Digital Twin Technology in GCC Smart Cities

Digital Twin Technology in GCC Smart Cities

Digital Twin Technology in GCC Smart Cities: Inside NEOM, Dubai & Lusail

Digital twin technology in GCC smart cities creates a live virtual replica of urban infrastructure so leaders in Riyadh, Dubai and Doha can monitor, simulate and optimise their cities in real time. By fusing IoT sensors, 3D city models and AI analytics on compliant local or regional clouds, Gulf governments cut congestion, improve services and de-risk mega-projects from NEOM to Lusail.

Introduction.

From Vision 2030 to Dubai 2040.

Saudi Vision 2030, Dubai 2040 and Qatar National Vision 2030 all promise world-class liveability, sustainability and digital government. But once you commit to giga-projects like NEOM’s THE LINE, Expo City Dubai or Lusail City, “traditional” dashboards aren’t enough city leaders need a virtual replica of urban infrastructure in the GCC that can be tested before they pour concrete or host millions of visitors.

The GCC Pain Point: Complex Cities, Siloed Data, High Expectations

Across Riyadh, Jeddah, Dubai, Abu Dhabi and Doha, data about traffic, utilities, permits, real estate, fintech, logistics and health is spread across dozens of systems and entities. Citizens and investors expect seamless digital services, yet operations teams still rely on static reports, satellite images or manual coordination especially during Hajj and Umrah, mega-events or extreme weather. The result: slower response, higher risk and wasted budget.

What Digital Twins Actually Do for Riyadh, Dubai and Doha

A city-scale digital twin lets mayors and control-room teams see a real-time 3D city model for traffic and utilities, run “what-if” simulations and then push decisions back into on-ground systems. In practice, that means fewer surprises during construction, smarter mobility planning, faster emergency response and more transparent reporting to national programmes like Vision 2030 and Dubai 2040.

What Is Digital Twin Technology in GCC Smart Cities?

What is a city-scale digital twin and how are Saudi and UAE smart cities using it today?

A city-scale digital twin is a constantly updating digital model of streets, buildings, infrastructure, people flows and assets, fed by IoT and enterprise systems. In Saudi Arabia and the UAE it underpins AI-driven urban planning and simulation in the Middle East, from NEOM’s cognitive city vision to Dubai’s real-time planning observatories.

Simple Definition.

Unlike a static 3D map, a city digital twin is:

Live: streams from sensors, cameras, SCADA, ERP, transport and even fintech platforms.

Dynamic: can simulate crowd flows, flooding, energy spikes or metro outages.

Connected: links to control systems so operators can adjust signals, dispatch crews or re-route buses directly.

Digital Twin vs GIS vs BIM for GCC Municipalities

GIS maps parcels, roads and zoning ideal for planning and regulation.

BIM models individual buildings for design and construction.

Digital twins sit above both, fusing GIS + BIM + live data so a municipality in Riyadh, Dubai or Doha can see how the whole city behaves and test policies before rollout for example, a new HOV lane or stadium access plan.

IoT, 3D Models, AI Analytics and Control Rooms

A robust city twin typically combines.

Integrated IoT and sensor data for smart city operations traffic loops, smart meters, CCTV, environmental sensors.

High-fidelity 3D models from BIM, LiDAR and photogrammetry.

AI analytics for anomaly detection, demand forecasting and predictive maintenance for city assets using digital twin models.

Command centres in Arabic and English, often built on web technologies and real-time frameworks similar to Next.js development services for streaming dashboards. (Mak it Solutions)

GCC Mega-Projects Leading the Digital Twin Wave

Cognitive City Digital Twin and Metaverse Vision

NEOM extends the digital twin idea with XVRS, a “cognitive digital twin metaverse” that mirrors THE LINE so residents, visitors and investors can experience and interact with the city virtually. (turnerandtownsend.com) This virtual layer lets planners test everything from mobility patterns to energy demand while staying aligned with Saudi Vision 2030. For Riyadh and Jeddah, NEOM becomes a regional benchmark for data-driven, AI-optimised urbanism.

Dubai Live and Smart City Platforms:.

Dubai Municipality’s Dubai Live platform integrates AI, digital twin tech and urban observatories to manage construction, licensing and city operations in real time. Combined with initiatives from Digital Dubai and the RTA’s command centres, this makes Dubai one of the most advanced examples of a city being run through a live virtual replica rather than siloed systems.

