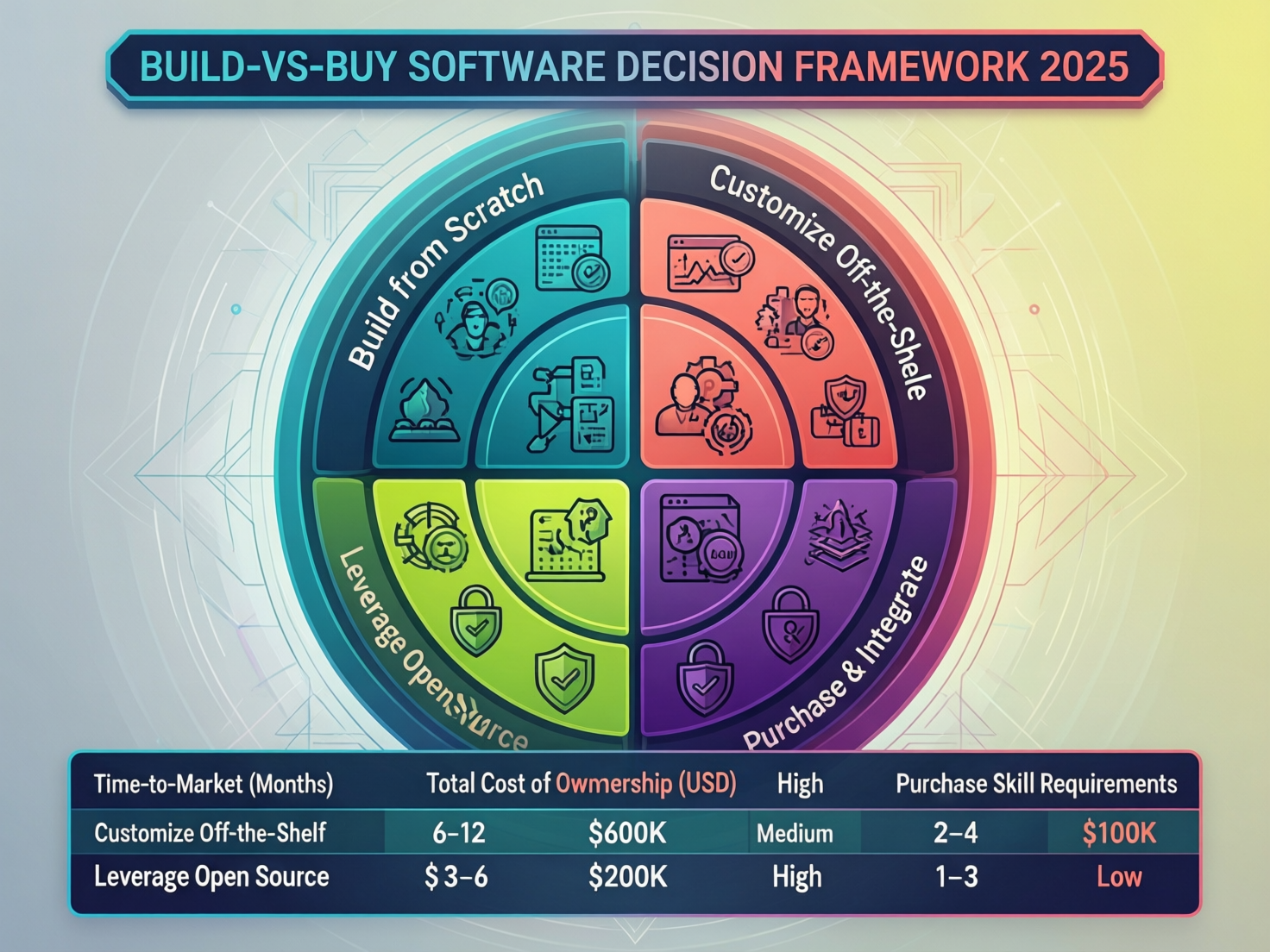

Customisable SaaS, off-the-shelf and “build on a platform” options

Between pure build and pure buy, there’s a large middle ground:

Highly configurable SaaS (workflows, fields, automations).

