Arabic LLMs for Banking, Telecom and Government in GCC

Arabic LLMs for Banking, Telecom and Government in GCC

Arabic LLMs for Banking, Telecom and Government in GCC

Arabic LLMs for banking, telecom and government in the GCC are Arabic-native large language models designed to understand MSA, Khaleeji dialects and English Arabic code-switching while respecting strict regional regulations and data residency. For banks, telcos and ministries in Saudi Arabia, the UAE and Qatar, they enable compliant automation of journeys like KYC, call centers and digital government in natural Arabic, often running on in-country or sovereign cloud infrastructure.

Introduction.

Most global AI tools were trained and tuned in English, then “extended” to Arabic as an afterthought. For leaders in Riyadh, Dubai, Doha and Jeddah, that is no longer enough: regulators expect Arabic disclosures, citizens expect Arabic-first UX, and customer journeys often blend MSA with Gulf dialects and English banking or telecom terms.

Who Is Asking? CIOs, Compliance Leads and CX Heads in Regulated Sectors

The people pushing hardest for Arabic-native large language models are CIOs, CISOs, Heads of Compliance and CX leaders across fintech, retail banking, telecom, logistics platforms and digital government. They’re not chasing “cool AI”, but looking for a GCC sovereign AI strategy that balances innovation with SAMA, TDRA, QCB, SDAIA and NDMO expectations on privacy, auditability and data sovereignty.

Banking, Telecom and Government Use Cases in 2026

Arabic generative AI is already drafting Sharia-compliant product summaries, powering Arabic AI voice bots in call centers, summarising regulations for civil servants, and guiding citizens through ID, permit and subsidy journeys. The question for 2026 is no longer “should we use Arabic AI?” but “which Arabic LLM, on which cloud, with which controls?” especially for Arabic LLMs for banking, telecom and government in GCC where regulation and trust are non-negotiable.

What Is a Sovereign Arabic LLM for GCC Banks and Governments?

A sovereign Arabic LLM for GCC banks and governments is an Arabic-native model whose training, deployment and governance are aligned with local data laws, regulators and in-region cloud or on-prem infrastructure. It’s designed so that sensitive financial and citizen data stays under regional legal control (KSA, UAE, Qatar), with clear audit trails, guardrails and Arabic-first UX not just an English model with a translation layer bolted on.

Arabic-Native vs Multilingual Models.

Arabic-native large language models are built and tuned on Modern Standard Arabic plus Gulf dialects and English Arabic code-switching G plan”, “Tammam, done”). They typically handle nuances like Saudi vs Emirati slang, names of local products and ministries, and right-to-left layouts better than generic multilingual models, which often hallucinate or mistranslate domain terms.

Sovereign AI, Data Residency and Local Clouds in Riyadh, Dubai and Doha

For a sovereign deployment, data and compute sit inside trusted perimeters: on-prem DCs, national sovereign clouds or in-country regions such as AWS Middle East (Bahrain and UAE), Azure UAE Central in Abu Dhabi, or Google Cloud’s Doha region.These setups make it easier to comply with NDMO data governance policies in Saudi Arabia and similar frameworks in the UAE and Qatar.

When Do You Need a Sovereign Arabic LLM Instead of Global Models?

You typically need a sovereign Arabic LLM when.

Data is highly regulated (core banking, telco CDRs, health, citizen registries).

Regulators expect data residency or sector-specific controls.

Decisions must be explainable in Arabic (loan declines, sanctions screening, subsidy eligibility).

For low-risk use cases (marketing content, internal drafts), a well-configured global model with redaction can still be fine but most GCC banks and ministries are building a sovereign tier for critical workloads.

Why Saudi and UAE Banks Need Arabic-Native LLMs for Compliance and Trust

Saudi and UAE banks increasingly need Arabic-native LLMs because SAMA and QCB expect clear Arabic disclosures, secure handling of financial data and strong cybersecurity and data-governance controls. A generic English chatbot with ad-hoc translation can’t reliably meet those standards or deliver the trust that retail, SME and corporate customers in Arabic-first markets expect.

