Quantum Computing in the Middle East: From Riyadh to Doha

Quantum Computing in the Middle East: From Riyadh to Doha

Quantum Computing in the Middle East: From Riyadh to Doha

Saudi Arabia, the UAE and Qatar are building a regional quantum ecosystem through flagship projects like Aramco Pasqal’s 200-qubit system, Abu Dhabi’s TII Quantum Research Center and Qatar’s QC2 plus the Quantinuum Al Rabban joint venture. Over the next 3–5 years, GCC governments, regulators and sovereign funds need to prioritise quantum workforce development, post-quantum cryptography and targeted industry pilots to turn this momentum into real quantum advantage for energy, finance, health and government.

Introduction

Quantum computing in the Middle East is moving from theory to industrial reality, with Saudi Arabia, the UAE and Qatar all positioning themselves as early movers rather than late adopters. For GCC leaders, the question is no longer if quantum computing will matter, but how quickly they can turn national strategies into concrete capabilities that deliver value on the ground.

In simple terms, the region is not starting from zero: it has industrial deployments, research hubs and serious capital in play. But readiness for quantum computing in the Middle East still depends on less visible layers regulation, skills, data, partners and security that will decide who gains real advantage and who remains stuck in perpetual “pilot mode.”

From hype to headlines: Aramco, TII and QC2 reshape the narrative

Saudi Aramco’s partnership with Pasqal to deploy a 200-qubit neutral-atom quantum computer in Dhahran gives the Kingdom the first industrial quantum system in the region. In parallel, Abu Dhabi’s Technology Innovation Institute (TII) is integrating its quantum software stack with NVIDIA’s CUDA-Q, while Qatar’s QC2 at HBKU is emerging as a regional quantum research hub in Doha. Together, these moves shift the conversation from “if quantum will arrive” to “how fast can we make it useful for the GCC economy.”

The real question: is the GCC actually ready for the qubit era?

Readiness is less about owning a neutral-atom or trapped-ion quantum computer and more about having the policies, talent, data and partners to unlock quantum advantage for real industry problems. GCC leaders must decide where quantum computing genuinely adds value to energy, finance, health and government and where it should stay in the lab for now.

Who this article is for in Riyadh, Dubai, Abu Dhabi and Doha

If you’re a minister or regulator in Riyadh, Abu Dhabi or Doha, a CIO in ADGM or DIFC, part of a sovereign fund team in PIF, Mubadala or QIA, or a researcher building quantum research ecosystems and innovation hubs across the GCC, this piece is written with you in mind. It is also relevant to enterprise leaders considering pilots with partners like Mak It Solutions for cloud, data and application readiness.

Where Quantum Computing in the Middle East Stands Today

Saudi Arabia under Vision 2030 Aramco Pasqal, KAUST and Quantum Valley

Under Saudi Vision 2030, the Aramco–Pasqal system is positioned as a platform for energy optimisation, materials science and industrial operations, not just academic experiments.KAUST’s emerging quantum foundry and initiatives like a “Quantum Valley” concept in NEOM give Riyadh and Jeddah a base for hardware, algorithms and a future quantum workforce, closely linked to existing AI and data programs.

UAE momentum TII’s Quantum Research Center, ATRC and cryptography regulation

Abu Dhabi’s TII Quantum Research Center, under ATRC, is investing in quantum hardware, software and quantum-safe security, including work on quantum middleware and integration with advanced GPU platforms. This aligns with the UAE’s National Encryption Policy and post-quantum cryptography controls in updated cyber standards, which encourage entities in Dubai and Abu Dhabi to start planning for quantum-safe security now.

Qatar, Bahrain, Kuwait and Oman QC2, Quantinuum JV and emerging GCC hubs

Doha’s QC2 and HBKU labs, combined with the Quantinuum–Al Rabban joint venture, position Qatar as an early access point to trapped-ion quantum computers for sectors like energy, medicine and finance. Bahrain’s Mumtalakat–SandboxAQ partnership on AI-driven drug discovery illustrates how quantum-inspired tools may flow into health and biotech, while Kuwait and Oman are watching closely as they shape their own advanced technology agendas.

