Inside Abu Dhabi’s 5GW AI Data Center Power Play

Inside Abu Dhabi’s 5GW AI Data Center Power Play

Abu Dhabi 5GW AI Data Center: What It Means for GCC CIOs, Banks and Regulators

Abu Dhabi’s 5GW AI data center campus is a new hyperscale AI infrastructure hub in the capital, designed to host GPU-intensive AI workloads for GCC governments, banks, enterprises and startups. For CIOs in Saudi, UAE and Qatar, it offers sovereign AI compute resources, lower latency across the Gulf, and a path to run advanced models while staying aligned with local data residency and sector regulations.

Introduction

AI infrastructure as the new oil for the Gulf

Across Riyadh, Dubai and Doha, AI is moving from pilot projects to core infrastructure for banking, logistics, government and energy. The Abu Dhabi 5GW AI data center campus turns AI compute itself into a strategic resource, similar to how oil and gas underpinned earlier growth waves, by concentrating massive GPU capacity close to GCC demand.

Scale, partners, vision

The 5GW UAE–US AI Campus in Abu Dhabi is planned as a 10-square-mile AI data center complex, powered by up to 5 gigawatts and operated with US hyperscalers alongside Emirati player G42 A 1GW flagship cluster, Stargate UAE, is being developed with partners including OpenAI, Nvidia, Microsoft, Oracle, Cisco and SoftBank to serve both regional and US workloads

Who should care in the GCC? Saudi startups, Qatar enterprises and UAE regulators

For KSA, this campus is a regional alternative to building all AI capacity inside HUMAIN or local colocation sites; for Qatar, it is a nearby GPU “backbone” sitting just a few milliseconds away from Doha’s Google Cloud region.For the UAE, it is the anchor for becoming a global AI hub and complements Azure UAE Central, AWS UAE and local Khazna facilities.Regulators such as SAMA, TDRA and QCB now need to treat AI data centers as critical financial-market and national-security infrastructure, not just IT capacity.

Inside Abu Dhabi’s 5GW AI Data Center Campus

What makes Abu Dhabi’s 5GW AI data center campus different from traditional hyperscale data centers in the Middle East?

Abu Dhabi’s 5GW campus is built from the ground up for GPU-intensive AI workloads and multi-hundred-megawatt clusters, rather than generic cloud and hosting. It combines sovereign AI compute, US technology oversight, nuclear and renewable-powered data centers, and a direct link into hyperscaler ecosystems to support training and serving of frontier-scale models.

What “5GW” actually means for AI GPU power and capacity

Traditional regional hyperscale data centers run in the tens of megawatts; here, “5GW” signals a roadmap to thousands of megawatts of IT load, spread across multiple AI-optimized buildings. This level of power enables dense racks of GPUs for model training, large-scale inference and latency-tolerant AI batch workloads, far beyond typical enterprise colocation.

The 1GW flagship inside the 5GW AI campus

Stargate UAE is a 1GW AI megacluster within the campus, with an initial 200MW phase targeted to come online around 2026, focused on cutting-edge Nvidia GPU fleets for frontier models.It is promoted as the first international deployment of OpenAI’s Stargate platform, positioning Abu Dhabi as a core node in OpenAI’s global infrastructure map.

G42, OpenAI, Nvidia, Microsoft, Oracle, Cisco, SoftBank

The UAE–US AI Acceleration Partnership brings together G42 and US hyperscalers, with Microsoft committing more than $15 billion to UAE AI and cloud datacenters and to shipping tens of thousands of Nvidia’s newest GPUs under US export licences For GCC CIOs, this means access to hyperscale AI data center campus capacity integrated with Azure regions, Oracle Cloud and sovereign AI compute resources managed under US-aligned security controls.

From 200MW to multi-GW by 2026 and beyond

Public statements today confirm a first 200MW phase of Stargate UAE by 2026, with the rest of the 1GW cluster and the broader 5GW campus following in staged expansions.For planning, GCC organisations should treat 2026–2028 as the period when Abu Dhabi becomes a fully-fledged alternative to Europe and US-based AI data centers for large-scale training.