SAMA, QCB and Arabic-Language Requirements for Banking Journeys

Saudi Central Bank (SAMA) cyber and data frameworks push banks toward strong access control, segregation of data and clear governance for cloud workloads. Qatar Central Bank (QCB) has issued digital-bank and fintech frameworks that emphasise governance, security and customer protection for digital channels. Arabic LLMs help ensure disclosures, consent flows, fee explanations and dispute responses are understandable in Arabic, not just legally correct in English.

Islamic Banking, Sharia Advisory and Arabic Knowledge Bases

Islamic banks in Riyadh, Jeddah, Dubai and Doha need models grounded in Arabic fiqh, Fatwa archives and product documentation. An “Arabic LLM for banking compliance in Saudi Arabia (SAMA rules)” might ingest Sharia board rulings, product term sheets and local regulations, then provide draft Fatwa summaries, Arabic product explanations and internal guidance always with human Sharia scholars in the loop.

Designing KYC, AML and Credit Journeys with Arabic UX and Explainable AI

Arabic-native LLMs can guide customers through eKYC, sanctions checks and small-business credit applications step by step in Arabic while generating structured logs for auditors. For example, a Riyadh fintech startup could combine an Arabic LLM with business intelligence services to explain why a loan was declined (“insufficient cash-flow history”) instead of returning a cryptic error code.

Arabic LLMs for GCC Telecom Contact Centers and Operations

Telecom companies across Saudi, UAE and Qatar are using Arabic LLMs to automate call centers, IVR and WhatsApp journeys without losing the human tone customers expect. In day-to-day operations, Arabic generative AI for call centers listens (or reads), understands Gulf dialects, and responds in natural Arabic while handing edge cases to human agents.

TelecomGPT-Arabic and Other Arabic Telecom LLMs for Call Centers

Telcos are experimenting with “TelecomGPT-Arabic”–style domain models trained on billing codes, plans, devices and network jargon, often integrated with Arabic AI voice bots similar to those described in Arabic AI voice bots for GCC call centers. This is where Arabic dialect understanding in AI directly impacts first-call resolution and CSAT.

Automating IVR, WhatsApp and Omnichannel CX in Saudi, UAE and Qatar

LLM-driven bots now answer prepaid balance queries, roaming questions and fibre-installation updates across IVR, WhatsApp and web chat. A Dubai operator might use a “UAE sovereign Arabic LLM for telecom and government clouds” running on local infrastructure to keep transcripts and metadata in-country while integrating with CRM and billing.

NOC/SOC, Network Optimization and Field Operations in Arabic

Beyond customer service, Arabic LLMs can summarise NOC alerts, explain SOC incidents and generate Arabic work orders for field engineers. Logistics-heavy telco operations benefit when incident reports, playbooks and post-mortems are searchable in Arabic, not just hidden in English PDFs.

Government and Smart City Arabic AI Assistants in GCC

Digital Government Portals in Riyadh, Dubai and Doha Using Arabic Chatbots

Digital government teams are embedding Arabic chatbots into portals for permits, fines, subsidies and SME support often alongside broader smart-city initiatives like those discussed in digital twin technology in GCC smart cities. Citizens can ask, in colloquial Arabic, how to renew a licence or book a health appointment and receive clear, step-by-step answers.

Secure Internal Assistants for Policy, Permits and Regulations in Arabic

Internally, ministries are trialling assistants that summarise new regulations, draft policy briefs and answer “what does article X say?” all in Arabic. These assistants sit behind VPN/zero-trust perimeters, with strict access control and logging aligned to SDAIA and NDMO data governance guidance.

Identity, Consent and Accessibility: UAE Pass, Absher and Qatar Digital ID Journeys

Arabic LLMs also help explain digital identity journeys such as UAE Pass, Absher and Qatar’s digital ID platforms in plain Arabic, particularly for elderly or low-literacy users. Done well, they reinforce trust rather than adding another confusing “smart” layer.