Low-code/no-code platforms for internal tools.

“Build on a platform” approaches e.g. apps and extensions on Salesforce, Atlassian, or cloud-native platforms on AWS/Azure/GCP.

For a UK ecommerce retailer, for instance, buying a platform like Shopify or Adobe Commerce and extending it is often better than building a full stack from scratch.

A Berlin fintech might build custom risk logic on top of a compliant banking-as-a-service platform, and US/EU hospitals may extend a healthcare platform with custom modules rather than starting from zero.

Cost, ROI and risk: a build vs buy software framework

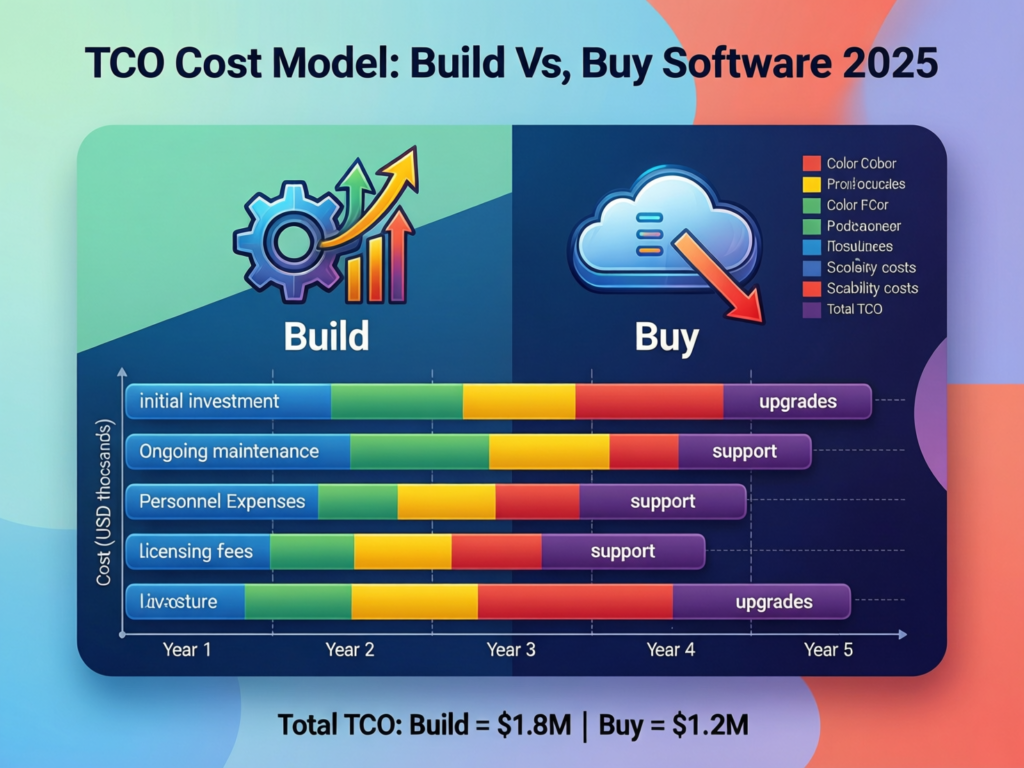

A practical build vs buy software framework compares total cost of ownership, speed, risk and strategic value over a 3–5 year horizon.

The “right” answer is rarely the cheapest option this quarter it’s the one with the best risk-adjusted ROI that still supports your roadmap and compliance obligations.

Build vs buy software cost comparison and TCO

A simple cost model in USD, GBP and EUR should include.

Upfront cost: licences, implementation, or initial build effort.

Ongoing cost: salaries, subscriptions, hosting, observability, support.

Integration cost: connecting to existing CRM, ERP, core banking or EHR systems.

Switching cost: exit fees, data migration effort, retraining if you need to change later.