Will the Middle East Become a Global AI Data Center Hub?

How does the UAE’s 5GW AI campus compare with Saudi’s HUMAIN and other Middle East AI data center initiatives?

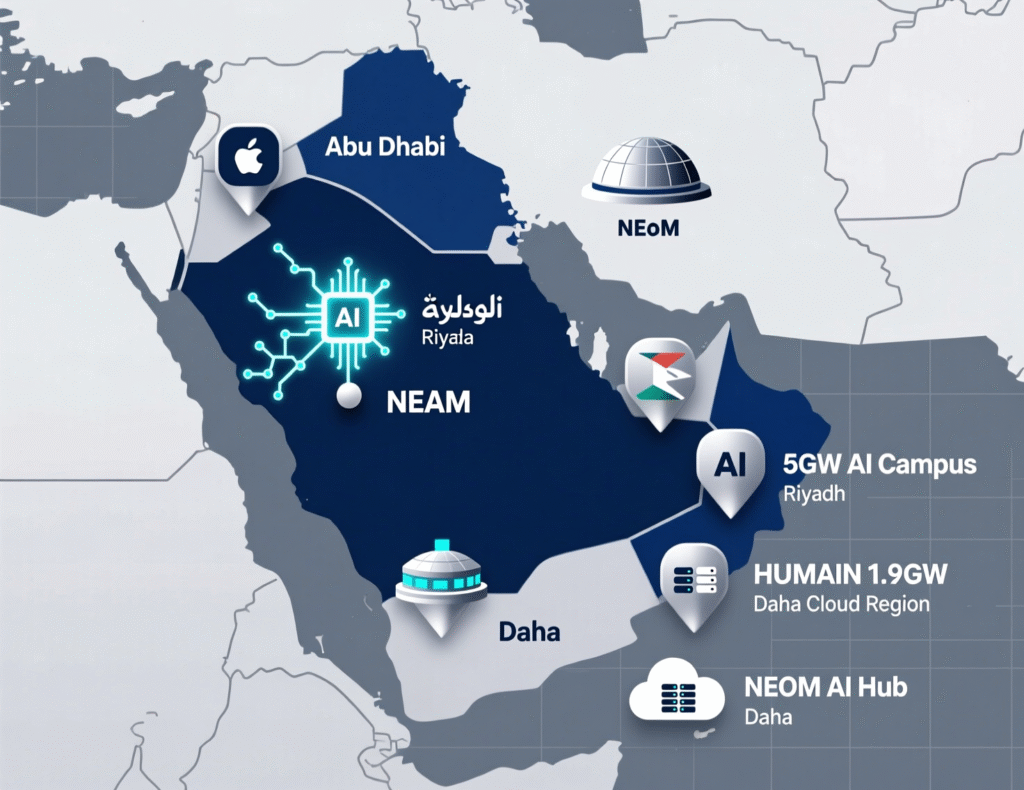

The UAE’s 5GW campus in Abu Dhabi is currently the largest single announced AI data center project in the region, while Saudi’s HUMAIN is targeting 1.9GW of AI data center capacity by 2030 across multiple sites. Together with Qatar’s Doha cloud region and local AI DC projects, these initiatives form a distributed GCC AI backbone rather than a single national winner.

Who is leading the AI infrastructure race?

KSA’s HUMAIN, backed by PIF and partners like Nvidia and AWS, aims to deliver 1.9GW of AI DC capacity this decade, with ambitions to become a top-three global AI infrastructure player.The UAE counters with the 5GW campus plus Khazna’s expanding AI-ready portfolio in Abu Dhabi and Dubai, while Qatar positions its Doha Google Cloud region and free zone incentives as the AI gateway for enterprises and sports/logistics workloads.