Lusail and Msheireb in Qatar.

Lusail City and Msheireb Downtown Doha were designed from day one as smart, sustainable districts, using IoT and digital-twin platforms for energy, water, mobility and stadium operations. Qatar’s TASMU programme has showcased digital twin capabilities for roads, buildings and stadiums and the same patterns now inform Doha-wide initiatives around metro, logistics and health services.

How Digital Twins Help Gulf Cities Run in Real Time

Traffic, Mobility and Crowd Management for Events and Pilgrimage

For Hajj and Umrah in Makkah and Medina, or Formula 1 weekends in Jeddah and Abu Dhabi, digital twins can simulate crowd flows across roads, metros and pedestrian routes, then optimise signal timing, shuttle capacity and emergency access. During a Riyadh football final, for example, a real-time 3D city model for traffic and utilities can highlight bottlenecks around the stadium so operators adjust routes before congestion hits.

Utilities, Energy and Climate Resilience in Harsh GCC Conditions

In desert heat, water leaks or cooling failures become critical quickly. Digital twins fed from smart meters and SCADA help utilities in Dubai, Abu Dhabi, Lusail or Msheireb predict load spikes, detect leaks early and coordinate field teams. (MWC Doha) Over time, AI models can recommend demand-response programmes or new solar capacity a key lever for Net Zero strategies.

Emergency Response, Risk Simulation and Scenario Planning

For fire, flooding, industrial incidents or cyberattacks, a digital twin lets civil defence, health and municipal teams rehearse “digital drills” before real crises. They can simulate road closures, hospital triage or port shutdowns, then codify best playbooks into decision-support tools.

GCC scenarios.

A Riyadh fintech startup models branch and ATM networks in a twin to meet SAMA service-level expectations while planning new locations.

A Dubai e-commerce brand uses digital-twin insights on delivery routes and mall footfall, then works with mobile app development services to optimise customer ETA and courier routing. (Mak it Solutions)

A Doha logistics SME hosts its operations twin in GCP Doha while keeping sensitive HR and payments data within Qatar or AWS Bahrain for compliance and latency.

Data, Cloud and Compliance for GCC City Digital Twins

Data Residency and Sovereignty.

Saudi Arabia’s NDMO and PDPL make local hosting the default for sensitive and personal data, with strict conditions for cross-border transfers. In the UAE, TDRA and emirate-level digital authorities encourage regulated use of local or regional clouds, while Qatar’s MCIT/TASMU and QCB set expectations for telecoms and financial data. Most city twins end up on:

National or sector gov-clouds

Regional public clouds like AWS Bahrain, Azure UAE Central and GCP Doha

Or hybrid models that keep GIS, citizen and CCTV data local while non-sensitive analytics can sit in regional zones.

Cyber Security, Privacy and Sensitive Mapping Rules for 3D City Data

High-resolution 3D models, indoor layouts and infrastructure schematics can fall under national security controls. Governance teams need:

Clear classification aligned to NDMO / national cybersecurity rules

Strong identity and access management.

Security frameworks aligned with global best practice from regulators like the for privacy-by-design.

Pen-testing, red-teaming and continuous monitoring should be baked into RFPs, not added at the end.

Arabic-First UX, Accessibility and Bilingual Control Rooms

Adoption fails if operators can’t comfortably use the system in Arabic. Control rooms in Riyadh, Dubai and Doha need:

Full Arabic + English interfaces and reports.

Accessibility for colour-blind and older users.

Mobile and web touchpoints for field teams, often delivered through modern web development services and web designing services providers.

Partners like Mak It Solutions’ web development team and web designing services can ensure UX is designed around Gulf operators, not just imported from global templates. (Mak it Solutions)