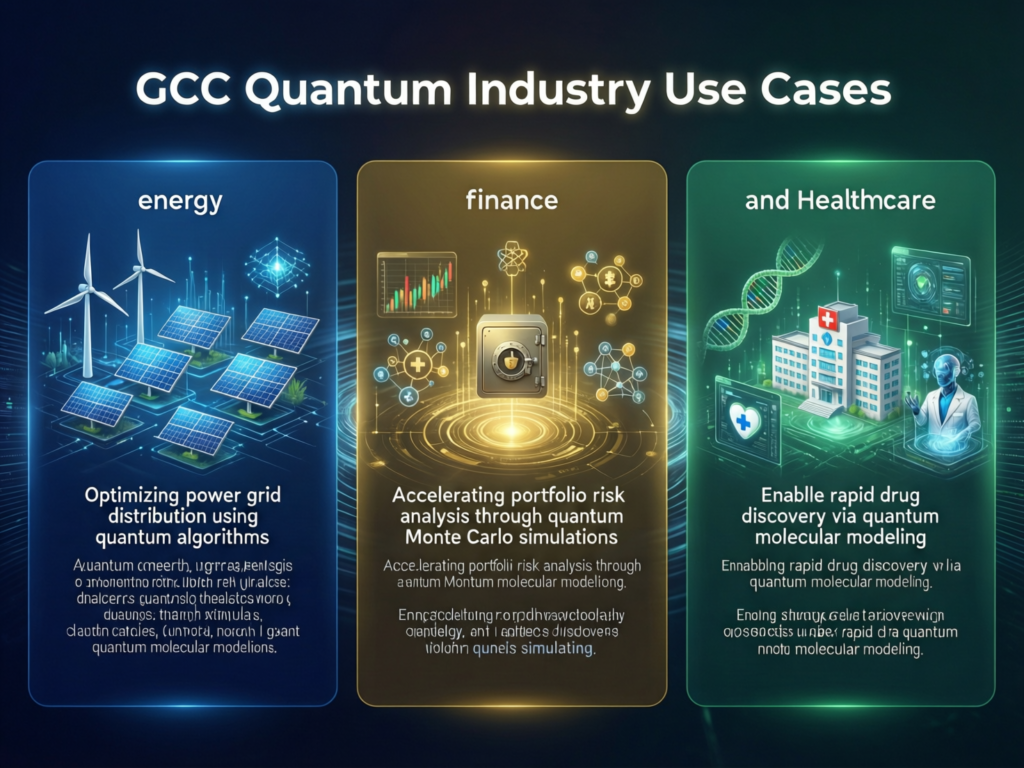

What Quantum Could Actually Change for GCC Industries

Energy and climate from upstream optimisation to NEOM-scale planning

For Saudi Aramco and national oil and gas firms across the GCC, early use cases include quantum-enhanced reservoir simulation, pipeline routing and portfolio optimisation that classical HPC struggles with. In NEOM and other giga-projects, quantum-inspired algorithms could support city-scale energy and mobility planning, especially when integrated with digital twins similar to those already explored in GCC smart cities.

Finance and fintech risk, optimisation and Sharia-compliant innovation

In ADGM, DIFC, Riyadh and Doha, banks are exploring how quantum algorithms might improve risk modelling, asset allocation and liquidity optimisation, while remaining consistent with Sharia compliance principles. SAMA’s open banking program and QCB’s digital finance agendas will eventually need quantum-safe security controls, particularly as payment and open-API ecosystems scale across borders.