Middle East AI data center capacity growth vs Europe, US and Asia

Recent consulting research estimates that Middle East AI data centers could serve up to 3 billion people across EMEA, India and Africa, if projects like HUMAIN and the Abu Dhabi 5GW campus are delivered.While Europe and the US still lead on absolute capacity, GCC sovereign wealth and energy advantages let the region grow faster from a smaller base, especially for GPU-intensive AI workloads and data centers.

Azure UAE, Google Cloud Saudi, Oracle and others

The 5GW AI campus plugs into an existing lattice of Middle East cloud regions: Azure UAE Central (Abu Dhabi) and UAE North (Dubai), AWS regions in Bahrain and UAE, and Google Cloud in Doha and Dammam.Combined, these create a hyperscale AI data center campus across the Gulf, where training can sit in Abu Dhabi while latency-sensitive services run from Riyadh, Jeddah, Manama, Muscat or Doha.

Sovereign AI, Data Residency and GCC Compliance

How can banks and regulators in the GCC ensure data residency and compliance when using UAE-based AI data centers?

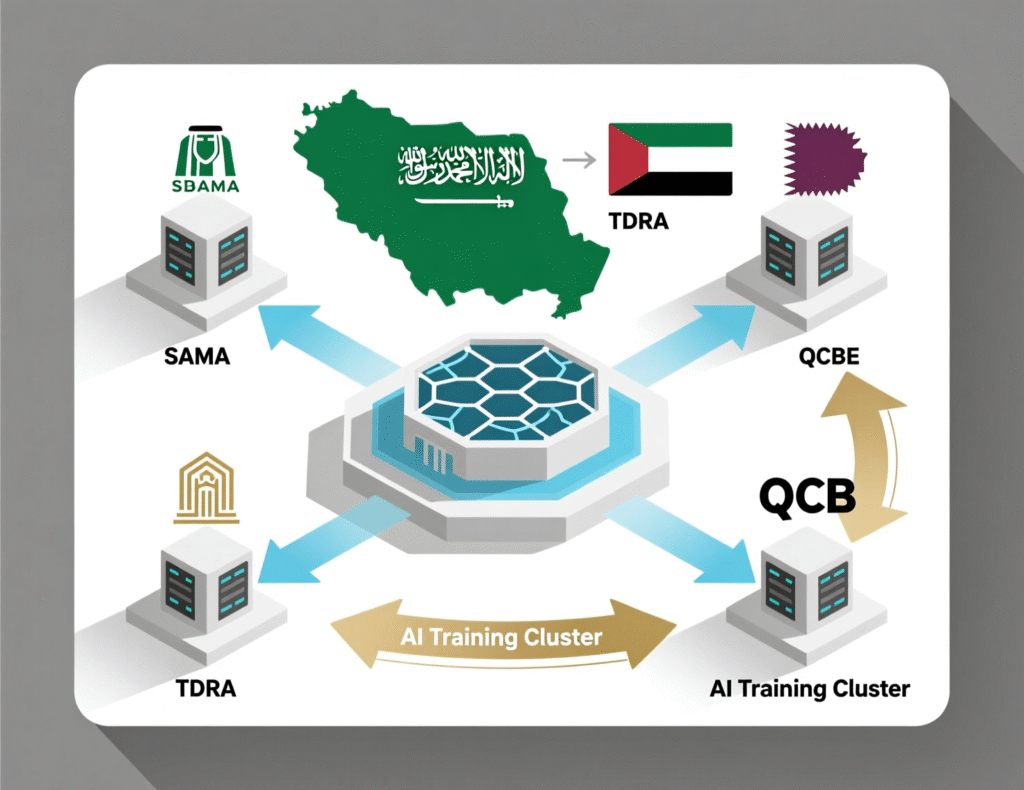

Banks and regulators must treat the Abu Dhabi AI campus as a cross-border outsourcing arrangement: classify data, keep regulated systems of record in-country, and use UAE regions mainly for anonymised or encrypted AI workloads. SAMA, TDRA and QCB frameworks already expect documented cloud strategies, residency controls, contractual audit rights and clear mapping of which datasets can cross borders.

