AI Governance Policy Template for SMEs in GCC

AI Governance Policy Template for SMEs in GCC

AI Governance Policy Template for SMEs in GCC

A simple AI governance policy for SMEs in the GCC in 2026 is a short, bilingual (Arabic/English) document that explains how your team chooses, uses, and monitors AI tools that touch customer and employee data. It should reflect Saudi, UAE, and Qatar data protection rules and assign clear roles, approvals, and logging so you can roll it out in 30 days.

Imagine a retail SME in Riyadh using ChatGPT-style tools to draft contracts, answer WhatsApp queries and summarise invoices. One morning its bank asks for an “AI governance policy”, and a big client in Dubai sends a security questionnaire about AI, PDPL and data residency. The owner suddenly realises: the team is using AI everywhere, but there is no written rulebook.

Across the Gulf Cooperation Council (GCC), SMEs often lack in-house lawyers or AI specialists. Yet they now face Saudi PDPL controls, UAE PDPL and free-zone rules, Qatar’s AI guidelines, plus long RFP forms from banks and government buyers.

This guide gives you a practical AI governance policy template for SMEs in GCC designed for family businesses and mid-size firms in Saudi Arabia, the United Arab Emirates and Qatar plus a 30-day rollout plan with a risk register and model inventory.

What is a simple AI governance policy that SMEs in the GCC can use in 2026?

A simple AI governance policy for GCC SMEs is a 5–7 page, bilingual document that defines where AI can be used, who approves it, how data is protected, and how risks are escalated. It is lighter than a full “AI ethics” manifesto but specific enough for banks, regulators and enterprise clients to trust how you run AI.

Plain-English definition of AI governance for GCC SMEs.

For a typical family business in Jeddah or Doha, AI governance means: who can use which AI tools, for what purpose, with what data, and under which safeguards. It sits next to your IT policy but focuses on tools like ChatGPT, copilots, fraud-scoring models and chatbots. Compared with generic “AI ethics” PDFs, this policy is concrete: it names tools, owners, and approval steps, so managers can actually enforce it a responsible AI framework for business, not just slogans.

Minimum controls your AI policy must cover in GCC.

At minimum, your policy template should include

Scope & acceptable use which AI tools and use cases are allowed or banned (e.g., no uploading national IDs or medical files into public models)

Roles & approvals who sponsors AI (owner/GM), who is AI champion, who signs off high-risk use.

Data protection & privacy how you meet PDPL-style consent, minimisation and logging duties.

Model & risk review simple checks for accuracy, bias and explainability for important decisions (credit, hiring, pricing).

Vendors & contracts what you ask from AI vendors about security, algorithmic transparency and explainability policy, and support.

Where the downloadable template fits in your handbook

Most SMEs already have HR, IT or quality manuals. Your AI governance policy template plugs in as:

A chapter in your HR or IT policy, with a one-page summary for staff.

An annex with your AI tools list and risk register that you update quarterly.

A bilingual attachment you can upload to procurement portals or share with banks.

For many owners searching “AI governance policy template for SMEs in GCC” or “Saudi AI policy template PDF for company use”, this structure is enough to pass first-line due diligence.

AI governance framework for GCC SMEs.

Even a 15-person SME in the GCC can run a clear AI framework: defined roles, a simple lifecycle from idea to monitoring, and a realistic maturity path. The goal isn’t perfection; it’s traceability and basic AI ethics and risk management for SMEs.

RACI roles for owners, managers, IT and compliance.

In a small firm, the framework can be.

Sponsor business owner or GM (accountable)

AI champion tech-savvy manager in operations or IT (responsible)

Data protection lead the person who knows PDPL/contract obligations best.

Tool owners HR, finance, marketing leads each own their AI tools.

SMEs in the Kuwait, Bahrain and Oman can use the same RACI model: one accountable sponsor, one coordinator, and clear process owners.

AI lifecycle governance from idea to monitoring.

Use a five-step AI lifecycle governance (design, deploy, monitor) loop.

Plan define the problem, data, and success metrics.

Test run pilots, check outputs, log issues.

Approve sponsor sign-off for high-risk tools.

Deploy document configuration, access and vendor details.