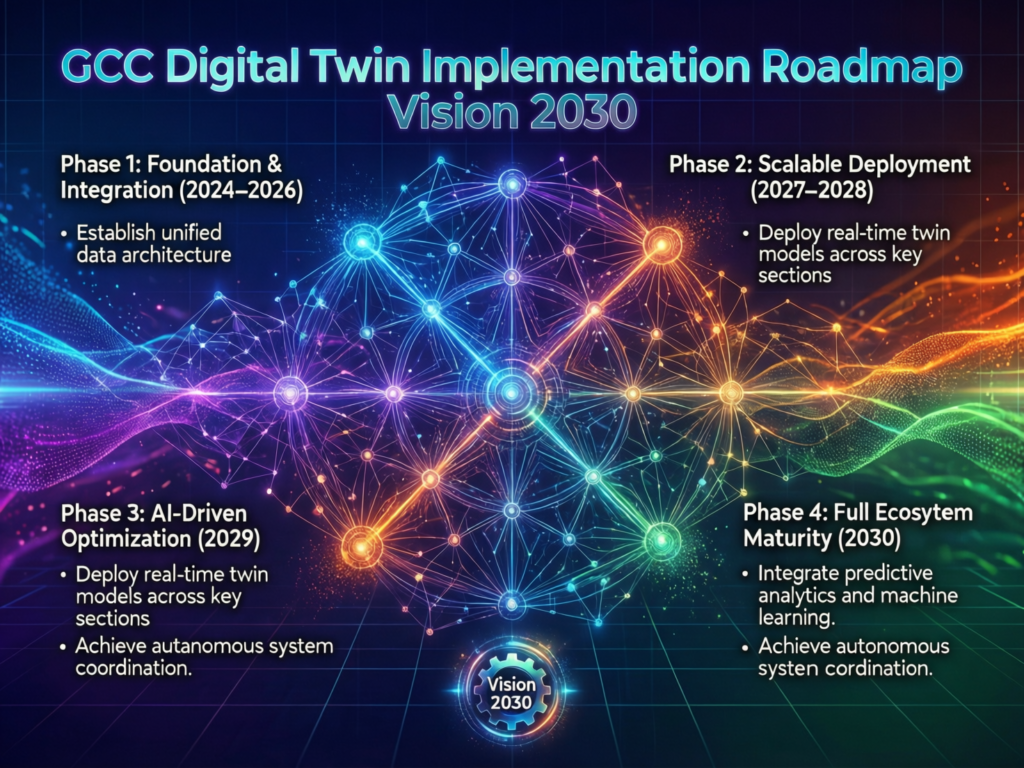

Implementation Roadmap.

Align with Vision 2030/2031, National AI and Smart City Plans

Start with a clear mandate: what Vision 2030, Dubai 2040 or Qatar 2030 outcomes will the twin support? Define 3–5 priority use cases (e.g. congestion, flood risk, stadium operations) and a governance model spanning municipal IT, national data authorities and operators. Use a short strategy sprint with advisors like Mak It Solutions’ business intelligence services to turn ambitions into measurable KPIs. (Mak it Solutions)

Choosing Platforms, Clouds and Integrators

Next, design the architecture:

Select digital twin/GIS/BIM platforms and integration patterns.

Choose cloud regions (e.g. AWS Bahrain, Azure UAE Central, GCP Doha) that meet data residency and latency needs.

Decide what will be custom-built by partners skilled in real-time web apps, such as Next.js development.

Plan APIs for transport, utilities, fintech, logistics, health and emergency services.

From District Pilot to Full City and Cross-GCC Blueprint

Pilot in one district (e.g. a CBD, industrial zone or stadium area) with clear success metrics. Once KPIs are proven, gradually onboard more agencies and layers: roads, utilities, environment, then economy and social services. Establish a cross-GCC blueprint so lessons from Riyadh or Dubai can be reused in secondary cities like Sharjah, Dammam or Al-Khobar.

Choosing the Right Digital Twin Partners in KSA, UAE and Qatar

Key Evaluation Criteria for GCC Governments and Master Developers

When issuing RFPs, focus on:

Proven large-scale integrations in transport, utilities or public safety.

Deep understanding of PDPL, NDMO, TDRA and sector rules.

Ability to deliver Arabic-first UX and on-site training.

Long-term support, not just a “project handoff”.

Reference calls with other GCC governments are critical.

Cloud Providers, Integrators, Consultants and Startups

Most successful projects combine:

Hyperscaler clouds (AWS, Azure, GCP).

Local integrators and control-room specialists.

Domain consultants (mobility, utilities, health, fintech).

Product and engineering partners like Mak It Solutions, whose services portfolio covers mobile, web, BI and SEO useful when you need citizen apps, portals and analytics around the twin. (Mak it Solutions)

Typical Budget Ranges, Timelines and RFP Questions in the GCC

A serious district-scale pilot often starts in the mid six-figure USD range, while full city deployments for capitals can grow to multi-million-dollar, multi-year programmes. Expect:

6–9 months for a focused pilot

2–4 years for full metropolitan rollout

Build RFP questions around outcomes (“How will you reduce incident response time by X%?”) as much as technology checklists.