Globally, the SaaS market is estimated at over $400 billion in 2025 and projected to grow toward or beyond $1 trillion by the early 2030s, so subscription costs are a steadily growing slice of IT budgets.

You can turn this into a simple “build vs buy software calculator” in a spreadsheet where stakeholders can play with assumptions on headcount, licence growth and discounting.

Note.

This guide shares general benchmarks and patterns, not financial or legal advice. Always model numbers for your own context and consult your advisers where needed.

Risk assessment.

A structured risk assessment should cover.

Technical debt: quality of code, coverage, documentation, bus-factor risk.

Vendor lock-in: how difficult/expensive is it to extract data and replace the tool?

Security and compliance: evidence of security controls, audit history, certifications, incident response.

Roadmap alignment: will internal or vendor roadmaps support your future use cases?

Operational risk: dependency on single individuals (build) or single vendors (buy).

Score each risk (e.g. 1–5) for both build and buy, then combine with TCO and ROI to avoid purely “gut feel” decisions.

ROI and payback period for different company sizes

Patterns you’ll often see.

US startups and European scaleups prioritise faster payback (around 12–24 months) and may favour SaaS to launch quickly, then gradually replace with in-house components as they grow.

UK SMEs may prefer predictable SaaS subscriptions aligned with cash flow, focusing build budgets only on high-impact differentiators.

German Mittelstand manufacturers typically accept longer payback periods for strategic platforms that must integrate deeply with plants, logistics and ERP systems.

Even if the build option looks more expensive on day one, it can still win if it unlocks new revenue streams, higher margins or stronger compliance positions over 3–5 years.

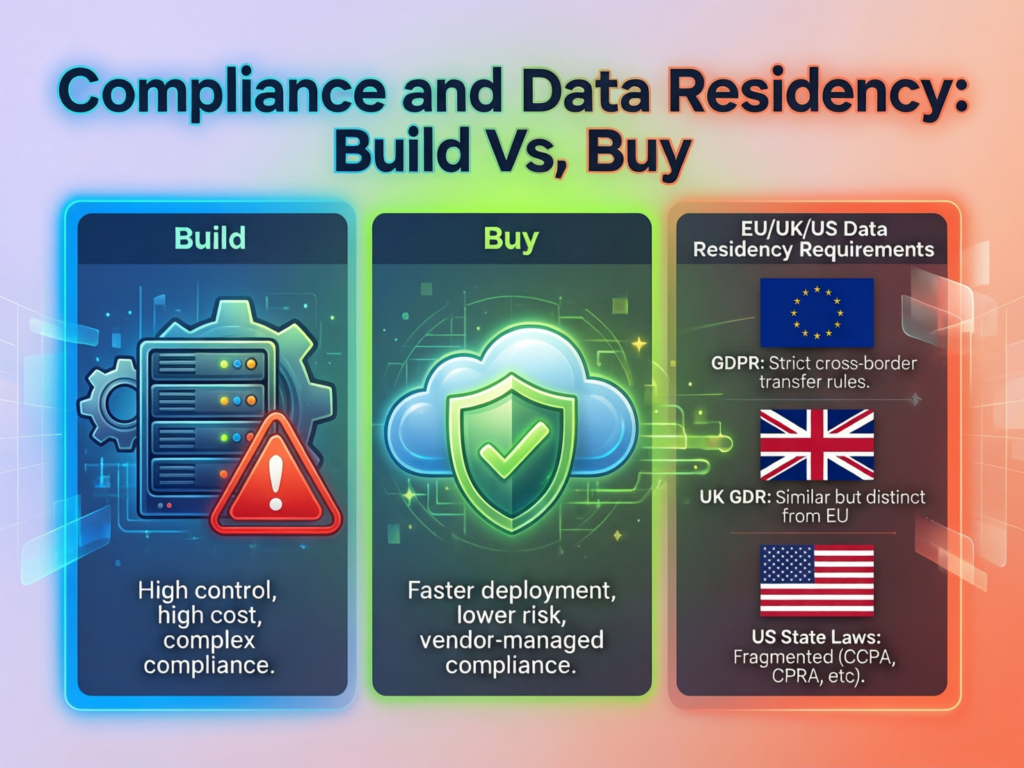

Why are compliance and data residency critical in the build vs buy decision in the US, UK and EU?