Monitor & retire review performance, drift and complaints; retire old models.

Micro-businesses can keep this on a single page but still show “AI audit and model validation for companies” when clients ask.

Maturity path for GCC organisations.

Think in three levels.

Basic spreadsheet inventory, one policy, annual review (typical SME in Qatar or Oman).

Managed quarterly reviews, KPIs, incident log (growing fintech in Bahrain).

Advanced formal AI committee, scenario testing, internal audits (regional groups expanding from Dubai or Riyadh).

Your downloadable template is “Basic–Managed” by default and can be scaled up as you grow.

Country-specific AI governance.

The template stays short, but a few clauses should be tuned for each major market so it aligns with national AI and data strategies.

How do Saudi SMEs align their AI use with SDAIA, PDPL and SAMA rules without a big compliance team?

At a high level, Saudi SMEs can: (1) respect PDPL principles, (2) apply SDAIA AI ethics and adoption guidance, (3) follow SAMA’s risk expectations if they touch finance. In practice:

Add explicit lines on consent, logging and data localisation for Saudi customer data.

Reference SDAIA/NDMO AI principles on fairness, transparency and accountability in your policy preamble.

For fintechs and payment firms in Riyadh or Jeddah, map your risk register to SAMA’s IT and outsourcing guidance and keep audit-ready logs of model changes, alerts and overrides.

You can always link to SAMA’s official site from your internal compliance wiki for deeper details.

How can UAE startups build an AI governance framework that fits PDPL and Free Zone requirements? (Commercial Investigation UAE mapping)

UAE startups should: (1) treat Federal PDPL as the minimum, (2) check if DIFC or ADGM rules also apply, and (3) align telecom/data handling with TDRA guidance. That means your AI policy should:

Clarify whether data is processed onshore or under free-zone regimes (DIFC, ADGM).

Include a simple DPIA-style checklist for high-risk AI, inspired by PDPL articles on automated processing and profiling.

Reference TDRA/telecom expectations for cloud, messaging and digital identity tools like UAE Pass.

Documenting this in English and Arabic turns your policy into an UAE SME AI governance checklist Arabic English ready for investors and regulators.

Why should Qatar SMEs care about QCB and national AI guidelines if they only use cloud AI tools?

Even if you “only” use SaaS AI, Qatari banks and suppliers are increasingly bound by QCB’s AI Guideline and the National AI Strategy. The policy template helps SMEs in Doha to.

Classify AI systems as low, medium or high-risk in line with QCB language.

Record when customers are informed that AI is used in credit, fraud or service decisions.