Cybersecurity and health post-quantum cryptography and AI–quantum drug discovery

UAE cyber standards already reference post-quantum cryptography and quantum-safe security, requiring entities to catalogue cryptographic assets and plan migration paths. (DTS) In health, Bahrain’s SandboxAQ–Mumtalakat program illustrates how quantum-inspired algorithms can accelerate drug discovery for diseases like diabetes and genetic disorders, offering a path GCC health ministries could replicate. As with any health- or finance-related technology, this article is for general information only and should not be treated as financial, medical or investment advice.

Infrastructure, Talent and Regulation – The Hidden Readiness Stack

Hardware and labs KAUST Quantum Foundry, TII facilities and Qatar’s QC2 lab

Riyadh’s and Jeddah’s KAUST facilities, Abu Dhabi’s TII labs and Doha’s QC2 give the GCC a spread of on-premise quantum and pre-quantum testbeds. Together with access to global quantum clouds and regional cloud regions like AWS Bahrain, Azure UAE Central and GCP Doha, they form a hybrid landscape where experiments can be run close to data while respecting GCC data residency rules.

Quantum workforce scholarships, PhDs and reskilling GCC engineers

Saudi, Emirati and Qatari students are now pursuing quantum PhDs and scholarships at KAUST, HBKU and UAE universities, but there is still a pronounced quantum workforce and skills gap. Partnerships between GCC universities and international vendors, plus practical reskilling tracks for cloud, data and security engineers, will matter more than a handful of star researchers. For most organisations, “good enough” quantum literacy across engineering and security teams will be more important than having one celebrity quantum scientist.

Regulation, data residency and quantum-safe policies (SAMA, TDRA, QCB, DGA, SDAIA)

Existing data and cybersecurity frameworks from SAMA, TDRA, QCB, DGA and SDAIA already define where sensitive data can sit and how it must be protected. These same rules will govern how organisations use international quantum clouds, how fast they migrate Open Banking KSA, UAE Pass and Qatar Digital ID to quantum-safe encryption, and which pilots regulators are willing to approve first.

Investment, Startups and Joint Ventures in the Middle East Quantum Ecosystem

Where GCC sovereign funds and national vehicles are placing quantum bets

Middle East sovereign funds such as QIA, Mubadala, PIF and Mumtalakat are increasingly treating quantum as a strategic asset class. The Quantinuum–Al Rabban JV in Qatar and SandboxAQ–Mumtalakat in Bahrain show a model where capital, data and local ecosystems come together around specific sectors like energy and biotech. (PR Newswire) For GCC leaders, the key is to ensure these investments connect back to local talent pipelines and real-world use cases rather than remaining isolated showcase projects.

Startups, JVs and vendor partnerships from Quantum Valley to Quantinuum Qatar

From NEOM’s emerging “Quantum Valley” concepts to vendor collaborations at TII and QC2, the GCC is largely partnering with global leaders in neutral-atom and trapped-ion quantum computers rather than trying to build everything from scratch. The opportunity for local startups lies in middleware, domain-specific applications and integration with existing cloud and data platforms provided by partners such as Mak It Solutions.

Build, buy or partner? Strategic options for GCC enterprises and ministries

For most ministries, banks and utilities, the pragmatic path is to stay hardware vendor-agnostic, build small internal research and architecture teams, and partner with specialised software and integration firms. Larger entities may selectively invest in JVs or minority stakes in quantum companies, but should still plan to consume “quantum-as-a-service” via cloud-like models. The winning strategies will combine patient capital, flexible architectures and realistic timelines.

