IT Outsourcing Trends: Offshoring vs Nearshoring Now

IT Outsourcing Trends: Offshoring vs Nearshoring Now

IT Outsourcing Trends: Offshoring vs Nearshoring Now

In 2025, IT outsourcing trends have shifted from pure cost-cutting to balancing offshoring and nearshoring for resilience, compliance and faster delivery. Offshoring offers the lowest rates and huge talent pools, while nearshoring gives US, UK and EU companies better time zone overlap, cultural fit and easier governance for regulated workloads.

Introduction

IT outsourcing trends in 2025 are no longer just about chasing the lowest day-rate in India or the Philippines. Today, CIOs and CTOs in New York, London and Berlin are weighing offshoring vs nearshoring to balance cost, speed, resilience and strict regulations like GDPR, UK-GDPR and HIPAA.

Global IT services outsourcing is often estimated at well over half a trillion dollars and is expected to grow steadily through 2030 as cloud, AI and data-intensive workloads expand. Where once the play was “single mega-vendor in one offshore hub”, the new game is strategic, multi-region sourcing: combining onshore, nearshore and offshore delivery centers with distributed software development teams.

In this guide, you’ll see how offshoring vs nearshoring compares in practice, which GEOs make sense for US, UK and DACH companies, and a simple decision framework you can reuse for your next product, data or cloud project.

IT Outsourcing Trends in 2025’s Post-Pandemic, Hybrid World

From emergency offshoring to strategic, multi-region sourcing

COVID-19, supply-chain shocks and the sudden shift to remote work forced companies in New York, London and Berlin to rethink long, single-country offshore bets. Instead of putting everything in one delivery center, leaders now spread risk across multiple regions, mixing offshore hubs like Bangalore or Manila with nearshore squads in Warsaw, Bucharest or Mexico City.

Surveys suggest that a very large majority of mid- to large-sized firms often quoted at around 90% now use some form of IT outsourcing, and most are increasing their use of remote, hybrid teams. The goal is resilience: if one country locks down, changes tax rules or faces political instability, another region can pick up the slack.

Global IT delivery models in a hybrid work era

In this new landscape of hybrid work and outsourcing, global IT delivery models have become more nuanced:

Onshore teams in the same country as the client (e.g., London-based squad for a UK bank).

Nearshore geographically and time-zone close (e.g., German SaaS company working with developers in Poland or Portugal).

Offshore teams in distant regions with bigger time zone gaps (e.g., US firm working with India, Vietnam or the Philippines).

Captive centers your own legal entity and delivery center abroad.

Vendor-based delivery centers delivered via an IT partner rather than your own entity.

Managed IT services typically cover outcomes (SLAs for support, cloud operations, cybersecurity), while staff augmentation plugs specific skill gaps in your product or platform teams. Many Mak It Solutions customers mix both models with broader web development services and mobile app development capabilities to match different workloads. (Mak it Solutions)

What US and European tech leaders now expect from outsourcing partners

US and European tech leaders now expect more than just “bodies in seats”:

Faster ramp-up and plug-and-play, distributed software development teams.

Strong cloud-native skills in AWS, Microsoft Azure and Google Cloud. (Mak it Solutions)

Product thinking, not just ticket-based delivery.

A robust security and compliance posture spanning GDPR/DSGVO, UK-GDPR, HIPAA, PCI DSS and SOC 2.

Cultural and language fit for collaboration across New York–Mexico City, London–Warsaw or Berlin–Cluj-Napoca time bands.

Offshoring vs Nearshoring.

What is offshoring in IT outsourcing today?

Offshoring means sourcing IT services from regions that are geographically distant and usually in very different time zones, such as India, the Philippines, Vietnam and other Asia-Pacific hubs. Offshore partners are often used for large-scale software development, 24/7 support, QA and cost-driven operations where rate arbitrage is still a major driver.

The offshore model shines when you need very large teams, round-the-clock coverage or access to specialist skills that are scarce locally. However, it usually involves bigger time zone gaps, more complex communication and sometimes higher overhead to manage quality, knowledge transfer and stakeholder expectations.

What is nearshoring for software development in Europe and the Americas?

Nearshoring means working with teams in neighboring or nearby countries that share closer time zones, cultural overlap and often similar regulatory frameworks.