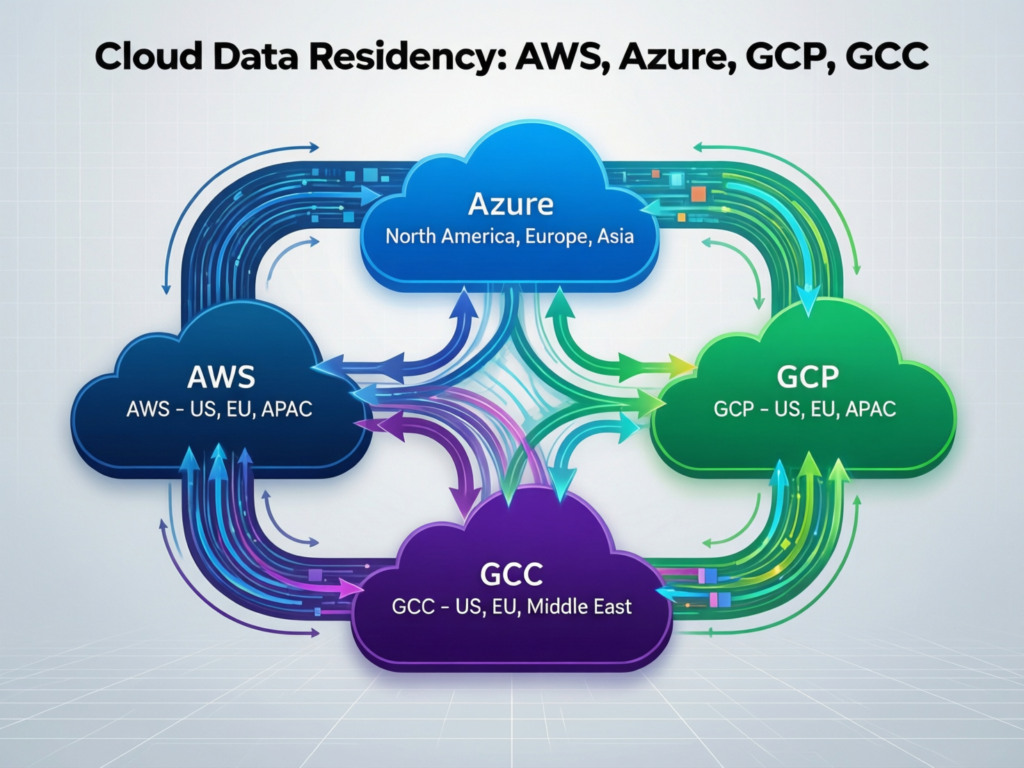

Show how your cloud choices (e.g., GCP’s Doha region) support Qatar’s data residency and Qatar Digital ambitions.

That way, your AI governance framework for SMEs in Qatar according to national AI strategy is more than a buzzword.

How SMEs and family businesses actually use AI

Most GCC AI usage is practical: saving time and improving service in logistics, hospitality, e-commerce and healthcare. Your policy should reflect these day-to-day realities, not just theory.

How do GCC family businesses create an AI usage policy that covers staff, vendors and chatbots?

Take a third-generation family retailer in Dubai, a logistics SME in Abu Dhabi, and a hotel group in Abu Dhabi:

Staff use AI for emails, translations and Excel formulas.

Vendors plug in AI-powered APIs for delivery routing and inventory.

Customer chatbots answer FAQs in Arabic and English.

Your AI policy should: require vendor SLAs on security and bias, define which customer data can be shared with chatbots, and set clear escalation rules when bots hand over to humans.

AI governance for HR, finance and marketing teams.

Typical scenarios.

HR

AI screening CVs; require human review for rejections and keep notes for explainability.

Finance

AI-assisted invoice coding and cash-flow forecasting; ensure approvals for any automated payment suggestions.

Marketing

AI drafting social posts; define content red lines (religion, politics, minors) and require disclosure for sponsored AI content.

Each scenario points back to a clause in your template, forming a practical AI ethics and risk management for SMEs playbook.

Data residency, cross-border transfers and Arabic UX.

GCC clients increasingly ask: Where is my data stored? You can answer by referencing regional cloud options like AWS Middle East (Bahrain), Azure UAE Central from Abu Dhabi, and Google Cloud’s Doha region. Your policy should:

Prefer in-region or in-country regions for sensitive workloads.

Document when data leaves the GCC and under what safeguards.

Emphasise Arabic/English UX, clear privacy notices, and culturally respectful content guidelines.

What steps should a GCC SME follow to build an AI risk register and model inventory in 30 days?

In 30 days, a GCC SME can: (1) map all AI tools, data types and owners, (2) create a simple risk register and model inventory, and (3) update the policy, train staff and run a first review.

Week 1 Map AI tools, data and owners.

Start with a whiteboard session: list every AI tool your teams use chatbots, copilots, in-app recommendation engines, fraud scores, even WhatsApp plugins. For each, note: business process, data used (HR, customer, payments, medical, minors), geography (KSA, UAE, Qatar, others) and a named owner. Flag obvious high-risk use such as credit scoring, KYC/AML, health and education.

Week 2 Build a simple risk register and model inventory.