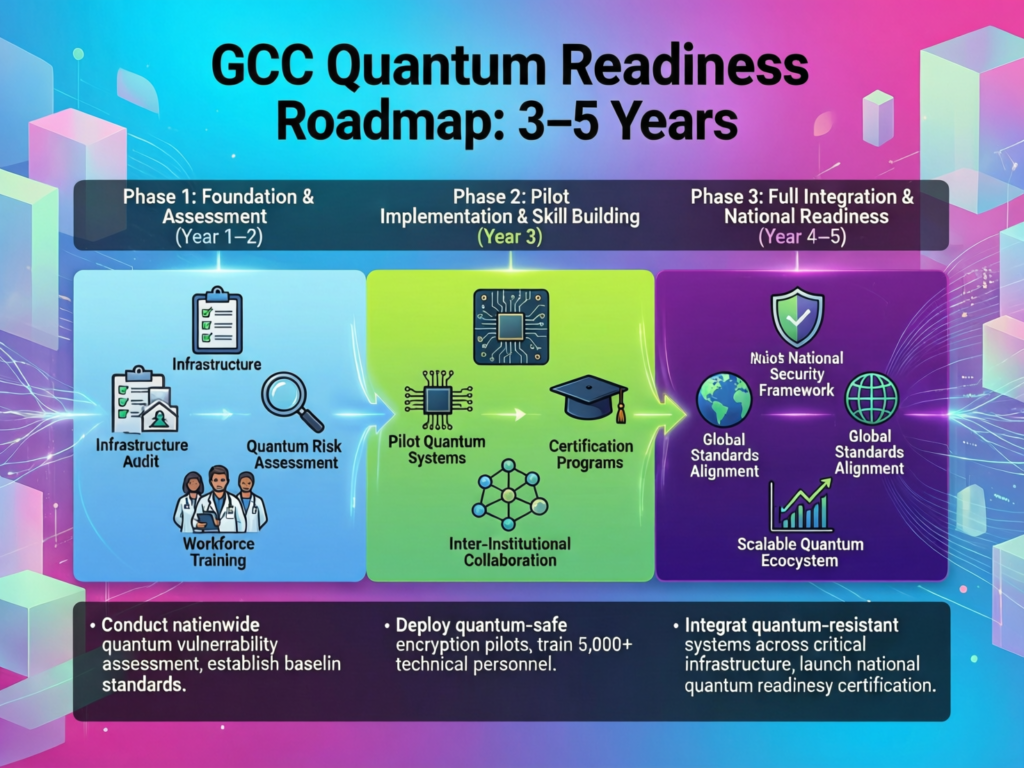

Is the Middle East Ready for Quantum? A 3–5 Year Roadmap for Decision-Makers

Readiness checklist for GCC organisations people, pilots, partners and policy

A realistic readiness checklist for quantum computing in the Middle East includes:

A named executive owner for quantum and post-quantum work

An inventory of cryptographic assets and long-lived data

A short list of high-value, testable use cases

At least one academic or vendor partner with hands-on quantum experience

CIOs should also align quantum plans with national AI strategies and digital economy goals in Saudi Vision 2030, the UAE’s digital government strategies and Qatar’s Vision 2030.

Low-regret moves to start now in Saudi Arabia, UAE and Qatar

Run awareness and discovery workshops.

Bring together business, security and data leaders to map realistic quantum advantage for industry, not just generic “quantum labs.”

Assess cryptography and data flows.

Conduct a post-quantum cryptography assessment on core systems such as Open Banking KSA, payment gateways, government IDs and health records.

Launch small, focused pilots.

In Riyadh, Dubai or Doha, test one or two use cases (for example, portfolio optimisation or logistics routing) using quantum or quantum-inspired solvers with a trusted integration partner.

Invest in people and partnerships.

Sponsor scholarships, secondments and joint labs with KAUST, HBKU and UAE universities, while building long-term relationships with implementation partners like Mak It Solutions for cloud, data and application readiness.

What to watch next signals of true quantum advantage in the GCC

Over the next 3–5 years, real signals of quantum advantage in the GCC will include: regulators issuing explicit guidance on quantum-safe timelines; production workloads running on neutral-atom or trapped-ion systems via cloud; measurable cost or performance gains in energy, finance or health; and an uptick in local quantum-skilled hires across Riyadh, Dubai, Abu Dhabi and Doha. When these signals appear together, quantum computing in the Middle East will have moved firmly from experimentation to capability.