For US companies, classic nearshore software development hubs include Mexico, Colombia, Brazil, Argentina and Costa Rica, with talent clusters in Mexico City, Guadalajara, Bogotá and São Paulo.

For UK, Germany and wider EU, nearshore software development in Europe often means Poland, Romania, Czech Republic, Hungary, Bulgaria, Portugal and Spain, with strong engineering communities in Warsaw, Kraków, Bucharest, Cluj-Napoca, Prague, Lisbon, Porto and Barcelona.

For regulated workloads or teams that need daily collaboration, nearshoring can be easier to align with GDPR, DSGVO and sector-specific rules, especially when teams sit within the EU or EEA.

Offshoring vs nearshoring.

At a glance, here’s how offshoring vs nearshoring stacks up for IT outsourcing trends in 2025:

Offshoring

Lowest headline rates and very large talent pools.

Strong fit for high-volume development, maintenance and 24/7 support.

Bigger time zone gaps and more travel friction.

Nearshoring

Slightly higher rates, but lower coordination cost and fewer surprises.

Better time zone overlap, easier travel for workshops and closer cultural / language proximity.

Often better fit for complex, agile and regulated projects in the US, UK, Germany and EU.

Offshoring vs Nearshoring by Cost, Talent and Time Zone

Cost comparison for US, UK and DACH companies

Pure rate arbitrage still favors offshore hubs: senior engineers in India or Vietnam typically cost less per day than equivalent profiles in Central and Eastern Europe. At the same time, global IT outsourcing revenues are expected to grow from roughly $470–600B in 2023–2024 to well over $1T by the early 2030s, showing that both offshore and nearshore demand is rising together.

For US startups and mid-sized firms in San Francisco or Austin, nearshoring to Mexico or Colombia often works out cheaper in total cost of ownership once you factor in coordination time, rework and speed of delivery. London-based SaaS or financial services teams may accept slightly higher day-rates in Warsaw or Bucharest because overlapping days reduce delays and miscommunication.

From a Germany/DACH perspective, Mittelstand manufacturers and banks in Munich, Frankfurt or Hamburg often prioritize quality, stability and continuity over bottom-of-the-barrel pricing. For them, nearshore rates in CEE combined with strong German/English skills and EU-aligned regulations are often easier to defend to boards and regulators.

Talent depth, specialization and collaboration quality

Specialist talent in cloud, data, AI and regulated sectors is now distributed across multiple regions:

Eastern Europe (Warsaw, Kraków, Bucharest, Cluj-Napoca, Prague) has deep engineering talent, strong maths backgrounds and growing experience in fintech and manufacturing. (Karat)

Latin America (Mexico City, Guadalajara, Bogotá, São Paulo) increasingly serves as a nearshore extension for US healthcare, fintech and SaaS teams.

India, the Philippines and Vietnam remain powerhouses for large-scale development, support and testing, with growing AI and cloud capabilities. (Radixweb)

For collaboration quality, language skills (English plus sometimes German or Spanish), agile practices and product culture often tilt the scales towards nearshore hubs serving the US and Europe. That’s why many organizations complement offshore teams with nearshore pods while relying on partners like Mak It Solutions for business intelligence services and cloud cost optimization. (Mak it Solutions)

Time zone alignment, travel and cultural proximity

Time zone alignment is one of the most tangible differences:

US–Asia: roughly 8–12 hours difference, meaning standups with India or the Philippines often happen very early or very late.

US–Latin America: about 0–3 hours difference for most US cities, so you get almost full-day overlap.

UK/Germany–Asia: around 4–7 hours difference, allowing a smaller collaboration window.

UK/Germany–CEE: about 0–2 hours difference; teams work essentially the same business day.

Travel and cultural proximity also matter. Jumping from New York to Mexico City or from London to Warsaw for a quarterly planning session is far easier than organizing frequent workshops in Bangalore or Manila. That proximity translates into faster decision-making, quicker feedback loops and better relationship building.

Nearshore and Offshore Destinations to Watch

Nearshore software development in Europe vs offshore to Asia

Central and Eastern Europe Poland, Romania, Czech Republic, Hungary and Bulgaria has evolved into a mature nearshore region for UK, Irish and DACH companies. These countries offer strong STEM education, high English proficiency and familiarity with EU regulations such as GDPR, DSGVO and the EBA’s cloud outsourcing guidelines.