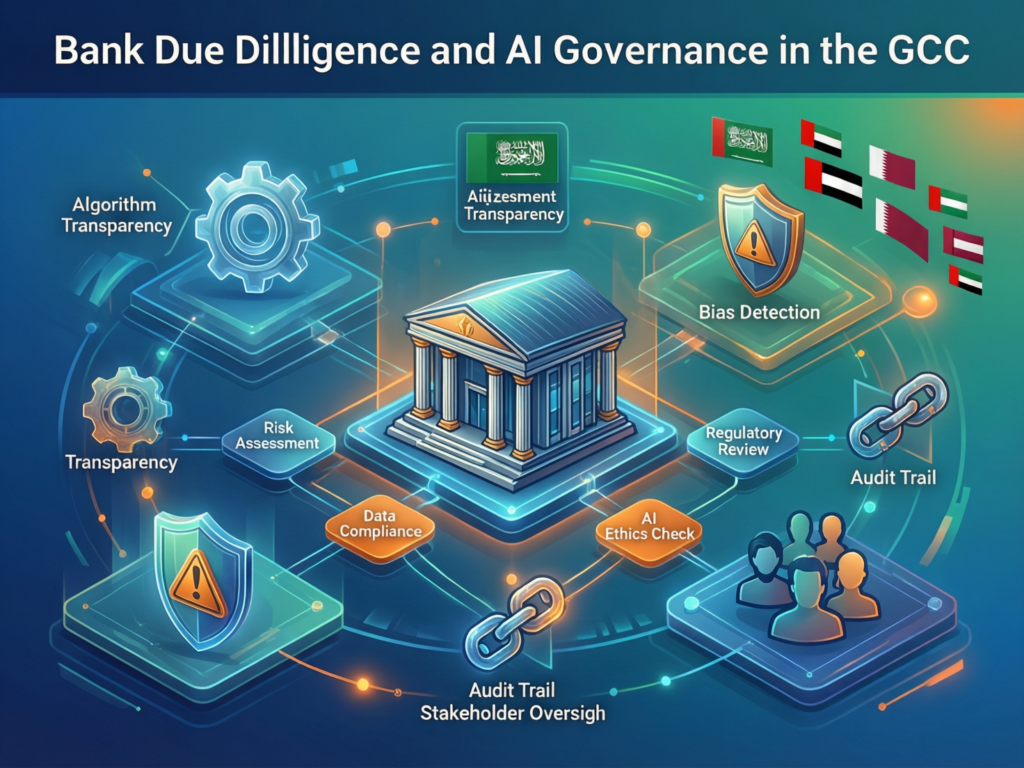

Create a one-sheet table with columns: tool/model, purpose, data categories, risks, controls, owner, review date. SMEs in Riyadh, Dubai and Doha can re-use this sheet for bank due-diligence and regulator questionnaires from PDPL, QCB or sector regulators. When you adopt a new AI tool, your AI champion adds a row and gets sponsor sign-off before going live.

Weeks 3–4 Update the policy, train staff and run a first review.

Update the policy template so it references your new inventory and risk register. Run a short bilingual training (30–45 minutes) per department explaining do’s and don’ts, with real screenshots of your tools. Capture sign-off via email or HR system, then book a 6–12-month review cycle. Most SMEs can do this with internal time plus light external support instead of hiring a full-time AI risk officer.

Best practices to keep your AI governance policy alive in GCC

AI governance is not “one and done”. Treat your policy and risk register like living documents that evolve with regulations, clients and tool and help you show up better in Google search and AI Overviews when people look for your company.

Annual health checks against changing GCC regulations.

Once a year, your policy owner should check updates from SDAIA/NDMO and the Digital Government Authority in Saudi, TDRA and telecom rules in the UAE, and QCB and Qatar Digital policies in Qatar. Note down changes that affect consent, automated decisions, cross-border transfers or AI audits, then tweak your policy and training slides.

When SMEs should bring in external advisors or legal counsel.

Bring in external help when.

You enter regulated sectors like fintech, healthcare or education.

You bid for government or semi-government contracts.

You expand cross-border beyond the GCC.

Advisors can stress-test your templates, design a deeper responsible AI framework for business, and align your AI stack with platform decisions (for example, insights from Mak It Solutions’ web development trends in the Middle East for KSA and UAE, mobile app development services or Webflow development services).

Communicating AI governance to banks, clients and regulators.

Package your work into a small evidence bundle:

AI governance policy (English/Arabic).

AI risk register and model inventory.

1–2 slide summary of AI lifecycle and roles.

You can attach this in RFPs, share it with banks, and reference it alongside more technical material such as your indexing controls and technical SEO or server-side rendering vs static generation guide. For some clients, simply being this organised about AI is a competitive advantage.