What “sovereign AI compute” means for KSA, UAE and Qatar regulators

Sovereign AI compute clusters are logically separated pools of GPUs, network and storage subject to a specific jurisdiction’s rules, even when hosted in multi-tenant facilities. For KSA, UAE and Qatar, that means controls on where model weights, training data and telemetry live, plus US export-control compliance on Nvidia chips under the US–UAE AI Acceleration Partnership.

KSA (SAMA, SDAIA, NDMO, CST) and Qatar (QCB, MOTC) using UAE data centers

A typical pattern is: production banking data stays in-country (e.g., Riyadh or Jeddah), while de-identified datasets are replicated to Abu Dhabi for model training, then distilled models are brought back on-prem or into local cloud for inference. This aligns with SAMA’s cloud computing framework, CST’s cloud regulations and QCB’s 2024 Cloud Computing Regulation, which all emphasise risk assessment, data classification and sovereignty.

UAE frameworks for AI, cloud, and data hosting

Within the UAE, TDRA’s cloud and internet guidelines, the National Cloud Security Policy and the UAE data protection framework give structure for compliant hosting of financial, health and government workloads.Financial free zones like ADGM and DIFC add sector-specific rules that GCC banks should map to their SAMA or QCB obligations before placing workloads on UAE AI infrastructure.

G42, security perceptions and US–UAE governance safeguards

G42 has restructured to align with US security expectations, divesting earlier China-linked relationships and operating the AI campus under strict cyber and physical safeguards agreed with Washington and Microsoft.For GCC regulators, this mix of Emirati ownership and US governance is central to treating Abu Dhabi’s campus as a trustworthy node in sovereign AI compute resources.

Energy, Power and Sustainability of the Abu Dhabi AI Campus

Why the 5GW campus needs nuclear, solar and gas together

Running multi-gigawatt AI data centers in the desert requires baseload plus flexibility: nuclear for steady zero-carbon power, solar for cheap daytime electricity, and gas for balancing and backup. The UAE–US AI Campus is expected to use a mix of nuclear, solar and gas to reach 5GW while managing grid stability and decarbonisation targets.

Water stress, efficiency and new designs

To cool dense GPU clusters in Abu Dhabi’s climate, designers are moving beyond traditional chillers to advanced evaporative and liquid cooling, with aggressive Power Usage Effectiveness (PUE) targets. Khazna’s recent AI-ready sites in Masdar City already combine solar plants with efficient cooling to demonstrate how nuclear and renewable-powered data centers can work in the region.

Sustainable AI as an investment theme for GCC sovereign wealth and Sharia compliant funds

For PIF, Mubadala, QIA and other investors, AI data centers are becoming an ESG-aligned infrastructure play: long-term contracted power, clear decarbonisation plans, and real-economy productivity gains in energy, logistics and health. Reports on Middle East AI data centers suggest the region could support AI services for more than 3 billion people, making sustainable AI infrastructure a global export asset, not just a local utility.

How GCC Businesses Can Use Abu Dhabi’s 5GW AI Data Center

AI model hosting under SAMA, QCB and TDRA oversight

Riyadh and Jeddah banks can use Abu Dhabi’s AI campus to train fraud-detection, AML and credit-risk models on tokenised or anonymised data while keeping core banking records inside KSA data centers that satisfy SAMA’s cloud rules Qatari banks can follow similar patterns under QCB’s Cloud Computing Regulation and Technology Risks rules, with TDRA-registered cloud providers serving as the UAE side of the arrangement.

Government, logistics and retail: real GCC AI workloads that need GPU-optimized data centers

Smart-city platforms in NEOM, Riyadh, Dubai and Abu Dhabi, regional airlines, ports in Jebel Ali and Hamad, and cross-border e-commerce platforms all generate massive data streams suited to GPU-intensive AI workloads and data centers. Using Abu Dhabi’s AI campus for training Arabic-first recommendation engines and traffic or customs-risk models, then deploying them on regional cloud regions, fits well with the GCC AI data center race UAE vs Saudi vs Qatar narrative.