Last Words

Quantum computing in the Middle East has moved beyond curiosity, anchored by Saudi, Emirati and Qatari investments that give the region early access to world-class hardware and software. The differentiator for GCC leaders will be disciplined prioritisation: choosing a few high-impact use cases, managing risk through PQC roadmaps, and avoiding premature “moonshots” that promise more than they can deliver.

Aligning quantum with Saudi Vision 2030, UAE and Qatar national strategies

When aligned with Saudi Vision 2030, the UAE’s digital government agenda and Qatar’s innovation-led growth plans, quantum becomes another tool to diversify economies, create high-value jobs and strengthen strategic autonomy. It should plug into existing AI, data, fintech and smart-city programs rather than compete with them.

Where to go next GCC-focused resources, pilots and partners

For many GCC organisations, the next step is a structured discovery and PQC assessment, supported by partners who understand regional regulation and cloud landscapes. If your stack spans custom portals, data platforms and multi-cloud, working with a partner like Mak It Solutions can help you design quantum-ready architectures while you continue leveraging proven web development services and business intelligence services.

If you’re a policymaker, CIO or sovereign fund team in Saudi Arabia, the UAE or Qatar, you don’t have to navigate quantum alone. The team at Mak It Solutions combines deep engineering experience with GCC-aware strategy, from specialised services to domain articles like digital twins in GCC smart cities and AI upskilling for employees in MENA. Explore our wider portfolio, including web design, backend development and digital marketing services, then talk to our team about a GCC-specific roadmap for quantum and post-quantum readiness.

FAQs

Q : Is quantum computing already being used by Saudi Aramco or other energy companies in KSA?

A : Saudi Aramco is deploying a 200-qubit neutral-atom quantum computer with Pasqal, focused on industrial optimisation and energy use cases rather than generic research experiments.While most national oil companies across the GCC are still in pilot or “watching brief” mode, Aramco’s move signals that quantum computing in the Middle East will likely land first in high-value upstream, trading and planning problems aligned with Vision 2030.

Q : How does the UAE’s quantum cryptography regulation affect banks and fintechs in Dubai and Abu Dhabi?

A : Updated UAE cybersecurity and encryption policies, backed by the UAE Cybersecurity Council and TDRA, explicitly reference post-quantum cryptography and require entities to start assessing their cryptographic exposure.For banks and fintechs in ADGM and DIFC, this means mapping where long-lived data and keys sit, ensuring vendors have PQC roadmaps, and coordinating timelines with global standards all while staying aligned with broader digital finance and AI strategies.

Q : What role will Qatar’s QC2 and HBKU play in supporting quantum projects across the wider GCC?

A : QC2 at HBKU is set up as a regional research and training hub, with mandates in quantum communication, computing and sensing. Combined with the Quantinuum–Al Rabban JV, Qatar can offer GCC governments and enterprises access to trapped-ion hardware, specialised training and joint research projects that complement initiatives in Riyadh and Abu Dhabi rather than compete with them.

Q : Are GCC data residency and localisation rules a barrier to using global quantum cloud providers?

A : Data residency rules from SAMA, TDRA, QCB and other regulators do not prohibit using international quantum clouds, but they do restrict which datasets can leave the country and how encryption is managed. In practice, this pushes GCC organisations toward hybrid models: sensitive data may stay in AWS Bahrain, Azure UAE Central or GCP Doha, while quantum or quantum-inspired workloads run on anonymised or synthetic data, or via carefully controlled gateways. Partners like Mak It Solutions can help architect such compliant patterns across existing web and data platforms.

Q : When do regulators like SAMA and QCB expect financial institutions to migrate to quantum-safe encryption?

A : No GCC regulator has yet published a fixed “quantum deadline,” but signals from global bodies and UAE’s National Post-Quantum Migration initiatives suggest that planning needs to start this decade, particularly for systems with long data lifetimes. For SAMA-regulated and QCB-regulated institutions, that means incorporating PQC into existing IT governance and open banking programs, running impact assessments, and aligning with emerging international guidance from bodies such as the European Commission and NIST.