Offshore destinations like India and Vietnam still dominate for large-scale, cost-sensitive development. However, when EU data residency, GDPR-compliant delivery or BaFin expectations for German banks come into play, EU-based nearshore partners often become the default for core platforms, with offshore partners supporting non-regulated workloads.

US nearshoring to Latin America vs offshoring to Asia

For US companies in New York, San Francisco or Austin, Latin America offers:

Similar working hours across Mexico, Colombia, Brazil and Argentina.

Strong cultural proximity and growing English skills.

Shorter flights for key workshops or incident response.

Offshoring to India or the Philippines can still win for cost and 24/7 coverage, especially for support and testing. But for product-driven teams running daily standups, nearshore LATAM squads often deliver higher velocity and better collaboration.

IT outsourcing options for German Mittelstand and regulated EU sectors

German Mittelstand manufacturers and regulated sectors like banking and insurance face strict rules from BaFin and the EBA around outsourcing, data location and concentration risk. EU- or EEA-based nearshore providers in Poland, Romania or Portugal can help align with GDPR, DSGVO and data residency obligations while still delivering material cost savings vs pure onshore teams.

For example, a Frankfurt-based bank might keep core payment systems in German data centers, run analytics in EU cloud regions (under GDPR and Open Banking rules) and use nearshore CEE teams for feature delivery while leveraging offshore centers only for lower-risk, non-production work.

Risk, Compliance and Vendor Governance in IT Outsourcing

Data protection and regulated workloads

Data protection and regulated workloads are now central to offshoring vs nearshoring decisions. GDPR, DSGVO and UK-GDPR restrict how personal data can be transferred outside the EU/UK, and sector rules such as HIPAA for US healthcare, NHS guidelines in the UK, PCI DSS for payments and SOC 2 for SaaS vendors add further obligations.

This means.

Healthcare workloads involving PHI (NHS trusts or US hospital systems) often favor EU/UK or US-based teams, or tightly controlled nearshore regions.

Fintechs and banks in London or Frankfurt need to align outsourcing with BaFin, EBA and Open Banking requirements.

Global SaaS platforms must ensure their vendors meet SOC 2 and often ISO 27001.

Nearshore teams in EU jurisdictions can reduce legal and contractual complexity compared with offshoring to non-adequacy countries, especially when combined with compliant cloud architectures like those discussed in Mak It Solutions’ guides to future cloud hosting and AWS vs Azure vs Google Cloud in 2025. (Mak it Solutions)

Vendor due diligence, SLAs and governance for nearshore/offshore partners

Whether you choose nearshoring or offshoring, your vendor due diligence should cover.

Security certifications (ISO 27001, SOC 2), data protection controls and secure SDLC.

Delivery track record in your sector (fintech, healthcare, manufacturing, public sector).

Financial stability, ownership structure and geo-distribution of delivery centers.

Well-structured SLAs define uptime, incident response, quality metrics and velocity expectations, while governance forums (e.g., monthly steering committees) keep alignment across time zones. Clear RACI matrices, escalation paths and quarterly business reviews reduce surprises and help you stay in control.

Managing distributed teams securely.

To manage distributed teams securely you need:

Modern tooling: SSO, least-privilege access, audit trails and DevSecOps pipelines.

Clear environment separation (dev/test/stage/prod) with stricter controls as you move closer to production.

Cultural practices that unify onshore, nearshore and offshore squads: shared rituals, consistent documentation and transparent communication.