Choosing Between Falcon Arabic, Allam, Jais and Domain LLMs

Foundation Arabic Models for GCC: Falcon Arabic, Allam, Jais in Brief

Regional foundation models like Falcon Arabic, Allam and Jais offer strong MSA and Gulf-Arabic coverage, competitive benchmarks and support for deployment in regional clouds. They’re a good starting point for experimentation and for non-regulated or semi-regulated workloads.

When to Use General Arabic Models vs Domain LLMs for Banking, Telecom, Gov

A general Arabic model is fine for FAQs, marketing content and internal knowledge search. For high-risk workloads (disputes, credit decisions, citizen eligibility) you usually want a domain LLM fine-tuned on your own Arabic knowledge bases for example, layered on top of AI agents and multi-agent systems for GCC businesses and your regulatory corpus.

Benchmarking and Evaluating “GCC-Ready” Arabic LLMs

Your GCC Arabic LLM comparison for banks, telcos and ministries should test.

Dialect and code-switching performance

Hallucination rates on regulations and policies

Safety on compliance-sensitive topics

Latency from GCC regions

Ease of red-team, monitoring and audit

Human reviewers in KSA, UAE and Qatar should sign off on both Arabic quality and risk behaviour before you scale.

Deployment Architectures for Arabic LLMs, Compliance and Data Residency in GCC

On-Prem, Local Cloud and Sovereign Cloud Options in KSA, UAE and Qatar

Typical architectures mix on-prem in Abu Dhabi or Riyadh for the most sensitive systems with regional clouds such as AWS Bahrain/UAE, Azure UAE Central and Google Cloud Doha for scalable inference. This is the heart of data residency for Arabic LLMs for banking, telecom and government in GCC: sensitive prompts and responses never leave approved jurisdictions.

Aligning with SAMA, TDRA, QCB, SDAIA and NDMO in One Reference Architecture

A solid reference architecture maps each control (logging, encryption, retention, residency, incident response) to a regulator: SAMA for bank channels, SDAIA/NDMO for data classification and governance, QCB for Qatari fintech and digital banks, and the UAE’s Telecommunications and Digital Government Regulatory Authority (TDRA) for telecom and federal digital services. (SAMA Rulebook) Free zones like Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) can add cross-border complexity that must be reflected in your data-flow diagrams.

Red-Teaming, Guardrails and Audit Trails for Arabic LLMs

Security teams should continuously red-team Arabic prompts (including abusive language and fraud attempts), implement guardrails to block unsafe outputs, and maintain audit trails that link each answer to its sources. This is essential for regulated investigations and for proving to auditors that your “Arabic LLM for banking, telecom and government in GCC” is controlled, not experimental.