AI training, sandboxing and colocation options in Abu Dhabi

A Riyadh fintech startup can colocate GPU nodes or reserve AI training capacity in Abu Dhabi while building its core app with web development services and cloud-native architecture. A Doha SME can run experiments on LLM-based Arabic UX or logistics optimisation using Abu Dhabi GPUs while serving production traffic from the Doha Google Cloud region for minimum latency. For Dubai and Abu Dhabi startups, combining local mobile app development with access to frontier models in the 5GW campus turns Abu Dhabi into a launchpad, not just a cost line.

Real-world examples GCC leaders can imagine today:

A Riyadh fintech that trains SAMA-compliant credit-risk models in Abu Dhabi and deploys them in KSA-hosted production systems.

A Dubai e-commerce brand that runs Arabic recommendation models from the campus while its storefront is built with modern front-end development services.

A Doha logistics SME using the Doha Google Cloud region for core apps but offloading large route-optimisation training jobs to Abu Dhabi’s sovereign AI compute resources.

Roadmap Getting Your GCC Organisation Ready for Abu Dhabi AI Infrastructure

Map AI workloads and latency needs (Riyadh, Dubai, Doha to Abu Dhabi)

Start by listing AI use cases (risk scoring, chatbots, route optimisation, Arabic CX) and grouping them by latency sensitivity and data criticality. Low-latency customer interactions may need to stay in Riyadh, Dubai or Doha regions, while latency-tolerant training workloads can be moved to Abu Dhabi.

Align with data residency and sector regulations across KSA, UAE, Qatar

Next, map each dataset to applicable rules: SAMA, SDAIA/NDMO and CST in KSA; TDRA, ADGM/DIFC and the UAE data protection law; QCB and MOTC regulations in Qatar. This is where many teams bring in partners experienced in secure cloud and business intelligence architectures.

Engage partners: cloud providers, system integrators and AI infrastructure consultants

Then, design a multi-region architecture with your hyperscaler (Azure, AWS, Google Cloud, Oracle), colocation providers and AI specialists. Firms like Mak It Solutions already advise GCC CIOs on Middle East cloud regions, as in their guide for KSA, UAE and Qatar CIOs, helping align AI infrastructure choices with broader digital roadmaps.Makitsol

Build a sovereign AI strategy and exit routes from single-vendor lock-in

Finally, build in optionality: use standard APIs, portable ML tooling and data-warehouse designs that can run across multiple regions and vendors. A mix of Abu Dhabi AI campus capacity, local KSA/Qatar data centers and cloud regions, plus on-prem systems, gives you sovereign AI options rather than a single-hyperscaler dependency and creates room to plug in future GCC sites like HUMAIN clusters.

Concluding Remarks

Three signals that the Middle East is becoming an AI infrastructure superpower

Three things stand out: a 5GW AI campus in Abu Dhabi, KSA’s HUMAIN targeting 1.9GW by 2030, and massive chip and cloud investments from Microsoft, Nvidia and others tied to sovereign AI deals Together, they show a region intentionally positioning itself as a global AI data center hub, not only a user of others’ compute.

What this means for your next 3–5 years of AI planning in the GCC

For CIOs and founders in Riyadh, Dubai, Abu Dhabi and Doha, AI infrastructure strategy is now as important as application strategy. Budget cycles, compliance roadmaps, digital marketing and product launches all need to assume ready access to hyperscale AI data center campus capacity in the Gulf, not just in Europe or the US.

How to start: internal questions every GCC organisation should ask this quarter

This quarter, leadership teams should ask: which AI workloads truly need sovereign hosting, which can run cross-border, and how will we document this for SAMA, TDRA or QCB? Do we have the architecture skills, or should we partner with specialised services and webflow development experts to modernise our stack first? Aligning those answers with Abu Dhabi’s 5GW roadmap will decide who leads the next decade of AI in the GCC.