Compliance and data residency determine where you can host data, which vendors you can use and how you pass audits.

For US, UK and EU companies, regulations like GDPR/DSGVO, UK-GDPR, HIPAA, PCI DSS, SOC 2 and NIS2 often narrow the vendor list and sometimes make in-house or EU-hosted solutions the safer option.

GDPR, UK-GDPR, DSGVO and NIS2.

GDPR/DSGVO and UK-GDPR set strict rules on lawful processing, data minimisation, data subject rights and cross-border transfers.

Implications.

You must know which sub-processors your SaaS vendors use and where data physically resides.

EU- and Germany-based organisations often prefer EU/German data centres to simplify Schrems II concerns and regulator discussions.

NIS2 tightens cybersecurity and vendor oversight for operators of essential and important entities across the EU, pushing organisations toward vendors with strong security governance—or in-house builds with robust controls.

HIPAA, PCI DSS, Open Banking, NHS, BaFin, EBA

Sector rules can override general convenience.

US healthcare

HIPAA and its Security Rule require strong safeguards around electronic protected health information (ePHI). SaaS vendors must sign BAAs and demonstrate technical and organisational measures.

Payments

PCI DSS and card schemes enforce strict controls on cardholder data; many teams opt for PCI-compliant payment gateways rather than building their own card storage.

UK finance and NHS

Open Banking APIs and NHS standards dictate interoperability and security requirements that any chosen vendor or in-house build must meet.

Germany/EU banking

BaFin and EBA guidelines raise expectations on outsourcing, cloud and operational resilience, meaning vendor risk management is as important as feature fit.

Pre-certified SaaS can reduce compliance workload, but sometimes only a custom build truly fits a complex regulatory and workflow mix.

US, UK and EU data residency scenarios

A few common scenarios.

A US healthtech startup using US cloud regions must ensure any analytics SaaS touching PHI is HIPAA-aligned or keep that capability in-house.

A London-based fintech serving UK and EU customers may choose EU data centres for production and UK/EU-only SaaS for KYC data to keep regulators comfortable.

A Berlin ecommerce brand might freely use global SaaS for marketing analytics but insist on EU-hosted platforms for customer profiles and payment data.

An Amsterdam SaaS scaleup planning a US expansion may split environments: EU data for EU customers, US data in US regions and carefully controlled cross-border transfers.

Key questions to ask every time.

“Where will our customer data live and which sub-processors are involved?”

“Which regulator(s) will audit us, and what are their expectations on cloud and SaaS?”