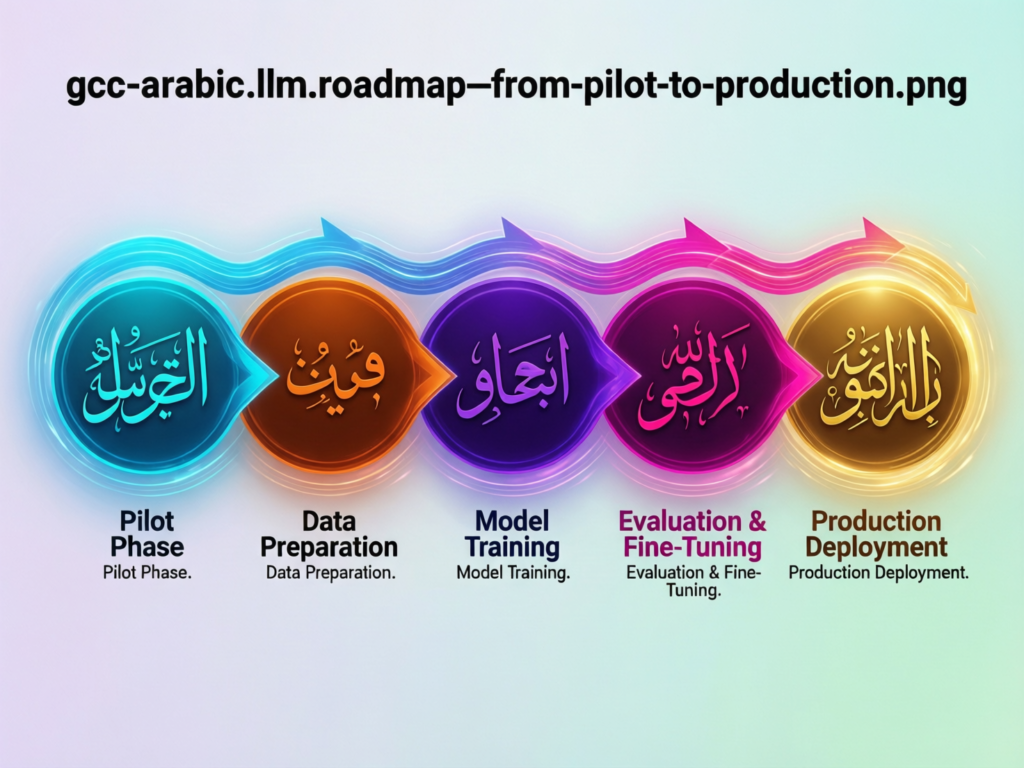

Roadmap for GCC Enterprises.

Readiness Checklist for Banks, Telcos and Government Teams

Before you start, align stakeholders (IT, risk, legal, CX), classify data under NDMO/PDPL or UAE/Qatar equivalents, and decide which journeys (e.g., KYC, tariff queries, permit FAQs) are safe for a first wave. Many organisations pair AI discovery with web development services and mobile app development services to make sure new assistants plug into real channels.

At a high level, your roadmap looks like this.

Discover & Design

Prioritise 2–3 Arabic journeys, map user intents, compliance constraints and KPIs.

Pilot (POC)

Launch a limited pilot (e.g., Riyadh SME lending, Dubai e-commerce support, Doha SME portal FAQ) on synthetic or masked data.

Harden & Integrate

Add monitoring, guardrails, red-teaming, and integrate with core systems and analytics.

Scale & Govern

Roll out to more products and cities with clear AI governance, model-lifecycle processes and training for frontline staff.

POCs, Limited Launches and Scale-Up Across Riyadh, Dubai, Doha

A Dubai e-commerce brand might start with an Arabic LLM answering order-tracking queries in chat, then extend to WhatsApp and voice IVR. A Doha SME could host its assistant in Google Cloud’s Doha region while keeping core banking records inside Qatar, gradually expanding from FAQs to form-filling and status updates. (Google Cloud)

How to Evaluate Vendors Claiming “Sovereign Arabic LLM for GCC”

When vendors pitch a “sovereign Arabic LLM for GCC”, ask.

Where is data stored and processed?

Which regulators and standards are they aligned with?

Which clouds and regions do they support?

How have they been red-teamed in Arabic?

Do you retain model, prompt and log ownership?

Cross-check that with independent advice or partners like Mak It Solutions who have already implemented Arabic generative AI use cases in MENA and enterprise-grade AI agents.

Concluding Remarks

For GCC leaders, Arabic LLMs are no longer optional; they’re becoming core infrastructure for compliant, human-centred digital services. The winners will combine strong Arabic language quality with clear alignment to regulators and in-region clouds, especially when designing Arabic LLMs for banking, telecom and government in GCC.

Common Pitfalls to Avoid When Adopting Arabic LLMs

Common pitfalls include piloting with production customer data, ignoring dialect testing, assuming generic English models are “good enough”, and skipping coordination with risk and compliance teams. Another trap is treating AI as a one-off project rather than part of a long-term GCC sovereign AI strategy with governance, change management and continuous evaluation.

Note.

Nothing in this article is legal, regulatory or financial advice. Always validate your architecture and deployments with internal legal, compliance and risk teams.