If you’re a CIO, CTO or founder in Saudi, UAE or Qatar, this is the moment to turn AI infrastructure from a risk into a competitive advantage. The Abu Dhabi 5GW AI data center campus, HUMAIN in KSA and Qatar’s cloud regions will reward organisations that move early with clear architectures and compliance stories.

Mak It Solutions can help you map workloads, design GCC-aware cloud and AI architectures, and translate regulator language into practical engineering choices. Reach out via our contact page to book a consultation or request a tailored GCC AI infrastructure strategy for your organisation.

FAQs

Q : Is Abu Dhabi’s 5GW AI data center suitable for hosting Saudi financial data under SAMA and NDMO rules?

A : Yes but typically only for specific types of Saudi financial data. Under SAMA’s Cloud Computing rules and the broader Cyber Security Framework, banks must classify data, keep critical systems of record in-country and seek SAMA approval for major cloud outsourcing arrangements.In practice, many KSA banks will keep core transaction data in Riyadh or Jeddah while sending tokenised, anonymised or synthetic data to Abu Dhabi for AI training. They then re-import trained models into KSA-hosted production environments aligned with Saudi Vision 2030 digital-finance goals.

Q : Can Qatari companies use the UAE 5GW AI campus while keeping critical workloads under QCB and MOTC guidelines?

A : Yes, Qatari companies can leverage the 5GW campus as an extension of their infrastructure if they follow QCB’s 2024 Cloud Computing Regulation and related technology-risk guidanceTypically, mission-critical banking or government systems stay in Qatar (including the Doha Google Cloud region and local DCs), while selected AI training jobs and GPU-heavy simulations run in Abu Dhabi. Contracts must clearly specify data-location, audit, incident-response and exit provisions, and enterprises should align designs with Qatar National Vision 2030 digital-transformation priorities.

Q : How does the Abu Dhabi AI campus change AI infrastructure options for startups in Riyadh, Dubai and Doha?

A : For startups, Abu Dhabi’s AI campus turns the Gulf into a genuine alternative to US or European GPU rentals, with lower latency and better Arabic-market context. A Riyadh fintech or Dubai SaaS startup can run day-to-day apps on regional hyperscaler regions while bursting AI training to Abu Dhabi when needed. Doha scaleups can keep customer data in Qatar but offload heavy simulations or foundation-model fine-tuning to sovereign AI compute clusters in the UAE. Combined with Saudi Vision 2030, Dubai’s D33 agenda and Qatar’s innovation zones, this unlocks more investor-friendly paths to scale.

Q : What are the main differences between hosting AI models in UAE data centers versus local data centers in Saudi Arabia?

A : UAE data centers like the Abu Dhabi 5GW campus typically offer larger GPU clusters, direct integration with Azure and other hyperscalers, and more mature AI partner ecosystems. Saudi local data centers and HUMAIN sites, by contrast, focus on strict in-kingdom data residency and alignment with SAMA, SDAIA/NDMO and CST requirements.Many GCC organisations will adopt hybrid patterns: KSA data centers for highest-sensitivity workloads, UAE AI campuses for large-scale training, and cross-border architectures that respect both KSA and UAE regulations.

Q : Does the Abu Dhabi 5GW AI campus support Arabic-first AI models and GCC-specific content moderation requirements?

A : While the campus itself is infrastructure, its partnerships with OpenAI, Microsoft and regional players such as G42 create a fertile environment for Arabic-first large language models and GCC-specific moderation pipelines. Microsoft and G42 are already co-building AI capabilities tailored to MENA languages and regulatory expectations, including safety and data-sovereignty controls GCC regulators like TDRA and SAMA increasingly expect content and risk controls that reflect local cultural norms, so AI workloads hosted in Abu Dhabi must embed policy-aware filters and regional datasets to be production-ready.