Concluding Remarks

Today, NEOM, Dubai Live, Lusail and Msheireb grab the headlines. Over the next decade, digital twin technology in GCC smart cities will quietly become the operating system for more ordinary tasks: fixing leaks faster in Medina, optimising bus routes in Sharjah, or planning schools in growing Riyadh suburbs. As national data and AI regulations mature, the pressure will shift from “can we build it?” to “are we using it to improve daily life?”

Practical Next Steps for GCC Decision Makers Considering Digital Twins

If you’re a mayor, regulator or master developer, your next move is simple: pick one or two high-value use cases, validate your data and cloud options, and run a tightly scoped pilot with clear KPIs. From there, you can scale with confidence, bringing in partners for UX, analytics and operations — and turning marketing-friendly digital twin demos into a real, long-term capability.

If you’re planning or operating a smart city project in Riyadh, Dubai, Abu Dhabi or Doha and want a practical roadmap for digital twin adoption, Mak It Solutions can help. Our teams combine web, mobile, BI and cloud expertise to design control-room interfaces, citizen apps and analytics that fit GCC regulations and Arabic-first reality. Reach out via our contact page to book a consultation or co-design a pilot tailored to your city or mega-project.

FAQs

Q : Is digital twin technology aligned with Saudi Vision 2030 and UAE smart city strategies?

A : Yes. Saudi Vision 2030 explicitly emphasises data-driven government, open data and smarter infrastructure, while programmes like NEOM and Riyadh’s digital transformation rely on digital twins to deliver those goals. In the UAE, Digital Dubai and emirate-level strategies push for integrated platforms such as Dubai Live, which is effectively a city-scale operational twin. For both countries, twins are not “nice-to-have visualisations” — they’re core enablers for better mobility, utilities, environment and quality-of-life metrics under national visions.

Q : Can GCC city digital twins be hosted on global public clouds, or must they stay in local data centres?

A : It depends on the data. Under Saudi PDPL and NDMO rules, many categories of personal and sensitive data must be hosted inside the Kingdom unless explicit conditions are met; non-personal, aggregated or anonymised data can sometimes sit in regional clouds such as AWS Bahrain. In the UAE and Qatar, regulators like TDRA and MCIT allow public-cloud use within approved regions, but critical government and financial workloads may need local or gov-cloud hosting. A practical pattern is hybrid: keep identity, CCTV and detailed GIS highly local; run heavy analytics and AI on regional zones.

Q : What is a realistic budget for a pilot digital twin district in Riyadh, Dubai or Doha?

A : Budgets vary by scope, but many GCC pilots for a single district, industrial zone or stadium area tend to sit in the mid six-figure USD range. This typically covers data integration for a limited set of systems (e.g. traffic, utilities), a 3D model, core analytics, and a basic control-room interface. Larger metros or multi-district pilots, especially those adding citizen apps and advanced AI, can move into low seven-figure budgets. Global benchmarks from smart-city case studies in Qatar, Saudi Arabia and the wider GCC suggest that clear KPIs and phased rollouts reduce cost risk significantly.

Q : Do GCC regulators require special approvals for using drones and high-resolution imagery in city digital twins?

A : Often yes. High-resolution aerial imagery, indoor scans and detailed 3D models can trigger aviation, security and privacy approvals especially around critical infrastructure, religious sites or borders. In Saudi Arabia, clearances may involve aviation and security bodies alongside SDAIA / NDMO for data governance, while in the UAE, TDRA and local police or defence entities can set rules for drone use and storage of imagery. Many cities now adopt policies inspired by international privacy guidance (for example from the combined with national security standards.

Q : How long does it usually take to move from a proof-of-concept to a full city-scale digital twin in the GCC?

A : A focused proof-of-concept for a single use case (say, stadium mobility or one utility network) can go live in 3–6 months if data is available and governance is clear. Moving to a full city-scale twin spanning land use, mobility, utilities, environment and social services tends to be a multi-year journey, often 2–4 years for the first full metropolitan deployment. Timeframes are heavily influenced by data readiness, procurement processes and regulatory reviews under bodies like NDMO, TDRA or Qatar’s MCIT.