Mak It Solutions often helps clients design these hybrid operating models alongside digital marketing and broader multi-cloud strategies to ensure security and delivery foundations stay aligned as teams and platforms scale. (Mak it Solutions)

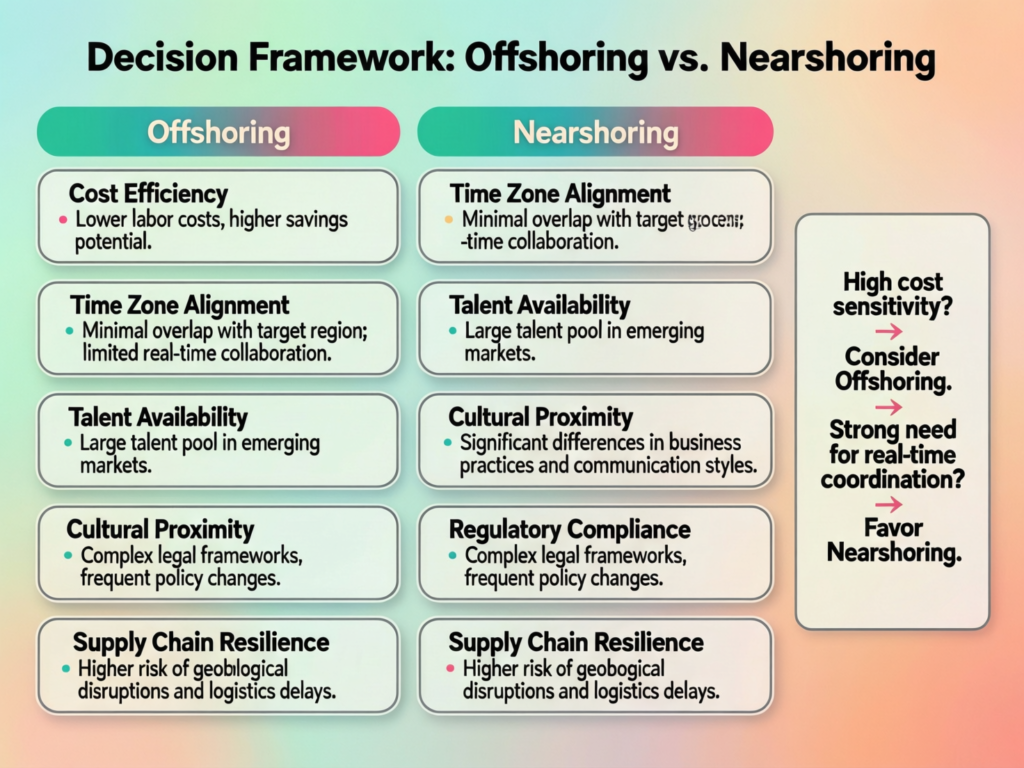

How to Decide Between Offshoring and Nearshoring for Your Next Project

Decision framework

A simple way to choose between offshoring vs nearshoring is to score each option against five dimensions: scope, speed, skills, budget and risk. For each dimension, score 1–5 for both nearshore and offshore options, then add up the totals to see which model fits best.

Scope

Is work well-specified and modular (offshore-friendly) or ambiguous and evolving (nearshore-friendly)?

Speed

Do you need tight feedback loops and daily collaboration, or can work happen more asynchronously?

Skills

Are skills rare in your region, or widely available offshore/nearshore?

Budget

How important is lowest rate vs total cost of delay and rework?

Risk & compliance

How sensitive is the data, and how strict are your regulators?

This scoring model quickly reveals whether nearshoring, offshoring or a hybrid model is most defensible for your board, regulators and product roadmap.

Example scenarios: startups vs mid-sized tech vs enterprise IT

US/UK SaaS startup

A London- or Austin-based SaaS startup building a new product might keep product leadership onshore, use a nearshore team in Warsaw or Mexico City for core development and selectively tap offshore specialists for AI or testing.

German Mittelstand manufacturer

A Munich-based manufacturer modernizing MES/ERP systems under DSGVO and BaFin-linked banking integrations may favor CEE nearshore for most app development, with onshore architects and minimal offshore involvement.

Global enterprise

A large multinational moving away from a single offshore mega-vendor might adopt a blended model: nearshore CEE for high-touch digital products, offshore India/Vietnam for scalable engineering capacity and onshore teams for critical regulatory interfaces.

When a hybrid model (nearshore + offshore + onshore) makes sense

For many CIOs, the best answer isn’t offshoring vs nearshoring it’s all of the above, applied intentionally. A hybrid model typically looks like this:

Onshore product, architecture, key stakeholder management.

Nearshore core engineering for regulated, high-impact products.

Offshore high-volume development, QA, run operations and 24/7 support.