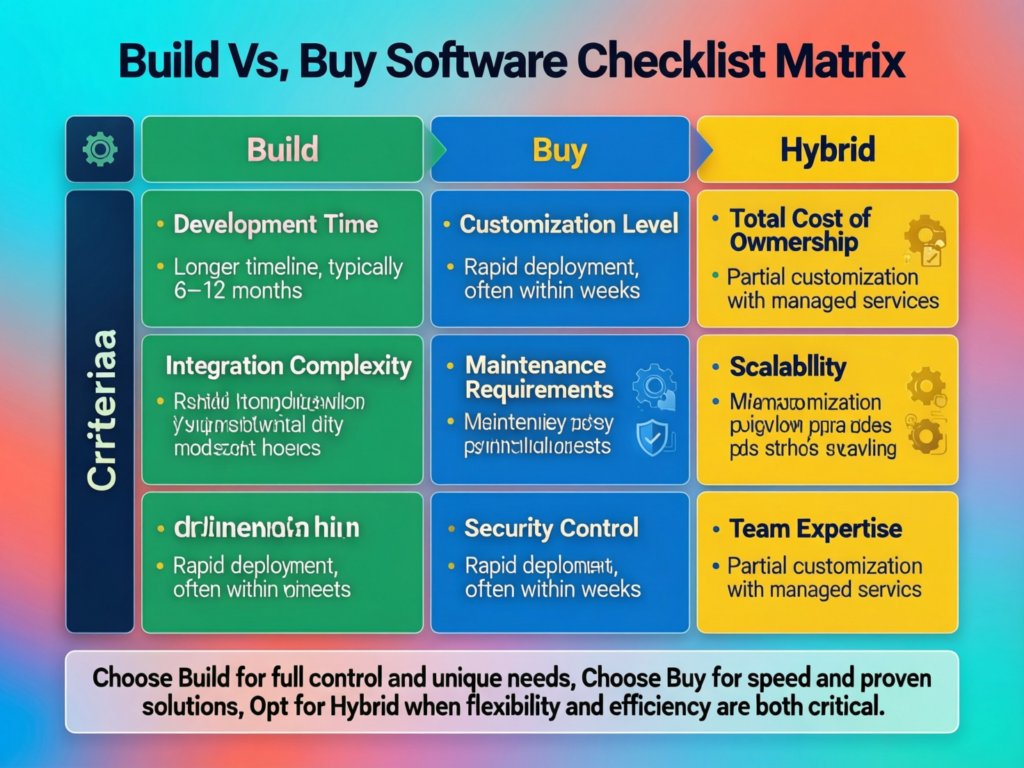

How do you decide whether to build or buy software for your business? A simple step-by-step checklist

You decide whether to build or buy by ranking your requirements, scoring options on value, cost, risk and compliance, and then choosing the route that best supports your 3–5 year strategy.

A lightweight checklist and decision matrix turns opinions into a transparent, auditable decision.

How can a simple framework or checklist help teams make a build vs buy decision faster?

A structured checklist transforms vague debates (“engineering wants to build, finance wants to buy”) into clear, scored criteria strategic importance, TCO, compliance, time-to-market and vendor risk.

This reduces unproductive argument, aligns product, engineering and compliance, and shortens the decision cycle.

A practical 6-step framework.

Define the problem clearly

Describe the business outcome, users, data and constraints so everyone is solving the same problem.

Classify it as core or non-core

Decide whether this software will be a true competitive differentiator or a supporting function.

List realistic options

Include pure build, pure buy, buy-and-extend and phased approaches such as “SaaS now, build later”.

Score each option against key criteria

Rate options on strategic value, TCO, time-to-market, compliance, data residency and risk.

Pilot the leading option(s)

Run a limited-scope pilot with real users to validate assumptions before committing fully.

Decide and document

Choose the preferred option and record assumptions, scores and rationale for governance, audits and future reviews.

Example build vs buy decision matrix for US, UK and EU teams

Create a simple matrix in Google Sheets or Excel:

Columns: Option A (pure SaaS), Option B (custom build), Option C (buy + extend), Option D (SaaS now, build later).

Rows: strategic importance, TCO 3-year, TCO 5-year, time-to-market, compliance fit, data residency, security posture, vendor risk, user experience.

Regional weighting examples.

EU/Germany: give higher weight to compliance, data residency and vendor oversight.

US startups: weight speed and flexibility more heavily.

UK public sector: add criteria for procurement fit, framework availability and accessibility standards.

Your matrix then becomes a reusable build vs buy software decision framework for future initiatives.

Who should be in the room when deciding?

For a robust decision, include.

CTO / Head of Engineering (architecture, feasibility, technical debt).

Product leadership (user impact, roadmap priorities).

Security & Compliance / Legal (regulations, contracts, audits).

Finance (budgets, TCO, payback).

Key business stakeholders (e.g. Head of Sales, Ops, or Medical Director).

US startups might run this in a single working session with a compact group, while a German enterprise or UK public sector body will have more formal governance but the principle is the same: cross-functional alignment to avoid expensive rework later.