Book a GCC Arabic LLM Strategy Workshop

If you’re planning Arabic LLMs for banking, telecom or government in KSA, UAE or Qatar, now is the time to move from slides to architecture and pilots. The next section explains how Mak It Solutions can help.

Mak It Solutions can help you design, deploy and govern Arabic-native LLMs that respect GCC regulations while delighting users in Arabic. Whether you’re a Saudi bank, a UAE telco or a Qatar government entity, our team blends AI strategy with software development services, search engine optimization services and digital marketing expertise so your assistants are discoverable, fast and trustworthy.

Book a consultation via our contact page to co-design a roadmap, or ask us to review vendor proposals claiming “sovereign Arabic LLM for GCC” before you commit.

FAQs

Q : Is an Arabic LLM allowed under SAMA rules for Saudi digital banking channels?

A : Yes, an Arabic LLM can be used under SAMA rules as long as the bank treats it like any other critical system: you must comply with SAMA’s Cybersecurity Framework, cloud and outsourcing rules, and data-governance expectations. In practice, that means hosting sensitive workloads in Saudi or approved regions, encrypting data, segregating tenants and logging all activity. Many banks start by using Arabic LLMs for lower-risk journeys (general FAQs, non-binding guidance) and only later extend them to authenticated flows after risk, legal and internal audit are comfortable. This staged approach fits both SAMA’s risk-based mindset and Saudi Vision 2030’s push toward digital financial inclusion.

Q : Can UAE enterprises host Arabic LLMs outside the country if customer data is encrypted or tokenised?

A : Technically, some UAE organisations use regional or global clouds with strong encryption and tokenisation, but they must still respect sector-specific rules and the spirit of UAE data-sovereignty guidance. Telecom and federal-government entities, supervised by TDRA, are especially cautious about where traffic content and identifiers are processed. A practical pattern is to keep raw identifiers and sensitive content in UAE regions or sovereign clouds while sending only anonymised, masked or synthetic data abroad for model training or experimentation. Always validate your design with legal and compliance teams, particularly if you serve critical national infrastructure.

Q : How can Qatar government entities use Arabic AI assistants without breaching QCB or data protection guidelines?

A : Qatar government entities typically separate financial-sector data supervised by QCB from general citizen-service data. For banking, digital-bank or payment-related assistants, entities must align with QCB’s digital-bank and fintech guidelines, focusing on security, consent and customer protection. For broader e-government services, authorities still need to respect Qatar’s data-protection laws by minimising stored data, encrypting traffic and clearly explaining how AI is used. Hosting assistants in the Google Cloud Doha region or equivalent local infrastructure helps keep logs in-country, while clear Arabic disclaimers and escalation paths maintain citizen trust.

Q : What is the best way to handle Gulf Arabic dialects and code-switching in GCC contact center bots?

A : The most reliable approach is to choose or fine-tune an Arabic-native LLM on real (but anonymised) GCC contact-center transcripts that include dialect, emojis and English technical terms. Start with high-volume intents like balance, bills and delivery tracking, and involve native speakers from Saudi, UAE and Qatar in evaluation loops. For voice use cases, combine ASR/TTS tuned to Gulf accents with an LLM that has been stress-tested on noisy audio transcriptions, as discussed in Arabic AI voice bots for GCC call centers. Over time, maintain a test suite of tricky dialect phrases and code-switching patterns to avoid regressions when models are updated.

Q : How do Falcon Arabic, Allam and Jais fit into a sovereign AI roadmap for GCC regulators and ministries?

A : Falcon Arabic, Allam and Jais are strong building blocks for a sovereign AI roadmap because they give GCC entities more control over where models run and how they’re customised. Regulators and ministries can use them as base models deployed on in-country clouds, then fine-tune smaller “task LLMs” for specific journeys like licensing, tax or subsidy eligibility. Combined with national data-governance initiatives led by bodies like SDAIA and NDMO in Saudi Arabia, these models help governments move away from opaque black-box AI toward transparent, locally governed Arabic AI stacks.