Concluding Remarks

You don’t need a huge legal or AI team to get started. In 30 days, you can understand the basics, map Saudi/UAE/Qatar rules, download and adapt an AI governance policy template for SMEs in GCC, and roll it out with a simple risk register and model inventory. Some governance is far better than none especially when banks, regulators and large clients are deciding which vendors to trust.

By treating AI governance as part of your broader digital stack alongside platform choices like WordPress, Webflow or Wix and compliance topics such as the Digital Markets Act impact on Big Tech you turn a perceived burden into a signal of maturity.

If you’d like help turning this outline into a tailored, sector-specific policy, the team at Mak It Solutions is ready to support you. We can adapt the AI governance policy template for your regulator (SDAIA, TDRA, QCB or others), align it with your existing web and app stack, and prepare the evidence bundle banks and enterprise clients expect.

Book a short consultation to review your current AI usage, or combine this work with broader projects such as mobile app development, Webflow-based frontends or more advanced indexing and technical SEO controls. Let’s build an AI governance framework that fits your GCC business and helps you win the next big RFP.( Click Here’s )

FAQs

Q : Is this AI governance policy template enough for Saudi PDPL compliance for a small company?

A : For a small Saudi company, this AI governance policy template is a strong starting point but not a full PDPL compliance programme. PDPL also expects you to manage data subject rights, cross-border transfers, incident response and vendor contracts across all systems, not just AI. Use the template to cover AI tools, then align it with broader PDPL guidance from SDAIA and its NDMO arm especially on data classification and governance. When in doubt, get brief legal advice to confirm your lawful bases, consent language and retention periods under Saudi Vision 2030’s digital transformation goals.

Q : Do UAE free-zone startups in ADGM or DIFC need a different AI policy from onshore SMEs?

A : Startups in ADGM or DIFC usually fall under those free zones’ data protection laws, while onshore entities follow the federal PDPL. You don’t need two separate AI policies, but you should add a short section stating which regime applies to which entity in your group and how you handle intra-group transfers. Many firms keep one master AI governance policy with annexes for DIFC/ADGM specifics. Make sure your risk register tracks which systems sit in each jurisdiction, and watch updates from TDRA and UAE regulators as the local AI landscape matures.

Q : How should Qatar SMEs handle AI tools that store customer data in Europe or the US?

A : Qatar SMEs using AI tools hosted in Europe or the US should first identify whether they serve regulated sectors such as banking, payments or capital markets. If they do, they must consider the QCB Artificial Intelligence Guideline and other fintech rules that emphasise governance, transparency and customer notification when AI is used. Even non-regulated SMEs should document where data is stored, apply standard contractual protections, and favour providers with recognised security certifications. In parallel, explore regional cloud regions like Google Cloud Doha or AWS Bahrain to reduce cross-border transfers and align with Qatar National Vision 2030 priorities.

Q : Does a GCC AI usage policy have to be written in Arabic as well as English for employees?

A : Legally, requirements differ by country and sector, but practically, a bilingual policy is almost always the safest option in the GCC. Many frontline workers in Saudi Arabia, UAE and Qatar are more comfortable in Arabic, and labour inspectors or public-sector buyers may expect key rules to be understandable in the local language. A short Arabic summary plus bilingual key clauses on acceptable use, privacy and escalation is usually enough. This aligns with digital government goals such as Saudi Vision 2030 and national digital strategies, and reduces the risk that employees misuse AI and later claim they never understood the rules.

Q : What AI governance documents do banks and fintech SMEs in Saudi, UAE and Qatar usually show to SAMA or QCB?

A : Banks and fintechs typically show regulators three layers of documentation: an enterprise-wide risk and compliance framework, specific AI or model risk policies, and detailed model registers with testing and monitoring evidence. In Saudi Arabia, that sits alongside PDPL and NDMO data policies under SDAIA, plus SAMA technology and outsourcing rules. In Qatar, QCB expects AI usage to be documented and governed at board level. Even if you’re a smaller SME, having a lean version of these artefacts policy, risk register, and periodic review notes shows you understand the direction of travel and can scale governance as you grow.