Final Words

There is no universal answer in the build vs buy software debate. The “right” decision depends on your strategy, industry, geographic footprint, compliance obligations and appetite for owning long-term technical risk.

Use the framework above to

Clarify whether the problem is truly core to your competitive edge.

Compare in-house, SaaS and hybrid options over a 3–5 year horizon.

Stress-test each option against data residency and regulatory realities in the US, UK, Germany and wider EU.

Key takeaways

Build when the capability is genuinely strategic, tightly coupled to your core systems and poorly served by existing SaaS.

Buy when the problem is standardised, vendors are mature and compliant, and speed matters more than perfect fit.

Always compare TCO, risk and ROI over several years not just upfront spend.

Document your assumptions, scoring and decision so you can defend it to boards, auditors and future-you.

Mak It Solutions works with US, UK, DACH and wider EU teams on exactly these choices from custom SaaS platforms to carefully integrated vendor stacks so you don’t have to navigate them alone.

If you’re currently debating whether to build or buy a key piece of software, you don’t need another generic blog you need numbers and context for your stack, your GEOs and your regulators.

Mak It Solutions can help you model 3–5 year TCO, map regulatory constraints (GDPR/DSGVO, UK-GDPR, HIPAA, PCI DSS) and design a pragmatic build vs buy roadmap across AWS, Azure and GCP.

Reach out to request a tailored build vs buy assessment for your next platform or product, or explore Mak It Solutions’ development and SaaS platform services to see how a hybrid “build on top of the right tools” approach could work for your organisation.( Click Here’s )

FAQs

Q : Is it usually cheaper to build your own software or buy SaaS over 5 years?

A : Over a five-year horizon, SaaS is often cheaper for standard use cases like CRM, ticketing or HR because you avoid large upfront build costs and spread spend as subscriptions. However, for high-scale or highly differentiated products, in-house builds can become more cost-effective once you amortise initial development and avoid rising per-seat SaaS fees. The real answer depends on user count, growth rate, required uptime and compliance overhead so a simple TCO model is essential before deciding.

Q : How long does it take to build custom software compared to rolling out an off-the-shelf tool?

A : Rolling out a mature SaaS product can take anywhere from a few weeks to a few months, depending on integrations, data migration and change management. Building equivalent functionality from scratch often takes several months to over a year, especially if you’re hiring a team and designing a new architecture. Low-code platforms and “build on a platform” options can shorten build timelines, but they rarely match the speed of switching on a well-chosen SaaS product.

Q : Can you start with SaaS now and switch to an in-house solution later without losing data?

A : Yes. Many teams deliberately start with SaaS to validate workflows and only move to custom builds once requirements stabilise. To keep your options open, choose vendors with good export capabilities (APIs, CSV dumps, webhooks), avoid deeply proprietary extensions and design your own data model with migration in mind. When you’re ready to switch, you can run a period of coexistence syncing data between SaaS and the new system before turning the old platform off.

Q : What are signs that your company has outgrown an off-the-shelf solution and should consider building?

A : Warning signs include constant workarounds, teams living in spreadsheets outside the core tool, hitting hard limits on custom fields or workflows, and vendor roadmaps that conflict with your strategy. If licence costs are ballooning, integrations are fragile and audits are getting harder because you can’t prove controls end-to-end, it’s time to evaluate custom or platform-based builds. A structured review every 12–18 months helps you catch these signals before they become emergencies.

Q : How should US, UK and EU companies evaluate a vendor’s security and compliance claims before buying?

A : Start by requesting security and compliance documentation: SOC 2 reports, ISO 27001 certificates, penetration test summaries and details of data centres and sub-processors. Verify how the vendor handles GDPR/DSGVO or UK-GDPR obligations, including data subject rights and international transfers, and check whether HIPAA or PCI DSS apply to your use case. For regulated industries or public sector buyers, involve security and legal teams early and run a structured vendor risk assessment rather than relying only on marketing pages or sales assurances.