This is how global players, from Big Tech to major European banks, structure multi-vendor, multi-region delivery, often assisted by partners like Mak It Solutions who can provide end-to-end web development and analytics expertise across regions. (Mak it Solutions)

Final Thoughts

Offshoring vs nearshoring is no longer a purely cost-driven choice; it’s a strategic lever for resilience, compliance and faster delivery in 2025. Offshore hubs still offer unmatched scale and attractive rates, while nearshore partners in CEE and Latin America bring tighter collaboration, easier travel and smoother alignment with US, UK and EU regulations.

Most mature teams now blend onshore leadership with nearshore product squads and offshore capacity, adjusting the mix as risk and workloads evolve. Start by mapping scope, skills, budget and regulatory constraints, then choose the sourcing pattern that best protects your roadmap, your customers and your compliance obligations.

Key takeaways

IT outsourcing trends in 2025 are driven by resilience, compliance and cloud-native skills, not just lowest cost.

Offshoring offers the largest talent pools and cheapest day-rates, but with bigger time zone and governance challenges.

Nearshoring to CEE or Latin America balances cost with collaboration, travel and regulatory alignment for US, UK and EU firms.

Regulated workloads (finance, healthcare, public sector, SaaS platforms) often favor EU/UK or US nearshore partners, with offshore used selectively.

A hybrid mix of onshore, nearshore and offshore underpinned by strong governance is becoming the default model for serious enterprises.

If you’re weighing offshoring vs nearshoring for your next product, cloud or data project, you don’t have to decide in a vacuum. Share your goals, GEO constraints and timeline, and the team at Mak It Solutions can help you design a balanced delivery model that fits your budget, regulators and roadmap.

Visit our contact page to request a scoped estimate or book a short discovery call with our senior consultants. (Mak it Solutions)

FAQs

Q : Is nearshoring always more expensive than offshoring for IT services?

A : Nearshoring typically has higher day-rates than classic offshore locations, but that doesn’t mean it’s more expensive overall. When you factor in time zone overlap, fewer handoff delays, less rework and faster release cycles, many US, UK and EU companies find that nearshore teams deliver a lower total cost of ownership for complex or regulated projects. Offshoring still wins on pure rate arbitrage, especially for high-volume development and support.

Q : Which European countries offer the best balance of cost and quality for nearshore software development?

A : For nearshore software development, many UK and DACH companies look to Poland, Romania, Czech Republic, Hungary, Bulgaria, Portugal and Spain. Cities like Warsaw, Kraków, Bucharest, Cluj-Napoca, Prague, Lisbon, Porto and Barcelona combine strong engineering talent, solid English proficiency and experience with EU regulations like GDPR and DSGVO. The “best” country for you will depend on language needs, domain expertise and your preferred time zone overlap.

Q : How do US and EU data residency rules affect where my outsourced teams can be located?

A : US and EU data residency rules don’t completely forbid offshoring, but they do shape how and where personal and regulated data is processed. Under GDPR/DSGVO, UK-GDPR, HIPAA and sector guidelines from BaFin, the EBA and Open Banking, you may need to keep data in specific regions or use additional safeguards such as SCCs, encryption and strict access controls. In practice, many organizations keep sensitive data in US/EU cloud regions, use nearshore teams in the same legal space and limit offshore partners to anonymized or non-production data. (Mak it Solutions)

Q : What KPIs should CIOs track to measure the success of a nearshore or offshore IT engagement?

A : Useful KPIs include deployment frequency, lead time for changes, defect escape rate, production incident volume and mean time to recovery. You should also track sprint predictability, team happiness, stakeholder NPS and financial metrics such as cost per feature, budget variance and realized savings vs onshore. For regulated sectors, add compliance metrics like audit findings, policy exceptions and time to remediate security issues.

Q : How long does it typically take to ramp up a nearshore development team compared with an offshore team?

A : Ramp-up time depends on scope and seniority, but nearshore teams often reach full productivity faster for US and European clients because they share time zones, working cultures and languages. A small nearshore squad can often be operational within 4–8 weeks, including discovery and onboarding, while large offshore teams may take longer to align on requirements, processes and communication norms. The biggest accelerators are clear product ownership, well-documented architecture and a partner with proven onboarding playbooks.